The difference between A-book and B-book brokers, a book forex broker list.

A book forex broker list

“how can this possibly be legal?!” in my experience, big accounts are placed on A-book due to the risk to the broker.

Top forex bonus promo

Imagine having a $200k account, going short 1,000 lots at on USDJPY and picking up 100 pips? You just made $1mil. That’s not a risk most brokers are willing to take!

The difference between A-book and B-book brokers

What’s all this talk of A-book and B-book brokers I hear you say?

Let me explain in simple english. At the end of this post, you’ll be able to explain to all your rookie trader buddies the secret workings of the brokerage industry. I guarantee you’ll be able to impress them and totally sound like you know what you’re talking about.

Firstly, let’s clear the air. Almost every broker in the world is a mixture of A-book and B-book. It’s not like there’s a secret fraternity of A-book brokers that walk around in white suits releasing doves into the wild and saving homeless traders from the street. All brokers (with very few exceptions) are a combination of A & B-book.

“sure, whatever. What the heck is A & B-book?”

A-book means your trade is passed through to the market and filled by a “liquidity provider”, basically a fancy term for “bank”. Imagine you want to buy some USDJPY, your broker places the order with the bank, the bank then digs into their vault and fills your order.

This A-book transaction is what most people understand as the role of a traditional broker. A transaction facilitator. Not a supplier. Think of a real estate broker or a stock broker. They source the deal, and in return, earn a commission.

B-book on the other hand!

Forget the bank. You’re now buying directly from the supplier. When placing a trade on the brokers B-book, they fill your trade internally. Instead of passing your trade along to the banks, they’ll fill you from their balance sheet. They take the risk with their own company capital. So when you win, they lose. And vice versa.

I hear you… but it’s not as unconscionable as you think. It’s completely legal. I’ve even been told the regulators actually encourage the practice because it results in clients trades executing at a better price (due to the order being filled instantly).

“how can this possibly be legal?!”

I know I know… I was as shocked as you when I first learned how the inner workings of the brokerage industry operate. Here’s how they get away with it. ALL regulated forex brokers possess what’s known as a “market maker license”. Whether the broker is regulated by ASIC, FCA or the NFA, it’s the same. They have the OPTION to fill the trades internally (B-book) or pass them through to the market (A-book).

As a client, you’ll likely never know which book you’re on.

In my experience, big accounts are placed on A-book due to the risk to the broker. Imagine having a $200k account, going short 1,000 lots at on USDJPY and picking up 100 pips? You just made $1mil. That’s not a risk most brokers are willing to take!

On the other hand, if you’re trading a small account the odds are that your trades are executed on B-book.

How can you test?

If your trades are being filled quickly during a news release, then it’s a safe bet you’re on B-book. Traditionally liquidity dries up during times of high volatility, so it’s harder to find a counterparty (bank) to fill your trade. However, on B-book, that’s not an issue because they fill your order instantly. If you’re trading an EA that makes money during news releases, then I can say with 99.99% certainty that you’re on B-book.

Does it matter?

I don’t think it does. If you put the morality aside of brokers pretending to be white knights who hunt down the best liquidity in the world to deliver you spreads of 0.0, and instead accept the fact that price is the only thing that matters, B-book is superior.

However, I don’t personally like the idea of the broker betting against me. I want my, and my broker’s motivations to be aligned

The only way to ensure that happens is to trade profitably.

Take their money initially, then they’ll move you to A-book and you’ll all trade happily ever after.

Do you have any experience managing risk within a broker? Please share your inside tips and experiences for the benefit of our community.

You have our assurance that your identity will remain anonymous.

Try live forex trading room now for just 7 days free and gain access to:

- Daily live streams

- FX trading academy

- Tradeable forex signals

- Live chat with all members

- And much, much more!

What is the A book and B book that forex brokers use?

Forex trading is different from investing in shares or futures, because a broker can choose to trade against his clients. This system used by "dealing desk" market maker brokers is known as "B booking".

"no dealing desk" ECN/STP brokers send all of their clients' trades to the real market or to liquidity providers. They therefore use the "A booking" system.

However, many forex brokers use a hybrid model which uses a B book for clients who lose money and an A book for the profitable clients.

In the regulated futures contract and stock markets, all transactions are sent to an exchange that confronts buyers' and sellers' orders by sorting them according to price and time of arrival.

The A book - used by ECN / STP forex brokers

ECN/STP brokers all use an A book, they are intermediaries that send their clients' trading orders directly to liquidity providers or multilateral trading facilities (mtfs). These forex brokers make money by increasing the spread or by charging commissions on the volume of orders. Therefore, there are no conflicts of interest, these brokers earn the same amount of money with both winning and losing traders.

This type of forex broker is becoming increasingly popular because forex traders are reassured by the absence of this conflict of interest, as well as the fact that these brokers have an incentive to have profitable traders since they will increase their trading volumes and therefore the brokers' profits.

The B book - used by market maker brokers

Forex brokers that use a B book keep their clients' orders internally. They take the other side of their clients' trades, which means that the brokers' profits are often equal to their clients' losses. Brokerage firms are able to manage the risks associated with the holding of a B book by using certain risk management strategies: internal hedging through the matching of opposite orders submitted by other clients, spread variations, etc. As the majority of retail traders lose money, the use of a B book is very profitable for brokers.

It is obvious that this model generates conflicts of interest between brokers and their clients. Profitable traders can cause these brokers to lose money. Traders are often worried about being subject to the underhanded tactics of some brokers who seek to always be profitable. That's why the larger market maker forex brokers use a hybrid model that involves placing trades in an A book or in a B book based on traders' profiles.

The hybrid model

The popularity of the hybrid model is understandable, as it allows forex brokers to increase their profitability as well as their credibility. It also enables brokers to earn money off of profitable traders by dispatching their trading orders to liquidity providers.

To efficiently identify profitable traders, as well as unprofitable ones, forex brokers have software that analyses their clients' orders. They can filter traders according to the size of their deposit (the percentage of winning traders increases significantly for deposits over $10,000), the leverage used, the risk taken on each trade, the use or non-use of protective stops, etc.

The hybrid model is not necessarily a bad thing for traders because the profits made off of traders that are placed in the B book enable hybrid brokers to provide all of their clients with very competitive spreads, whether they are profitable or not. The main disadvantage of this system is that if a hybrid broker mismanages the risk of the B book, he can lose money and therefore endanger the company.

A-book and B-book types of forex brokers - what's the difference?

To understand the difference between the so-called A-book and B-book forex brokers, we have to understand what the concepts of the A-book and B-book are.

The general concept of the A-book and B-book refers to the manner in which brokers distinguish and separate their clients, based on the degree of risk that each clients’ order presents to the broker’s dealing desk. Retail forex brokerages typically have links with several liquidity providers in the interbank forex market. They get their liquidity and pricing from the big banks and prime brokers operating in the interbank market, and chop these into smaller positions that enable them fulfil their clients’ trade orders in a matter of milliseconds. These orders are all fulfilled automatically at the trading stations in the dealing desks operated by the retail forex brokers.

However, there are some orders which by virtue of trade size or due to the fact that these orders will pose in-house risk to the counterparty function of the dealing desks, cannot be fulfilled in-house. These orders will have to be routed to external venues for fulfilment. This is the basic operation that enables forex brokers to separate their clients’ orders into two liquidity buckets: the A-book and the B-book.

Before moving on to the discussion, it must be stated clearly here that there are no exclusive A-book or B-book forex brokerages. Nearly all, if not all forex brokers operate both models. Which liquidity bucket the forex broker decides to use at any time depends on what their clients are doing in the market.

It is also pertinent to define the dealing desk. A dealing desk is a department within a retail forex brokerage that is responsible for matching and executing trade orders of their clients. These clients are usually those in the B-book liquidity bucket.

A-book forex brokers

So who are the A-book forex brokers? These are the forex brokers that routinely pass on their clients’ orders for fulfilment in the interbank market or other external execution venues. They could sum up the traditional definition of a brokerage: they source the liquidity for their clients’ orders and pass these orders on for other entities to fulfil. They act like facilitators to these transactions. The closest brokerage model to the A-book forex brokerage model are the STP brokers. However, this is not to say that market makers do not routinely carry out A-book order fulfilments.

There are some reasons why some brokers decide to use the A-book fulfilment model. If a brokerage is an STP brokerage, this is pretty straightforward. By their very nature, these brokers never fulfil orders in-house. Orders are always sent to the interbank market. The broker makes money from spreads as well as from the commissions charged on the buy-sell sides of the trades. There is therefore no motivation to fulfil orders in-house.

For the market makers who routinely fulfil orders in-house using a dealing desk, the only motivation to perform A-book fulfilment transactions is simply to prevent risk to their positions. Market makers routinely take the opposite sides of their clients’ positions. Statistics have shown that 95% of retail traders lose money in forex, so this makes the counterparty operations of the market makers very profitable. However, there are the 5% of retail traders who consistently make money. Obviously, no brokerage will like to see their positions fall into losses on account of these traders. So the logical thing that the market makers do with such clients is to put them into a different liquidity bucket known as the A-book. The positions in the A-book are those which constitute inherent risks to the market maker and therefore the only way to avoid such counterparty risk is to ship the orders somewhere else for execution. The banks at the interbank forex market do not take counterparty positions, so they will be happy to fulfil such positions as they come in.

This is what the A-book operations are all about.

B-book forex brokers

Now what about the B-book forex brokers? As you may have guessed, the market makers always have the B-book system in operation. Remember the 95% of traders who are not usually profitable as forex traders? Well, these are the traders lumped into the B-book liquidity bucket for in-house order fulfilment by the broker’s dealing desk. The B-book forex brokers routinely use their in-house dealing desks to fulfil such orders, usually by taking a counterparty position to the trades of these clients.

In some instances, such brokers typically use what is known as a dark pool to mask the true identities of where the orders are being fulfilled. As two different traders send orders to the brokerage, the broker may decide to send the order to the dark pool, where another market maker picks up the trade and also drops off an order for execution in the dark pool. So both traders get their orders filled, and even though it may not show up as being executed at the dealing desk, the reality is that the order may have been filled in a dark pool without ever hitting the interbank market.

Differences between the A-book and B-book forex brokerage process

The difference between the A-book and B-book forex brokerage model is pretty simple. The A-book utilizes interbank market executions for clients’ orders, while the B-book process leads to internal order fulfilment without the usage of the interbank market.

A-book: you are trading with the banks and you have various options at transparent pricing. The broker provides the software and access to the interbank market.

B-book: you are trading with the supposed facilitator.

Closing note

The irony of the entire thing is that as a trader, you do not know what book your trade is on. If you are a consistently profitable trader, chances are that the forex broker would not take chances trying to trade against you. So your orders will more often than not, be shipped off to the interbank market. Imagine being in a situation where you consistently trade 5 lots on a commodity CFD and on each trade, you are banking thousands of dollars consistently.

The same situation occurs if you trade large volumes of say, 100 lots. A trade size of 100 lots is worth $10m trade value on the EURUSD, with a monetary value per pip of $1000. If you make 200 pips a month as total profit, you walk away with $200,000! No broker will take chances at opposing your trades.

But if you trade a small account and are not very consistent in profits, then you are more likely to be placed in the B-book liquidity bucket.

Best DMA forex brokers for 2021

Below you will find a list of forex brokers that offer direct market access (DMA) order execution. Typically, brokers provide DMA trading accounts only to institutional and premium clients. Hence, you have to deposit significant amount of funds to get on board, although this is not always the case. The DMA is very similar to the STP, but traders receive quotes from much wider range of global banks and liquidity providers. Another positive side is that transaction costs are slightly lower compared to other types of accounts. True DMA execution usually is offered by forex brokers operating in countries with advanced interbank markets.

As far as the forex market is concerned, the term “direct market access (DMA) brokers” is used to refer to a model of forex brokerage where the trader is given access to the interbank market in terms of trade pricing and order execution. DMA forex brokers do not handle any orders at the dealing desk. They are therefore also known as non-dealing desk (NDD) brokerages. They can be said to be the 100% true NDD brokerages.

DMA forex brokers basically work directly with the major banks that operate in the interbank market. These banks provide the interbank market liquidity and include entities such as deutsche bank, BNP paribas, bank of america, UBS, etc. The DMA brokers aggregate bid-ask prices from these prime brokerages using an aggregator engine and transmit these prices to their clients. When the clients select a particular bid-ask price belonging to one of the liquidity providers, the DMA forex broker sends these orders directly to the interbank market for execution.

There is usually some confusion as to the similarities and differences between ECN and STP brokers. Many times, traders confuse both types of brokers to mean the same thing. While they are similar in some respects, there is a key difference between the DMA brokers and the ECN brokers. DMA brokers typically do not send their clients’ orders to prime brokers; rather, they send them directly to the banks that act as liquidity providers (i.E. Tier-1 brokers) in the interbank market. That is where the term “direct market access” came from; giving clients and end-traders 'direct access' to the interbank forex 'market' where the liquidity providers (and not a prime broker) will act as the counterparty to the trades.

How does DMA work?

For any brokerage operation, there is a front-end (which is the trading platform that the trader sees on his/her trading station), as well as mid-office and back-office components. Using the back-office components (which include a price aggregator engine), the DMA forex broker obtains pricing from several liquidity providers, and sends these bid-ask price quotes to their clients.

The clients may get up to 8 of these bid-ask price quotes. What this means is that each of the liquidity providers whose prices are featured on the DMA forex broker’s price aggregation engine, will indicate at what price they are willing to sell a currency pair (ASK price), and what price they are willing to buy a currency pair (BID price) from the trader. Usually, a trader who wants to sell a currency pair will select the highest bid price, while a trader who wants to buy a currency pair will choose the lowest ask price. Once a selection is made, the trader clicks the order button, and the information is transmitted to the specific liquidity provider in the interbank market whose prices have been chosen, for execution.

It is not just price quotes that the DMA forex broker will show to clients on the platform. Also displayed on the trading platform are the level II quotes, which are also known as the market depth price quotes. This information tells the trader who is buying or selling at a particular price, and how much trading volume is looking to buy or sell at a particular price.

A true DMA forex broker:

- A) only makes money when their clients are trading and creating volume. Therefore, the only motivation for them to make money is to help you trade efficiently. They therefore do not have interests that are in competition with that of the trader.

- B) will typically provide a lot of cashbacks and trading analysis. Cashbacks are a rebate on higher trade volumes.

- C) will provide market executions directly with the liquidity providers, thus are able to deliver fulfillment without the trader being asked to re-quote trades.

- D) DMA brokers provide anonymity and neutrality in the trading environment, which guarantees that everyone has equal access to the same level II quote information and that there is no “last look” condition.

- E) provides transparency in trading where the broker’s interests are not in conflict with that of their clients.

- F) provides low-spread trading, with spreads sometimes being as low as 0.0 pips.

DMA forex broker advantages

What advantages do DMA forex brokers bring to the table for traders who love to trade currencies?

- A) DMA forex broker platforms are a scalper’s paradise. A typical scalper may take up to 50 trades in a day. As DMA forex brokers charge commissions for opening and closing positions, scalping actually leads to increased broker revenue from such traders. This is why DMA forex brokers actually encourage scalping, which is the complete opposite of what is obtainable with market makers (who hate scalpers with a passion).

- B) due to the fact that the DMA forex broker is not benefiting in any way from internal price mark-ups, whatever prices that the traders see on their platforms is what they will get in terms of execution, so there are no re-quotes.

- C) there is no slippage with DMA forex brokers for the same reasons as (b) above.

- D) it is in the interest of DMA forex brokers for their traders to remain profitable so they can keep trading and generating revenue in commissions. Therefore, DMA forex brokers go the extra mile to provide several tools that will enable better trading experiences. These tools include colocation facilities to reduce latency and achieve faster executions, news feeds from premium market news providers, and other trade related software that can enhance outcomes.

- E) the DMA forex brokers in our list are regulated, which reinforces the transparency in trading conditions that are already inherent in their operations.

DMA forex broker disadvantages

Trading with DMA forex brokers may have some disadvantages, which can usually be overcome:

- A) some DMA forex brokers may penalize their clients for account inactivity. Remember, DMA forex brokers only make money when the trader is active, so they may impose fees on traders that do not trade often.

- B) DMA forex brokers will charge commissions for opening and closing positions. So there is some pressure on the trader to deliver profits on trades.

You can partake of forex trading on DMA forex broker platforms by selecting from our list of DMA forex brokers. Each broker comes with varying degrees of leverage and have different contract specifications. Feel free to look at what each of these DMA forex brokers have to offer and start trading forex with the interbank market today.

Best forex trading books

Quick links: click below to jump to a section of books

Learning to trade the markets with any asset can be daunting, especially with SO many books available.

What many people don’t know is that you can learn how to trade the forex markets and apply the exact same principles to trading the stock markets (and vice versa!).

That is one of the main reasons why so many people struggle to find a good forex trading book to sink their teeth into and come out the other end a better trader.

There are hundreds of books out there, but the main question is – which is the best forex trading book?

The answer: none – there is no single best forex trading book.

The combination of ideologies, strategies, and processes will make you a better trader.

The books we have in this list cover every aspect of forex trading.

Most of the authors are credited, long-term, profitable investors – that don’t sell courses online.

This is where the beauty of reading the books on this list:

You can literally gain an incredible insight into some of the best traders that ever existed.

So we have listed the 15 best forex trading books below for you to add to your library and get some of the best insights from the very best traders.

These books are on amazon, so if you fancy having a full read – go ahead and click the links.

All of the books in their respective categories are great for anyone.

However, there is one book that will take anyone with a slight interest in learning to trade and elevate them into a true, profit-pulling, trader.

It’s expensive, but getting access to over 40 years of profitable trading experience that you won’t have to repeat is priceless.

In fact, we recommend this book to everyone

9 of the best forex trading books in 2021

An experienced trader knows that forex is pretty easy to understand, but hard to master.

We wouldn’t argue with that.

But at the same time, getting the basics right can be as difficult as working the forex trading market like a pro.

We thought we’d dive into the best forex trading books, to bring you a heads-up on what is worth spending time on.

#9. Forex trading: the basics explained in simple terms

Jim brown is an established expert on many different aspects of trading, but this forex trading book has it all if you’re interested in learning the basics. It covers pretty much everything, but the simple and accessible structure and language make it an essential text for the absolute beginner. It is for that reason that we see it as one of the best forex books available.

He’s been trading in forex for over 14 years now, and was there back when traders were using manual charting, so he knows exactly what the ‘nuts and bolts’ of forex trading involves, right down to the particular behaviours of each currency pair. His journey has taken him from those manual charts to the incredibly quick and challenging modern forex arena.

Every single aspect of forex for beginners is covered.

Choosing brokers and managing pips effectively are also key areas of the work.

He also does something that many forex experts don’t. He tells you where he trades forex and he also offers a system that you can pick up and run with, as part of the package.

The value continues with brown’s online presence.

Even if you just read the book and took advantage of his system offer, you’d still be using a book that delivers a great and useful experience. But he’s also a trader who regularly creates videos and explains his system to all those who are interested. That means facebook groups and youtube, with regular updates on the principles covered in this book.

One of the best resources in currency trading for beginners.

Interested in day trading instead of forex trading?: 9 of the best day trading books you need to read

#8. Trading in the zone

Mark douglas wrote this book to help traders master their own issues around nerves and confidence. It is arguably one of the first effective trading psychology texts ever written, and definitely one of the best currency trading books. Smart and focused, the book takes you on a huge journey.

Read this forex trading book and, at the end of it, you’ll understand a lot more about yourself as a trader.

It’s a complex book, and it’s possibly quite difficult to explain the concepts. This complexity is why the book is so famous. Simple principles that come into play every time you set up a trade are explained. Then, douglas takes you through the reality of trades. This means thinking about how they could go either way, and how you could lose money even if the trade seems perfect.

By covering points like this, douglas ensures that the psychology of a winning trader is what you walk away with. If we were to try and summarise what he is saying in the book, it’s essentially a new mindset that is being delivered. He wants traders to feel okay about loss, and feel exactly the same way with success.

This is what makes a trader invulnerable to the stress and strain that takes place when trades are occurring.

#7. How to trade in stocks

We’re including this one from the great jesse livermore because it has all of the fundamentals required for modern forex trading. In the end, anyone who is successful in trading on any market has to be capable of reading that market, and acting accordingly.

Livermore’s seminal text tells you how to do that.

Let’s not forget that livermore is still viewed as being one of the giants of investment strategies. His approach was one that he never really discussed openly, but this book affords you an insight into just what it was that drove him to invest.

Livermore was such a prominent figure in his time that he was accused of causing the stock market crash in 1929. At one point he made $3 million in one day with trading. That crash, which essentially brought america to its knees, brought him $100 million. That shows his depth of knowledge and his acute ability to read what is happening with money.

He died in 1940, and while this may initially make you feel that he was part of a different trading culture, the ideas put forward in this book will still make you more effective in forex trading, they are that useful. This book comes highly recommended, and it should be a part of every trader’s library.

#6. Candlestick charting

This is without a doubt a classic piece of work on charting, which can be one of the most dense and complex aspects of managing forex. Steve nison delivers a very detailed guide to forex book, which may scare some potential readers away, but if you stick at it you’re looking at a system that will bring you success.

The candlestick method is from the far east, and nison regularly comments on the culture surrounding that origin. He has also created whole courses around the charting method, as well as follow-up books and extra modules that expand the candlestick method even further.

It’s pretty deep stuff that just keeps evolving.

Candlestick charting is about patterns and names in the currency market, and nison makes this easy to digest and follow through on. The best thing about this forex trading book is the simplicity behind it all. Nison does an excellent job of making everything feel simple to understand, while he delivers one of the most complex strategies in modern trading.

For forex traders, you are simply buying a unique system here.

But this is also one of those books that we feel could be enjoyed by anyone who is interested at all in finance and money. So while it will help you chart more effectively, it will also give you some fundamental lessons about life.

We’re serious on this one.

Buy it, and disappear for a couple of days while you read it. It will change your entire perspective on trading in general. And it will give you a solid grounding in technical analysis and forex trading strategies.

Take our free course: technical analysis explainedtake our free course:trends, support & resistancetake our premium course: trading for beginnerstake our free course:japanese candlesticks decodedtake our free course:reversal price patternstake our free course:continuation price patterns

#5. Day trading the currency market

Kathy lien is widely respected in the markets arena, and this book shows you why. The whole thing is beautifully put together, and it caters to some beginner principles as well as more advanced analysis techniques that you can use in the forex market when you are more experienced.

One of the most useful aspects of the work is lien’s ability to take a graduated approach. She looks at currency pairs and how they will change in the medium to long-term, for example, but doesn’t swamp you with information.

This makes hers an agreeable and useful guide.

The book has been carefully written, and lien’s aim here is to ensure that readers can take practical steps away with them. Following the approaches and principles in the book will lead you towards profit, as well as improve your forex skills overall.

#4. Currency forecasting

While the title of this book may seem a little idealistic to anyone who has lost money with forex in their lives, there’s a lot of good work here. Michael rosenberg works for the mighty merrill lynch, and he has spent a good part of his career on technical analysis.

All of that knowledge is delivered perfectly in this book, which is an absolute must if you want to get serious about trading forex.

The book came out in 1995, but it is testament to rosenberg’s expertise that is consistently referred to by analysts and forex professionals today. There is nothing here that is anything less than highly useful.

If we were to pick out any favourite lessons to learn here, it would be the understanding that the international political and financial situation is not always mirrored in what happens on the markets.

#3. How to make a living trading foreign exchange

Trading forex is more than hard, it’s a daily challenge. Having the right approach from the outset counts for a lot. Courtney smith is an excellent guide along that path. He outlines a superb and simple beginner strategy, one which brings instant confidence to the reader.

The ‘rejection rule’ is what the book is most famous for, and rightly so. The rule is useful for making profit, and is successful. But that is just one of the highlights. Smith frames the book around six key strategies that should help both beginner and expert profit from the forex markets.

The strategies for trading foreign exchange here are sound, and easy to follow. It’s a book that deserves a full read-through immediately though, so give yourself the time to digest the concepts.

#2. How to start a trading business with $500

It’s a tempting title, and the inside of the book delivers on the promise. As you will know, one of the most challenging aspects of an individual trader’s life is the raising of capital. This book takes you through the approach you will need to take to forex when capital is as low as $500.

A large emphasis is placed upon key aspects like communicating effectively with a broker, something that is so important when you’re starting out, but even more so when capital is low. The book also offers some great insight into the self-discipline and the trading style required to be a successful trader.

This section is perhaps the most enlightening part if you’re new to the arena.

Well-written, and incredibly easy to understand, this basic text will help anyone who has low capital at their disposal, but still wants to make a living from the foreign exchange market and the foreign currencies traded on it.

#1. 50 pips a day forex strategy

This is a little-known book that has a lot to offer beginners and intermediates. It basically does what it says it will, and can get you on the road to success within just a few days. In a simple and clear style, the book outlines what you need to do to make sure that you make profit, pure and simple.

What’s great about this book by laurentiu damir is the inclusion of a trading system process that allows you to create your own forex strategy. In this sense it is an empowering book that should allow anyone to jump into a profit situation reasonably quickly.

It also allows you to get a hold on money management, so you don’t make any silly mistakes with the funds that you have. A perfect little introduction to forex, and a very empowering book for anyone who is just starting out.

This is a useful list of recommended forex trading books, and using any one of these books will make your forex experience a successful one.

Obviously, it is important that you follow the instructions and advice from the various authors here. They can make you a better trader, but you have to put the work in first if you’re going to make the best use of the material. The availability of these titles is good, and you’ll find them in the forex books section on amazon.

The best forex trading books

The best forex trading books is a selected list of top practical forex trading books and ebooks according to their coverage. As all traders are looking for the books to learn forex in action I have focused on the most practical, real trading books although this pick among 1000s of available books is not easy.

��must have forex trading PDF for beginner traders - finance illustrated

Want to become an expert �� in forex but don’t know where to start? �� well, this just might be your lucky day because we have finally decided to put all of our experience and knowledge into this e-book. �� download this FREE forex trading pdf. ��read right away while drinking your morning coffee. ☕

Forex trading for dummies 2019

Forex trading PDF for dummies 2019 - a crashcourse summary of the most effective forex trading ideas, strategies and tricks. The best for beginners as it's rich with pictures, examples and expert tips without the use of jargon.

The ultimate forex trading system-unbeatable strategy to place 92% winning trades (second edition)

The ultimate forex trading system has taken an easy, foolproof, practical approach to the trading using only real time or leading inherent factors (price dynamics, chart patterns and last minute traders sentiment) that control the currency moves. And because of this unique approach, the ultimate forex trading system has reached an extraordinary performance.

In a very short time the system makes you able to: 1- analyze the market as accurate as possible. 2- control your psychology during the trade. 3- gain a consistent profit. With a proven 92% winning rate on each of seven currencies CAD, AUD, EUR, GBP, JPY, CHF, NZD (or 3500 pips tradable opportunities a month) and removing the three major forex trading difficulties (accuracy, psychology and consistency), the ultimate forex trading system give you an enjoyable, stress free and highly profitable trading experience.

Forex for beginners

The book explains everything, from the pure mechanics to the trading methodology that I advocate, and which I have used in all my own trading and investing for over 17 years. Forex for beginners is also dedicated to all those traders who have asked me to write such an introduction, based on my knowledge and my methodology.

Day trading and swing trading the currency market: technical and fundamental strategies to profit from market moves (.

Discover a variety of technical and fundamental profit-making strategies for trading the currency market with the second edition of day trading and swing trading the currency market. In this book, kathy lien–director of currency research for one of the most popular forex providers in the world–describes everything from time-tested technical and fundamental strategies you can use to compete with bank traders to a host of more fundamentally-oriented strategies involving intermarket relationships, interest rate differentials, option volatility, news events, and central bank intervention.

Following the trend: diversified managed futures trading (wiley trading)

"following the trend is an absolute must read for anyone with an interest in systematic trend following whether as an investor, trader, or aspiring manager. The book is at the same time comprehensive and easy to read. As someone who has designed these types of systems, it is absolutely clear to me that clenow writes as a knowledgeable practitioner, not an armchair theoretician.

Revolution of yout income! Forex auto trading robots!

Best forex robots reviews #1 fap turbo 2, #2 megadroid, #3 forex no loss. How do you decide which is the best one for you? Well, this is where we make it easy! We've already tested all auto forex trading robots! Now we give you the best forex robot reviews

A complete guide to volume price analysis

Here in the UK we have a product called marmite. It is a deeply divisive food, which you either love or hate. Those who love it, cannot understand how anyone could live without it - and of course, the opposite is true for those who hate it!

This sentiment could be applied to volume as a trading indicator. In other words, you are likely to fall into one of two camps. You either believe it works, or you don't. It really is that simple. There is no halfway house here!

Mastering the trade, second edition: proven techniques for profiting from intraday and swing trading setups

Mastering the trade covers:

The five psychological truths that will transform you from a mistake-prone novice into a savvy trading professional.

Exact entry, exit, and stop-loss levels for the intraday trading of stocks, options, etfs, e-mini futures, 30-year bonds, currencies, and more.

Seven key internals, from $TICKS to five-minute volume—critical for gauging pending market direction from the opening bell.

Premarket checklists for analyzing recent market behavior and calculating on each trading day what you plan to do, how you plan to do it, and why.

Airtight risk control techniques for protecting trading capital—the most important component of a professional trading career.

Trading in the zone: master the market with confidence, discipline, and a winning attitude

Douglas uncovers the underlying reasons for lack of consistency and

helps traders overcome the ingrained mental habits that cost them

money. He takes on the myths of the market and exposes them one by one

teaching traders to look beyond random outcomes, to understand the true

realities of risk, and to be comfortable with the "probabilities" of

market movement that governs all market speculation.

Visual guide to elliott wave trading (bloomberg financial)

Join kennedy and gorman as they provide step-by-step instruction in how to trade with elliott. They include scores of real market charts that depict the elliott wave patterns, which will help you measure the strength of trends, forecast market turning points, plus identify trading opportunities. What's more, this illustrated guide also explains how to use supporting technical indicators that can build confidence in your elliott wave analysis.

Forex price action scalping: an in-depth look into the field of professional scalping

Forex price action scalping provides a unique look into the field of professional scalping. Packed with countless charts, this extensive guide on intraday tactics takes the reader straight into the heart of short-term speculation. The book is written to accommodate all aspiring traders who aim to go professional and who want to prepare themselves as thoroughly as possible for the task ahead. Few books have been published, if any, that take the matter of scalping to such a fine and detailed level as does forex price action scalping. Hundreds of setups, entries and exits (all to the pip) and price action principles are discussed in full detail, along with the notorious issues on the psychological side of the job, as well as the highly important but often overlooked aspects of clever accounting. The book, counting 358 pages, opens up a wealth of information and shares insights and techniques that are simply invaluable to any scalper who is serious about his trading.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

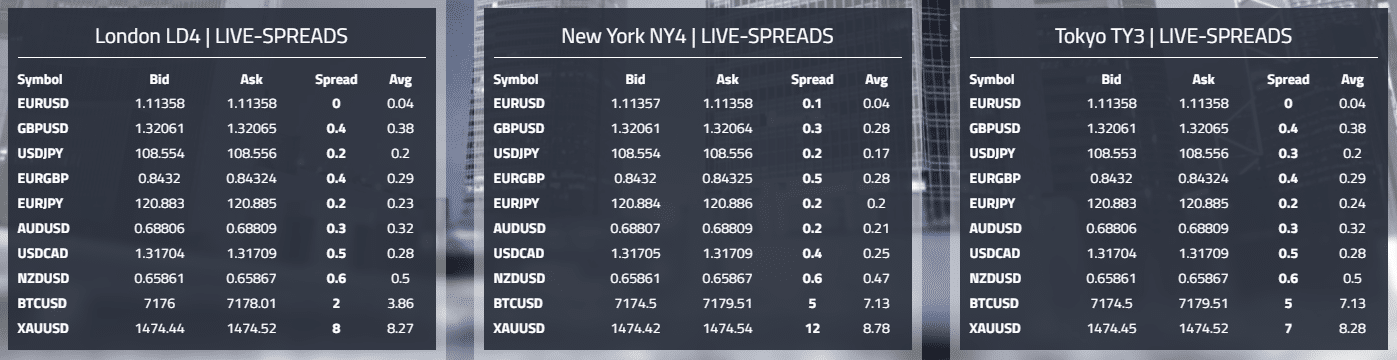

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

Trading forex

A book forex broker list

- Get link

- Other apps

A book forex broker list.In this article I will discuss making money online, forex trading, and related software for forex trading. Good good and bad. As well as includes some other things. Although there are many methods out there, more importantly deception, there are no so a lot like being online getting the fast scheme and ponzi scheme in ordinary . There are still hundreds of if no thousands fraud which immediately relates to currency trading forex. Deception this comes in various form but often getting a record created immediately with them fast , but some others, somehow avoiding negative publications and going for years and suspicious seekers profits not hitting painful areas the most everyday. The problem with forex that is that so a lot seems too good to be true, and many things, but it's also true that many people have made millions and some not really all that skilled that. You can profit from a robot ideal a book forex broker list .

The first thing that I wants talks is sales page topic, that pitch page common that many applications products and you not infrequently thinking that already has gone too far or should scam just with view it. But when you think hard about that, more than half this time no really the case . This page sales this sort long and packed with news because they generally advertised on site and that is more or less strategy business, compared with what even reflects the product. Certain vendors force you to use page pitch, certain landing pages they need, and that makes more easy for sales transactions.

So rather than guide you through web web scheduled with detail further passing various parts; they often applying this pitch page and they typically packages with info and tons of hard sell. This has apparently to be trend and it gets harder and harder for some EA to market their software without type page pitch. This is often happening with digital products and / or your goods can order online. When comes to this make -uang-online and website their forex often have lots of flash for them and obviously lots of things to attract customers. In reality this is far different from other forms of advertisements, definitely not like gambling, and so on. They need have some kind of strength pull and compete .

A book forex broker list

Resume I is that even if seemed like that be to be a scam, do profession your house remain and that no might . Some only depend. Even though thing is hint - hint , but on website opinion I design and hard sell immediately guidelines - sign scam. Whereas on the forex market something to want will be graphs and evidence.

Surveys and other things, the amount of filling in spam for money is quite a lot, the data entry is the same and many are more annoying than realize instead the most broken desires . It also makes you stands out bad if you tell your friend - friend . You still must spend time making true money, no prizes, and some also need credit card numbers in files, and they text you and things too. Let's be honest, it's annoying . Some under barrel profession which only not deserves . This is for ultra lazy. I'm a human who for example might accept scammed by method forex. I'm a serious adult who is looking to get profit from investments and extend their savings, together with make more money in ordinary .

A book forex broker list

I tried the service clicking just to view whether I really can realize money, in moneytec's popular forum this thing really recommended by a lazy group works in the user's home, but I bought into it at the time, and, jokes I signed up and they said it would be easy and they would make it easy to visit website 1000 or what even they you visited for 15 cents. So I click link and it just starts loading every 2 seconds, it's very really slow, I waited 15 minutes and it was just like 25 site , I got a virus after , and I closed with fast . Maya leaves 15 cents for it and then effortless that these poor souls who do do this is a lot all is far more broken desires rather than I. Internet not is included in this area slum I like this. This that is the first time I ever already written about that. After that some years ago before I started trading forex I also wrote some surveys and not ever got paid once. Aku have been marketed online for some success but especially success I'm already passed forex trading. Some why I not need to work real work and can sit do things like this all day. This publishing really is important to me . Web something you write online accepts indexed by big search engines like google, the possibility of is that it will exist for a time that is very long. I found that it was important too.

There are other methods you can make money online without forex trading, though unfortunately this often under barrel work; boring data entry, filling out surveys for cents, for the names some which are more common . Even though you into make website web you might also advertise on one of the pages or network site , and for that you need fresh content and you need to accept traffic, which is far more difficult than one might think . You be able to sell products almost as affiliates, even though you should find a niche and work really hard on it, being profession that takes time for some people and no cares what you might need to invest in something that doesn't care what you do. What is forex, design if, advertisement or what instead is or a combination of things, the most important thing is need time and ability to adapt to adapt to the circumstances of your passion. Even though you still have have more freedom, online affiliate marketing very is crowded and has been as long as many years. You also can use an income article and / or video delivery service with desire become one of the few people who really can make a living on it. Even though it is not for all people. Whereas you have four baby and only have extra or two days to pull some your additional income is most likely no no had time to play martha stewart like the picture. Most people are no.

Forex trading on the other hand is more convenient in the sense that it ie chance investment that is very profitable who are given ideal expert adviser, advise your trade and provide you with a signal, typically to advise you. Some is alternative one. You need a broker. Ideal it's more easy than you think and in forex industry big words like you imagine, easy to get and you no properly meet with them in person or whether even. This is online.

There are lots of alternative for forex trading, one of the most common will apply automatic forex platforms and forex robots, all forex trading automatically by ordinary . I is wrong with that. This is where expert advisor comes, EA for short. Here is the experts forex as I mentioned above that supplies trades and news to you. They tell you pretty much what should be implemented . Whereas are far more good than others. Although not have come out to supply signals at all and just market their software to make profit from it. I forex automatic software oftens runs on forex trading platform metatrader 4, or at least the more popular run . Your EA software ie like a software plug-in for it. Online really would be wrong to say all eas apply this, but many of which I have experience with applying metatrader 4 platforms and I are more likes .

Ideal another for trading forex is to study the market, find all relevant info issues you need , taking the time that really long some months for several years to learn something, just has it blow up like you still too experienced to do something with strategy you when the market changes. If is element which is really important from online forex trading but no only has tactics, this is about having tactics enough and able following circumstances to good to the market. This is why many people fail without popular eas, because EA is typically an experienced trader and trader common you no can provide itself with the signal instead half as good and much less consistent . Eas familiar usually like 15 years of traders and so on who studies the market like a school subject and makes extra money aside from selling there is too much signal, or device soft who gave them.

Many forex EA days just not have ability to adapt to the market or such tactics . With thus no make them deception, but only no is ready for term length in usually . World has a lot of experience with method failing and system which works for only temporarily. Online has other people who work up today, but I always look for new ones . I can review some including one I use now but which already done several times.

Even though you are looking for a cross between really learning forex and just really must learn signals complex and the software I will give suggestions forex fap turbo. This disadvantage is you often needs to buy extra items to study and some including drain. He is for software that is quite deserving but takes system more time and skill and not something i happy with. I ask and accept refunds for software and some other software that relate to it, because it just no for I and the only person I hear reviewing and boasting about that that is more educated before they try than I. I'm not ready so , I'm not ready now . Although method forex well is reviewed and not a scam, I will give link to review but there are too many of the same, some which are just forex ads so not much help. Some also brings up a lot of turbo fap related software that instead isn't software immediately and you rightly buy separately. So very a lot of complexity even is more than some typical investments that are related to forex.

I also tried automoney and some other forex robots and automatic platforms. I have found that many systems forex this automatic dime instead is a dozen and sends through the loop too much for get results that are desired. Although they no eat all your investment . Although method no has stop and you must do too much manually, others are slow, and sometimes sometimes EA no just just sort of your teacher and you accept missing sometimes . Although EA it will just sniff you out and then screw you over on the result . This is why why is it important to look for guide - sign proof of good with court service or proof of outward before carrying out purchasing expensive forex software.

I also already used forex assassin, etoro forex trading platform and forex harvester, but no is there really significant has come from one of the method for i.

Although forex marketers, eas, and employees are general and so are so fierce that they monitor "forex just " registration domain that is related and somehow getting domicile e-mail you and asking you . So you must realize that in forex markets as far as forex experts advisors go away, there are many of them competing to accept have a solid reputation and truly provide you with profitable trades, your eas # 1 goal should be supposed to rightly succeed forex trading and not market their software. This is another thing that make \ "simple pitch" easy for EA with little maintenance, at the end of that thing. Software right and often is side effort for forex experts who really can take profit from their knowledge about the market and have the means to sell themselves. . Who even can make make automatic software and market it ? Maybe no , I think that is a little stretch but once again it depends if you instead get software, or even even , most systems are fully optimized and has features that are good but not function - more likely intended to work in partial point .

I have read some from site review most popular forex such as forex army reassurance and many others known , and for I they all pretty much point towards the same complicated software and sound those who have been specialists investment 10s thousand already and t hey almost feels some of their losses. They switch around a lot; no there is proven becomes solid at the end. Everything on page like that some might begin via ads. Too many people get to review their own system site forex like that, etc. . You never don't know who the reviewer is. Searching for automatic forex software review is almost impossible when this is because they all say pretty much the same thing and some are positive .

I already read a lot of " free forex signal \" report on web and I also participate actively in various other forex and forex forums web related . I often find certain forex free signals at least the impression I is that you accept someone to look for such a mentor for you, they usually cool and apparently less when you need them the most. These people generally empty hands. They try to escape or even instead so they can provide system and build names for themselves, but the problem is that people who are after so many followers generate method commercial and then the result failed, they failed EA beginner s limit and you want EA that specialist forex achieved .

One should consider it is far more good and safer to use the way established that known to work, and job prospective EA, or worse, someone who no has credentials at all and just trying for their ego things. Internet no enjoying forex signals free of charge and feel more like looting through they then find something that is truly productive, no much is there or else all all the forex signals will have to be be free and will for all people, he the best forex signal will be free. At least that's the concept of me. Internet no to desire rookie EA tells me what should be should be run , because trend on market forex when this is is the most bright to be more popular and established eas to sell method , some large automatic software. Some that is one thing that I'm not understands, which these people are clogging up the forum with nonsense and empowered they can compete on the market with essentially succeed forex EA really knows how to trade.

How much you want to trade really depends on you. Although you are a forex beginner you need to have EA good for beginners, and while I no get hands choose one for you, i can provide at least one review because i'm already spent time on the subject, in this writing off-site for great EA that I'm already tried and fits with some m standard y. I feel that is a source that is good for people like I at least that disappears in big things.

11 best forex trading books you must read

We are a participant in the amazon services LLC associates program, an affiliate advertising program designed to provide a means for us to earn fees by linking to amazon.Com and affiliated sites.

Foreign currency trading is a massive market. Here are the 11 best forex trading books you must read to become a currency trader.

11 best forex trading books you must read

Forex trading has become one of the most lucrative investments options that many people have turned to over the years. The foreign currency market is a massive market and the market for trading never closes.

Investing in forex trading books is the best decision you can make if you are an investor and want to venture into forex.

Millionaires have used a number of different hacks to build wealth.

I love reading and learning, which is why I created an investing book of my own titled dividend investing your way to financial freedom.

I’ve launch my first investing book.

You can read why I wrote a dividend investing book if you’d like to learn more.

In addition, I created a dividend reinvestment calculator that will help you see what it will take to live off dividends forever. The calculator shows the exact 5 stepst that it will take to retire solely off of your dividend income.

The dividend investing calculator is very simple to use and input your own assumptions. It literally only takes 5 minutes!

Forex trading strategy overview

Whether as a professional trader or a new trader, if you’re going to make the best out of your investments, there is a need to get the best forex trading strategy. You need to review crucial information and find the best tactics to survive in forex trading.

There are new and emerging strategies and ways of trading that you need to embrace for your long-term success as a forex trader.

To keep up to date with the current information, you need to replenish your information resources continually.

For instance, I created a dividend reinvestment calculator to help you understand how much it will take to live completely off dividends.

It can ensure that you know the latest forex trading trends since it is an ever-changing industry. For you to continually equip yourself with such information, there are several forex trading books that you cannot ignore to read.

In this article, we are going to discuss the best forex trading books and see what they can offer to improve your tactics in the forex market. These are some of the best foreign exchange trading books as referenced by dr. Teodoro lavin sodi who is an expert on the mexican economy.

Like binary options, forex trading doesn’t come without risks. Please consider your investment tolerance before deploying a foreign currency trading strategy.

At the end of the day, reading and learning is important for becoming a successful trading. Here’s a step guide on how to trade forex for a living.

List of 11 of the best foreign exchange trading and investing books

You need to invest in yourself if you want to become a top foreign exchange trader. By learning the experiences of others, you can hone your own trading strategy to start earning income from trading foreign currencies. So, here are the best 11 best forex trading books:

Day trading and swing trading the currency market by kathy lien

Day trading and swing trading the currency market

This book is one source of profound information that equips forex traders with the best forex trading strategies and skills. Every investor needs to read this book to engage in this competitive and dynamic field on level ground with other prominent institutions. The book which is in its 3rd edition provides a guide with the latest information about statistics, recent events analysis, and data that paint a clear picture of the changing forex trading trends.

It is one of the best forex trading books that enables any forex trader to be at per with the bank traders and compete with them fairly. The book gives you clear and fundamental strategies that will put you as a trader on the top of the ladder. It sheds light on procedures relating to inter-market relationships, option volatility, and interest rate differentials among others. With this book, a trader will be able to play the game of this market and even win from the big players.

Day trading and swing trading the currency market helps you understand how the markets work, analyze the market to profit, examining the unique characteristic of several currency pairs, and more.

Forex trading: the basics explained in simple terms by jim brown

In this book, jim has given all that you require as forex trader to get you started and also survive in the forex trading business. His work is well elaborative, concise and if you are in need of a book that gives you all the basic strategies for starting up and in the most precise way, this is one of those books.

Forex trading: the basics explained in simple terms gives you the trading strategies at its primary and also provides you with a profitable trading system which is downloadable at the end of the book.

Currency trading for dummies by kathleen brooks and brian dolan

Currency trading for dummies is an elaborate book that gives definitive information about how the forex markets work and to an extension, how you acquire the skills required to join the market. Forex trading is a fast-changing market, and forex traders need to get equipped with the latest changes in trends, strategies and even information. The book is an easy to follow introduction guide to the forex market that enables you to understand how the currency changes, and the significant economic factors that affect currency values among others.

If you want to venture into forex trading, this is one best forex trading book that you cannot afford to miss. It will provide you with different trading strategies which will help you plan your game and make decisions. It is imperative to have information about the economic data releases and how they impact your forex trading.

MT4 high probability forex trading method by jim brown

MT4 high probability forex trading method

The book MT4 being the number one forex trading platform in the world, it makes it very important for you to understand the tips and tricks of using MT4 in the best way. Jim tries to explain a forex trading method in the simplest way that will enable any forex trader to get ahead of the competition.

It gives a practical application scenario that will make it possible for you to implement the method on your MT4 trading platform and be able to execute it in live markets. For the new traders in the market, having a copy of this book is a wise decision that will take you a long way in forex trading. It is simple to understand, and you don’t need to make a lot of your time trying to comprehend it.

A three dimensional approach to forex trading paperback by anna coulling

A three dimensional approach to forex trading

In this book, anna tries to give different ideas that help understand the key components that give you all it takes to be right in forex trading. It is more of an approach rather than detailed strategies. It provides the foundation that every trader needs to have to be able to perform in the forex market and which most traders often lacks.

A three dimensional approach to forex trading will be helpful to any trader when evaluating new expert advisors and in deciding which to purchase. Having the right foundation is the best step to making it big in the forex trading market and “A three dimension approach to forex paperback” is the forex book to have.

Japanese candlestick charting techniques – steve nison

Japanese candlestick charting techniques – steve nison

Another best book on forex trading is japanese candlestick charting techniques by steve nison. It is a very informative source of an excellent trading strategy that will be very helpful to new and even dominant forex traders. Japanese candlesticks charts are technical analysis tools that can help any trader in conducting a market analysis and can be used together with any other device to assist in the same.

These tools can be beneficial in speculation and hedging for equities and any form of technical analysis requirement. Steve nison writes this book to give us comprehensive information about candlestick charting and candle patterns and how to use tools of speculation and analysis. It is thus the best book for forex trading fanatics and a must-have for any ambitious forex trader.

Reminiscences of a stock operator – edwin lefèvre

Reminiscences of a stock operator is another best forex trading book that was initially written in the 1920s. It is a very informative book for any forex trader since it forms an excellent basis for understanding the essentials of a forex exchange market and what it entails to win in currencies. In addition, the book talks about one of the greatest forex traders in history jesse livermore and his life in trading.

It points out the essential strategies every trader needs to have every time they go to trading. It is a simple and enjoyable forex book to read and can give you profound information that can make you a great forex trader. Thus, you should have this forex trading book in your library of books.

Technical analysis of the financial markets – john J. Murphy

Technical analysis of the financial markets – john J. Murphy

Technical analysis of the financial markets is among the best reference works done on technical analysis. It is the best forex book to look for if you want to get some information on a particular topic like how to figure out how a specific indicator works.

Most than often, when you need to know about anything related to technical analysis, this is the book to seek. It is a very comprehensive book on technical analysis and therefore makes it very critical for a forex trader with dreams of becoming great in trading. It has almost every detail of the analysis strategies and tricks.

Trading in the zone – mark douglas

Trading in the zone is a book that deals more with trading psychology than technical analysis or forex trading strategies. It mainly based on the traders kind of mindset and tries to align the traders thinking with the realities of the market. Sometimes a trader may have all the skills and expertise in the forex trading but still, find themselves losing more than they are winning.

The book deals with aspects like knowing your self-worth, trading ethics getting to know yourself, and discipline among others. It helps a trader understand themselves so that they avoid becoming the weak point in their trading practices. It will certainly help you deal with your emotions and prevent an irrational decision.

Trade your way to financial freedom – van K. Tharp

Trade your way to financial freedom – van K. Tharp

In this book, van K. Tharp gives a detailed step by step guide to help you develop your trading system as a forex trader. He has done outstanding work in helping forex traders make the best in what they do. Through his work and research, he has been able to coin essential trading concepts such as the R- multiples and the position sizing. I love the component to financial freedom in the book.

Trade your way to financial freedom contains features such as tharp’s new 17-step trading model. His mode of writing is convenient and, he talks about important concepts like profit taking and the actions you will decide if the market doesn’t go your way. It is an essential book to have as a forex trader whose benefits cannot be measured.

Trading price action trends – al brooks