Lot size in forex; What is it and How to calculate it, lot size for $100.

Lot size for $100

A micro lot is a portion of 1000 units of your accounting funding currency. Nano lot is not offered by many forex brokers.

Top forex bonus promo

Lot size in forex – what is it and how to calculate it?

A lot is the smallest trade size that you can place when trading the forex market

What is a lot? A lot is the smallest available trade size that you can place when trading the forex market. The brokers will point to lots by parts of 1000 or a micro lot. You have to know that lot size directly influences the risk you are taking.

Hence, finding the best lot size with a tool like a risk management calculator can help you determine the desired lot size. It has to be based on the size of your accounts. No matter if you exercise or trade for real. You must understand the amount you would able to risk.

In the stock market, lot size refers to the number of shares you buy in one transaction.

In options trading, lot size signifies the total number of contracts contained in one derivative security. The theory of lot size allows financial markets to regulate price quotes.

It basically refers to the size of the trade that you make in the financial market. With the regulation of prices, investors are always aware of exactly how many units they are buying an individual contract. Hence, they can quickly evaluate what is the price they are paying for each unit.

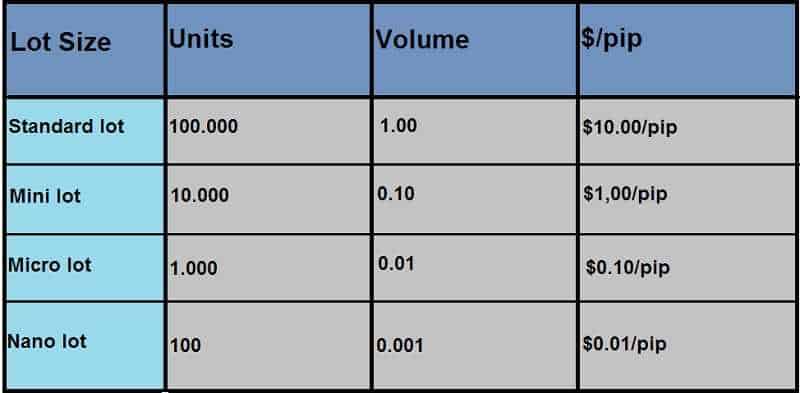

As it is already written in our previous post, currency movements are measured in pips and depending on your lot size a pip movement will have a different monetary value.

How much is 1 lot?

In forex, 1 standard lot refers to the volume of 100.000 units. So when you buy 1 lot of a forex pair, that means you purchased 100.000 units from the base currency.

Assume that you want to buy EUR/USD and let’s say that the EUR/USD exchange rate is 1.10.

When you buy 1 lot of EURUSD you will be making $110.000 worth of purchase.

If you are using leverage on your broker you don’t need to have $110.000. With 1:100 leverage, you will only need $1.100 (110.000 / 100 = $1.100) in order to be able to execute the order.

When the leverage goes higher, the margin you need to open the trade goes lower.

For example, if you are using 1:500 leverage, you need only $220 (110.000 / 500 = $220) to buy 1 standard lot of EUR/USD.

For 1 lot or standard lot, worth of one pip is equal to $10 if USD is on the counter currency in that pair. Therefore, if EUR/USD goes upwards for 100 pips after you buy, you will make $1000 of profit.

Every trader must define the volume of the trades based on own risk perception. The bigger lot means bigger the profit/loss from the trades.

Of course, it is reasonable sometime to open trades under 1 lot using the mini lot, micro lot and nano lot.

Mini lot size

Suppose you are new in forex trading, it is strongly recommended to use mini, micro or nano lots to avoid big losses.

Mini lot is equal to 10% of standard lot (100.000 x 0.10 = 10.000 units). Thus, when you open 0.10 lot, you will trade 1 mini lot. With every mini lot, the worth of 1 pip for EUR/USD equals to $1.

If you are a novice and you want to start trading using mini lots, be well capitalized.

$1 per pip seems like a small amount but in forex trading, the market can move 100 pips in a day, occasionally even in an hour. If the market moves against you, that is a $100 loss. To trade a mini account, you should start with at least $2000.

Micro lot size

Micro lot is equal to %1 of standard lot (100.000 x 0.01 = 1.000 units).

When you trade 0.01 lot of EUR/USD, you buy or sell 1.000 units of EURUSD.

The worth of every 1 pip for EUR/USD is $0.10 if you use a micro lot (0.01).

Micro lots are the smallest tradable lot.

A micro lot is a portion of 1000 units of your accounting funding currency.

If your account is financed in US dollars a micro lot is $1000 worth of the base currency you want to trade. If you are trading a dollar-based pair, 1 pip would be equal to 10 cents.

Micro lots are very good for beginners.

Nano lot size

Nano lot, named cent lot by some forex brokers, is equal to either 100 or 10 units. In some forex brokers, nano lot refers to 10 units while in some other brokers, it may refer to 100 units.

Nano lot is not offered by many forex brokers.

Truly, only a few brokers offer this option as an account type such as FXTM and XM.

Nano lot is the safest way to trade if you are a novice trader or if you want to test a new trading strategy.

You can go through the training process with much less risk and loss.

Also, if you bought a new expert advisor or are trying a new trading strategy, it is smart to use nano lot for the first few weeks. Just in order to avoid big losses.

The bottom line

It is smart to likening the lot size that you trade and how a market move would affect you to the amount of support you have when something suddenly happens.

When you place an extremely large trade size relative to your accounts, you can be faced with many troubles.

Even small movement in the market could send a trader the point of no return.

Forex for beginners

Traders ask about:

- What is FOREX

- Beginner trading

- Forex brokers

- Forex currencies

- Forex indicators

- Forex pivot points

- Forex systems

- Forex technical analysis

- Fundamental analysis

- Leverage and margin

Forex lot sizes and risks

What is lot size and what's the risk?

Currencies in forex are traded in lots.

A standard lot size is 100 000 units.

Units refer to the base currency being traded. For example, with USD/CHF the base currency is US dollar, therefore if to trade 1 standard lot of USD/CHF it would be worth $100 000.

Another example: GBP/USD, here the base currency is british pound(GBP), a standard lot for GBP/USD pair will be worth £100 000.

There are three types of lots (by size):

Standard lots = 100 000 units

mini lots = 10 000 units

and micro lots = 1000 units.

Mini and micro lots are offered to traders who open mini accounts (on average from $200 to $1000). Standard lot sizes can be traded with larger accounts only (the requirements for a size of standard account vary from broker to broker).

The smaller the lots size traded, the lower will be profits, but also the lower will be losses.

When traders talk about losses, they also use term "risks". Because trading in forex is as much about losing money as about making money.

Risks in forex refer to the possibility of losing entire investment while trading. Trading forex is known as one of the riskiest capital investments.

With every standard lot traded (100 000 units) a trader risks to lose (or looks to win) $10 per pip. Where pip is the smallest price increment in the last digit in the rate (e.G. The smallest price change/move).

With every mini lot traded (10 000 units) a trader risks to lose (or looks to win) $1 per pip.

With each micro lot (1000 units) - $0.10 per pip.

In forex traders always search for the most efficient ways to limit risks or at least lessen risk effects. For this purpose various risk management and money management strategies are created.

It is impossible to avoid risks in forex trading. In order to limit risks traders use methods of setting protective stops, trailing stops; use hedging techniques, study scalping strategies, look for the best deals on spreads among brokers etc.

Traders with the best risk management strategy earn the largest profits in forex.

Would you like to add your own comment or ask another question?

Discussions speed up learning. Let's talk.

Where some brokers provide their lot size in the format below.How can i set it to 10,000.

0.01

0.0001

1.0 etc

With every mini lot traded (10 000 units) a trader risks to lose (or looks to win) $1 per pip.

With each mini lot (1000 units) - $0.10 per pip.

Isn't it supposed to be: with each MICRO lot (1000 units) - $0.10 per pip. ?

Yes, should be "micro" there. Thank you.

Don understand this lot thing, can i get detailed explanation

I' also new, when you guys say: 1000 units risk $0.1 per pip, you are assuming that my leverage is 1:100

To the average person;this is a stupid very explanation: pips, units. What is that?

Is there any fixed time limit to sell? How long one can wait for the sell to get profit or sell at no loss?

Pls what does it mean to have traded 40 standard lots for a 400 usd forex accoun

How do I set the lot size to receive $10.00 per pip?

If am trading with $3000 and I risk about 0.20 lot per trade, how much have I invested from my capital.

Thanks

How do I set the lot size to receive $10.00 per pip?

If am trading with $3000 and I risk about 0.20 lot per trade, how much have I invested from my capital.

Thanks > best to start off with a mini lot.

If u wanna knw/share all the info about forex add me on skype. My id is fx.Aarish

While changing the lot size adjusts the pip value, adjusting your stop loss and target price also affects the overall risk of that particular trade. Essentially, without a stop loss, you are risking your whole account. The larger the lot size, the faster you'll blow the account up, or the faster you'll double it.

Still trying to find good tools to calculate risk in metatrader4, but starting to get a feel for it.

For those who trade micro accounts using the metatrader 4 or 5 i will explain how the lot size goes. You would see a 0.01 format under lot size (some brokers use this format) what this really means is that you are trading at 1000 units which will mean $0.10 per pip. A pip is a price movement from one price to another so if the price of the EUR/USD was 1.4600 and it moved 5 pips upward the new price should be 1.4605, however if it moves 5 pips downward it should 1.4595. Prices move on a vertical scale (UP or DOWN) and therefore it all comes down to either buying the currency or selling it, plain and simple.

Here is further breakdown of the lot size, units traded and amount risked

0.02 - 2000 units - $0.20

0.03 - 3000 units - $0.30

0.04 - 4000 units - $0.40

0.05 - 5000 units - $0.50

1.00 - 10000 units - $1

2.00 - 20000 units - $2

3.00 - 30000 units - $3

I see this an old post but I am sure other new traders will come across this so I thought I would write this to try to help about your risk!

Basically 1 lot = $100.000 dollars or pounds depending on what the base currency is.

If you trade one lot $100.000 you risk to lose or profit $10 per pip.

If you trade one mini lot $10.000 you risk to lose or profit $1 per pip

if you trade one micro lot $1000 you risk to lose or profit $0.10 per pip

A good rule is not to risk more than 2% of your equity in your accounton any one trade.

If you have an acoount with $10.Ooo and trade one lot you would not want to risk any more than 2% which = $200 dollers so that gives you a 20 pip loss or profit at 1:100 levarage

So if you have a mini account and have $1000 dollers you would only have $20 dollers to risk so with a full lot that is two pips. Just dont do it you will lose your money in no time unless you win every trade which wont happen. You need to trade 1 mini lot which you can risk $20 and have a spread of 20 pips. And win or lose 1 doller a pip. It is not unuasal for a good patient trader to do 200 pips a week at a steady pace. Thats a 20% return on your account which is higher than most hedge fund managers .. Obviosly they deal in millions but the moral is all about % percantage return of your total equity.. Good luck pips.

If you want a good broker and you are in the uk .. Barx direct fx.. Min deposit 5000 pounds or fxpro ecn platform 1000 pounds min deposit.

Keep to this startergy ubtil you are in continuios profit and build up your account.

I want to start trading with $1000, what type of lot should i use? Can u help me.

Thanks

Thread: what is the best lot size for $100? (part 2)

Thread: what is the best lot size for $100? (part 2)

Thread tools

Search thread

Display

What is the best lot size for $100? (part 2)

I think forex is very hard and risky business in the world.So we need to huge capital for forex trade.As your capital is 100$,so you can easily trade as .10.Then you can easily success in forex business.

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

2 users say thank you to tajmilur for this useful post.

This capital not poor but it enough to make more money but you must walk at good strategy to make more money after training at demo and see yourself very good after that you can put 0.5 for size even if the market change no dangerous happen to your capital

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Money management is the most important thing in forex market. You have to make a good money management based on your amount. So try to make a good money management and you will understand what lot size will be perfect for you.

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Forex is financial online trading systems business platform. So, trading lot size is a important matter of this market. For safety account and comfortable trade. If your trading balance is $ 100 then the best lot is 0.10 in instaforex, and others brokers lot size is 0.01 .

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Yes this is very important that choosing good volume size by comparing capital size then if you have 100 dollar balance then you should start trading with 0.25 lot size without any fear of loss for both technical and fundamental trading .

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

In my point of view for capital 100$ you should trade not more than 0.2 lot or volume. Because it is risky for your capital. Any parson strata real market trading save or oldsmobile volcanism used save tropics is the best lot size for 100$ market forex trader straightway.

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Actually forex trading is huge profit able business, but 0nly 100$ capital not good, but we first time doing properly practice demo trading and good trading skill, than we doing 0.05 sent start trade and some earning easily.

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Money management is also a very important factor for trade because if we don't manage our capital then our capital may destroy within an hour so for the protection of our capital we set the volume as lot size , for $100 we set 1 lot size for better profit and 0.05 for low profit .

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

The following user says thank you to shyammandal for this useful post:

I think 0.04$ is very safe lot size for you. Cause there are a rules for take lot size and that is capital/3000. I am always follow this rules. I hope you can also follow this rules without any fear.

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

According to me the best lot size for 100$ is 0.50 and i also use this lot size when i have such balance so keep working and keep earning profits from forex trading business wish you best of luck and successful trading

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

How to calculate lot size in forex? – lot size calculator

How to determine position size when forex trading

For a foreign exchange (forex) trader, the trade size or position size decides the profit he makes more than the exit and entry points while day trading forex. Even if the trader has the best forex trading strategy, he takes too little risk or too much risk if the trade size is very small or huge. Traders should avoid taking too much risk since they will lose all their money. Some tips on how the trader should determine position size are provided.

Lot size in forex trading

What is lot size in currency trading?

What is a lot in forex? Lot in forex represents the measure of position size of each trade. A micro-lot consists of 1000 units of currency, a mini-lot 10.000 units, and a standard lot has 100,000 units. The risk of the forex trader can be divided into account risk and trade risk. All these factors are considered to determine the right position size, irrespective of the market conditions, trading strategy, or the setup.

Now let us define a standard lot.

What is the standard lot size in forex?

The standard forex size lot is 100,000 units of currency. Usually, brokers represent forex lot size with currency units. For example, 5 lots are 500 000 currency units.

In this video, we will see lot size forex trading example:

How to calculate lot size in forex?

Forex lot size can be calculated using input values such as account balance, risk percentage, and stop loss. In the first step, the trader needs to define a risk percentage for trade and then define stop loss and a dollar per pip. A trader needs to determine lot size (number of units) for currency pair in the last step.

Determine the risk limit for each trade

Most traders consider specifying the dollar amount or percentage limit risked on each trade as the most crucial step in determining the forex position’s size. Lot size forex calculation is simply because professional and experienced traders will usually risk a maximum of 1% of their account in trade; usually, the amount is lower. While the other trading variables may change depending on the trade, most traders will keep the percentage they risk on the trade constantly, though the amount risked for the trade may be reduced if it exceeds the 1 percent limit.

(max risk per trade position should be 1%-2%)

Determine dollar per pip

A pip is an abbreviation for price interest point or the percentage in point, which is the lowest unit for which the currency price will change. When currency pairs are considered, the pip is 0.0001 or one-hundredth of a percent. However, if the currency pair includes the japanese yen, the pip is one percentage point or 0.01. Some brokers show prices with an additional decimal place, and this fifth decimal place is called a pipette. In the case of the japanese yen, the third place is the pipette. M the pip risk for each trade is calculated as the difference between the point where the stop-loss order is placed and the entry point.

A stop-loss will close a trade when it is losing a specified amount. Traders use this to ensure that their loss does not exceed the account’s loss risk. The stop-loss level also depends on the pip risk for a specific trade. The volatility and strategy are some factors that determine pip risk. Though traders would like to ensure that their stop loss is as close to the entry point as possible, keeping it too close may end the trade before the expected forex rate movement occurs.

Determine forex lot size position

In a currency pair that is being traded, the second currency is called the quote currency. If the trading account is funded with the quote currency, the pip values for various lot sizes are fixed at 0.0001 of the lot size. Usually, the forex trading account is funded in US dollars. So if the quote currency is not the dollar, the pip value will be multiplied by the exchange rate for the quote currency against the US dollar.

What information do we need to make a forex position size calculator formula?

Let us repeat all steps once time more:

Account currency: USD

account balance: $5000 for example

risk percentage: 1% for example

stop loss: 200 pips, for example

currency: EURUSD

How to find a lot of size in trading? In the first step, we need to calculate risk in dollars, then calculated dollars per pip, and in the last step, calculate the number of units.

Step 1: calculate risk in dollars.

Calculate risk percentage from account balance: 1% for $5000 is : $5000/100=$50.

$50 is 1% of $5000.

Step 2: calculate dollars per pip

(USD 50)/(200 pips) = USD 0.25/pip

Step 3: calculate the number of units

USD 0.25 per pip * 10 000 = 2,500 units of EUR/USD

For 5 digits brokers, we use 10 000 as a multiplicator.

2.5 micro lots or 0.25 mini lots is the final answer. Technically, it is 2 micro lots because most brokers do not allow trading less than micro-lots.

In the end, here, you can use the position size calculator.

Lot size calculator

The lot size forex calculator is represented below. You can use to calculate forex lot position size:

The risk you can define either using % or either using risk in dollars.

Forex lot size vs. Leverage

The terms used by participants in the forex market can be confusing for novice traders. But everyone who comes to the exchange to earn money should understand these concepts. Below we will look at such key concepts as leverage and lot size on forex, and find out what pips are.

The article covers the following subjects:

Leverage and lots in forex

Leverage vs lot size are different concepts on forex, but there is a certain connection between them. Let's figure out what are leverage and lots means.

Leverage means that the trader borrows funds from their forex broker or a related third party. With this financial support, they can open trades more effectively than without leverage.

Now let's define the concept of lot on forex.

Lot is a contract measured in base currency units. So the number of lots or portions of a lot determines the size of the opened trade.

The trader sets the volume in contracts when opening a position. Its value can be from 0.01 to 100.

It is important for beginners on forex to remember the connection between the concepts of forex lot size and leverage.

Leverage actually doesn’t affect the size of the contract and its price. However, the concept of leverage plays a significant role in determining the size of a trader's position. The greater the leverage, the more a trader can afford to buy or sell large lots in quantities that are many times greater than their own funds.

What are the pips?

Above we have discussed what lot and leverage are. The connecting link between these two concepts is a pip (short for percentage in point). It represents the minimum fraction of the change in the value of a trading instrument.

In other words, a pip is the standard smallest unit of measure by which a currency quote can change. On the foreign exchange market, 1 pip is usually equal to $0.00001 in pairs with the US dollar.

Oil and stocks, for example, have two characters after the decimal point. So the last (second after the decimal point) figure is a pip for these assets.

Let's look at the concept of a pip through an example. This way we can clearly see the relationship between lot size and leverage on forex. Suppose we have a direct quote of EURUSD at 1.18699. This means that 1 euro is worth 1.18699 USD.

If this quotation grew by one point (up to 1.18700), the value of 1 US dollar would decrease relative to the euro, since now you have to pay 0.00001 USD more for 1 euro.

Even 1 pip of price change has a direct impact on the final value of the trade.

The standard size of one contract for most brokers is 100,000 units. 1 unit of EURUSD will be equal to 1.18699 USD.

Suppose an investor buys 0.1 lots, hence the contract size will be $11,869.9 (100,000 * 0.1 * 1.18699). Suppose the exchange rate of this pair increases by one pip. Then the price of the contract of the same size will be equal to $11,870.0.

So the cost of 1 pip with a 0.1 contract will be equal to 0.1 USD.

An investor can buy much more with leverage. Suppose that our trader uses a 1:100 leverage and can increase the position by 100 times – they will not buy 0.1, but 10 lots. With such a large position, the cost of 1 pip will be 10 USD.

This example clearly shows how leverage affects the value of a pip through trade size. The more leverage, the larger position a trader can open. The larger the position, the higher the value of one point.

What is lot size

Now let's expand our knowledge of lot sizes. We mostly encounter four varieties.

Number of units

Mini (1/10 of standard lot)

Micro (1/100 of standard lot)

Nano (1/1000 of standard lot)

Standard lot is perhaps the most common type of contract on the forex market and among brokers.

Mini lot is called fractional, it is equal to 1/10 of the standard lot size. It’s much less used than the standard lot. This type of contract is mostly used when trading contracts for cryptocurrency. Sometimes it can be encountered when trading on the metals market.

Micro lot is an even rarer on the forex market. This fractional contract is more common among forex brokers that provide access to CFD trading for cryptocurrencies and metals.

Nano lot is mostly found on the markets for raw materials, metals, and cryptocurrencies. This type of contract is extremely rare on the foreign exchange market.

Important! The size of one lot expressed in base units is usually not determined by the client, but by the requirements of the liquidity provider.

We can see through the example of liteforex that there are completely different lot sizes for different asset groups and types of trading instruments. Liteforex uses a standard lot of 100,000 units for currency pairs and a nano lot for gold. If you look at the cryptocurrencies, liteforex offers its clients to trade bitcoin and ethereum in lots of only 1 unit! Detailed information on contract sizes for each trading instrument can be found here.

It should be remembered that the cost of a position depends not only on the number of units in the contract but also on the value of the underlying asset or currency in which these units are expressed.

In the example above, we counted 0.1 lots for the EURUSD pair as 10,000 euro units denominated in dollars. Other instruments are calculated by the same principle.

For example, a position in XAUUSD with a lot of 100 units will be equal to 100 troy ounces in US dollars.

In the same way, for 1 GBPJPY contract equal to 100,000 units, the trade value will be 100,000 british pounds against the japanese yen.

What does all this mean for the forex market participant? Only that by buying cross rates (currency pairs that are not quoted against the US dollar), you are not only betting that the quoted instrument will grow, but also that the value of the quote currency will fall.

It is important for every trader and investor to know all the details of trading a specific instrument.

You can find the most detailed information about each asset in the trader's personal account. It’s accessible even without registration. To do this, go to the "trade" section, select the desired trading instrument, click on "instrument information" and scroll down to the "additional information" widget.

In addition to information about the lot, you can see a lot of useful data there:

The cost of one pip when buying 1 contract for this instrument.

Quoted currency - the monetary unit in which the quote price is expressed. It always comes second in the designation of the pair. So it’s pretty easy to identify. Stocks, oil, indices have no quotation currency in the name of the asset. You can find information on how the asset is denominated in the section “information about instrument”.

Base currency is the currency in which the contract price is expressed and which is traded in relation to the quoted currency.

Size of 1 lot and the currency it is expressed in for this asset. This currency is usually called the base currency.

Leverage set up on your account. If the broker has a leverage set for an asset in the form of % of the margin, you will also see the leverage it corresponds to.

The size of the buy and sell swap and the day of the triple swap. Swap is an overnight fee.

What is leverage

Leverage is a concept very closely related to margin. It is a financial tool that allows traders to trade a much larger position than their own trading account size allows.

You have deposited 5,000 USD to your balance. You have chosen to use 1:20 leverage. Therefore, you can open positions for a total amount of 20 times your account = 100,000 USD.

Want to know more about leverage and how it works? Then read this complete beginner's guide here.

Differences & relationship between leverage and lot size in forex

As we now know, leverage and lot size in forex are different concepts.

Let's emphasize again: leverage does not affect the value of one contract. The standard contract in currency will be one hundred thousand units at any leverage.

However, leverage affects the amount of funds at the trader's disposal. In order to see how the size of the forex lots and leverage affect the real value of the trade, let’s look at the calculation formulas with and without leverage.

With leverage, the trade value will be equal to the amount of margin.

So we see that the size of the contract is directly proportional to the value of the trade. This means with an increase in the size of the lot or its quantity, the value of the trade also increases.

The leverage ratio is inversely proportional to the value of the trade and with an increase in the amount of leverage, the value of the trade decreases.

Important: there are different recommendations for using leverage for different types of trading instruments, depending on the conditions of the liquidity provider the broker works with.

The liteforex broker uses leverage for metals, oil, indices, cryptocurrencies, and stocks. This is a decrease in the trade value by setting the percentage of the margin with. You can find this parameter in the specification of a trading instrument.

For currency pairs, the leverage is set by the trader.

So in order to open a position, depending on the asset, you need either a percentage of its actual value or the amount divided by the leverage set by the trader in their account settings:

The principles behind lots trading and pips calculation

What you will learn:

- Lot definition

- Different lot sizes explained

- USD and EUR practical illustrations

- The correlation between margin and leverage

- Understanding the intrigues in margin call calculation

What is a lot size in forex?

In forex trading, a standard lot refers to a standard size of a specific financial instrument. It is one of the prerequisites to get familiar with for forex starters.

Standard lots

This is the standard size of one lot which is 100,000 units. Units referred to the base currency being traded. When someone trades EUR/USD, the base currency is the EUR and therefore, 1 lot or 100,000 units worth 100,000 eurs.

Mini lots

Now, let’s use smaller sizes. Traders use mini lots when they wish to trade smaller sizes. For example, a trader may wish to trade only 10,000 units. So when a trader places a trade of 0.10 lots or 10,000 base units on GBP/USD, this means that he trades 10,000 british pounds.

Micro lots

There are many beginners or small investors who wish to use the smallest possible lots sizes. In contrary to the mini lots that refer to 10,000 units, traders are welcome to trade 1,000 units or 0.01. For example, when someone trades USD/CHF with a micro lot the trader basically trades 1,000 usds.

Pip value

Now that we understand what lots are, let’s take one step further. We need to calculate the pip value so we can estimate our profits or losses from our trading.

The simplest way to calculate the pip value is to first use the standard lots. You will then have to adjust your calculations so you can find the pip value on mini lots, micro lots or any other lot size you wish to trade.

USD base currency

Our calculations in this sector are when your base currency is the USD. We will provide three different examples.

USD quote currency of the currency pair. You’re trading 1 standard lot (100,000 base units) that the quote currency is the USD such as EUR/USD. The pip value is calculated as below:

100,000*0.0001 (4th decimal)=$10

USD base currency of the currency pair. You’re trading 1 standard lot (100,000 base units) and the base currency is the USD such as USD/JPY. The pip value is calculated as below:

The USD/JPY is traded at 99.735 means that $1=99.73 JPY 100,000*0.01 (the 2nd decimal) /99.735≈$10.03. We approximated because the exchange rate changes, so does the value of each pip.

Finding the pip value in a currency pair that the USD is not traded. You’re trading 1 standard lot (100,000 base units) on GBP/JPY.

The GBP/JPY is traded at 153.320. Because the value changes in the quote currency times the exchange rate ratio as

The pip value => 100,000*0.01JPY*1GBP/153.320JPY = 6.5 GBP

Because the base currency of the account is the USD then we need to take into account the GBP/USD rate which let’s assume that is currently at 1.53560.

6.5 GBP/(1 GBP/1.53560 USD)= $9.98

EUR base currency

Now let’s make our examples when the base currency of our account is the EUR

EUR base currency of the currency pair. You’re trading 1 standard lot (100,000 base units) on EUR/USD. The pip value is calculated as below

The EUR/USD is traded at 1.30610 means that 1 EUR=$1.30 USD so

100,000*0.0001 (4th decimal)/1.30610 ≈7.66 EUR

Finding the pip value in a currency pair that the EUR is not traded. You’re trading 1 standard lot (100,000 base units) on GBP/JPY. From our example before, we know that the value is 6.5 GBP. Now, we need to take into account the EUR/GBP rate in order to calculate the pip value. Let’s assume that the rate is currently at 0.85000. So:

6.5GBP/(1GBP*0.85 EUR)= (6.5 GBP/1 GBP)/0.85 EUR≈7.65 EUR

Leverage – how it works

You are probably wondering how can I trade with lot sizes of 100,000 base units or even 1,000 base units. Well, the answer is very simple. This is available to you from the leverage you have in your account. So let’s assume that your account’s leverage is set at 100:1. This means that for every $1 used, you’re actually trading $100 in the forex market. In order for you to trade a position of $100,000 then the required margin to open such a position will be $1,000. As for any losses or gains these will be deducted or added to the remaining balance in your account.

If your account’s leverage is set at 200:1 this means that for every $1 you use you’re actually trading $200. So for a trade of $100,000 you will require a margin to be at $500.

Margin call – what you should know

Now looking at the examples above regarding the leverage you’re probably thinking that is the best to work with the highest possible leverage. However, you need to take into consideration your margin requirements as well as the risks associated with higher leverages.

Let’s just say that you have deposited first $5,000 to your trading account that the leverage is set at 100:1. Your nominated currency is the USD. The first time you will login to your MT4 trading account you will notice that the balance and the equity is $5,000 and this is due to the fact that you did not place any trades yet.

Now, you have decided to open a position on the USD/CHF of the 1 standard lot which means that you will require use a margin of $1,000. The floating P/L is at -9.55. The account will show the following

| balance | equity | margin | free margin | margin level |

|---|---|---|---|---|

| 5,000 | 4,990.45 (5,000-9.55) | 1,000 | 3,990.45 (4,990.45-1000) | 499.05% (4990.45/1000)*100 |

If your forex broker margin call level is set at 100% this means that when the margin level reaches this percentage it will notify you to add more funds. As you can understand from the example above, the P/L, and your margin will affect your margin level. Now, if your broker sets the stop out level at 50% this means that your position will be closed by the broker when the margin level reaches that level.

Let’s use another example when your leverage is set at 200:1. We will use the same example above to understand how the leverage will affect your margin level. Your account will show the following

By looking at the numbers above, you will prefer to use a higher leverage for your account. However, let’s assume that the market goes against you and you have bought 9 lots of USD/CHF but the pair falls. When you open your position you will have the following numbers:

As we explained above, the broker will give you a margin call when you have 100% margin level. This means that you will receive a margin call when the USD/CHF falls 5 pips only. On the other hand, if you had a leverage set at 100:1 the would not allow you to enter into such a position from the first place and you would have saved your equity.

What is a lot in forex?

Forex is commonly traded in specific amounts called lots, or basically the number of currency units you will buy or sell.

A “lot” is a unit measuring a transaction amount.

When you place orders on your trading platform, orders are placed in sizes quoted in lots.

It’s like an egg carton (or egg box in british english). When you buy eggs, you usually buy a carton (or box). One carton includes 12 eggs.

The standard size for a lot is 100,000 units of currency, and now, there are also mini, micro, and nano lot sizes that are 10,000, 1,000, and 100 units.

| Lot | number of units |

|---|---|

| standard | 100,000 |

| mini | 10,000 |

| micro | 1,000 |

| nano | 100 |

Some brokers show quantity in “lots”, while other brokers show the actual currency units.

To take advantage of this minute change in value, you need to trade large amounts of a particular currency in order to see any significant profit or loss.

Let’s assume we will be using a 100,000 unit (standard) lot size. We will now recalculate some examples to see how it affects the pip value.

- USD/JPY at an exchange rate of 119.80: (.01 / 119.80) x 100,000 = $8.34 per pip

- USD/CHF at an exchange rate of 1.4555: (.0001 / 1.4555) x 100,000 = $6.87 per pip

In cases where the U.S. Dollar is not quoted first, the formula is slightly different.

- EUR/USD at an exchange rate of 1.1930: (.0001 / 1.1930) X 100,000 = 8.38 x 1.1930 = $9.99734 rounded up will be $10 per pip

- GBP/USD at an exchange rate of 1.8040: (.0001 / 1.8040) x 100,000 = 5.54 x 1.8040 = 9.99416 rounded up will be $10 per pip.

| Pair | close price | pip value per: | ||||

|---|---|---|---|---|---|---|

| unit | standard lot | mini lot | micro lot | nano lot | ||

| EUR/USD | any | $0.0001 | $10 | $1 | $0.1 | $0.01 |

| USD/JPY | 1 USD = 80 JPY | $0.000125 | $12.5 | $1.25 | $0.125 | $0.0125 |

Your broker may have a different convention for calculating pip values relative to lot size but whatever way they do it, they’ll be able to tell you what the pip value is for the currency you are trading at that particular time.

In other words, they do all the math calculations for you!

As the market moves, so will the pip value depending on what currency you are currently trading.

What the heck is leverage?

You are probably wondering how a small investor like yourself can trade such large amounts of money.

Think of your broker as a bank who basically fronts you $100,000 to buy currencies.

All the bank asks from you is that you give it $1,000 as a good faith deposit, which it will hold for you but not necessarily keep.

Sounds too good to be true? This is how forex trading using leverage works.

The amount of leverage you use will depend on your broker and what you feel comfortable with.

Typically the broker will require a deposit, also known as “margin“.

Once you have deposited your money, you will then be able to trade. The broker will also specify how much margin is required per position (lot) traded.

No problem as your broker would set aside $1,000 as a deposit and let you “borrow” the rest.

Of course, any losses or gains will be deducted or added to the remaining cash balance in your account.

The minimum security (margin) for each lot will vary from broker to broker.

In the example above, the broker required a 1% margin. This means that for every $100,000 traded, the broker wants $1,000 as a deposit on the position.

Let’s say you want to buy 1 standard lot (100,000) of USD/JPY. If your account is allowed 100:1 leverage, you will have to put up $1,000 as margin.

The $1,000 is NOT a fee, it’s a deposit.

You get it back when you close your trade.

The reason the broker requires the deposit is that while the trade is open, there’s the risk that you could lose money on the position!

Assuming that this USD/JPY trade is the only position you have open in your account, you would have to maintain your account’s equity (absolute value of your trading account) of at least $1,000 at all times in order to be allowed to keep the trade open.

If USD/JPY plummets and your trading losses cause your account equity to fall below $1,000, the broker’s system would automatically close out your trade to prevent further losses.

This is a safety mechanism to prevent your account balance from going negative.

Understanding how margin trading works is so important that we have dedicated a whole section to it later in the school.

It is a must-read if you don’t want to blow up your account!

How the heck do I calculate profit and loss?

So now that you know how to calculate pip value and leverage, let’s look at how you calculate your profit or loss.

Let’s buy U.S. Dollars and sell swiss francs.

- The rate you are quoted is 1.4525 / 1.4530. Because you are buying U.S. Dollars you will be working on the “ASK” price of 1.4530, the rate at which traders are prepared to sell.

- So you buy 1 standard lot (100,000 units) at 1.4530.

- A few hours later, the price moves to 1.4550 and you decide to close your trade.

- The new quote for USD/CHF is 1.4550 / 1.4555. Since you initially bought to open the trade, to close the trade, you now must sell in order to close the trade so you must take the “BID” price of 1.4550. The price that traders are prepared to buy at.

- The difference between 1.4530 and 1.4550 is .0020 or 20 pips.

- Using our formula from before, we now have (.0001/1.4550) x 100,000 = $6.87 per pip x 20 pips = $137.40

Bid/ask spread

Remember, when you enter or exit a trade, you are subject to the spread in the bid/ask quote.

When you buy a currency, you will use the offer or ASK price.

When you sell, you will use the BID price.

Next up, we’ll give you a roundup of the freshest forex lingos you’ve learned!

Understanding lot sizes & margin requirements when trading forex

Historically, currencies have always been traded in specific amounts called lots. The standard size for a lot is 100,000 units. There are also mini-lots of 10,000 and micro-lots of 1,000.

To take advantage of relatively small moves in the exchange rates of currency, we need to trade large amounts in order to see any significant profit (or loss).

| Lot | number of units |

| standard | 100,000 |

| mini | 10,000 |

| micro | 1,000 |

As we have already discussed in our previous article, currency movements are measured in pips and depending on our lot size a pip movement will have a different monetary value.

So looking at an order window below we see that we have chosen to BUY a mini-lot of 10,000 units of the EURUSD. So what we are effectively doing is buying €10,000 worth of US dollars at the exchange rate 1.35917. We are looking for the exchange rate to rise (i.E. The euro to strengthen against the US dollar) so we can close out our position for a profit.

So let’s say the exchange rate moves from 1.35917 to 1.36917 –the exchange rate rose by 1c ($). This is the equivalent of 100 pips.

So with a lot size 10,000, each pip movement is $1.00 profit or loss to us (10,000* 0.0001 = $1.00).

As it moved upwards by 100 pips we made a profit of $100.

For example’s sake, if we opened a one lot size for 100,000 units we would have made a profit of $1,000.

Therefore lot sizes are crucial in determining how much of a profit (or loss) we make on the exchange rate movements of currency pairs.

We do not have to restrict ourselves to the historical specific amounts of standard, mini and micro. We can enter any amount we wish greater than 1,000 units. 1,000 units is the minimum position size we can open. So for example, we can sell 28,000 units of the GBPJPY currency pair at the rate of 156.016. Each pip movement is ¥ 280 (28,000 * 0.01). We then take our ¥ 280 per pip and change it to the base currency of our account which of course our broker does automatically. So with a euro-denominated account a fall of 50 pips to 155.516 would mean a profit of 106.00 (50* 2.12).

What is leverage & margin?

Trading with leverage allows traders to enter markets that would be otherwise restricted based on their account size. Leverage allows traders to open positions for more lots, more contracts, more shares etc. Than they would otherwise be able to afford. Let’s consider our broker a bank that will front us $100,000 to buy or sell a currency pair. To gain access to these funds they ask us to put down a good faith deposit of say $500 which they will hold but not necessarily keep. This is what we call our margin. For each position and instrument we open, our broker will specify a required margin indicated as a percentage. Margin can, therefore, be considered a form of collateral for the short-term loan we take from our broker along with the actual instrument itself. For example, when trading FX pairs the margin may be 0.5% of the position size traded or 200:1 leverage. Other platforms and brokers may only require 0.25% margin or 400:1 leverage.

The margin requirement is always measured in the base currency i.E. The currency on the left of the FX pair

Let’s look at an example. Say we are using a dollar platform and we wanted to buy a micro lot (1,000 units) of the EUR/GBP pair and our broker was offering us 200:1 leverage or 0.5% required margin.

Our broker will, therefore, take just €5 as margin and we were able to buy 1,000 units of the EUR/GBP pair. If we were using a US dollar platform that €5 is automatically converted to dollars by our broker at the current exchange rate for the EUR/USD.

| Trade type | buy |

| instrument | EURGBP |

| trade size | 1,000 units |

| margin requirement (leverage) | 0.5% (200:1) |

| used margin for trade | €5 (or $6.75 @ EURUSD rate of 1.3500) |

Another example:

Say we wanted to sell 50,000 units of the USD/ JPY and we are using a euro platform and our broker was offering us 400:1 leverage or 0.25% required margin. Our broker will, therefore, take $125 from our balance as our margin requirement and we are able to sell 50,000 units of the USD/JPY.

This time we are using a euro platform so that $125 is converted to euro at the current EUR/USD exchange rate.

| Trade type | sell |

| instrument | USDJPY |

| trade size | 50,000 units |

| margin requirement (leverage) | 0.25% (400:1) |

| used margin for trade | $125 (or €96 @ EURUSD rate of 1.3000) |

Overnight premiums/swaps

When an FX position (or a CFD position) is held overnight (or ‘rolled over’) there is a charge known as a ‘swap’ or ‘overnight premium’. We call it a charge; however, it is possible to earn a positive sum each night too. When trading FX, it is based on the interest rates of the currencies we are buying and selling.

So for example, if we were buying the AUD/CHF we would earn a positive overnight sum as we would earn interest on the australian dollars we bought as the australian interest rate is higher than the swiss interest rate (in fact the swiss interest rate is zero). So often buying currencies against the swiss franc will result in a positive swap.

For the most part, however, an overnight premium will be a charge on our account and again this relates to the size of our position. The actual percentage is very small each night as it is the annual interest rate divided by 360 (days in a year). Our broker automatically calculates overnight premiums and they usually take effect after 10 pm GMT. Under the trading conditions, most brokers will stipulate the swap rates for a buy or sell position on each pair. We multiply this rate by our trade size and divide by 360 like the formula above to know what premium we are charged or we earn.

Trading scenario: what happens if you trade with just $100?

What happens if you open a trading account with just $100?

Or €100? Or £100?

Since margin trading allows you to open trades with just a small amount of money, it’s certainly possible to start trading forex with a $100 deposit.

But should you?

Let’s see what can happen if you do.

In this trading scenario, your retail forex broker has a margin call level at 100% and a stop out level at 20%.

Now that we know what the margin call and stop out levels are, let’s find out if trading with $100 is doable.

If you have not read our lessons on margin call and stop out levels, hit pause on this lesson and start here first!

Step 1: deposit funds into trading account

You now have an account balance of $100.

This is how it’d look in your trading account:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – |

Step 2: calculate required margin

You want to go short EUR/USD at 1.20000 and want to open 5 micro lots (1,000 units x 5) position. The margin requirement is 1%.

How much margin (“required margin“) will you need to open the position?

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,000.

Now we can calculate the required margin:

Assuming your trading account is denominated in USD, since the margin requirement is 1%, the required margin will be $60.

Step 3: calculate used margin

Since we just have a SINGLE position open, the used margin will be the same as required margin.

Step 4: calculate equity

Let’s assume that the price has moved slightly in your favor and your position is now trading at breakeven.

This means that your floating P/L is $0.

Let’s calculate your equity:

The equity in your account is now $100.

Step 5: calculate free margin

Now that we know the equity, we can now calculate the free margin:

The free margin is $40.

Step 6: calculate margin level

Now that we know the equity, we can now calculate the margin level:

The margin level is 167%.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | – | $100 | – | |||||

| short | EUR/USD | 6,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

EUR/USD rises 80 pips!

EUR/USD rises 80 pips and is now trading at 1.2080.

Used margin

You’ll notice that the used margin has changed.

Because the exchange rate has changed, the notional value of the position has changed.

This requires recalculating the required margin.

Whenever there’s a change in the price for EUR/USD, the required margin changes!

With EUR/USD now trading at 1.20800 (instead of 1.20000), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,040.

Previously, the notional value was $6,000. Since EUR/USD has risen, this means that EUR has strengthened. And since your account is denominated in USD, this causes the position’s notional value to increase.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Since the margin requirement is 1%, the required margin will be $60.40.

Previously, the required margin was $60.00 (when EUR/USD was trading at 1.20000).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has risen from 1.20000 to 1.2080, a difference of 80 pips.

Since you’re trading micro lots, a 1 pip move equals $0.10 per micro lot.

Your position is 5 micro lots, a 1 pip move equals $0.50.

Since you’re short EUR/USD, this means that you have a floating loss of $40.

Equity

Your equity is now $60.

Free margin

Your free margin is now $0.

Margin level

Your margin level has decreased to 99%.

The margin call level is when margin level is 100%.

Your margin level is still now below 100%!

At this point, you will receive a margin call, which is a WARNING.

Your positions will remain open BUT…

You will NOT be able to open new positions as long unless the margin level rises above 100%.

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.2080 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

EUR/USD rises another 96 pips!

EUR/USD rises another 96 pips and is now trading at 1.2176.

Used margin

With EUR/USD now trading at 1.21760 (instead of 1.20800), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,088.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Previously, the required margin was $60.40 (when EUR/USD was trading at 1.20800).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has now risen from 1.20000 to 1.217600, a difference of 176 pips.

Since you’re trading 5 micro lots, a 1 pip move equals $0.50.

Due to your short position, this means that you have a floating loss of $88.

Equity

Your equity is now $12.

Free margin

Your free margin is now –$48.88.

Margin level

Your margin level has decreased to 20%.

At this point, your margin level is now below the stop out level!

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

Stop out!

The stop out level is when the margin level falls to 20%.

At this point, your margin level reached the stop out level!

Your trading platform will automatically execute a stop out.

This means that your trade will be automatically closed at market price and two things will happen:

- Your used margin will be “released”.

- Your floating loss will be “realized”.

Your balance will be updated to reflect the realized loss.

Now that your account has no open positions and is “flat”, your free margin, equity, and balance will be the same.

There is no margin level or floating P/L because there are no open positions.

Let’s see how your trading account changed from start to finish.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $10,000 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

| – | $12 | – | $12 | $12 | – |

Before the trade, you had $100 in cash.

Now after just a SINGLE TRADE, you’re left with $12!

Not even enough to pay for one month of netflix!

You’ve lost 88% of your capital.

And with EUR/USD moving just 176 pips!

Moving 176 pips is nothing. EUR/USD can easily move that much in a day or two. (see real-time EUR/USD volatility on marketmilk™)

Congratulations! You just blew your account! ��

Since your account balance is too low to open any new trades, your trading account is pretty much dead.

So, let's see, what we have: what is lot size in forex? Simply, it is a minimum amount the forex trader can order when trading the forex market. But there is the maximum size, also >> at lot size for $100

Contents of the article

- Top forex bonus promo

- Lot size in forex – what is it and how to calculate it?

- A lot is the smallest trade size that you can place when...

- How much is 1 lot?

- Mini lot size

- Micro lot size

- Nano lot size

- Forex for beginners

- Traders ask about:

- Forex lot sizes and risks

- What is the best lot size for $100? (part 2)

- 2 users say thank you to tajmilur for this useful post.

- The following user says thank you to shyammandal for this...

- Lorem ipsum dolor sit amet, consectetur adipiscing elit,...

- Lorem ipsum dolor sit amet, consectetur adipiscing elit,...

- Lorem ipsum dolor sit amet, consectetur adipiscing elit,...

- How to calculate lot size in forex? – lot size calculator

- Lot size in forex trading

- Lot size calculator

- Forex lot size vs. Leverage

- Leverage and lots in forex

- Differences & relationship between leverage and lot size in...

- The principles behind lots trading and pips calculation

- What you will learn:

- What is a lot size in forex?

- Standard lots

- Mini lots

- Micro lots

- Pip value

- USD base currency

- 100,000*0.0001 (4th decimal)=$10

- The pip value => 100,000*0.01JPY*1GBP/153.320JPY = 6.5 GBP

- 6.5 GBP/(1 GBP/1.53560 USD)= $9.98

- EUR base currency

- 100,000*0.0001 (4th decimal)/1.30610 ≈7.66 EUR

- 6.5GBP/(1GBP*0.85 EUR)= (6.5 GBP/1 GBP)/0.85 EUR≈7.65 EUR

- Leverage – how it works

- Margin call – what you should know

- What is a lot in forex?

- What the heck is leverage?

- How the heck do I calculate profit and loss?

- Understanding lot sizes & margin requirements when trading...

- Trading scenario: what happens if you trade with just $100?

- Step 1: deposit funds into trading account

- Step 2: calculate required margin

- Step 3: calculate used margin

- Step 4: calculate equity

- Step 5: calculate free margin

- Step 6: calculate margin level

- EUR/USD rises 80 pips!

- EUR/USD rises another 96 pips!

- Stop out!

Comments

Post a Comment