UK 100 FTSE 100 Index, forex 100.

Forex 100

FOREX.Com products and services are not intended for belgium residents. Last updated:

UK 100 FTSE 100 index

Containing some of the largest companies in the world, the UK 100 is correlated to the country's economic indicators as well as global growth.

Latest research

USD/JPY technical analysis: long-term outlook still favors bears

Top US ipos to watch out for in 2021

US market open: yellen to urge politicians to ‘act big’ on fiscal stimulus

Interesting facts

The UK 100 is one of the most widely used metrics when evaluating the performance of the UK economy. The index is comprised of the largest companies in the UK by market capitalisation, and the larger the company the more influence it has over the index’s price. In the UK, the largest companies are usually found in the mining, energy (particularly oil and gas) and financial services sectors.

Price drivers

The UK 100 is closely linked to economies throughout europe through trade and geographical proximity, thus it can be influenced by investor sentiment surrounding large equity markets in europe. Furthermore, during times of global crisis the economy can sometimes ignore domestic fundamentals in favour of overall investor sentiment (for example: 08/09 financial crisis and the european debt crisis), with the possible exception being the bank of england’s interest rate decisions and policy announcements. More specifically, the index is susceptible to the sentiment surrounding global banking markets due to the high weighting banking stocks have on the index. Also, mining and energy companies account for a significant proportion of the index, which means investors should keep an eye on commodity prices and the level of demand for these assets.

Pivot points

Distance

Distance shows the difference between the pivot point and bid rate. It is calculated by subtracting the ask rate from the pivot point rate.

Daily

Weekly

Monthly

Last updated:

Understanding pivot points

Economic calendar

Trade a demo account risk free

Trade market events in live market conditions for 30 days.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

Try a demo account

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

It's your world. Trade it.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

Welcome bonus forex $100

Get our welcome bonus forex 100 and start your forex trading career. Try our award-winning platform for free on any device and develop your trading skills.

FREE $100 BONUS TO TRADE - AM broker gives you free money to start your forex journey and trade real

BOOST YOUR SKILLS - besides $100 you get a full set of educational materials and trading strategies

DOUBLE YOUR BONUS - refer 3 live clients and get no deposit bonus of $100

Top forex bonus promo

How to get the welcome bonus forex 100?

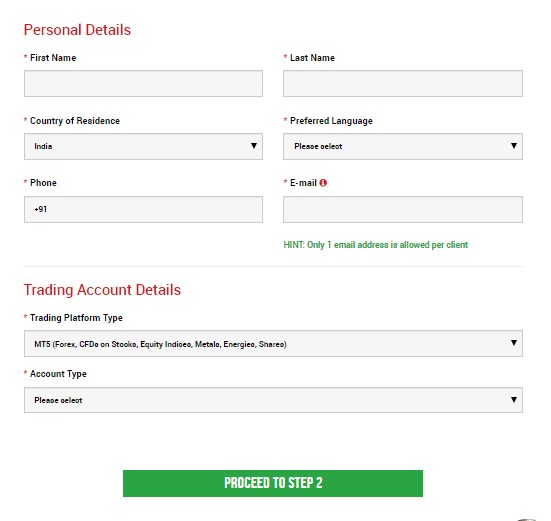

Step 1: sign up

Just enter your details into the fields of our online form and click ‘submit’. Once email is confirmed you will be able to access the trader's room.

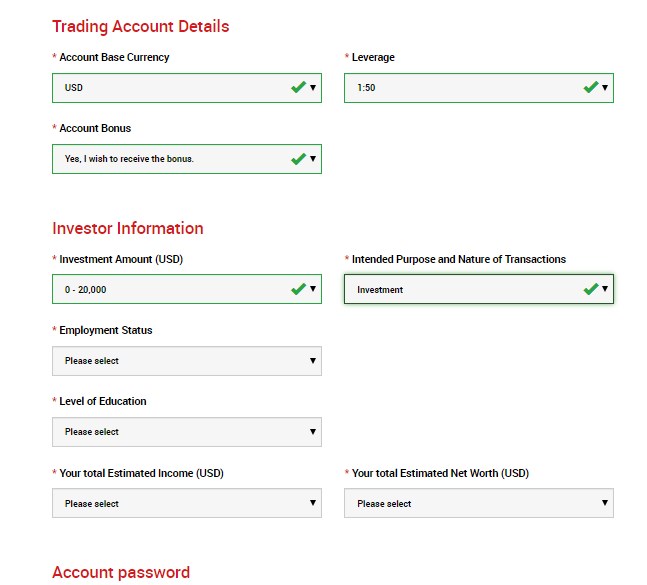

Step 2: open real account

Click on create an account, select real account, leverage 1:500 and USD as currency. You will receive an email with the credentials: login and password.

Step 3: upload documents

Fill out your personal profile and upload the required documents: ID copy, bank book and proof of residence.

Step 4: activate your account

Deposit a minimum of $30 to activate a real trading account and be eligible for the welcome bonus.

Step 5: claim your bonus

Click on "promo codes" and type in "WELCOME100" to be eligible for the welcome forex bonus 100. Click on "claim your bonus" to activate the campaign and the 100$ forex welcome bonus will be visible in your live trading account.

Step 6: start trading

Access the trading account from any device with metatrader 5 for desktop, web and mobile and start trading. The maximum profit you can withdraw is 200$. Good luck and happy trading!

Welcome bonus forex 100 faqs

This promotion gives new client a chance to test our trading conditions (execution, spreads, work of the trading platform) on the real account (on the real trade server). If the client likes trading conditions, he/she can fund account and continue trading with us.

As an international company, AM broker respects the anti-money laundering (AML), meaning that clients can not receive funds without depositing funds previously. Allowing profit withdrawals from free money offerings may put ourself and our clients at risk. Clients have to make an extra $30 deposit to be able to get the welcome bonus and withdraw funds according to the AML policy.

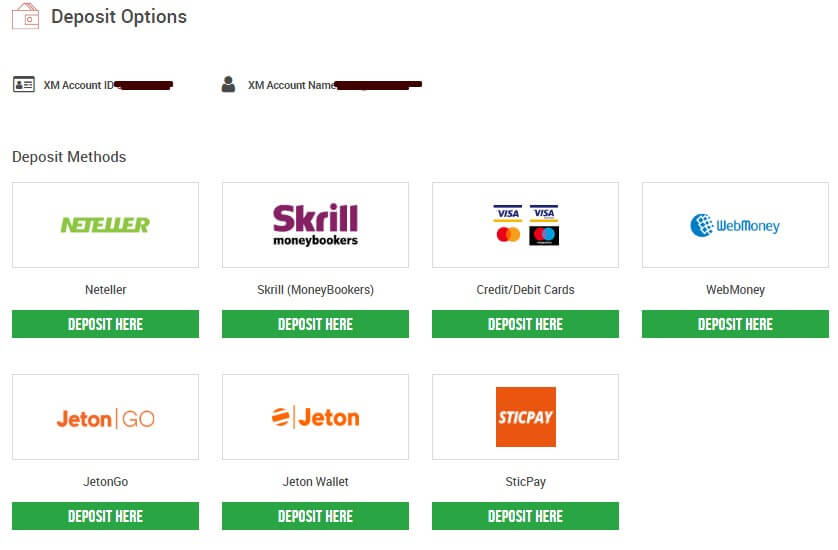

You can easily add more funds to your real accounts by logging in to AM broker trader’s room. Once you log in to trader’s room, click the deposit button and select one of the multiple options available with AM broker.

The welcome bonus forex 100 can be used by the client in trading operations without any restrictions. You can use automated trading or scalping techniques, any trading method is allowed with AM broker

You can receive a welcome bonus forex 100 only once. It is an welcome bonus. However, you can get a new type of bonus for any of your new deposits with AM broker.

You can get up to 25% bonus at deposit and 12% fixed annual interest for your next deposits at your wish. Just choose the suitable campaing, make a deposit and claim your new bonus.

If you forgot your username, please contact us for assistance. If you forgot your password, please go to trader’s room to reset your password.

- Trading

- Trading

- Accounts

- Demo trading

- Margin requirments

- Trading platform

- Web trading

- Android trading app

- Ios trading app

- Markets

- Markets

- Forex

- Indices

- Shares

- Funds

- Commodities

- Resources

- Resources

- Economic calendar

- Robo advisor

- Trading signals

- Webinars

- Courses

- Other

- Other

- Become a partner

- Marketing affiliate HUB

- Fixed annual bonus

- Bonus at deposit

- About us

- Contact

- Support center

Cfds are complex financial instruments traded on margin. Trading cfds carries a high level of risk and may not be suitable for all investors. Please ensure that you understand the risks involved as you may lose all your invested capital. Past performance of cfds is not a reliable indicator of future performance. Most cfds have no set maturity date and a CFD position matures on the date an open position is closed. Please read our ‘risk disclosure notice’. When trading cfds with AM globe services LTD, you are merely trading on the outcome of a financial instrument and therefore do not take delivery of any underlying instrument, nor are you entitled to any dividends payable or any other benefits related to the same.

AM globe services ltd. Is the holding company of AM broker.

AM globe services ltd, the financial services center, stoney ground, kingstown, st. Vincent and the grenadines is incorporated under registered number 24863 IBC 2018 by the registrar of international business companies, registered by the financial services authority of saint vincent and the grenadines.

AM glober services ltd reserves the right to amend and upgrade its policies, terms and conditions. Most updated and valid company policies are published on AM broker website. Using any services of AM broker, clients and partners agree with the current terms and conditions provided in the company's agreements and legal documents. Clients and partners are considered aware of all risks concerning financial services and charges applied by AM globe services ltd.

Please be advised, the services and products described on this website are not offered to citizens of E.U. Member states, the united states, canada, japan, turkey and australia. AM globe services ltd and its products and services offered on the site www.Ambroker.Com are NOT registered or regulated by any U.S. Or canadian regulator and not regulated by FINRA, SEC, NFA or CFTC.

© AM globe services ltd. All rights reserved.

Forex 100

"rayn is the go-to-guy for anything forex related. He has a wealth of knowledge and is quick to give advice about the best time for exchanging of currency. This service has been extremely helpful to my business as it helps me to maximise my profits by cutting down on currency exchange loss."

It is our great honour to be invited as a speaker for traders fair, malaysia 2020, during the 40mins session our speaker, mr rayn lim, is going to .

The L.E.A.D advancement program

Regardless of your level of experience as a trader, we have the relevant materials to satiate your desire to improve. Our L.E.A.D advancement program provides you with the ladder you need to reach the peak of your trading journey. Not only to ignite your passion for trading, but to allow you to develop your trading skills into a career path of endless potential.

L earn

E arn

A dvise

D rive

Easy to understand and apply!

The course teaches trading strategies and patterns based on each individual’s psyche, personality and lifestyle. The rock solid basics and techniques are easy to understand and apply, and is based on the trainer’s many years of trading experience. The trainer imparts both implicit and tacit knowledge which expands my perspective of the world of trading.

They have a great system in place to minimise losses and maximise earnings.

After graduated from (forex100) course, I am super excited about forex trading and really believe that achieving financial goals through trading is possible.

The trainers were very professional and patience in guiding me through the crucial concepts of forex trading such as understanding my risk profile and appetite in trading.

Trading scenario: what happens if you trade with just $100?

What happens if you open a trading account with just $100?

Or €100? Or £100?

Since margin trading allows you to open trades with just a small amount of money, it’s certainly possible to start trading forex with a $100 deposit.

But should you?

Let’s see what can happen if you do.

In this trading scenario, your retail forex broker has a margin call level at 100% and a stop out level at 20%.

Now that we know what the margin call and stop out levels are, let’s find out if trading with $100 is doable.

If you have not read our lessons on margin call and stop out levels, hit pause on this lesson and start here first!

Step 1: deposit funds into trading account

You now have an account balance of $100.

This is how it’d look in your trading account:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – |

Step 2: calculate required margin

You want to go short EUR/USD at 1.20000 and want to open 5 micro lots (1,000 units x 5) position. The margin requirement is 1%.

How much margin (“required margin“) will you need to open the position?

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,000.

Now we can calculate the required margin:

Assuming your trading account is denominated in USD, since the margin requirement is 1%, the required margin will be $60.

Step 3: calculate used margin

Since we just have a SINGLE position open, the used margin will be the same as required margin.

Step 4: calculate equity

Let’s assume that the price has moved slightly in your favor and your position is now trading at breakeven.

This means that your floating P/L is $0.

Let’s calculate your equity:

The equity in your account is now $100.

Step 5: calculate free margin

Now that we know the equity, we can now calculate the free margin:

The free margin is $40.

Step 6: calculate margin level

Now that we know the equity, we can now calculate the margin level:

The margin level is 167%.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | – | $100 | – | |||||

| short | EUR/USD | 6,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

EUR/USD rises 80 pips!

EUR/USD rises 80 pips and is now trading at 1.2080.

Used margin

You’ll notice that the used margin has changed.

Because the exchange rate has changed, the notional value of the position has changed.

This requires recalculating the required margin.

Whenever there’s a change in the price for EUR/USD, the required margin changes!

With EUR/USD now trading at 1.20800 (instead of 1.20000), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,040.

Previously, the notional value was $6,000. Since EUR/USD has risen, this means that EUR has strengthened. And since your account is denominated in USD, this causes the position’s notional value to increase.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Since the margin requirement is 1%, the required margin will be $60.40.

Previously, the required margin was $60.00 (when EUR/USD was trading at 1.20000).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has risen from 1.20000 to 1.2080, a difference of 80 pips.

Since you’re trading micro lots, a 1 pip move equals $0.10 per micro lot.

Your position is 5 micro lots, a 1 pip move equals $0.50.

Since you’re short EUR/USD, this means that you have a floating loss of $40.

Equity

Your equity is now $60.

Free margin

Your free margin is now $0.

Margin level

Your margin level has decreased to 99%.

The margin call level is when margin level is 100%.

Your margin level is still now below 100%!

At this point, you will receive a margin call, which is a WARNING.

Your positions will remain open BUT…

You will NOT be able to open new positions as long unless the margin level rises above 100%.

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.2080 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

EUR/USD rises another 96 pips!

EUR/USD rises another 96 pips and is now trading at 1.2176.

Used margin

With EUR/USD now trading at 1.21760 (instead of 1.20800), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,088.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Previously, the required margin was $60.40 (when EUR/USD was trading at 1.20800).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has now risen from 1.20000 to 1.217600, a difference of 176 pips.

Since you’re trading 5 micro lots, a 1 pip move equals $0.50.

Due to your short position, this means that you have a floating loss of $88.

Equity

Your equity is now $12.

Free margin

Your free margin is now –$48.88.

Margin level

Your margin level has decreased to 20%.

At this point, your margin level is now below the stop out level!

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

Stop out!

The stop out level is when the margin level falls to 20%.

At this point, your margin level reached the stop out level!

Your trading platform will automatically execute a stop out.

This means that your trade will be automatically closed at market price and two things will happen:

- Your used margin will be “released”.

- Your floating loss will be “realized”.

Your balance will be updated to reflect the realized loss.

Now that your account has no open positions and is “flat”, your free margin, equity, and balance will be the same.

There is no margin level or floating P/L because there are no open positions.

Let’s see how your trading account changed from start to finish.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $10,000 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

| – | $12 | – | $12 | $12 | – |

Before the trade, you had $100 in cash.

Now after just a SINGLE TRADE, you’re left with $12!

Not even enough to pay for one month of netflix!

You’ve lost 88% of your capital.

And with EUR/USD moving just 176 pips!

Moving 176 pips is nothing. EUR/USD can easily move that much in a day or two. (see real-time EUR/USD volatility on marketmilk™)

Congratulations! You just blew your account! ��

Since your account balance is too low to open any new trades, your trading account is pretty much dead.

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

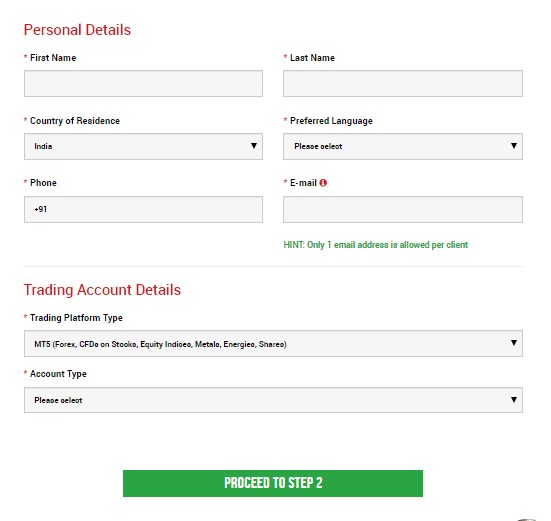

Step 2: filling the personal details

Fill all the box with accurate details

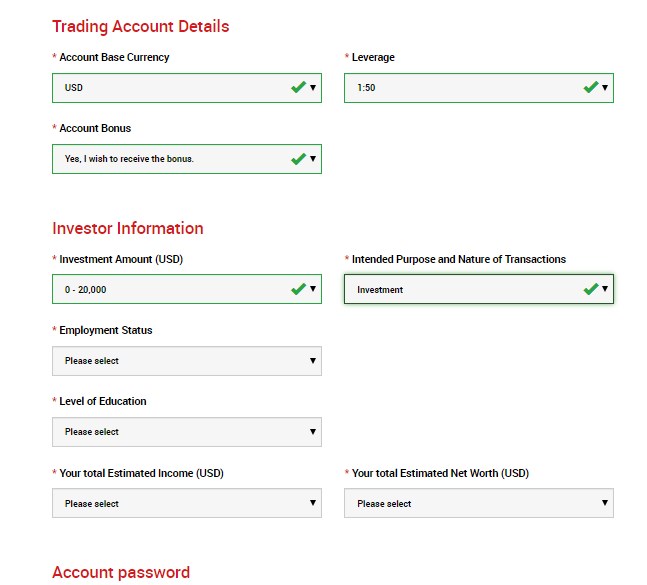

Step 3: investor information & trading account details

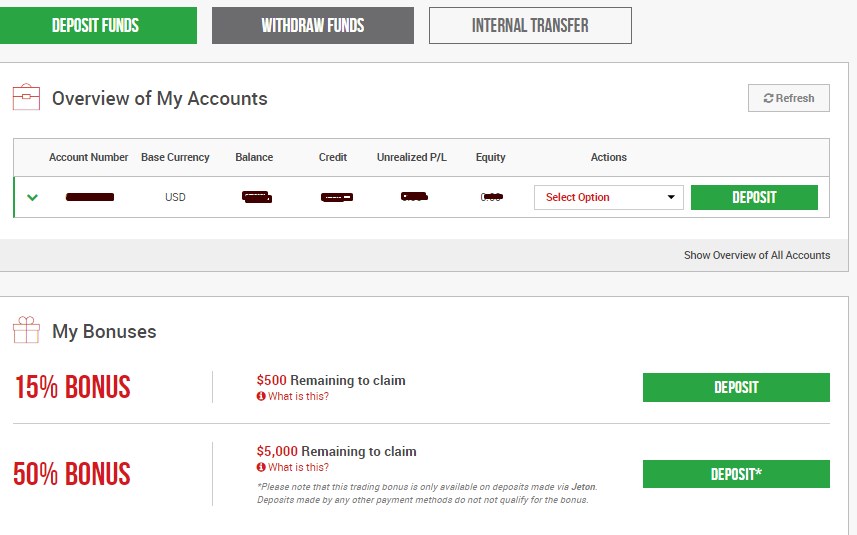

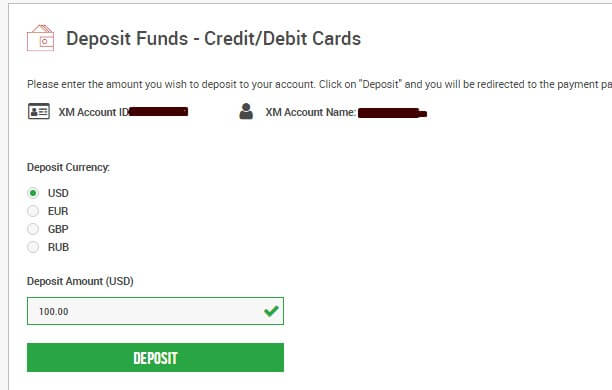

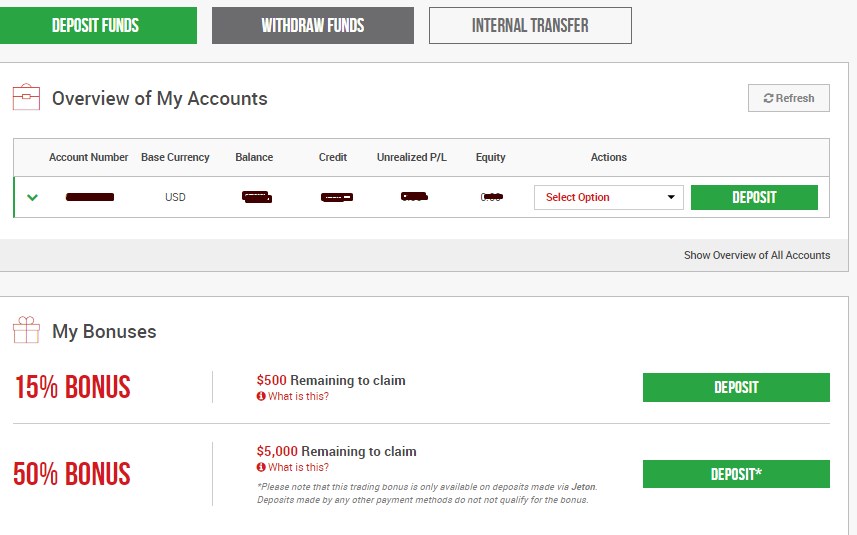

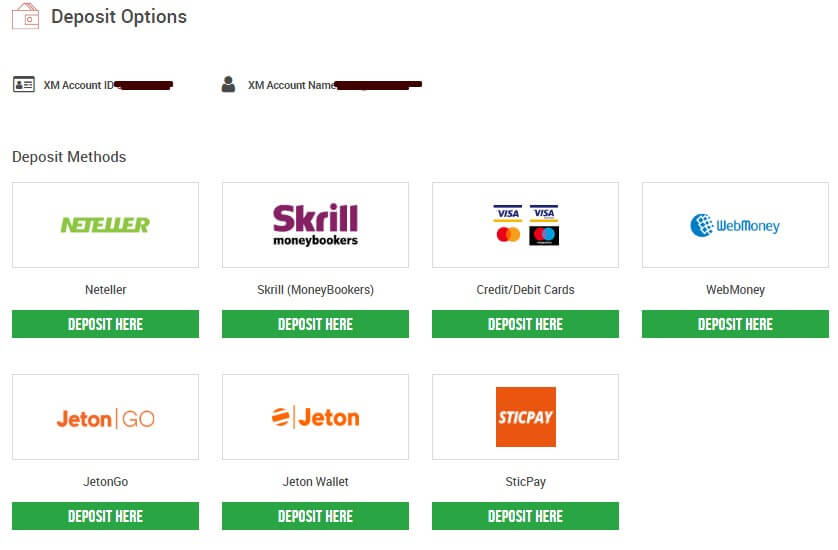

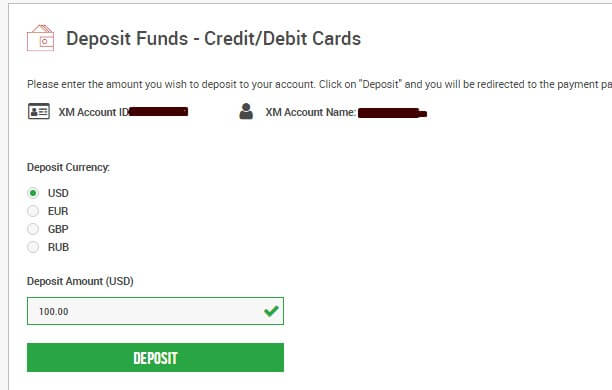

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

Click deposit button

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

UK 100 FTSE 100 index

Containing some of the largest companies in the world, the UK 100 is correlated to the country's economic indicators as well as global growth.

Latest research

USD/JPY technical analysis: long-term outlook still favors bears

Top US ipos to watch out for in 2021

US market open: yellen to urge politicians to ‘act big’ on fiscal stimulus

Interesting facts

The UK 100 is one of the most widely used metrics when evaluating the performance of the UK economy. The index is comprised of the largest companies in the UK by market capitalisation, and the larger the company the more influence it has over the index’s price. In the UK, the largest companies are usually found in the mining, energy (particularly oil and gas) and financial services sectors.

Price drivers

The UK 100 is closely linked to economies throughout europe through trade and geographical proximity, thus it can be influenced by investor sentiment surrounding large equity markets in europe. Furthermore, during times of global crisis the economy can sometimes ignore domestic fundamentals in favour of overall investor sentiment (for example: 08/09 financial crisis and the european debt crisis), with the possible exception being the bank of england’s interest rate decisions and policy announcements. More specifically, the index is susceptible to the sentiment surrounding global banking markets due to the high weighting banking stocks have on the index. Also, mining and energy companies account for a significant proportion of the index, which means investors should keep an eye on commodity prices and the level of demand for these assets.

Pivot points

Distance

Distance shows the difference between the pivot point and bid rate. It is calculated by subtracting the ask rate from the pivot point rate.

Daily

Weekly

Monthly

Last updated:

Understanding pivot points

Economic calendar

Trade a demo account risk free

Trade market events in live market conditions for 30 days.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

Try a demo account

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

It's your world. Trade it.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

How to trade forex with $100

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Many people realize that $100 doesn’t buy much these days, but if you want to trade the forex market, $100 can get you started and could even generate a new source of income you can earn at home. If you manage to develop and implement a successful trading plan, then your first $100 forex account could ultimately change your life for the better.

On the other hand, if you plan to just get into the currency market to make a few practice trades or to gamble a bit, then a loss of $100 usually won’t break the bank for most people.

The key to success as a forex trader consists of having a viable trading plan that you can easily stick to, no matter whether you’re trading with $100 or $1,000,000 in your margin account. Read to learn how to get started trading forex with $100.

Step 1: research the market.

Knowledge is power. These words take on a special meaning when applied to trading in the forex market that holds the top position for trading volume among the world’s financial markets. Knowing more about markets and trading in general increases your chances of succeeding when you trade forex.

Of course, if you just want to take a quick gamble with your $100, then you wouldn’t need to learn much more than how to enter orders in your brokerage account using an online trading platform.

To achieve any level of consistent long-term success, however, you will need to acquire a certain amount of knowledge about currencies and the fundamental factors that influence their relative valuation. Most online brokers provide ample educational resources for new traders that can include articles, ebooks, webinars and tutorial videos. All of these can help you learn more about the forex market before you begin risking money.

You will probably also need to learn how to analyze a market’s behavior to have a better chance of predicting its future direction. The 2 principal analytical market research methods for traders consist of fundamental and technical analysis.

Fundamental analysis

This method analyzes the impact of economic releases and news on the market. Each currency’s relative value generally reflects the state of that particular nation’s economy and its geopolitical situation compared with the currency it is quoted relative to.

Below are the most important news events and indicators watched by fundamental forex analysts:

- Geopolitical shifts and other major news events

- Central bank monetary policy and benchmark interest rate levels

- Gross domestic product (GDP)

- Employment statistics (non-farm payrolls, unemployment rate, weekly initial jobless claims, etc.)

Fundamental analysis gives you an important edge when you trade. Not only can it help predict longer term exchange rate trends, but it can also help explain and predict sharp short-term movements, such as those that coincide with significant economic releases.

Most online forex brokers include a news feed with their trading platform to help you perform fundamental analysis. Another important resource for fundamental trading is the economic calendar that lists all the important upcoming economic releases for various major economies.

Technical analysis

You can study the forex market using technical analysis such as charts and computed technical indicators — a common method to determine the levels of supply and demand in the market that can influence and predict an exchange rate’s future movement.

By looking at exchange rate charts you can identify common patterns with predictive value. You could also use a variety of popular indicators based on market observables to help predict short- and long-term trends in the market.

These indicators can include moving averages, momentum oscillators, overbought or oversold indicators and volume figures. Some important indicators include the moving average convergence divergence indicator (MACD), the relative strength index (RSI) and the 200-day moving average, to name just a few.

Trading volume is another important market observable to give an indication of how much activity accompanies a particular market move. Also, support and resistance levels suggest the degree of supply and demand existing at different exchange rate levels.

The charts themselves can also give important information to use and act upon. For example, a fascinating system of interpreting and trading candlestick charts was originally developed by japanese rice merchants. These informative charts indicate the opening and closing exchange rates, the range of the currency pair and whether the exchange rate increased or decreased for each period displayed on the chart.

Overall, technical analysis provides a relatively objective way to analyze the forex market that can work well for predicting short-term market moves. Many scalpers and day traders use technical analysis to inform their trading activities.

Step 2: open a demo account.

Most online forex brokers provide clients with a fully functional demo account, which reflects market conditions but does not require you to make a deposit.

The forex platforms provided by these brokers generally have comprehensive technical analysis tools such as charting and indicators that incorporate into the chart. If the broker supports the popular metatrader 4 platform developed by metaquotes, then you can automate your trading with expert advisor (EA) software you can buy or develop yourself.

The reason opening a demo account makes sense is so that you can get a feel for the market and learn how to use a broker’s trading platform without committing any funds. You can also use a demo account to begin working out your own trading strategy and putting it into a trade plan.

By learning how to take risk as a forex trader and seeing how disciplined you are when dealing with taking profits and losses, you can also determine if you have the necessary mindset to become successful as a forex trader.

Once you’ve opened your demo account and have begun trading with virtual money, you can start developing a trading plan. If you plan on success, remember that the more you know, the easier developing a trading strategy becomes. Take the time to review as many of the online educational resources on trading that you can, so that your trading plan has a solid foundation in best practices.

Step 3: fund an account and start trading.

Once you’ve traded in your demo account and worked out a trading plan you feel confident with, you can fund a live account and make your first real trade. Although trading in a live account may seem identical to trading in a demo account, you’ll have to deal with the emotional swings that come with winning and losing money, even if you’re only risking $100.

Fortunately, any viable trading plan can be traded with a $100 account since most brokers will let you trade in micro units or 0.01 lots. After you’ve refined your trading plan and have increased your working capital with profitable trading, you can then increase the size of your trading units. Avoid taking larger than expected losses by incorporating a sound money management component into your trading plan.

If you’re a beginning trader, you may want to restrict your trading activities to one particular currency pair before taking positions in multiple pairs in your account. Each currency pair differs in the way it trades because of the underlying fundamentals of the component currencies.

Get free forex 100$ bonus with FBS

Get FBS free forex 100$ bonus and start your forex career! It works the same way as in sport – first you train and learn, then you earn and get stronger, faster, and more efficient. Trade 100 bonus is your personal tool for toning up your brain

What you get with trade 100 bonus

FREE $100 TO TRADE

FBS gives you real money to start your forex journey and trade on a real acount.

BOOST YOUR SKILLS

To level up your trading skills you need power-ups: besides $100 you get a full set of educational materials

START WITHOUT DEPOSIT

Learn how to trade and make a real profit out of it – without your own money involved in the process

Get real $100 and level up your trading

How can trade 100 bonus help you

Trade 100 bonus gives beginner traders a chance to study the basics, get fully involved in the process of real account trading. And the best part is you don’t need any initial investments for it! Take your time to get to know forex and FBS platform, test your hand, gear up with knowledge with fewer risks involved

If you are an experienced trader, trade 100 bonus is your chance to get familiar with the FBS platform. Trade on major currency pairs, enjoy low spreads and swap free options for your trading and, of course, make some profit out of our welcome gift!

How to get $100 of profit?

- Register a bonus account with $100 on it

- Trade 5 lot for 30 active trade days

- Succeed and get your profit of $100

Sounds good? Then start pumping up right now!

Bonus conditions

- The bonus is only available on the metatrader 5 platform

- The max lot is 0.01 lot

- The maximum number of orders opened at the one time is 5

- The amount available for withdrawal is 100 USD

- At least 30 active trading days using 100$ bonus required (an active trading day is a day when the order was opened or closed also it must be at least 10 pips)

You must trade at least 5 lots. Considering that you only have to trade with 0.01, you need to have 500 trades in 50 days! And each of them must be at least 10 pips. In other words, 10 trades each day on average.

Trusted and accurate forex signal provider: visit

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

Step 2: filling the personal details

Fill all the box with accurate details

Step 3: investor information & trading account details

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

Click deposit button

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

So, let's see, what we have: ready to trade the FTSE 100 and over a dozen other popular indices? Find FOREX.Com’s live pricing, leverage, latest research and price drivers for the UK 100. At forex 100

Contents of the article

- UK 100 FTSE 100 index

- Latest research

- Top US ipos to watch out for in 2021

- US market open: yellen to urge politicians to ‘act big’ on...

- Interesting facts

- Price drivers

- Pivot points

- Distance

- Daily

- Weekly

- Monthly

- Economic calendar

- Try a demo account

- Welcome bonus forex $100

- Top forex bonus promo

- How to get the welcome bonus forex 100?

- Step 1: sign up

- Step 2: open real account

- Step 3: upload documents

- Step 4: activate your account

- Step 5: claim your bonus

- Step 6: start trading

- Welcome bonus forex 100 faqs

- Forex 100

- Trading scenario: what happens if you trade with just $100?

- Step 1: deposit funds into trading account

- Step 2: calculate required margin

- Step 3: calculate used margin

- Step 4: calculate equity

- Step 5: calculate free margin

- Step 6: calculate margin level

- EUR/USD rises 80 pips!

- EUR/USD rises another 96 pips!

- Stop out!

- How to trade forex with $100 in just 5 minutes january, 2021

- Reliable steps to trade forex with $100 january,...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account details

- Step 4: depositing $100 to trade

- Most important point after opening trading account...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- UK 100 FTSE 100 index

- Latest research

- Top US ipos to watch out for in 2021

- US market open: yellen to urge politicians to ‘act big’ on...

- Interesting facts

- Price drivers

- Pivot points

- Distance

- Daily

- Weekly

- Monthly

- Economic calendar

- Try a demo account

- How to trade forex with $100

- Step 1: research the market.

- Step 2: open a demo account.

- Step 3: fund an account and start trading.

- Get free forex 100$ bonus with FBS

- Bonus conditions

- How to trade forex with $100 in just 5 minutes january, 2021

- Reliable steps to trade forex with $100 january,...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account details

- Step 4: depositing $100 to trade

- Most important point after opening trading account...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

Comments

Post a Comment