XM Account Types, Features and Openings (2021), xm live account.

Xm live account

XM live accounts bonuses work as follows where available: if you are satisfied with how your XM demo account worked out, the next logical step to make is the opening of you XM live account.

Top forex bonus promo

These account types are all detailed above for your consideration.

XM account types, features and openings (2021)

When dealing with any broker, you will be faced with the task of choosing your account type, and learning more about that account.

Trading with XM is no different.

Here we will run you through every account type and provide the basic information you need in order to run and manage your account.

Our XM review also covers some of these points in great detail.

Table of contents

69.75% of retail CFD accounts lose money

XM account types

As a top forex broker around the world, you can choose from a wide range of account types when opening an XM account.

Here is more detailed information on the exact account types offered:

Demo account

An XM demo account is an excellent starting place to learn more about the broker and trading.

Major points to note about XM demo accounts are that the trial is unlimited. You can also open as many as 5 XM demo accounts with a single email address. Every account type offered is also available as a demo account with the exception of the XM shares account.

There is essentially no difference between demo and XM live accounts. A full range of markets is still available. You can also benefit from a $30 XM bonus if you live outside of the cysec regulatory area. This XM welcome bonus does have some conditions which we will explain in greater detail.

As you are learning with your demo account, you can benefit from additional educational information provided through XM webinars and materials.

Standard account

The XM standard account is available in every operating area. This account features a spread from 1pip and you can benefit from an XM maximum leverage of 1:500 (non-EU), or 1:30 within the EU. The XM standard account also has commission-free trading.

Micro account

The XM micro account is also available in every jurisdiction with a similar spread starting from 1pip and commission-free trades. Here you can benefit from a lower minimum deposit and trading in smaller lot sizes. Again, the leverage is 1:500 for those outside the EU, and 1:30 within that area.

XM zero account

The XM zero account is available in most jurisdictions where the company operates. This includes under cysec and FCA regulation and most countries within the XM global market. The notable exception here is australia which is not included.

Spreads start from 0pips on this account, although there is a commission of $3.50 per lot traded.

You can benefit from a free VPS as well as XM maximum leverage of 1:500 outside, and 1:30 inside the EU.

Ultra low account:

The XM ultra low account type is one which is available only to australian-based traders. This has a spread which starts from 0.6pips and also provides for no commissions on trades.

The leverage available is again up to 1:500 or 1:30 for those located within the EU.

Professional account

If you are a professional trader within europe, and you meet certain criteria as set by XM in terms of trading knowledge, volume, and frequency, then you may be eligible for the XM professional account. This account provides for leverage up to 1:500.

If you are interested in this account type, you should contact XM for more information and they will gladly assist.

Shares account

The XM shares account, as the name suggests, deals with shares and caters for those who wish to trade from a choice of company stock cfds. The account is only available to XM global market traders and both to those located in the EU or australia.

A few more conditions of this account type include that commission is charged on trades at varying amounts, bonuses are not available, and no hedging is permitted. The MT5 trading platform must be used with the XM shares account.

Islamic account

Islamic accounts are an important feature for any broker and trader following shariah law. Every XM account can be turned into a rollover free account. To activate this, you should simply contact XM support. The shares account does not charge a rollover-fee by default, though you may still want to check with the support team.

The assets available remain the same, and the spreads match those of a standard account.

XM account openings

Now that you have hopefully selected the best account type for you, here are a few things connected with the XM account opening process which may be useful for you to know:

Live account opening

If you are satisfied with how your XM demo account worked out, the next logical step to make is the opening of you XM live account. These account types are all detailed above for your consideration.

Live account verification

XM verification does not have to be a daunting task. It is one which can be completed in just a few simple steps if you have the correct documents at hand. This is something which our XM live account opening tutorial will also help with.

Account currency

The account currency available through XM depends on both your account type, and the regulator which controls it as follows:

- Standard and micro account – every major currency including PLN and HUF. ZAR and singapore dollar are also available. RUB is available if you are outside cysec and FCA areas.

- XM zero accounts – both USD and EUR are accepted for deposit worldwide, although the global markets only accept JPY.

- Ultra low account – EUR, USD, GBP, AUD, and CHF are all accepted.

- Shares account – USD is the only available currency

Account funding

XM account funding options depend solely on the country you live in. The generally accepted methods include major credit cards like visa and mastercard, e-wallet payment methods, and bank wire transfer.

These methods will change depending on each country of residence so it is best to check your member area for clarification.

Minimum deposit

The XM minimum deposits are as follows:

- Micro and standard accounts – €5

- Ultra low accounts – €50

- XM zero accounts – €100

- Shares accounts – $10,000

Deposit and withdrawal

With XM deposit and withdrawal, you must deposit and withdraw in your own name. In addition, you must use the same method for withdrawal as deposit, unless one is a bank transfer.

In the case of bank transfer, this can take between 2-5 days. Other methods are available for immediate deposit and a withdrawal time of 24-hours.

Deposit and withdrawal capability is only available after verification has been completed. There are also no fees for deposit or withdraw other than western union and moneygram. When the bank transfer deposit is more than $200, XM covers the fee.

Bonuses

XM bonus amounts are not available under cysec and FCA regulation, but are available elsewhere. According to broker terms and conditions, the bonus amount itself cannot be withdrawn, but profits made from the bonus can be. There are no bonuses available on shares accounts.

Live accounts

XM live accounts bonuses work as follows where available:

- First deposit – 50% up to 500 EUR

- Other deposits – 20% with a 5000 EUR limit

- XM is the only platform to offer a welcome bonus. This bonus is 30USD

Demo accounts

Your XM welcome bonus can be claimed through your demo account and be used when you switch over to a real account through the simple process.

XM account management

Now that you are in the know about most things XM account related. Here are just a couple of final points to add in relation to your account management.

Account number

XM will email you your account number directly after sign up if you ever require it.

Invalid account

If you are receiving this error message with your metatrader trading platform, then it is likely your login credentials are incorrect. Simply contact support after double checking and they can help you out.

Account expiring and reactivation

In regards to XM account expiration, demo accounts are cancelled after 30 days of inactivity. This period is 90-days if you are outside cysec and FCA regulation.

XM live accounts are cancelled after 90 days of inactivity. In this case, a monthly inactivity fee of $5 will be applied to keep the account running if there is a balance. If not, the account may be closed. If this does happen, there is no reactivation as such and you will have to create a new account.

Close account

XM account closing may only be applicable in very few cases. If it is, then you best course of action will be to contact XM support for assistance in doing so.

69.75% of retail CFD accounts lose money

Xm live account

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Trading account types

XM CY trading account types

Micro account

- Base currency options

- USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size

- 1 lot = 1,000

- Spread on all majors

- As low as 1 pip

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots (MT4)

0.1 lots (MT5)

- Lot restriction per ticket

- 100 lots

- Islamic account

- Optional

- Minimum deposit

- 5$

Standard account

- Base currency options

- USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size

- 1 lot = 100,000

- Spread on all majors

- As low as 1 pip

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots

- Lot restriction per ticket

- 50 lots

- Islamic account

- Optional

- Minimum deposit

- 5$

XM zero accounts

- Base currency options

- USD, EUR, JPY

- Contract size

- 1 lot = 100,000

- Spread on all majors

- As low as 0 pips

- Commission

- Maximum open/pending orders per client

- 200 positions

- Minimum trade volume

- 0.01 lots

- Lot restriction per ticket

- 50 lots

- Islamic account

- Optional

- Minimum deposit

- 100$

The figures above should only be regarded as reference. XM is ready to create custom-tailored forex account solutions for every client. If the deposit currency is not USD, the amount indicated should be converted to the deposit currency.

You may be new to forex, so a demo account is the ideal choice to test your trading potential. It allows you to trade with virtual money, without exposing you to any risk, as your gains and losses are simulated. Once you have tested your trading strategies, learned about market moves and how to place orders, you can take the next step to open a trading account with real money.

What is a forex trading account?

A forex account at XM is a trading account that you will hold and that will work similarly to your bank account, but with the difference that it is primarily issued with the purpose of trading on currencies.

Forex accounts at XM can be opened in micro, standard or XM zero formats as shown in the table above.

Please note that forex (or currency) trading is available on all XM platforms.

In summary, your forex trading account includes

- 1. Access to the XM members area

- 2. Access to the corresponding platform(s)

Similarly to your bank, once you register a forex trading account with XM for the first time, you will be required to go through a straightforward KYC (know your customer) process, which will allow XM to make sure that the personal details you have submitted are correct and ensure the safety of your funds and your account details.

By opening a forex account, you will be automatically emailed your login details, which will give you access to the XM members area.

The XM members area is where you will manage the functions of your account, including depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing leverage, accessing support and accessing the trading tools offered by XM.

Our offerings within the clients’ members area are provided and constantly enriched with more and more functionalities and therefore giving our clients more and more flexibility to perform changes or additions to their accounts at any given time, without needing assistance from their personal account managers.

Your trading account login details will correspond to a login on the trading platform which matches your type of account and is ultimately where you will be performing your trades. Any deposits/withdrawals or other changes to settings you make from the XM members area will reflect on your corresponding trading platform.

What is a multi-asset trading account?

A multi-asset trading account at XM is an account that works similarly to your bank account, but with the difference that it is issued with the purpose of trading currencies, stock indices cfds, stock cfds, as well as cfds on metals and energies.

Multi-asset trading accounts at XM can be opened in micro, standard or XM zero formats as you can view in the table above.

Please note that multi-asset trading is available only on MT5 accounts, which also allows you access to the XM webtrader.

In summary, your multi-asset trading account includes

- 1. Access to the XM members area

- 2. Access to the corresponding platform(s)

- 3. Access to the XM webtrader

Similarly to your bank, once you register a multi-asset trading account with XM for the first time, you will be requested to go through a straightforward KYC (know your customer) process, which will allow XM to make sure that the personal details you have submitted are correct and ensure the safety of your funds and your account details. Please note that if you already maintain a different XM account, you will not have to go through the KYC validation process as our system will automatically identify your details.

By opening a trading account, you will be automatically emailed your login details that will give you access to the XM members area.

The XM members area is where you will manage the functions of your account, including the depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing the leverage, accessing support and accessing the trading tools offered by XM.

Our offerings within the clients members area are provided and constantly enriched with more and more functionalities, allowing our clients more and more flexibility to perform changes or additions to their accounts at any given time, without needing assistance from their personal account managers.

Your multi-asset trading account login details will correspond to a login on the trading platform which matches your type of account, and it is ultimately where you will be performing your trades. Any deposits and/or withdrawals or other setting changes you make from the XM members area will reflect on your corresponding trading platform.

Who should choose MT4?

MT4 is the predecessor of the MT5 trading platform. At XM, the MT4 platform enables trading on currencies, cfds on stock indices, as well as cfds on gold and oil, but it does not offer trading on stock cfds. Our clients who do not wish to open an MT5 trading account can continue using their MT4 accounts and open an additional MT5 account at any time.

Access to the MT4 platform is available for micro, standard or XM zero as per the table above.

Who should choose MT5?

Clients who choose the MT5 platform have access to a wide range of instruments ranging from currencies, stock indices cfds, gold and oil cfds, as well as stock cfds.

Your login details to the MT5 will also give you access to the XM webtrader in addition to the desktop (downloadable) MT5 and the accompanying apps.

Access to the MT5 platform is available for micro, standard or XM zero as shown in the table above.

What is the main difference between MT4 trading accounts and MT5 trading accounts?

The main difference is that MT4 does not offer trading on stock cfds.

Can I hold multiple trading accounts?

Yes, you can. Any XM client can hold up to 8 trading accounts of their choice.

How to manage your trading accounts?

Deposits, withdrawals or any other functions related to any of your trading accounts can be handled in the XM members area.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

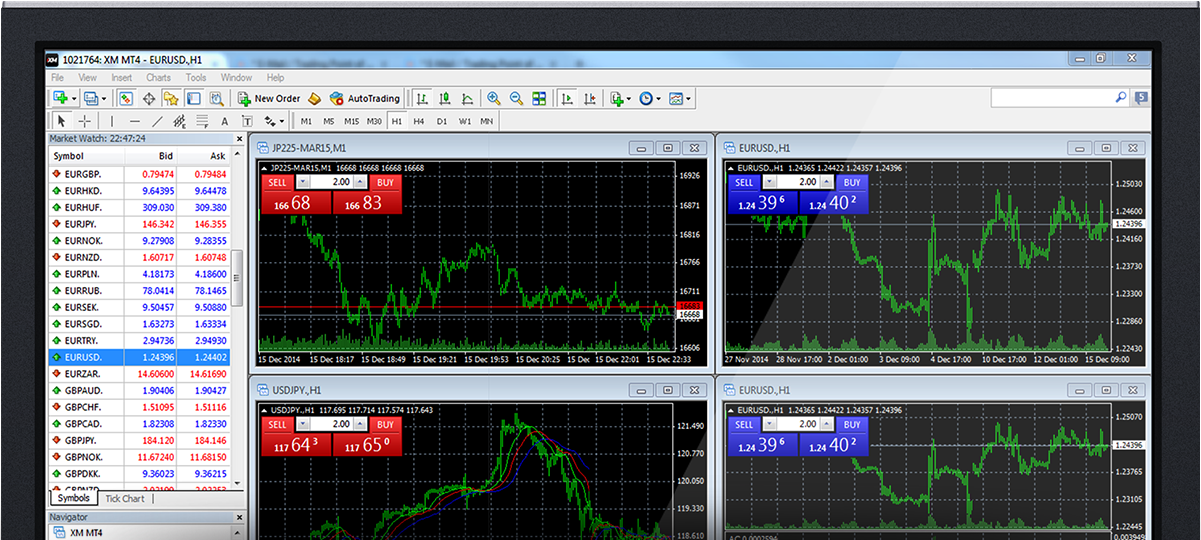

Metatrader 4 (MT4)

Why XM MT4 is better?

XM pioneered offering an MT4 platform with trading execution quality in mind. Trade on MT4 with no re-quotes, no rejection of orders and with leverage ranging from 1:1 – to 30:1.

XM MT4 features

- Over 1000 instruments including forex, cfds and futures

- 1 single login access to 8 platforms

- Spreads as low as 0 pips

- Full EA (expert advisor) functionality

- 1 click trading

- Technical analysis tools with 50 indicators and charting tools

- 3 chart types

- Micro lot accounts (optional)

- Hedging allowed

- VPS functionality

XM MT4, faster and better.

Gain access to the world’s financial markets.

- Download the terminal by clicking here. (.Exe file)

- Run the XM.Exe file after it has downloaded

- When launching the program for the first time, you will see the login window

- Enter your real or demo account login data

- Works with expert advisors, built-in and custom indicators

- 1 click trading

- Complete technical analysis with over 50 indicators and charting tools

- Built-in help guides for metatrader4 and metaquotes language 4

- Handles a vast number of orders

- Creates various custom indicators and different time periods

- History database management, and historic data export/import

- Operating system: microsoft windows 7 SP1 or higher

- Processor: intel celeron-based processor, with a frequency of 1.7 ghz or higher

- RAM: 256 mb of RAM or more

- Storage: 50 mb of free drive space

- STEP 1: click start → all programs → XM MT4 → uninstall

- STEP 2: follow the on-screen instructions until the uninstall process finishes

- STEP 3: click my computer → click drive C or the root drive, where your operating system is installed → click program files → locate the folder XM MT4 and delete it

- STEP 4: restart your computer

How can I find my server name on MT4 (PC/mac)?

Click 'file' -> click "open an account" which opens a new window, "trading servers" -> scroll down and click the + sign at "add new broker", then type 'XM' and click "scan".

Once the scanning has been done, close this window by clicking "cancel".

Following this, please try to log in again by clicking "file" -> "login to trading account" in order to see if your server name is there.

How can I gain access to the MT4 platform?

To start trading on the MT4 platform you need to have an XM MT4 trading account. It is not possible to trade on the MT4 platform if you have an existing XM MT5 account. To download the MT4 platform click here.

Can I use my MT5 account ID to access MT4?

No, you can’t. You need to have an XM MT4 trading account. To open an XM MT4 account click here.

How do I get my MT4 account validated?

If you are already an XM client with an MT5 account, you can open an additional MT4 account from the members area without having to re-submit your validation documents. However, if you are a new client you will need to provide us with all the necessary validation documents (i.E. Proof of identity and proof of residency).

Can I trade stock cfds with my existing MT4 trading account?

No, you can't. You need to have an XM MT5 trading account to trade stock cfds. To open an XM MT5 account click here.

What instruments can I trade on MT4?

On the MT4 platform you can trade all the instruments available at XM including stock indices, forex, precious metals and energies. Individual stocks are only available on MT5.

Metatrader 4, commonly nicknamed MT4, is a widely used electronic trading platform for retail foreign exchange, developed by the russian software company metaquotes software corp, which is currently licensing the MT4 software to almost 500 brokers and banks worldwide. Released in 2005, the MT4 trading software became extremely popular with retail forex traders especially for its easy to use features and the ability to even facilitate automated trading by allowing users to write their own trading scripts and trading robots (commonly known as expert advisors). For most online traders and investors, whether they are trading forex or cfds (contracts for difference on various financial instruments), metatrader 4, is undoubtedly a household name today.

Not only is MT4 considered to be the most popular online trading platform to access the global markets but it is also regarded as the most efficient software for retail foreign exchange trading (i.E. Especially developed for individual online traders). Online (or electronic) trading platforms are computer-based software programs used to place trading orders for various financial instruments through a network with financial institutions (e.G. Brokerage companies) that operate as financial intermediaries (i.E. Facilitate online transactions between buyers and sellers by executing their trades). Online investors can trade on live market prices being streamed by trading platforms, as well as enhance their profit potential with some additional trading tools provided by these platforms such as trading account management, live news feeds, charting packages and can even use trading robots, also called expert advisors.

As compared with today’s online trading platforms used for trading a series of financial instruments such as currencies, equities, bonds, futures and options, the very first such software versions were almost exclusively associated with stock exchange. Until the 1970s, financial transactions between brokers and their counterparties were still being processed manually, and traders did not have the possibility to access the global financial markets directly but only through an intermediary. It was also was during this time that electronic trading platforms started being applied to carry out at least a part of these transactions. The first such platforms were mainly used for stock exchange and known as RFQ (request for quote) systems, in which clients and brokers placed orders that were only confirmed later. Starting from the 1970s, e-trading platforms that did not provide live streaming prices were gradually replaced by more developed software with near instant execution of orders, along with live price streaming and more enhanced client user interface.

How MT4 developed

The very first generation of internet-based foreign exchange (forex) trading platforms emerged in 1996, making it possible for foreign exchange to develop at a much faster pace and for customer markets to expand. As a result, web-based retail foreign exchange allowed individual customers to access the global markets and trade on currencies directly from their own computers. Although the first generation of such electronic trading platforms was basic software downloadable to computers and still lacking user-friendly interfaces, gradually new features such as technical analysis and charting tools were added, resulting in more enhanced attributes and also the option for these programs to be used as web-based platforms and on mobile devices (e.G. Smartphones, tablets) compatible with automated tools such as trading robots.

Along with the introduction of online trading platforms, a rapidly growing segment of the foreign exchange market had also emerged, which involved individuals who could access the global markets and trade online through brokers and banks: retail forex. This market segment allowed even small investors to access the markets and trade with smaller amounts. The demand for technically more sophisticated trading platforms kept growing, in particular for retail forex trading, and the need grew for individuals to trade the global markets directly. Released in 2005, the metatrader 4 online trading platform was just the kind of software that made it possible for a great number of retail forex traders to speculate and invest in currency exchange and other financial instruments from virtually every spot of the world.

Usage of metatrader (MT4)

Currently, over half a million retail traders are using the MT4 platform in their daily trading practices, benefitting from its wide range of features that facilitate their investment decisions such as automated trading, mobile trading, one-click trading, news feed streaming, built-in custom indicators, the ability to handle a vast number of orders, an impressive number of indicators and charting tools. Suitable for both beginner and seasoned traders with versatile investment skills and practices, MT4 can be regarded today’s ultimate trading software in virtually every spot of the globe.

MT4 and automated trading

Automated trading is well known to online investors as a helpful tool to automatically process trade orders with extremely fast reaction time and according to a series of pre-determined trading rules (such as entries and exits) set up by traders by using the MQL programming language of metatrader4. Also known by the name of system trading, automated trading has another great advantage: as it carries out trades mechanically and based on the settings of traders, it excludes the emotional factor from trading, which may very often affect investment decisions negatively. Thus it has the ability to handle trading on investors’ behalf, along with all the analytical processes involved in the trading process.

The cutting-edge technology of the MT4 platform provides automated trading as its fully integrated feature, executing repetitive trading orders at a speed otherwise impossible with manual trading. For many investors this saves up a considerable amount of time from the routine of market watch as well as trade execution.

Backtesting (i.E. Testing trading strategies on prior time periods) is yet another advantage of automated trading in that it applies trading rules to historical market data and so it helps investors assess the efficiency of several trading ideas. On applying proper backtesting, traders can easily evaluate and fine-tune trading ideas, which they can later apply in their own trading practices for better results. Effective as it is, automated trading is also a sophisticated method to trade the markets and as such it, mainly for beginner traders, it is advisable to start with small sizes during the learning process.

Additionally, potential mechanical failures can also affect the outcome of trades carried out by the automated system, and many traders with poor internet connection are compelled to also manually monitor trades being handled by automated trading. In order to exclude any negative factors such as slow internet connectivity, computer failures, or unexpected power cuts, the optical fibre connectivity based free MT4 VPS (virtual private server) service of XM ensures smooth operations of automated trading and expert advisors at all times by allowing clients to connect to the MT4 VPS and enjoy seamless trading.

Automated trading and MQL

Automated trading is undoubtedly one of the most popular features of metatrader 4. It is remarkable data in itself that since 2014, over 75% of the united states stock share trades, including NASDAQ and the new york stock exchange, have been carried out through automated trading system orders. The fact that today automated trading on the MT4 software is also available for retail traders and investors is a huge plus, allowing trading not only on stocks but also on foreign exchange (forex), futures and options. The MT4 platform uses MQL4, a proprietary scripting language for implementing trading strategies, which helps traders to develop their own expert advisors (i.E. Trading robots), custom indicators and scripts, as well as to test and optimize their eas with the MT4 strategy tester.

MQL4 encompasses a great number of functions that enable traders to analyse previously received and current quotes, follow price changes by means of built-in technical indicators and not just manage but continuously control their trading orders. Over 30 custom technical indicators are at traders’ disposal on the MT4 software and available on various financial instruments besides forex, which helps investors identify price dynamics patters, market trends and also to determine possible entry and exit points, as well as to manage trading signals.

The trading programs written in the MQL4 programming language serve different purposes and present traders with various features. Expert advisors, which are linked to specific charts, provide valuable information to online investors about possible trades and can also perform trades on their behalf, sending the orders directly to the trading server. Along with this, by using MQL4, investors can write their own custom indicators and use them in addition to those already available on the MT4 client terminal. MQL4 also includes scripts, but unlike expert advisors, these do not execute any pre-determined action on traders’ behalf and are meant to handle the single execution of certain trading activities.

Mobile trading and MT4

Metatrader4 was designed by taking into account all the requirements of the 21st century technology and thus it ensures flexibility at its very best, the core of this being mobility. This is exactly why the MT4 mobile trading option allows investors to also access the trading platform, apart from their windows and mac operating system based pcs, directly from their smartphones and tablets. Trading portfolio as well as multiple trading account management and/or monitoring is thus possible practically speaking on the go. Having the ability to manage multiple trading accounts from one interface and from portable devices like smartphones, pocket and tablet pcs gives investors a definite edge in trading, while the software’s compatibility with the IOS operating system allows mac users to follow up with market changes 24 hours a day and place trades directly from iphone, ipad or ipod touch.

The MT4 mobile trading makes it extremely easy for online investors to follow the global markets at any time and from anywhere, place and execute orders instantly and of course manage their accounts even when away from their home pcs. Additionally, mobile trading also provides a wide array of analytical options and the graphical display of quotes for proper account management. Since the MT4 mobile trading options are exactly the same for smartphones and tablets as for trading from table pcs, online investors can perform their trading activities at the same speed and with the same trading tools for best results.

Одна учетная запись для всех служб microsoft

Одна учетная запись. Одна панель управления. Добро пожаловать на страницу учетной записи.

Нет учетной записи microsoft?

Узнайте, как начать работу с продуктами microsoft.

Безопасность

Изменяйте пароль, обновляйте секретные вопросы и поддерживайте актуальность важных сведений учетной записи.

Конфиденциальность

Просматривайте историю поиска, посещений веб-страниц, местоположений и многое другое.

Семья

Обезопасьте свою семью в интернете и оставайтесь на связи, даже когда находитесь вдали друг от друга.

Платежи и выставление счетов

Обновляйте платежную информацию, просматривайте историю заказов, используйте подарочные карты и получайте помощь с оплатой.

Подписки

Быстро продлевайте подписки и управляйте службами microsoft из единой панели.

Устройства

Найдите и заблокируйте утерянное или украденное устройство windows 10, сотрите с него данные или запланируйте ремонт и получите помощь.

Справка

Получите помощь и советы экспертов по продуктам и службам microsoft.

Войдите в учетную запись и начните работу

Пользуйтесь всеми любимыми продуктами и службами microsoft с помощью единого входа. От office и windows до xbox и skype – одно имя пользователя и один пароль объединяют вас с самыми важными файлами, фотографиями, людьми и контентом.

Outlook

Почта и календарь в одном. Все, что нужно для эффективной работы и общения дома и в дороге.

Skype

Оставайтесь на связи с близкими на всех устройствах с помощью текстовых сообщений, голосовых и видеозвонков skype.

Microsoft edge

Быстрый браузер для эффективной работы в сети: с ним удобно искать информацию, узнавать новое и систематизировать закладки.

Microsoft bing

Интеллектуальные функции поиска помогают быстро и удобно находить все необходимое — ответы, новости, развлечения и многое другое.

Играйте в любимые игры где угодно. Играйте, общайтесь с друзьями и заходите в сообщества на xbox one, компьютерах с windows 10 и мобильных устройствах.

Microsoft 365

Выполняйте важные задачи с word, excel, powerpoint и не только. Каким будет ваш следующий успех с office 365?

Onedrive

Бесплатно сохраняйте и просматривайте файлы и фотографии на своих устройствах. В учетной записи microsoft доступно 5 ГБ хранилища, и вы сможете добавить больше при необходимости.

Windows

Найдите и заблокируйте утерянное или украденное устройство windows 10, сотрите с него данные или запланируйте ремонт и получите помощь.

Microsoft store

Воспользуйтесь лучшими предложениями microsoft — от приложений для работы и творчества до игр и развлечений.

Кортана

Экономьте время и будьте организованными — кортана помогает решать повседневные задачи, чтобы вы не отвлекались на мелочи.

Благодаря MSN полезная информация доступна в любое время.

Forgot password

To reset the password for your real account, please fill in the form below.

In case you forgot the MT4/MT5 ID of your real account, please feel free to contact us by live chat or by email at support@xm.Com.

Alternatively, you can search your email inbox for the welcome email sent when you opened your account. The email title is "welcome to XM".

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Change settings

Please select which types of cookies you want to be stored on your device.

XM forex live account rebate setup

Open a new XM account

Step 1. Open a real account

XM account opening requires identification, handheld front ID photo and address proof.

Identification accepts ID card, passport and driving license.

Proof of address accepts bank bills or utility bills, such as credit card bills, property fees, water bills, electricity bills, etc.

If your ID has an address on it, you can use the ID as proof of address.

Step 2. Submit the account.

Login goodib.Com and let us know that your trading account is ready, we will confirm that your account was opened through us, so we can pay the rebates to you.

There may be no rebate for transactions before account confirmation.

Step 3. Trade and get rebates.

Transfer an existing account

Step 1. Open a new additional account

Existing trading accounts cannot be transferred directly. You can open an additional account to earn rebates. Click the “ open live account ” button below to open the registration page of the official website, then find “ require an additional account ” at the right side of the page, then follow the prompts to log in and open a new additional account.

Step 2. Submit the account.

Login goodib.Com and let us know that your trading account is ready, we will confirm that your account was opened through us, so we can pay the rebates to you.

There may be no rebate for transactions before account confirmation.

Step 3. Trade and get rebates.

Most of trading system can not makes profits greater than the transaction costs. —— van K. Tharp

Goodib.Com does not accept applications from residents of the U.S and iran.

The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions. Any data and information is provided ‘as is’ solely for informational purposes, and is not intended for trading purposes or advice.

Xm live account

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please consider our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Hear what’s streaming on siriusxm

Enjoy the best entertainment experience anywhere—on your phone, at home, and online.

Premier

$1 for 3 months

with a premier subscription. Then $13 a month. Fees and taxes apply. See offer details below.

Our premium streaming package. Listen on your phone, at home, and online. View channel lineup

- 300+ channels to enjoy on your phone, at home, and online

- News, entertainment, comedy, and sports

- Ad-free music for every genre and decade, plus streaming channels for your party, workout, and more

- Thousands of shows and videos available on demand

- Top sports talk and analysis

- NHL®, NCAA® play-by-play

- NFL play-by-play

- Create your own stations based on artists or songs you choose

- Two dedicated howard stern channels, including video

Offer details for premier package: activate a siriusxm premier streaming subscription and get your first 3 months for $1.00. Fees and taxes apply. A credit card is required on this offer. Service will automatically renew thereafter every month. At the beginning of month 4, you will be charged at then-current rates (currently $13.00/month). You must cancel your subscription during your promotional period to avoid future charges. Please see our customer agreement at www.Siriusxm.Com for complete terms and how to cancel, which includes calling us at 1-866-635-2349. Promotional fees and taxes are nonrefundable and there are no refunds or credits for any partially used promotional periods. If you cancel during the initial promotion period, you have the option to continue service through the end of your paid promotional period. All fees, content and features are subject to change. This offer cannot be combined with any other and may be modified or terminated at any time. Offer good only for new siriusxm streaming subscriptions. Channel lineup varies by package.

Select

$5 /mo for 12 months + an amazon echo dot.

Billed upfront. Then $16.99 per month. Subject to amazon's inventory. Please allow a minimum of 8 weeks for delivery. Fees and taxes apply. See offer details below.

All your favorites. Listen in your car, on your phone, or at home. View channel lineup

- 325+ channels, including 155+ in your car, plus even more you can stream on your phone, at home, and online

- News, entertainment, comedy, and sports

- Ad-free music for every genre and decade, plus streaming channels for your party, workout, and more

- Thousands of shows and videos available on demand

- Top sports talk and analysis

- MLB®, NBA, NHL®, NCAA® play-by-play

so, let's see, what we have: discover all the type of accounts you can open with XM, their characteristics and features, and how you can try them all. Learn now at xm live account

Contents of the article

- Top forex bonus promo

- XM account types, features and openings (2021)

- XM account types

- Demo account

- Standard account

- Micro account

- XM zero account

- Ultra low account:

- Professional account

- Shares account

- Islamic account

- XM account openings

- Live account opening

- Live account verification

- Account currency

- Account funding

- Minimum deposit

- Deposit and withdrawal

- Bonuses

- XM account management

- Xm live account

- Trading account types

- XM CY trading account types

- Micro account

- Standard account

- XM zero accounts

- What is a forex trading account?

- What is a multi-asset trading account?

- Who should choose MT4?

- Who should choose MT5?

- What is the main difference between MT4 trading accounts...

- Can I hold multiple trading accounts?

- How to manage your trading accounts?

- This website uses cookies

- This website uses cookies

- Your cookie settings

- Metatrader 4 (MT4)

- Why XM MT4 is better?

- XM MT4, faster and better.

- How can I find my server name on MT4 (PC/mac)?

- How can I gain access to the MT4 platform?

- Can I use my MT5 account ID to access MT4?

- How do I get my MT4 account validated?

- Can I trade stock cfds with my existing MT4 trading account?

- What instruments can I trade on MT4?

- How MT4 developed

- Usage of metatrader (MT4)

- MT4 and automated trading

- Automated trading and MQL

- Mobile trading and MT4

- Одна учетная запись для всех служб microsoft

- Нет учетной записи microsoft?

- Безопасность

- Конфиденциальность

- Семья

- Платежи и выставление счетов

- Подписки

- Устройства

- Справка

- Войдите в учетную запись и начните работу

- Outlook

- Skype

- Microsoft edge

- Microsoft bing

- Microsoft 365

- Onedrive

- Windows

- Microsoft store

- Кортана

- Forgot password

- XM forex live account rebate setup

- Open a new XM account

- Transfer an existing account

- Xm live account

- Hear what’s streaming on siriusxm

Comments

Post a Comment