Best Forex Brokers in India 2021, best forex brokers for iranian.

Best forex brokers for iranian

The leverage available at forex.Com ranges from 0.5% to 20%, depending upon currency pairs.

Top forex bonus promo

Fxpro is best for forex and CFD traders who want a wealth of choices in trading markets. Their range of forex pairs and the ability to trade equity indices, cryptocurrencies, commodities, and futures set them above competitors in the space. Fxpro competes among the top metatrader brokers, offering the full suite of MT4 and MT5 platforms with multiple accounts and execution methods. The primary drawback to an otherwise balanced offering is pricing that is higher than the industry average.

Best forex brokers in india 2021

Overview

Trading foreign exchange in india involves quite a few limitations and legal issues. In india, the reserve bank oversees foreign exchange transactions while the securities and exchange board of india (SEBI) is the principal regulator of the stock market. The role of SEBI is to regulate the capital markets in india. Forex brokers based in india are licensed under FEMA. Currency pairs that don’t have the indian rupee as the quote currency are restricted from being traded in india unless a specific transaction is authorized by the indian government.

Forex brokers in india are only allowed to offer indian rupee based currency pairs for USD, EUR, GBP, and JPY because if the majority of indians traded the dollar (which is the most traded currency) outside of india, the reserve bank of india would come to a point to be compelled to buy the USD with INR at cheaper rates. That would weaken the already weak indian rupee.

Due to an increase in financial scams involving foreign exchange brokers in india, the government was forced to severely restrict the way citizens can operate in the forex market.

It would seem that while the reserve bank of india (RBI) has many restrictions around trading, there are ways for residents to trade. If you want to open an account with a foreign-based broker, you should at all costs avoid wire transfers from banks or any other financial institutions based in india or a credit or debit card issued by an indian entity to fund a forex trading account. Instead, deposit through an electronic wallet like paypal or neteller.

Not all forex brokers are created equal, so make sure your needs as a trader are adequately met by the forex broker you select before committing any funds.

The best forex brokers in india

If you’re from india and looking for a reliable online forex broker, the list below names some of the best online FX brokers outside of india but regulated by reputable financial authorities.

Saxo bank

We selected saxo bank as the best site for forex trading in india on our list based on in-depth analysis and testing the live accounts of 30 online forex brokers. Saxo bank group , a danish investment bank founded in 1992, provides online trading and investment services. Backed by superior research, the saxo bank trading platform is the most user-friendly and well-designed one out there. The extensive product portfolio covers all asset types and many international markets. Saxo capital markets offers an excellent option for advanced forex traders and sophisticated professionals with well-funded accounts.

PROS

- Extensive range of offerings

- Industry’s best research

- Superior user interface

- Offers protection for client accounts

CONS

- Lack of emphasis on customer service

- Confusing financial instruments fee structures

- No MT4 broker

FOREX.Com

Forex.Com, founded in 2001 as part of GAIN capital holdings, is an established global online forex broker that caters to individuals seeking to trade the retail F.X. And CFD markets. FOREX.Com ranks as the no. 1 U.S. Forex broker by client assets as per FOREX.Com review . One can trade on 80+ currency pairs, equities, indices, commodities, and cryptocurrencies.

Forex.Com offers its customers access to the company’s proprietary advanced trading platform for desktop, web trading platform if you prefer to trade via a web browser and mobile trading through apps. The platform has 70+ technical indicators, a host of time intervals, multiple chart types, and 50+ drawing tools.

The leverage available at forex.Com ranges from 0.5% to 20%, depending upon currency pairs.

PROS

CONS

- Equities are not available on the metatrader 4 platform

- Account funding through credit & debit cards and wire transfer

Interactive brokers

Interactive brokers (IBKR) ranks very near to the top in our 2021 review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Interactive brokers india pvt. Ltd. Is a member of NSE, BSE, SEBI. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Interactive brokers has made a great effort to make their technology more appealing to the mass market, and its wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. You can know more about its features, trading platforms from our review page.

PROS

- Extremely smart order router

- Wide range of offerings around the world and across asset classes

- Mutual fund replicator finds less expensive etfs

Cons

- Streaming data runs on a single device at a time

- IBKR lite customers cannot use the smart order router

- Small or inactive accounts generate substantial fees

Fxpro

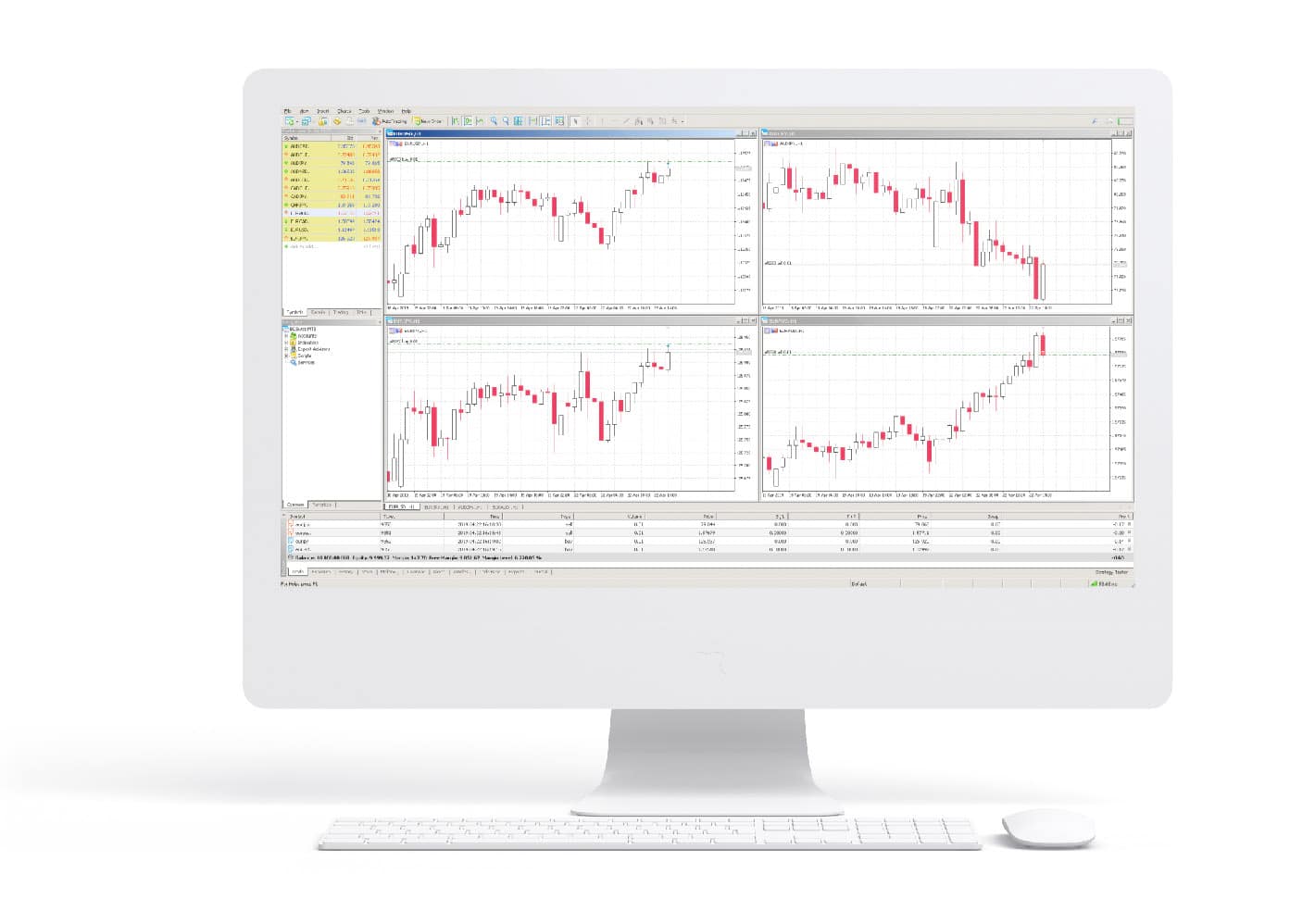

Fxpro is best for forex and CFD traders who want a wealth of choices in trading markets. Their range of forex pairs and the ability to trade equity indices, cryptocurrencies, commodities, and futures set them above competitors in the space. Fxpro competes among the top metatrader brokers, offering the full suite of MT4 and MT5 platforms with multiple accounts and execution methods. The primary drawback to an otherwise balanced offering is pricing that is higher than the industry average.

PROS

CONS

- Relatively high fees

- No anonymous demo account

- Weak educational platform

Etoro

Etoro’s social trading platform has provided forex products and more to its retail clients for over 11 years. Etoro platform creates a trading community for users. Etoro’s most popular forex trading features include copytrader, copyportfolios, and the social news feed. Copytrader and copyportfolio give you the ability to locate a successful forex trader and copy their strategy. You can copy 100 traders, and the feature is easy to set up and access. Etoro advocates social trading, where forex traders get to share their strategies and tips. The minimum first-time deposit varies from $50 to $10,000 based on your region and country regulations. Etoro offers leverage of up to 1:400 with a facility of negative balance protection so that you trade comfortably.

PROS

- 2000+ financial instruments

- $100,000 virtual practice account

- Copy-trading and social trading facility

CONS

- Flat $5 withdrawal fees

- Minimum withdrawal amount of $50

- Leverage of 1:400

71% of retail investor accounts lose money when trading cfds with this provider. You should consider whether losing your money is a risk you can take.

Olymp trade forex broker

Olymp trade is an award-winning broker managed by saledo global LLC and offers leverage up to 500 times. At olymp trade, you can trade commodities, stocks, indices, etfs, currencies, and crypto assets using the olymp trade platform.

PROS

- Access to a demo practice account

- Trading guides and insights

- Profitable fixed time trading

CONS

Octafx

Octafx was founded in 2011 and offers forex ECN trading, as well as CFD trading on indices, metals, and cryptocurrencies, across the metatrader and ctrader suite of trading platforms for windows desktop, web (windows and mac), and mobile (android and ios), as well as their own octafx trading app. New fx traders can explore video tutorials and get started with copy trading. You can open an account online with a minimum deposit of $20. Deposits can be made using neteller, skrill, bitcoin, and paytm. You can trade higher limits with a maximum leverage of 1:500 and negative balance protection.

PROS

- Wide range of trading accounts (micro, ECN, pro, sharia) for beginners and advanced traders

- Ctrader ECN platform for automatic (similar to algorithmic) trading

- Access copy trading, bonus promotions, and a wide range of research tools

- Zero commission on deposit & withdrawal

- Customer support available in hindi

CONS

Libertex

Libertex is the trading arm of indication investments ltd, a part of the forex club group. Libertex serves indian forex traders and is the perfect choice for those who want to trade across a variety of different industries. Leverage rates on libertex can change dependent on the trades considered by the user. The maximum leverage rate is 1:30.

PROS

- Libertex provides a user-friendly in-house platform

- Low minimum deposit requirement of 10 EUR

- Multiple asset classes

- E-wallet withdrawals processed within 24 hours

- More than 20 years of experience

CONS

- Has only one account type

- Specific commission fees are vague

- Lack of fundamental research

- It can be hard to find bid/ask spreads

X.M. Group

X.M. Global limited is a subsidiary company of trading point holdings ltd and is regulated by the international financial services commission (belize). X.M. Has over 2.5 million traders from over 196 countries. You can trade over 55 global currency pairs and cfds on indices, commodities, stocks, metals, and energies on its site. XM offers MT4 and MT5 trading platforms across 16 devices (android, ios, ipad, mac, and P.C.) and even on the web through M.T. Web trader. New traders can test their forex trading skills on a demo account that comes with $100,000 of virtual balance.

PROS

- Demo account with $100,000 of virtual balance

- Low minimum deposit forex account

- Negative balance protection

CONS

Wrap up

There are several factors to be taken into consideration before setting up an account with a broker. Forex markets are complicated. Without the right research, novice investors who set up accounts lose money on the very first trade. Good forex brokers publish research reports and provide on-call guidance to help their clients understand the forex market, what factors affect the currency prices, and how to trade. You should trust and trade your money with those forex brokers who offer the best of what has been described in the article. Before you trade global forex, check your forex trading requirements, risk-taking capacity, and local regulations. Not all broker trading platforms are the same, and this is where it gets interesting. Every platform appears to have its advantages and disadvantages. You have to find something you are comfortable with. Another suggestion is that you do not place all of your funds into one broker, especially if you have a substantial amount. If you had, say, $100,000 to trade (which you don’t need!), you shouldn’t be depositing all of this with the one broker. Instead, spread it amongst two or more forex brokers, or keep funds in reserve and only deposit them with your broker if they are required – you will sleep better at night!

Once you have found the right broker to work with, focus on learning as much as you can. This will allow you to trade more confidently and increase your chances of success trading in the forex market.

Top 10 best forex brokers with bonus and promotions for 2021

Top rated:

Are you on the lookout for the best forex brokers with bonus and promotions to offer?

They can be tricky to find, but if the answer is yes, then you are certainly in the correct place. Here we will give you all of the information you need, not only on the top recommended brokers if you are looking for a bonus, but also what these promotions mean, and how they can best work to your benefit as a trader.

With that in mind, let’s take a closer look at the best brokers we have found that can offer bonus and promotions to you as a trader.

Are these bonuses really free money?

Although it may be hard to believe at first, it is true. The bonuses really are free money that is sent to your account by the broker. Now what is often asked is, can I withdraw these bonus funds?

Generally, the answer is yes with most top brokers. Their policy will vary though and in many cases, there are certain trading criteria that you must meet in order to withdraw the bonus funds from your account.

What should I check when choosing a bonus?

There are a couple of very important steps that you must run through when checking the bonus that you should choose, and the broker who is providing that bonus.

First off, it is vital that you read the terms and conditions carefully, so you know exactly what is on offer. Added to that, it is important to consider the whole offering of a broker. This means not only the bonus amounts, but what else they have to offer such as spreads, minimum deposits, and more.

Please note that the following bonuses may not be available in every country, and that brokers are not allowed to offer these to customers based in the EU or UK due to local regulatory restrictions. Read T&C before applying to a bonus.

Top 9 forex brokers with bonus and promotions

Here are the top 9 forex broker bonus and promotion offers we have found available:

1. FBS

FBS is the first broker to make our listing for having some of the top promotions and bonus offers in the industry. They are well-known as being a very respected broker around the world, and they have a huge amount of bonuses on offer.

At FBS you can win a wide range of prizes from holidays to new cars, and you can also double your deposit with the great FBS 100% deposit bonus they have in place. An FBS no deposit bonus is also available at no-risk at all to your funds as well as a cashback bonus if certain conditions are met. The FBS bonus offering continues to grow and expand with many contests and challenges also available where you can win cash, trips, and VIP event invites. They also run contests directly on social media like facebook where all you need to do is share posts with your friends. These are just some of the reasons why FBS is a top bonus broker for all traders.

XM is another top international broker, and one of the most easily recognizable in the industry. They too offer a strong range of bonuses and promotions. These start with an excellent $30 no deposit bonus which you can use for completely risk-free, real money trading.

Beyond this you will also find a deposit bonus of up to $4500 which means your deposit will be matched by the broker with free money up to this high value. Aside from those regular types of bonus offerings, XM also runs a lucky draw which has a huge total value of $1,000,000. As a regular trader with the broker you can also join their loyalty program which is points based. You can redeem these points through your trading actions to obtain a wide range of great benefits with the broker.

Please note that these bonuses may not be available with every XM entity

3. Instaforex

Instaforex is the next broker to make the top list of brokers providing bonuses and promotions. They too are very well-trusted by a broad range of traders across the industry. They start their bonus offering with one of the very best no deposit bonus offers in the sector. This is the instaforex $1,000 no deposit bonus.

Further to this monster bonus offer, the broker also provides a deposit bonus of 30% so you can always receive an additional 30% on top of your initial deposit as risk-free bonus funds to trade with the broker. Added to this, instaforex makes a huge range of contests and challenges available where you only need to have a demo account to participate and win. Here you can win a great range of physical prizes including cars, money, and much more.

4. Fxopen

The next broker on the list offering top promotions and bonuses is fxopen. They kick their bonus offering off with a $10 no deposit bonus. This is great if you are new to trading and looking to try out the broker with no risk at all to your own money.

Another great offer for beginners is the $1 welcome bonus on micro accounts. This makes sure you are covered to trade with free money, even at lower risk levels. Like many of the other brokers they also provide access to a large number of trading contests with a unique prize attached. This prize is that if you reach a certain benchmark of profit in the contest with virtual funds, they will then turn 10% of these funds into real money for you to trade with. A very attractive bonus proposition indeed from this popular broker.

5. Roboforex

Roboforex are in on the act too as another respected top broker offering bonuses and promotions to their traders. The excellent bonus infrastructure here starts with a deposit bonus that can be either 10%, 60%, or a huge 120% depending on how much you are depositing.

The offers do not stop there with roboforex either. Just for joining the broker, you will be entitled to a $30 welcome bonus. This can be used for completely risk-free trading on the markets of your choice. You will also be entered into weekly and monthly contests which are free to enter but where you can win real prizes on both demo, and live accounts. Regular traders are not forgotten either with cash rebates stretching up to 15% based on how much you trade.

6. Hotforex

Hotforex are one of the cornerstones of the industry and regularly feature as a top broker in many listings. They too have a very strong bonus infrastructure though it may not be available in every country the same. This is particularly true in europe.

Outside of that though, their offer is strong. They provide a number of unique bonuses the first of which is a 100% credit bonus. This acts to double your deposit with completely free bonus funds. They also offer a very unique 30% rescue bonus. This bonus protects your funds from drawdowns up to $7,000. The 100% supercharged bonus is one of their most popular though. This provides for a huge amount in cash rebates that can reach up to $8,000, on top of a 100% deposit bonus. All of these great offerings maintain hotforex as a very popular bonus broker of choice.

Please note that these bonuses may not be available with every XM entity

7. Octafx

Octafx is another popular, and rapidly growing name in the sector. They are not stepping back when it comes to offering a bonus either. If you are trading with this broker, the first thing you may want to try out are some of the demo account contests.

These great contests come with prizes of up to $500 real cash if you are trading through metatrader, and $150 if you are using ctrader. If these pique your interest, then you can decide to deposit for real, and benefit more from a 50% deposit bonus which is on offer. On top of this, there are many other prizes including merchandise to be won from a broker who is strong, trusted, and growing all the time.

8. FXTM

FXTM is one of the biggest names in the industry. They have also not forgotten a strong bonus infrastructure, and for this reason, they too feature on our list of the best brokers for bonus offers and promotions.

At the core of the FXTM bonus offering is their excellent loyalty program. Here, the more you trade, the more you can get paid. At the maximum level you have the ability to earn as much as $10,000 from the program. Also offered by the broker are a great range of both demo and live trading contests where you can compete against your fellow traders to win top prizes.

9. Vantage FX

Vantagefx is next in our selection of the best forex brokers who offer a good range of bonus systems. Here you will be able to take advantage of a 50% deposit bonus that will allow you to trade risk-free with bonus cash from the broker based on how much you deposit.

Vantagefx also offers a great and very rewarding loyalty program where you can avail of 10% rebates on your trades up to $2 per lot traded when you deposit at least $1,000. With the broker and this program, there is no limit on the trade size at all. The higher the lot size you trade, the higher your bonus will be.

Different type of bonuses

When choosing your forex broker bonus, it is also important to keep in mind that there are many different bonus types available. Here is a more detailed look at exactly the kind of bonuses that are offered by brokers:

Forex deposit bonus: the forex deposit bonus is a certain amount of money offered as a bonus based on the amount which you deposit. In the case of many brokers, this can mean matching your deposit amount with an equal bonus amount.

Forex no deposit bonus: A forex no deposit bonus, as you might gather from the name, is a bonus which is offered to you with no deposit required. In most cases, you simply have to complete the registration process. This money is free and can be used in real trading at no risk to your own money.

Welcome forex bonus: the welcome bonus can be similar to a no deposit bonus. You will get a bonus money amount for completing registration, and in some cases based on the amount of your first deposit.

Loyalty program: A forex broker loyalty program, just like any other, is usually based on how much you use the service. In this case, the more you trade, the more you will be rewarded by such programs. These rewards could come in the form of lower trading costs, additional premium trade tools, physical prizes, access to live events and meetings, and much more.

Points system: the forex broker point systems can also be based on loyalty programs. With these systems, the more you trade, the more points you will earn. These points can then be used to access monetary prizes, cars, vacations, and more.

Cash back and rebates: cash back and rebate programs are also a very common form of bonus. Just as the name suggests, with this form of bonus, you can earn money back for each lot you trade.

Money protection bonus: this is not a very common form of forex broker bonus, though it exists, nonetheless. This kind of bonus from your broker actually protects your funds from reaching a certain negative level, and in some cases, anything beyond this negative point can be refunded.

Forex contest prize: there are a wide range of brokers who organize contests which you can participate in with virtual funds against other traders. If you win some of these contests through making the most profit from virtual funds, then you can win all kinds of great prizes including cash, cars, and more.

Why do brokers offer forex no-deposit bonuses and other bonuses?

There are several reasons why your broker may offer a no deposit, or other type of bonus. One of the primary reasons for this is to create value for you as a trader, and to attract new traders to the industry and that broker.

This method is accepted in many parts of the world, though not in europe. Within the EU, the offering of the majority of these kinds of bonuses is not allowed by the regulator. ESMA does this in a large part to protect beginners from getting involved in trading without the proper knowledge and ultimately losing their money.

Tips on how to choose a bonus and a broker

If you are thinking about choosing a forex broker, the bonus is just one element of this choice, and it should not be a large factor in your decision-making process. First and foremost, you have to choose a broker who is trustworthy, and well-regulated. Luckily all of the brokers on our listing are both of these things.

Once you have done this, then you can think about the bonus they are offering, but do not make your choice based on the broker bonus alone. You have to consider all of your trading needs. In this case, you may want to try out a broker first. This would be a great time to select a no deposit bonus broker so you can try out their real trading at no risk to you.

Best forex brokers denmark for 2021

The forexbrokers.Com annual forex broker review (five years running) is the most cited in the industry. With over 50,000 words of research across the site, we spend hundreds of hours testing forex brokers each year. How we test.

Trading forex (currencies) in denmark is popular among residents. While recommended, forex brokers are not required to become authorised by the danish financial supervisory authority (DFSA) to accept residents of denmark as customers.

The danish financial supervisory authority is the financial regulatory body in denmark. Website: https://www.Dfsa.Dk/. The DFSA does not have any social media accounts to follow.

The DFSA was established in 1988 and is responsible for regulation, supervision and collecting statistics of financial participants. For a historical breakdown, here's a link to the danish financial supervisory authority webpage on wikipedia.

Best forex brokers denmark

To find the best forex brokers in denmark, we created a list of all brokers that list denmark as a country they accept new customers from. We then ranked brokers by their trust score ranking.

Here is our list of the best forex brokers in denmark.

- IG - best overall broker 2021, most trusted

- Saxo bank - best for research, trusted global brand

- XTB - best customer service, great trading platform

- Etoro - best copy trading platform

- Swissquote - trusted global brand, diverse offering

- Avatrade - multiple trading platform options

- XM group - well-rounded offering

Denmark forex brokers comparison

Compare denmark authorised forex and cfds brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by the firm's forexbrokers.Com trust score.

| Forex broker | accepts DK residents | average spread EUR/USD - standard | minimum initial deposit | trust score | overall | visit site |

|---|---|---|---|---|---|---|

| IG | yes | 0.745 | £250.00 | 99 | 5 stars | visit site |

| saxo bank | yes | 0.800 | $10,000.00 | 99 | 5 stars | visit site |

| XTB | yes | 0.860 | $0.00 | 92 | 4.5 stars | visit site |

| etoro | yes | 1.00 | $200 | 91 | 4 stars | visit site |

| swissquote | yes | N/A | $1000.00 | 99 | 4 stars | N/A |

| avatrade | yes | 0.910 | $100.00 | 93 | 4 stars | visit site |

| XM group | yes | 1.600 | $5-100 | 84 | 4 stars | N/A |

| FP markets | yes | 1.140 | $100 AUD | 81 | 4 stars | visit site |

| plus500 | yes | 0.600 | €100 | 98 | 4 stars | visit site |

| pepperstone | yes | 1.160 | $200.00 | 90 | 4 stars | visit site |

| IC markets | yes | 0.800 | $200 | 83 | 4 stars | visit site |

| tickmill | yes | 0.530 | $100.00 | 81 | 4 stars | visit site |

| fxpro | yes | 1.510 | $100.00 | 89 | 4 stars | visit site |

| vantage FX | yes | 1.350 | $200 | 79 | 3.5 stars | N/A |

| moneta markets | yes | 1.300 | $200.00 | 79 | 3.5 stars | N/A |

| HYCM | yes | 2.00 | $100 | 84 | 3.5 stars | visit site |

| eightcap | yes | $100 | 69 | 3.5 stars | N/A | |

| VT markets | yes | 1.30 | $200 | 79 | 3.5 stars | N/A |

| blackbull markets | yes | 0.76 | $200 | 70 | 3.5 stars | N/A |

| octafx | yes | 1.100 | $5 | 59 | 3.5 stars | N/A |

| easymarkets | yes | 0.900 | $100.00 | 81 | 3.5 stars | N/A |

| hotforex | yes | 1.20 | $50 | 83 | 4 stars | N/A |

How to verify DFSA authorisation

To verify the authorisation of a broker, search the name of the broker in the company register on the DFSA website. If a company is authorized, a company profile will be available with a registration number and date upon searching.

More forex guides

Methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Compare brokers in ghana

For our ghana comparison, we found 23 brokers that are suitable and accept traders from united kingdom.

We found 23 broker accounts (out of 147) that are suitable for ghana.

Forex.Com

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About forex.Com

Platforms

Funding methods

69% of retail investor accounts lose money when trading cfds with this provider

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About IG

Platforms

Funding methods

76% of retail investor accounts lose money when trading spread bets and cfds with this provider

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About XTB

Platforms

Funding methods

82% of retail investor accounts lose money when trading cfds with this provider.

Avatrade

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About avatrade

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider.

Plus500

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About plus500

Platforms

Funding methods

76.4% of retail CFD accounts lose money

Axitrader

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About axitrader

Platforms

Funding methods

68.5% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Etoro

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About etoro

Platforms

Funding methods

75% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

XM group

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About XM group

Platforms

Funding methods

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

City index

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About city index

Platforms

Funding methods

72% of retail investor accounts lose money when trading cfds with this provider

Easymarkets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About easymarkets

Platforms

Funding methods

83% of retail investor accounts lose money when trading cfds with this provider.

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

The ghanaian financial market

After almost two decades of planning and hard work, the ghana stock exchange (GSE) finally opened it doors as a a uthorized stock exchange in october 1990. Based in accra and a member of the african securities exchanges association (ASEA) , as of january 2019 the exchange has an approximate market capitalisation of 62,918 million ghanaian cedi (9.9 billion GBP).

While the exchange remains fairly small overall with respect to assets traded and participants, the ghana stock exchange acts as the primary secondary market for the stock of ghanaian companies and has shown undulating real returns since the early 1990’s. The ghana stock exchange composite or GSE-CI is as the primary stock market index in ghana and tracks the performance of all companies traded on the GSE.

In general, ghanaian financial markets and the ghanaian cedi benefit from ghana’s economic strength, although they can come under pressure when geopolitical events create an uncertain investment or trade environment. Furthermore, ghana remains a net importer when it comes to goods and services, with imports making up 25 percent of GDP as of 2005.

Other factors that influence the ghanaian cedi and ghanaian financial markets include the price of key strategic commodities like oil, of which ghana is a net importer, as well as that of ghana’s major exports like gold, timber, cocoa, tuna, bauxite, aluminium, diamonds, manganese ore and horticultural produce.

The financial markets in the republic of ghana include relatively small bond, equity, forex and derivative markets. Money markets can therefore tend to dominate as a result of their relative stability compared to the high volatility seen in the country’s capital markets.

Trading in ghana

The bank of ghana acts as the primary financial regulator in ghana responsible for overseeing forex and contract for difference (CFD) trading activities and financial institutions. When it comes to regulation, the central bank has the mandate to make sure that depositors’ funds are safe, banks’ solvency, assets, liquidity and profitability are maintained, enforce adherence to statutory and regulatory requirements, promote fair competition among banks, and maintain an efficient payment system.

With respect to stocks, traders will want to open an account with a licensed dealer or stockbroker that operates on the ghana stock exchange. While no minimum deposit is usually required, an account needs to be funded to execute a transaction. Furthermore, fees and commissions will cost around 2.5 percent of the transaction value. A central securities depository account also needs to be set up for a trader to keep a record of their ghanaian stock holdings.

Those looking to trade speculatively on the ghanaian financial market have a number options available through online brokers that let clients operate using their trading platforms. In general, traders will want to choose well-regulated brokers that have a good reputation with customers and that seem trustworthy enough to place a margin deposit with.

- Forex trading: exchanging one currency for another forms the basis of forex trading. Exchange rates fluctuate as one currency rises or falls relative to another in particular currency pair. The popularity of forex trading has expanded greatly once online trading became possible. The forex market is the most liquid and largest financial market globally and had a daily turnover of $5.1 trillion/day in april 2016 , according to data compiled by the bank for international settlements (BIS).

- CFD trading: making transactions in derivative financial instruments known as contracts for difference (cfds) allows traders to speculate on the future of their underlying assets. Such assets can consist of a currency pair, commodity, stock, stock index or other financial instruments.

- Demo accounts: funded with virtual money, these accounts can be used to practice trading, test a strategy or check out a broker’s services and platform. Find out more on opening demo accounts here .

- Islamic accounts: these are suitable for traders who wish to trade in an account that conforms to sharia law. Find out more on trading with an islamic account .

Opportunities of trading in ghana

In ghana, the banking act of 2007 helped lay a solid foundation for favourable change in the country’s financial services industry. Also, the ghanaian oil and gas sector has been growing strongly and telecom companies have expanded infrastructure construction projects to improve phone communication quality and service across the country. An expansion of road construction projects throughout the country was also notably funded in the ghanaian government budget for 2019.

Challenges of trading in ghana

Ghana was only ranked 114th for the ease of doing business by the world bank . Furthermore, the country came in 108 th for starting a business, 73 rd for getting credit and 99 th for protecting minority investors, so this indicates a rather challenging environment for traders.

Interest and exchange rate fluctuations and high inflation rates have made it challenging for traders to predict the direction of financial markets in ghana, thereby also making it difficult to participate or borrow money in this unstable environment. In addition, a lack of stringent regulation means higher investment and inflation risks. While off its peak slightly, ghana’s government debt also remains very high at 70.5 percent of GDP in 2017.

Summary

While ghana does not rank high among safe places to do business, some opportunities still exist. Traders also have some comfort in knowing that ghana’s financial institutions and stockbrokers are regulated by its central bank, although high market volatility, inflation and interest rates remain concerns for traders and businesses alike.

When a trader needs an online broker to trade through, they should make sure a firm has a decent range of asset classes to trade, a fast and easy to use trading platform, is overseen by a reputable financial regulator, and will be secure enough for them to give a margin deposit to.

Why choose forex.Com

for ghana?

Forex.Com scored best in our review of the top brokers for ghana, which takes into account 120+ factors across eight categories. Here are some areas where forex.Com scored highly in:

- 19+ years in business

- Offers 300+ instruments

- A range of platform inc. MT4, web trader, ninjatrader, tablet & mobile apps

Forex.Com offers one way to tradeforex. If you wanted to trade EURUSD

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

Top 10 best forex brokers in india for 2021

Top rated:

So you are a forex trader, or a new trading looking to break into the forex trading world in india? You have likely considered the global and indian forex market very carefully.

When thinking about which of the top forex brokers offer to take up on opening an account, you may or may not have considered brokers in india, or at least those that are available for indian citizens. If that is the case, then you find yourself in the perfect place.

Here we have taken at the foreign exchange market for indian citizens and compiled a listing of the best forex brokers in india just for you.

Table of contents

Is forex trading illegal in india?

For indian citizens, this is the key question when getting involved in forex trading. The simple answer here is no. This however comes with some complexities for indian forex traders that we will explain.

Forex trading in india is regulated by SEBI (securities and exchange board of india) similarly to the way in which foreign exchange and trading is regulated in other countries. The difference comes though with the fact that the RBI (reserve bank of india) has made trading with some other currencies and the indian rupee illegal for fear of devaluing the indian currency.

With that in mind then, the only forex trading acceptable for indian forex traders to participate in is that of INR based pairs with major currency the USD, EUR, GBP, and JPY. The indian government have recently relaxed the rules to allow the introduction of trading on other major foreign currency pairs such as EUR/USD, GBP/USD, and USD/JPY. Other pairs are currently not available.

When it comes to online forex brokers and the indian forex market, it is however illegal for indian forex traders to use any online forex trading platform that is not regulated by SEBI. If you are reading this review as an indian citizen based abroad, then you typically have more freedom from these regulations and you can follow the regulations of your local area.

Disclaimer: the following top 10 illustrates international forex brokers that offer forex trading services in india. However, we couldn’t find any information regarding their SEBI compliances (except from alpari). If you’re based in india, and you want to open an account with them, contact local experts before taking any further action.

Top 10 of the best forex brokers in india today

1. Alpari

The first broker we will take a look at for indian forex trading is alpari. This is the only international broker that is considered a SEBI compliant forex broker for indian traders. As an indian forex trader or any other, we would recommend that you display some degree of caution in your forex trading here. This is due to the revocation of many of their top-tier regulations due to 2015 bankruptcy.

The broker is still regulated offshore by the FSC (C113012295). For indian citizens you can check up on the companies regulatory licensing through SEBI with the following registration numbers:

INE271381233

INE231376935

INE261383637

With alpari, there are no INR currency pairs available, though the other permitted pairs for indian traders are certainly available. The spreads with this broker start from 0 pips with the ECN accounts.

There are a total of 3 retail accounts available for indian traders. The standard account, ECN account, and micro account. The alpari minimum deposit starts from $5 for the micro account, $100 for a standard account, and $500 for ECN account holders. You can deposit indian rupee through a local bank transfer or neteller. This may incur some fees.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

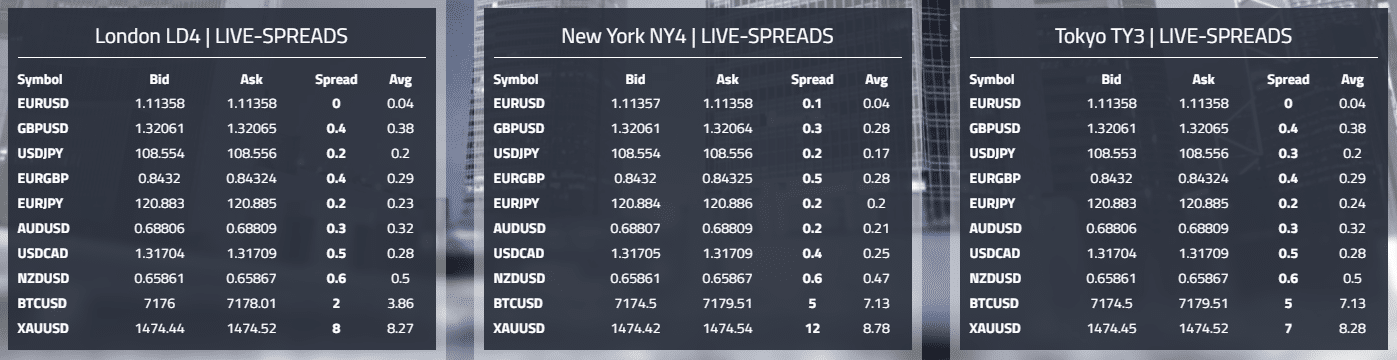

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

Fxdailyreport.Com

- Sharia-compliant

While a normal forex account earns interest on swap /rollover paid on positions held open overnight, the shariah law prohibits muslims from earning interest. In such a case, you need to choose a fx broker that offers an islamic account.

An islamic account, also known as a swap-free account, is a trading account that incurs no interest charges or swaps on overnight positions to comply with the islamic shariah principles. In its place, a trader is charged an administration fee on positions which is deducted from the balance of the account.

Forex brokers that offer islamic trading account 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $100 spread: starting 0 pip leverage: 500:1 regulation: FCA UK, FSA (seychelles), cysec | visit broker | ||

| min deposit: $100 spread: from 0,2 pips leverage: 1:200 regulation: FCA UK (#186171), cysec (#259/14), CIMA (1442313) and DFSA (F000048) | 10% welcome bonus up to $5,000 | visit broker |

- Cost of trading

It is quite obvious that since islamic forex accounts don’t charge interest, brokers will want to find a different way to make an income. They do this by charging an extra flat fee each month or by charging slightly higher spreads. When choosing a sharia-compliant forex broker, take the time to look at their overnight rates and then compare them to what they are asking in return. If you find that you will be worse off, in terms of returns, then consider looking at other options.

You can find forex brokers that ask for no extra charge for islamic accounts. If you can find such brokers, take the time to examine their spreads to see if they are competitive.

The difference between the ask and bid price or trading instruments, also known as a spread, is usually a point of debate among fx traders. Still, we highly recommend that you choose a forex broker with tight spreads. These types of spreads lower trade costs and enhance your opportunities to trade successfully. It also minimizes traders’ losses and brings about the possibility to open as many positions simultaneously.

- Demo account

A demo account is an online trading practice account that allows amateur currency traders to familiarize themselves with a particular platform and the features it provides in a simulated environment. Make sure to choose a forex trader that offers a demo account to get a risk-free way of testing whether the trading platform fulfills your currency trading requirements. You will also be able to use the demo account to develop, test and optimize trading strategies, helping you to improve your own trading strategies.

- Safety of funds

When choosing a forex broker, the goal is to find one that ensures your funds are both safe and accessible. Therefore, make sure to choose a broker that is covered sufficiently by a government-backed deposit insurance scheme. They should also deposit your funds into a fully segregated client account that is completely separate from their own funds.

- Trade executions

While the safety of your funds should be at the top of your priorities, you also need to be able to trade effectively as well. The time a fx broker takes to execute trades is crucial as it can make or break a trade. Therefore, you need to choose a currency broker that offers fast trade execution and with a reliable server that does not go down when the market is very active.

- Trading platform

The trading platform provided by your fx broker is crucial to your success in trading currencies. Therefore chose a broker whose platform is both easy to use and functional with all the right tools to improve your chances of making profits. If you prefer to trade on the go, choose a broker that offers mobile trading platforms.

- Multiple instruments

Although most fx traders stick to the most popular currency pairs, there are those who enjoy heightened volatility that comes with trading on more exotic instruments. Therefore, always choose a broker who offers as many instruments as possible.

Choosing a forex broker does not have a one size fits all formula. The best broker is the one that aligns best with your trading needs and priorities when trading currencies. Use these tips to improve your chances of making profits trading currencies.

Forex trading brokers – best choice 2021

This post is also available in: indonesia

The best forex brokers, according to the editorial board, for 2020. High level of popularity in your country. A convenient platform, a large selection of account types, and the ability to complete training.

These platforms have been tested over time and by many users. When choosing the best forex broker, you need to take into account the trust of users in it. We only provide reviews, the choice of broker is up to you.

Who is an FX broker?

The forex broker is the institution that connects you to the online currency exchange. They work with liquidity providers like large banks that are considered FX dealers.

Top forex brokers for your country:

Updated january , 2020

CFD service. Your capital is at risk

Regulation: cysec, FCA, IFSC

CFD service. Your capital is at risk

Regulation: BVI FSC, cysec

CFD service. Your capital is at risk

Regulation: mifid, CBI, FSA, ASIC, SFB, BVI, FSCL

CFD service. Your capital is at risk

Regulation: cysec

CFD service. Your capital is at risk

CFD service. Your capital is at risk

Regulation: IFSC, cysec

CFD service. Your capital is at risk

CFD service. Your capital is at risk

Regulation: ASIC, cysec, IFSC

CFD service. Your capital is at risk

Regulation: FSC mauritius

CFD service. Your capital is at risk

Regulation: FCA, cysec, MAS, IE, ASIC, AFSL, FMA, FSP

CFD service. Your capital is at risk

Regulation: FCA, cysec, ASIC

* amount to be credited only for a successful outcome.

This post is also available in: indonesia

Copyright 2021 best brokers , all rights reserved.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading cfds. You should consider whether you can afford to take the high risk of losing your money.

5+ best forex brokers in the world 2020

We are going to help you to find best forex brokers in the world. There has never been a better time to get into trading than now. There are a plethora of options as regards selecting a broker for anyone out there, irrespective of the size of the account you want to run. Unfortunately, an abundance of options also means that there are also a lot of scam brokers who don’t have your best interest at heart. That is why you have to be careful when choosing a broker to go with.

Minimum deposit: $100

Max.Leverage 1:500

Spread from 0.2 pips

Head office: cyprus

Minimum deposit: $200

Max.Leverage 1:500

Spread from 0.1 pips

Head office: australia

Minimum deposit: $10

Max.Leverage 1:1000

Spread from 0.1 pips

Head office: cyprus,UK

Recommended: bdswiss

- Minimum deposit: $100

- Max.Leverage 1:500

- Spread from 0.1 pips

- Platform: metatrader 4, metatrader 5,

- Trading instruments: 50 + currency pairs, 140+ cfds, 20 crypto currencies

Bdswiss is one of the best broker offer cheapest spread with no commission at all. It is regulated by europe (cysec). Bdswiss offers a wide range of deposit methods including credit cards, bank transfers, sofortüberweisung, skrill and many more. The average spread 0.0 to 1.5.

Account types

- Standard account

- Ctrader account

- Raw spread account

- Islamic account

Account features

- Allows scalping

- Allows hedging

- Offers STP

Payment methods

- Bank wire

- Credit cards

- Skrill

- Neteller

- Paypal

- Fasapay

- Bitcoin

- Bpay

1. Icmarkets

- Minimum deposit: $200

- Max.Leverage 1:500

- Spread from 0.1 pips

- Platform: metatrader 4, metatrader 5, ctrader

- Trading instruments: 60 currency pairs, 215 cfds, 10 crypto currencies

IC markets is known to have some of the lowest fees in the business. The fee structure varies depending on the type of account you have and the currency pairs or commodities you trade. The average spread for EUR/USD is 0.1 while USD/CAD is 0.6, the other currency pairs fall somewhere in-between.

Account types

- Standard account

- Ctrader account

- Raw spread account

- Islamic account

Account features

- Allows scalping

- Allows hedging

- Offers STP

Payment methods

- Bank wire

- Credit cards

- Skrill

- Neteller

- Paypal

- Fasapay

- Bitcoin

- Bpay

2. Forex time (FXTM)

- Minimum deposit: $10

- Max.Leverage 1:1000

- Spread from 0.1 pips

- Platform: metatrader 4, metatrader 5

- Trading instruments: 59 currency pairs, 5 metals, 14 cfds, 4 crypto currencies

Fxtm is one of the leading forex brokers out there. They launched in 2011 and are based in cyprus. They are regulated by several financial institutions in different countries, like the FCA, cysec and FSCA. That tells you that they are indeed trustworthy.

Account types

- Standard account

- Cent account

- Shares account

- ECN account

- ECN zero account

- FXTM pro account

- Islamic account

Account features

- Allows scalping

- Allows hedging

- Offers STP

- Offers negative balance protection

Payment methods

- Bank wire

- Credit cards

- Skrill

- Neteller

- Perfectmoney

- Webmoney

- Bitcoin

- Qiwi,yandex,dixipay,tcpay etc

3. FBS

- Minimum deposit: $5

- Max.Leverage 1:3000

- Spread from 0.0 pips

- Platform: metatrader 4, metatrader 5

- Trading instruments: 35 currency pairs, 4 metals, 3 cfds

FBS is a huge forex broker in asia founded in 2009. They have offices across asia and are regulated by the IFSC in belize. FBS lets you deposit a minimum of $1 and they offer a maximum leverage of 1:3000; the highest in the industry.

Account types

- Standard account

- Micro account

- Cent account

- ECN account

- Zero spread account

- Islamic account

Account features

- Allows scalping

- Allows hedging

- Offers STP

Payment methods

- Credit cards

- Skrill

- Neteller

- Perfectmoney

- Webmoney

- Bitwallet

- Sticpay

4. Octafx

- Minimum deposit: $100

- Max.Leverage 1:500

- Spread from 0.1 pips

- Platform: metatrader 4, metatrader 5,ctrader

- Trading instruments: 28 currency pairs, 4 metals, 3 cfds10, 3 crypto currencies

Octafx was founded in 2011 and regulated by cysec (cyprus securities and exchange commission). Octafx lets you deposit a minimum of $5 for a maximum leverage of 1:500.

Account types

- Micro account

- Pro account

- ECN account

- Islamic account

Account features

- Allows scalping

- Allows hedging

- Offers STP

Payment methods

- Credit cards

- Skrill

- Neteller

- Bitcoin

5. Exness

- Minimum deposit: $1

- Max.Leverage 1:2000

- Spread from 0.0pips

- Platform: metatrader 4, metatrader 5

- Trading instruments: 120 currency pairs, 4 metals, 3 crypto currencies

The exness group was founded in 2008 and is regulated by cysec, FCA and FSA. You can deposit a minimum of $1 and they offer a maximum leverage of 1:2000. You can trade over a hundred currency pairs.

Account types

- Standard account

- Raw spread account

- Zero account

- Pro account

- Islamic account

Account features

- Allows scalping

- Allows hedging

- Offers STP

Payment methods

- Credit cards

- Skrill

- Neteller

- Perfectmoney

- Webmoney

- Bitcoin

- Sticpay

We will be going over some of the key factors to consider when choosing top forex brokers in world. Let’s dive in.

Reputation of best forex brokers in the world

Before you decide to deposit your money with a particular broker, you should do your due diligence and research into what their users are saying about them. You can go check online forums and review websites to see what the general consensus is about a certain broker. Of course, you are expected to take every opinion with a grain of salt, as you know, traders who incur losses are more likely to badmouth their trading platforms than others who are making a killing. But if all you hear about a particular broker is bad, then you should probably stay away.

Spread and commission best forex brokers in the world

Forex brokers have to make money, and they do this through spreads and commissions. By charging a fee on every trade; spread or by taking a percentage of your profits commission. Some forex brokers only charge spreads (plus rollover charges of course), others charge commissions, while some charge a combination of both. If you are going to be doing a lot of trades, then going with a broker that charges a little fee per trade will be in your best interest. If you don’t plan to be a very active trader, the fee per trade might not be so important to you. The idea, in general, is to be able to balance fees, with security and reliability. After all, quality doesn’t come cheap.

So, let's see, what we have: looking for the best site for forex trading in india? Here we provide the top 9 best forex brokers in india for 2021 with their pros & cons so check it now. At best forex brokers for iranian

Contents of the article

- Top forex bonus promo

- Best forex brokers in india 2021

- Overview

- The best forex brokers in india

- Saxo bank

- FOREX.Com

- Interactive brokers

- Fxpro

- Etoro

- Olymp trade forex broker

- Octafx

- Libertex

- X.M. Group

- Saxo bank

- Wrap up

- Top 10 best forex brokers with bonus and promotions for 2021

- Are these bonuses really free money?

- What should I check when choosing a bonus?

- Top 9 forex brokers with bonus and promotions

- Different type of bonuses

- Why do brokers offer forex no-deposit bonuses and other...

- Tips on how to choose a bonus and a broker

- Best forex brokers denmark for 2021

- Best forex brokers denmark

- Denmark forex brokers comparison

- How to verify DFSA authorisation

- More forex guides

- Methodology

- Forex risk disclaimer

- Compare brokers in ghana

- We found 23 broker accounts (out of 147) that are...

- Forex.Com

- Spreads from

- What can you trade?

- About forex.Com

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About IG

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About XTB

- Platforms

- Funding methods

- Avatrade

- Plus500

- Axitrader

- Etoro

- XM group

- City index

- Easymarkets

- The ghanaian financial market

- Why choose forex.Com for ghana?

- Top 10 best forex brokers in india for 2021

- Is forex trading illegal in india?

- Top 10 of the best forex brokers in india today

- List of the best 23 forex brokers | trusted reviews

- Strict criteria for the forex broker review

- How does a forex broker work?

- Warning: only trade with regulated and licensed...

- How risky is forex trading?

- How to deposit and withdrawal money:

- Not every country is available for forex trading

- Review conclusion: start trading with a reliable forex...

- Fxdailyreport.Com

- Forex brokers that offer islamic trading account 2021

- Forex trading brokers – best choice 2021

- Who is an FX broker?

- 5+ best forex brokers in the world 2020

- Recommended: bdswiss

- 1. Icmarkets

- 2. Forex time (FXTM)

- 3. FBS

- 4. Octafx

- 5. Exness

- Reputation of best forex brokers in the world

Comments

Post a Comment