Pay someone to trade Forex for me, Can someone day trade for me, pay someone to trade forex for me.

Pay someone to trade forex for me

Pay someone to trade forex for me is the question of most investors, the forexsq financial experts answer the question of can someone day trade for me?

Top forex bonus promo

The answer is yes but below is how you must do it. However some forex managed account companies like fxstay team use international money managers around the world in their team to handle trading for you but there are alot of companies who are not qualified that you pay them to handle trading on your forex account.

Pay someone to trade forex for me, can someone day trade for me?

Pay someone to trade forex for me is the question of most investors, the forexsq financial experts answer the question of can someone day trade for me? The answer is yes but below is how you must do it.

Can someone day trade for me

Last week forexsq experts got an email and someone asked can someone day trade for me? Another investor from different country asked is it possible to pay someone to trade forex for me? The simple answer is yes you can pay someone to trade forex for you, many forex managed accounts brokers or hedge fund managers companies provide you such this service and can trade on your behalf. You open forex account and give the user and password and they trade for you and after a while share profit with you, but this is the good part of paying someone day trade for you and handle trading for you.

However some forex managed account companies like fxstay team use international money managers around the world in their team to handle trading for you but there are alot of companies who are not qualified that you pay them to handle trading on your forex account.

So what is the best answer to the question of “pay someone to trade forex for me?” the forexsq experts suggest if you want to paying some trade on stock markets or forex market then share your main capital between several managed companies and after while increase your investment with those companies that you like their trading style and bring you more profit.

Pay someone to trade forex for me conclusion

Now you know how to pay someone to trade forex for me so if you like this article so tip forexsq experts please by share this article on social media networks and help other investors to know about can someone day trade for me ?

Can you get someone to trade forex for me, on my behalf?

Finding a team to administer your FX trading that you have confidence in is crucial. Acorn2oak offers you a totally FREE service that allows you to compare the best services, all in one location. We will link you up with money managers who will share their performance reports to make sure you have all the information you need prior to making a deposit.

Our top priority is to help you with administered FX by providing specialist advice and guidance to help you save time and money. If you want to benefit from this FREE service that allows you to compare services, please enter your details in the form above, it takes less than a minute.

Managed FX accounts services

Here at acorn2oak, we have pre approved a range of providers that we believe put the performance of their investor’s accounts first. They offer:

• access to trading teams with considerable experience in managing money

• A range of deposit levels in multiple currencies

• full 24 hour 7 days a week transparency so you can view your account

• A proven trading strategy that has demonstrated consistent returns

More and more individuals are attracted to fund administration for their trading account because they simply don’t have the time to buy and sell or are yet to access the profits of the markets. If this is you we have made it our number one goal to connect you with the highest quality of services that best suit your requirements.

Let acorn 2 oak connect you to a range of regulated providers currently available

Benefits of our service

We provide instant access to performance reports of managed FX providers

- Managed FX guides to assist you with your due diligence

- Up to date performance reports

- Tailor made quotes to suit your requirements

We only deal with regulated providers

- Acorn 2 oak code of conduct

- Existing investors feedback

- Returns independently verified

Make a smarter forex investment and save money by choosing the best provider for you

- Here you can find regulated managed forex account providers

- Free quotes from up to 4 providers

- Compare managed FX providers in one place

Are you a managed FX provider looking for investors?

Testimonial

“acorn 2 oak connected me with a leading provider that had the consistent returns I was looking for. I would never have found them without using the free service at acorn 2 oak”

The smarter way for traders to find forex opportunities

Thousands of traders looking to find a forex provider, carry out your search here

Can you get someone to trade forex for me, on my behalf?

Can I get someone to trade forex for me, on my behalf? I hear you ask.

Yes you can.

In fact, paying someone to buy and sell in the forex market for you is a becoming a popular thing to do and increasingly more so as folk, like yourself, discover them. They are a relatively unknown investment, that historically have been only accessible to large financial institutions and investors with a lot of money behind them. With the advent of the internet and high speed broadband connections, they have become accessible to everyone.

You are probably wondering how it is done, well, I will tell you.

It is all very straightforward. First of all you don’t need to go out and find a trader for yourself, nor do you need to negotiate deals with them. No, it is all done for you. You end up paying them to buy and sell currency for you but it is taken out of the profits that they make for you.

This type of trading is called managed FX trading, and you can read all about them on this site, starting here acorn2oak-fx.Com.

In summary though, this is what happens –

• you open up a forex trading account in your name.

• you fund the account.

• you give the trader an LPOA (limited power of attorney). This enables them to buy and sell FX for you.

• they do the buying and selling for you.

• the trader takes a performance fee from the profits. Usually 25% to 50%. Although I have found one that only charges 15% .

• you withdraw funds whenever you want to.

Quite simple really: as I said, you will find much more info on this site, FAQ, due diligence etc.

COMPARE LEADING FOREX FUND MANAGERS – GET YOUR PERSONALISED QUOTE NOW

Can I pay someone to trade forex for me? 2020

“is it possible to pay someone to trade forex for me?”

I have heard that phrase many times during the time I have been involved with this website and my other websites.

The simple answer to this question is that, yes, there are companies that trade forex on your behalf.

The word “pay” is slightly erroneous because you don’t actually pay the company from your own money, the forex trader will get his payment from the profits that you make on your account. So yes, he gets paid because of you but it doesn’t actually cost you anything.

The type of investment that will get someone to trade for you is called forex managed accounts. Check out our sister site www.Acorn2oak-fx.Com/managedforexaccounts/blog/ukcitizens.Html they are not widely known as they are a type of alternative investment and are therefore different from traditional investments such as insurance, savings accounts, bonds, mutual funds etc.

A managed account that will trade your forex account for you are becoming more and more popular year by year, mainly because ease of access.

Only a decade ago, it was only high net worth individuals and institutional investors that had a minimum of 100,000 dollars and more often 1,000,000 dollars to take part in this investment, and they had to be invited to join.

Nowadays, managed forex companies will trade forex on your behalf with as little you depositing a minimum opening balance of £5,000 or $10,000 dollars. Some companies will let you start with as little as $1,000, but I would be very aware of these companies as the will not be regulated by the regulating body, such as the FCA (financial conduct authority) in the UK.

Why let someone trade forex for you? A little background information

People that want to invest their funds will discover a forex managed trading account an ideal medium to build up profits in the long term as they start to soar over time because of the compounding effect of those profits. Read more on our page www.Managed-forex-accounts.Info

For the short term investors such as pensioners and those that want a monthly income it could be an ideal investment because funds can be taken out as a portion of their month to month cash flow.

Forex trading has the potential to make great profits for customers. Nevertheless, before investing into a managed currency exchange account, there are numerous questions that should be considered. Below, I found some of the most common concerns that clients ought to weigh up.

Most importantly, while aiming to obtain the largest profits, the chief objective of the trader and management team is to protect the investment of the depositor. Many trading groups will have a maximum drawdown limit to keep losses to a quantified amount. Depending on saver’s individual risk profiles, these drawdown limitations need to be considered.

Account managers make their money by charging the client a performance fee. They fluctuate with various firms but usually they are between 25 to 50 per cent. Don’t let the larger fees discourage you because in numerous instances, the profits are much greater than those whose performance fees are smaller.

A limited power of attorney (LPOA) is granted to the agent by the depositor so that the dealer can access the account merely to position the trades. Dealers will not be able to withdraw funds from depositor’s account aside from performance charges.

The FX market does not have a central location and is dealt all over the planet which means that operating can happen twenty four hours each day.

The client can withdraw cash and add capital from the trading account as and when they like since they have total control of the account. It is in the client’s name or business name. As long as all positions are closed, the account can be closed down at any time.

The operating platform that the traders use to position the dealings can be loaded down onto the depositor’s laptop or computer. It will be in view only mode, however and the depositor cannot position any transactions on it. If any transactions are occurring at the time, the customer can view them taking place as they take place. Reports will be able to be downloaded from the trading system.

The smallest investment sum differs from managed foreign exchange group to group. Some begin with as little as £5,000 or $10,000 dollars to begin, and the larger revenue accounts may need millions to commence.

Managed FX accounts are perfect for clients who have no time or aspiration to study how to deal on their own. It is the fact that it is a hands off alternative investment that many investors find quite attractive.

The amount of cash that changes hands every single day is in the vicinity of five trillion dollars so it can’t be swayed by other factions as does the stock market.

Summing up paying someone to trade forex for you has the potential to create big returns whatever the fees are incurred and kind of account so they are a superb investment option. Leaving income to build over time is the key element conversely because in a handful of years, they will go through the roof due to compounding profits.

Investors who put money into a foreign currency account are keen on the fact that it is a hands free category of investment which allows them to take profit from the forex marketplace without having to do all of the work.

Can I get someone to trade forex for me? (auto trading explained)

Are you a newbie forex trader? If yes, then you must be new to different terms and concepts of the forex market. As a newbie forex trader, you don’t want to lose money and learn. When you are completely new to this market, you have two options – either learn to trade from scratch or get someone to trade forex on your behalf.

So can you get somebody to trade forex for you?

Yes, you can get someone to trade forex on your behalf. There are so many professional forex traders out there in the market that can help you with forex trading. Getting this type of service to allow you to invest in the market without having expert-level knowledge. New traders often choose this kind of service, because this way they invest in the market and reduce the chances of losing money.

FOREX managed account brokers

A forex managed account is the account managed by the professional forex trader on behalf of his/her client. There are so many forex managed account brokers out there in the market. If you don’t want to spend time doing research, studying the market, and invest in the forex, then you can hire a professional forex trader or money manager for it.

The professional trader you hire will keep an eye on trading opportunities and based on his/her knowledge & experience, he/she will manage your forex trading account.

A managed forex account can be compared with the investment accounts of equities. These are the accounts in which the manager handles the account. Before hiring a particular forex professional to trade on your behalf, the money manager (forex professional) and you (client) have to sign a contract.

The signed agreement or document states that the client allows the trader to trade in the forex market on his/her behalf. By getting someone to trade forex on your behalf, you will not require any technical knowledge or skills regarding the forex market. Apart from this, this also helps you to save a great amount of time.

This way, you do not have to spend time researching the market and learning how to trade. While hiring someone trade forex for you, make sure the hired forex professional is reliable and trustable.

Pros & cons of letting someone trade forex for you

Whether you invest in the market by yourself or let someone trade for you, both of them have their pros and cons. Which one you should choose is based on your situation.

Pros of letting someone trade forex for you

Here are some benefits of getting someone trade forex for you:

1. You don’t have to spend time researching

The major headache in trading forex is you have to spend a huge amount of time doing research and understanding the market. If you don’t have enough time sitting and doing research, then letting someone trade forex on your behalf is a good idea. This way, you can avoid getting bored by doing research and looking at data charts for hours.

2. You don’t have to spend time studying the forex

If you are a newbie and want to start investing in the forex market, you have two options first, hire someone trade forex for you and the second one, trade forex by yourself. The major advantage of getting someone to trade forex for newbies is they don’t have to spend a huge amount of time studying the forex. When you have someone trading on your behalf, you don’t have to worry about studying from scratch (if you are new to the market)

Cons of letting someone trade forex for you

There are also some cons of letting someone trade forex for you. Here are some cons:

1. Hiring a professional forex trader can be expensive

The major disadvantage of hiring a professional trader is it can be really expensive. When you hire someone to trade for you, you have to pay commissions, depending upon the expertise of the trader.

2. Not all of them are reliable

While getting someone trade forex for you, you need to make sure that the professional you have selected is trustable and reliable. You don’t need to give access to your account and money to some stranger or the person you don’t trust. Hence, getting the wrong person for this may result in huge losses.

So these are some pros and cons of letting someone trade forex on your behalf. Depending upon your situation, this could be ideal for you. Now let’s discuss some pros and cons of trading forex by yourself.

Pros & cons of trading the forex by yourself

If you have got knowledge and experience in the forex market, then it is advisable to trade by yourself. Again, trading by self has its own pros and cons. Here’s the list:

Pros of trading the forex by yourself

Are you an experienced forex trader? Then, you should trade by yourself. Here are some major advantages of trading in the forex market on your own:

1. You don’t have to pay commissions

Hiring a professional forex trader for trading on your behalf can be expensive. And, this may not be suitable for each and every person out there. The best thing about trading your own is you do not have to pay any commission and you will earn all the profits you make. You will be responsible for the profits or losses that occur. So, if you have experience in forex trading, you should not hire anyone to trade on your behalf.

2. Don’t worry about finding the right trader

Another advantage of doing it yourself is you do not have to worry about finding the right professional forex trader. For the people who want to hire someone who can trade on their behalf, they have to mess with finding the right person. It is essential because no one would like to give account access & money to the professional who is not trustable.

Cons of trading the forex by yourself

There are also some disadvantages when it comes to doing forex trading your own. Here are some of them:

1. You have to mess with researching

If you don’t like researching and spending long hours looking at data charts, then you should consider hiring a professional who can trade forex on your behalf. In order to make correct decisions and make the most, it is important to focus on the research part. So, the major disadvantage of trading the forex by yourself is you have to spend long hours doing research.

2. You need to learn so much

If you are a complete beginner in this field, you should not simply start doing trading. If you get started in this field without having proper knowledge, the chances are you will lose. For a newbie, it is advisable to gain proper knowledge then get started with forex trading. Hence, if you want to trade forex by yourself, you have to spend a great amount of time learning.

Conclusion

So, the answer to this question is yes, you can get someone to trade forex on your behalf. By getting someone to trade for you, you will be worry-free and stress-free. This way, you do not have to worry about doing market research and spending long hours looking at data charts.

Forex managed account brokers provide this kind of service. They are the professional forex traders. While hiring someone to trade on your behalf, keep in mind the trust and reliability factor. It is essential because you should not give your account access to the stranger or someone unreliable.

Is it worth it to pay someone to trade for you?

Can you pay someone to do your active trading for you? Yes, you can.

Some people love to trade - they love following the markets and the day-to-day work involved with trading. But it isn't for everyone. Not everyone wants to spend their time looking at the markets, and entering orders.

I like doing all this - but I am a bit of a geek. It's entirely possible you won't like doing the work of trading, but you'd still like to get the returns. You want the gain with less pain -and it's possible.

It's really common to pay people for active trading in the stock market. It's just called "mutual fund investing" instead of "paying someone to actively trade a passive, low return/high risk system for me". (by the way, I don't like the word "investing" - I'll tell you why in a bit.)

In a mutual fund, the manager gets paid for selecting stocks, and charges fees to cover the costs of trading. So it's not much of a surprise you can pay someone to actively trade for you in other markets, too.

If you want someone to do all of the work of trend following for you, there are at least two strong choices:

You can hire a broker to "auto-trade" trading signalsyou can open an account and have a commodity trading advisor (CTA) trade for you. Both options are more costly than doing the trading yourself. The extra costs might be worth it for you.

Entering the trades for a trend trading system is not hard work, and it doesn't require a PHD in physics. It's certainly something most people can do if they put their energy into it.

But it does require consistent work. It does require time every day.

Some people don't feel like they have time to do this every day or they simply don't want to do the work. I don't blame them. The work can be boring, and some people just don't like doing it.

It's like changing the oil in your car yourself. It's not hard work, but there are about 1,000,000 things I'd rather do than change the oil in my car.

When I was a teenager, I changed the oil in my car myself to save a few bucks. I know how to change the oil in a car, and it doesn't take more than 15 minutes to do on your own.

But now I take my car to the quick change oil place. It's tedious, grimy work that I would much rather pay someone else to do. It costs a few bucks more to have someone change the oil for me, but it's so worth it for me.

It might be worth it to you to have someone do execute a trend trading system for you.

Auto execution of futures trading signals many futures brokers will auto-execute a trading system for you. All you need to do is setup an account with the broker, and let them know what service you're using. They will do the rest of the work for you.

This is a good way to go if you still want to trade in your own account. You have the ability to place trades in your account when you choose.

The fees you'll pay a broker for this can vary widely, depending on the levels of service.

You'll need to sign some paperwork called either a "letter of direction" or "limited power of attorney", depending on the exact system.

The limited power of attorney gives the broker the ability to place trades in your account according to the directions given by a newsletter or other trading signal provider.

The limited power of attorney (usually) does not give the broker the ability to remove or transfer funds from the account. That's the "limited" part. Please read any agreement carefully before signing anything .

You can use a letter of direction with a 100% mechanical system.

Commodity trading advisors you can also have someone simply do all of the trading for you. Commodity trading advisors - usually just shortened to CTA - take care of every part of the execution of a trading system.

CTA's are a bit harder to find.

CTA's can't advertise - they can only actively solicit people who have a rather high net worth. It's not like you are going to see internet advertising for different CTA's - you'll have to do nearly all of the legwork yourself.

Here is the good thing - many CTA's are trend followers.

Here the bad thing - most CTA's don't take small accounts. Many trend following ctas end up being very successful, so they stop taking small accounts.

You'll need to search for someone who is both highly capable and just starting their trend following system to be able to invest less than $1,000,000 with a CTA. I don't like the odds of that.

If you are looking for a CTA, please let me know. You can find a list of CTA's over at a website called autumn gold. They have a large list of CTA's, with contact information and returns for the last several years.

(P.S. I don't like the word "investing". Investing is a word that tricks people into thinking they are not trading, when they are still trading. Usually, if you hear someone use the word investing, you should hold on to your wallet. You're probably getting a passive, expensive trading strategy with almost no risk management.

Mutual fund fees are actually very, very high for the service provided - as far as I can tell, there is very little or no actual risk management in most mutual funds. It's common to pay 2% fees for mutual funds - on a $100,000 account, that's $2000.

Can you get someone to trade forex for me, on my behalf?

Can I get someone to trade forex for me, on my behalf? I hear you ask.

Yes you can. In fact paying someone to trade the forex market for you is a very popular thing to do and is becoming ever more so. You are probably wondering how it is done, well, I will tell you.

Related articles

It is all very straightforward. First of all you don’t need to go out and find a trader for yourself, nor do you need to negotiate deals with the trader. No, it is all done for you. You end up paying the trader to trade for you but it is taken out of the profits that the trader makes for you.

This type of trading is called managed forex accounts trading, and you can read all about them on this site, starting here acorn2oak-fx.Com/managedforexaccounts.Html.

In summary though, this is what happens –

- You open up a forex trading account in your name.

- You fund the account.

- You give the trader an LPOA (limited power of attorney). This enables them to trade your account for you.

- The trader makes the trades for you.

- The trader takes a performance fee from the profits. Usually 25% to 50%. Although I have found one that only charges 15% .

- You withdraw funds whenever you want to.

Quite simple really: as I said, you will find much more info on this site, FAQ, due diligence etc.

The trader I was talking about that above, charges a 15% performance fee, I was thinking about letting him trade forex for me, has a very good return of over 600% profit. That was for each of the last two years, 2014 and 2015. Read more about him here.

This post first appeared on acorn2oak-FX - forex investment opportunities, please read the originial post: here

The truth about trading daily timeframe nobody tells you

Last updated: october 28, 2020

Trading daily timeframe is not exciting to most traders.

It requires a ton of patience.

It has fewer trading opportunities.

Trading daily timeframe is the answer for most traders (with many “hidden” benefits) — especially if you have a full-time job.

The truth about trading daily timeframe

You might not know this but, trading daily timeframe offers many benefits not found on the lower timeframe.

1. You’re more relaxed and make better trading decisions

Have you ever traded on the 5mins timeframe?

Then you’ll agree it can be stressful because a new candle is formed every 5minutes.

You’ve got to make a decision to buy, sell, hold, or stay out in a short period of time.

This means you have less time to think which cause you to make wrong trading decisions (like chasing the markets).

If you trade the daily timeframe, a new candle is formed every 24 hours.

You have more time to think, plan and execute your trades — so you’re less prone to making the wrong trading decision.

You make better decisions, your results improve — and trading becomes more relaxed.

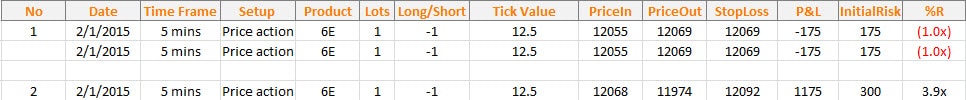

2. News events don’t matter

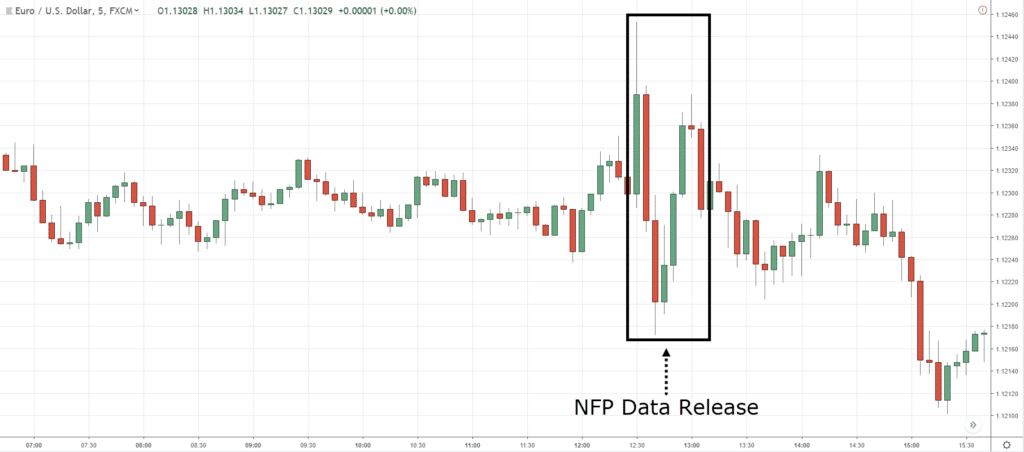

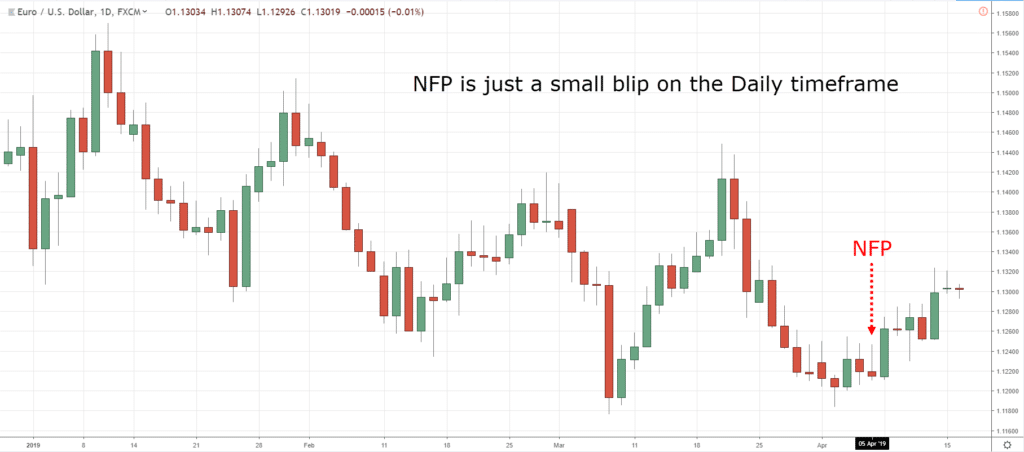

When you trade on the lower timeframe, news events (like FOMC, NFP, etc.) is a big thing.

You’ll notice the price goes “crazy” and flies up and down on your charts.

Here’s an example: NFP on EURUSD 5mins timeframe:

This means if you trade the lower timeframe you must be aware of the news or, you’ll get stopped out for nothing.

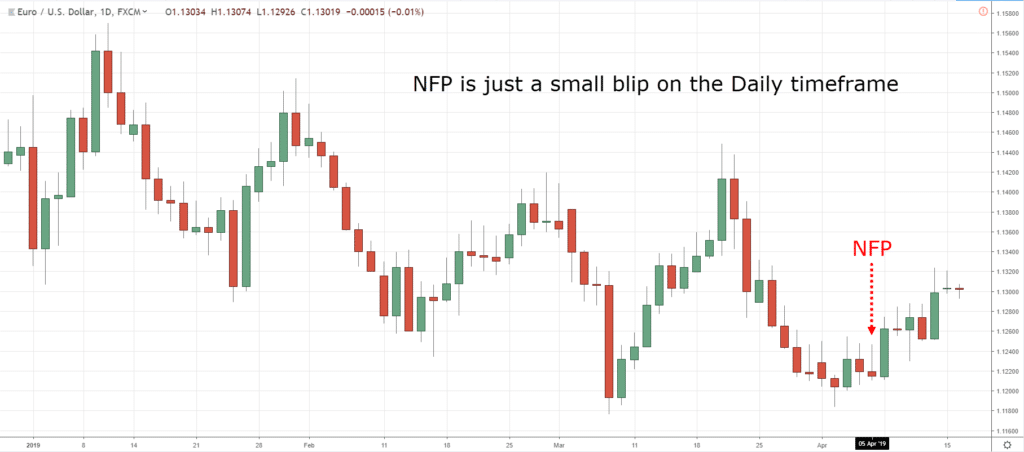

If you trade the daily timeframe, then news event hardly matter.

Here’s an example: NFP on EURUSD daily timeframe:

Notice there’s only a small blip on the chart?

You’re unlikely to get stopped out of your trades as your stop loss is wider (and can accommodate the “crazy” swings on the lower timeframe).

So the bottom line is this:

If you trade the higher timeframes, the less impact news has on your trading.

3. You have freedom

The daily timeframe only paints a candle once per day.

So there’s no need to constantly watch the markets because there’s “nothing” to do till the market closes (and a new candle is formed).

Imagine, how much more freedom you’ll have when you’re no longer a slave to the markets?

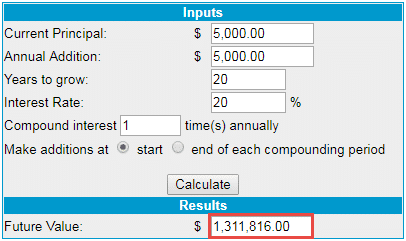

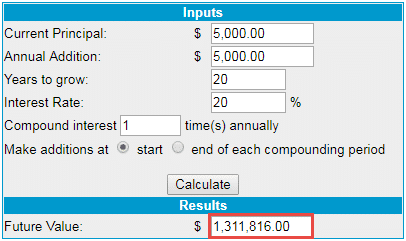

4. You can compound your returns and grow massive wealth (even with a small trading account)

Now as a daily timeframe trader, you don’t need to spend all day watching the charts.

This means you can get a full-time job and combine with trading to grow massive wealth.

Let’s say you make an average of 20% a year with an initial sum of $5,000 and you contribute $5000 to your account each year.

Do you know how much it’ll be worth after 20 years?

After 20 years, it will be worth… $1,311,816.

5. You can focus on the process and become a consistently profitable trader, fast

I’ve seen many traders who go all in to trade full-time, and fail.

Now it doesn’t matter if their trading strategy works or not because the odds are against them.

Because they encounter the “need to make money” syndrome.

This is where you break your trading rules (like widening your stop loss) to avoid a loss.

The reason you do it is because you rely on your trading profits to pay the bills — and you’ll do whatever it takes to prevent a loss.

But if you’re trading the daily timeframe, then you can have a full-time job.

And now the odds are in your favour because you don’t have to rely on your trading profits.

Even if you have losing months, it’s not the end because your job will provide your living needs.

This means you can focus on learning how to trade and not worry about whether you can pay the bills.

Won’t this help you become a profitable trader in the fastest possible time?

6. You put the odds in your favour

One of the biggest reasons why traders fail is because they don’t pay attention to the transaction cost.

And that can be a difference between a winning and losing trader.

- You have a $10,000 account

- Transaction cost is $10 per trade (buy and sell)

- You place 500 trades per year (from day trading)

If you do the math, you need a return of 50% just to break even!

But what about trading daily timeframe?

- You have a $10,000 account

- Transaction cost is $10 per trade

- You place 50 trades per year (longer-term trading)

Now, you just need 5% to breakeven — a big difference.

Can you see how transaction cost is a killer?

So if you want to put the odds in your favour, trade smarter and trade lesser.

So, is trading daily timeframe for you?

Trading daily timeframe is not for everyone because different traders have different goals.

So, if you fall into any of the categories below, then trading daily timeframe (or higher) isn’t for you.

Trading daily timeframe is NOT for you if…

- You want to generate a consistent income

- You want “fast action”

- You’re into proprietary trading

Why trading daily timeframe don’t offer you a consistent income

When you the higher timeframe, you have a lower trading frequency.

This means you need time for your edge to play out (possibly over a few months).

So, if you’re looking for a consistent income from trading, this approach is not for you.

Why trading daily timeframe is not for “fast action” traders

Every candle on the daily timeframe is painted once per day.

It’s a slow trading approach for traders who don’t want to be glued to the screen all day.

Why trading daily timeframe is a proprietary trader’s nightmare

The goal of a proprietary trader is to generate a consistent income from trading (by trading frequently).

But as you’ve learned, trading the daily timeframe doesn’t allow your edge to play out fast enough to generate a consistent income

So decide now whether trading daily timeframe is for you.

Because if it isn’t, then you can stop reading and find something else that suits you.

But if you know it’s for you, then read on…

Trading strategy for the daily timeframe

The 2 most common ways to trade the daily timeframe are…

- Swing trading

- Position trading

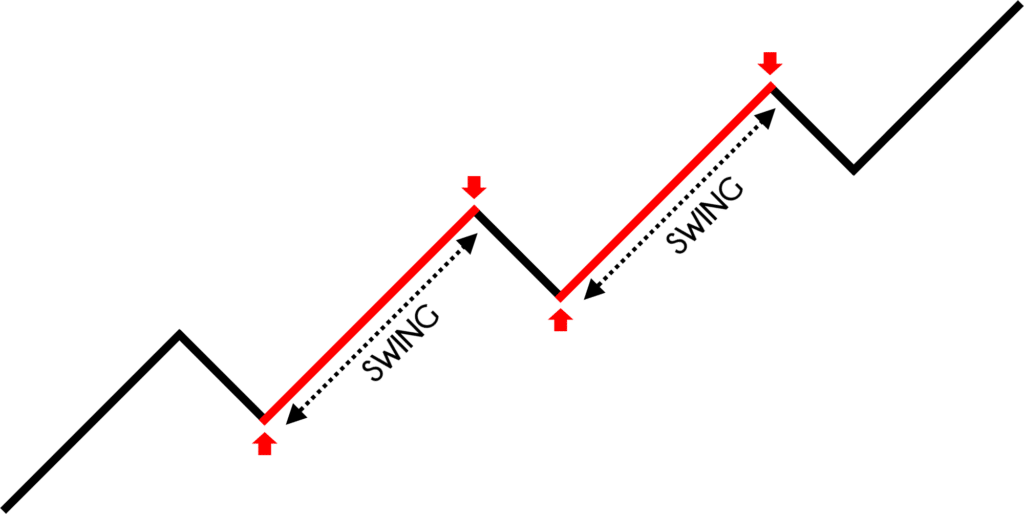

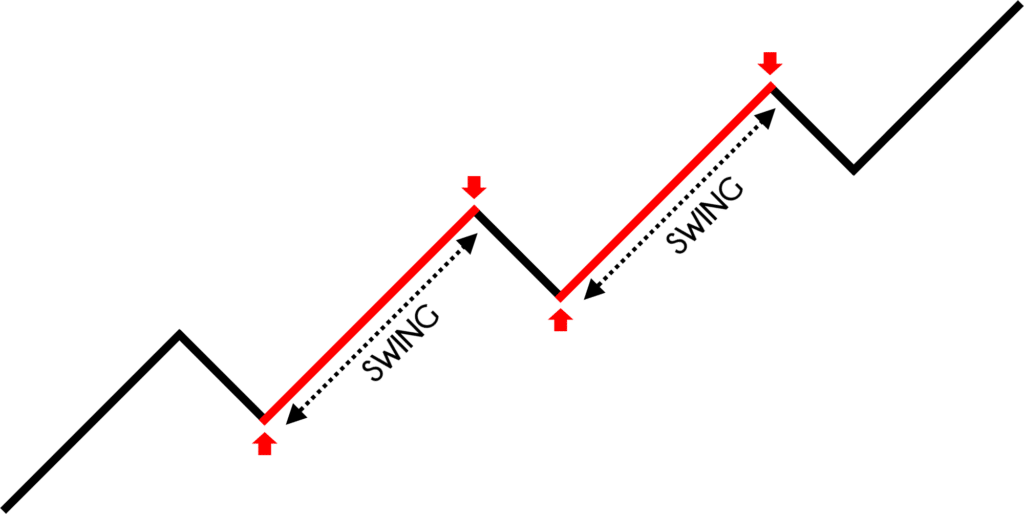

Swing trading

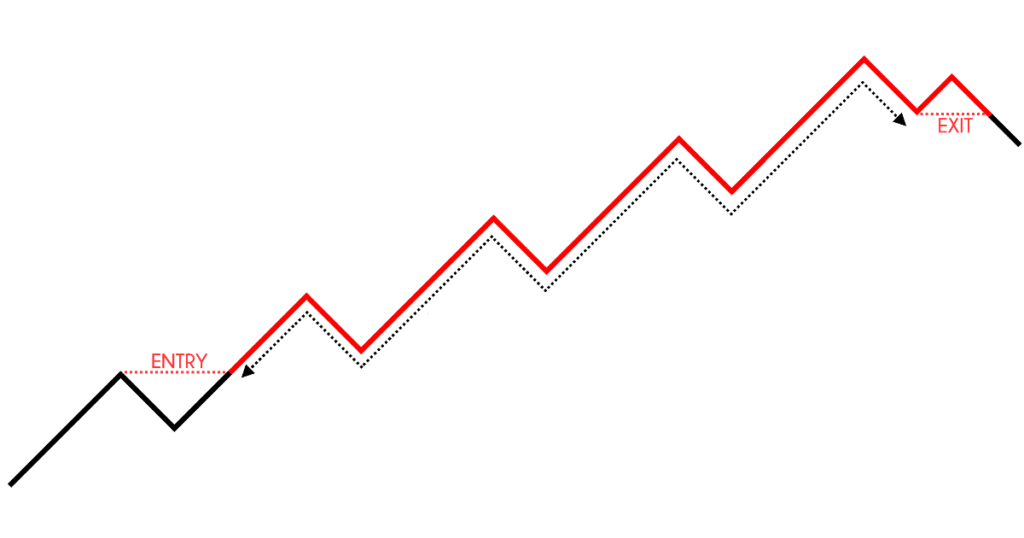

Swing trading is an approach which seeks to capture “one move” in the market.

The idea is to endure as “little pain” as possible by exiting your trades before the opposing pressure comes in.

This means you’ll book your profits before the market reverse and wipe out your gains.

- You don’t need to spend hours in front of your monitor because your trades last for days or even weeks

- It’s suitable for those with a full-time job

- Less stress compared to day trading

- You won’t be able to ride trends

- You have overnight risk

If you want to learn more, then go read…

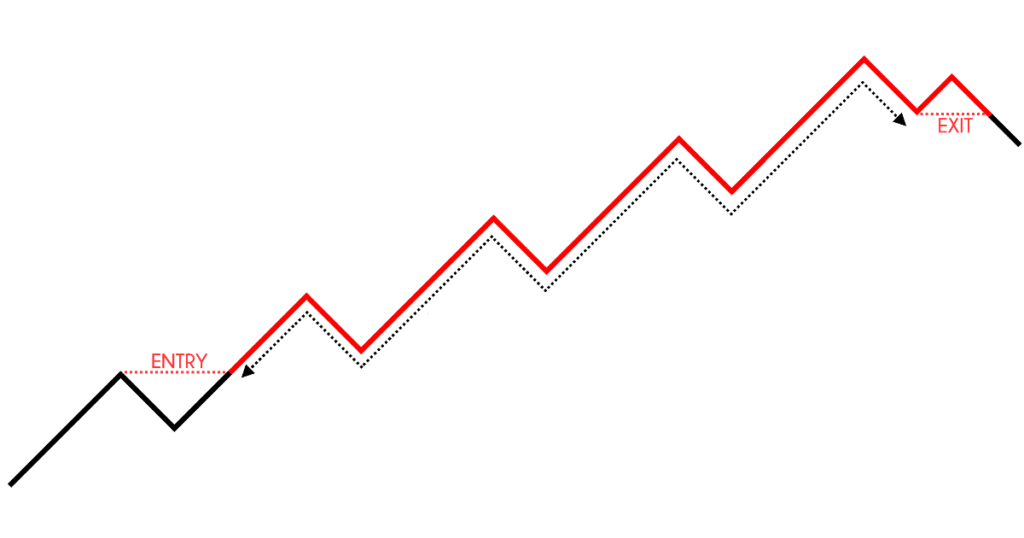

Position trading

Position trading is an approach which seeks to ride trends in the market.

The idea is to capture “the meat” of the move and exit your trades only when the trend shows signs of reversal.

- It requires less than 30 minutes a day

- It’s suitable for those with a full-time job

- Less stress compared to swing and day trading

- You’ll watch your winning trades turn into losing trades, often

- Your winning rate is low (around 30 – 40%)

If you want to learn more, then go read…

Now, once you’ve developed your trading strategy, the next step is to develop a routine to ensure your trading success.

The secret to daily timeframe trading success

(this is important so don’t skip this section.)

A trading strategy is only one part of the equation.

Because you still need a trading routine or you won’t find trading success. If you ask me, this is the secret between winning and losing traders.

You’re probably wondering:

“so, how do I develop a trading routine?”

Well, there are 3 parts to it…

- Create and update your watch list

- Commit to your schedule (execute and record)

- Review your results

1. You create and update your watch list of markets

(this can be done on the weekends when the markets are closed.)

After you’ve developed a trading strategy, create a watch list of markets to trade (whether it’s forex, stocks, futures, etc.).

Next, scan through your watch list and identify the markets which offer a potential trading setup (this should be according to your trading strategy).

You want to “mark” these markets so you can focus on them in the coming week.

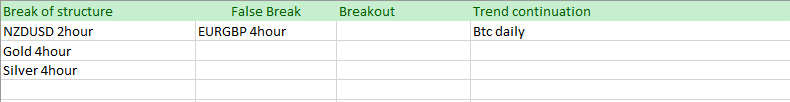

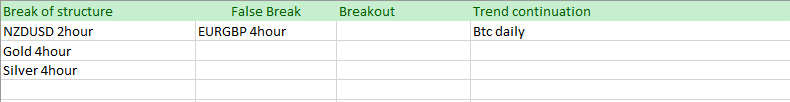

You can do it on excel like this…

Or if you’re using tradingview, you can highlight it like this…

2. You commit to your trading schedule

Since you’re trading the daily timeframe, then it makes sense to make your trading decision after the close of the daily candle.

This could be morning, afternoon, or night (depending on where you are) — so create a schedule where you can commit to it no matter what.

If you’re in asia, then the daily close would be in the morning for you.

So, every morning you’ll check the markets from your watch list and see if there’s a potential trading setup.

If there is, then you move onto the next step…

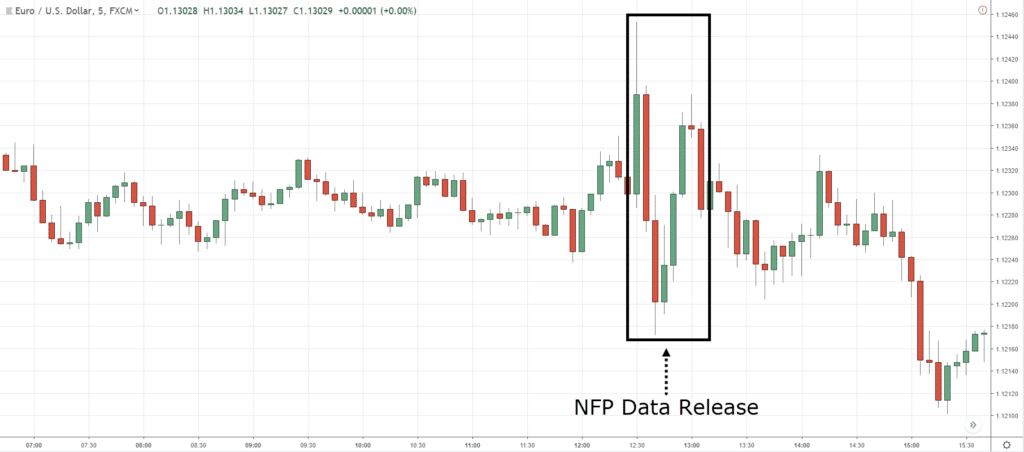

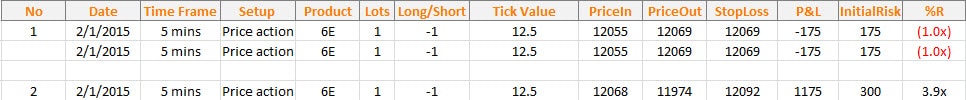

3. You execute and record your trades

Now if there’s a valid trading setup, you execute the trade with proper risk management.

Then, you’ll record the metrics like…

Date – date you entered your trade

Time frame – time frame you entered on

Setup – trading setup that triggers your entry

Market – markets you’re trading

Price in – price you entered

Price out – price you exited

Stop loss – price where you’ll exit when you’re wrong

Initial risk in $ – nominal amount you’re risking

R multiple – your P&L on the trade in terms of R. If you made two times your risk, you made 2R.

For the full breakdown, check out this post below…

4. You review your trades and find your edge

Once you’ve executed 100 trades consistently, you’ll know whether your trading strategy has an edge in the markets.

Expectancy = (winning % * average win) – (losing % * average loss) – (commission + slippage)

If you have a positive expectancy, congratulations!

It’s likely your trading strategy has an edge in the markets.

But what if it’s negative?

Then you apply my AFTER technique…

- Identify the patterns that lead to your losses — and avoid trading these setups

- Identify the patterns that lead to your winners — and focus on these setups

- Tweak your trading plan according to your findings

- Execute the next 100 trades with your updated trading plan and record the trades

- Review your trades

If you do what I just shared, you’ll improve your trading results and eventually, find your edge in the markets.

Whether you’re a winning or losing trader, the AFTER technique can be applied to you.

If you’re a winning trader, then it’ll take your trading to the next level.

If you’re a losing trader, then you have a method to get yourself into the green.

Conclusion

So, here’s what you’ve learned:

- The benefits of trading daily timeframe — you’re more relaxed, the news doesn’t matter, you have freedom, you can grow massive wealth, and you put the odds in your favour

- Trading daily timeframe is not for you if you want a consistent income or you want a career in proprietary trading

- You can adopt a swing trading or position trading strategy on the daily timeframe

- Your trading routine consists of creating your watch list, committing to your trading schedule, executing your trades, and reviewing your trades

The truth about trading daily timeframe that nobody tells you.

Now here’s what I’d like to know…

Do you trade on the daily timeframe? Why or why not?

Leave a comment below and share your thoughts with me.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

Forex scams

Top 7 forex scams to avoid today

As forex markets promise to give you an incredible return on investment, they became trendy in the last few years. However, often forex traders don’t have a great understanding of how forex markets work and what a forex broker does exactly, which leaves the latter a lot of room to scam the trader. Whether it is about proposals on instagram or simply fake investment advice, beware.

It’s a complicated industry, and even experienced people fall victim to intricate trading schemes. There are quite a few variations of the forex fraud. Let’s take a look at a few of them. Feel free to add names of questionable forex platforms in the comments section, at the bottom of the article.

Forex trading strategies – scam 1: the whole package

According to the specialists at investorguide.Com, this might come your way by crooks “creating false customer accounts for the purpose of generating commissions, selling software that is supposed to garner large profits for the customer, false claims of customers making huge money, the theft of a customer’s account and phony marketing.

Forex scams draw customers in with sophisticated advertisements placed in the newspaper, heard on the radio, or seen on internet websites.

Recommended read: sell annuity payments scam

Forex promoters often lure investors into scams with various assurances, including their ability to predict an increase in currency prices and claims of high returns with low risk. An unregulated financial company trading off-exchange forex, foreign currency futures and options contracts with retail customers is illicit and may be a fraud or scam.

In many cases, investors may be guaranteed high returns in the tens of thousands of dollars over a few weeks or months, with a relatively low initial investment. In reality, the investor’s money is never used for forex trading, but is simply stolen.”

Watch the video below see a few extra tips from a victim, talking about forex scams, training courses, and hedge funds.

Forex trading strategies – scam 2: computer manipulation of bid/ask spreads

How does this scam work? According to dailyforex.Com (a great team of analysts and researchers who watch the market throughout the day to provide unique perspectives and helpful analysis on forex trading), “the point spread between the bid and ask basically reflects the commission of a back and forth transaction processed through a broker. The point spreads differ widely among brokers and differ between currency pairs.

Since brokers don’t usually offer the normal two- to three-point spread in the EUR/USD, for example, but go for spreads of seven pips or more, any potential gains resulting from a good investment were eaten away by commissions. These commissions found themselves in the broker’s pocket.

Suggested read: sell my structured settlement fraud

Today, it is unusual to find a broker that claims he takes a commission. Don’t be fooled by this promotion. He is still making his money from the difference in the spread but spreads are now regulated and only smaller spreads are permitted.

However, there are still offshore retail forex brokers who are not regulated by the CFTC, NFA or their nation of origin and it’s quite easy for these firms to pack up and disappear with the money when confronted with investigations of irregularities”. Great explanation by dailyforex.Com.

Suggested read: 13 gold IRA investment scams

Forex strategies – scam 3: commingling funds

In law, commingling is a breach of trust in which a fiduciary mixes funds that he holds in the care of a client with his own funds, making it difficult to determine which funds belong to the fiduciary and which belong to the client.

When it comes to the forex scam, the same team at dailyforex.Com explains: “commingling funds gives forex brokers the opportunity to pocket much of an investor’s money without the client ever noticing any discrepancy. The broker benefits financially during the trading and eventually disappears with a customer’s money.”

“if a forex trader looks carefully and states vigilant he/she can pick up are certain warning signs which can alert him/her when all is not on the straight and narrow. If a broker won’t allow the withdrawal of monies from investor accounts or if problems exist within the trading station, the trader should take immediate notice.

Additionally, guarantees of high performance levels-some much higher than those offered by other forex brokers-should be viewed with considerable skepticism.”

Suggested read: 15 types of securities fraud

Forex strategies – scam 4: robots/automated systems

Surprised? Don’t be. This is an increasing scam especially with the advancement of the technology. Questionable brokers sell automatic trading systems which claim to generate automatic trades even when the trader is sleeping.

Some shady companies sell their special “packages” for thousands of dollars, only to find out that some of these you can find on the internet for free.

“most of these robots have not been tested by an independent source for formal review. Their trading system’s parameters and optimization codes are usually invalid and at the end of the day, the system generates totally random buy and sell signals”, concludes dailyforex.Com.

Suggested read: list with government grants for individuals

Forex strategies – scam 5: fake investments funds

All kinds of HYIP funds have been notoriously showing up everywhere. Simply because they work; for the scammers! The high yield investment program funds ‘guarantee’ you a great level of return for temporary use of your money in their forex fund.

The concept that sells this ponzi scheme is that the investors of yesterday get paid back by the investors of tomorrow. How the scam works is that once the fund runs out of prospects, it closes down and takes whatever money it has with it.

Must read: online college course scam

Forex strategies – scam 6: signal seller membership

Just like the robots, certain ‘signal sellers’ claim to sell you information on which trades you should make in order to get rich. The trick is – they charge a weekly or monthly fee for their service (‘signals’).

Little do you know that not only you are lose your money, but they do not even offer you anything that will help improve your trading!

Forex on instagram – scam 7: fake accounts

With the advancement of technology, there are many well-run online scams on social media when it comes to forex. Some have over a thousand ‘followers’ losing money as the fraud is advertised as a get rich quick scheme.

People are signed up to a trading platform through so-called ‘companies’ and are asked to deposit their hard-earned money to deposit $400 (or EURO). Ultimately, they lose it all through investment advice from kids who earn a kickback when clients give money to the platform used to sign up.

These questionable forex platforms have recruited and paid multiple young adults from ages 18-21 to promote their scheme online. They get paid for luring new people into the system. They also use well known social media influencers to promote them and tell lies about the service.

How to avoid the forex scams:

There are many red flags you should be aware of. The first one would be when you are guaranteed a profit. There are no guarantee profits in forex. Use your computer and search reviews featuring the broker, or the system, or the signal seller.

Make sure the testimonials are genuine and do not come from their own websites. Check all the forex forums and google the name of the broker followed by the word ‘scam’.

Check their website very carefully. If they don’t have a legitimate contact page with phone numbers and emails, that’s another red flag.

Last but not least, keep in mind that there is no ‘miracle’ software that will figure out the forex market for you. If anybody would own that, why would they sell it?

How to report the forex strategies scams:

Make your family and friends aware of this scam by sharing it on social media using the buttons provided. You can also officially report the scammers to the federal trade commission using the link below:

How to protect yourself more:

If you want to be the first to find out the most notorious scams every week, feel free to subscribe to the scam detector newsletter here. You’ll receive periodical emails and we promise not to spam. Last but not least, use the comments section below to expose other scammers.

Related articles:

Verify a website below

Are you just about to make a purchase online? See if the website is legit with our validator:

How to start trading forex (4 steps)

Welcome to the world of forex. There might be many reasons why you are reading this article. It could be that your friend or acquaintance mentioned about how they trade and perhaps even make a living by trading forex. Whatever your reasons may be; this article will give you an overview of the forex markets and how to start trading forex … and perhaps make money for yourself.

Step 1. What is forex?

Step 2. Learn forex basics

Step 3: find a forex broker

Step 4: start trading

Step 1. What is forex?

Forex, or foreign exchange is an unregulated market, also known as OTC (over-the-counter) and is the biggest market with average daily turn-over that runs into billions. It is even bigger than the US stock markets. Although due to its OTC nature, no one can really give the correct numbers as to the forex turnover. But nonetheless, forex is indeed a big market and thus allows many market participants. From your neighborhood bank to specialized investment companies, to your friend; the forex markets always offers a piece of the action whoever you are and wherever you are (even from your home).

The basic concept of trading forex is very simple. You trade or speculate against other traders on the direction of a currency.

So, if you believe that the euro is going to rise, you would BUY the euro, or SELL the euro if you think the euro would fall. It’s as simple as that.

Step 2. Learn forex basics

Before you get ready to deposit your funds and start trading there are some important points you must understand, each of which are outlined below.

Forex brokers: in order to start trading forex, you will need to trade with the help of a forex broker. There are many forex brokers out there today who allow you to open a forex trading account for as little as $5. The forex broker is the one who facilitates your buy and sell orders and also allows you to research into the markets (also known as technical or fundamental analysis) to help you make more informed decisions… and of course allows you deposit more funds or withdraw your profits when you want to. ( click here to see our forex brokers rating )

Trading platform:you need a trading platform from which you can place your trades, which are then sent to the broker for settlement. Also, a trading platform is essential for you to conduct your technical analysis and also to see the current market prices. Most retail brokers offer the MT4 (short for metatrader 4) trading platform, which is free of cost. You can also open a demo trading account and practice trading with virtual money to gain the experience required before trading with real money.

Forex trading hours:while you might have heard that the forex markets never sleeps, it actually does. Firstly, you won’t be able to trade on weekends (saturday and sundays). But for the rest of the week, the forex market operates 24 hours a day. This is due to the fact that forex trading is global. At any point in time, you will always find an overlap of a new market session while the previous market closes. What time of the day or which market session you trade plays a big role if you are an intra-day trader or a scalper. This is another vast topic, which we will cover at a later stage. ( click here to learn more about forex trading hours . )

Now that you have a basic overview of the forex markets, here are some final pointers to remember before you start trading for yourself.

What is a pip?:pip is a measure of change in a currency pair’s value and is the 5 th decimal. For example, if EURUSD changes from 1.31428 to 1.31429, the change is denoted as 1pip (1.31428 – 1.31429 = 0.00001). When you trade, the more pips you make, the more profit you have. Ex: buying EURUSD at 1.31428 and selling (or closing your trade) at 1.31528 would give you 100pips in profit. ( read more about forex PIP )

Reading quotes: forex quotes are presented in a bid and ask price (both of which vary by a few pips and from one broker to another). The bid price is the price at which you can buy and the ask price is the price as which you can sell. So, a EURUSD quote would look like this 1.31428(bid)/1.31420(ask).

What is a spread?: spread is nothing but the difference between the bid and ask price. So in the above example, for 1.31428/1.31420, the spread would be 8 pips. ( read more about forex spread)

What is a leverage?: leverage is the amount by which you can request your broker to magnify (or increase) your trade value. Leverage is often quoted in ratios such as 1:50, which means that when trading on a 1:50 leverage, your $100 is magnified to $50000. Leverage is a big topic in itself and it is recommended to read this article to learn more. Leverage is important both in terms of making profits as well as managing risks and therefore, your trades.

What is a lot?: A lot is a unit by which you place your trade. In financial terms, a lot is also referred to as a contract. There are preset lots (or contract sizes) that you can trade. For example a standard lot is nothing but 100,000 units (known as 1 lot). ( read more about lot)

Reading charts: the ability to understand and read the charts is very essential to trading. Depending on your approach, you can choose between a line, bar or candlestick charts and trade accordingly (for example trading based on candlestick patterns). ( read more how to read forex charts)

Placing orders (how to buy and sell): in forex trading, it is possible to either buy or sell any currency pair. Most trading platforms, give you this option. You buy when you think that price will go up and you sell when you think that price will fall. There is a common terminology used in forex trading, which is buy low, sell high; which is an important point to remember. ( read more how to place orders with MT4 )

Order types: besides buy and sell, another point to remember the types of orders. There are two basic order types: market orders and pending orders. When you click on ‘buy’ or ‘sell’ you are basically buying (or selling) at the current market price. A limit order on the other hand tells the broker that you want to buy or sell only at a particular price. ( read more about types of forex orders)

Step 3. Find a forex broker

As mentioned, there are many forex brokers today and therefore it can get confusing on how to choose the forex broker that is right for you. To briefly summarize, remember the following points while choosing a forex broker:

- Look for a forex broker that is regulated

- See if the forex broker offers a minimum deposit amount

- What is the leverage that the broker offers

- What is the minimum contract size that you can trade

- Bonuses and the terms and conditions (see on our site list of forex deposit bonuses and forex no deposit bonuses)

- Deposit and withdrawal types as well as the terms and conditions

- Trading methods that are allowed by the broker

We can also help you choose a forex broker by reading our article how to choose forex broker

Step 4. Start trading

Finally, now that you have selected a forex broker to trade with it is recommended to first open a demo trading or a practice account. Most forex brokers offer unlimited demo trading account (but will be deactivated if not used for 30 days). This is a good way to get acquainted with the forex markets and also help you to understand your trading style (scalper or intra day trading, swing trading, etc) and approach (fundamental or technical analysis). You can search for various trading methods and systems or you can develop one yourself when you have a good understanding of technical or fundamental indicators.

Conclusion:

Forex trading is one of the most active and dynamic ways to trade the financial markets. At the heart of everything, it is the basic fluctuations in currency values which drives everything else. Learning to trade forex and understanding the forex markets can give a good foundation to trading other markets such as derivatives or equities.

So, let's see, what we have: pay someone to trade forex for me is the question of most investors, forexsq experts answer can someone day trade for me ? The answer is yes but at pay someone to trade forex for me

Contents of the article

- Top forex bonus promo

- Pay someone to trade forex for me, can someone day trade...

- Can someone day trade for me

- Pay someone to trade forex for me conclusion

- Can you get someone to trade forex for me, on my behalf?

- Managed FX accounts services

- Benefits of our service

- Can you get someone to trade forex for me, on my behalf?

- Can I get someone to trade forex for me, on my behalf? I...

- You are probably wondering how it is done, well, I will...

- Can I pay someone to trade forex for me? 2020

- Can I get someone to trade forex for me? (auto trading...

- FOREX managed account brokers

- Pros & cons of letting someone trade forex for...

- Pros & cons of trading the forex by...

- Is it worth it to pay someone to trade for you?

- Can you get someone to trade forex for me, on my behalf?

- The truth about trading daily timeframe nobody tells you

- The truth about trading daily timeframe

- 1. You’re more relaxed and make better trading...

- 2. News events don’t matter

- 3. You have freedom

- 4. You can compound your returns and grow massive...

- 5. You can focus on the process and become a...

- 6. You put the odds in your favour

- So, is trading daily timeframe for you?

- Why trading daily timeframe don’t offer you a...

- Why trading daily timeframe is not for “fast...

- Why trading daily timeframe is a proprietary...

- Trading strategy for the daily timeframe

- The secret to daily timeframe trading...

- 1. You create and update your watch list of...

- 2. You commit to your trading schedule

- 3. You execute and record your trades

- 4. You review your trades and find your...

- Conclusion

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- Forex scams

- Top 7 forex scams to avoid today

- Forex trading strategies – scam 1: the whole...

- Forex trading strategies – scam 2: computer...

- Forex strategies – scam 3: commingling...

- Forex strategies – scam 4: robots/automated...

- Forex strategies – scam 5: fake investments...

- Forex strategies – scam 6: signal seller...

- Forex on instagram – scam 7: fake accounts

- How to avoid the forex scams:

- How to report the forex strategies...

- How to protect yourself more:

- Related articles:

- How to start trading forex (4 steps)

- Step 1. What is forex?

- Step 2. Learn forex basics

- Step 3. Find a forex broker

- Step 4. Start trading

- Conclusion:

Finding a team to administer your FX trading that you have confidence in is crucial. Acorn2oak offers you a totally FREE service that allows you to compare the best services, all in one location. We will link you up with money managers who will share their performance reports to make sure you have all the information you need prior to making a deposit.

Our top priority is to help you with administered FX by providing specialist advice and guidance to help you save time and money. If you want to benefit from this FREE service that allows you to compare services, please enter your details in the form above, it takes less than a minute.

Managed FX accounts services

Here at acorn2oak, we have pre approved a range of providers that we believe put the performance of their investor’s accounts first. They offer:

• access to trading teams with considerable experience in managing money

• A range of deposit levels in multiple currencies

• full 24 hour 7 days a week transparency so you can view your account

• A proven trading strategy that has demonstrated consistent returns

More and more individuals are attracted to fund administration for their trading account because they simply don’t have the time to buy and sell or are yet to access the profits of the markets. If this is you we have made it our number one goal to connect you with the highest quality of services that best suit your requirements.

Let acorn 2 oak connect you to a range of regulated providers currently available

Benefits of our service

We provide instant access to performance reports of managed FX providers

- Managed FX guides to assist you with your due diligence

- Up to date performance reports

- Tailor made quotes to suit your requirements

We only deal with regulated providers

- Acorn 2 oak code of conduct

- Existing investors feedback

- Returns independently verified

Make a smarter forex investment and save money by choosing the best provider for you

- Here you can find regulated managed forex account providers

- Free quotes from up to 4 providers

- Compare managed FX providers in one place

Are you a managed FX provider looking for investors?

Testimonial

“acorn 2 oak connected me with a leading provider that had the consistent returns I was looking for. I would never have found them without using the free service at acorn 2 oak”

The smarter way for traders to find forex opportunities

Thousands of traders looking to find a forex provider, carry out your search here

Can you get someone to trade forex for me, on my behalf?

Can I get someone to trade forex for me, on my behalf? I hear you ask.

Yes you can.

In fact, paying someone to buy and sell in the forex market for you is a becoming a popular thing to do and increasingly more so as folk, like yourself, discover them. They are a relatively unknown investment, that historically have been only accessible to large financial institutions and investors with a lot of money behind them. With the advent of the internet and high speed broadband connections, they have become accessible to everyone.

You are probably wondering how it is done, well, I will tell you.

It is all very straightforward. First of all you don’t need to go out and find a trader for yourself, nor do you need to negotiate deals with them. No, it is all done for you. You end up paying them to buy and sell currency for you but it is taken out of the profits that they make for you.

This type of trading is called managed FX trading, and you can read all about them on this site, starting here acorn2oak-fx.Com.

In summary though, this is what happens –

• you open up a forex trading account in your name.

• you fund the account.

• you give the trader an LPOA (limited power of attorney). This enables them to buy and sell FX for you.

• they do the buying and selling for you.

• the trader takes a performance fee from the profits. Usually 25% to 50%. Although I have found one that only charges 15% .

• you withdraw funds whenever you want to.

Quite simple really: as I said, you will find much more info on this site, FAQ, due diligence etc.

COMPARE LEADING FOREX FUND MANAGERS – GET YOUR PERSONALISED QUOTE NOW

Can I pay someone to trade forex for me? 2020

“is it possible to pay someone to trade forex for me?”

I have heard that phrase many times during the time I have been involved with this website and my other websites.

The simple answer to this question is that, yes, there are companies that trade forex on your behalf.

The word “pay” is slightly erroneous because you don’t actually pay the company from your own money, the forex trader will get his payment from the profits that you make on your account. So yes, he gets paid because of you but it doesn’t actually cost you anything.