FBS Broker Review, fbs ecn account review.

Fbs ecn account review

We make it our mission to not recommend anything but the best – which, according to industry experts, is IQ option, the top regulated broker for your country with a minimum deposit of ONLY $10!

Top forex bonus promo

With a $5 initial deposit, clients can open an FBS micro account, supporting financial trading in 35 currency pairs, cfds, cryptocurrencies and metals. Notably, the micro account offers fast STP market execution, leverage up to 1:3000 and is free of commission. However, the spreads from 3 pips are relatively wide and a maximum of 200 open positions and pending orders is permitted.

FBS broker review

Launched in 2009, FBS is a regulated forex broker providing financial services to millions of traders in more than 170 countries. We saw that the website is available in 6 european languages and 13 asian languages including chinese, japanese, arabic and korean. Notably, FBS has received multiple prestigious industry accolades including ‘best forex broker’ awards in indonesia, south-east asia, thailand, middle east, and the asia-pacific region. We were impressed by the broad choice of trading accounts available from just $1 deposit. Indeed, clients can trade with multiple financial instruments including, forex currency pairs, indices, stocks, cfds, precious metals and cryptocurrencies with up to 3,000:1 leverage and spreads from 0 pips.

Conclusion:

We make it our mission to not recommend anything but the best – which, according to industry experts, is IQ option, the top regulated broker for your country with a minimum deposit of ONLY $10!

Between 74-89 % of retail investor accounts lose money when trading cfds

Account features

FBS promotional bonus offers

For traders seeking bonus rewards, FBS offers a vast program of promotional offers including a 100% deposit bonus and a $123 welcome bonus. We saw numerous contests, promotions and bonuses at FBS, ranging from cashback for losing orders, traders parties and ‘get a car from FBS’ amongst many others. Nevertheless, we suggest that traders read the terms and conditions of any promotional offer before opting to participate, ensuring that they fully understand the rules. Especially the potentially large volume of trading investment that may be required to fulfil some bonus terms.

Live trading account types

Clients can choose from six types of live trading account at FBS. Significantly all the trading accounts use market order execution with straight through processing (STP) within the non-dealing desk. Moreover, we saw that 95% of orders are executed within 0.4 seconds because of the high-speed execution guaranteed to clients by FBS. It’s worth noting that all live trading accounts except for the ECN account, support free funds insurance and swap-free trading.

FBS cents account

Specially designed for those clients just starting out in forex trading, the FBS cents account requires an initial deposit of $1. Notably, the account is commission free and provides leverage up to 1:1000. However, the order volumes are limited to between 0.01 and 1,000 cents lots and only up to 200 open/pending orders can be open at one time.

FBS micro account

With a $5 initial deposit, clients can open an FBS micro account, supporting financial trading in 35 currency pairs, cfds, cryptocurrencies and metals. Notably, the micro account offers fast STP market execution, leverage up to 1:3000 and is free of commission. However, the spreads from 3 pips are relatively wide and a maximum of 200 open positions and pending orders is permitted.

FBS standard account

To open an FBS standard account requires an initial deposit of $100. We saw that the account is tailored to the needs of seasoned traders, supporting a broad range of financial instruments including 35 currency pairs, metals, cryptocurrencies and cfds. The standard account has floating spreads from 0.5 pips and gives access to leverage up to 1:3000. Notably, clients with the standard account are not permitted to have more than 200 positions and pending orders open simultaneously.

FBS zero spread account

For traders seeking STP market execution trading at incredibly high speeds (from 0.3 seconds), the FBS zero spread account provides the way. An initial deposit of $500 is required to set up an account with zero pip fixed spread and commission of $20 per lot. We saw that traders can select instruments from multiple asset classes including 34 currency pairs, cfds, cryptocurrencies, gold and silver to trade with up to 1:3000 leverage. However, trading is limited to 200 open positions and pending orders at any one time.

FBS unlimited account

To set up an FBS unlimited account with STP market execution, requires an initial deposit of $500. The account supports trading in 35 currency pairs, cfds, cryptocurrencies and metals with zero commission. Clients get access to leverage up to 1:500 and floating spreads from 0.2 pip.

FBS ECN account

With a minimum first deposit of $1,000, clients can open an ECN account in USD only, with access to 25 currency pairs. The FBS ECN account features ECN market execution and unlimited trading. Leverage up to 1:500 is available and floating spreads from 1 pip. Notably, commission of $6 is payable on completed trades and the accepted order volumes are from 0.1 up to 500 lots.

FBS exclusive VIP client advantages

Customers who have made deposits totalling $10,000 to their trading accounts since registering with FBS, and have traded at least 50 lots, get VIP client status automatically. We saw that VIP clients enjoy several exclusive advantages, including dedicated account managers who speak their client’s native languages, also VIP gifts on special occasions and priority treatment of deposit and withdrawal requests.

FBS swap free islamic account

Clients following the moslem faith can request a swap free account from customer support at FBS. Notably, positions left open for more than two days are charged a fixed fee clearly indicated by FBS, which is not an interest on the trade, and depends on whether the trade is a buy or sell.

FBS limitations on leverage

We saw that FBS offers leverage to traders of up to 1:3000 which is probably the highest level of leverage offered by any broker in the industry. Notably, the leverage offered by FBS, depends on the account type and the amount of investment equity. We saw that leverage of 1:3000 is available on the sum of equity up to $€200. The leverage falls to 1:2000: on equity up to $€2,000 and to 1:1000 on equity up to $€5,000. With the sum of equity up to $30,000, traders can invest with leverage of 1:500 with the leverage falling to 1:200 on equity up to $€150,000. Traders can access leverage of 1:50 and 1:100 without any limitations on equity. Moreover, the maximum leverage for trading in gold from any type of trading account is set at 1:400 and on other metals 1:100. However, it’s important to realise that whilst very high leverage gives traders the opportunity to execute orders for much bigger amounts of money than they have deposited in their trading accounts, the amount that may be lost through unsuccessful financial trading is also magnified.

Try trading with an award-winning broker like IQ option

Between 74-89 % of retail investor accounts lose money when trading cfds

Become an IQ option trader today

Join IQ option and become a trading master! IQ option is a world-famous regulated broker that takes your trading to the next level. It allows you to trade forex, crypto, stocks, options and much more on its award-winning platform. The best part? You can start trading with a minimum deposit of ONLY $10! Read our IQ option review.

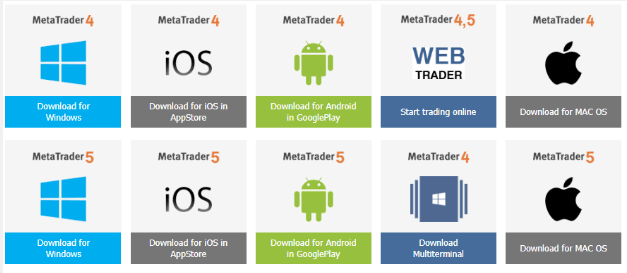

Trading software & assets

Traders at FBS can choose from a wide range of meta trader forex platforms for both mac and windows powered computers. Whilst traders need to download the MT software to desktop, access to trading accounts is also available through the MT4 or MT5 webtrader, with the same password. Additionally, trading on the move, using smartphones and tablets is possible through the free MT mobile apps for android and ios (download in the app store and google play store). The FBS meta trader platforms offer high leverage and market execution, trading without re-quotes or deviations. Conveniently, the meta trader provides in built multi-lingual support and simple one click trading. Moreover, both the MT4 and MT5 offer demo accounts with access to an authentically replicated trading environment for risk-free practice trading with virtual money.

FBS metatrader4 platform features

The MT4 trading platform is typically regarded as the industry ‘standard’ forex trading platform. Notably, the MT4 is customisable, reliable and secure, with an intuitive interface making it very easy to use by even the most inexperienced traders. The FBS MT4 offers trading with 41 financial instruments across currency pairs, cryptocurrencies, cfds and futures. Importantly, the platform supports automated (algorithmic) trading with expert advisors. Moreover, live market news is streamed onto the platform and clients have access to several charts and 50 technical indicators as well as technical analysis.

FBS metatrader5 platform features

The MT5 trading platform is the ‘follow up’ version of the MT4 designed to eventually replace the MT4. Whilst novice traders may be wary of the technologically advanced platform, it is also user-friendly with an intuitive interface and inbuilt support. The FBS MT5 provides 41 tradable instruments including currency pairs, cfds and futures. Importantly, the MT5 offers market depth and 21 time frames as well as more technical indicators and charts than the MT4.

Copy trading platform for investors at FBS

Any client investing in forex trading at FBS can choose to copy traders with impressive records of profitable trades on the FBS copytrade social trading platform. Significantly, traders don’t need financial trading experience to copy other traders’ portfolios. Simply select the top traders, create a portfolio of traders to track, connect to them and copy their trades with one click. We saw that the FBS copytrade platform is accessible through the dedicated app for android and ios mobile phones in the app store and google play store.

Copy trading for FBS traders

Successful traders with an FBS micro, standard or unlimited account, who opt for the MT4 trading platform, can earn commission for their trading skills, from less experienced traders who want to copy them. Importantly, traders who want to be copied and earn a percentage of the copy traders’ profits, must enable the FBS copytrade function in the personal area of the trading account and trade normally.

Trading cryptocurrencies at FBS

Reflecting the ever-growing popularity in online cryptocurrency trading, FBS has added four cryptocurrency cfds to the existing range of trading instruments available to clients. We saw that traders can trade in bitcoin, ethereum, DASH and litecoin, against the USD, with as little as $10 invested on a single position. Furthermore, FBS offers leverage up to 1:3 allowing clients to potentially increase profits substantially. Significantly, cryptocurrency trading never stops, allowing FBS clients to trade 24/7, unlike forex trading which is limited to 24/5. Moreover, trading in crypto cfds allows traders to profit from the typically huge price volatility without being impacted as crypto asset owners. In our experience, the biggest advantages of trading cryptocurrency cfds is that traders don’t need to own the physical cryptocurrency assets renowned for their hugely volatile price movements. Neither do they need to run the risk of being hacked and potentially having their cryptocurrencies stolen whilst trading on cryptocurrency exchanges.

FBS risk management for traders

Customers at FBS can manage trading risks to some degree by utilising leverage prudently and using stop-loss orders on the trading platform. We were pleased to see that FBS provides automatic negative balance protection in trading accounts. Additionally, clients with a cent, micro or standard account can take out ‘free deposit insurance’ protecting from 10% to 100% of their funds in case of trading losses. However, the deposit insurance is included under the various bonus offers made by FBS and comes with terms and conditions that should be considered carefully before applying. Notably customers can apply for deposit insurance only after a specific number of lots have been traded. From the example given on the website, a trader with a $1000 deposit can apply for 40% deposit insurance when trading a volume of 50 lots. In the event of an ‘insured event’ happening whilst trading, FBS compensates the trader with $400. The exact details of the deposit insurance and what qualifies an insurance event, are described in the client’s live trading account in the ‘personal area’.

If you want to trade with an award-winning licensed broker, we recommended using IQ option

Between 74-89 % of retail investor accounts lose money when trading cfds

Support information

FBS provides 24/7 support to customers all over the globe through live chat on the interface, email and telephone. We saw on the contact page that support is also available over ‘telegram’ messaging service, messenger, twitter feeds, facebook and ‘what’s app’.

Try trading with an award-winning broker like IQ option

Between 74-89 % of retail investor accounts lose money when trading cfds

Master the markets with IQ option

- Get a FREE $10,000 demo account

- Start trading with only $10

- Invest with a licensed and regulated broker

With IQ option, you will be trading with an award-winning broker recognised and praised by industry experts. Get your IQ option account today!

Between 74-89 % of retail investor accounts lose money when trading cfds

Banking & company information

FBS is the trading name of FBS markets inc. Regulated in belize with an IFSC license number 60/230/TS/17. Additionally, the company is authorised and regulated by the cyprus securities and exchange commission (cysec) under license number 331/17. FBS has multiple representative offices across the globe providing 24/7 customer support in national languages.

Customers with FBS trading accounts have an astonishingly wide range of payment methods to choose from including credit/debit cards, multiple digital methods, local payment methods and wire transfers. We saw that the list of payment methods is set out transparently on the FBS website with processing times and exact commission rates, if any, for both deposits and withdrawals. We were pleased to see that the majority of payment methods, are totally free of commission to FBS and withdrawals are processed and delivered rapidly.

Conclusion:

We make it our mission to not recommend anything but the best – which, according to industry experts, is IQ option, the top regulated broker for your country with a minimum deposit of ONLY $10!

- FREE $10,000 demo account

- Award-winning trading platform

- Licensed and regulated broker

FBS review and tutorial 2021

FBS is a top online broker offering MT4 & MT5 trading across a range of instruments.

Trade on nearly 50 leveraged forex pairs.

FBS is an online broker that offers financial market trading in forex and cfds. Our review in 2021 takes a thorough look at the broker’s legitimacy, leverage offering, spreads, and minimum deposits. Sign up for an FBS account and start trading.

History & headlines

FBS is a global broker founded in 2009. In the EU, FBS is operated by tradestone ltd and regulated by the cyprus securities and exchange commission (cysec). The global branch is run by FBS markets inc and regulated by the international financial services commission of belize (IFSC).

FBS has a head office location in cyprus and claims to have over 15 million active traders across more than 190 countries, from malaysia and indonesia to south africa, pakistan and the EU.

Trading platforms

FBS uses a non-dealing desk (NDD) system with STP for rapid order execution. After registration and login clients have a choice of two platforms to access the markets.

Metatrader 4

MT4 is a market-leading platform that FBS clients can download for PC. The trading platform includes a range of features:

- One-click execution and copy-trading

- Expert advisors (EA) service and apis

- Wide range of technical indicators and charting tools

- Support for clients using a virtual private server (VPS)

The global branch of FBS also offers MT4 multiterminal, which allows clients to operate multiple accounts simultaneously.

Metatrader 5

This broker recently added MT5 integration to its portfolio. This platform is a recent update to MT4 with greater versatility that offers the following:

- Hedging & netting

- Market depth view

- More technical indicators

- More order types and timeframes

MT4 and MT5 are also both available without a download via any browser through the webtrader solution. This service works across all operating systems and has all the features of the original software.

Markets

Clients can access a wide range of assets for trading:

- Forex – 28 standard pairs plus 16 exotics

- Metals – four precious metals

- Energies – WTI and brent crude oil

- Stocks (global only) – 40 company shares

- Indices – four indices including the NASDAQ

Unfortunately trading on the FTSE100 is not offered and neither is cryptocurrencies, such as bitcoin.

Trading fees

Spreads offered by FBS vary by account type and region. For EURUSD, the global firm offers a spread of 3.0 pips on its micro account, 1.1 on its standard and cent accounts and zero pip spreads on its zero and ECN accounts. In the EU the same spread is 0.7 pips with both the standard and cent accounts. Our review was pleased to see competitive spreads with the zero and ECN accounts.

The global branch charges a fixed rate commission of $20 per lot on the zero spread account and $6 on the ECN account. It also charges $3 for stock trades and $25 for CFD trading.

FBS charges overnight rollover fees (swap-free is available) and a cancellation fee of €5 for transactions that have taken advantage of price latency. Accounts dormant for 180 days are charged a €5 monthly fee.

FBS leverage

The maximum leverage available depends on account type and branch. In the EU the broker provides leverage up to 1:30 on standard and cent account types. Globally it offers up to 1:1000 on the cent account, 1:500 on the ECN account, and 1:3000 on other account types.

FBS has a margin call of 40% and lower, whereafter it is entitled to close a client’s position.

Mobile apps

FBS trader app

The owner and CEO have ensured that FBS trader is a free and fully-featured trading app. It can be downloaded to android (APK) devices from google play. Outside the EU it’s also available on ios. The broker’s downloadable app offers forex and top instruments for trading, alongside real-time stats and easy management.

MT4 & MT5 apps

Both metatrader platforms are also available as mobile apps from the app store and google play. The apps have the main features of the native platforms including technical analysis with the convenience of one-click trading on-the-go.

Payments

The minimum deposit at the online forex broker is different for each account type and trading region. The EU firm requires an initial deposit of €10 on the cent account and €100 on the standard. The global branch offers minimum deposits of $1, $5, $100, $500, and $1000 for the cent, micro, standard, zero spread, and ECN accounts respectively. Our review was pleased to see the low minimum deposit offering.

Several deposit and withdrawal methods are available including wire transfer (EU only), visa, and electronic payment systems, such as skrill and neteller. Deposits are instant for all methods bar wire transfer and withdrawals take up to 48 hours. Commission fees apply to withdrawals at the global FBS firm and identifying documents may be requested.

Demo account review

FBS offers demo versions of the cent and standard accounts in the EU. MT4 and MT5 integration are available and a range of instruments are offered to practice trading with zero deposit requirement. Once comfortable with the broker’s services, you can then sign up for a live account.

Trading bonuses

FBS has a wide selection of promotions and bonuses advertised on its global website. For example, the broker offers a trade $100 bonus with no deposit necessary. The broker credits clients with $100 and if the client has 30 active trading days with 5 lots traded, the bonus can be withdrawn. FBS also offers a 100% deposit bonus, which doubles the deposit available for trading, and many contests.

Licensing

FBS is a legitimate broker with regulations from respected authorities. The company that owns the EU branch of FBS is regulated by the cyprus securities and exchange commission (cysec). The global branch is regulated by the international financial services commission of belize (IFSC).

In the EU, the broker also offers negative balance protection to retail clients. Overall, we’re happy FBS is not a scam.

Note, traders from the USA cannot register for an account, though clients from most other countries are accepted, including canada, india and nigeria.

Additional features

The FBS website has an analysis section with resources including forex-related news, market updates, and a forex TV feature that displays informational videos, weekly insights, and trading plans. This broker also provides an economic calendar and forex calculators alongside extensive educational materials such as live webinars and tutorials.

Copy trading

The copytrade solution from FBS lets beginners replicate the success of top traders with secure, flexible trading tools. Clients can use the user-friendly mobile app to compare traders, allocate funds and create a unique trading portfolio.

Trading accounts

New clients have the option of several live account types. In the EU, the broker offers the standard and cent accounts. The global branch additionally offers the micro, zero spread, and ECN account. Order volumes are the same across account types. The ECN account has no trading limits and market execution is by ECN, unlike the other accounts which use STP. In general, the more you can deposit the higher the account tier and the more competitive the trading requirements.

When opening an account, you’ll need to submit documents to verify your name, address and the country you’re registering from.

Pros and cons

Benefits

Advantages of trading with FBS include:

- MT4 and MT5 integration

- Ultra-low minimum deposits

- Competitive zero-pip spreads

- Range of promotions & deposit bonuses

Drawbacks

Bad areas flagged in our review include:

- Fewer account and trading options in the EU

- Commissions payable on many trade types at the global firm

Trading hours

The FBS broker website is available at all times. Opening hours for each asset depends on the market and timezone, but forex runs 24 hours a day on weekdays. The broker also provides a virtual private server (VPS) service, which allows the client to keep their trading platform on a virtual machine 24/7.

Customer support

Customer support is available in english, spanish, portuguese, french, german and italian:

- Email – info@fbs.Eu

- Live chat – logo in bottom right

- Contact number – +357 25313540

- Address – vasileos georgiou A 89, office 101, potamos germasogeias 4048, limassol, cyprus

Global

Contact options including live chat, callback, and whatsapp are available on the global website.

Trader safety

FBS ensure client personal information and privacy is safeguarded. Transactional information is also protected using transport layer security (TLS). The metatrader platforms also offer dual-factor authentication at the login stage for added security.

FBS verdict

FBS is an international forex broker that offers low minimum deposits and a variety of trading accounts with MT4 and MT5 integration, alongside the FBS trader app. Spreads are competitive, and both novice and advanced traders will feel at home with this broker.

Accepted countries

FBS accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use FBS from united states, japan, canada, myanmar, brazil, israel, iran.

Where is FBS regulated?

This broker is regulated in the EU by the cyprus securities and exchange commission (cysec) and elsewhere by the international financial services commission of belize (IFSC).

Is FBS a good broker?

FBS is a legitimate broker and not a scam. It is licensed by respected financial authorities and has positive online reviews.

Does FBS offer any bonuses?

The global branch of FBS offers 100% deposit bonuses and promotions where no deposit is required. This broker also offers trader contests and a VPS service.

What is the minimum deposit at FBS?

Clients can open an account with $1 at the global branch and $10 in the EU. The greater the initial deposit, the tighter the spreads and more advanced the trading tools.

What platforms does FBS offer?

FBS has both MT4 and MT5 platforms, which are available on any browser and as mobile apps. This broker also offers FBS trader, an in-house mobile application.

Does the FBS broker have trading on nas100?

Yes, clients can trade on the NASDAQ and three other major indices, including the S&P 500, dax30, and dow jones.

FBS REVIEW - IS FBS A GOOD FOREX BROKER?

BRKV - FBS is rising as one of the best forex brokers for the asian regions in 2019, especially in thailand and indonesia. So, today I will give an FBS review for new traders who are still struggling to find themselves a suitable forex broker. FBS was founded in 2009. They allow traders to trade up to 35 currency pairs, 4 precious metals, 2 CFD, and cryptocurrencies.

When finding the best brokers, we need to have standards to rate them. These standards are the fundamentals that any brokers who want to become the best should meet. Those are:

| Trustworthy | trading costs | trading conditions | local services |

| regulations | low spread | good quotes | payment system |

| historical activities | low commission | trading platforms | local offices |

| low slippages | availability | ||

| good rebate / bonus | |||

| low swap |

Now, let’s have an FBS review based on the standards mentioned above. Also, I will compare some aspects of this broker to the top brokers such as exness or XM.

Credibility of FBS review

When it comes to credibility, of course I’m talking about regulations. The first and foremost factor used to judge a broker is their regulations. Regulations are the licenses that trusted financial organizations give to a broker to manage that broker. Regulation is the thing that makes sure a broker has to follow a certain set of rules to guarantee traders’ safety. Only big forex brokers can meet the demands of those regulations. FBS is regulated by cysec and IFSC , two of the most trusted regulations. So you can rest assured that you are in safe hands.

Speaking of regulations, there is one thing I think I need forex traders to understand. Some new traders tend to think that the broker who has more regulations is better than those who have less. This is actually a wrong idea. Having many regulations doesn’t mean that broker is better in term of trading. There are two scenarios here. If your country already has a regulation, you should work with broker who has that regulation. You won’t need any other regulations from elsewhere. Your own country’s regulation is enough. FBS has IFSC, a south african regulation, so traders in south africa can be safe when trading with FBS. On the other hand, if your country does not have a regulation, like most asian countries, you should trade with brokers who have at least one trusted regulation, FBS in this case is cysec. Too many regulations will only put more limits on the broker. Regulation is just a signal that lets us know that this broker is decent, reliable, and safe to trade with. A broker only need one trusted regulation.

Trading costs of FBS review

Spread of FBS review

Most traders would love to do business with a low-spread broker. Spread is the difference between the ask price and the bid price of a currency pair. The spread of FBS is only from 0.2 to 1.1 pip which is in the top low spread brokers . And it's spreads are much lower than XM, FXTM, FXCM. CHECK FBS SPREAD -> HERE.

Commission of FBS review

Some brokers charge commissions for income, so does FBS. Based on the type of account, FBS has different commission rates. For the cent and standard accounts, there is no commission. CHECK FBS COMMISSION RATE -> HERE.

Bonuses of FBS review

FBS offers many types of bonuses like deposit bonus, welcome bonus, or loyalty program. They have a bonus with the highest rate ever, up to $100. Their deposit bonus gives back trader 100% of the deposit amount. Also, there is the cashback program, which rebate you $7 for every lot traded. Right now, they are having the $50 bonus. You just need to sign up and $50 will be transferred to your account immediately. CHECK FBS BONUSES -> HERE.

Trading conditions of FBS review

Account types of FBS review

BRKV - FBS offers traders 4 different types of account, which are the regular accounts (cent account, standard account, and fixed spread account) and the ECN account. Each account type has its own features that are suitable for different types of traders.

Cent account: this is the account for beginners or new traders. Why so? The required deposit is only $1. When you first start trading, you don’t want to put too much money in it because 90% of new brokers lose everything when they begin trading. With only $10, I think you can practice trading in real-life conditions for up to 3 months. The spread is relatively low, only around 1 pip. The order volume is from down to 0.01 lot cent up to 1000 lots. The lower the better because that way you won’t lose too much money. And even better, this type of account does not charge any commission, so you can trade as much as you want without costing a penny.

CHECK FBS CENT ACCOUNT NOW.

Standard account: traders with a bit more experience will trade with this account. The minimum deposit is average, at about $100. The spread is better, only around 0.5 pip. The leverage is up to 1:3000, which is pretty high. Higher leverage is better. XM’s standard account leverage is only 1:888. The order volume is from 0.01 to 500 lots. And just like cent account, this account is commission free, which is amazing.

Fixed spread account: it is also called zero spread account. You can tell it by the name. This type of account has no spread. Instead, it charges traders $20 for commission. This is understandable because spread is main income of brokers. If the spread is zero, the broker must charge commission. The minimum deposit for this acco unt is $500. The other features are the same as standard account like the leverage and the order volume.

ECN account: this is the account for experts and long-term traders. The minimum deposit required is $1000, which is pretty high, but the commission are much lower than other brokers ($6). Actually, this commission rate is just as low as that of exness and XM, which is $5 and $6 respectively.

CHECK FBS ECN ACCOUNT NOW.

Payment system of FBS review

I’m sure that some US or UK brokers are very good in their country, but overseas, they are relatively bad, especially in asian countries like thailand or indonesia. In asia, if traders deposit by their credit cards, their banks will charge them from 1.7 to 4% of their total fund. Having a profit rate at 5% monthly is hard enough and now they have to pay 4% just for depositing? I don’t think so. That’s why it is not wise for thai traders to trade with those US and UK brokers. Therefore, choosing brokers who can offer local payment systems is very important. FBS is great in this field. They offer depositing and withdrawing through almost all local banks and e-wallets in asian countries. Furthermore, what makes FBS really wonderful is their transferring speed. They only come second to exness , the fastest in the market. Transactions at FBS only take from half to an hour to complete through banks, while other brokers can waste you hours or even days.

Customer support of FBS review

Customer care is vital in this forex field, because forex is a very complicated subject. Traders are constantly need as much help and support from brokers as possible. That’s why how a broker assist its clients is a standard to evaluate it. FBS supporting team is fantastic in my opinion. They can support clients in english 24/7 on live chat. You can even tell them to call you back. That can show how dedicated they are to customers. For non-english speakers, they have offices in indonesia, malaysia, egypt, thailand, china, korea and myanmar that are always ready to help customers 5 days a week.

FBS review

Editors summary

With accounts to serve even the lowest volume traders and plenty of tools to help you become established as a good trader, there is a lot to love about this broker. The licensing and regulation in the EU, and internationally make them a reliable choice for traders. There is a bonus for non-EU traders to welcome you and get you off to a great start as well as excellent customer support and an intuitive and easy to navigate website. If you want to find an excellent all-around broker that can help you become a better trader, then this is a solid choice.

Risk warning: the products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad disclosure: some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

Introduction

FBS markets has been established and offering forex services now for a decade having launched in 2009. Based in belize and cyprus and regulated by the cyprus security and exchange commission (cysec) and the international financial services commission (IFSC), they offer their services to 1.3 million customers in 120 countries.

Like many forex brokers, they offer trading on the popular metatrader4 and metatrader5 platforms on a secure website and offer a choice of 37 currency pairs in which to trade. Whether you are an absolute beginner or more experienced in forex, this platform is suitable for all strategies. There are several accounts and many educational features.

Like all things, when it comes to choosing the best product or service for you, there are many things to consider. The fact that there is so much choice only makes it a more difficult decision. Which broker is the right one for you? How do you decide which of them will provide the right conditions? We endeavour to help your choice with our detailed review:

Account types

FBS markets provide a great deal of choice when it comes to account types. Not only do they have a demo account, but they also have a demo cent account. In addition to this, there are several live accounts with deposit requirements ranging from $1 to $1,000. The number of accounts depends on where you are trading. While there are six open to non-EU residents, if you are within the EU, the number is two. The two available to EU traders are the standard and cent account with different deposit requirements.

Demo account

There are two types of practice account – the standard demo and demo cent. The difference is that you can be more cautious and trade smaller lots with the demo cent version. Both are free to use and allow you to test the platform with virtual funds until you are ready to go live.

Cent account

With a deposit of just $1, you can open a cent account. With floating spreads from 1 pip and leverage of up to 1:1000, there is no commission charged, ideal for beginners who wish to practise on a live account as a next step up from a demo.

Micro account

Deposit $5 and enjoy fixed spreads from 3 pips with no commission and leverage of up to 1:3000. The micro account is better suited to those of you that like to calculate the exact profits.

Standard account

The standard account is open to all non-EU and EU traders, and you will require a deposit of $100. Floating spreads from 0.5 pips and leverage of up to 1:3000 make this account a popular choice across the board.

Zero spread account

Fixed spreads of 0 pips and leverage of up to 1:3000 can be enjoyed by those of you that deposit a minimum amount of $500. The zero spread account attracts commission of $20 per lot.

ECN account

ECN traders that wish to use the power of ECN technology can open this particular account with a minimum deposit of $1,000 and benefit from floating spreads from 1 pip and commission of $6 per lot.

FBS review: is FBS A scam? No, but it’s not worth it!

If you’re interested in the stock market and foreign exchange as a way to make money online then you’ve probably come across FBS and maybe you’re interested in trying the platform out or still on the fence because you’re unsure if it’s legit or just another scam.

So I did a lot of research and this review is about what I found out about FBS. I suggest you read on to know more about what you’re about to get yourself into. After this review, you’ll be able to make a better judgment about whether to try FBS out or not.

By the end of this review you’ll know:

- A background on FBS

- How it works

- What tools FBS offer

- The pros and cons

- If it’s A scam

- And lots more

FBS review in A nutshell

Product description: international brokerage company

FBS is a forex company that operates in more than 190 countries. It claims to have 410,000 partners and 15,000,000 traders. FBS offers seminars and events that provide training materials and trading technologies. They claim to cater to both beginner and professional traders.

Overall, I’d say FBS is legit but there are a few some red flags you should know about.

Overall

- Lots of tools

- Cheap capital

- No info on who runs it

- Doesn't operate in large markets because of legal restrictions

User review

Wanna make money online but sick of scams?

Here's my top recommended training >>

What is FBS exactly?

FBS prides itself to be an award-winning international forex broker since 2009. FBS started in belize and later on expanded to cyprus then to other parts of the world.

Want more idea about what forex is? Here's a helpful explainer video:

Most of the international awards they received are about recognizing them as a transparent broker with some of the best levels of customer service.

One thing I can tell you is that award committees do not easily give out recognition without doing a lot of research. I must say, FBS passed the legitimacy test with flying colours here.

FBS is also regulated by european financial authorities making them a legitimate forex trading company. (I’ll give you more details about these licenses later on)

Although the claim to be partnering with FC barcelona adds to their credibility, the lack of information on who runs it doesn’t sit well with me. I mean come on, if I join a company, I’d like to know who’s behind it to make sure he’s not just another scammer and that what I’ve read are not just hyped-up claims that will fail to materialise.

Sick and tired of hyped-up claims?

Discover a scam-free way to make money online instead >>

How does FBS work?

First, you make an account by clicking “open live account”. After entering your information, click the “open an account” button. A single mission password will then be emailed to you to verify.

Although FBS offers a total of 6 account types internationally, EU clients are only offered the standard account.

This tells me that the other account offers don’t go in line with EU financial regulations. So to avoid losing their license, they just offered that one account.

Here’s a list of the account types FBS offers:

- Cent account – this is designed for tyro traders (beginners) who’d like to try their skills with live trading. This starts with a $1 opening balance.

- Micro account – this is designed for traders who want to calculate their exact profit. This starts with a $5 opening balance.

- Standard account – this is designed to be the regular account. This starts with a $100 opening balance, for EU clients thought the opening balance is €100.

- Zero spread account – this is designed for fast speed traders.

- ECN account – this is for traders who want to experience ECN technology.

To test the waters, FBS also offers a:

- Demo account – this is designed to allow a trader to simulate the actual trading platforms minus the risks for free. This kind of account is filled with virtual funds of up to one million dollars.

In my opinion, they offer these various trading accounts to cater to the needs of different kinds of traders, so there’s an account for everyone and fewer reasons not to try it out.

FBS is an international company BUT is not available to traders in japan, USA, canada, UK, myanmar, brazil, malaysia, israel, and iran. That’s a major red flag to me there. These countries have great market potential but FBS is not available for them.

Here’s what I think the reason is:

Japan, USA, canada, UK, myanmar, brazil, malaysia, israel, and iran have tighter financial regulations and may have already seen this might create issues. The trouble could be in the system itself or in obtaining the necessary licenses.

Whatever the case, I think they are evading these countries for legal restrictions. And I know restrictions are made to prevent fraud.

FBS trading platforms

FBS uses MT4 and MT5, products of metaquotes software corporation, a company that specializes in developing trading systems.

MT4 was developed in 2004 and MT5, its updated version was developed in 2010. The 2 platforms basically look alike. The only difference is that because MT5 is more recent than MT4, so it offers more features.

Both these platforms can be accessed using windows and MAC computers.

How about for other gadgets?

This is also available as an app. That's a big thumbs up for FBS.

They also have an FBS copytrade platform; a social platform that allows traders to copy expert traders’ strategy for a commission. This will be really helpful for those who don’t know all the ins and outs of forex trading.

Other FBS tools

1. Personal area mobile app

It allows a trader to access his demo and real accounts, managing them all in one place. From this app, you can manage your personal profile and add or withdraw funds from those accounts.

Makes things more convenient, great to know!

2. Economic calendar

You can find this at the MT5 platform or on the FBS markets website. It shows the time and date of events that impact the forex market. You can then use this to make analyses and calculated forecasts.

3. Currency converter

This can help a trader who has a different currency from the trading instrument. You can then use this tool to convert currencies based on prevailing rates.

4. Trader’s calculator

This can help you estimate potential profits in a specific trade.

5. Forex news

The news is grouped into categories to help you check when the best time to trade is.

6. Forex TV

Allows you to access weekly marketing insights giving you a better picture of the trading status.

What I like about FBS

- Lots of tools to help make a good trade

- Low capital required to open an account

What I don’t like about FBS

- No info on who runs it

- It doesn't operate in large markets because of legal restrictions

Wanna make money anywhere in the world?

Get started with your FREE step-by-step beginners course here >>

Is FBS A scam?

Although I’ve mentioned a few red flags, I’d still say FBS is legit and here’s why:

- FBS market inc. Has the registration number: 119717

- IFSC regulates it and gives it the authority to operate with the registration number: IFSC/60/230/TS/19

- FBS.Eu is the european branch of the company. Trade stone ltd is its operator, an investment firm in limassol cyprus. Cysec regulates and gives it authority to operate with the registration number: 331/17

- As a regulatory directive, FBS keeps the traders’ funds in a different bank account and claims that is it now used for company operations. The good thing with this is even if a broker becomes bankrupt, trader’s investments are safe.

- EU clients are protected by the ICF. This means that if FBS collapses, investors can receive up to €20,000 as compensation.

- As protection against fraudsters, FBS implemented standard digital security which involves encrypting its website and platforms with SSL.

When a company goes the extra mile to obtain these licenses and security measures, I’d say they’re legit, because if they were not, they’d be behind bars in an instant.

Other than that, they’ve been operating for 11 years, I’d say that much history won’t be possible if they were just scams.

But here’s the thing: even if I believe that they’re legit, I’d still not recommend it to you. Legitimacy doesn’t erase the inherent risk that comes with forex.

The bottom line

Overall I’m pretty impressed with FBS's platforms and history. Plus I put them in the legit list because of the licenses they obtained.

But like what I’ve said earlier, I still won’t recommend it to you.

If I’d give you a bit of advice on how to make money online the legit way, I’d avoid anything that comes with a lot of risk like forex.

As always with these programs, there's a lot of hype around how much you can make, but they don’t say anything about how much you could lose.

The risk warning down at the bottom of the website is just another way of saying there’s no guarantee you can earn from this.

Remember, forex’s last name is risk. Forisk.

A wayyyy better opportunity to make money online is through affiliate marketing.

It’s legit minus the risk forisk comes with. (I’m getting used to that word now!)

With affiliate marketing, you can start from scratch and learn from their training platforms. Not just that, affiliate experts will offer to coach you when needed.

Affiliate marketing also equips you with the tools to build a solid and legit business.

And you can test the waters out for free. If you want to know more about affiliate marketing, check out this link.

And if you want to start building your business, discover how wealthy affiliate can help you with that.

How I make A living online?

After years of working in call centres I finally figured out how to create a 5-figure monthly passive income stream and become financially free.

Thanks to the right training and a lot of hard work I kissed my old boss goodbye and booked a one way ticket to thailand.

So if you're serious about building a thriving online business, click here for the exact step-by-step formula I follow.

Fbs ecn account review

This FBS review 2021 contains answers to some common questions that many traders ask or search on the internet about FBS charges, services and legitimacy.

About FBS review

This brokerage firm was established in the year 2009. Since that time, the firm has worked hard to expand its service and features to meet traders’ demand. However, it still needs to focus on certain areas to stand in the neck to neck competition with various other emerging but advanced brokerage firms. The firm mainly operates through two following locations:

1) cyprus: vasileos georgiou A 89, office 101, potamos germasogeias 4048, limassol, cyprus

2) belize: 2118, guava street, belize belama phase 1, belize

Yes, the thing must be bothering you though being one of the oldest financial service providers, the firm has two physical office locations. It is the broker’s major drawback. The broker serves thousands of customers from just two office locations, making it hard to reach them for major problems. It is also significant to note that the broker claims that it consistently gets partner accounts and 7,000 novice traders every day. However, there is no information on the official website of the broker to back this data.

Types of account offered by FBS and fee charged

The broker offers four different accounts to traders: cent account, micro account, standard account, zero spread account and ECN account. The minimum deposit of a cent account and the micro account is average. However, if we look into the minimum deposit of a standard account ($100), ECN account ($1000) and zero spread account ($500), it is extremely high. It is hard for traders to meet this requirement. And also it is too high concerning other advanced and renowned brokerage firms like hftrading ($250), roinvesting ($100) and 101investing ($100).

Apart from these professional accounts, the broker also offers a demo trading account for beginners and islamic account for muslim traders. The time provided for the demo trading account is limited. Again, the brokerage firm may charge an additional fee for islamic trading account if you open your trading position for more than two days.

Minimum deposit

In various reviews, the minimum deposit fee of FBS is written as $1. But, it is clear from their official website that their minimum fee is $1, and it goes as high as $1,000 depending on the types of account and country you belong.

Trading fees

Apart from the minimum deposit, you must pay some additional fees on trade, including the following.

1) overnight fee: the broker charges the fee if you hold your trading position overnight. FBS overnight fee is high and varies daily depending on the market closing.

2) inactivity fee: the broker charges an inactivity fee if you are inactive for more than 180 days. The inactivity fee is $10 per year, which is relatively high concerning other firms.

Commission and spreads

The broker’s spreads are not up to the market. The minimum spread is 3pips which is high compared to other brokerage firms such as t1markets and global tradeatf. Also, the broker charges $20 per lot as a traded common on zero spread account.

Leverage on trading

The official website of the broker says that it allows leverage of 1:3000 on trading. It might seem an attractive figure, but, the reality is that this value is too high to believe in it. And if we consider that it is real, how can we forget that leverage is a double-ended sword? It magnifies your profit, but at the same time, it magnifies losses too. Trading on such high leverage is very risky.

Tradable assets and markets

FBS brokerage does offer an extended list of seventy-eight favourable assets ranging from stocks up to cfds and forex. From the recent data, you can trade the following assets:

1) forex pairs: 28 (including minor and major pairs and nine exotic pairs)

However, if we compare these assets with other advance brokerage, firms will find that FBS’s assets are seriously quite limited. They need to add some more to expand the trading portfolio of traders. Also, stock cfds are not present for trading in the EU.

Available countries

Because of several legal constraints from particular counties, the broker cannot accept customers originating from the following regions: UK, japan, USA, canada, israel, myanmar, brazil, islamic republic of iran and malaysia. These restrictions might be partial or complete. Thus, if you live in any of these countries, you will have to look for other alternative brokerage firms.

Is FBS a scam or safe?

The FBS review is regulated by the cyprus securities and exchange commission and has a licence for the same. However, despite getting a license from cysec, a step up from belize’s IFSC, the broker has not been enrolled in any onshore jurisdiction.

Deposit and withdrawal

There are numerous methods for deposit and withdrawal with FBS review like other brokerage firms. It includes wire transfers, e-wallet, credit card and several others. The deposit is instant, but the withdrawal takes three to four business days. Also, the process of filling the withdrawal form is time-consuming and tiring. The fees for the deposit of withdrawal are as follows:

Deposit fees

Deposit is absolutely free with the broker. However, some deposit methods may charge a certain amount. It includes stic pay with a commission of $0.30 and a fee of 2.5%, globe pay with an amount of 1.5% and perfect money also charges a certain amount depending on the method of funding. Also, it may require a conversion fee if you deposit a non-base currency.

Withdrawal fees

If you are a european trader, you may not need to pay a high withdrawal amount to the broker. Other than this, traders are subjected to withdrawal charges. It depends on the payment method and conversion fee (if the base currency is not similar to your bank account’s currency). The fees and commission are listed below in detail:

- Visa: $1 commission

- Skrill: 1% + $0.32

- Stic pay: 2.5% + $0.30

- Neteller: 2% (max $30 and min $1)

- Globe pay: 1%

- Perfectmoney: 0.50%

Customer support service

The customer support service of the broker is good. The available options to contract the team are email, phone, chat option (web-based). But, all these options will work if you are well versed in english. The customer service with FBS is available only in the english language.

Pros of FBS

Cons of FBS

- The demo account for novice traders is available for a short duration.

- If you are an EU trader, the broker offers only two accounts types.

- The broker does not offer any service in the USA, japan, UK, canda, israel and several other countries.

- The number of base currencies available with the broker is also limited.

- They have limited trading tools.

- They provide limited tradable assets (less than 90 assets).

- High spreads on their cent accounts.

The bottom line

The broker is experienced working in the financial market since 2009. However, it is the right time for the firm to upgrade its trading features, services and trading assets as the market is no more the same and has changed to a greater extent in the past few years. New brokerage firm pops up every single day with excellent features that too at very low charges. Also, these firms are safe and carry regulation for central regulatory bodies. So, it is high time they should pay heed to several areas to stand in the market firmly.

Frequently asked questions

What is the minimum deposit of FBS?

The minimum deposit required to open an online trading account with the broker varies from $1 to $1000.

FBS review – is FBS scam or legit broker?

Rating

- Demo trading account

- 3-5 money pairs, including metals, cfds and crypto

- Full licensing and regulation with IFSC and CYSEC

- Metatrader 4 along with metatrader 5 to mac, windows, ios along with android

- A little bit clunky to navigate to desired sections

- Sourcing the right information is only a little difficult online

- Not easy to understand unique benefits/merits of each account type

FBS could be the name of this forex broker which trades under FBS markets incorporated. The business ‘s registration number is 119717, also it’s fully governed by the cyprus securities and exchange commission (331/17) and also IFSC (permit #IFSC/ / 60/230/TS/ / 17). This forex brokerage delivers a vast selection of currency pairs, and higher leverage on certain account (1:3,000), completely free deposit insurance policy, thorough payment systems, and also very low hazard balances for novice traders. At profits of trading money pairs together with FBS would be the next:

* there are no requotes

* high leverage of 1:3,000

* all reports have been offered to 5 digits

* all commissions are all insured by FBS

* traders love 24/7 professional assistance

* eas and expert trading approaches allowed

Overview/ desktop

FBS is actually a fully licensed and regulated forex trading brokerage. It’s controlled by FBS – a trading thing of several businesses including tradestone limited (number 353534), parallax inc (#VC0100), and also FBS markets inc (number 119717). This forex brokerage is fully licensed and governed by multiple jurisdictions including IFSC (international financial services commission) of belize. The IFSC permit #is IFSC/60/230/TS/17. FBS can also be fully licensed and governed by the cyprus securities and exchange commission (CYSEC) using permit #331/17 to supply a real income forex currency trading solutions to legal era traders around europe.

FBS provides multiple currency pairs including majors, minors and exotic pairs for people in most completely controlled authorities. Back in japan, thailand, myanmar, along with brazil that the services offered by FBS is obtained through parallax inc.. The trading tools supplied via this brokerage include contracts for difference (cfds), metals, and even forex pairs. The forex pairs incorporate multiple monies like the AUD/USD, BTC/USD, EUR/USD, EUR/AUD, EUR/CAD, EUR/CHF, AUD/CHF, CAD/CHF and heaps of other folks.

Account types

There are multiple account types in FBS, each offering different dictate reductions, marketplace executions or maximum available places along with pending orders. The 6 accounts kinds comprise the next:

- Cent account – dictate drops starting at 0.01 through 1000 penny lots and marketplace executions out of 0.3 sec STP. The utmost open places and also impending orders payable is 200.

- Micro account – arrange drops from 0.01 through 500 lots and marketplace executions of 0.3 sec STP. The utmost open places and also impending orders payable is 200.

- Standard accounts – dictate drops starting at 0.01 through 500 a lot of marketplace executions starting at 0.3 sec, STP. The utmost open places and also impending orders payable is 200.

- Zero spread accounts – dictate drops starting at 0.01 through 500 lots with marketplace executions out of 0.3 sec, STP. The utmost open places and also impending orders permissible is 200

- Unlimited accounts – together with order amounts from 0.1 to 500 tons with short-term marketplace executions without trading limits.

- ECN accounts – dictate drops starting 0.1 through 500 lots with ECN marketplace executions without trading limits.

With respect into account types, a few 3-5 money pairs have been encouraged including 4 cryptocurrencies, two cfds, along with 4 alloys. The single real exception for that is your ECN accounts type.

Trading platform/ applications

The FBS trading platform comprises metatrader 4 and also metatrader 5. All these are ideally suitable for forex traders using windows or mac. In addition, the metatrader software is fully appropriate for ios along with android apparatus so you are able to trade out of any smartphone tablet computer or phablet. The trading platform can readily be downloaded via the programs, also there are numerous features inherent from the metatrader programs.

For instance, metatrader 4 supplies a few 4 1 tools for example futures, cfds and money pairs. Additionally, there are reduced spreads, both eas and 1-click functionality. The computer software also lets users make use of a similar username/password combo. Metatrader 5 features comprise calculating functionality, micro-lot reports, VPS service support, as well as hedging. Forex traders need to download applications such as windows, ios, android, webtrader, multi-terminal, or even mac systems.

Deposit options

Deposit options comprise a multitude of neighborhood payment methods like visa, mastercard, skrill, bitcoin from skrill, perfect money, astropay, cable transfer, along with NETELLER. All residue options are ensured secure, as a result of stable socket layer technology and also the maximum encryption protocols. Once you’re all set to earn a deposit, then only log in your accounts and browse into the cashier. It’s possible to get a deposit on your forex, and also the deposit amount will be converted into USD/EUR dependent on the established exchange rate. To produce a deposit, then browse into a private area during the financial surgeries category. Deposits which is created via EPS are immediately processed, though other payment processing approaches usually take as many as two hours during business hours. The most period for you to process a deposit via electronic payment systems would be 48 hours from the moment of its own production. Wire transfers may take around seven business days to process.

Markets

The marketplaces have been divided into three broad classes including forex, metals, along with CFD trading. There are additional marketplaces including cryptocurrency trading including as for example ethereum, dash, bitcoin etc.. There are a few 3-5 money pairs, 4 cryptocurrencies, two cfds4 and 4 alloys which traders may enjoy.

Currency pairs comprise: AUD/CAD, AUD/CHF, USD/JPY, USD/EUR, GBP/USD and many others. In general, you can find numerous dozen forex pairs including majors, minors and exotic money pairs.

Metals trading: metals consist of palladium, platinum, XAG/USD along with also others. All these are traded with nominal spreads along with many different elements are comprised like prevent amount, swap short, swap, and also the common spread.

CFD trading: this consists of BRN, DAX 30, WTI yet also others.

Bonuses

There are dozens of bonuses and promotional supplies now offered by FBS. These incorporate a $50 incentive to trade forex without a deposit needed. Traders will possess leverage 1:500 to enhance their trading actions. To make up for this incentive, the complete registration is required. There are additional promotional supplies out there. These contain the subsequent:

- A 100% deposit bonus

- Promotional substances made to improve your trading achievement

Other supplies incorporate the bonus $1 2 3 that offers ‘7-day bonus trading’ with infinite benefit potential and boundless accessibility. No confirmation or contact details will be necessary with this incentive. There are cashback supplies offered to forex traders, also FBS is your only real provider of cash-back services. The bonus level is left up to 15 USD a lot traded and there’s an infinite incentive trading span, boundless benefit potential, no expiry with this particular promotional offer. There are quite a few different bonuses available, and so they may be discovered under the promotions tab, recorded from the promotions & bonuses category.

Customer support

Customer service is accomplished by calling the FBS service representatives thanks to live-chat functionality. Simply make use of the zendesk live chat service option to consult your questions and they’ll respond for you in real-time, even during working hours. Other service options incorporate interpersonal networking on youtube, twitter, along with facebook. You will find also contact us options on the footer of every web page, for example wechat, messenger, along with telegram. These interactive communication stations ensure rapid response times from courteous and professional customer care agents. Other contact options readily available to traders consist of local offices, live chat, and call back functionality. FBS agents are available across the world, such as egypt, china, korea, thailand, malaysia, turkey, thailand, indonesia etc..

Safety

Safety is ensured in any way times, as a result of stable socket layer technology, encryption, accounts verification, and so on. All of deposit/withdrawal options are fully guaranteed secure and safe, a lot of like online banking trades.

Ease of use

FBS broker is relatively user friendly, however, you’ll need to understand the intricacies of working with the stage. By clicking onto the major three flat lines onto the side of your monitor, you’re going to have the ability to get into general advice, financials, trading tools, trading platforms and trading requirements, enterprise data, promotional supplies, analytics & education, along with company specifics. The supply of demo trading accounts and real currency trading account provides traders with the essential tools and tools to be successful in online forex trading.

Final thoughts

FBS broker is a major european online forex broker with heaps of money pairs, cryptocurrency, metals, cfds along with additional options out there. Security and safety is on top of the schedule, and customers will see all the vital checks and balances set up. If you ever require support and service, then you may readily reach them via societal networking, email, livechat (zendesk) along with also other options. They’re exceptionally tuned in to forex trader inquiries, and also do their utmost to supply prompt and expert support.

FBS review

Finance brokerage services

FBS are forex brokers. FBS offers the metatrader 4, metatrader 5, and MT mobile forex online trading top platforms. FBS.Com offers over 30 forex pairs, stocks, gold, silver, other metals, and cfds for your personal investment and trading options.

Related websites of this company include F-B-S.Com, hotoption.Com and https://fbs.Ae/.

February 2011: the website appears to be blocked in the USA.

Other websites of this company include fibexch.Com, fbs.Ae, fbs.Id, fbsforex.Com, fbs.Cn, jpfbs.Com, esfbs.Com, ptfbs.Com, fbs.Ae, vnfbs.Com etc.

Broker details

Video

Your company video here? Contact ad sales

Live discussion

Join live discussion of FBS.Com on our forum

FBS.Com profile provided by regina FBS, sep 5, 2019

FBS is an international broker with more than 190 countries of presence. 13 000 000 traders and 370 000 partners have already chosen FBS as their preferred forex company. We work since 2009 and provide fast and honest services.

Working with us is easy, convenient and, most of all, profitable. We are happy to offer exclusive terms unprecedented in the forex market.

To provide the best customer experience we organize seminars and special events, providing our clients with training materials, cutting-edge trading technologies and the latest strategies on the forex market. Both newbie and professional traders will find these sessions useful.

If you prefer to choose the best for yourself, FBS is just right for you. We even launched a COPYTRADE app which allows you to earn money both by copying a successful trader and by having people invest in your trading.

Once a client of FBS – always a client of FBS.

Www.Fbs.Com

Unique trading conditions for traders:

• minimal deposit of $1

• spread starting from -1 pip

• leverage up to 1:3000

• 35 currency pairs, 4 metals, 3 CFD

• split-second execution

• no requotes

• minimal order volume of 0.01 lot

• quotes precision of 0.00001

• trade with any advisors or strategies

• customer support in 15 languages

• deposits and withdrawals via visa/mastercard, wire transfer, neteller, skrill, perfect money, fasapay; local indonesian banks: bank central asia, mandiri, bank negara indonesia, bank rakyat indonesia, OCBC NISP; thai banks: krungthai bank, krungsri bank, siam commercial bank, kasikorn bank, bangkok bank; vietnamese bank: vietcombank. Lots of exchangers in different countries

Permanent promotions:

• $100 bonus - work out for more

• 100% bonus on each deposit

• cashback up to $7 per 1 lot

Loyalty program:

• VPS service

• guaranteed lucky T-shirt for a deposit of $500 or more

• guaranteed iphone X gift for a deposit of $5000 and 500 traded lots

• mercedes S-class for platinum status

• VIP membership

Partner program:

• $10 commission on EUR/USD

• monthly partner bonus up to $3000

• 3 levels of payments (15% from 2nd level partners and 5% from 3rd level partners)

Awards:

• best FX broker vietnam 2019

• most progressive broker europe 2019

• best FX broker europe 2019

• most promising broker 2018

• best forex broker asia 2018

• best investor education 2017

• best FX IB program

FBS review

Review

FBS is a cypriot forex broker owned and operated by tradestone LTD headquartered in limassol, cyprus. The brokerage was founded in 2009 and is regulated by the cyprus securities and exchange commission (cysec), license number 331/17. Since its inception, FBS has received over 40 international recognitions and awards and is home to over 13,000,000 clients. According to the broker, 7,000 new accounts are opened every day and FBS receives and processes one withdrawal request every 20 seconds. 80% of FBS clients remain loyal to the broker and 48% list trading revenues generated at FBS as their prime source of income. As a truly global forex broker, FBS serves clients in 190 countries and expands its market share on a daily basis. The 24/7 customer service team usually responds to requests in less than 30 seconds and speaks multiple languages. Negative balance protection offers another layer of security and protects traders against critical market developments and volatile price swings.

Regulation and security

Tradestone LTD is an investment firm registered in cyprus (company registration number 353534) and is regulated by the cyprus securities and exchange commission (cysec license number 331/17). Cyprus is part of the european union and offers a great mix of regulation and freedom to operate as a global financial firm. Prior to acquiring the cysec license, the firm was offering its services from its belize registered subsidiary and was well known for its aggressive market expansion. Since the acquisition of the license, traders can rest assured that their funds are safe and that the regulator ensures that FBS will comply with the directives of the legislative and regulatory framework.

Since cyprus is a member of the EU, FBS is under the regulatory framework as set out in the markets in financial instruments directive (2004/39/EC) or mifiid. It has been in effect since november of 2007 and aims to create and maintain a high degree of harmonized protection for investors in financial instruments. Mifid II came into effect in january of 2018 and was designed to further strengthen investor protection and increase transparency.

In june of 2015 the EU released its 4 th anti-money laundering directive which represents the most stringent AML legislation across europe. All EU member states have been complicit since june of 2017 and FBS adheres to the rules as outlined in the directive. In addition, FBS is a member of the investor compensation fund (ICF) which ensures eligible retail clients will get reimbursed if their broker fails to comply due to financial difficulties as outlined in the fund.

FBS generates its revenue primarily from spreads which is the difference between bid and ask prices as well as swap rates charged on holding positions overnight. FBS doesn’t offer ECN accounts and therefore is not charging trading commissions. Spreads start as low as 1.0 pip and increase depending on the liquidity of the currency pair. The broker offers “swap free islamic accounts” accounts in order to offer their services to muslim traders who are prohibited by their faith to accept or be charged interest.

Forex traders may activate this type of account while other traders can check the exact swap rates from inside their MT4 platform by following these steps:

1. Right-click on the desires symbol in the “market watch” window and select “symbols”.

2. Select the desired currency and then click on “properties” located on the right side.

3. Scroll down until you see “swap long” and “swap short”

In addition, forex traders can use the FBS trading calculator to get full information on a trade before entering it.

According to FBS, it doesn’t charge traders for deposits or withdrawals which represents an added service to forex traders and reduces the overall cost per trade. This will have a big impact for frequent retail traders as well as professional outlets where costs play an important role.

What can I trade

FBS offers a rather limited selection of assets with only 28 currency pairs and two metals. The contract specification differs for their standard account and their cent account. The overall selection should be viewed as bare minimum and is not adequate for professional clients.

Contract specifications forex standard account

Contract specifications metal standard account

Contract specifications forex cent account

Contract specifications metal standard account

The lack of more currency pairs as well as metals is unfortunate, FBS also lacks CFD’s on equity and indexes as well as cryptocurrencies. While it provides the basics for a forex trading account, true diversification cannot be achieved which makes it unsuitable for traders who seek cross-asset trading opportunities.

Account types

FBS extends its limitations to trading accounts where it offers two types, a standard account and a cent account. The main difference between both is the minimum deposit which starts at $/€10 for cent accounts and at $/€100. The minimum spread in both is a floating one which starts at 1.0 pip and the maximum leverage is 1:30. The cent account also comes with a maximum order volume of 5 standard lots (1 standard lot is equal to 100,000 units) where the standard account sees this limit increased to 500 standard lots. The maximum amount of open/pending positions is set at 200 with a starting execution speed of 0.3 seconds.

The cent account is basically an entry level account for new forex traders to get started with micro deposits and best suitable to create and test new strategies, but fairly irrelevant as the standard account has a very small minimum deposit requirement. FBS doesn’t offer special trading conditions to traders with higher balances or more frequent trading activity, a feature which is another unfortunate miss for this forex broker.

Trading platforms

FBS extends its limitation to just the MT4 trading platform for windows, apple macos, android, apple ios and FBS webtrader. While MT4 remains the most used trading platform for forex traders, FBS makes no effort to offer traders something which is not included with the standard operating license for the MT4 trading platform. Many forex brokers don’t even pay for the full license and can obtain their trading platform under a white label partnership through another forex broker at a fraction of the cost.

Popular choices, especially for new traders, such as social trading or copy trading remain absent as FBS once again sticks to its minimalistic approach and offer the bare minimum in order to operate as a forex broker. Features listed are part of the MT4 trading platform and should not be credited to what FBS offers.

Unique features

During the course of this FBS review we found that there were few unique features available to the brokerage’s traders. FBS does very little outside normal operating procedures, but it does those things rather well as evident by the awards the brokerage received.

Research and education

It is nice to note that FBS does offer a range of research, analytics and educational aspects which are beneficial to new traders. The market analytics section is broken down into three parts: forex news, daily market analysis and forex TV. The educational section comes divided into five categories: forex guidebook, tips for traders, webinars, video lessons and glossary.

Forex news

Traders get access to forex news and have the option to filter the articles by commodities, currencies, stocks and economy. Since FBS doesn’t offer CFD trading, the stocks sections appear out of place and more for marketing purposes and SEO than for the benefit of its trader base.

Daily market analysis

The FBS daily market analysis is broken down into technical analysis and fundamental analysis and may offer the best feature this broker offers. Forex traders can easily navigate the research, but the extent of each analysis is rather limited and refined to a few basic aspects of technical analysis summed up in one paragraph. The fundamental analysis is a bit more detailed and offer forex traders basic coverage of key topics.

The forex TV section is broken down into weekly insights, daily trading plans and webinars and FBS has spent the most attention on this part. It is a great feature and offers forex traders the best service. The weekly insights section may be the most relevant which walks traders through important events as marked in the economic calendar. New traders may find the daily trading plans to be useful, especially if they don’t have their own trading strategy developed yet. It would be nice to see FBS expand their current approach and make better use of technology in order to allow traders to act on what they view.

Forex guidebook

The forex guidebook is filled with educational content and covers the entire spectrum of technical as well as fundamental analysis. New traders will find this course very useful and it is broken down into four sections: beginner, elementary, intermediate and experienced. This may be the most beneficial feature to new traders which is offered by FBS and the perfect starting point for those who are serious about learning how to trade. It is easy to navigate and filled with examples which makes it easy to understand.

Tips for traders