Earn from forex without investment, how to do forex trading without investment.

How to do forex trading without investment

- no deposit account the world of forex is a game of investment and return.

Top forex bonus promo

It is a place where currency pairs are bought and sold. In order to make money by selling a currency pair, one has to invest a certain amount as well. So, if one asks, “how to make money in forex without investment”, the proclamation may seem impractical. However, to everyone’s surprise, brokers in forex have provided certain amenities using which a trader whether new or seasonal can fulfill his dream of reaping profits without investing a single penny from his pocket. The following section mentions three such approaches.

Earn from forex without investment

The world of forex is a game of investment and return. It is a place where currency pairs are bought and sold. In order to make money by selling a currency pair, one has to invest a certain amount as well. So, if one asks, “how to make money in forex without investment”, the proclamation may seem impractical. However, to everyone’s surprise, brokers in forex have provided certain amenities using which a trader whether new or seasonal can fulfill his dream of reaping profits without investing a single penny from his pocket. The following section mentions three such approaches.

- no deposit account

As the name suggests, a no deposit account does not require investing any money in it. Your broker opens this account for you and provides a certain sum of money as welcome bonus. It facilitates investors to try their hand at the real market without involving any risk of loss. It is one of the best forms of free forex trading without investment.

The biggest advantage with welcome bonus is that you can even leverage the amount to escalate your initial investments. As a result, this will be able to give your trade a much bigger opening resulting in chances of greater profits.

Suppose trader A is planning to earn from forex without investment. So, he signs up with his trader to open a no deposit account. As said, his new account gets a welcome bonus of $1000 from his broker. Trader A now opts to leverage his position in the ratio of 50:1. With a sum of $1000, he now equips himself to trade with $50,000. And this is all possible without risking a single dime from his pocket.

- contests

A plethora of contests are available each day on the internet. These contests pertain to live as well as demo accounts. The principle of forex trading without any investment here is pretty simple here. Traders have to earn as much profits as possible within a stipulated time period using their virtual accounts. The winner receives the prize money in his real account.

Every veteran recommends traders to participate in such contests as these help them in gathering up pace in trading – a much needed attribute of every forex trader.

- affiliate programs

This is the new trend that answers the question, “how to make money in forex without investment.” with affiliate programs your job is to attract new potential customers for your broker. It is a kind of chain program where once your referred trader starts making money in forex, you receive your honest share of commission.

Referrals also help to increase the trust base through word of mouth marketing. Any person will preferably join a broker that is recommended by his near and dear ones. Such promotions are often done by words or though blog posts and info graphics.

So, the answer to “how to make money in forex without investment” is pretty obvious. Be it a no deposit account, affiliate programs or demo contests, each of them provides their own share of benefits to a trader. So, get up and get going. Approach the way you like and make money from forex without investment.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

How to make money in the forex market without investment?

Six ways of making money with a forex broker

We all know that forex is a currency market where currencies are bought and sold.

In order to earn money at forex, you need to have a currency of one country, which you can exchange for a currency of the other country and make a profit. That is true; however, if you read more about investing at forex you will know that it is possible to earn money at forex without making investments.

You will nevertheless have to invest your time and energy, but it is true - you can start with $0 and make millions. Just like those billionaires. You can always start with demo-contest or an affiliate program.

Read about the ways of earning money at forex without the initial capital.

Trading in forex without investing

First of all, you should understand that it is impossible to make a high profit without making investments. If you decide to become a real trader and earn big money in the long-term prospect, you will need to open an account and deposit money on it.

Do not trust information assuring you that it is possible to earn millions without investing a penny. High profits without investments are impossible and statements promising this are questionable.

And still, it is possible to earn money at forex without making investments, although the profit maybe not too big. In this case, you will earn money not in the market but will receive it from your broker. What are the ways of earning money without making deposits at forex? I have gathered the information from different sources and will review it here. So let's figure out with the ways to make money with forex without investment.

Trading on the account without a deposit

You open an account and your broker deposits some money on it. You cannot withdraw this deposit but you can trade using this fund. If you trade successfully a broker will allow you to withdraw your profit. This option enables a trader to earn at forex without investing money and, which is more important, to gain valuable experience of work on the trading platform.

A deposit, which a broker puts on your account, usually ranges from $5 to $70. With the help of this fund, you can start trading without investment on the real trading account. What is the benefit of a broker? It is just a promotion, and a broker is prepared to spend some money on it.

Affiliate programs

Do you know how to make money in forex without actually trading? Just choose the broker and promote it to get the commission from people you attract. Today forex affiliate programs are becoming more popular among traders as they give a chance of earning money without investing. Participation in the affiliate program means that you attract new clients, who are ready to work in the forex market and receive a bonus for it. Depending on the terms and conditions of an affiliate program you sometimes receive your bonus regardless of the trader’s success in trading; your interest also depends on the terms of the affiliate program. You can calculate the expected earning here.

If you have your own site or a blog, affiliate programs is a good option of earning money for you, as you can advertise a broker on your site.

You can open an account with a broker where he will transfer money for the clients attracted by you. You also can use this account for trading at forex to make more money. So, you start forex with no money and now you have investments to trade. If you do not know how to trade profitably, you can join the copy trading network and choose the professional trader to start copying his trades to your own account. You can find the traders' list here, draw your attention on profitability, risk level, and the experience when choosing the trader to copy.

So the affiliate programs and copy trading forex system is a good collaboration to earn money in financial markets without investment and make money from forex without trading. Here you can also read a lot of articles about forex programs.

Contests

Some brokers regularly organize contests for demo and real accounts. As with other forms of competition, nature of competition in forex is simple — to come forward in relation to other bidders, increasing your income on a demo account several times in a short period of time, and in the end to get money on the real account as a reward. So, as a participant, you can start trading on forex without any investment. In case of a demo account, you should increase your profit for a certain amount on your account within a certain period of time and finally, you will receive a bonus on your real account. So starting with participating in the contest, you can become a trader at forex without investing money. For now, I found the demo contest with the huge prise finds 10000 USD, and to will this contest you need to trade as good as you can on all cryptocurrency pairs. Cryptocurrencies are very appropriate assets to get high profit because of their volatility. It is really amazing, you can start trading without money on a demo account and if you win you will get the prize money to your live account to trade without investment on it and ear the real profit. To participate in the contest we need to register first here to get an account and then register this account on the contest here. Let's compete? :) let me know in the comments section below about your results.

Comments, reviews and posts on various information portals

Placement of the interesting comments on the forums, participation in the opinion polls devoted to forex and publication of the surveys and articles about forex is often rewarded by brokers. So you can receive a bonus on your real trading account and also gain experience and reputation of a professional market analyst. Brokers are prepared to pay big money for the forex reviews.

Professional forex copy trading and PAMM systems

Some traders are ready to pay interest from their profit to the experienced traders for investing their funds into PAMM-accounts. This is a good incentive for achieving more improvements in trading for the experienced trader at forex. The automated copy-trading systems allow you to duplicate the best traders and communicate on specialized chat with traders community from all of the word.

Hopefully, now you know all about how to make money in forex without investment!

In conclusion, I would like to say that it is possible to trade and gain profit at forex without investing money. Note, however, that for earning large amounts of money a trader should have experience and knowledge of trading and investing money.

It is quite common that traders start to work at forex without making investments, but later they open real accounts and achieve real success in trading. Just remember that it is important to start the first step.

P.S. Did you like my article? Share it in social networks: it will be the best “thank you" :)

Ask me questions and comment below. I’ll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo-code BLOG for getting deposit bonus 50% on liteforex platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.Me/liteforexengchat. We are sharing the signals and trading experience

- Telegram channel with high-quality analytics, forex reviews, training articles, and other useful things for traders https://t.Me/liteforex

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

Forex trading without deposit | no deposit bonus explained

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

How to start trading forex (4 steps)

Welcome to the world of forex. There might be many reasons why you are reading this article. It could be that your friend or acquaintance mentioned about how they trade and perhaps even make a living by trading forex. Whatever your reasons may be; this article will give you an overview of the forex markets and how to start trading forex … and perhaps make money for yourself.

Step 1. What is forex?

Step 2. Learn forex basics

Step 3: find a forex broker

Step 4: start trading

Step 1. What is forex?

Forex, or foreign exchange is an unregulated market, also known as OTC (over-the-counter) and is the biggest market with average daily turn-over that runs into billions. It is even bigger than the US stock markets. Although due to its OTC nature, no one can really give the correct numbers as to the forex turnover. But nonetheless, forex is indeed a big market and thus allows many market participants. From your neighborhood bank to specialized investment companies, to your friend; the forex markets always offers a piece of the action whoever you are and wherever you are (even from your home).

The basic concept of trading forex is very simple. You trade or speculate against other traders on the direction of a currency.

So, if you believe that the euro is going to rise, you would BUY the euro, or SELL the euro if you think the euro would fall. It’s as simple as that.

Step 2. Learn forex basics

Before you get ready to deposit your funds and start trading there are some important points you must understand, each of which are outlined below.

Forex brokers: in order to start trading forex, you will need to trade with the help of a forex broker. There are many forex brokers out there today who allow you to open a forex trading account for as little as $5. The forex broker is the one who facilitates your buy and sell orders and also allows you to research into the markets (also known as technical or fundamental analysis) to help you make more informed decisions… and of course allows you deposit more funds or withdraw your profits when you want to. ( click here to see our forex brokers rating )

Trading platform:you need a trading platform from which you can place your trades, which are then sent to the broker for settlement. Also, a trading platform is essential for you to conduct your technical analysis and also to see the current market prices. Most retail brokers offer the MT4 (short for metatrader 4) trading platform, which is free of cost. You can also open a demo trading account and practice trading with virtual money to gain the experience required before trading with real money.

Forex trading hours:while you might have heard that the forex markets never sleeps, it actually does. Firstly, you won’t be able to trade on weekends (saturday and sundays). But for the rest of the week, the forex market operates 24 hours a day. This is due to the fact that forex trading is global. At any point in time, you will always find an overlap of a new market session while the previous market closes. What time of the day or which market session you trade plays a big role if you are an intra-day trader or a scalper. This is another vast topic, which we will cover at a later stage. ( click here to learn more about forex trading hours . )

Now that you have a basic overview of the forex markets, here are some final pointers to remember before you start trading for yourself.

What is a pip?:pip is a measure of change in a currency pair’s value and is the 5 th decimal. For example, if EURUSD changes from 1.31428 to 1.31429, the change is denoted as 1pip (1.31428 – 1.31429 = 0.00001). When you trade, the more pips you make, the more profit you have. Ex: buying EURUSD at 1.31428 and selling (or closing your trade) at 1.31528 would give you 100pips in profit. ( read more about forex PIP )

Reading quotes: forex quotes are presented in a bid and ask price (both of which vary by a few pips and from one broker to another). The bid price is the price at which you can buy and the ask price is the price as which you can sell. So, a EURUSD quote would look like this 1.31428(bid)/1.31420(ask).

What is a spread?: spread is nothing but the difference between the bid and ask price. So in the above example, for 1.31428/1.31420, the spread would be 8 pips. ( read more about forex spread)

What is a leverage?: leverage is the amount by which you can request your broker to magnify (or increase) your trade value. Leverage is often quoted in ratios such as 1:50, which means that when trading on a 1:50 leverage, your $100 is magnified to $50000. Leverage is a big topic in itself and it is recommended to read this article to learn more. Leverage is important both in terms of making profits as well as managing risks and therefore, your trades.

What is a lot?: A lot is a unit by which you place your trade. In financial terms, a lot is also referred to as a contract. There are preset lots (or contract sizes) that you can trade. For example a standard lot is nothing but 100,000 units (known as 1 lot). ( read more about lot)

Reading charts: the ability to understand and read the charts is very essential to trading. Depending on your approach, you can choose between a line, bar or candlestick charts and trade accordingly (for example trading based on candlestick patterns). ( read more how to read forex charts)

Placing orders (how to buy and sell): in forex trading, it is possible to either buy or sell any currency pair. Most trading platforms, give you this option. You buy when you think that price will go up and you sell when you think that price will fall. There is a common terminology used in forex trading, which is buy low, sell high; which is an important point to remember. ( read more how to place orders with MT4 )

Order types: besides buy and sell, another point to remember the types of orders. There are two basic order types: market orders and pending orders. When you click on ‘buy’ or ‘sell’ you are basically buying (or selling) at the current market price. A limit order on the other hand tells the broker that you want to buy or sell only at a particular price. ( read more about types of forex orders)

Step 3. Find a forex broker

As mentioned, there are many forex brokers today and therefore it can get confusing on how to choose the forex broker that is right for you. To briefly summarize, remember the following points while choosing a forex broker:

- Look for a forex broker that is regulated

- See if the forex broker offers a minimum deposit amount

- What is the leverage that the broker offers

- What is the minimum contract size that you can trade

- Bonuses and the terms and conditions (see on our site list of forex deposit bonuses and forex no deposit bonuses)

- Deposit and withdrawal types as well as the terms and conditions

- Trading methods that are allowed by the broker

We can also help you choose a forex broker by reading our article how to choose forex broker

Step 4. Start trading

Finally, now that you have selected a forex broker to trade with it is recommended to first open a demo trading or a practice account. Most forex brokers offer unlimited demo trading account (but will be deactivated if not used for 30 days). This is a good way to get acquainted with the forex markets and also help you to understand your trading style (scalper or intra day trading, swing trading, etc) and approach (fundamental or technical analysis). You can search for various trading methods and systems or you can develop one yourself when you have a good understanding of technical or fundamental indicators.

Conclusion:

Forex trading is one of the most active and dynamic ways to trade the financial markets. At the heart of everything, it is the basic fluctuations in currency values which drives everything else. Learning to trade forex and understanding the forex markets can give a good foundation to trading other markets such as derivatives or equities.

The minimum capital required to start day trading forex

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/486965081-56a22da85f9b58b7d0c784b7.jpg)

Martin child / getty images

It's easy to start day trading currencies because the foreign exchange (forex) market is one of the most accessible financial markets. Some forex brokers require a minimum initial deposit of only $50 to open an account and some accounts can be opened with an initial deposit of $0.

And unlike the stock market, for which the securities and exchange commission requires day traders to maintain an account with $25,000 in assets, there is no legal minimum amount required for forex trading.

But just because you could start with as little as $50 doesn't mean that's the amount you should start with. You may want to consider some scenarios involving the potential risks and rewards of various investment amounts before determining how much money to put in your forex trading account.

Risk management

Day traders shouldn't risk more than 1% of their forex account on a single trade. You should make that a hard and fast rule. That means, if your account contains $1,000, then the most you'll want to risk on a trade is $10. If your account contains $10,000, you shouldn't risk more than $100 per trade.

Even great traders have strings of losses; if you keep the risk on each trade small, a losing streak can't significantly deplete your capital. Risk is determined by the difference between your entry price and the price at which your stop-loss order goes into effect, multiplied by the position size and the pip value.

:max_bytes(150000):strip_icc()/minimum-capital-required-to-start-day-trading-forex-1031370_FINAL1-0fd72348a80a4951b802a7df8b988713.png)

Pip values and trading lots

The forex market moves in pips. Let's say the euro-U.S. Dollar (EUR/USD) currency pair is priced at 1.3025. That means the value of one euro, the first currency in the pair, which is known as the base currency, is $1.3025.

For most currency pairs, a pip is 0.0001, which is equivalent to 1/100th of a percent. If the EUR/USD price changes to 1.3026, that's a one pip move. If it changes to 1.3125, that's a 100 pip move. An exception to the pip value "rule" is made for the japanese yen. A pip for currency pairs in which is the yen is the second currency—called the quote currency—is 0.01, which is equivalent to 1 percent.

Forex pairs trade in units of 1,000, 10,000 or 100,000, called micro, mini, and standard lots.

When USD is listed second in the pair, as in EUR/USD or AUD/USD (australian dollar-U.S. Dollar), and your account is funded with U.S. Dollars, the value of the pip per type of lot is fixed. If you hold a micro lot of 1,000 units, each pip movement is worth $0.10. If you hold a mini lot of 10,000, then each pip move is $1. if you hold a standard lot of 100,000, then each pip move is $10. Pip values can vary by price and pair, so knowing the pip value of the pair you're trading is critical in determining position size and risk.

Stop-loss orders

When trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your bet. A simple stop-loss order would be 10 pips below the current price when you expect the price to rise or 10 pips above the current price when you expect the price to fall.

Capital scenarios

$100 in the account

Assume you open an account for $100. You will want to limit your risk on each trade to $1 (1% of $100).

If you place a trade in EUR/USD, buying or selling one micro lot, your stop-loss order must be within 10 pips of your entry price. Since each pip is worth $0.10, if your stop loss were 11 pips away, your risk would be $1.10 (11 x $0.10), which is more risk than you want.

You can see how opening an account with only $100 severely limits how you can trade. Also, if you are risking a very small dollar amount on each trade, by extension you're going to be making only small gains when you bet correctly. To make bigger gains—and possibly derive a reasonable amount of income from your trading activity—you will require more capital.

$500 in the account

Now assume you open an account with $500. You can risk up to $5 per trade and buy multiple lots. For example, you can set a stop loss 10 pips away from your entry price and buy five micro lots and still be within your risk limit (because 10 pips x $0.10 x 5 micro lots = $5 at risk).

Or if you choose to place a stop loss 25 pips away from the entry price, you can buy two micro lots to keep the risk on the trade below 1% of the account. You would buy only two micro lots because 25 pips x $0.10 x 2 micro lots = $5.

Starting with $500 will provide greater trading flexibility and produce more daily income than starting with $100. But most day traders will still be able to make only $5 to $15 per day off this amount with any regularity.

$5,000 in the account

If you start with $5,000, you have even more flexibility and can trade mini lots as well as micro lots. If you buy the EUR/USD at 1.3025 and place a stop loss at 1.3017 (eight pips of risk), you could buy 6 mini lots and 2 micro lots.

Your maximum risk is $50 (1% of $5,000), and you can trade in mini lots because each pip is worth $1 and you've chosen an 8 pip stop-loss. Divide the risk ($50) by (8 pips x $1) to get 6.25 for the number of mini lots you could buy without exceeding your risk. You would break up 6.25 mini lots into 6 mini lots (6 x $1 x 8 pips = $48) and 2 micro lots (2 x $0.10 x 8 pips = $1.60), which puts a total of only $49.60 at risk.

With this amount of capital and the ability to risk $50 on each trade, the income potential moves up, and traders can potentially make $50 to $150 a day, or more, depending on their forex strategy.

Recommended capital

Starting out with at least $500 gives you flexibility in how you can trade that an account with only $100 in it does not have. Starting with $5,000 or more is even better because it can help you produce a reasonable amount of income that will compensate you for the time you're spending on trading.

10 ways to avoid losing money in forex

The global forex market is the largest financial market in the world and the potential to reap profits in the arena entices foreign-exchange traders of all levels: from greenhorns just learning about financial markets to well-seasoned professionals with years of trading experience. Because access to the market is easy—with round-the-clock sessions, significant leverage, and relatively low costs—many forex traders quickly enter the market, but then quickly exit after experiencing losses and setbacks. Here are 10 tips to help aspiring traders avoid losing money and stay in the game in the competitive world of forex trading.

Do your homework

Just because forex is easy to get into doesn’t mean due diligence should be avoided. Learning about forex is integral to a trader’s success. While the majority of trading knowledge comes from live trading and experience, a trader should learn everything about the forex markets, including the geopolitical and economic factors that affect a trader’s preferred currencies.

Key takeaways

- In order to avoid losing money in foreign exchange, do your homework and look for a reputable broker.

- Use a practice account before you go live and be sure to keep analysis techniques to a minimum in order for them to be effective.

- It's important to use proper money management techniques and to start small when you go live.

- Control the amount of leverage and keep a trading journal.

- Be sure to understand the tax implications and treat your trading as a business.

Homework is an ongoing effort as traders need to be prepared to adapt to changing market conditions, regulations, and world events. Part of this research process involves developing a trading plan—a systematic method for screening and evaluating investments, determining the amount of risk that is or should be taken, and formulating short-term and long-term investment objectives.

How do you make money trading money?

Find a reputable broker

The forex industry has much less oversight than other markets, so it is possible to end up doing business with a less-than-reputable forex broker. Due to concerns about the safety of deposits and the overall integrity of a broker, forex traders should only open an account with a firm that is a member of the national futures association (NFA) and is registered with the commodity futures trading commission (CFTC) as a futures commission merchant. each country outside the united states has its own regulatory body with which legitimate forex brokers should be registered.

Traders should also research each broker’s account offerings, including leverage amounts, commissions and spreads, initial deposits, and account funding and withdrawal policies. A helpful customer service representative should have the information and will be able to answer any questions regarding the firm’s services and policies.

Use a practice account

Nearly all trading platforms come with a practice account, sometimes called a simulated account or demo account, which allow traders to place hypothetical trades without a funded account. Perhaps the most important benefit of a practice account is that it allows a trader to become adept at order-entry techniques.

Few things are as damaging to a trading account (and a trader’s confidence) as pushing the wrong button when opening or exiting a position. It is not uncommon, for example, for a new trader to accidentally add to a losing position instead of closing the trade. Multiple errors in order entry can lead to large, unprotected losing trades. Aside from the devastating financial implications, making trading mistakes is incredibly stressful. Practice makes perfect. Experiment with order entries before placing real money on the line.

$5 trillion

The average daily amount of trading in the global forex market.

Keep charts clean

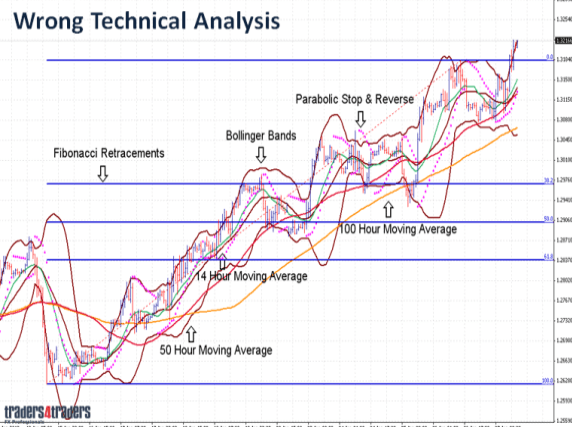

Once a forex trader opens an account, it may be tempting to take advantage of all the technical analysis tools offered by the trading platform. While many of these indicators are well-suited to the forex markets, it is important to remember to keep analysis techniques to a minimum in order for them to be effective. Using multiples of the same types of indicators, such as two volatility indicators or two oscillators, for example, can become redundant and can even give opposing signals. This should be avoided.

Any analysis technique that is not regularly used to enhance trading performance should be removed from the chart. In addition to the tools that are applied to the chart, pay attention to the overall look of the workspace. The chosen colors, fonts, and types of price bars (line, candle bar, range bar, etc.) should create an easy-to-read-and-interpret chart, allowing the trader to respond more effectively to changing market conditions.

Protect your trading account

While there is much focus on making money in forex trading, it is important to learn how to avoid losing money. Proper money management techniques are an integral part of the process. Many veteran traders would agree that one can enter a position at any price and still make money—it’s how one gets out of the trade that matters.

Part of this is knowing when to accept your losses and move on. Always using a protective stop loss—a strategy designed to protect existing gains or thwart further losses by means of a stop-loss order or limit order—is an effective way to make sure that losses remain reasonable. Traders can also consider using a maximum daily loss amount beyond which all positions would be closed and no new trades initiated until the next trading session.

While traders should have plans to limit losses, it is equally essential to protect profits. Money management techniques such as utilizing trailing stops (a stop order that can be set at a defined percentage away from a security’s current market price) can help preserve winnings while still giving a trade room to grow.

Start small when going live

Once a trader has done their homework, spent time with a practice account, and has a trading plan in place, it may be time to go live—that is, start trading with real money at stake. No amount of practice trading can exactly simulate real trading. As such, it is vital to start small when going live.

Factors like emotions and slippage (the difference between the expected price of a trade and the price at which the trade is actually executed) cannot be fully understood and accounted for until trading live. Additionally, a trading plan that performed like a champ in backtesting results or practice trading could, in reality, fail miserably when applied to a live market. By starting small, a trader can evaluate their trading plan and emotions, and gain more practice in executing precise order entries—without risking the entire trading account in the process.

Use reasonable leverage

Forex trading is unique in the amount of leverage that is afforded to its participants. One reason forex appeals to active traders is the opportunity to make potentially large profits with a very small investment—sometimes as little as $50. Properly used, leverage does provide the potential for growth. But leverage can just as easily amplify losses.

A trader can control the amount of leverage used by basing position size on the account balance. For example, if a trader has $10,000 in a forex account, a $100,000 position (one standard lot) would utilize 10:1 leverage. While the trader could open a much larger position if they were to maximize leverage, a smaller position will limit risk.

Keep good records

A trading journal is an effective way to learn from both losses and successes in forex trading. Keeping a record of trading activity containing dates, instruments, profits, losses, and, perhaps most important, the trader’s own performance and emotions can be incredibly beneficial to growing as a successful trader. When periodically reviewed, a trading journal provides important feedback that makes learning possible. Einstein once said that “insanity is doing the same thing over and over and expecting different results.” without a trading journal and good record keeping, traders are likely to continue making the same mistakes, minimizing their chances of becoming profitable and successful traders.

Know tax impact and treatment

It is important to understand the tax implications and treatment of forex trading activity in order to be prepared at tax time. Consulting with a qualified accountant or tax specialist can help avoid any surprises and can help individuals take advantage of various tax laws, such as marked-to-market accounting (recording the value of an asset to reflect its current market levels).

Since tax laws change regularly, it is prudent to develop a relationship with a trusted and reliable professional who can guide and manage all tax-related matters.

Treat trading as a business

It is essential to treat forex trading as a business and to remember that individual wins and losses don’t matter in the short run. It is how the trading business performs over time that is important. As such, traders should try to avoid becoming overly emotional about either wins or losses, and treat each as just another day at the office.

As with any business, forex trading incurs expenses, losses, taxes, risk and uncertainty. Also, just as small businesses rarely become successful overnight, neither do most forex traders. Planning, setting realistic goals, staying organized, and learning from both successes and failures will help ensure a long, successful career as a forex trader.

The bottom line

The worldwide forex market is attractive to many traders because of the low account requirements, round-the-clock trading, and access to high amounts of leverage. When approached as a business, forex trading can be profitable and rewarding, but reaching a level of success is extremely challenging and can take a long time. Traders can improve their odds by taking steps to avoid losses: doing research, not over-leveraging positions, using sound money management techniques, and approaching forex trading as a business.

Fxdailyreport.Com

The internet has opened a sea of job opportunities for people who previously had nothing to do. A lot of people are now making a living online either part time or full time. Many of the jobs done online do not require you to make an initial investment to start working. Some of them such as blogging may need you to make a small investment but nothing significant enough to stretch your budget. Below are some of the online job ideas that require little or no investment to begin:

1. Forex trading with no deposit bonus

Forex trading is growing rapidly and attracting new investors every day. In fact, the forex market is now the largest in the world with transactions totaling an average of over 3.98 trillion daily. There have been a lot of developments in the market since the invention of forex trading, making it the most exciting business to venture in.

One of the recent development that is changing the forex market and attracting more investors is the emergence of no-deposit bonus programmes. This means that you can create and operate a forex account without making an initial deposit. Your account will be funded by a broker, and all you have to do is fill a sign-up form.

A few dollars will then be deposited into your account to help start trading. With this arrangement, you will gain some skills in forex, and you have nothing to lose in case the business fails.

2. Affiliate marketing

Affiliate marketing is a digital marketing arrangement whereby a marketer promotes or advertises products from an online retailer for a small commission. An affiliate marketer is a given a unique ID by the retailer, which is used to track the sells made by traffic from the marketer’s affiliate link.

Every time a customer buys something from the online retailer using your affiliate link, you are paid a certain commission, for example, 11% of the total product price. Some of the most popular affiliate marketing programs include:

- Forex affiliate programs

- Amazon associates

- Clickbank

- Ebay partner network

- CJ affiliate

- Jet

- Target affiliates

- JVZOO

- Walmart affiliates

- Warrior plus

3. Freelance writing

You do not get to enjoy the benefits enjoyed by the employees of the company you work for as a freelance writer. Your contract is to strictly write content, submit them, get paid and that’s all.

There are different types of freelance writing jobs, including:

- Newspaper articles

- Blog content

- Research reports

- Speeches

- Press release

- Business plans

- Magazine articles

- Case studies

- Annual company reports etc

There are a lot of websites on the web where you can sign up and start getting freelance writing jobs. Some of the best are:

- Upwork

- Iwriter

- Fiverr

- Freelance

- Guru

- Peopleperhour

- Elance

- Freelance writing gigs

4. Virtual assistant

A virtual assistant is someone who is skilled in a particular job and offers their services remotely to companies, private entrepreneurs, and businesses. This means that you work as an assistant to your employer in the comfort of your home. As a virtual assistant, there are a lot of services you can offer based on your training or the skills you possess. These may include:

- Making and receiving phones calls

- Content writing

- Making appointments

- Graphic design

- Project management

- Email correspondence

- Data entry

- Tech support

- Customer service

- Planning events

- Managing social media accounts

Some of the great websites that you can find virtual assistant jobs include:

- Upwork

- Freelancer

- People per hour

- Fiverr

- Freelancer

- Eahelp

- Vava virtual assistants

- Zirtual

- Virtual staff finder

- Flexjobs

- 24/7 virtual assistant

5. Dropshipping

Dropshipping is a type of retail business where a merchant orders and sells products to consumers without physically owning or stocking them in their stores. What happens is that the merchant purchases inventory from a wholesaler or manufacturer and have them shipped straight to the consumer.

This means that the merchant does not physically come into contact with the products they sell. All they have to do is make arrangements with the manufacturer to ship the products to the consumer without the merchant’s involvement.

Some of the advantages of drop shipping are:

- You don’t have to handle the product personally, so you don’t incur shipping expenses or cases of spoilage

- It is easy to set up and start selling

- You can start the business with a small investment

- You can do it from anywhere. You only need a computer and internet connection, and you are good to go

6. SEO service / consulting

Most content creators are beginning to appreciate the role of SEO in helping websites grow. Companies and huge organizations are investing a lot of money into ensuring that their SEO techniques are competitive enough. To effectively do this, they need SEO consultants.

As an SEO consultant, your job is to critically analyze websites and give expert guidance regarding search engine optimization. Some of the basic responsibilities of an SEO specialist include:

- Doing keyword research and analysis

- Doing on-page SEO optimization

- Assigning keywords to specific pages, which is also known as keyword mapping

- Troubleshooting any SEO issues such as broken links or missing pages

- Doing exhaustive website audits to determine SEO strengths and weaknesses

- Ensuring that the site, in general, is SEO friendly

- Giving content ideas that improve website SEO

- Optimizing existing content to comply with current SEO strategies

- Supervising web design and development to ensure SEO compliance

7. Blogging / publisher

A lot of people around the world are making a living from their blogs. To start earning as a blogger, you first create a blog on a specific niche and monetize it. However, before monetizing your blog and start making real income, you have to put in a lot of work.

You have to create high quality content around your specific niche. Then, do keyword research and other SEO strategies such as link building to make your content rank well in the search engines results page (SERP). From there, you have to share your content widely to attract a huge reader base. Some of the most effective ways to monetize and start earning from your blog include:

- Selling a product or services such as ebooks or online courses

- Selling affiliate products

- Signing up for advertising programs such as google adsense

These are some of the most common online business ideas that do not require any investment. You can analyze your options and settle on one that you would feel most comfortable doing. However, do not try to do all of these jobs at once as you will simply get confused and give up before you earn anything.

Making money in forex is easy if you know how the bankers trade!

How to make money in forex?

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a chief trader its second knowledge how to extract cash out of the market. It all comes down to understanding how the traders at the banks execute and make trading decisions.

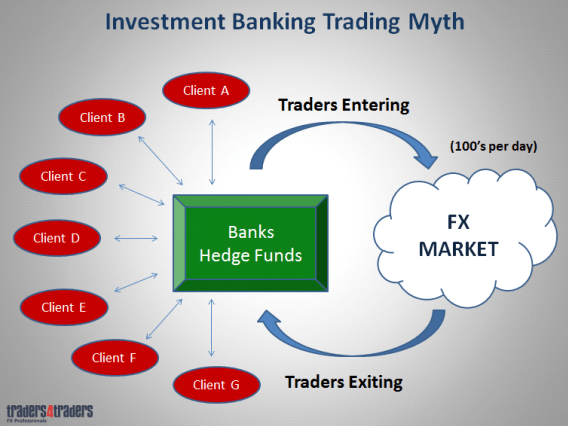

Why? Bank traders only make up 5% of the total number of forex traders with speculators accounting for the other 95%, but more importantly that 5% of bank traders account for 92% of all forex volumes. So if you don’t know how they trade, then you’re simply guessing. First let me bust the first myth about forex traders in institutions. They don’t sit there all day banging away making proprietary trading decisions. Most of the time they are simply transacting on behalf of the banks customers. It’s commonly referred to as ‘clearing the flow”. They may perform a few thousand trades a day but none of these are for their proprietary book

How do banks trade forex?

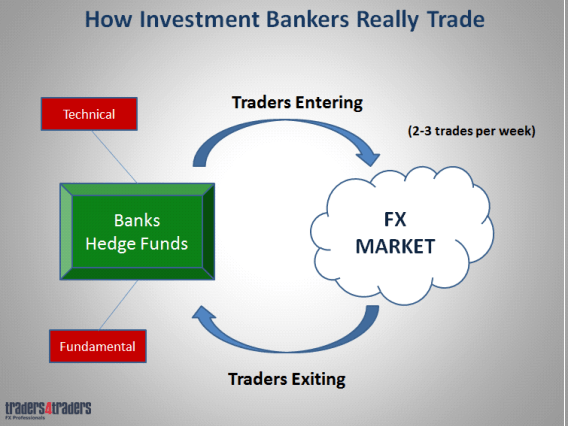

They actually only perform 2-3 trades a week for their own trading account. These trades are the ones they are judged on at the end of the year to see whether they deserve an additional bonus or not.

So as you can see traders at the banks don’t sit there all day trading randomly ‘scalping’ trying to make their budgets. They are extremely methodical in their approach and make trading decisions when everything lines up, technically and fundamentally. That’s what you need to know!

As far as technical analysis goes it is extremely simple. I am often dumbfounded by our client’s charts when they first come to us. They are often littered with mathematical indicators which not only have significant 3-4 hour time lags but also often contradict each other. Trading with these indicators and this approach is the quickest way to rip through your trading capital.

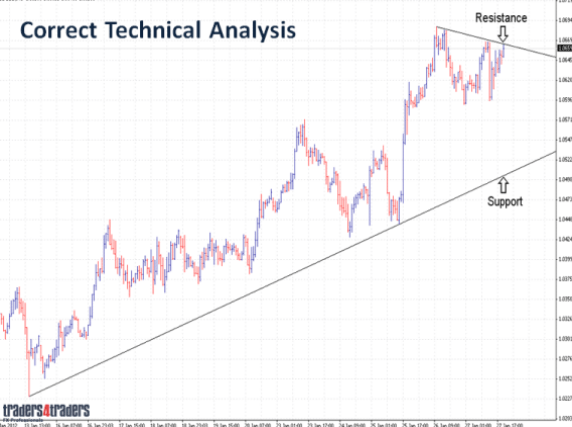

Bank trader’s charts look nothing like this. In fact they are completely the opposite. All they want to know is where the key critical levels. Don’t forget these indicators were developed to try and predict where the market is going. The bank traders are the market. If you understand how they trade then you don’t need any indicators. They make split second decisions based on key technical and fundamental changes. Understanding their technical analysis is the first step to becoming a successful trader. You’ll be trading with the market not against it.

What it all comes down to is simple support and resistance. No clutter, nothing to alter their trading decisions. Simple, effective and highlighting the key levels. I’m not going to go into the ins and outs of where they actually enter the market, but let me say this: it’s not where you think. The trendlines are simply there to indicate key support and resistance. Entering the market is another discussion all together.

How to make money in forex?

The key aspect to their trading decisions is derived from the economic fundamentals. The fundamental backdrop of the market consists of three major areas and that’s why it’s hard to pin point currency direction sometimes.

When you have the political situation countering the central bank announcements currency direction is somewhat disjointed. But when there are no political issues and formulated central bank policy acting in accordance with the economic data, that’s when we get pure currency direction and the big trends emerge. This is what bank traders wait for.

The fundamental aspect of the market is extremely complex and it can take years to master them. This is a major area we concentrate on during our two day workshop to ensure traders have a complete understanding of each area. If you understand them you are set up for long term success as this is where currency direction comes from.

There is a lot of money to be made from trading the economic data releases. The key to trading the releases is twofold. First, having an excellent understanding of the fundamentals and how the various releases impact the market. Secondly, knowing how to execute the trades with precision and without hesitation. If you can get a control of this aspect of trading and have the confidence to trade the events then you’re truly set up to make huge capital advances. After all it is these economic releases which really direct the currencies. These are the same economic releases that central banks formulate policy around. So by following the releases and trading them you not only know what’s going on with regards central bank policy but you’ll also be building your capital at the same time.

Now to be truly successful you need an extremely comprehensive capital management system that not only protects you during periods of uncertainty but also pushes you forward to experience capital expansion. This is your entire business plan so it’s important you get this down pat first.

Our stringent capital management system perfectly encompasses your risk to rewards ratios, capital controls as well as our trade plan – entry and exits. This way when you’re trading, all your concerned about is finding entry levels. Having such a system in place will also alleviate the stresses of trading and allow you to go about your day without spending endless hours monitoring the market.

I can tell you most traders at banks spend most of the day wandering around the dealing room chatting to other traders or going to lunches with brokers. Rarely are they in front of the computer for more than a few hours. You should be taking the same approach. If you understand the technical and fundamental aspects of the market and have a comprehensive professional capital management system then you can.

From here it just takes a simple understanding of the key strategies to apply and where to apply them and away you go. Trust me you will experience more capital growth then you ever have before if you know how the bank traders trade. Many traders have tried to replicate their methods and I’ve seen numerous books on “how to beat the bankers”. But the point is you don’t want to be beating them but joining them. That way you will be trading with the market not against it.

So to conclude let me say this: there are no miraculous secrets to trading forex. There are no special indicators or robots that can mimic the dynamic forex market. You simply need to understand how the major players (bankers) trade and analyse the market. If you get these aspects right then your well on the way to success.

The risk of loss in forex trading can be substantial. You should, therefore, carefully consider whether such trading is suitable for you in the light of your financial condition. The high degree of leverage that is often obtainable in forex trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Past performance is not indicative of future results.

How forex trades are taxed

Find out the basics before you make your first foreign exchange trade

For traders in foreign exchange, or forex, markets, the primary goal is simply to make successful trades and see the forex account grow. In a market where profits and losses can be realized in the blink of an eye, many just want to make money in the short-term without really thinking about the longer-term ramifications. Nevertheless, it usually makes some sense to consider the tax implications of buying and selling forex before making that first trade.

Forex options and futures traders

For tax purposes, forex options and futures contracts are considered IRC section 1256 contracts, which are subject to a 60/40 tax consideration. In other words, 60% of gains or losses are counted as long-term capital gains or losses, and the remaining 40% is counted as short term.

Key takeaways

- Aspiring forex traders might want to consider tax implications before getting started.

- Forex futures and options are 1256 contracts and taxed using the 60/40 rule, with 60% of gains or losses treated as long-term capital gains and 40% as short-term.

- Spot forex traders are considered "988 traders" and can deduct all of their losses for the year.

- Currency traders in the spot forex market can choose to be taxed under the same tax rules as regular commodities 1256 contracts or under the special rules of IRC section 988 for currencies.

A 60/40 tax treatment is often favorable for individuals in high income tax brackets. For example, the proceeds of stocks sold within one year of their purchase are considered short-term capital gains and are always taxed at the same rate as the investor's ordinary income, which can be as much as 37%. When trading futures or options, investors are effectively taxed at the maximum long-term capital gains rate, or 20% (on 60% of the gains or losses) and the maximum short-term capital gains rate of 37% (on the other 40%).

For over-the-counter (OTC) investors

Most spot traders are taxed according to IRC section 988 contracts, which are for foreign exchange transactions settled within two days, making them open to treatment as ordinary losses and gains. If you trade spot forex, you will likely be grouped in this category as a "988 trader." if you experience net losses through your year-end trading, being categorized as a "988 trader" is a substantial benefit. As in the 1,256 contract category, you can count all of your losses as "ordinary losses," not just the first $3,000.

Which contract to choose

Now comes the tricky part: deciding how to file taxes for your situation. While options or futures and OTC are grouped separately, the investor can choose to trade as either 1256 or 988. Individuals must decide which to use by the first day of the calendar year.

IRC 988 contracts are simpler than IRC 1256 contracts. The tax rate remains constant for both gains and losses, which is better when the trader is reporting losses. Notably, 1256 contracts, while more complex, offer 12% more savings for a trader with net gains.

Most accounting firms use 988 contracts for spot traders and 1256 contracts for futures traders. That's why it's important to talk with your accountant before investing. Once you begin trading, you cannot switch from one to the other.

The rules outlined here apply to U.S. Traders with accounts at U.S. Brokerage firms.

Most traders naturally anticipate net gains, and often elect out of 988 status and into 1256 status. To opt out of a 988 status, you need to make an internal note in your books as well as file the change with your accountant. Complications can intensify if you trade stocks as well as currencies because equity transactions are taxed differently, making it more difficult to select 988 or 1256 contracts.

Keeping track

You can rely on your brokerage statements, but a more accurate and tax-friendly way of keeping track of profit and loss is through your performance record.

This is an IRS-approved formula for record-keeping:

- Subtract your beginning assets from your end assets (net)

- Subtract cash deposits (to your accounts) and add withdrawals (from your accounts)

- Subtract income from interest and add interest paid

- Add in other trading expenses

The performance record formula will give you a more accurate depiction of your profit/loss ratio and will make year-end filing easier for you and your accountant.

Things to remember

When it comes to forex taxation, there are a few things to keep in mind:

- Mind the deadline: in most cases, you are required to select a type of tax situation by jan. 1. If you are a new trader, you can make this decision any time before your first trade.

- Keep good records: it will save you time when tax season approaches. That will give you more time to trade and less time to prepare your taxes.

- Pay what you owe: some traders try to beat the system and don't pay taxes on their forex trades. Since over-the-counter trading is not registered with the commodities futures trading commission (CFTC), some think they can get away with it. You should know that the IRS will catch up eventually, and the tax avoidance fees will be greater than any taxes you owed.

The bottom line

Whether you are planning on making forex a career path or are simply interested in dabbling in it, taking the time to file correctly can save you hundreds if not thousands in taxes. It's a part of the process that's well worth the time.

Investing in a foreign currency

Follow this guide to get started with forex.

For some traders and investors, investing in a foreign currency offers an exciting opportunity to speculate on the exchange rates between currencies around the world. While it is risky, many can walk away with a profitable foreign exchange, also called forex or FX. If you are new to investing in foreign currencies, here's what you need to know to get started.

In this guide:

What is investing in foreign currency?

When you travel around the world, you can't always use U.S. Dollars for purchases. Instead, you have to convert your money into euros, yen, pesos, or whatever currency is used by the country you are visiting.

When buying or selling money to travel, you probably noticed the exchange rate. This tells you how much of the other currency you get per dollar, and vice versa. These rates change regularly. The price changes are based on economic news, projected economic data, and other factors.

In forex trading, you buy a large amount of foreign currency just like you would buy a stock, bond, or mutual fund. Instead of trying to earn a profit through the value of that investment going up, you hope the U.S. Dollar value of that currency will move in the direction you're hoping for (up or down). When it does, you earn a profit when converting the currency back into dollars.

Steps to investing in foreign currency

Here are the steps to invest in foreign currency:

- Options — currency options give you the ability to buy or sell currency at a set price at a specific date and time. If the specifics work out in your favor, you can exercise the option for a profit. Learn more about options trading here.

- Futures — futures work like options in many ways. But instead of having the option to exercise at a set time, you are obligated to exercise the contract when it's up. Learn more about futures here.

- Funds –mutual funds and exchange-traded funds (etfs) often hold stocks and bonds, but they are not limited to those assets. A fund can also hold foreign currencies. Learn more about investment funds here.

- Diversify your portfolio — many investors focus heavily on stocks and bonds. Forex is a popular alternative to diversify your portfolio.

- Profit on international economic news — news and statistics enthusiastic can develop trading strategies around news releases, elections, and other current events.

- Trade around the clock — unlike the stock market, which has fixed hours, forex markets are almost always open somewhere. Some forex platforms support 24-hour trading, so you never have to wait for the markets to open.

- High volatility — news travels fast among forex traders, and these markets tend to move quickly. Forex markets are often more volatile than stock and bond markets.

- Less predictable markets — when investing in U.S. Stocks, you can count on company guidance, financial reports, and other data to predict the future. Forex markets can take big swings with less warning.

- Many bad investment options — investor junkie recommends working with reputable companies to manage your portfolio. There are some bad players in the industry that offer poor products with extremely high risk, which can be made worse with margin trading.

- Top forex bonus promo

- Earn from forex without investment

- How to make money in the forex market without investment?

- Six ways of making money with a forex broker

- Trading in forex without investing

- Trading on the account without a deposit

- Affiliate programs

- Contests

- Comments, reviews and posts on various information portals

- Professional forex copy trading and PAMM systems

- Price chart of EURUSD in real time mode

- Forex trading without deposit | no deposit bonus explained

- No deposit bonus in a glance

- How to start forex trading without deposit: tips &...

- Start forex trading without deposit: introduction to best...

- No deposit bonus as an alternative – is it worth it?

- How to start trading forex (4 steps)

- Step 1. What is forex?

- Step 2. Learn forex basics

- Step 3. Find a forex broker

- Step 4. Start trading

- Conclusion:

- The minimum capital required to start day trading forex

- Risk management

- Pip values and trading lots

- Stop-loss orders

- Capital scenarios

- Recommended capital

- 10 ways to avoid losing money in forex

- Do your homework

- Find a reputable broker

- Use a practice account

- Keep charts clean

- Protect your trading account

- Start small when going live

- Use reasonable leverage

- Keep good records

- Know tax impact and treatment

- Treat trading as a business

- The bottom line

- Fxdailyreport.Com

- Making money in forex is easy if you know how the bankers...

- How to make money in forex?

- How do banks trade forex?

- How to make money in forex?

- How forex trades are taxed

- Find out the basics before you make your first foreign...

- Forex options and futures traders

- For over-the-counter (OTC) investors

- Which contract to choose

- Keeping track

- Things to remember

- The bottom line

- Investing in a foreign currency

- Follow this guide to get started with forex.

- What is investing in foreign currency?

- Steps to investing in foreign currency

- Types of foreign currency investments

- Risks and advantages of investing in forex

- What you need to invest in foreign currency

- Enter the world of forex with care

Open a brokerage account — first, you need a place to hold your foreign currency. That's a brokerage account. Open one to get started if you don't already have a favorite brokerage. We recommend using one of the following discount brokers:

| highlights |

Types of foreign currency investmentsWhile you can buy and sell foreign currency directly, many traders use different tools to invest in currencies. Here are a few popular methods to get into forex trading with a brokerage account: Some investors may use one of these investments as a hedge. Currency hedging is a combination of trades designed to offset other risks. It may also be useful for expats who want to keep accounts in multiple currencies. You could also get the currency directly from your bank in some cases. And some online banks allow you to hold foreign currencies. Forex is riskier and more complicated than some other types of investments, so your options here are a bit more limited than with other asset classes. Risks and advantages of investing in forexForeign currency investing can be exciting, but it isn't for everyone. Before getting started with forex, it's a good idea to look at the risks and advantages of this type of investment. What you need to invest in foreign currencyTo buy or sell foreign currency, you need a brokerage account that supports this type of asset. If your broker doesn't allow you to invest directly in foreign currency-related options or futures, most support a wide range of etfs and mutual funds that give you FX exposure. We've already said it, but it's important to emphasize that foreign currency investing is very risky. You need to fund your account to get into the forex. Make sure it is money you can afford to lose if things don't go as planned. Enter the world of forex with careForex is an exciting place to invest, but it's a more expert area of the investment landscape. Newer investors should start with less risky assets before dabbling in currencies. Like every investment, there are risks and rewards with forex trading. You should look at all of your options before deciding. To try out forex without risking any real money, look for a brokerage with paper trading, which works like a stock market game. Once you feel comfortable, head to your favorite brokerage to get started. So, let's see, what we have: how to make money in forex without investment? – A layman’s guide at how to do forex trading without investment Contents of the article |

|---|

Comments

Post a Comment