How to Start Trading Forex (4 steps), how to start forex trading for free.

How to start forex trading for free

What is a spread?: spread is nothing but the difference between the bid and ask price.

Top forex bonus promo

So in the above example, for 1.31428/1.31420, the spread would be 8 pips. ( read more about forex spread) trading platform:you need a trading platform from which you can place your trades, which are then sent to the broker for settlement. Also, a trading platform is essential for you to conduct your technical analysis and also to see the current market prices. Most retail brokers offer the MT4 (short for metatrader 4) trading platform, which is free of cost. You can also open a demo trading account and practice trading with virtual money to gain the experience required before trading with real money.

How to start trading forex (4 steps)

Welcome to the world of forex. There might be many reasons why you are reading this article. It could be that your friend or acquaintance mentioned about how they trade and perhaps even make a living by trading forex. Whatever your reasons may be; this article will give you an overview of the forex markets and how to start trading forex … and perhaps make money for yourself.

Step 1. What is forex?

Step 2. Learn forex basics

Step 3: find a forex broker

Step 4: start trading

Step 1. What is forex?

Forex, or foreign exchange is an unregulated market, also known as OTC (over-the-counter) and is the biggest market with average daily turn-over that runs into billions. It is even bigger than the US stock markets. Although due to its OTC nature, no one can really give the correct numbers as to the forex turnover. But nonetheless, forex is indeed a big market and thus allows many market participants. From your neighborhood bank to specialized investment companies, to your friend; the forex markets always offers a piece of the action whoever you are and wherever you are (even from your home).

The basic concept of trading forex is very simple. You trade or speculate against other traders on the direction of a currency.

So, if you believe that the euro is going to rise, you would BUY the euro, or SELL the euro if you think the euro would fall. It’s as simple as that.

Step 2. Learn forex basics

Before you get ready to deposit your funds and start trading there are some important points you must understand, each of which are outlined below.

Forex brokers: in order to start trading forex, you will need to trade with the help of a forex broker. There are many forex brokers out there today who allow you to open a forex trading account for as little as $5. The forex broker is the one who facilitates your buy and sell orders and also allows you to research into the markets (also known as technical or fundamental analysis) to help you make more informed decisions… and of course allows you deposit more funds or withdraw your profits when you want to. ( click here to see our forex brokers rating )

Trading platform:you need a trading platform from which you can place your trades, which are then sent to the broker for settlement. Also, a trading platform is essential for you to conduct your technical analysis and also to see the current market prices. Most retail brokers offer the MT4 (short for metatrader 4) trading platform, which is free of cost. You can also open a demo trading account and practice trading with virtual money to gain the experience required before trading with real money.

Forex trading hours:while you might have heard that the forex markets never sleeps, it actually does. Firstly, you won’t be able to trade on weekends (saturday and sundays). But for the rest of the week, the forex market operates 24 hours a day. This is due to the fact that forex trading is global. At any point in time, you will always find an overlap of a new market session while the previous market closes. What time of the day or which market session you trade plays a big role if you are an intra-day trader or a scalper. This is another vast topic, which we will cover at a later stage. ( click here to learn more about forex trading hours . )

Now that you have a basic overview of the forex markets, here are some final pointers to remember before you start trading for yourself.

What is a pip?:pip is a measure of change in a currency pair’s value and is the 5 th decimal. For example, if EURUSD changes from 1.31428 to 1.31429, the change is denoted as 1pip (1.31428 – 1.31429 = 0.00001). When you trade, the more pips you make, the more profit you have. Ex: buying EURUSD at 1.31428 and selling (or closing your trade) at 1.31528 would give you 100pips in profit. ( read more about forex PIP )

Reading quotes: forex quotes are presented in a bid and ask price (both of which vary by a few pips and from one broker to another). The bid price is the price at which you can buy and the ask price is the price as which you can sell. So, a EURUSD quote would look like this 1.31428(bid)/1.31420(ask).

What is a spread?: spread is nothing but the difference between the bid and ask price. So in the above example, for 1.31428/1.31420, the spread would be 8 pips. ( read more about forex spread)

What is a leverage?: leverage is the amount by which you can request your broker to magnify (or increase) your trade value. Leverage is often quoted in ratios such as 1:50, which means that when trading on a 1:50 leverage, your $100 is magnified to $50000. Leverage is a big topic in itself and it is recommended to read this article to learn more. Leverage is important both in terms of making profits as well as managing risks and therefore, your trades.

What is a lot?: A lot is a unit by which you place your trade. In financial terms, a lot is also referred to as a contract. There are preset lots (or contract sizes) that you can trade. For example a standard lot is nothing but 100,000 units (known as 1 lot). ( read more about lot)

Reading charts: the ability to understand and read the charts is very essential to trading. Depending on your approach, you can choose between a line, bar or candlestick charts and trade accordingly (for example trading based on candlestick patterns). ( read more how to read forex charts)

Placing orders (how to buy and sell): in forex trading, it is possible to either buy or sell any currency pair. Most trading platforms, give you this option. You buy when you think that price will go up and you sell when you think that price will fall. There is a common terminology used in forex trading, which is buy low, sell high; which is an important point to remember. ( read more how to place orders with MT4 )

Order types: besides buy and sell, another point to remember the types of orders. There are two basic order types: market orders and pending orders. When you click on ‘buy’ or ‘sell’ you are basically buying (or selling) at the current market price. A limit order on the other hand tells the broker that you want to buy or sell only at a particular price. ( read more about types of forex orders)

Step 3. Find a forex broker

As mentioned, there are many forex brokers today and therefore it can get confusing on how to choose the forex broker that is right for you. To briefly summarize, remember the following points while choosing a forex broker:

- Look for a forex broker that is regulated

- See if the forex broker offers a minimum deposit amount

- What is the leverage that the broker offers

- What is the minimum contract size that you can trade

- Bonuses and the terms and conditions (see on our site list of forex deposit bonuses and forex no deposit bonuses)

- Deposit and withdrawal types as well as the terms and conditions

- Trading methods that are allowed by the broker

We can also help you choose a forex broker by reading our article how to choose forex broker

Step 4. Start trading

Finally, now that you have selected a forex broker to trade with it is recommended to first open a demo trading or a practice account. Most forex brokers offer unlimited demo trading account (but will be deactivated if not used for 30 days). This is a good way to get acquainted with the forex markets and also help you to understand your trading style (scalper or intra day trading, swing trading, etc) and approach (fundamental or technical analysis). You can search for various trading methods and systems or you can develop one yourself when you have a good understanding of technical or fundamental indicators.

Conclusion:

Forex trading is one of the most active and dynamic ways to trade the financial markets. At the heart of everything, it is the basic fluctuations in currency values which drives everything else. Learning to trade forex and understanding the forex markets can give a good foundation to trading other markets such as derivatives or equities.

How to start forex trading for free

Forex trading career is a passion for a big amount of peoples, but it is a risky business for newbies. Most of the newbies are falling from starting. Many peoples worried about investment and many peoples don’t have the way to start trading because there are a lot of restrictions available in the market. You will be glad to know that you can start your live forex trading career for free. Here we are going to discuss the ways of starting your free forex trading career.

So, how could you start your trading for free?

There are only two ways available for you’re to start your forex trading for free. The most effective way is a demo account and another one is no deposit bonus. If you are really want to start your trading as an experience, I will recommend you start with a demo account. If you keep an eye on the market, you will see most of the experienced brokers was started their trading by a demo account. After gathering a complete knowledge they tried by a free no deposit bonus. Here we are going to discuss both of the ways.

Start trading with demo account:

A demo account is basically like a sandbox of the forex market. Almost every forex broker has a demo account version. When you apply for it, the broker transfers virtual money (not real money) to this account and gives you the opportunity to place trades.

But, since it is virtual money that means that all of the profits you may be generating cannot be withdrawn.

That’s why I call it a sandbox. It’s basically a place for beginners to learn how forex trading works, and for veterans to simply try out some of their new strategies before using them on their real accounts.

This account will not make you any money, but it will indeed allow you to trade for free.

Nowadays almost 99% of forex brokers are providing demo trading opportunities. You can start with any of them. Most popular forex brokers like, FXTM, FBS, instaforex, easy markets, octafx, tickmill and a lot of others are providing demo trading opportunities. You can start with any of them. You will not be charged for opening a demo account. Just register an account and start trading with a big demo trading amount. If you can gain money from the demo, obesely you will be able to gain money from live trading.

Start trading with no deposit welcome account:

There is a good scope to start your trading for free. You can start your trading without investing money from your own pocket. There are a lot of brokers available who is providing free forex no deposit bonus for starting a live trading account. You will be glad to know that, there are $10 to $100 or $1000 no deposit bonus providing by brokers.

This is how the no deposit bonus works:

- You register with the broker and apply for the bonus

- The broker gives you the bonus, usually in the range of $50-$300

- The bonus is immediately credited so you can start trading right away

- In order to withdraw the bonus and the profits, the broker will ask you to trade a specific amount of funds.

- Once you’ve reached those volumes, the platform will allow you to withdraw.

We will tell you about some incredible no deposit bonuses which are providing by various brokers. You can easily start your trading by claiming these bonuses. Here are some welcome no deposit bonus details we talked about.

FBS $100 welcome no deposit bonus:

FBS is one of the most popular forex brokers in the world. You can start with them by claiming a $100 forex welcome no deposit bonus. The broker providing this bonus to all of the new customers. After completing the terms and conditions of the bonus requirements clients will able to withdraw their profits.

Instaforex $500 to $5000 welcome no deposit bonus:

The broker instaforex is offering a huge amount of no deposit bonus to all of the new customers. Clients will be able to withdraw their profits from the broker when they will fill up the withdrawal conditions. This is the biggest amount of no deposit welcomes bonus for newbies. The bonus is proving in various amounts, and it is depending on the continent.

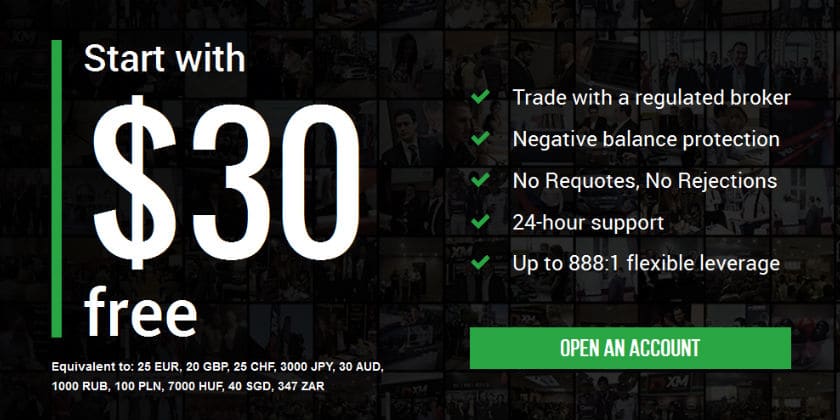

XM $30 no deposit bonus:

XM group is one of the most popular forex broker and the broker providing $30 forex no deposit bonus to new customers. The bonus is providing on learning purposes. But, if clients can make profits they will be able to withdraw their profits.

$30 welcome no deposit bonus from tickmill:

Tickmill is providing this bonus in the whole year. This is a very good opportunity for customers to start their live forex trading account. Only new and verified customers can receive the bonus once a time.

$30 welcome bonus from roboforex:

Most of the newbie traders are joining with the broker for their reliability. This is the easiest no deposit bonus for withdrawing profits. The broker keeps it very easy for customers. But, after making profits clients have to deposit at least $10 to withdraw their profits.

Fort financial services ltd $35 welcome no deposit bonus:

Fort financial services ltd called fortfs, the broker is providing a $35 forex no deposit welcome no bonus to their new customers. A newbie can easily claim the offer to start live forex trading for free.

As you can see there are a lot of brokers are providing this incredible opportunity to start your dreaming forex live trading journey without investing money from your pocket. There are almost 60% of forex brokers are offering a free welcome bonus to start live forex trading. You can start any of them. But, before starting with a broker you should justify them, how reliable they are in the market.

How to start forex trading for free

Forex trading career is a passion for a big amount of peoples, but it is a risky business for newbies. Most of the newbies are falling from starting. Many peoples worried about investment and many peoples don’t have the way to start trading because there are a lot of restrictions available in the market. You will be glad to know that you can start your live forex trading career for free. Here we are going to discuss the ways of starting your free forex trading career.

So, how could you start your trading for free?

There are only two ways available for you’re to start your forex trading for free. The most effective way is a demo account and another one is no deposit bonus. If you are really want to start your trading as an experience, I will recommend you start with a demo account. If you keep an eye on the market, you will see most of the experienced brokers was started their trading by a demo account. After gathering a complete knowledge they tried by a free no deposit bonus. Here we are going to discuss both of the ways.

Start trading with demo account:

A demo account is basically like a sandbox of the forex market. Almost every forex broker has a demo account version. When you apply for it, the broker transfers virtual money (not real money) to this account and gives you the opportunity to place trades.

But, since it is virtual money that means that all of the profits you may be generating cannot be withdrawn.

That’s why I call it a sandbox. It’s basically a place for beginners to learn how forex trading works, and for veterans to simply try out some of their new strategies before using them on their real accounts.

This account will not make you any money, but it will indeed allow you to trade for free.

Nowadays almost 99% of forex brokers are providing demo trading opportunities. You can start with any of them. Most popular forex brokers like, FXTM, FBS, instaforex, easy markets, octafx, tickmill and a lot of others are providing demo trading opportunities. You can start with any of them. You will not be charged for opening a demo account. Just register an account and start trading with a big demo trading amount. If you can gain money from the demo, obesely you will be able to gain money from live trading.

Start trading with no deposit welcome account:

There is a good scope to start your trading for free. You can start your trading without investing money from your own pocket. There are a lot of brokers available who is providing free forex no deposit bonus for starting a live trading account. You will be glad to know that, there are $10 to $100 or $1000 no deposit bonus providing by brokers.

This is how the no deposit bonus works:

- You register with the broker and apply for the bonus

- The broker gives you the bonus, usually in the range of $50-$300

- The bonus is immediately credited so you can start trading right away

- In order to withdraw the bonus and the profits, the broker will ask you to trade a specific amount of funds.

- Once you’ve reached those volumes, the platform will allow you to withdraw.

We will tell you about some incredible no deposit bonuses which are providing by various brokers. You can easily start your trading by claiming these bonuses. Here are some welcome no deposit bonus details we talked about.

FBS $100 welcome no deposit bonus:

FBS is one of the most popular forex brokers in the world. You can start with them by claiming a $100 forex welcome no deposit bonus. The broker providing this bonus to all of the new customers. After completing the terms and conditions of the bonus requirements clients will able to withdraw their profits.

Instaforex $500 to $5000 welcome no deposit bonus:

The broker instaforex is offering a huge amount of no deposit bonus to all of the new customers. Clients will be able to withdraw their profits from the broker when they will fill up the withdrawal conditions. This is the biggest amount of no deposit welcomes bonus for newbies. The bonus is proving in various amounts, and it is depending on the continent.

XM $30 no deposit bonus:

XM group is one of the most popular forex broker and the broker providing $30 forex no deposit bonus to new customers. The bonus is providing on learning purposes. But, if clients can make profits they will be able to withdraw their profits.

$30 welcome no deposit bonus from tickmill:

Tickmill is providing this bonus in the whole year. This is a very good opportunity for customers to start their live forex trading account. Only new and verified customers can receive the bonus once a time.

$30 welcome bonus from roboforex:

Most of the newbie traders are joining with the broker for their reliability. This is the easiest no deposit bonus for withdrawing profits. The broker keeps it very easy for customers. But, after making profits clients have to deposit at least $10 to withdraw their profits.

Fort financial services ltd $35 welcome no deposit bonus:

Fort financial services ltd called fortfs, the broker is providing a $35 forex no deposit welcome no bonus to their new customers. A newbie can easily claim the offer to start live forex trading for free.

As you can see there are a lot of brokers are providing this incredible opportunity to start your dreaming forex live trading journey without investing money from your pocket. There are almost 60% of forex brokers are offering a free welcome bonus to start live forex trading. You can start any of them. But, before starting with a broker you should justify them, how reliable they are in the market.

How to learn to trade for free

Want to learn how to trade, but don’t have the thousands of pounds needed to buy a trading course? Find out exactly how to learn how to trade for free!

Share on facebook

share on twitter

share on linkedin

share on whatsapp

Online trading is currently becoming one of the most sought-after sources of income and ways to make money online. Whether you want more disposable income, want to save for a house or simply want to take care of your family, trading offers the unlimited earning potential many are craving for. However, the financial markets are extremely volatile and challenging to predict for the average person. It’s often difficult to find the right place to learn and get started.

The ‘foreign exchange’ market, better known as forex, is one of the largest financial markets in the world. One of the main reasons for the growing popularity of forex is perhaps the ‘ease’ of access in comparison to the somewhat ‘complex’ world of the stock market.

However, understanding the forex market and how to trade it successfully can be just as difficult. It requires skills, patience, and also a good amount of training.

Why should I learn to trade?

“an investment in knowledge pays the best interest” – benjamin franklin.

Learning to trade is investing in your education and your financial future. Learning to trade is investing in yourself. Trading allows you to effectively generate wealth without impacting on your work life, family life and other commitments.

Here is a list of 5 reasons you should learn how to trade:

- Trading will make you use your money.

- Trading will help you become independent.

- Trading has unlimited earning potential – making 6 figures a year as a trader is not unheard of.

- Trading teaches you to control your emotions.

- Trading makes you a master of risk management and probability.

Where can I go to learn how to trade?

When making any investment it is important to gain some understanding in what you’re getting into. This will allow you to achieve the best results possible and limits the amount of mistakes you make. If you want to actually learn how to trade forex, you’ll need a basic understanding on how forex trading works to begin with.

Starttrading.Com, the leading online trading academy, is a great place to start learning the basics of the forex market, the way it functions, and why it behaves the way it does for free. Our free online course has over 40+ in-depth lessons across 7 units and is designed to help you prepare for success in the financial markets. Not only will we teach you the technical and fundamental side of trading, we will also teach you the mentality needed to trade like a pro.

What is starttrading.Com all about?

Starttrading.Com is a free online platform allowing you to design a tailored trading plan around your own understanding of the markets, with the aim for you to suffer the least losses whilst learning.

If you want to become a profitable trader, you need to master your mentality and risk management. These are arguably the most important things on your journey to becoming a successful trader. Starttrading.Com has dedicated a whole unit to mastering the mindset of a successful trader helping you learn the ‘risk management’ skills that are required for a safe and long-term profitable trading career.

Whilst it is impossible to guarantee the exact profits and the losses that can occur whilst trading, starttrading.Com provides you with all the tools and skills necessary to start trading in safest and most structured way.

What sets starttarding.Com apart?

The fact that it is as flexible as one might imagine it to be. This is an online portal that is dedicated to helping out the investors with the market trends and how we need to be handled.

- Learn to trade for free! Starttrading.Com believe learning to trade should be for everyone, we have made our course 100% free, allowing anyone to learn how to get started and take control of our finances.

- You get to learn at your own time and pace, as the lessons can be learned as many times as one requires.

- Whether you are a beginner or an expert trader, starttrading.Com has something for everyone. Staring with the very basics to the more advanced tips, you will always have expert guidance to help you in the markets.

- The website is designed so as to offer you a feature where you can keep track of your progress as you go through the lessons. This helps to look back and take notes as needed.

- The lessons are well-placed where you can join right from the basics and learn all about the forex as needed.

- Learn everything technical analysis. Want to learn how to anaylsis a chart and use indicators to identify profitable opportunities in the market? Starttrading.Com has you covered! Learn support & resistance, MACD, RSI, trend lines and much more…

- The ‘copy trading’ is an exclusive feature on the website, where you can follow the trends and patterns of the more successful players in the field. Here you simply have to copy the pattern of a particular investor and you will be allowed to use their expertise on your own individual investments. This allows you to earn from the pros, whilst you are still learning!

- Not sure which broker is best for you? Our broker reviews will breakdown all the pros and cons of trading platforms allowing you to choose which platform is best suited for your trading style.

- Get access to a free practice account, allowing you to understand how the market works without having to suffer any real losses. This is a great feature where the new investors can in a way practice all that they have learned and understood from the online lessons.

- Whilst you learn about the trends, tricks, and technical aspects, you will also be able to understand the mindset required while dealing with the fickle nature of the financial markets.

What you need to know

When making any investment it is important to gain some understanding in what you’re getting into. This will allow you to achieve the best results possible and limits the amount of mistakes you make. If you want to actually learn how to trade forex, you’ll need a basic understanding on how forex trading works to begin with. This is where startrading.Com comes into picture.

The hardest part of successful trading is that all-important first step to getting started. At starttrading.Com we make this step that little bit easier, you don’t have to start trading alone. Take your trading to the right level, simply sign up to our FREE online trading course so that we can give you the help you need today!

Share on facebook

share on twitter

share on linkedin

share on whatsapp

How to start forex trading with no money on your account

One of the main requirements of a profitable forex trading session is for you to open a position with a hefty size. In fact, the most popular position sizes in forex are equal to a standard lot (100,000 units), mini lot (10,000 units), and a micro lot (1,000) units.

However, not many people are willing to spend tens and hundreds of thousands of dollars willy-nilly. For one, they cannot afford to, and for another, they want to feel confident that their investment will pay off.

But what if there was a way to start trading for free? In fact, what if you could trade forex for free but still get some payouts? Yes, that’s what we’re going to discover in this guide. First, we’ll explore demo trading, after which we’ll talk about a no deposit bonus and how you can use it to your advantage.

Start trading with no money using a demo account

In forex, you can find tons of varying trading accounts from different brokers. There are many different live accounts, be it standard, micro, or VIP, as well as ECN accounts and even islamic accounts. Alongside them, there’s also one account type that comes with pretty much all broker platforms – a demo account.

Just as the name suggests, a demo trading account allows you to demonstrate your trading skills and knowledge in the market. What differentiates this account from other live accounts is that with it, you can enjoy forex trading without making a deposit

But exactly how to start forex trading for free? Well, one of the distinctive differences between live and demo accounts is that the latter lets you trade in a virtual market. What this means is that the price movements simulate the real-time market developments, yet you’re not spending your money to open new trades, modify them, and close them at an appropriate time.

For example, with a demo account from forex.Com, you can open a position for the EUR/USD pair for 100,000 USD. You’ll be able to buy a certain number of euros with your virtual money in a live market, then wait for it to increase, and once it reaches the desired point, sell it to make a virtual profit.

But why would you want to use this approach, instead of just engaging in live trading and earning real money? Well, as we have noted earlier in the introduction, many traders are either reluctant or cannot even afford to deposit thousands of dollars from their pockets. First, they want to get the gist of real-like forex trading and then they’ll decide, whether they’re ready for the real thing.

And with a demo account, they can do just that. They can do forex trading without investment, try out different currency pairs and observe their performance patterns, test different strategies, and find the best times to enter the market. And if they find that their skill levels are enough to start generating real profits, they can go ahead and trade forex with real money.

Pros and cons

As previously pointed out, a demo account is a great tool to see yourself perform in a life-like trading market. You can put your newly-learned skills to test and determine your readiness to get to real trading.

Here are some of the main benefits of trading with a demo account:

- You can actually start forex trading without a deposit;

- You can perform all your trading skills and techniques in a virtual market, which means all the price fluctuations are identical to the actual market, although you’re not affected by them;

- You can determine whether you’re ready to start real forex trading or it’s still a bit early to think about it;

- Even as an experienced trader, you can also take advantage of a demo account. If you want to try out a different currency pair or a strategy, a demo account can really come in handy.

With all of the above-mentioned advantages in mind, we should also point out some of the disadvantages of a demo account. And rest assured – there are a few, namely:

- Regardless of how profitable your demo positions get, you’re not getting any profits from them;

- Since you’re not risking your own money, the psychological factor in the learning process is squashed. More precisely, you’re not worried about losing your hard-earned money when you trade forex without deposit. In light of this, you can afford to be less careful and more risk-taking, thus, not learning as much about trading.

Where to find a demo account?

The overwhelming majority of forex brokers offer demo trading accounts to their clients. This is and has been the case for a long time now. With that being said, however, not all demo accounts are the same.

When choosing a broker with their demo platform, you need to account for a number of variables, including the broker’s reliability, the flexibility of its demo account, and the amount of virtual money it offers you. Let’s check out some of the best options now:

Best overall – XM demo account

So, how to start forex trading free with the best possible option? Meet the demo trading account from XM. This is a truly international broker that holds licenses from multiple different regulators, including the UK (FCA), cyprus (cysec), and australia (ASIC). In short, if you’re searching for a demo account from a reliable broker, XM is your choice.

Now, the demo account itself. With XM, it’s pretty easy to set up your own practice account, although, depending on your jurisdiction, you might need to disclose varying personal documents. Once you get your demo account, you’ll be able to use both metatrader 4 and metatrader 5 to trade forex, as well as many other financial assets, including stocks, commodities, and indices.

Therefore, the XM demo account is the best option if you’re looking for the safest and most effective way to hone your trading skills.

2nd place – exness demo

While the XM demo account is a well-rounded option for the majority of forex traders, there are other options that are no less beneficial. For example, the exness demo account will redefine the ways of how to trade without money for you.

First things first, exness is a seychelles-based forex broker with the FSA license, which means it’s held accountable for its actions by a reputable regulator. But what makes exness and its trading offerings, including its demo account, impressive is its exceptional leverage rate. The maximum leverage you can get with this broker goes up to 1:unlimited!

As for the demo account itself, you can utilize its full potential within metatrader 4 or metatrader 5. There are also tons of instruments to choose from, be it forex pairs, stocks, energies, or even cryptocurrencies. And your virtual account balance will refill regularly, allowing you to use the available trading app without deposit continuously.

Best for the US-based traders – forex.Com

Now, the two above-mentioned demo accounts are the best choices if, granted, you’re residing outside of the US. As you may or may not know, the united states has some of the strictest financial trading regulations in the industry, which makes it an unappealing marketplace for the majority of brokers.

Forex.Com is one of the few forex brokers that do provide services to american citizens. What this means is that it abides by all the rules and guidelines of the US regulator, and offers one of the safest trading platforms in the world. And its demo account is a testament to this.

As an american trader, you can easily set up the forex.Com demo account. And just like the other two demos, this one also utilizes the full potential of MT4 and MT5, as well as web and mobile trading platforms. But unlike the above-mentioned accounts, there is a limited selection of assets you can trade without deposit: currencies, precious metals, and futures.

Best web platform – IQ

In the nomination for the best web platform for demo trading, IQ option is a definite winner. The broker has a truly international reach out of all mentions here, providing services to almost 50 million people in 189 countries.

With the license from the cyprus securities and exchange commission (cysec), IQ option provides safe and reliable trading resources, including demo and live trading platforms, for all sorts of traders, be they beginner or experienced. The broker offers its own trading platform, which is full of technical/fundamental indicators, as well as high-powered charting features and whatnot.

And how to start forex trading without money with IQ option? Well, there’s a full-fledged demo account with an automatically-refillable virtual balance of 1,000 USD. It lets you trade all sorts of assets, including currency pairs, cryptocurrencies, and even options.

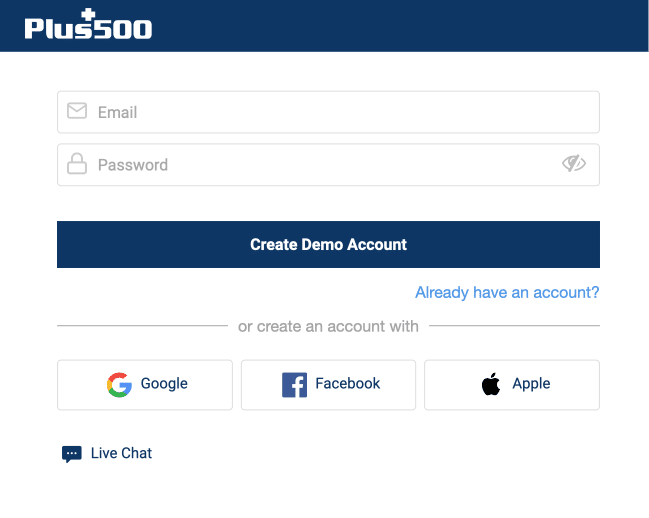

Best for starters – plus500

Now, if you’re a complete amateur in forex and haven’t had any connection with this field, there are quite a few options you can choose from. However, if you want the best possible contender, plus500 is the one for you.

Right after you boot up the website, plus500 welcomes you with a splash screen, letting you set up either a live or a demo account. Both accounts heavily depend on the available platforms, be it a proprietary windows 10 trader, webtrader, or an android trading app.

The reason why we recommend you to start forex trading for free with plus500 is that you can very easily set up a demo account with it; you just need to enter your email, password, and that’s it! Plus, the broker holds a license from the financial conduct authority (FCA) from the UK, which adds a whole new scope of reliability to the plus500 demo account.

Use no deposit bonus to trade without money

Everything we’ve discussed in this guide above was about how you can trade forex without making a deposit. However, what if you still want to trade for free and earn real money? Is there a way you can actually do that?

As it turns out, there is! Meet a no deposit bonus, which lets you trade forex without any deposit but still generate profits. The brokers that offer this bonus give it out to the newcomers to their platforms and the amount of the no deposit bonus ranges between $5 to $100.

Benefits and disadvantages of a no deposit bonus

Just like a demo account, a no deposit bonus does also come with its fair share of benefits and disadvantages. First, let’s list all the benefits you can reap from a no deposit bonus:

- Unlike a demo account, you’re trading with the actual trading balance here. This means at any point of your trading career, you can generate profits and withdraw them to your account;

- Since you’re using a live trading account, a no deposit bonus allows you to grow more than a demo account. As noted earlier, one of the weaknesses of a demo account is the fact that it doesn’t let you risk your hard-earned money, thus, the learning outcomes are a bit limited. With a no deposit bonus, tho, there’s the money on the line, even if it’s not your own;

- During forex trading without investment, you can also use leverage to further increase the no deposit bonus capital and earn larger profits.

On the flip side, here are the disadvantages of a no deposit bonus:

- A regular no deposit bonus ranges in-between $5-$100, which is an insignificant amount for earning decent profit sizes;

- Due to the previous shortcoming, you’re compelled to use leverage in your trades, which adds an extra layer of risk to an otherwise safe trade;

- There aren’t many reliable brokers that offer no deposit bonuses.

Which brokers offer it? – options are limited

When it comes to finding a reliable broker that offers a no deposit bonus, your options are quite a bit limited, unfortunately.

Sure, you might find quite a few brokers that come with similar offerings but one thing you need to make sure of is how trustworthy they are. And in that case, the options narrow down quite a bit. Whether it’s sturdy regulation, realistic promotions, or flexible conditions, there’s only a handful of legit brokers that offer free money to trade forex.

XM bonus

The XM no deposit bonus is one of the rarest promotions, simply because it’s available for US traders. Considering how difficult it is to not only feature a bonus but to even run a brokerage in the US, it’s definitely a creditworthy feat for XM.

As you sign up on the broker’s platform, you get $30 within the next 24 hours to trade forex. And there are no strings attached to it, which is always important.

How to join forex trading without money?

So, still wondering how to start trading with no money? As we’ve discovered in this guide, there are a couple of great options you can use to get started in forex.

The first one on our list is a demo account. Pretty much all forex brokers feature a fully-functional demo account on their platforms. They come with an automatically-refillable virtual balance, which lets you trade currencies, stocks, and many other instruments in a virtual market. In short, a demo account is a great tool to improve your trading game.

Another option you can use to trade forex without any deposit is a no deposit bonus. And while it’s a bit rare to find a reliable bonus provider, it’s still possible and the example of the XM no deposit bonus is a testament to that. With this bonus, you can get started for free but actually generate some profits, which is even more beneficial for you.

All in all, if you actually want to start trading without making an investment from your pocket, a demo account or a no deposit bonus are two great options for you.

Frequently asked questions

The usefulness of a demo account becomes apparent when you’re trading to hone your skills in forex. It lets you trade in a virtual market, eliminating all the risks of losing money, and helping you to find the best possible strategy suitable to your preferences.

For example, if you don’t want to search a lot, then a demo account is hands down the best choice, simply because pretty much all brokers offer it. However, if you want to trade forex for free but still earn a buck, then no deposit bonus is a no brainer for you.

Comments (0 comment(s))

Subscribe to receive updates about FX bonuses

Be the first one to find out about available forex trading bonuses that can be trusted

How to start forex trading for free

Forex trading career is a passion for a big amount of peoples, but it is a risky business for newbies. Most of the newbies are falling from starting. Many peoples worried about investment and many peoples don’t have the way to start trading because there are a lot of restrictions available in the market. You will be glad to know that you can start your live forex trading career for free. Here we are going to discuss the ways of starting your free forex trading career.

So, how could you start your trading for free?

There are only two ways available for you’re to start your forex trading for free. The most effective way is a demo account and another one is no deposit bonus. If you are really want to start your trading as an experience, I will recommend you start with a demo account. If you keep an eye on the market, you will see most of the experienced brokers was started their trading by a demo account. After gathering a complete knowledge they tried by a free no deposit bonus. Here we are going to discuss both of the ways.

Start trading with demo account:

A demo account is basically like a sandbox of the forex market. Almost every forex broker has a demo account version. When you apply for it, the broker transfers virtual money (not real money) to this account and gives you the opportunity to place trades.

But, since it is virtual money that means that all of the profits you may be generating cannot be withdrawn.

That’s why I call it a sandbox. It’s basically a place for beginners to learn how forex trading works, and for veterans to simply try out some of their new strategies before using them on their real accounts.

This account will not make you any money, but it will indeed allow you to trade for free.

Nowadays almost 99% of forex brokers are providing demo trading opportunities. You can start with any of them. Most popular forex brokers like, FXTM, FBS, instaforex, easy markets, octafx, tickmill and a lot of others are providing demo trading opportunities. You can start with any of them. You will not be charged for opening a demo account. Just register an account and start trading with a big demo trading amount. If you can gain money from the demo, obesely you will be able to gain money from live trading.

Start trading with no deposit welcome account:

There is a good scope to start your trading for free. You can start your trading without investing money from your own pocket. There are a lot of brokers available who is providing free forex no deposit bonus for starting a live trading account. You will be glad to know that, there are $10 to $100 or $1000 no deposit bonus providing by brokers.

This is how the no deposit bonus works:

- You register with the broker and apply for the bonus

- The broker gives you the bonus, usually in the range of $50-$300

- The bonus is immediately credited so you can start trading right away

- In order to withdraw the bonus and the profits, the broker will ask you to trade a specific amount of funds.

- Once you’ve reached those volumes, the platform will allow you to withdraw.

We will tell you about some incredible no deposit bonuses which are providing by various brokers. You can easily start your trading by claiming these bonuses. Here are some welcome no deposit bonus details we talked about.

FBS $100 welcome no deposit bonus:

FBS is one of the most popular forex brokers in the world. You can start with them by claiming a $100 forex welcome no deposit bonus. The broker providing this bonus to all of the new customers. After completing the terms and conditions of the bonus requirements clients will able to withdraw their profits.

Instaforex $500 to $5000 welcome no deposit bonus:

The broker instaforex is offering a huge amount of no deposit bonus to all of the new customers. Clients will be able to withdraw their profits from the broker when they will fill up the withdrawal conditions. This is the biggest amount of no deposit welcomes bonus for newbies. The bonus is proving in various amounts, and it is depending on the continent.

XM $30 no deposit bonus:

XM group is one of the most popular forex broker and the broker providing $30 forex no deposit bonus to new customers. The bonus is providing on learning purposes. But, if clients can make profits they will be able to withdraw their profits.

$30 welcome no deposit bonus from tickmill:

Tickmill is providing this bonus in the whole year. This is a very good opportunity for customers to start their live forex trading account. Only new and verified customers can receive the bonus once a time.

$30 welcome bonus from roboforex:

Most of the newbie traders are joining with the broker for their reliability. This is the easiest no deposit bonus for withdrawing profits. The broker keeps it very easy for customers. But, after making profits clients have to deposit at least $10 to withdraw their profits.

Fort financial services ltd $35 welcome no deposit bonus:

Fort financial services ltd called fortfs, the broker is providing a $35 forex no deposit welcome no bonus to their new customers. A newbie can easily claim the offer to start live forex trading for free.

As you can see there are a lot of brokers are providing this incredible opportunity to start your dreaming forex live trading journey without investing money from your pocket. There are almost 60% of forex brokers are offering a free welcome bonus to start live forex trading. You can start any of them. But, before starting with a broker you should justify them, how reliable they are in the market.

FREE FOREX COURSE FOR FOREX TRADERS

1,000s of forex traders go through our free forex course every month.

“finally, a proven free forex course that highlights how to accurately trade properly and not another cut and paste guide!”

(zero experience required)

Isn’t it time you separated from the beginners & amateurs and joined the experts?

Trading is not something you should be taking lightly and neither is your education. How many youtube videos and free guides must you take before you take real action to obtain real results?

We have worked with many clients who have been in your position, most likely watched youtube videos and read re-hashed content that has been lost in translation from one guru to another…

You wouldn’t want a surgeon who youtube’d “open heart surgery” to perform an operation on you, would you?

You must stop living in dreamland where the idea of making money from trading feels A LOT better than putting in the work, effort and money (and losses) to learn and take risks to become the ideal trader you have a picture of in your mind.

No, not the trader that is sitting on a throne made out of cash…

Trading and making money is an ART and it has been LOST.

Even in today’s teachings online, you are NOT even taught how to properly execute a trade… trust us, this is one of the most common problems we fix and it can save you A LOT of money.

What you will learn is the EXACT SAME process successful traders have been monetising from for DECADES. The strategies, execution plans, frameworks and systems included in this FREE forex

Course have been fine-tuned and brought up to speed in the 21st century.

If you’re serious to become a better trader, become consistently profitable and take your knowledge to the next level, then this is the first step.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

5 basic steps to start trading forex

When it comes to business, you can’t just dive in with no knowledge and make huge bucks out of it. You first gather all the relevant information and then move to the next step. So, you need to do when starting trading forex.

Earlier we have understood some basics about forex and stock trading. We also learn some differences between the two trading markets. And found that forex trading is relevantly easier to understand and get started. And it’s time for us to start with a plan of action.

Learn the basics of trading forex

You don’t necessarily have to join some institute to get started. There are plenty of online forex trading courses, both free and paid. Forex trading apps guiding you with the basics of the market. And tons of well-written books.

If you choose to register or join an online course, beware of scammers. They’ll tell you to join their course and in no time you’ll be making ten grand or more. Don’t fall for them.

I recommend joining free courses on youtube first to get a better idea if this is the right investment place for you. Once you’re clear, you then can enroll in some paid courses.

Strategy making

Once you have a good hold on the basics of forex trading, the second step is your strategy.

In this step, you’re going to plan when you’re going to buy or sell the currency. And how you plan to face the risk related to this financial market.

So in the beginning you can be as simple as you want to be. In this phase, you might make some losses (which is meant to happen in every business). But as you gain experience, you’ll learn to minimize the risk of losing.

With time you’ll get to build a great strategy. You’ll be able to understand the trends of the forex market and predict the trends based on some well-known platforms in this market.

One more thing to add here is that you can always test your strategy by trading on some demo accounts. Demo accounts usually give you a real-time market picture of this financial market. And they’re one best way to learn and plan ahead.

Choosing the best forex trading broker

Now that you’ve learned the basics and have a strategy to proceed, it’s time to choose the broker. A broker helps you trade the foreign currency for, perhaps a little commission.

You must have seen some forex trading apps when surfing facebook or youtube. These are usually the brokers. Since everything is going digital, you can trade in this financial market without having to go to an actual in-house broker. Rather you find the best broker app (forex trading apps), sign up, and start trading.

Again there are some fraudsters not working for your best interest. They would give you sweet dreams of making loads of money. They’d ask to invest the money and would want you to lose your cash.

One key point to see if a broker is a fraud is if they ask to give you huge leverage. In simple words, for example, they ask you to invest $500 and trade in a million worth of currency. This is huge and usually, no one takes this huge risk.

When choosing a broker, you’d learn that some brokers charge a commission and some don’t. Broker in the forex market usually makes their profits from the spread. Spread is the difference in the value of buying and selling price of a currency.

Also, check if that broker is regulated by some authority or not.

Dummy trading

We have talked about this earlier. This is the one account that allows you to play with the dummy cash as you like. If you’ve followed the basic procedures and done the maths, you’ll win using this demo account. And if you’ve have succeeded in the demo account, chances of winning in the real account are very high.

Real forex trading

It’s time to get on your feet.

You’ve got the basics, you have a strategy, you know your broker and have tested yourself using demo accounts. It’s time to start investing some real cash and trade with it.

But don’t get too excited. Don’t go too easy this time. This is your real cash and it needs serious attention. Start with low leverage initially. Be very active on and review the trends with each passing day.

There are some apps that would help you analyze and discuss the trends of the market. Use them to become an expert.

These are some very basic tips for a beginner forex trader. You start with knowledge-gathering, move up to making a strategy using experts’ guidance, choose the best broker, test your guts with demo accounts, and then start trading with real cash.

So, let's see, what we have: how to start trading forex: what is forex, learn forex basics, find a forex broker, start trading at how to start forex trading for free

Contents of the article

- Top forex bonus promo

- How to start trading forex (4 steps)

- Step 1. What is forex?

- Step 2. Learn forex basics

- Step 3. Find a forex broker

- Step 4. Start trading

- Conclusion:

- How to start forex trading for free

- So, how could you start your trading for free?

- Start trading with demo account:

- Start trading with no deposit welcome account:

- This is how the no deposit bonus works:

- FBS $100 welcome no deposit bonus:

- Instaforex $500 to $5000 welcome no deposit bonus:

- XM $30 no deposit bonus:

- $30 welcome no deposit bonus from tickmill:

- $30 welcome bonus from roboforex:

- Fort financial services ltd $35 welcome no deposit...

- How to start forex trading for free

- So, how could you start your trading for free?

- Start trading with demo account:

- Start trading with no deposit welcome account:

- This is how the no deposit bonus works:

- FBS $100 welcome no deposit bonus:

- Instaforex $500 to $5000 welcome no deposit bonus:

- XM $30 no deposit bonus:

- $30 welcome no deposit bonus from tickmill:

- $30 welcome bonus from roboforex:

- Fort financial services ltd $35 welcome no deposit...

- How to learn to trade for free

- Why should I learn to trade?

- Where can I go to learn how to trade?

- What is starttrading.Com all about?

- What sets starttarding.Com apart?

- What you need to know

- How to start forex trading with no money on your account

- Start trading with no money using a demo account

- Pros and cons

- Where to find a demo account?

- Best overall – XM demo account

- 2nd place – exness demo

- Best for the US-based traders – forex.Com

- Best web platform – IQ

- Best for starters – plus500

- Use no deposit bonus to trade without money

- How to join forex trading without money?

- Frequently asked questions

- How to start forex trading for free

- So, how could you start your trading for free?

- Start trading with demo account:

- Start trading with no deposit welcome account:

- This is how the no deposit bonus works:

- FBS $100 welcome no deposit bonus:

- Instaforex $500 to $5000 welcome no deposit bonus:

- XM $30 no deposit bonus:

- $30 welcome no deposit bonus from tickmill:

- $30 welcome bonus from roboforex:

- Fort financial services ltd $35 welcome no deposit...

- FREE FOREX COURSE FOR FOREX TRADERS

- “finally, a proven free forex course that highlights how to...

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- 5 basic steps to start trading forex

- Learn the basics of trading forex

- Strategy making

- Choosing the best forex trading broker

- Dummy trading

- Real forex trading

Comments

Post a Comment