XM Minimum Deposit Guide (2021), xm paypal deposit.

Xm paypal deposit

Russian RUB is available only if you are located outside of cysec and FCA regulatory areas.

Top forex bonus promo

69.75% of retail CFD accounts lose money

XM minimum deposit guide (2021)

Trading with a top forex broker like XM is a forward step in the trading career of anyone looking to break into the sector.

Our XM review details exactly what is on offer with this broker providing extensive access to a wide range of markets.

Here we will take a closer look at the financial side of things.

The XM minimum deposit to be exact.

This is something which can certainly influence how you trade so it is well worth noting.

We will look at the minimum deposit for XM by funding method and account type to make sure that we cover all traders.

Table of contents

69.75% of retail CFD accounts lose money

XM account base currency

As with most top brokers, XM accounts are available with many several base currencies. The XM base currency is the one that you trade with and effectively depends upon which account and regulatory type you fall under.

If you have an XM standard or micro account, you can look forward to choosing every major currency as your XM base currency. Also included are PLN and HUF as other options as well as ZAR and SGD.

Russian RUB is available only if you are located outside of cysec and FCA regulatory areas.

If you are an XM zero account holder, you can access USD or EUR as base currencies with JPY available under global market regulation.

XM ultra-low account holders can select between five base currencies. These are EUR, USD, GBP, AUD, and CHF.

If you are an XM shares account holder, USD only is available for trading with.

XM funding and deposit methods

Again there is a range of XM deposit methods available to traders. These will depend on the country in which you live and not the regulatory jurisdiction you fall under.

Wondering for example if you can make a minimum deposit in ZAR?

The answer is yes, you can deposit in any currency, this includes ZAR. These funds will then simply be converted into your base currency for trading on your account.

Wire transfer

XM deposit by wire transfer is, of course, available and widely used. This funding method is available to traders worldwide and there is an minimum deposit of $60 in place here.

With that said, you will incur a fee if the wire transfer you make falls below $200. If the deposit is above this amount, then not only will XM waive any fees they charge, they will also cover any fee you would usually incur from your own bank side. Therefore, although it is not explicitly required, it is in your best interest to deposit more than $200.

Credit cards

Credit card deposits are available through both visa and mastercard at XM. These are accessible to traders around the world with a minimum deposit amount of just $5.

There are no fees associated from the broker side, but again if your financial provider does levy a fee, this will be covered for anything over a $200 deposit by XM.

Ewallet

Again, the minimum XM deposit through an ewallet is only $5. This can be made through neteller, skrill, perfect money, or a host of others dependent upon your country. At this time XM paypal deposits are not available.

Cryptocurrency deposit in the form of bitcoin is available but again this will depend on your location to determine if this option is open to you or not. There are no fees from the broker side for deposits through these methods.

Other XM deposit options

Other XM deposit options available include both western union and moneygram although these will depend on your location and fees may be applied for these services although not from the broker side.

Various local methods and local bank transfer deposits may also be open to you depending on your area. These minimum deposits will vary.

69.75% of retail CFD accounts lose money

XM minimum deposits

As with most low deposit forex brokers, beyond the funding methods, the XM broker minimum deposits may also depend on the account type you are holding. Here is a rundown of what to expect depending upon the account type you have.

Standard account

The XM standard account is available under every jurisdiction and with a very good value $5 being the minimum deposit here, it is easy to see why many choose to trade with it.

Islamic accounts are also available if you should require them.

Micro account

Again, the XM minimum deposit on their micro accounts is suitably small at just $5. These accounts facilitate trading in micro lots at excellent rates and are available to all traders in every regulatory area. Islamic traders are also catered for.

XM zero account

Changing things up slightly, we arrive at the XM zero account. This account type is available under cysec, FCA, and most of the countries regulated under the XM global market regulatory framework.

The spreads here are unbeatable starting at 0 pips although commissions are charged on trading. The XM minimum deposit for trading on these accounts is still just $100. This represents good value since you can also have access to your own VPS. Again islamic, shariah law compliant accounts are available.

Ultra low account

This XM low spread account type is available to traders based in australia and within the XM global market regulatory framework. This account comes with extra low spreads and no commission to worry about.

The minimum deposit on this account type is $50.

Shares account

Finally, the XM shares account which focuses on shares trading is available only within the XM global market regulatory area and with a $10,000 minimum deposit.

Related guides:

69.75% of retail CFD accounts lose money

Deposit bonus

XM bonus amounts and XM deposit bonuses are available though not to those regulated under cysec or FCA rules. Also, although you can receive bonuses under certain circumstances with XM, the bonus amounts themselves are typically not eligible to withdraw, though any profits derived from them usually are.

No deposit bonus

Unlike many brokers, an XM no deposit bonus is available. This means you can effectively start trading without any real money. While you cannot withdraw the bonus funds, you can withdraw any profits made from them.

This XM bonus amount is in the form of a $30 welcome bonus or the equivalent amount based on your account.

XM bonus program

An XM bonus program is in place. This program provides for a 50% deposit bonus up to $500 and then a further 20% deposit bonus on amounts up to $4500. This can be redeemed through trading with the broker. The only exception with this is that it is not available with XM ultra-low accounts.

69.75% of retail CFD accounts lose money

XM: login, minimum deposit, withdrawal time?

Recommended broker

XM is the brand name of trading point holdings limited. They own four subsidiaries, each with their own license.

In cyprus, XM is licensed by cysec. This regulatory body is authorized to work by the governing laws of cyprus when investigating broker firms. Cysec covers its clients’ funds with the ICF which permits for a compensation of up to €20 000 to be paid to traders in case the broker fails to pay its dues.

In australia, XM is certified by ASIC. As most regulatory bodies do, ASIC aims to enforce laws concerning the financial markets, and strives to deliver good investment environment.

XM is also regulated in the mesoamerican country of belize by their respective body: the international financial services commission (IFSC). Their main goal is to promote belize as a financial offshore center while also providing the appropriate regulatory measures to support said endeavor.

The average EUR/USD spread at XM is 1.6 pips, and goes as low as 0.1 pips for XM zero account (plus commission- read below). The leverage can go as high as 1:500. However, due to ESMA introduced laws the leverage in the UK and EU has been limited to 1:30.

XM provides a rich choice of assets, making sure that almost every taste is met accordingly. These are: forex cfds, commodities cfds, equity indices cfds, precious metals cfds and energies cfds.

Expanding XM even further is the baffling volume of languages available: english, australian english, russian, italian, polish, japanese, thai, czech, malaysian, greek, indonesian, swedish, arabian, portuguese, filipino, bengali, chinese, hungarian, french, german, spanish, vietnamese and dutch.

XM LOGIN

The inclusion of the two most popular trading platforms- MT4 and MT5- is not surprising.

METATRADER 4

MT4 is always a good reminder of just how far the industry has gotten. This platform holds the popularity title for many a reason: advanced charting tools, custom indicators, expert advisors and more. MT4’s VPS allow for seamless automated trading at all times, uninterrupted by computer failures, sudden power cuts or connectivity issues.

Average EUR/USD spread is 1.6 pips, and 0.8 pips for the XM zero account (including commission). Due to ESMA the UK and EU are limited to provide a leverage no bigger than 1:30. Offshore subsidiaries of trading point holdings limited are not bound by this rule and can afford a max leverage of 1:500.

XM zero account holders will be commissioned by $3.5 per side (7$ round turn) for every standard lot ($100 000), in turn changing the minimum cost of trading from 0.1 pips to 0.8 pips.

Besides the desktop version of MT4, there is also a neat web based alternative (no trading bots though). Get direct access to MT4 on virtually any device (mobile or tablet) operating with an android or ios operating system.

METATRADER 5

Offering more in pure quantity than MT4, MT5 has still a hard time replacing its predecessor mostly due to the fact that MT4 is universal, and essentially used by every online broker. Nevertheless, MT5 allows for full expert advisor support, has a built in economic calendar, more pending orders are available, has increased time-frames, and much more. Virtual private servers can be utilized as well.

The spread has not changed: with standard account it is 1.6 pips for EUR/USD. By adding the commission to the 0.1 pip spread for XM zero, account holder will get an actual spread starting from 0.8 pips.

In the UK and EU the leverage has been set by ESMA to 1:30 max. Outside of the EU and UK expect the leverage to be as high as 1:500.

The means of access to MT5 are various: desktop, web based platform, ios and android apps.

XM MINIMUM DEPOSIT

The minimum deposit is $5, and $100 if you’re using an XM zero account.

The broker purposefully retains payment methods information from non-deposited traders. From what we gathered, after extensive digging in the website and long customer support chat sessions, XM group is accepting multiple local payment methods including credit/debit card, skrill, bank wire transfer, etc. The full list of payment methods can be seen in user’s member’s area once an account is registered.

The base currencies at XM are: USD, EUR, GBP, CHF, AUD, HUF, PLN.

Wire transfer users will have to wait 2-5 days for their XM accounts to be funded. Card methods and ewallet deposits are instant.

The broker offers free of charge deposits for all methods except those made by wire transfer. If such is the case anything below a $200 (or other currency) will be billed with a commission by the broker.

XM WITHDRAWAL TIME AND FEES

Cysec regulations guarantee that all withdrawals will be safe and secure.

As mentioned above, payment methods are vague and unspecified unless you open an account. What we got from our own research is that XM group is accepting multiple local payment methods including credit/debit card, skrill, bank wire transfer, etc.

All withdrawals are processed within 24 hours. Users of XM card or any ewallet methods will receive their money on the same day the request has been processed, while wire transfer and credit/debit card user will have to wait 2-5 working days.

The minimum withdrawal amount is $5. However the amount does vary depending on the payment methods. And as specified, without an account you cannot see all available methods of payment.

XM covers the fee for wire transfer for 200$ withdrawal and above. Anything below will not be covered by XM and can be burdened with a fee by the client’s bank of choice. All other withdrawal methods are free of taxes.

BOTTOM LINE

XM is massive in both quantity and quality. The regulations mean business, but also security for clients, while the amount of content is, quite frankly, impressive to say the least.

However every rose has its thorns. In XM’s case it’s the commission for XM zero account holders, and the withheld information on deposits and withdrawals.

XM deposit and withdrawal methods in 2021

In our xm.Com broker review, we described the basic features and offers of this famous forex broker. In this article, we will analyze only deposit and withdrawal options.

XM is one of the leading foreign exchange (forex) brokers globally, and millions of traders worldwide are using XM for forex trading. Many of these forex traders are investing large amounts of money for forex trading. They would like to find out the XM deposit and withdrawal methods to make a decision accordingly. One of the factors affecting the choice of the deposit or withdrawal method is the country in which the trader is residing. Some payment/withdrawal methods are popular in each country due to several factors, and the trader will usually use that method since the fees will be less. Unless specified, the currencies for the deposit and withdrawal methods are USD, EUR, GBP, CHF, HUF, PLN, AUD.

XM deposit and withdrawal methods are online payment methods that XM forex broker allows for traders. XM.Com deposit and withdrawal methods are credit card, debit card, neteller, skrill, unionpay, bank wire. XM withdrawal options for partners are skrill, neteller, and bank wire.

XM offers payment options for traders, such as:

- VISA

- VISA electron

- Mastercard

- Maestro

- Diners club international

- Unionpay

- XM card

- Skrill

- Neteller

- Web money

- Bank wire

The minimum deposit for an XM account is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, $10 000 for SHARES accounts.XM minimum withdrawal value is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, while for SHARES accounts is $10 000. The minimum deposit value for the XM account and minimum withdrawal for the XM account is related to the type of order and not the payment method. Skrill withdrawal option is one of the most used payment methods, and the minimum deposit for skrill (withdrawal too) is based on account types.

XM deposit methods

How to deposit the XM account? There are several XM deposit options:

XM credit/debit card

XM accepts deposits using credit and debit cards from visa, visa electron, mastercard, maestro. The minimum deposit amount is $5, and the amount is immediately credited to the user’s forex account. There are no fees for using this deposit method. Since most people have a debit or credit card, this deposit method is widely preferred. However, most credit and debit cards have a limit, so the amount which can be deposited is also limited.

XM electronic payment

All the electronic payment methods have no fees and a minimum deposit of $5. Neteller, skrill, and unionpay are some of the electronic payment methods. For neteller and skrill, the amount is credited to the forex account immediately, while for union pay, the deposit will be processed within 24 hours. Cash only accepts USD deposits and przelewy24 accepts PLN deposits, and the amount is instantly credited to the forex account. For bitcoin, deposits in only three currencies, USD, EUR, JPY, are accepted, and it may take up to one hour for the payment to get processed.

XM banking

For sofort banking, deposits are only accepted in eur & GBP. Though the minimum amount is $5, and there are no fees, the deposit processing time will vary depending on the country. For conventional bank transfer of deposit amount in the forex account, at least two hundred USD or equivalent will have to be deposited in the forex account at a time. The fees depend on the bank, which is used. The amount deposited in the bank account will be credited to the forex account within two to five business days.

XM withdrawal review

If a user wishes to withdraw his money from the XM account, they will have to provide the know your customer (KYC) documents, which are specified. These documents are necessary to prevent money laundering according to the various regulatory bodies’ requirements in different countries. XM has an online and offline form where the customer’s personal information and background details have to be provided. This information will help XM in providing better service to their customers.

Compared to deposits, there are fewer withdrawal methods, which are discussed below. Unless specified, the XM user will have to withdraw at least five USD at a time, and there are no fees for withdrawal. The processing time for the withdrawal request is usually 24 hours on working days if the customer has completed the KYC requirements and submitted the documents required. These documents are the identity proof and proof of address of the trader. However, the amount will be credited to the linked bank account, usually only after three to five business working days.

XM credit cards and electronic payment

Visa, visa electron credit and debit cards, maestro and mastercard credit cards can be used for withdrawing funds. Unionpay is another option for fund withdrawal. Similarly, skrill ( earlier called moneybookers) and neteller are electronic payment methods used for fund withdrawal. Bitcoin can also be used for withdrawing the money in the XM account, though funds can only be withdrawn in USD, EUR, and JPY. Usually, credit/debit card withdrawals are given top priority by XM, followed by bitcoin withdrawals and neteller/skrill (e-wallet) withdrawals.

XM bank wire transfer

Many of the forex traders are trading in large amounts, and they prefer to make bank wire transfers to withdraw their profit.

The smallest amount permitted for making a withdrawal to a bank account is two hundred dollars. The withdrawal fees will vary based on the bank selected by the trader. The amount is usually credited to the bank account two to five business days after the withdrawal request is made. XM may process the bank withdrawal requests more slowly. The longest period XM bank wire transfer withdrawal was 5 days in my case in the last 8 years.

XM fund safety

To keep their clients’ funds, the forex traders, safe, XM is taking all measures to prevent unauthorized access to their information systems. All the funds of their clients are segregated and kept with the most reputed banks worldwide. Additionally, XM is also offering negative balance protection to their clients. XM has a risk management system implemented, which will ensure that the trader’s loss will be limited to the amount deposited with XM only.

Forex trading without any deposit

Many people are interested in forex trading yet do not have the money to take the risk. However, it is still possible to get some experience in forex trading without making a deposit.

XM no deposit bonus

To encourage people who are curious about forex trading, XM offers a $30 no deposit bonus to all those who create a new account with XM. This allows the new trader to take the risk of trading without risking his own money. The amount is directly credited to the live trading account and helps the trader understand market conditions.

XM demo account

XM also allows new traders to create a demo or virtual account to trade in forex with virtual money. The trader will be given $50,000 in virtual money for each account created, which he can use for trading, becoming familiar with the features, and testing strategies. A trader can create any number of demo accounts to practice trading. If the demo account is inactive for a long period, it will be deleted immediately.

Members area access

Use your MT4/MT5 real account number and password to log in to the members area.

New to XM?

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Change settings

Please select which types of cookies you want to be stored on your device.

Top 10 best paypal forex brokers 2021

Top rated:

Since the invention of the internet, retail online trading expanded incredibly.

Every day new people get connected started in online trading for the first time, bringing stiff competition among forex brokers to bring in new customers. Choosing the right broker is not an easy task either, and paypal forex brokers have certain advantages.

Brokerage houses fight for each customer, making it difficult picking the right broker to trade with. The payment methods used for depositing and withdrawing the funds is just one way to differentiate them.

Besides the classic credit cards and wire transfer, there are forex brokers that use paypal as an option to deposit or withdraw money. And, for a good reason.

By offering such an option, the trader has the chance to deposit funds without filling in all the credit card fields, and so on. Paypal already did that.

On top of that, it is an efficient, low cost and quick process to deposit funds in the trading account. Paypal forex brokers offer this funding option for all the advantages it brings: it’s a fast, secure, reliable and less expensive option to use for funding.

We’ve looked at a range of brokers and made a top ten best forex brokers with paypal list.

Table of contents

Top 10 paypal forex brokers

1. Etoro

Etoro tops the list of best forex brokers with paypal. It is no wonder. With over a decade of experience in offering access to financial markets, it revolutionized the traditional money management industry. The paypal option to fund or withdraw funds comes as complementary to the classical ways of banking with etoro. Regardless of the deposit method you utilize, there is a $200 minimum deposit with etoro.

Etoro is a really popular choice among new traders, both for the very user-friendly trading platform on offer, and also for the unlimited free demo account they provide for you to learn the ropes risk-free. The USD as a base currency is supported, and you may incur a small fee if you deposit another currency, though this fee and others can be eliminated or reduced if you join the excellent etoro club program that can reward your trading.

Compare brokers that accept paypal

For our paypal comparison, we found 6 brokers that are suitable and accept traders from united kingdom.

We found 6 broker accounts (out of 147) that are suitable for paypal.

Avatrade

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About avatrade

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider.

Pepperstone

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About pepperstone

Platforms

Funding methods

Cfds and FX are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading cfds.You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About XTB

Platforms

Funding methods

82% of retail investor accounts lose money when trading cfds with this provider.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About IG

Platforms

Funding methods

76% of retail investor accounts lose money when trading spread bets and cfds with this provider

Fxpro

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About fxpro

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About HYCM

Platforms

Funding methods

82% of retail investor accounts lose money when trading cfds with this provider.

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

Finding a broker that accepts paypal

For those who are interested in opening an account with a forex broker, there are several factors which need to be considered.

Firstly, the broker in question should be regulated and trustworthy. Beyond that though, other features, such as a wide variety of underlying assets and amenable spreads, are also important. For example, the available payment methods can be just as critical, as you must be able to withdraw and deposit funds in order to trade.

Why use paypal as a trading payment option?

One thing that makes paypal a great payment option is that it’s simple to use. With just a few clicks, you can make instant deposits while paypal’s service coverage is offered in 202 countries worldwide and in 52 different currencies, including but not limited to USD, CAD, EUR, DKK, JPY, GBP and INR.

Paypal also supports a wide range of payment platforms including e-banking, PLAN and MXN. Paypal allows you to make payments online through your email address. You can deposit money to your account, instantly send it to your broker and receive any payout and withdraw it to your bank. It also offers a safe and secure online platform for sending money and receiving money electronically.

Paypal’s system of paying fees can also suit trading well. There are no fees charged for opening an account, while the payment fees for paypal vary according to your location and the payment method used.

Advantages & disadvantages of using paypal as a payment option

There are many benefits of using paypal for forex trading, including:

- It’s very simple and easy to use. With just a few clicks, you can make your deposits.

- It has a wide coverage and is available internationally in over 200 countries and 52 currencies.

- Forex traders don’t need a credit card as paypal account allows receiving and sending money to up to 202 countries globally, including but not limited to USA, canada, UK, france and italy.

- Payments are instant and withdrawals take less time to reflect in your bank account in comparison to traditional bank transfers.

- Payments made via credit cards or paypal account balance are processed instantly.

- Withdrawal of funds to bank account take at most 3 business days to reflect in bank account once approved by your bank.

- Forex companies recognise paypal as a payment method for speeding up transactions. With the endless number of benefits for forex traders, we believe paypal is certainly the easiest convenience that any trader can ever need.

The main disadvantages of using paypal are that the payment processing fees may be higher in comparison to a bank transfer, depending on your country and currency. If you don’t already have an account, there is also the additional work involved in setting up and managing a new paypal account.

Why choose avatrade

for paypal?

Avatrade scored best in our review of the top brokers for paypal, which takes into account 120+ factors across eight categories. Here are some areas where avatrade scored highly in:

- 12+ years in business

- Offers 250+ instruments

- A range of platform inc. MT4, mac, mirror trader, zulutrade, web trader, tablet & mobile apps

- 24/7 customer service

- Tight spreads from 0.70pips

- Used by 200,000+ traders.

Avatrade offers four ways to tradeforex, cfds, spread betting, social trading. If you wanted to trade EURUSD

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

Avatrade have a AAA trust score. This is largely down to them being regulated by central bank of ireland, ASIC, IIROC, FSA, FSB, UAE and BVI, segregating client funds, being segregating client funds, being established for over 12

Trust score comparison

| avatrade | pepperstone | XTB | |

|---|---|---|---|

| trust score | AAA | AAA | AAA |

| established in | 2006 | 2010 | 2002 |

| regulated by | central bank of ireland, ASIC, IIROC, FSA, FSB, UAE and BVI | financial conduct authority,UK and ASIC | financial conduct authority |

| uses tier 1 banks | |||

| company type | private | private | private |

| segregates client funds |

A comparison of avatrade vs. Pepperstone vs. XTB

Want to see how avatrade stacks up against pepperstone and XTB? We’ve compared their spreads, features, and key information below.

XM deposit bonus: policies and limitations

Platform

Expiration

Min. Volume

If you are someone who trades on the forex market for a while now, you shall definitely know the XM forex broker. As that is undeniably one of the most reliable and trustworthy ones out there. However, if you are a beginner, you shall undeniably consider taking a look at it. This is a broker you should go for if you are looking for trust and reliability, as well as if you are seeking for the beneficial XM deposit bonus.

With the metatrader 4 and metatrader 5 platforms, the brokerage gives you a wide spectrum of ways to increase your trading profit. Moreover, that allows you to get the deposit bonus we will talk about in more details in that article. Reliability is vital for one to make a deposit with a broker and this is why we have decided to highlight the main points of the XM deposit bonus. However, now without any hidden conditions, XM gives you an impulse with their new deposit bonus for you to start trading right away. Should you or shouldn’t you go for it? Find out in the XM bonus review!

XM deposit bonus description

XM forex broker guarantees that your account will be increased by 50% for any deposit below $1,000. Thus, if you deposit, for instance, $50, then you will get an additional bonus of $2.50. And your trading capital will reach $7.50.

However, the maximum amount of the bonus that might be received equals $500. That means that you are granted a 50%-bonus only until your deposit does not exceed $1,000.

Once your deposit amount is more than $1,000, you will still have that 50% added on the first $1,000 of your deposit. Also, 20% will be given as a bonus for any amount more than that.

This means if you deposit an amount of USD $22,500, your account balance will become USD $28,500. The math on this is pretty simple and you can see it in more details in this table:

Any account holder can have his own bonus! No matter if you are a new customer or have been trading with XM for years. However, as you see from the table above, the biggest bang for your buck can be achieved with actually a $1,000 worth deposit.

XM bonus limitations

That is important to mention that the bonuses are not available on the XM ultra low account, as well as on the XM shares account.

This is not a limited one-time deal offer. If a client an XM bonus deposit worth $250 four times, $125 will be added each time to the account until it reaches the $1,000. However, the maximum bonus a person can receive is $5,000. Trading bonus is there to help new and existing clients to hold their positions open for a longer period. XM forex bonus is not eligible for clients registered under trading point of financial instruments ltd and trading point of financial instruments UK ltd.

XM trading bonus withdrawal policies

Even though getting a deposit bonus is easy with that broker, the withdrawal procedure is not that primitive. And is rather targeted to make traders leave the funds on their accounts.

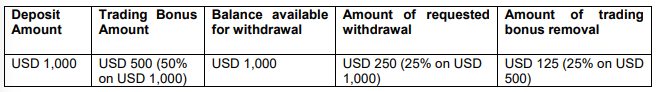

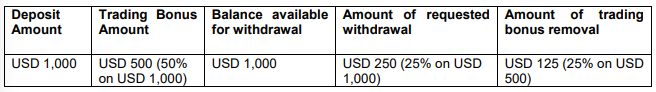

Therefore, when you are trying to withdraw funds from your XM bonus account, the broker will charge you with the amount of the bonus that will be proportional to the amount of the funds for withdrawal. Just to illustrate: imagine you deposited $1,000 and you were given $500 as a bonus (50%). Then you decided to withdraw $250 (25%) out of $1,000 available, as you still can’t withdraw the bonus. As a result, a total sum of $125 (25% of the bonus) will be removed.

But, for instance, if you have managed to generate some additional profit, then the picture will be a bit different. Imagine that you have deposited $1,000, received a $500 worth XM deposit bonus, and things turned out to be great for you. And you gained a profit of $2,000 from trading. Now you have $3,000 available to withdraw and you want to take them all out of the account. In that case, $500 of the bonus will be removed just because that will equal 100%. Maybe the table will help you to understand that easier:

Another XM bonus program

XM forex broker is constantly coming up with innovative bonus programs that will ensure that traders will stay loyal and interested. Thus, augmented XM points service was recently launched as an added bonus one may use while trading on the platform. You can subscribe and unsubscribe to that any time you want without any restrictions.

XMP has a status of reward for the loyal customer. Thus, as you trade, you received those bonus points that might be later transferred to the monetary bonus. That can be calculated in the following way:

However, in order to received XMP in the first place, you need to create an account and sign up for the loyalty program. There are several you may choose from XM executive, XM gold, XM diamond, XM elite.

If you are the part of the executive loyalty program, then you will receive 10XMP per lot straight away. If you are the gold loyalty program’s member, then you will receive 13XMP per lot after at least 30 days of trading. If you are a member of diamond loyalty program, then you will be guaranteed to receive 16XMP per lots only after 60 days of trading on the platform. Finally, if you are the holder of elite loyalty program, then you will be provided with 20XMP per lot after 100 days of trading with XM broker.

So, imagine you have 10,000XMP gained and you have decided to redeem 3,000XMP. Then, according to the formula provided above, you will receive $1,000 of bonus and will still have 7,000XMP on your account to convert and withdraw later.

However, there are some details worth mentioning when it comes to withdrawal of XMP from an account. For instance, you have 3,000XMP to redeem and you have gained an additional $1,500 while trading that you are allowed to withdraw. You have decided to withdraw only the part of it, $750, which is 50% of the total sum stored on the account. That means that the same 50% will be removed from your XMP bonus, which will equal $500 (3,000XMP / 3= $1,000). Take a look at the table below to understand the process better:

XM broker account types

There are various account options available while registering with the XM broker. Thus, you can choose between micro, standard and XM ultra low one. They differ depending on the size of lots, as well as the minimum deposit rate and leverage, availability of the bonus.

- The micro account has a leverage of 1:1 to 1:888, the spreads can be as low as 1 pip, the minimum deposit can be $5, the minimum trade volume is 0.01 lots, and there is no commission charged. However, you won’t be able to obtain an XM deposit bonus on that account.

- The standard account has a leverage of 1:1 to 1:888, the spreads can be as low as 1 pip, the minimum trade volume is 0.01 lots, the minimum deposit is $5 as well. And you can obtain bonus using that account.

- The XM ultra low account has a leverage of 1:1 to 1:888, the spreads can be as low as 0.6 pip, the minimum deposit should be at least $50, the minimum trade volume is 0.01 lots, and there is no commission charged. And you cannot get the bonus on that account as well.

Among the currencies available for trading there are:

- USD

- EUR

- GBP

- JPY

- CHF

- AUD

- HUF

- PLN

- RUB

Advantages

Even though we would recommend you to open an account with XM, there is one big benefit of the XM deposit bonus. It comes with a multi-account availability. When an XM bonus deposit comes to an account and then it’s transferred to another one, the bonus value will be transferred as well! The system calculates the share of the bonuses that should be transferred and makes sure you get an equal proportion on your other account. This is quite comfortable, as many brokers would simply remove your bonus if you try to move funds from one account to another.

Subscribe to receive updates about FX bonuses

Be the first one to find out about available forex trading bonuses that can be trusted

XM deposit and withdrawal methods in 2021

In our xm.Com broker review, we described the basic features and offers of this famous forex broker. In this article, we will analyze only deposit and withdrawal options.

XM is one of the leading foreign exchange (forex) brokers globally, and millions of traders worldwide are using XM for forex trading. Many of these forex traders are investing large amounts of money for forex trading. They would like to find out the XM deposit and withdrawal methods to make a decision accordingly. One of the factors affecting the choice of the deposit or withdrawal method is the country in which the trader is residing. Some payment/withdrawal methods are popular in each country due to several factors, and the trader will usually use that method since the fees will be less. Unless specified, the currencies for the deposit and withdrawal methods are USD, EUR, GBP, CHF, HUF, PLN, AUD.

XM deposit and withdrawal methods are online payment methods that XM forex broker allows for traders. XM.Com deposit and withdrawal methods are credit card, debit card, neteller, skrill, unionpay, bank wire. XM withdrawal options for partners are skrill, neteller, and bank wire.

XM offers payment options for traders, such as:

- VISA

- VISA electron

- Mastercard

- Maestro

- Diners club international

- Unionpay

- XM card

- Skrill

- Neteller

- Web money

- Bank wire

The minimum deposit for an XM account is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, $10 000 for SHARES accounts.XM minimum withdrawal value is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, while for SHARES accounts is $10 000. The minimum deposit value for the XM account and minimum withdrawal for the XM account is related to the type of order and not the payment method. Skrill withdrawal option is one of the most used payment methods, and the minimum deposit for skrill (withdrawal too) is based on account types.

XM deposit methods

How to deposit the XM account? There are several XM deposit options:

XM credit/debit card

XM accepts deposits using credit and debit cards from visa, visa electron, mastercard, maestro. The minimum deposit amount is $5, and the amount is immediately credited to the user’s forex account. There are no fees for using this deposit method. Since most people have a debit or credit card, this deposit method is widely preferred. However, most credit and debit cards have a limit, so the amount which can be deposited is also limited.

XM electronic payment

All the electronic payment methods have no fees and a minimum deposit of $5. Neteller, skrill, and unionpay are some of the electronic payment methods. For neteller and skrill, the amount is credited to the forex account immediately, while for union pay, the deposit will be processed within 24 hours. Cash only accepts USD deposits and przelewy24 accepts PLN deposits, and the amount is instantly credited to the forex account. For bitcoin, deposits in only three currencies, USD, EUR, JPY, are accepted, and it may take up to one hour for the payment to get processed.

XM banking

For sofort banking, deposits are only accepted in eur & GBP. Though the minimum amount is $5, and there are no fees, the deposit processing time will vary depending on the country. For conventional bank transfer of deposit amount in the forex account, at least two hundred USD or equivalent will have to be deposited in the forex account at a time. The fees depend on the bank, which is used. The amount deposited in the bank account will be credited to the forex account within two to five business days.

XM withdrawal review

If a user wishes to withdraw his money from the XM account, they will have to provide the know your customer (KYC) documents, which are specified. These documents are necessary to prevent money laundering according to the various regulatory bodies’ requirements in different countries. XM has an online and offline form where the customer’s personal information and background details have to be provided. This information will help XM in providing better service to their customers.

Compared to deposits, there are fewer withdrawal methods, which are discussed below. Unless specified, the XM user will have to withdraw at least five USD at a time, and there are no fees for withdrawal. The processing time for the withdrawal request is usually 24 hours on working days if the customer has completed the KYC requirements and submitted the documents required. These documents are the identity proof and proof of address of the trader. However, the amount will be credited to the linked bank account, usually only after three to five business working days.

XM credit cards and electronic payment

Visa, visa electron credit and debit cards, maestro and mastercard credit cards can be used for withdrawing funds. Unionpay is another option for fund withdrawal. Similarly, skrill ( earlier called moneybookers) and neteller are electronic payment methods used for fund withdrawal. Bitcoin can also be used for withdrawing the money in the XM account, though funds can only be withdrawn in USD, EUR, and JPY. Usually, credit/debit card withdrawals are given top priority by XM, followed by bitcoin withdrawals and neteller/skrill (e-wallet) withdrawals.

XM bank wire transfer

Many of the forex traders are trading in large amounts, and they prefer to make bank wire transfers to withdraw their profit.

The smallest amount permitted for making a withdrawal to a bank account is two hundred dollars. The withdrawal fees will vary based on the bank selected by the trader. The amount is usually credited to the bank account two to five business days after the withdrawal request is made. XM may process the bank withdrawal requests more slowly. The longest period XM bank wire transfer withdrawal was 5 days in my case in the last 8 years.

XM fund safety

To keep their clients’ funds, the forex traders, safe, XM is taking all measures to prevent unauthorized access to their information systems. All the funds of their clients are segregated and kept with the most reputed banks worldwide. Additionally, XM is also offering negative balance protection to their clients. XM has a risk management system implemented, which will ensure that the trader’s loss will be limited to the amount deposited with XM only.

Forex trading without any deposit

Many people are interested in forex trading yet do not have the money to take the risk. However, it is still possible to get some experience in forex trading without making a deposit.

XM no deposit bonus

To encourage people who are curious about forex trading, XM offers a $30 no deposit bonus to all those who create a new account with XM. This allows the new trader to take the risk of trading without risking his own money. The amount is directly credited to the live trading account and helps the trader understand market conditions.

XM demo account

XM also allows new traders to create a demo or virtual account to trade in forex with virtual money. The trader will be given $50,000 in virtual money for each account created, which he can use for trading, becoming familiar with the features, and testing strategies. A trader can create any number of demo accounts to practice trading. If the demo account is inactive for a long period, it will be deleted immediately.

Paypal

Technical analysis – paypal stock eases slightly; maintains long-term bullish outlook

Paypal stock has reversed back down after it failed to hit the 81.20 resistance level, achieved on july 31. The price rebounded on the five-month low of 74.40 but the technical indicators are signaling weak upside movement. The RSI indicator was moving upwards but it now appears to be turning slightly to the downside, while the MACD oscillator remains in the negative zone and is heading higher. If price action jumps above 81.20 (immediate resistance), there is scope to test 84.14, which stands near the [..]

Legal disclaimer: the material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instruments. XM accepts no responsibility for any use that may be made of these comments and for any consequences resulting in it. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. The research and analysis does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it.

It has not been prepared in accordance with legal requirements designed to promote the independence of research, and as such it is considered to be marketing communication. Although we are not specifically constrained from dealing ahead of the publication of our research, we do not seek to take advantage of it before we provide it to our clients. We aim to establish, maintain and operate effective organisational and administrative arrangements with a view to taking all reasonable steps to prevent conflicts of interest from constituting or giving rise to a material risk of damage to the interests of our clients. We operate a policy of independence, which requires our employees to act in our clients’ best interests and to disregard any conflicts of interest in providing our services.

Cfds are leveraged products. CFD trading may not be suitable for everyone and can result in losing all of your invested capital, so please make sure that you fully understand the risks involved.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Forex trading with paypal

Different forex brokers differ by different things. And even though most of traders prefer to make comparisons according to features like bonus systems, trading platforms and even additional options like education centre, possibility to hedge and auto trade, some forex members consider their choice as to the payment methods a website offers. According to this specification in a forex broker trading system, most of traders prefer to stay at paypal forex brokers. These are brokers they believe are the most secured ones since their payment system is well-known as one of the safest e-payment platforms. But let us give you some more information about paypal forex brokers now, so you might think over them in your own way and see if they should be also your favorite trading arenas.

What is paypal and why traders love it so much?

Paypal is a very popular and world wide known payment system. It began as a simple method for shopping online and currenlty they are thousands of different online stores and shops, where paypal is yet allowed for making payments or sending refunds. Later, paypal has gained even more popularity and it spread in many different areas in internet. As a result of this it ended up to be considered as a universal payment system that can be even used for more serious and significant payments such as paying salaries, for instance. Today, forex brokers – or at least some of them – have also adopted paypal as one of their main ways to make deposits and to claim for withdrawals. Forex traders love it, because they know it and they are completely aware how secured and safe this way for paying is. And since trading at the forex market has a big business with money, safety is supposed to be considered all the time and this makes paypal one of the most preferred systems ever. Moreover – paypal makes its paypal forex brokers quite favorite for many traders, too. The system, by the way is based in USA, but it is allowed for using for all the internet customers with no limits and restrictions. People from all the round have found paypal as their e-payment approach and paypal forex brokers are not exceptions in this rule.

How to find paypal forex brokers?

Don’t get deluded that all the forex brokers use paypal. The financial policy of each trading and financial services provider company is different and some brokers just do not accept paypal as their favorite. Though, you can find many paypal forex brokers with an ease. Before giving you some tips about this task, note that there are really a lit of trading platforms that uses paypal, so you are able to get your best shot very easy and quickly:

- Find them among our forex broker reviews, because we always mention the payment methods in them. Besides, save for getting the proper paypal forex brokers, you will also be prepared with more additional information about their platforms, while reading our reviews.

- Get some information from a friend or pro. The advanced players are experienced enough to avoid looking for a good broker due to its bonus system, but prefer to find decent platforms with good facilities and 100% safety. Payment methods and the availability of paypal are parts of this criteria.

Why using paypal forex brokers?

There are many features that paypal rewards you with, but as to the trading experience, it offers you the following pros:

- Safety at the highest level with no exception and restrictions about traders and their experience level or origin.

- Simplicity – paypal is integrated in many websites that uses it and due to this, when you are in a rush and out of money, making a deposit will be very easy.

- Paypal is directly connected to your credit or debit card, but in addition to this it protects it from any types of frauds.

Consider paypal forex brokers, because they are indeed 100% secured and simplified as to the dynamic trading activity by all means!

So, let's see, what we have: discover the XM minimum deposit needed to open an account, and the best way to do it, depending on base currencies, funding methods and deposit bonuses. At xm paypal deposit

Contents of the article

- Top forex bonus promo

- XM minimum deposit guide (2021)

- XM account base currency

- XM funding and deposit methods

- XM minimum deposits

- Deposit bonus

- XM: login, minimum deposit, withdrawal time?

- Recommended broker

- XM LOGIN

- XM MINIMUM DEPOSIT

- XM WITHDRAWAL TIME AND FEES

- BOTTOM LINE

- XM deposit and withdrawal methods in 2021

- Members area access

- New to XM?

- Top 10 best paypal forex brokers 2021

- Top 10 paypal forex brokers

- Compare brokers that accept paypal

- We found 6 broker accounts (out of 147) that are...

- Avatrade

- Pepperstone

- Spreads from

- What can you trade?

- About pepperstone

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About XTB

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About IG

- Platforms

- Funding methods

- Fxpro

- Spreads from

- What can you trade?

- About fxpro

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About HYCM

- Platforms

- Funding methods

- Finding a broker that accepts paypal

- Why use paypal as a trading payment option?

- Advantages & disadvantages of using paypal as a payment...

- Why choose avatrade for paypal?

- A comparison of avatrade vs. Pepperstone vs. XTB

- XM deposit bonus: policies and limitations

- XM deposit bonus description

- Another XM bonus program

- XM broker account types

- Advantages

- XM deposit and withdrawal methods in 2021

- Paypal

- Technical analysis – paypal stock eases slightly; maintains...

- Forex trading with paypal

- What is paypal and why traders love it so much?

Comments

Post a Comment