Islamic (Swap-Free) Account, tickmill swap rates.

Tickmill swap rates

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade.

Top forex bonus promo

Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees. Once your documents are approved, create a live trading account.

Islamic (swap-free) account

Get yourself a swap-free account that is compliant with the sharia law.

The islamic account

in a nutshell

Here at tickmill, our clients’ interests always come first. For this purpose, we continuously strive to facilitate our trading conditions to suit the various needs of clients throughout the world. With this in mind, we offer islamic accounts that are compliant with the sharia law.

Forex islamic account is known as a swap-free account as there is no swap or rollover interest on overnight positions, which is against the muslim faith. All muslim clients can benefit from tickmill’s best trading conditions by opening any account with us – classic, pro or VIP – and converting it to an islamic type.

Islamic accounts have exactly the same trading conditions and terms as our regular trading account types. The only difference is that there are no swaps on trading instruments, however, a handling charge applies for holding exotic currency pairs overnight for more than three consecutive nights.

Our all-star client support team will process your request for an islamic account status within 1 business day and you will receive an email confirmation once all is set up. All subsequent trading accounts opened by you at tickmill will be automatically classified as swap-free meaning there will be no need for contacting us again.

Overnight charges

| instruments |

| EURCZK |

| EURDKK |

| EURHKD |

| EURHUF |

| EURMXN |

| EURNOK |

| EURPLN |

| EURSEK |

| EURSGD |

| EURTRY |

| EURZAR |

| GBPCZK |

| GBPDKK |

| GBPHKD |

| GBPHUF |

| GBPNOK |

| GBPPLN |

| GBPSEK |

| GBPTRY |

| GBPZAR |

| NZDSGD |

| USDCZK |

| USDCNH |

| USDDKK |

| USDHKD |

| USDHUF |

| USDMXN |

| USDNOK |

| USDPLN |

| USDSEK |

| USDSGD |

| USDTRY |

| USDZAR |

| BRENT |

| WTI |

| XTIUSD |

| charge per lot |

| $5 |

| $5 |

| $5 |

| $10 |

| $20 |

| $10 |

| $10 |

| $10 |

| $10 |

| $50 |

| $20 |

| $5 |

| $10 |

| $5 |

| $10 |

| $10 |

| $10 |

| $10 |

| $50 |

| $20 |

| $10 |

| $5 |

| $10 |

| $10 |

| $5 |

| $10 |

| $20 |

| $10 |

| $10 |

| $5 |

| $10 |

| $50 |

| $20 |

| $0.04 |

| $0.04 |

| $0.04 |

- Day 1 position opened

- Day 2 no charge (1st night)

- Day 3 no charge (2nd night)

- Day 4 no charge (3rd night)

- Day 5 charge 5 USD (per lot) at 00:00 (4th night)

- The above charges are in USD and are converted automatically to the account’s base currency if this is different.

- The fees are fixed per 1 lot regardless of the type of position (long or short) and apply to MT4 swap-free accounts as a separate balance operation at 00:00 server time.

Benefit from EXCEPTIONAL trading conditions

available base currencies: USD, EUR, GBP execution model: NDD execution type: market execution average execution speed: 0.20 seconds margin call / stop-out: 100% / 30%

Access some of the most

POPULAR INSTRUMENTS

of the market

FOREX

STOCK INDICES & OIL

METALS

BONDS

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Spreads & swaps

Erfahren sie mehr über die mit ihrem handel verbundenen kosten

Absolut transparente

handelskosten

Schauen sie sich unsere typischen spreads und swaps unten an.

Was sind forex spreads?

Wenn sie mit dem handel beginnen, werden sie feststellen, dass ihnen ein "gebotspreis" (oder "verkaufspreis") und ein "anfragepreis" (oder "kaufpreis") angeboten wird. Das "gebot" ist der preis, zu dem sie die basiswährung verkaufen, und die "anfrage" ist der preis, zu dem sie die basiswährung kaufen. Der unterschied zwischen diesen beiden preisen ist das, was wir den "spread“ nennen.

Wenn ein handel eröffnet wird, gibt es immer dritte, die die eröffnung und schließung dieses handels ermöglichen, wie eine bank oder ein liquiditätsgeber. Diese dritten müssen sicherstellen, dass es einen geordneten fluss von kauf- und verkaufsaufträgen gibt, was bedeutet, dass sie für jeden verkäufer einen käufer finden müssen und umgekehrt.

Diese drittpartei akzeptiert das risiko eines verlustes bei gleichzeitiger ermöglichung des handels. Deshalb behält die drittpartei einen teil jedes handels ein - dieser teil wird als spread bezeichnet!

Wie kann man den

spread berechnen?

Wie berechnen sie ihre handelskosten?

Was sind swaps?

Wichtig swap/rollover rate fakten

die swapsätze werden um 00:00 uhr plattformzeit angewendet. Jedes währungspaar hat seine eigene swap-gebühr und wird auf einer standardgröße von 1 lot (100.000 basiseinheiten) gemessen. Swaps werden jede nacht auf ihre offenen positionen angewendet und wenn die position offenbleibt, erhält sie ein neues "valutadatum". Am mittwochabend wird jedoch das neue valutadatum für einen offenen handel auf montag geändert. Aus diesem grund werden swaps mit dem dreifachen satz berechnet. Überprüfen sie ihre swaps auf ihrem MT4 market watch panel. Klicken sie einfach mit der rechten maustaste, wählen "symbole", wählen das instrument aus und wählen dann "eigenschaften"

STARTEN SIE IHR TRADING mit tickmill

Es geht einfach und schnell!

REGISTRIEREN

Vollständige registrierung: loggen sie sich in ihren

KONTO ERÖFFNEN

Sobald ihre dokumente genehmigt sind, können sie ein live trading konto erstellen.

EINE EINZAHLUNG VORNEHMEN

Wählen sie eine zahlungsart aus, kapitalisieren sie ihr handelskonto und starten sie mit dem handel.

Handelsinstrumente

Handelsbedingungen

Handelskonten

Plattformen

Weiterbildung

Werkzeuge

Partnerschaften

Über uns

Kundendienst

Tickmill ist der handelsname der tickmill group of companies.

Tickmill.Com gehört und wird innerhalb der tickmill-unternehmensgruppe betrieben. Die tickmill group besteht aus tickmill UK ltd, reguliert von der britischen financial conduct authority (eingetragener sitz: 3. Stock, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, reguliert von den cyprus securities and exchange commission (eingetragener sitz: kedron 9, mesa geitonia, 4004 limassol, zypern), tickmill südafrika (PTY) ltd, FSP 49464, reguliert von der financial sector conduct authority (FSCA) (eingetragener sitz: the colosseum, 1. Stock, century way, office 10, century city, 7441 kapstadt), tickmill ltd, reguliert von der financial services authority der seychellen und seiner 100% igen tochtergesellschaft procard global ltd, britische registrierungsnummer 09369927 (eingetragener sitz: 3. Stock, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - reguliert von der financial services authority of labuan malaysia (lizenznummer: MB/18/0028 und eingetragener sitz: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T., labuan, malaysia).

Kunden müssen mindestens 18 jahre alt sein, um die dienstleistungen von tickmill nutzen zu können.

Hochrisikohinweis: der handel mit contracts for difference (cfds) auf marge birgt ein hohes risiko und ist möglicherweise nicht für alle anleger geeignet. Bevor sie sich für den handel mit contracts for difference (cfds) entscheiden, sollten sie ihre handelsziele, den erfahrungsstand und die risikobereitschaft sorgfältig prüfen. Sie riskieren ihr investiertes kapital zu verlieren. Daher sollten sie kein geld einzahlen, das sie sich nicht leisten können, zu verlieren. Vergewissern sie sich, dass sie die risiken vollständig verstanden haben, und sorgen sie bei der verwaltung ihres risikos für angemessene vorsicht.

Die website enthält links zu websites, die von dritten kontrolliert oder angeboten werden. Tickmill hat keine überprüfung vorgenommen und lehnt hiermit jegliche haftung für informationen oder materialien ab, die auf einer der mit dieser website verlinkten seiten veröffentlicht wurden. Durch die einrichtung eines links zu einer drittanbieter-website unterstützt oder empfiehlt tickmill keine produkte oder dienstleistungen, die auf dieser website angeboten werden. Die informationen auf dieser website dienen nur zu informationszwecken. Es sollte daher nicht als angebot oder aufforderung an eine person in einer rechtsordnung, in der ein solches angebot oder eine aufforderung nicht zulässig ist, oder an eine person, der ein solches angebot oder eine solche aufforderung unzulässig wäre, oder als empfehlung angesehen werden einen bestimmten währungs- oder edelmetallhandel zu kaufen, zu verkaufen oder anderweitig damit zu handeln. Wenn sie sich nicht sicher sind, ob sie in ihrer lokalen währung handeln und handelsregeln für metalle beachten, sollten sie diese seite sofort verlassen.

Es wird dringend empfohlen, eine unabhängige finanz-, rechts- und steuerberatung einzuholen, bevor sie mit einem devisen- oder spothandel mit metallen beginnen. Nichts auf dieser website sollte als hinweis von tickmill oder einem seiner verbundenen unternehmen, direktoren, leitenden angestellten oder mitarbeitern gelesen oder ausgelegt werden.

Die dienstleistungen von tickmill und die informationen auf dieser website richten sich nicht an bürger / einwohner der vereinigten staaten von amerika und sind nicht zur verteilung an oder nutzung durch eine person in einem land oder einer rechtsordnung bestimmt, in der eine solche verteilung oder verwendung entgegenstehen würde nach lokalen gesetzen oder vorschriften.

Tickmill review

Tickmill is a forex trading services broker. They give traders access to a wide variety of instruments in several markets like currencies and indices.

To open a live account, you’ll need a minimum deposit of at least £25. Alternatively, tickmill offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by the financial conduct authority, UK (FRN: 717270). Tickmill puts all client funds in a segregated bank account and uses tier-1 banks for this. Tickmill has been established since 2014, and have a head office in seychelles, UK.

Before we dive into some of the more detailed aspects of tickmill’s spreads, fees, platforms and trading features, you may want to open tickmill’s website in a new tab by clicking the button below in order to see the latest information directly from tickmill.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

What are tickmill's spreads & fees?

Like most brokers, tickmill takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on tickmill’s website. The colour bars show how competitive tickmill's spreads are in comparison to other popular brokers featured on brokernotes.

| Tickmill | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.2 pips + $4.00 | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.7 pips + $4.00 | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.2 pips + $4.00 | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.4 pips + $4.00 | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.7 pips + $4.00 | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.6 pips + $4.00 | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.7 pips + $4.00 | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.5 pips + $4.00 | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, tickmill’s minimum spread for trading EUR/USD is 0.2 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with tickmill vs. Similar brokers.

How much does tickmill charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with tickmill at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $6.94. Here’s a rough breakdown of the fees and how this compares against XTB & avatrade .

| Tickmill | XTB | avatrade | |

|---|---|---|---|

| spread from : | $ 0.00 | $ 2.00 | $ 7.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 0.00 | $ 2.00 | $ 7.00 |

| $2 more | $7 more | ||

| visit tickmill | visit XTB | visit avatrade |

All fees/prices are for informational purposes and are subject to change.

What can you trade with tickmill?

Tickmill offers over different instruments to trade, including over currency pairs. We’ve summarised all of the different types of instruments offered by tickmill below, along with the instruments offered by XTB and avatrade for comparison.

| FX / currency cfds | tickmill | XTB | avatrade |

|---|---|---|---|

| # of forex pairs offered | 48 | 59 | |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | |

| exotic forex pairs | yes | yes | |

| cryptocurrencies | no | yes | yes |

| commodity cfds | tickmill | XTB | avatrade |

|---|---|---|---|

| # of commodities offered | 21 | 16 | |

| metals | yes | yes | yes |

| energies | no | yes | yes |

| agricultural | no | yes | yes |

| index & stock cfds | tickmill | XTB | avatrade |

|---|---|---|---|

| # of stocks offered | 1606 | 99 | |

| UK shares | no | yes | yes |

| US shares | no | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see tickmill's instruments | see XTB's instruments | see avatrade's instruments |

What’s the tickmill trading experience like?

1) platforms and apps

Tickmill offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers. The combination of downloadable platforms for both mac and windows allows traders to trade with their device of choice.

Tickmill also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Tickmill allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument. As tickmill offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades.

As a market maker, tickmill may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As a nice bonus, tickmill are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Finally, we’ve listed some of the popular funding methods that tickmill offers its traders below.

Trading features:

Accounts offered:

- Demo account

- Mini account

- Standard account

- Zero spread account

- ECN account

- Islamic account

Funding methods:

3) client support

Tickmill support a wide range of languages including english, spanish, russian, chinese, indonesian, and vietnamese.

Tickmill has a brokernotes double AA support rating because tickmill offer over three languages email and phone support.

4) what you’ll need to open an account with tickmill

As tickmill is regulated by financial conduct authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore tickmill’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with tickmill you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from http://www.Tickmill.Com/ on 01/01/2021.

Tickmill not quite right?

Compare these tickmill alternatives or find your next broker using our free interactive tool.

PRO ACCOUNT

Designed for experienced traders who expect advanced features and optimal conditions.

Why choose our PRO account?

PRO ACCOUNT

Take advantage of tight spreads and competitive commissions.

| Minimum deposit | 100 |

|---|---|

| available base currencies | USD, EUR, GBP |

| spreads from | 0.0 pips |

| max leverage | 1:500 |

| min lots | 0.01 |

| commissions | 2 per side per 100,000 traded |

| all strategies allowed | |

| swap-free islamic account option |

Trade cfds on 62 currency pairs, major stock indices, oil, precious metals and bonds on your pro account, with fluctuating spreads starting from 0.0 pips.

You will pay commission of only 2 currency units per side per lot (0.0020% notional) on your pro account in the base currency of the trading instrument.Our standard commission is one of the lowest in the world.

Example: if you trade 1 lot of EURUSD, which has a contract size of 100,000 EUR, then your commission per side would be 2 EUR and 4 EUR round turn.

Though many brokers do not allow placing stop and limit orders close to market prices, we allow you to do just that. So stop and limit levels for pro account users are zero.

*no commission on cfds on stock indices, oil and bonds.

Benefit from EXCEPTIONAL trading conditions

available base currencies: USD, EUR, GBP execution model: NDD execution type: market execution average execution speed: 0.20 seconds margin call / stop-out: 100% / 30%

Access some of the most

POPULAR INSTRUMENTS

of the market

FOREX

STOCK INDICES & OIL

METALS

BONDS

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill review

Tickmill is a forex trading services broker. They give traders access to a wide variety of instruments in several markets like currencies and indices.

To open a live account, you’ll need a minimum deposit of at least £25. Alternatively, tickmill offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by the financial conduct authority, UK (FRN: 717270). Tickmill puts all client funds in a segregated bank account and uses tier-1 banks for this. Tickmill has been established since 2014, and have a head office in seychelles, UK.

Before we dive into some of the more detailed aspects of tickmill’s spreads, fees, platforms and trading features, you may want to open tickmill’s website in a new tab by clicking the button below in order to see the latest information directly from tickmill.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

What are tickmill's spreads & fees?

Like most brokers, tickmill takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on tickmill’s website. The colour bars show how competitive tickmill's spreads are in comparison to other popular brokers featured on brokernotes.

| Tickmill | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.2 pips + $4.00 | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.7 pips + $4.00 | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.2 pips + $4.00 | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.4 pips + $4.00 | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.7 pips + $4.00 | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.6 pips + $4.00 | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.7 pips + $4.00 | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.5 pips + $4.00 | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, tickmill’s minimum spread for trading EUR/USD is 0.2 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with tickmill vs. Similar brokers.

How much does tickmill charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with tickmill at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $6.94. Here’s a rough breakdown of the fees and how this compares against XTB & avatrade .

| Tickmill | XTB | avatrade | |

|---|---|---|---|

| spread from : | $ 0.00 | $ 2.00 | $ 7.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 0.00 | $ 2.00 | $ 7.00 |

| $2 more | $7 more | ||

| visit tickmill | visit XTB | visit avatrade |

All fees/prices are for informational purposes and are subject to change.

What can you trade with tickmill?

Tickmill offers over different instruments to trade, including over currency pairs. We’ve summarised all of the different types of instruments offered by tickmill below, along with the instruments offered by XTB and avatrade for comparison.

| FX / currency cfds | tickmill | XTB | avatrade |

|---|---|---|---|

| # of forex pairs offered | 48 | 59 | |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | |

| exotic forex pairs | yes | yes | |

| cryptocurrencies | no | yes | yes |

| commodity cfds | tickmill | XTB | avatrade |

|---|---|---|---|

| # of commodities offered | 21 | 16 | |

| metals | yes | yes | yes |

| energies | no | yes | yes |

| agricultural | no | yes | yes |

| index & stock cfds | tickmill | XTB | avatrade |

|---|---|---|---|

| # of stocks offered | 1606 | 99 | |

| UK shares | no | yes | yes |

| US shares | no | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see tickmill's instruments | see XTB's instruments | see avatrade's instruments |

What’s the tickmill trading experience like?

1) platforms and apps

Tickmill offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers. The combination of downloadable platforms for both mac and windows allows traders to trade with their device of choice.

Tickmill also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Tickmill allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument. As tickmill offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades.

As a market maker, tickmill may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As a nice bonus, tickmill are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Finally, we’ve listed some of the popular funding methods that tickmill offers its traders below.

Trading features:

Accounts offered:

- Demo account

- Mini account

- Standard account

- Zero spread account

- ECN account

- Islamic account

Funding methods:

3) client support

Tickmill support a wide range of languages including english, spanish, russian, chinese, indonesian, and vietnamese.

Tickmill has a brokernotes double AA support rating because tickmill offer over three languages email and phone support.

4) what you’ll need to open an account with tickmill

As tickmill is regulated by financial conduct authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore tickmill’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with tickmill you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from http://www.Tickmill.Com/ on 01/01/2021.

Tickmill not quite right?

Compare these tickmill alternatives or find your next broker using our free interactive tool.

How to earn swap points with high interest rate currency on tickmill MT4

Start earning swap points by trading high interest rate currencies with tickmill.

Promotions

Top pages

- How to withdraw tickmill $30 no deposit bonus on MT4? What's the requirement/conditions?

- What happens if I withdraw funds from XM $30 bonus account?

- Octafx $1,000 instagram contest

- Completed the verification but I didn't get XM's $30 bonus. Why is that?

- Verified my account but I can't get XM $30 bonus. Why is that?

- XM 100% deposit bonus

- Fxgiants $70 no deposit bonus

- Instaforex $1000 no deposit bonus

- Hotforex MT4 christmas & new year holiday market hours

- Trade stocks & metals with "$50 no deposit bonus" by xtrade

How to earn swap points with high interest rate currency on tickmill MT4 table of contents

Tickmill now offers optimal swap points

There are two typical profits of FX which are “gain on trading” called “capital gain” and “swap point” on income gain.

It is common and easy to imagine the gain on sale as the profit gained by buying when it is cheap and selling it when it is high.

However, “swap point” is a word that may not be familiar to those who are new to FX.

In the first place, there may be some who do not know what a swap point represents and what kind of benefits it has.

Tickmill has recently updated the swap points to offer even better rate for all traders across forex currency pairs.

In this article, we will introduce what swap points are in FX trading and what advantages and disadvantages they have.

Finally, we also introduce recommended currency pairs to aim for high swap.

You already know what swap point is? Then go to tickmill official website to see the latest swap points to start planning your trading.

What is swap point?

What is a swap point in the first place?

In FX trading, swap points mean “ profit and loss resulting from interest rate difference between high interest rate currency and low interest rate currency “.

Basically, the swap points earned per day are determined as follows.

In case of buy position:

“ interest rate of bought currency – interest rate of sold currency ”

For instance, when buying TRYUSD, “turkish lira” is the buying currency and “US dollar” is the selling currency.

If the turkish lira interest rate is 24% and the USD is 0.01%, the swap points are:

In case of sell position:

“ interest rate of sold currency – interest rate of bought currency ”

For instance, when selling TRYUSD, “turkish lira” is the selling currency and “US dollar” is the buying currency.

Therefore, if you buy a currency with a high interest rate, you can receive swap points according to the difference in interest rates.

Conversely, if you sell a currency with a high interest rate, you need to pay swap points according to the interest rate difference.

Swap points tend to attract attention when you buy high interest rate currencies, but be careful as some transactions require payment.

On tickmill MT4, the swap point works the same way as the examples above.

When swap points are credited?

When are swap points credited? Swaps occur when you hold positions across days.

Forex brokers carry out a process called rollover during the transaction break time when the date is changed, and a swap is given during this process.

This rollover time is set around the closing time of the new york market, and there are slight differences for each forex company.

However, FX trading cannot be done on saturdays and sundays.

The swap points given on saturdays, sundays and holidays are collectively given on the days specified by each forex broker.

Merits and demerits of swap points

Swap points are attractive for continuous profit, but of course there are disadvantages.

Let’s consider both the merits and demerits of swap points and think about how to minimize the risk.

First of all, there are two merits and demerits of swap points.

1. Swap points merit – continuous profit

The advantage of swap points is that you can continue to receive profits.

For example, if you try to aim for “gain on sell” in stock trading or FX trading, you can receive the profit basically only once at the time of sell.

However, you can get swap points every day except the weekends and holidays as long as you hold the position.

The swap points you can get per day are not so large, but if you accumulate it with dust, it will be a mountain.

For example, let’s say that when you trade TRY/USD, the swap points you can get per day are “10 USD/100,000 currency”.

And if you continue to hold a position for 100,000 currencies for one year, it will be “10 USD x 365 days = 3,650 USD”.

If it is 1,000,000 currency, it will be 36,500 USD.

2. Swap points merit – large swap points with leverage

In addition, FX has a system called “leverage” that allows you to trade more than your own funds.

With this leverage, you can trade up to 500 times your own money with tickmill.

In other words, it is possible to have a position with a small investment fund.

Also, since swap points increase according to the amount of currency traded, the larger the leverage, the more swap points you can get.

Even if the profit is about 10 USD per 100,000 currency, there is a possibility that it will be a big profit if leverage is used.

However, because leverage can move a large amount of money, it also carries risks.

Therefore, do not over-leverage at first, and try to decide your leverage by considering your own funding.

Don’t let your immediate profits dazzle you and leverage 500 times from the beginning.

3. Swap points demerit – exchange rate fluctuation risk

In FX trading, the exchange rate basically fluctuates for 24 hours.

Therefore, while holding the currency for a long time, the unrealized loss may be larger than the profit from the swap point.

In addition, high interest rate currencies are often “emerging country” currencies, and are characterized by rapid fluctuations in exchange rates.

So be aware of these risks when you hold a high interest rate currency for a long time.

If the exchange rate fluctuates, the swap points received will also fluctuate.

4. Swap points demerit – interest rate fluctuation risk

Next is interest rate fluctuation risk.

If the policy interest rate of the country that issues the target currency changes, the interest rate difference may become smaller or may reverse.

In particular, if the exchange rate fluctuates significantly due to the financial crisis and the policy interest rate is also lowered, the interest rate difference may be reversed.

If that happens, “payment of swap points” will be required.

The risk of fluctuations in interest rates is one of the disadvantages.

Even if the policy interest rate does not change, the swap point will change due to factors such as exchange rate fluctuations.

Therefore, it is good to have a habit to regularly check the amount of swap points on the websites of forex brokers.

Recommended forex currency pairs for swap points

Let us introduce the recommended currency pairs to aim for swap points, and their advantages and disadvantages.

First of all, there are emerging countries’ currencies, which have one of the highest interest rates of all currencies.

The major emerging market currencies that are attracting attention in swaps are the turkish lira, the mexican peso, and the south african rand.

The three currencies from developing countries are attractive for high swaps, but compared to developed countries, there is a greater risk of price fluctuations, and there is a risk that prices will fall sharply.

Therefore, let’s fully understand that it is “high risk, high return”.

If you are distracted by emerging countries’ currencies, it is recommended that you aim for a knack for swap points in developed countries’ currencies.

TRY – turkish lira the turkish lira has a very high interest rate of around 25%, making it a highly profitable currency for swaps. However, please note that the turkish lira is a currency with a small trading volume and a sharp price movement. MXN – mexican peso “mexican peso” has been attracting attention in recent years. Although the mexican peso does not have a high interest rate as much as the turkish lira, the fluctuation range of the exchange rate is 5 to 8 cents and the exchange rate fluctuation risk is relatively suppressed. The policy interest rate is around 10%, and you can expect sufficient profit from swaps. ZAR – south african rand south african rand also has a fairly high interest rate of around 7%, so you can aim for a profit with swap point. And south africa is an emerging country and one of the world’s most resource-rich countries. Therefore, resource prices and exchange prices are often linked. AUD – australian dollar australia’s currency is both a developed country and a resource country. Australia is growing year by year, and the australian dollar is a stable currency. In addition, the australian dollar interest rate is 1.0%, and although it is by no means large, we can aim for a continuously stable swap. USD – US dollar the most popular foreign currency is the US dollar. The US dollar is said to be the center of the world’s currencies and has the largest amount of currency trading. Therefore, it is a very stable currency. Also, the US policy interest rate is 2.5%, making it a very balanced currency that can firmly target swaps.

For all new traders, tickmill is giving away 30 USD for free as a no deposit bonus.

You haven’t opened an account with tickmill yet?

Open a live trading account to get tickmill’s $30 no deposit bonus today.

Tickmill swap rates

To register for an individual client area, you must submit your proof of address (POA) and proof of identity (POI) documents, whereas to register for a corporate client area, you must submit:

1. Articles of association, identification document and proof of individual and corporate address.

2. Certificate of incorporation or company registration card (must show the address, legal representatives, registration data).

We may ask for additional documents depending on the country, beneficiary etc. (offshore:).

1. Certificate of incorporation

2. Articles of association

3. Memorandum of understanding

4. Certificate of good standing

5. Certificate of incumbency/ register of members

6. The last full year’s audited accounts

Is it possible to archive an account that is not in use?

No, it is not possible to archive an account. If the account balance is 10 USD or less and there were no login attempts made for 90 days, then it will be automatically archived by the system and it will no longer be visible in the client area.

When are swaps charged at a triple rate for currency pairs and metals?

Triple swap charges apply for positions on FX pairs, silver and gold that are held overnight on wednesday. For the rest of the instruments, triple swap charges apply for positions that are held overnight on friday. This is a standard practice in the forex industry.

These swaps cover the interest for saturday and sunday when the markets are closed. All swaps are calculated based on the quote currency.

If you open a long position of 1 lot on EURAUD, the overnight swap charge would be -14.11 australian dollars. If you had opened the same position on a wednesday and roll over the position to the next day, the swap would be -14.11 * 3.

If the account currency is in USD, then we have to convert the amount above to USD by using AUDUSD spot rate.

Where can I check the SWAP rates?

We update the swaps based on the rates given to us by our counterparties and we recommend checking the swap rates on a regular basis within the MT4 platform. Our updated swaps are always available by clicking here.

You can also check the swap rates by logging into the MT4 trading platform and select: view > symbols > select instrument > properties

There are two types of positions: buy and sell. You must look at the financing long for swaps for buy positions and at the financing short for swaps for sell positions. Swaps are charged at 00:00 platform time.

Can the account be closed/deleted?

You can close an account but we will keep your data, in accordance with legislation, on our files for a minimum period of 7 years.

If your account balance is 10 USD or less and there are no login attempts made for 90 days, then it will be automatically archived by the system and it will no longer be visible in the client area.

What account types do you offer?

We offer 3 account types: classic, pro and VIP. All accounts have the same execution speed.

The pro and VIP accounts start at 0.0 pips, whereas the classic account starts at 1.6 pips.

Commission:

*there is no commission on the classic account.

*there is a commission of 2 currency units per side per lot (0.0020% notional) on the pro account in the base currency of the trading instrument. Example: if you trade 1 lot of EURUSD, which has a contract size of 100,000 EUR, then your commission per side would be 2 EUR and 4 EUR round turn.

*there is a commission of 1 currency unit per side per lot (0.0010% notional) on the VIP account in the base currency of the trading instrument. Example: if you trade 1 lot of EURUSD, which has a contract size of 100,000 EUR, then your commission per side would be 1 EUR and 2 EUR round turn.

The minimum deposit for the pro and classic account is: 100 USD/EUR/ GBP/PLN.

The minimum deposit for the VIP account is 50,000 USD/EUR/ GBP/PLN.

You can find out more information about our account types at: https://www.Tickmill.Com/trading/accounts-overview

Can I have a demo and live account working at the same time?

Yes. In order to do so, install an MT4 platform in different folders on your computer for each of your trading accounts.

Can I change the balance of my demo account?

Yes. Simply send an email with your demo account number and decided balance to our support team.

Are trading conditions the same on my demo and live account?

Yes, the trading conditions are the same. However, please note that demo accounts operate in a simulated environment which means that no slippage occurs whereas price updates might differ from live accounts.

Can I change the settings of my demo account?

Yes. Simply send an email with your demo account number and decided changes to our support team.

Will my funds be protected at tickmill?

Tickmill ltd is regulated as a securities dealer by the seychelles financial services authority (FSA). As such, our internal systems are in compliance with the FSA regulations, which means that your funds are held in segregated accounts to protect your assets.

How do I open a metatrader 4 account?

You can open an account in the client area, efficiently and securely. Click here to open an account with us.

How do I modify or delete a trade in MT4 platform?

Right-click on the instrument you placed the trade with and use the options 'modify the trade' or 'delete the trade'.

I forgot my MT4 password. What do I do?

You can change the password of your metatrader 4 account inside the secure client area. For further assistance, please contact our client support team.

I forgot my client area password. What do I do?

Go to the client area login page click on the ‘forgot your password?’ link under the ‘login’ button and follow the instructions on how to reset your password. For further assistance, please contact our client support team.

Where can I find my account balance and my trading history?

You can find your account balance and trading history in the metatrader 4 platform. The account balance can also be seen in your client area.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Forex swap rates

What is a swap?

You have noticed for sure, that if you leave any transaction open, the next day you will notice the minor change of your account balance even if during this period have not been made any trading activities. The swap is the commission for the transfer of your open position for the next trading day.

But why this happens, when the forex market is famous for non-stop trading? Despite the status of the free and independent market, the forex market has certain rules which extend to all his players. According to the exchange canons, at the end of the working day (trading session) have to be made the calculation in real money on all open transactions. However, participants of the forex OTC market earn on a difference from the purchase and sale of currencies, using electronic terminals and means of communication, that is why this process is physically unavailable to them. Therefore, instead of cash calculation, all transactions are closed and reopened the next trading day. The commission paid for such service is called a swap.

Trading swaps

For traders swaps don't represent a big problem, moreover, they figured out how to make money on them. This particular strategy is known as carry trade. The main principle consists in purchasing the tool with higher interest rate than quoted at the expense of what it is possible to get profit (a positive swap) in the case of open transaction transfer to the next day.

Nevertheless, do not forget that this strategy has a very high risk due to the unpredictability of the currency market. The risk is that the profit got on swaps for transfer of a transaction cannot block a possible loss from the transaction if the purchase price of a currency pair appears high prices of its sale. Therefore, if you decided to earn on swaps, do it only during those periods when the volatility of the market is minimized.

Risk disclosure: gurutrade assumes no liability for loss or damage as a result of reliance on the information contained within this website including data, quotes, charts and forex signals. Operations in the international foreign exchange market contain high levels of risk. Forex trading may not be suitable for all investors. Speculating only the money you can afford to lose. Gurutrade remind you that the data contained in this website is not necessarily real-time and may not be accurate. All stock prices, indexes, futures are indicative and not appropriate for trading. Thus, gurutrade assumes no responsibility for any trading losses you might incur as a result of using this data. Version of the document in english is a defining and shall prevail in the event that there are discrepancies between the english and russian languages. Seeking stocks, quotes, charts and forex? Take a look at the portal gurutrade.Com - the best directory of brokers and modern economic calendar for your service!

© 2013-2021 gurutrade. All rights reserved.

Swap rates vs. Bond yields

The swap rate market gained widespread institutional popularity during the 1980s. Reportedly, IBM and the world bank completed the first modern swap agreement in 1981. Today, hundreds of trillions of dollars’ worth of swaps are outstanding – many multiples of world GDP of some $88 trillion – making them among the most traded financial instruments in the world.

Swaps are derivative contracts in which two counterparties exchange the cash flows of each party’s financial instrument. This means they are usually custom-made for each party and traded “over the counter” (OTC). Certain exchanges, such as the CBOE, CME, and ICE, all support OTC swap trading on their platforms for the standard arrangements in these instruments (e.G., swaps pertaining to US treasury bonds).

Swaps most commonly apply to bonds, interest rates, and currencies. They are used to either speculate on the direction of the price of the underlying instrument (typical among hedge funds and other types of traders). Or they can be used to hedge out certain types of risks, commonly pertaining to interest rates or FX, which is more common among corporate participants to hedge out their financial related liabilities. There are also swaps designed to speculate on or hedge out the risk associated with certain commodity or equity prices.

In the case of a swap involving two different bonds, the form of cash flow exchange heavily depends on the coupon payment associated with these bonds.

The swap agreement itself will specify which cash flows are to be paid by what date, and how they will be calculated and accrued. There is usually some type of floating or variable rate associated with swap contracts, usually a reference rate (e.G., LIBOR) that is determined by an independent third party.

The notional principal amount of the underlying instrument is typically not exchanged between counterparties. This makes swaps unique relative to other contracts, such as options, forwards, and futures.

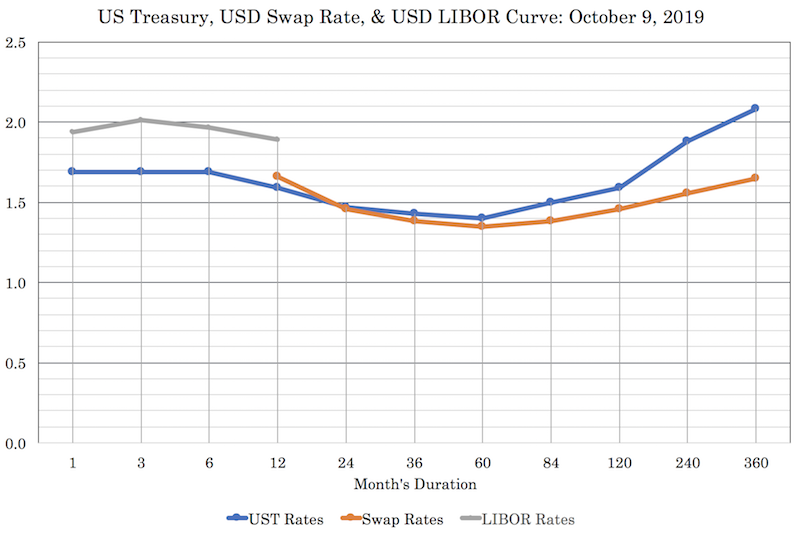

Swap rates vs. Bond yields

For swaps that pertain to fixed income cash flow exchanges, swap rates typically trade at a premium over their corresponding bond yields. Treasury bonds have corresponding swap rates, and these swap rates have historically traded at a premium over treasury yields.

However, if we look at the US treasury and USD swap rate curves, we see the treasury curve being above the swap curve for all durations beyond two years (24 months).

This negative spread is a whopping 43bps on the 30-year duration. Traditionally, it doesn’t make sense that buying a security from the government would be more risky than buying the same type of security underwritten by a commercial, investment, or merchant bank, or independent swap underwriter. The US government is more creditworthy than any given entity that can write a swap for you.

Theoretically, the extra risk premium for a US treasury swap over the corresponding bond is a few basis points. This represents the extra compensation expected for the marginally higher likelihood that the swap’s underwriter will default in comparison to the federal government defaulting on a debt maturity.

You would think that this fundamental relationship doesn’t make sense and would theoretically reverse. And if something is mispriced, then you could trade it (i.E., short “overvalued” US treasury swap, long “undervalued” corresponding US treasury futures contract).

But prices can remain out of whack for rational reasons even if the fundamental cause doesn’t seem right.

So, why has the negative relationship become so endemic to the US treasury curve?

These days, banks have higher capital requirements, less latitude on what they can hold on their balance sheets, and a more stringent regulatory environment as a whole. Companies that issue debt also have an outsized role in the swap market. Corporations and institutional traders use swap contracts to exchange fixed rates for floating rates. When a company sells debt at a fixed rate, it can contact an investment bank to design a swap to help the company pay a lower floating rate, such as a short-term reference rate (e.G., three-month LIBOR).

Moreover, market makers (also known as dealers, and comprise large financial institutions) are having to sell larger quantities of treasury bonds to their clients. This keeps their inventories of these securities higher.

Treasury bond and swap trading is also heavily intertwined in the repurchase (“repo”) market. The use of repurchase agreements to buy treasuries is also shrinking among market makers. This helps to push up demand for swaps instead, which lowers their yields relative to the underlying bonds. Naturally, as capital and balance sheet capacity decrease in availability, banks have decided to reduce their repo books given the balance sheet intensive nature and thin margins of the business. Banks have to be more selective, and this means doing fewer transactions in less profitable areas.

Accordingly, traders are no longer as able to use the repo funding market to buy US treasuries and pay the fixed rate (and receive the floating rate) on a swap. If a bank were to enter into that trade, the repo transaction would consume capital on its balance sheet, which it can’t afford if regulation constricts bank capital and how much of what they can and can’t hold in various forms.

All of this activity has the effect of pushing demand away from treasury cash bonds and toward swaps as instruments of speculation. Holding all else equal, more demand means higher prices, and higher prices means lower yields.

Moreover, as the US fiscal deficit climbs, both in gross terms and as a proportion of GDP, tighter bank regulation increases gross funding costs for the US government.

In a typical free market, where supply and demand meet at a certain price unimpeded by exogenous forces, treasury swap market inversions would be reversed. But with more stringent bank capital regulations, the counterintuitive relationship where higher-credit-risk swaps have lower yields than “risk free” treasury bonds has become the new norm.

Takeaway

Most retail / individual traders don’t have access to the swaps market (though interactive brokers offers some exposure to swaps on treasury futures). But the general point is not just the unusual relationship in this particular niche of finance, but rather the idea that just because something seems fundamentally out of whack (and therefore ripe to exploit) doesn’t mean that it’s necessarily a good trade idea.

Anyone who follows the markets is probably aware of the storyline of how “value investing” has become either “ineffective” or “out of style” in some form.

While buying something that’s notionally undervalued is good in theory, movements in financial markets are based on buying and selling activity, and clearly that’s not always based on strict adherence of what something is theoretically worth. In all markets, there are different buyers and sellers of different sizes and various motivations. While some markets may be more expensive or cheaper than others, they can remain that way for long periods of time. Some markets, such as cryptocurrencies, have little to do with value and are more speculative pursuits.

Shorting a higher-credit-risk security and going long its equivalent corresponding lower-credit-risk counterpart sounds good in theory as a relative value opportunity. However, in the case of the US treasury swap market there is an underlying reason why this spread is backwards and out of line with its putative equilibrium value.

No matter what the market is, when something doesn’t make sense fundamentally, always question whether you are missing something and why other players in the market – all looking for the same forms of money-making opportunities – haven’t already exploited a seemingly obvious trade.

So, let's see, what we have: tickmill provides clients of muslim faith with a swap-free islamic account that is 100% compliant with shariah law. Open an islamic account with tickmill! At tickmill swap rates

Contents of the article

- Top forex bonus promo

- Islamic (swap-free) account

- The islamic account in a nutshell...

- Access some of the most POPULAR...

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Spreads & swaps

- Absolut transparente handelskosten...

- Was sind forex spreads?

- Wie kann man den spread berechnen?...

- Wie berechnen sie ihre handelskosten?

- Was sind swaps?

- Wichtig swap/rollover rate fakten

- STARTEN SIE IHR TRADING mit tickmill

- Es geht einfach und schnell!

- REGISTRIEREN

- KONTO ERÖFFNEN

- EINE EINZAHLUNG VORNEHMEN

- Handelsinstrumente

- Handelsbedingungen

- Handelskonten

- Plattformen

- Weiterbildung

- Werkzeuge

- Partnerschaften

- Über uns

- Kundendienst

- Es geht einfach und schnell!

- Tickmill review

- What are tickmill's spreads & fees?

- What can you trade with tickmill?

- What’s the tickmill trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with tickmill

- Tickmill not quite right?

- PRO ACCOUNT

- Why choose our PRO account?

- PRO ACCOUNT

- Access some of the most POPULAR...

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill review

- What are tickmill's spreads & fees?

- What can you trade with tickmill?

- What’s the tickmill trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with tickmill

- Tickmill not quite right?

- How to earn swap points with high interest rate currency on...

- Start earning swap points by trading high interest rate...

- How to earn swap points with high interest rate currency on...

- Tickmill now offers optimal swap points

- What is swap point?

- When swap points are credited?

- Merits and demerits of swap points

- 1. Swap points merit – continuous profit

- 2. Swap points merit – large swap points with leverage

- 3. Swap points demerit – exchange rate fluctuation risk

- 4. Swap points demerit – interest rate fluctuation risk

- Recommended forex currency pairs for swap points

- Tickmill swap rates

- Is it possible to archive an account that is not in use?

- When are swaps charged at a triple rate for currency pairs...

- Where can I check the SWAP rates?

- Can the account be closed/deleted?

- What account types do you offer?

- Can I have a demo and live account working at the same time?

- Can I change the balance of my demo account?

- Are trading conditions the same on my demo and live account?

- Can I change the settings of my demo account?

- Will my funds be protected at tickmill?

- How do I open a metatrader 4 account?

- How do I modify or delete a trade in MT4 platform?

- I forgot my MT4 password. What do I do?

- I forgot my client area password. What do I do?

- Where can I find my account balance and my trading history?

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Forex swap rates

- What is a swap?

- Trading swaps

- Swap rates vs. Bond yields

- Swap rates vs. Bond yields

- So, why has the negative relationship become so endemic to...

- Takeaway

Comments

Post a Comment