Forex without broker, forex without broker.

Forex without broker

The only skills you require is to understand the whole concept of copy trading, that is mostly, how to choose a good trader to follow.

Top forex bonus promo

You should, however, keep in mind that forex trading, in general, is risky and high returns are not guaranteed. Although copy trading gives you an opportunity to make profits without investing in research and having to understand the ins and outs of forex, the risk is still there and a lot of caution is required. The following tips will help you land the perfect trading pro:

Fxdailyreport.Com

For beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. The problem is, it takes a lot of time to master all the crucial skills that are required to qualify as a professional. Often times, many novice traders give up without making a dime.

But do you really have to trade to make money on forex? What if there was a way to invest profitably without actually having to trade? The good news is, there is a way. It is called forex copy trading.

What is copy trading ?

As the name suggests, copy trading is a form of forex trading where you copy or replicate the trading patterns of other traders. This is a trend that emerged in the early 2000’s and has over the years proved to be a real savior for inexperienced traders. With copy trading, also known as mirror trading or sometimes social trading, you can make profits as a forex trader even with minimum skills.

The only skills you require is to understand the whole concept of copy trading, that is mostly, how to choose a good trader to follow. You should, however, keep in mind that forex trading, in general, is risky and high returns are not guaranteed. Although copy trading gives you an opportunity to make profits without investing in research and having to understand the ins and outs of forex, the risk is still there and a lot of caution is required.

In most cases, forex copy trading can backfire because of a poor choice of traders to follow. That is why it is important that you carefully analyze your potential “masters” using the stats provided by the copy trading platform of your interest to make good money.

Below are a few tips on how to find a good trader to follow.

How to find A good trader to follow

The following tips will help you land the perfect trading pro:

- Discover the most followed traders

The number of followers often point to the credibility and prowess of that particular trader. If a potential professional is followed or copied by many traders, it usually means that they have consistently recorded outstanding performance.

- Analyze their followers/copiers

Sometimes followers can be fabricated. That is why you should critically analyze the followers to ensure that they are real humans. Another reason for this is to ensure that the follower base is consistently growing. If the number of traders copying your potential professional grows and suddenly drops, it may mean a drop in good performance. However, if the followers are ever increasing, you should add that investor to your list.

- Should have consistent monthly performance

Your search for the perfect trader should not end with the most followed. Sometimes, they might have a lot of traders copying them, but the balance between profits and losses is not promising. That is why it pays to dig deeper and unearth trading gurus who have posted good and consistent monthly performance.

- Number of trades and time on a platform

Traders who have been on the platform for a long are most preferred. They are usually more experienced and know their way around trading. The number of trades conducted is also another indicator. The person you wish to follow should have done a good number of trades with consistent profits.

You might not find the perfect trader to follow, but as you gain more useful skills, you will be able to make more constructive analysis and choose wisely. The type of copy trading platform you choose also matters. A lot of seasoned traders use credible forex brokers and you will hardly see them on new platforms or those with a bad reputation.

Benefits of forex copy trading

Copy trading presents a lot of good opportunities for both those who copy others and those who are copied.

- You gain invaluable trading skills from professionals you follow

- There is a lot of transparency as the trading history of the trader is publicly disclosed to followers

- You can make passive income without actively trading

- You don’t have to understand all the aspects of forex trading

With forex copy trading, you can make good money without having to actively trade. The point is to choose the right trader to follow by carefully analyzing their profiles and utilizing the stats provided by the various platforms.

Download MT4 and open metatrader 4 demo account without a broker

Want to get free forex demo account fast without registering with any forex broker? Follow this MT4 tutorial and rimantas will teach you how to download MT4 and open MT4 demo account without a broker in a few minutes. In this video guide, you’ll learn exactly how to do that.

Rimantas makes it simple for you to download MT4, install MT4 on PC and open forex demo account without a broker.

Why would you want to have metatrader 4 demo account without a broker?

There are two mains reasons for that:

- There are many forex brokers with a bad reputation and people usually do not start trading at all because they don’t know which broker to choose. When you can get a demo trading account without a broker you don’t have to stop yourself from learning how to trade forex. Now you can start demo trading without a broker. You can always pick one later when you feel you are ready to begin live trading.

- You do not need to register with any forex broker and get your email inbox filled with spam messages and getting promotional phone calls every day from the broker ��

Here’s what rimantas teaches in this MT4 tutorial:

- How to download MT4 platform from fxopen. We download from fxopen because they give direct MT4 download link without website registration required.

- How to open metatrader 4 demo account without a broker (even when we download metatrader 4 from fxopen).

- Why didn’t I download the MT4 installation file from the official metatrader 4 website?

- How to open a demo trading account with fxopen broker (in case you’ll need it later). We are not affiliates for fxopen or recommend them. We use them only as an example because they give a direct MT4 download link.

Author profile

EA coder

EA coder is a nickname of one of the most well-known programmers among forex traders - rimantas petrauskas. Having more than 20 years of programming experience, he created two of the most popular trade copiers for the metatrader 4 platform — the signal magician and local trade copier.

A #4 amazon best-selling author in forex category, rimantas's book is called "how to start your own forex signals service".

Forex trading with or without a broker

There is a myth making the rounds in the forex universe. This rumor that’s whispered and spread from keyboard to keyboard over cyberspace states that in order to take part in forex trading, you must have a broker.

A rumor is all this is because there’s no truth in the must part of the rumor. You can do your forex trading with a broker if you choose to do so, but it certainly isn’t a must. Many traders act without a broker and conduct their trading business successfully.

Even if you don’t have the first clue about how forex trading is done, and you’ve never done it, you still don’t have to have a broker if you don’t want one. Can you gain from having a forex broker in your corner?

Yes and no. It depends on whether or not your forex broker is smart about trading and whether or not he’s going to be smart about trading for you. Some forex brokers look at those who want to partake of trading currencies as another zero on their own paycheck and they will actually work against you in a practice known as sniping.

Sniping is a practice committed by some forex brokers who in effect cheat you out of profits. Yes, it’s dishonest and no, you have no recourse whatsoever to protect yourself from sniping done by a forex broker bent on taking advantage of you.

There are decent forex brokers who do help those are involved with forex trading or want to get involved with forex trading. These are professionals in the trading world who value both their customers and their own reputations.

They would no more think of cheating you than they would themselves. Most forex brokers are legitimate in the trading world but it’s the actions of a few bad apples that tend to spoil the bushel.

You can learn about forex trading and you can trade without going through a broker if you’re afraid you might encounter one who isn’t what he claims to be. But on the other hand, an honest broker brings to the table his expertise with the forex.

While forex trading with a broker has the advantage of using his expertise to aid you in making trades, sometimes this leads to a tendency on the part of the trader to ignore getting a forex knowledge on his own. If you’re not knowledgeable about forex trading, then you won’t know if the moves your broker are making are for your good or his.

Forex trading without leverage

Financial leverage attracts a lot of traders to the forex market. You might see many results on google such as 'best leverage to use in forex'' which make it seem like this is the only option when trading with forex. However, it is not the foolproof tool that some people make it out to be, nor is it the only option in terms of professional forex trading. While leverage can be beneficial, it can also lead to some disastrous outcomes.

This is especially likely in the case of traders with no experience. It's also worth noting that many large financial companies are actually practising currency trading without leverage. So what are the advantages of trading with and without leverage? And what are the pros and cons of forex trading? You can find out the answers to these questions yourself with a free demo account, if you want to jump ahead and start practising now.

However, if you would like to possess a little more knowledge beforehand, we encourage you to read on.

Defining leverage

Perhaps you already know what leverage is? If not, here's a brief summary:

Financial leverage is a credit provided by a broker. Leverage allows traders to place orders that are significantly higher than their actual deposit. It is possible to use leverage to trade stocks and other financial instruments, but it is far more accessible when trading currencies. Leverage potentially helps traders to achieve higher profits in the market. Of course, the same also applies to losses. Traders risk losing their deposit faster when using leverage – so use it cautiously!

(note that the leverage shown in trades 2 and 3 is available for professional clients only. A professional client is a client who possesses the experience, knowledge and expertise to make their own investment decisions and properly assess the risks that these incur. In order to be considered to be professional client, the client must comply with mifid ll 2014/65/EU annex ll requirements.)

A financial leverage example

Image that a trader has a deposit of 10,000 EUR. The trader's broker offers a leverage of 1:100 for a deposit of this size. Knowing these two values, we can easily calculate the largest position available to this trader. We need to multiply the trader's balance by the first value in the leverage ratio (i.E. 10,000 multiplied by 100). Therefore, this trader can open a deal up to 1,000,000 EUR in volume.

Of course, this may sound too optimistic. The position size doesn't mean much if you are not aware of how you're trading. Before you begin trading, you should learn about the positives and negatives of trading, and then try it without leverage.

Forex trading with leverage

Ok, so now you know what leverage is, but what does leverage mean in forex? Let's answer that question by looking at how leverage is used within forex trading:

The biggest advantage of leverage is that it allows traders to boost their trade sizes, even when they don't have substantial capital. Traders usually consider 1,000 USD to be a decent starting sum. However, not all traders can afford this – especially when starting out. And this is where financial leverage comes into play. Even leverage as low as 1:10 allows traders with a 100 USD deposit to open a 0.01 lot position. But this is not a 100% beneficial condition, as you also expose yourself to risk.

But how does forex leverage work exactly? Let's consider an example of trading with no leverage to answer that question:

Let's say you buy 1000 USD for 800 EUR, and then the price of USD drops by 50%. You would only lose half of your funds (in this particular example, you would lose 400 EUR). However, if you were using 100:1 leverage, and the price changed by less than 1%, you would then lose all of your funds. Always be aware of the risks leverages pose, and try to prepare yourself for them. Preparation can be as simple as practising leveraged and unleveraged trades on a demo account.

If you can't create good returns with low leverage, expect potentially significant loses with over-leverage.

Trading with A demo account

Trader's also have the ability to trade risk-free with a demo trading account. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. For instance, admiral markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders.

To open your FREE demo trading account, click the banner below!

Forex trading without leverage

The main downside of trading forex without leverage is that it is simply not accessible for most traders. Forex trading without leverage means that changes in the price of an asset directly influence the trader's bottom line. The average monthly return a trader can generate is 10%. But in reality, the return is around 3 to 5% a month.

However, this figure already includes marginal trading. With no leverage forex trading you would probably only make between 0.3 to 0.5% a month. It may be enough for some forex traders – but perhaps not for the majority. The need for substantial trading capital is the biggest drawback of trading without leverage. On the other hand, currency trading without leverage gives you less risk exposure.

However, this doesn't mean that there are no risks involved in trading without leverage. Let's proceed with an example of 'no-leverage trading'. Let's say you deposit 10,000 USD and make a monthly return of 5%. You would only get 500 USD each month, and that's before any taxation. You could probably make the same money with a 9-to-5 job, without risking your own capital in the process.

Depicted: EUR/USD wave analysis with a MACD indicator applied - disclaimer: charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by admiral markets (cfds, etfs, shares). Past performance is not necessarily an indication of future performance.

Institutional trading

What is institutional trading? As we've already mentioned, a lot of institutions choose forex trading without leverage. Yet these organisations are still able to achieve large profits. How is this possible? Large banks have access to billions in capital. They can afford to trade large amounts on attractive entry signals. Institutions also often trade long term, so unlike the average trader, institutions can have their position open for months or even years.

Since they don't use leverage, the swap expense tends to be quite low too. In fact, in many cases there is no swap at all. Institutions directly benefit, or suffer from the differences in interest rates. Many of the largest forex market trades have been made by institutions without leverage. These deals have a speculative motivation, and typically use extensive capital in the billions.

Jens klatt, an experienced trader, explains institutional trading in detail, including his top institutional trading strategies, in the webinar below.

To leverage or not to leverage

But unfortunately, there's no definitive answer to it – it depends on the situation. You have to consider your trading strategy, your financial targets, the capital at your disposal, and how much you are willing to lose. Like any financial market, the forex market is generally risky. The higher your leverage is, the riskier your trading gets.

So consider trading with as little leverage as possible, to ultimately get the profit you want. And conversely, keep in mind that the more leverage you use in forex trading, the more profit you can potentially make. In most cases, a beginner trader should consider using leverage between 1:5 to 1:100. The table below illustrates the importance of trading with the right leverage. It displays 10 consecutive losing trades in a row when using high vs low leverage.

Source: example of trading with low leverage vs trading with high leverage

Final thoughts

Hopefully, we've answered some of your questions about forex trading without leverage.

By now, you should understand why leverage is risky, and that high leverage means a higher risk, with the possibility of a higher return and vice versa. So again, practising with leverage on a demo account is a smart initial move. It is important to ensure your trading strategy considers your deposit amount, how much you are willing to lose, and the minimum you are willing to make - before you start leveraged trading. Keep learning, keep educating yourself, and most importantly, keep trying out new things.

Free trading webinars with admiral markets

If you're just starting out with forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion on the latest developments in the live markets. Click the banner below to register for FREE trading webinars!

About admiral markets

admiral markets is a multi-award winning, globally regulated forex and CFD broker, offering trading on over 8,000 financial instruments via the world's most popular trading platforms: metatrader 4 and metatrader 5. Start trading today!

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

Email was send successfully!

Please check your inbox for

our authentication email.

Thank you for registering

to finance magnates.

Please open the email we

sent you and click on the

link to verify your account.

How to trade forex completely anonymously (without KYC documents)

The reasoning behind KYC requirements is a noble one, but there are problems that the requirements present

Since the very inception of forex trading, KYC (know your customer) documents have been presenting challenges to both traders and brokers alike. These documents are often the one thing that stands between a prospective trader and the platform they need to use to profit from FX trading.

In this article, we’re going to talk about what these document requirements are, why brokers have always asked for them, and how you can now partner with brokers such as eaglefx in order to avoid having to trade off your personal information in exchange for access to a forex trading platform.

KYC documents overview

The foundation of know your customer documents is rooted in an anti-money laundering initiative that was put in place in 2014. The initiative’s goal was to battle money laundering, especially laundering on the part of those who wish to help finance global terrorism.

Clearly, KYC requirements stem from a very noble cause and as such, we cannot refer to them as a “bad” thing exactly.

What we can refer to them as is a challenge, simply because a surprising number of individuals do not have the identification and documents required to meet KYC requirements.

KYC documents are requested from a variety of financial institutions, such as banks, money lenders, and other businesses that deal with incoming and outgoing financial payments.

The document requirements include a legal, government-issued color photo identification card. This could be a passport, driver’s license, military ID card, or other official ID.

They also require proof of one’s residence and could be either a bank account or credit card statement, utility bill, telephone bill, or other official documents that show proof of residency.

This proof must be dated and must be dated no more than 3-months from the day that the document was submitted as proof.

Problems stemming from KYC requirements

As mentioned above, the reasoning behind KYC requirements is a noble one, but the problems that the requirements present are two-fold. On the one hand, the sharing of the documents puts one at risk of identity theft.

On the other, not everyone has them. There are a million and one reasons as to why one might not have one or both of the document types which are required and the fact of the matter is that brokers that adhere to know your customer rules do not care why you do not have them, instead, caring only that you don’t.

Sharing your personal details presents its own set of problems, but when combined with sharing payment method details, the threat grows by leaps and bounds.

When funding an account via credit or debit card, or even by bank wire transfer, you’re going to have to share payment information. This could include card numbers, account numbers, or other information which is best left private.

Often, it is not the broker that requires that you share this information, but instead the payment processors and banks that work with the brokerage in order to accept deposits and issue withdrawals.

Issues with credit/debit and bank wire deposits

When it comes time to make a purchase, most people immediately reach for their wallet or purse to grab a credit or debit card.

Some think nothing of entering their card numbers online, while others go to great lengths to avoid doing so.

When making a card deposit with a forex broker, you will need to share not only the complete card number but also card information such as the expiry date and special CVV code from the backside of the card.

The broker may go one step further in asking you to send a photo of the physical card with all by the last four card numbers covered in order to help establish that you are in fact the owner of the card and payment account.

For larger deposits, in particular, bank wire transfers are often opted for. Wire transfers offer a more secure method of fund transfer but are of course the slowest of the available deposit and withdrawal options.

In some cases, you may be asked to send a wire transfer receipt to the broker, and this receipt may contain a substantial amount of personal information. It should be possible to blackout any private details that are not pertinent to the actual transfer, but even this might not be enough to offer total protection.

Wire transfers also tend to be costly. Even when the broker forgoes any wire deposit fees, the average wire transfer fee charged by a bank is around $30 per outgoing and incoming transfer.

Avoiding know your customer document submission

The most important step to avoiding the KYC process completely will be to select a broker that allows you this right. The aforementioned broker, eaglefx, is one of the most reputable brokerages that now permit their clients to trade FX anonymously. Their registration process requires that one only submit their first and last name, along with their email address.

An email will be used to send important information to you, which includes confirmations, monthly activity statements, and much more.

Because of this, you’ll want to provide a real email address rather than a bogus one.

The next step will be to only deposit and withdraw using a cryptocurrency such as bitcoin. With other payment methods, the broker is required to collect your KYC documents, but are at liberty to bypass the requirement when the trader opts to conduct all of their banking transactions by way of digital coins.

This step is completely necessary, so if you’ve never purchased cryptocurrency in the past, now is the perfect time to become familiar with them. The purchasing and submission processes are actually quite simple and even better, take very little time to complete.

Potential problems?

There are a few potential problems with anonymous FX trading, but the bulk of these fall onto the broker. For example, allowing private trading means that the broker is unable to manage certain controls, such as the location of the trader.

Perhaps the broker doesn’t want to accept clients from china. By not requiring KYC documents to be submitted, they are much less likely to be able to control this. The same applies to a client’s age.

When identification is required, the broker can ensure that the trader does meet their age requirements. These are just two of the risks that the broker accepts when allowing for private forex trading.

What about problems on the trader’s end of things? Well, this really comes down to the fact that no regulated broker is going to ever be allowed to accept clients into their platform without having them meet the KYC requirements.

They fully understand that they are missing out on a large segment of the market, but there’s really nothing that they can do to change that.

Who knows what the future may hold, but for now, there’s no immediate solution for regulated brokers who want to allow anonymous trading within their platforms.

The best-case scenario for those who wish to trade forex privately is to select a trusted brokerage that allows it to do their trading with.

Brokerages such as eaglefx are beneficial not only in that they allow clients to trade completely anonymously, but they also offer the perks that all traders want, such as excellent platform conditions, high leverage, 24/7 interactive customer support, same-day withdrawals, low minimum deposit requirements, and much more.

Whether you want to protect your identity and payment information, or simply do not have the documents required to pass the KYC test, you now have a solid option for trading FX on your own terms.

Sign up and start trading 100% anonymously with eaglefx!

Disclaimer: the content of this article is sponsored and does not represent the opinions of finance magnates.

Reputable anonymous forex brokers 2021 (no KYC required)

Whatever forex broker you select to start a real trading account, a KYC process is required.

KYC means know your customer and is a common process of a forex who asks proof to identify and verify the identity of its clients (individual traders).

In a few words KYC process means that some sensitive personal data must be provided to the broker, in order to sign up a new trading account and start trading. Failure to meet these requirements may occur to deposit and withdrawls problems.

It depends to the brokerage company what kind of documents will be asked from a new trader. Some brokers have strict KYC requirements while others are more flexible.

For example cysec regulated brokers (which is a common license for a forex broker that operates in european union) are becoming stricter these days, mainly because mifid II directive, while offshore forex brokers are not asking so much information.

Common KYC requirements

Most brokers ask verification documents for:

- Passport or national ID card (to prove the true name of the trader, date and place of birth)

- A recent telephone utility bill (to prove current permanent address, home and mobile phone number)

- Email address

- Educational status, profession and/or occupation

- Purpose of opening investment services account with the company

- Estimated levels of turnover from the account and the source of funds

- Sample signatures

As you can see, the first two are in bold because they are sensitive personal data, and although the top trusted forex brokers claim to offer the maximum possible protection tothese data, i strongly believe that they dont!

Answer: all of us thought so! Until we met cambridge analytica…

And i am not reffering to terostits, fanatic muslims etc… i am reffering to the biggest threatens of this world: the governments (and in some cases the tax authorities).

How to stay anonymous

Reading this article you will learn how to trade forex using only an email address…

- A forex broker that accepts bitcoin deposits and withdrawls, and have no KYC process

Here is the list of forex brokers that offer anonymous forex trading. Using the bitcoin as deposit currency, you can enjoy forex trading with leverage, commodities trading, crypto trading etc.

Read carefully the list and select the broker that fits better your needs.

Key facts for the future

- The world is going forward and anonymity is going to be struck. Today there are some trading brokers that do not have KYC process (for the moment)!

- In the future more and more brokers will add KYC verification as obligatory step to start trading.

- Anonymous forex brokers plan to add KYC proccess in the future, such as evolve markets. Evolve markets introduces a quick and simple know your customer (KYC) verification. For now, it is not mandatory, but in 2021 it will be for every trader uses evolve markets services.

- Basefex has a no KYC promise. More specific, they write into their website: “we promise there will never be KYC checks. As believers of cryptocurrency and its anonymity spirit, we respect our users’ privacy and will never require KYC checks from our users. Users can use all of our services with just an email address.” can this statement become true? No is the answer. Nobody can promise for the future, because noone knows how things will be in 5 or 10 years! If a KYC proccess becomes mandatory for all countries worldwide, then what will basefex do? They will shut down their company, or just a add a KYC verification? Thats a great question, in fact we believe that they will add a KYC.

Primexbt

- Anonymous trading accounts (no KYC)

- High variety of widgets, great user experience

- 4-level referral system

- Brilliant charting software for comprehensive technical analysis

- Low commissions, tight spreads

- High leverage up to 1000:1

- Easy to use, even for a newbie

Prime XBT is an modern bitcoin trading platform with high leverage.

Anonymous trading, no KYC required, no personal data shared.

Start an anonymous bitcoin trading account, take advantage of 100:1 leverage and of ultra-fast order execution (

- Cryptocurrency derivative & margin exchange

- No KYC, no IP blocks, trade anonymously

- Highest level of security

- Low trading fees

- 24/7 live chat support

- Stable server with no breakdowns

- Leverage up to 100:1 in BTC

- Leverage up to 20:1 to all other trading instruments

- Listed on coinmarketcap.

Basefex is an anonymous margin trading broker, launched in october 2018.

No KYC required, keep your personal data safe! Basefex is the broker that has no KYC promise, the declare that they will never add a KYC verification!

Forex trading without deposit | no deposit bonus explained

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

How to start forex trading without investment

If you don’t have an initial investment for starting a business I believe better to know how to start forex trading without investment. But if you expect high returns without investment, it will never happen. To get high returns you have to deposit a lot of money.

Of course, it is possible to engage in foreign exchange transactions without investment but not make a lot of money at once. For one thing, without investment, you get money not from the foreign exchange market but from brokers.

This will allow you to not only trade without investment but also have a good experience in the forex market. If you do not have a large or small amount of money to invest in forex trading, you can do so by studying this carefully.

I have given you some important facts about it below, check it out and get an understanding of how to start forex trading without investment and make a profit.

Actually how to start forex trading without investment.

- Choosing a free forex trading account

- Affiliate program

- Contestsprogram

Choosing a free forex trading account

You have the opportunity to get a free account and engage in foreign exchange transactions. You can open a free account by choosing a broker who offers bonuses as well as special offers.

XM

Founded in 2009 and it is regulated by cysec. It great for beginners because they provide good educational videos and demo account facilities. In addition, you can trade over 700 instruments and also gives special bonus offers for new clients.

Nordfx

Founded in 2008 and it is regulated by cysec and VFSC. Nordfx gives MT4 and MT5 facilities and also they offer 30 currency pairs, the other one is provided special offers for new clients.

Affiliate program

If you want to make money in foreign exchange without any investment, you can do so through the affiliate program.

This method is becoming very popular nowadays. You can do this successfully without using your money and you can make money without trading.

All you have to do is advise new traders on how to choose a good broker to deal with the forex market. This will allow you to earn a bonus. You can do this by doing a good review of brokers for new traders.

You will get a fee from the brokers if traders registered under the referral link, and you can use that money to make trading if you want. To do this, you must first connect with a broker and open an account.

So if you run affiliate programs like this, you will have the opportunity to earn money without any investment. It will be easier for you if you do this on your own website or blog.

Contests

Most brokers hold open contests for real and demo accounts for everyone. The nature of this competition is to give a real account to the people who earn the most in a short period of time.

Then you will be able to get the amount of money you earned. In addition, you can get some more benefits from this. You will not get real money first but the person who wins at the end of the competition will get real money.

You can use this money to invest in foreign exchange transactions. Because you do not need to risk money.

Forex trading without stop loss

One area where all traders struggle with is determining where to place their stop loss. New traders are repeatedly told to stick to a strict risk-reward ratio and religiously follow their trading plan. Fiddling with a stop loss can be a sign that you are on a slippery slope to margin call or worst, stop out.

Despite all the experts telling you that trading without a stop loss is close to being a criminal offense, there is some appeal in the idea that you might be able to afford yourself some leniency. After all, the markets swing up and down day and night. The level where you originally placed your stop loss may be obsolete after a few hours, and a reevaluation makes total sense. Using no stop loss trading methods can undoubtedly be risky.

In this article, we will explore if and when you should be trading without a stop loss in your forex strategy and how you might be able to overhaul your approach to using stop losses.

Why do we use stop losses?

Before we can decide whether we should trade forex without a stop loss or not, let’s remember why we use them in the first place.

- Stop losses are an essential component of responsible risk management. They limit the maximum amount of damage your position can cause.

- You determine your trade parameters based on analysis that you made in advance while you were cool-headed and not yet emotionally involved in a trade.

- You can move your stop loss once your position in gaining a certain amount in order to secure profits should a trend start to reverse.

A big problem in the forex education space is that traders are educated on the importance of using stop losses. New traders are notoriously prone to blowing their accounts in a very short space of time, so this is not a bad thing. The downside is that many new traders don’t learn how to set a stop loss properly in order to learn the different stop loss strategies retrospectively.

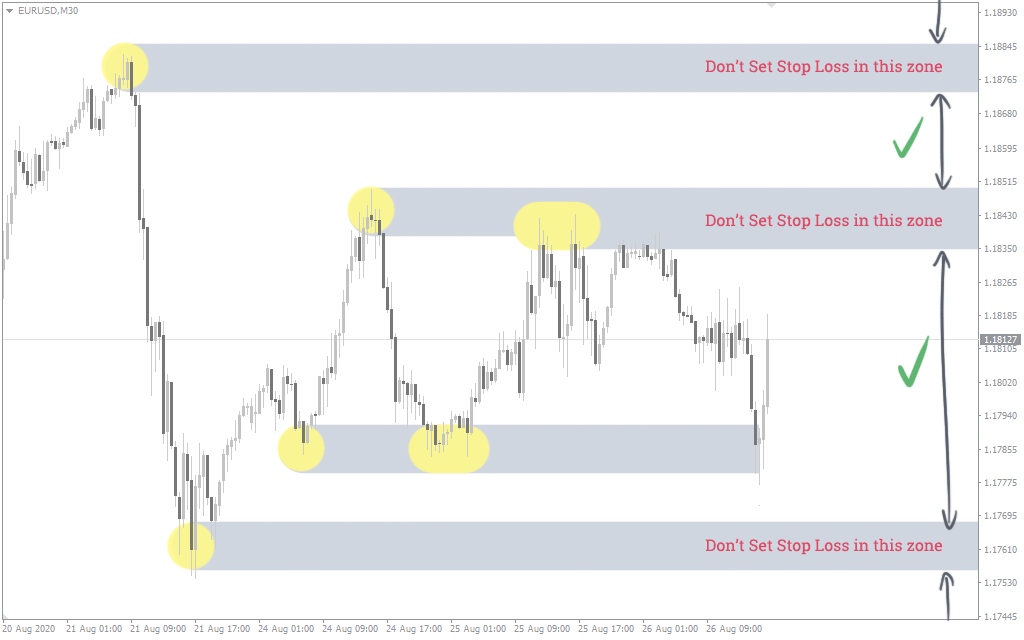

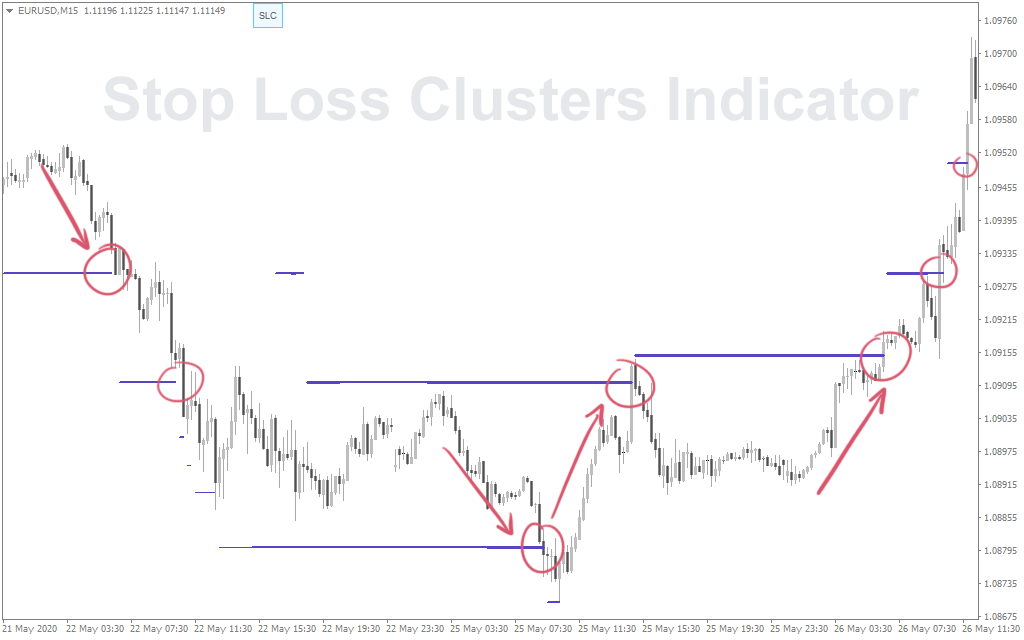

One of the approaches we discuss in the aforementioned article is setting stop losses outside of the high and low ranges and the round price levels. Most traders place their stop losses inside of these zones, which are ranges where the market is likely to fluctuate within.

There is a strange phenomenon in the online trading world whereby prices seem to gravitate towards wherever stop losses are clustered. Considering the scale of this phenomenon, it’s unlikely to be manipulation, but rather a widespread and common behavior exercised by traders everywhere. By knowing where other traders are setting their stop losses, you can place yours further from theirs.

What is the problem with stop losses

The advantages of using a stop loss are clear. This is forex trading 101. Less often discussed is the common issues faced by traders when using a stop loss. There are some valid arguments for trading without a stop loss.

- Stop losses are a definitive statement that a specific trade has failed.

- Many traders place their stop losses on resistance levels which may turn out to be pivot points. This results in traders losing money even if their trade was right, but just the entry point was misjudged.

- Traders place their stop losses too close to their entry point. This does not give the trade enough breathing room to pull back. This is especially true when traders oversize their positions, they focus on monetary losses in their risk-to-reward ratio, and neglect the trading pair’s range of movement.

- You may think that a trade has become invalid, yet you stick to the plan and wait for it to reach the stop loss.

- Stop losses are prone to be triggered by erroneous spikes in the price or short term volatility.

- You can misjudge your entry point and have your stop loss hit despite the setup still being valid.

Do professional traders use stop losses?

As traders become more experienced, their abilities evolve. Many professional traders reduce their reliance on indicators as their interpretation of the markets becomes instinctive. Take price action traders, for example; they are well known for forex trading without indicators.

Professional traders most likely are using stop losses in their strategies, but not in the same way as an average trader would. Professional traders recognize that drawdown is a natural element of trading forex; it doesn’t spook them and doesn’t make them feel their trade is invalid. Professional traders express that their stop loss setting tactics allow for plenty of breathing room.

In many ways, a stop loss takes control away from you. A professional trader objective is actually not to allow their stop losses to be triggered but to decide for themselves if their trade is invalid and close it themselves. Doing this limits how much they lose.

Professionals do trade forex profitably without stop loss orders. Still, they can only do that if they are constantly monitoring their account or have a significant amount of available margin to be able to sustain this strategy.

Trading forex without a stop loss – should you do it?

It would never be responsible for anyone to advise forex traders not to use a stop loss. The best advice you can take away from this article is that you should reevaluate how you are deciding where to place your stop losses. Suppose you can’t allow enough room to let your downside move through the established trading ranges. In that case, you should consider decreasing the size of your positions or increasing the margin in your trading account (does not necessarily suggest increasing leverage on your account).

Naturally, before you choose to attempt forex trading without a stop loss, you should test this approach on a demo account. When you move to a live account, consider starting on a cent account or by trading micro-lots until you can adjust to this bold change and the psychological effects that it may have on you.

So, let's see, what we have: fxdailyreport.Com for beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. At forex without broker

Contents of the article

- Top forex bonus promo

- Fxdailyreport.Com

- What is copy trading ?

- Download MT4 and open metatrader 4 demo account without a...

- Why would you want to have metatrader 4 demo account...

- Here’s what rimantas teaches in this MT4 tutorial:

- Forex trading with or without a broker

- Forex trading without leverage

- Defining leverage

- A financial leverage example

- Forex trading with leverage

- Forex trading without leverage

- Institutional trading

- To leverage or not to leverage

- Final thoughts

- How to trade forex completely anonymously (without KYC...

- The reasoning behind KYC requirements is a noble one, but...

- KYC documents overview

- Problems stemming from KYC requirements

- Issues with credit/debit and bank wire deposits

- Avoiding know your customer document submission

- Potential problems?

- Reputable anonymous forex brokers 2021 (no KYC required)

- Common KYC requirements

- How to stay anonymous

- Key facts for the future

- Forex trading without deposit | no deposit bonus explained

- No deposit bonus in a glance

- How to start forex trading without deposit: tips &...

- Start forex trading without deposit: introduction to best...

- No deposit bonus as an alternative – is it worth it?

- How to start forex trading without investment

- Actually how to start forex trading without...

- Forex trading without stop loss

- Why do we use stop losses?

- What is the problem with stop losses

- Do professional traders use stop losses?

- Trading forex without a stop loss – should you do it?

Comments

Post a Comment