IC Markets Sign Up Bonus, ic markets deposit bonus.

Ic markets deposit bonus

Trading bonuses serve the purpose of encouraging traders to increase their trading activity in addition to trading higher volumes to gain access to bonuses that offer some cashback.

Top forex bonus promo

Various brokers also offer no deposit bonuses to traders in the same effort to draw in more customers and bonuses like this may aid not only the broker in acquiring new clients, but also traders who have strict budgetary restrictions.

IC markets sign up bonus

IC markets sign up bonus

A first time IC markets sign up bonus is not offered by IC markets.

Traders who register a real account with IC markets are not offered with either a first time sign up bonus, a deposit bonus, or a welcome bonus.

Brokers often offer these broker bonusses to new traders in an effort to draw in more customers in addition to encouraging trading activities. Offering a deposit or welcome bonus is the best way in which to assure traders that they will receive some money back depending on the initial deposit made.

Various brokers also offer no deposit bonuses to traders in the same effort to draw in more customers and bonuses like this may aid not only the broker in acquiring new clients, but also traders who have strict budgetary restrictions.

Although IC markets does not offer bonuses, rewards, promotions, or competitions traders should not be discouraged by this from registering for a real account as bonuses may still be in planning and development phases to be announced at a later stage.

Referral bonus

IC markets does not currently offer referral bonuses to new or existing traders who make use of the products and services offered by IC markets.

Referral bonuses are offered by brokers to traders in an attempt to draw in new clients and expand their customer base.

Often these types of bonuses have strict criteria that will have to be fulfilled before the trader can benefit from referring a friend or family member.

Some of the criteria includes, but is not limited to:

- The referral has to register a real account with the broker using a unique referral link so that the registration can be traced back to the trader.

- The referral bonus is only applicable should referrals register a real account as these bonuses are not available when using a demo account.

- A certain minimum deposit amount has to be made by the referral.

- The referral may be required to execute a certain number of trades on the new account before the trader becomes eligible to receive the referral bonus

Referral bonuses may also have a limited time in which they can be utilized by traders, perhaps in a given month that brokers see a decrease in activity and attempts to counter it by providing such bonuses.

Additional bonuses, promotions and rewards

IC markets does not currently cater for trading bonuses and there are no current initiatives to reward loyal customers.

Trading bonuses serve the purpose of encouraging traders to increase their trading activity in addition to trading higher volumes to gain access to bonuses that offer some cashback.

Pros and cons

| PROS | CONS |

| 1. Comprehensive and competitive trading conditions despite lack of bonuses and rewards | 1. Welcome bonus, deposit bonus, no deposit bonus and no other broker bonuses offered with first time sign up |

| 2. No referral bonus offered | |

| 3. No trading bonus for loyal customers |

Conclusion

IC markets does not currently offer any bonuses for new traders who register an account, neither do they offer any rewards for loyal customers but despite this, IC markets has favourable trading conditions that cater for beginner traders and experts.

IC markets review 2021

Regulated by: ASIC, cysec, FSA(SC)

Headquarters : international capital markets pty ltd level 6 309 kent street sydney NSW 2000, australia

Trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A product disclosure statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw spread accounts offer spreads from 0.0 pips with a commission charge of USD $3.50 per 100k traded. Standard account offer spreads from 1 pips with no additional commission charges. Spreads on CFD indices start at 0.4 points. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A product disclosure statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transaction with us. Raw spread accounts offer spreads from 0.0 pips with a commission charge of USD $3.50 per 100k traded. Standard account offer spreads from 1 pips with no additional commission charges. Spreads on CFD indices start at 0.4 points. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC MARKETS REVIEW 2020

IC markets summary

IC markets has managed to become one of the leading forex trading providers in australia and the APAC region as a whole. They provide an array of trading instruments to trade with, including cryptocurrencies, commodities, stocks, equities, bonds, and futures.

IC markets cryptocurrency trading, allows trading pairs fiat currencies against bitcoin, dash, bitcoin cash, ripple, ethereum, and litecoin. They permit long or short positions, with a leverage level of 1:5, a margin level of 20% and a minimum trade size of 0.01.

IC markets is an electronic communications network(ECN) broker, that offers raw spreads from 0.0 pips directly from various liquidity suppliers. They also acquire dark pool liquidity across sixty forex currency pairs.

Many high volume traders, scalpers, EA traders, and day traders will benefit more from IC markets; this is because there is no dealing desk and there is no manipulation in the prices.

The execution has minimal slippage and low latency through the use of fiber optic technology. Traders’ requests are executed in real time and directly with market prices through their NY4 and LD5 IBX equinix data centers in new york and london.

IC markets attempts to provide the best technological solutions, along with the crucial aspect of top-of-the-line customer service and technical support. Its employees have long-term experience in the forex industry, and that is why they understand what traders need.

This IC markets review is an in-depth analysis of the features of IC markets, and what can IC markets offer their traders.

| IC markets main features | |

|---|---|

| established in: 2007 | headquarters: sydney |

| regulations: ASIC, FSC and cysec | country of regulation: australia |

| minimum deposit: $200 | platforms: MT4, MT5, ctrader, zulutrader |

| demo account available: yes | leverage: 1:500 |

| withdrawal fee amount: 0$ | inactivity fee: no |

- No deposit and withdrawal fee

- Demo account available

- Regulated by australian securities and investments commission (ASIC)

- Regulated by the cyprus securities and exchange commision (cysec)

- Fast and easy to open an account

- No negative balance protection

- Slow live chat response

- No investor protection

Safety and regulation

As the broker is headquartered in australia, its main operating licenses come from the australian financial services (AFSL) no. 335692 and the australian securities and investments commission (ASIC), which authorizes them to carry on a financial services business in australia, limited to the financial services covered by our AFSL.

Furthermore, the AFSL and the ASIC are one of the strictest and most challenging of financial regulators, which is why traders of IC markets will have nothing to worry about.

The extra layer of protection that is provided to the clients’ funds and personal information is proof of their credibility; they also keep clients’ funds stored in segregated accounts as per regulatory requirements. The trading accounts are accessed by the client only and they are utilized for the purpose of making it easier for clients to trade.

Along with the AFSL, IC markets is a member of the financial ombudsman service (FOS); they are an australian conflict resolution corporation that autonomously and justly resolves conflict that occurs between clients and financial service providers.

IC markets is also registered and regulated by the cyprus securities and exchange commission, in order to fully be allowed to provide services to clients from the european union.

As a precaution, the broker highly recommends reading their account terms and their product disclosure statement on cfds before trading with them, to ensure the right decision for prospective clients.

IC markets

IC markets incelemesi

IC markest firması, piyasada 2007 yılından beri hizmet veren bir firmadır. Firmanın incelemesi yapılırken göze çarpan ilk özelliklerinden birisi piyasadaki en yüksek bütçelerden birisine sahip olmasıdır. IC markets ülkesi, avustralya olarak belirlenmektedir. IC markets işlem koşulları genel olarak şu şekilde sıralanabilmektedir:

- IC markets alt limit belirlemesi 200 dolar olarak belirlenmiştir. Firmanın minimum yatırım miktarı belirlemesi piyasa koşullarına göre biraz fazladır. Forex piyasasında 100 dolar ve altında limit belirlemeleri çok daha idealdir.

- IC markets kaldıraç oranı 1:500 olarak belirlenmiştir. Piyasa koşullarında gayet ideal bir belirleme olduğu söylenebilmektedir.

- IC markets stop out seviyesi %50 dir. Diğer forex firmalarının stop out seviyeleri %20 ike IC forex de bu oran biraz yüksek.

- Firmanın spread oranları çok yüksek değildir. Ortalama bir seviyede olduğu ve yatırımcıları rahatsız etmeyeceği söylenebilmektedir.

- Firmanın işlem platformları meta trader 4, meta trader 5 ve ctrader olarak belirlenmiştir.

IC markets güvenilir mi?

Forex şirketlerinin güvenilirliğini belirleyen ilk ve en önemli husus lisans bilgileridir. Lisans sahibi olmayan merdivenaltı forex firmaları güvenilir olarak nitelendirilememektedir. IC markets firması ise bu açıdan oldukça güvenilir olarak belirlenmektedir. IC markets firması ASIC lisansına sahiptir. ASIC lisansı, forex piyasasında en sıkı şartlara sahip lisanslardan birisidir. Kurum bu lisansı oldukça zor koşullar altında vermektedir. Bu açıdan ASIC lisansı tek başına bir firmayı güvenilir kılmaya yetmektedir. Ancak para transferi işlemlerinin ve müşteri yorumlarının da incelenmesinde fayda bulunmaktadır.

IC markets minimum deposit

IC markets minimum deposit

The IC markets minimum deposit amount that IC markets requires is US dollar 200.

The minimum deposit amount of US dollar 200 when registering a live account is equivalent to ZAR3,517.66 at the current exchange rate between US dollar and south african rand on the day that this article was written.

IC markets is a australian-based broker which is authorized and regulated by one of the strictest and most demanding regulating entities namely ASIC, and as a regulated broker, one of the requirements is that client funds be kept in segregated accounts.

In complying with this, amidst several other strict rules and regulations, all client funds must be kept separate from the broker account, and it can only be used by traders to conduct trading activities.

In addition to ensuring client fund security through segregated accounts, regulated brokers such as IC markets are required to be a member of a compensation scheme or fund which pays out a certain amount to eligible clients in the case of company insolvency.

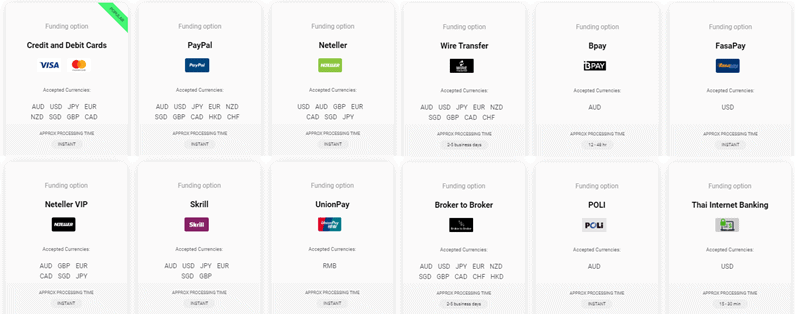

Deposit fees and deposit methods

IC markets does not charge any fees when deposits are made into the trader’s account. Traders can make use a variety of methods to fund their trading account with the minimum deposit amount including, but not limited to:

- Credit/debit cards

- Paypal

- Neteller and neteller VIP

- Skrill

- Unionpay

- Bank wire transfer

- Bpay

- Fasapay, and several others.

IC markets supports a variety of deposit currencies in which traders can fund their accounts including:

- AUD

- USD

- EUR

- CAD

- GBP

- SGD

- NZD

- JPY

- HKD

- CHF

Step by step guide to deposit the minimum amount

Once the trader has completed the process of registering on the website, the trader can make the initial minimum deposit by following these steps:

- Log into the client portal and select ‘deposit’

- Select the deposit method along with the amount.

- After the trader has made their selection, they will be redirected to the payment processor page to confirm their deposit.

Traders should take note that with making deposits by using bank wire transfer, the transactions may take a certain amount of time depending on the method, time of the day, and day of the week.

Bank wire transfers take anything from a day to a few business days depending on the time the payment was made during the day along with the day of the week.

Pros and cons

| PROS | CONS |

| 1. Deposit fees and withdrawal fees are not charged | 1. None noted |

| 2. Quick and easy depositing of funds | |

| 3. Variety of payment methods supported | |

| 4. Variety of supported deposit currencies |

What is the minimum deposit for IC markets?

How do I make a deposit and withdrawal with IC markets?

You can make use of the following payment methods to deposit or withdraw funds:

- Credit/debit cards

- Paypal

- Neteller and neteller VIP

- Skrill

- Unionpay

- Bank wire transfer

- Bpay

- Fasapay, and several others.

Ic markets deposit bonus

Forex no deposit bonus is one of the unique promotions that offers new traders money to open a trading account. The GICM offers the ability of forex accounts to place an amount of money into an account, so that the new traders can do trade with real money. It helps user to trade actual trades.

The term and conditions imply that the trader does not have to deposit any money of their own to get this bonus and start trading. Deposit bonus is not totally free, it will be applicable to anyone following services by traders.

Terms & conditions of no deposit bonus

- To take part in the promotion, you need to be a client of GICM with a real account and verified personal details

- Minimum withdrawal is 25 USD

- Bonus amount can't be used for internal transfer

- Account should be maintained with us for 30 days

- Trades should be done as per our terms and conditions terms and conditions

- Only profit amount is allowed to withdraw and it can be processed in any of our payment methods in the direction of the company.

- The bonus can be awarded once per household or IP address or phone number or a customer.

Write an forex and binary 100% unique article and submit us and avail $10 in your trading account and will be withdrable after maintaining trading conditions.

Eligibility

- Should be written in english

- Should have at least 90% uniqueness according to any one of these: dupli checker, small seo tools, plag spotter.

- Articles should be related to forex options which should not be existing posted by GICM.

- Company reserves the right to change terms and duration of the present promotion unilaterally at any time.

- Post our articles in page rank site should be financial or trading sites only be counted.

Post our articles in page rank sites and avail $2 for each PR articles.

Eligibility

- Post our articles in page rank sites and get bonus for each article.

- Your posting should be under finance/forex categories sites.

Place our banners and promote our site and avail $10 to your trading account, you can withdraw money without any conditions.

Eligibility

- You can request a deposit once in every three months. The amount will be deposited to your trading account. You can make an withdrawal without any trading conditions.

- Our advertisement should run for 2 months duration.

- You can place our advertisement in any third party sites which should be related to trading and financial information.

- The advertisement banner should run for 3 months, running the banners on rolling 3rd party adds will not be counted.

Like us, follow us, share our articles get $2 per month.

Eligibility

- GICM promotes our news in social media channels such as facebook, google+, twitter, pinterest. Those who follow and keep all of our posting active and get engaged will be awarded trice a month.

- Follows maybe done through your real account

GICM FEATURES

STP brokerage

ECN/STP brokerages are preferred by many traders, because it tends to mean faster execution, more accurate pricing and more liquidity.

Fast execution

Provides you an unparalleled trade execution speed advantage. GICM makes use of advanced order routing algorithms to calculate the best quote.

Deep liquidity

GICM is a technology driven next generation trading conditions,deep top tier liquidity and the security of financial registration and oversight.

Zero point technology

GIC markets provides retail clients with an infrastructure class previously only available to high frequency traders and quants.

Low cost trading

Get started with a low minimum deposit of $1, spreads from 0.0pips on ECN accounts, and no commission on other accounts.

24x7 support

GICM's live support is available 24/7 for any inquiries you may have about our services. Feel free to contact us for any questions or assistance

RISK WARNING : trading in forex and contracts for difference (cfds), which are leveraged products, is highly speculative and involves substantial risk of loss. It is possible to lose more than the initial capital invested. Therefore, forex and cfds may not be suitable for all investors. Only invest with money you can afford to lose. So please ensure that you fully understand the risks involved. Seek independent advice if necessary. Full disclosure

LEGAL :GIC market is the trading name for global integrated captech markets, we are one of the rapidly growing online forex & CFD’s brokerage service with a management of over 20 years experience in the industry. GIC markets is registered in ST vincent’s and grenadines with the number 22818 IBC .

Ic markets deposit bonus

Счета raw spread – это все, что вам нужно! Спреды от 0 пунктов, отсутствие реквотинга, манипуляций и ограничений. IC markets – отличный выбор для крупных трейдеров, скальперов, и тех, кто пользуется роботами.

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

The website www.Icmarkets.Com/global is operated by IC markets global an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by IC markets or any other entity within the group.

**данные, полученные из независимых источников, подтверждают, что сводный недельный спред по EURUSD был лучше, чем среди 32 прямых конкурентов в секторе форекс в 96% времени в период с января по декабрь 2019 года.

***среднее время исполнения ордера, включающее его получение, обработку и подтверждение исполнения, составляет 36,5 мс.

IC markets не принимает запросы на открытие счета от жителей США, канады, израиля и исламской республики иран. Информация на этом сайте не предназначена для жителей любой страны, территории или юрисдикции, где распространение или использование такой информации противоречит местному законодательству или нормативным актам.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please read our legal documents and ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice.

The information on this site in not intended for residents of the U.S. Canada, israel, new zealand, japan and islamic of iran and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets is an over the counter derivatives issuer, transactions are entered into on a principal to principal basis. The products issued by us are not traded on an exchange.

International capital markets pty ltd (ACN 123 289 109), trading as IC markets, holds an australian financial services licence (AFSL no. 335692) to carry on a financial services business in australia, limited to the financial services covered by its AFSL. The trading name, IC markets, used by international capital markets pty ltd is also used by other entities.

IC markets EU ltd is authorised and regulated by the cyprus securities and exchange commission with license number 362/18, registration number 356877 and with registered office at 141 omonoias avenue, the maritime centre, block B, 1st floor, 3045 limassol, cyprus.

Raw trading ltd registered in seychelles with company number: 8419879-2, trading as IC markets global, regulated by the financial services authority of seychelles with a securities dealer licence number: SD018. The website is operated by IKBK holdings ltd, registered in cyprus with registration number 362049 and registered address at 38 karaiskaki street, kanika alexander center, block 1, 1 st floor office 113B, 3032, limassol cyprus.

IC markets minimum deposit requirement

The minimum deposit is $200 at IC markets.

IC markets minimum deposit by base currency

When funding a raw spread or standard account, the funding requirement is set by the base currency. Below details the ‘top 5’ base currencies traders choose when opening an account and their respective funding requirements.

IC markets minimum deposit in pounds

The minimum deposit in the UK at IC markets is £200. When using the standard or raw spread account with pound sterling as the base currency, you can select a credit/debit card, neteller, skrill, klarna or a wire transfer to fund your account.

IC markets minimum deposit in euros

The minimum deposit for european traders with IC markets is €200. Funding options for european trader are the same as in the UK as shown above.

IC markets minimum deposit in dollars

USD, AUD, and SGD base currency account with IC markets minimum deposit requirement is $200. All three base currencies allow deposits with a credit card, debit card, paypal, neteller, skrill and wire transfer. IF you are using AUD as the base currency you can also choose bpay or poli. USD traders have the option of fasapay and thai/vietnamese internet banking.

IC markets minimum deposit comparison

Below compares minimum deposit requirements of leading forex brokers based on the four major currency pairs.

| USD | AUD | EUR | GBP | |

|---|---|---|---|---|

| IC markets | $200 | $200 | €200 | £200 |

| pepperstone | $200 | $200 | €200 | £200 |

| axitrader | $0 | $0 | €0 | £0 |

| CMC markets | $0 | $0 | €0 | £0 |

| IG group | $300 | $450 | €250 | £250 |

| thinkmarkets | $0 | $0 | $0 | $0 |

| FXCM | $50 | $50 | €50 | £50 |

| FXTM | $10 | N/A | €10 | £10 |

| swissquote | $1,000 | N/A | €900 | £800 |

| saxo markets | $10,000 | $3,000 | N/A | £500 |

Some brokers such as saxo markets have a higher deposit requirement to discourage small traders. Other brokers such as axi offer no minimum deposit to reduce the barriers to signing up for accounts.

A $200 deposit is realistically the smallest amount required to trade currency markets. Trading with low deposits makes it difficult to earn enough profits to make the investment worthwhile, this is why most brokers will encourage higher minimum deposits.

IC market’s minimum deposit requirement of $200 is around the ideal mark for decent trading.

IC markets deposit methods and fees

IC markets have no payment fees however it is worth noting that international transactions can result in a $20 charge from the bank itself which is forwarded to the client. No deposit and withdrawals fee is a strong offering from IC markets as some brokers such as etoro will charge you to with funding your accounts. View our fees and charges section in our review of IC markets for more details.

IC markets offers traders a plethora of funding methods. The funding methods you can choose will depend on the base currency chosen and the region you are trading in. Instant funding options include debit/credit cards, paypal, neteller, skrill and unionpay. Bitcoin and bpay can take a few hours for funds to clear while wire transfer can take a few days.

Base currencies available

When a trader opens an account with any broker, a base currency is chosen. This currency will normally be the trader’s native currency conversion fees when deposits are made. Some brokers such as IG. Offer duel accounts so traders can nominate two different base currencies for use when appropriate. IC markets offers 10 base currencies as shown below:

| base currencies available | |

|---|---|

| IC markets | 10 |

| pepperstone | 10 |

| axitrader | 11 |

| CMC markets | 10 |

| IG group | 10 |

| thinkmarkets | 5 |

| FXCM | 6 |

| FXTM | 4 |

| swissquote | 9 |

| saxo markets | 5 |

IC markets offers all the major currencies, along with a selection of minor ones however some currencies are not available such as the south africa ZAR. Traders who want to choose IC markets in regions where the local base currency is not available will need to choose a major currency (such as the USD) and then transfer funds across which means traders will incur conversion charges. To minimise currency conversion fees, an intermediary service such as OFX or transferwise is suggested. Using an intermediary service will result in significant savings compared to a wire transfer.

How to open an IC markets account

There are three main steps to open an IC markets account and then make a process.

1) open the IC markets account

IC markets offers a 100% online joining process which can be viewed here. This joining process involves providing your personal details, giving details about yourself and then configuring the trading account. The final stage of the joining process is the declaration confirming that all the information provided is accurate. This is an important requirement as IC markets need to be sure the finances are not used for money laundering. The declaration will need to be verified with some sort of identification such as bank accounts, drivers licence or passport details.

2) make A deposit

Once an account is opened traders will be directed to the IC markets deposit section. A trader needs to select a deposit method that accepts the base currency selected. Factors a trader needs to consider when selecting a deposit method are:

- How long will it take for funds to be cleared using the payment method? (eg credit card is instant while wire transfer can take days)

- Are there be any fees from this payment method? (IC markets doesn’t charge deposit fees but institutions may have their own fees)

- Are you happy for the withdrawal to go back to this deposit method (IC markets requires withdrawals to go back to the funding method)

3) monitor the deposit

While most deposit methods are instant, some other options such as direct transfer, bitcoin wallet and bpay can take hours to days. It’s worth monitoring to ensure these funds clear (as issues can occur) and IC markets will send a confirmation e-mail once the funds arrive.

Conclusion on IC markets deposit requirements

IC markets leads the way when it comes to the number of base currencies offered, the range of deposit funding methods and the fact that no additional fees are charged on deposits. While IC markets minimum deposit of $200 is not the lowest of forex brokers, it is not realistic to trade with a lower amount. Based on this IC markets ticks all the boxes with it comes to the deposit and funding category.

Justin grossbard has been investing for the past 20 years and writing for the past 10. He co-founded compare forex brokers in 2014 after working with the foreign exchange trading industry for several years. He also founded a number of fintech and digital startups including innovate online and SMS comparison. Justin holds a masters degree and an honours in commerce from monash university. He and his wife paula live in melbourne, australia with his son and siberian cat. In his spare time, he watches australian rules football and invests on global markets.

Deposit categories

More on IC markets

The leading forex broker comparison site, compare forex brokers pty ltd is an authorised representative of guildfords funds management pty ltd australian financial services licence no. 471379 (A/R no. 001274082). Copyright 2021 and all rights reserved. Trading forex and cfds with leverage poses significant risk of loss to your capital.

We use cookies to ensure you get the best experience on our website. By continuing to browse you accept our use of cookies.

IC markets

Risk warning: your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please be advised that certain brokers, products, bonus and/or leverage may not be available for traders from some countries due to legal restrictions.

Risk warning: your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please be advised that certain brokers, products, bonus and/or leverage may not be available for traders from some countries due to legal restrictions.

Alternatives

Video

Risk warning: your capital is at risk.

Forum, user reviews and feedbacks

Alternatives

Risk warning: investments involve a high level of risk. It is possible to lose all your capital. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

The information on this site is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation and is not directed at residents of: belgium · france · japan · latvia · turkey · united states ·

so, let's see, what we have: an up-to-date actionable broker summary of IC markets revealing the LATEST forex no deposit promotions, sign-up bonus and rewards. Claim your bonus here. At ic markets deposit bonus

Contents of the article

- Top forex bonus promo

- IC markets sign up bonus

- IC markets sign up bonus

- Referral bonus

- Additional bonuses, promotions and rewards

- Pros and cons

- Conclusion

- IC markets review 2021

- IC MARKETS REVIEW 2020

- IC markets summary

- Safety and regulation

- IC markets

- IC markets incelemesi

- IC markets minimum deposit

- IC markets minimum deposit

- Deposit fees and deposit methods

- Step by step guide to deposit the minimum amount

- Pros and cons

- Ic markets deposit bonus

- GICM FEATURES

- Ic markets deposit bonus

- Торговля на форекс

- Характеристики

- О компании IC markets

- Торговля на форекс

- Характеристики

- О компании IC markets

- IC markets minimum deposit requirement

- IC markets minimum deposit by base currency

- IC markets minimum deposit in pounds

- IC markets minimum deposit in euros

- IC markets minimum deposit in dollars

- IC markets minimum deposit comparison

- IC markets deposit methods and fees

- Base currencies available

- How to open an IC markets account

- Conclusion on IC markets deposit requirements

- IC markets

- Alternatives

- Video

- Forum, user reviews and feedbacks

- Alternatives

Comments

Post a Comment