Tickmill withdrawal proof; tutorial, how to withdraw from tickmill.

How to withdraw from tickmill

Insert your tickmill withdrawal methods tickmill offers more than 10 different payment methods for money transactions.

Top forex bonus promo

You can use the method which you want in order to do the withdrawal or deposit. Electronic methods like neteller are very fast (in our withdrawal test only 1 day duration). Generally, tickmill confirm your payment within 1 working day.

Tickmill withdrawal proof & tutorial

Many traders are worried about withdrawals with forex brokers because on the internet you will find a lot of claims about bad brokers. But with tickmill you will trade with a serious and trusted forex broker. How to do a withdrawal with tickmill? – on this page, we will show you an exact tutorial on how to do it and our personal withdrawal proof with tickmill. Inform you about the methods and processes.

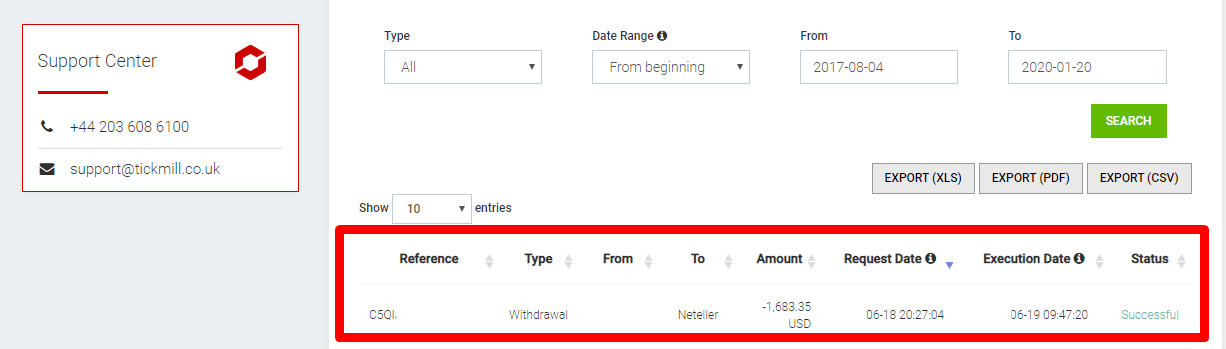

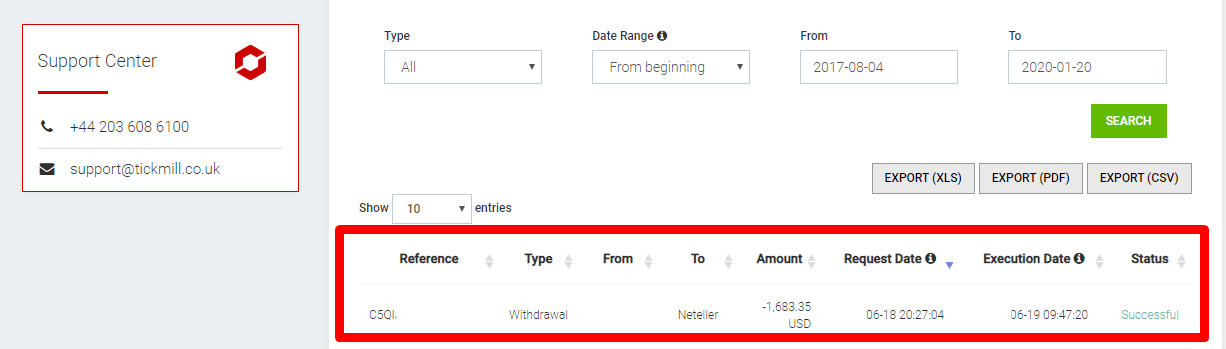

Tickmill withdrawal proof with neteller

As you see in the picture above the withdrawal with tickmill is done in less than 3 days (1 day on our example). The following steps will show you exactly how to do a withdrawal and in the next section, we will go in detail.

How to do the withdrawal:

- Be sure your trading account is fully verified

- Select your trading account

- Select the payment method

- Choose the amount and submit the withdrawal

- You will get an email when the withdrawal is processed

There are no withdrawal fees

(note: get 5% commission rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Step 1: an verified trading account is important

Tickmill is a regulated forex broker who is acting under strict laws and rules. The company has to verify your identity and trading account in order to confirm your payments. Also, trading with real money is not possible with a non verified account under the FCA or cysec regulation. The broker will always ask you for the real documents.

The documents will be verified in a few hours. Just upload a picture or scan of the required identity check. After you did it you can use all the functions of the tickmill trading account and very fast withdrawal.

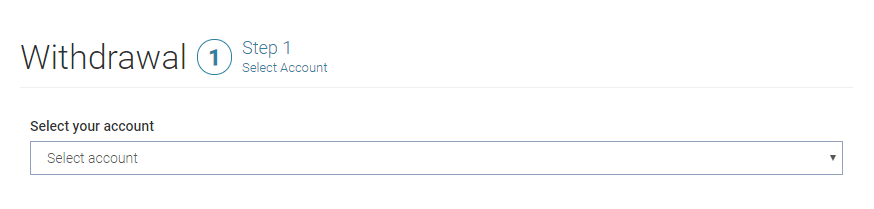

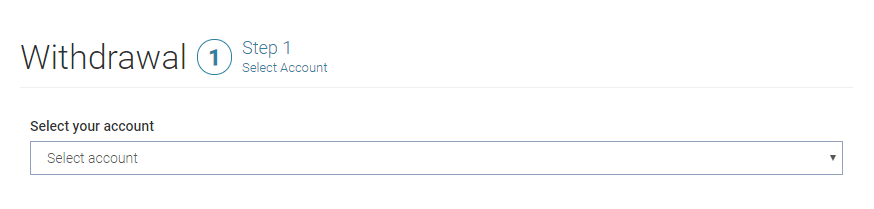

Step 2: select your tickmill trading account

To do the withdrawal you have to select your trading account. You directly see your account balance that you can withdrawal.

Select your tickmill trading account for the withdrawal

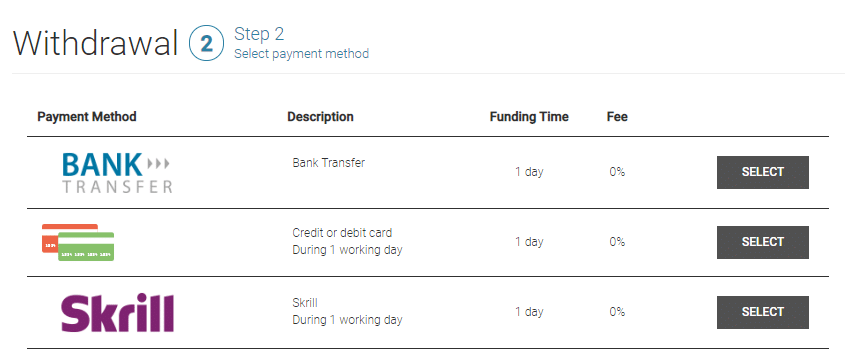

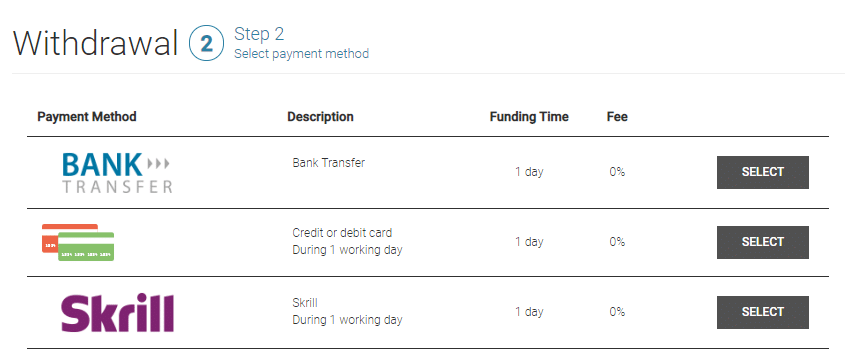

Step 3: select the payment method

Tickmill offers more than 10 different payment methods for money transactions. You can use the method which you want in order to do the withdrawal or deposit. Electronic methods like neteller are very fast (in our withdrawal test only 1 day duration). Generally, tickmill confirm your payment within 1 working day.

The payment methods are depending on your country of residence and the regulation.

Select your payment method

Payment methods:

- Bank transfer

- Credit cards

- Skrill

- Neteller

- Sticpay

- Fasapay

- Unionpay

- Nganluong.Vn

- Qiwi

- Webmoney

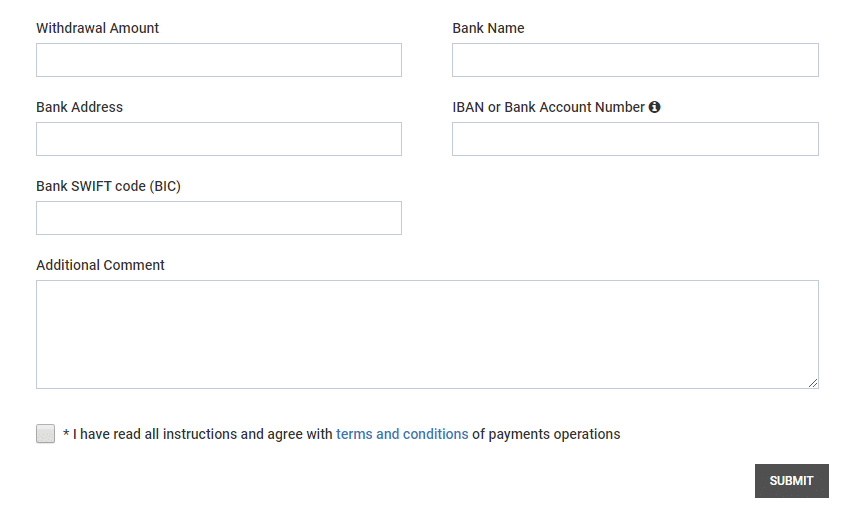

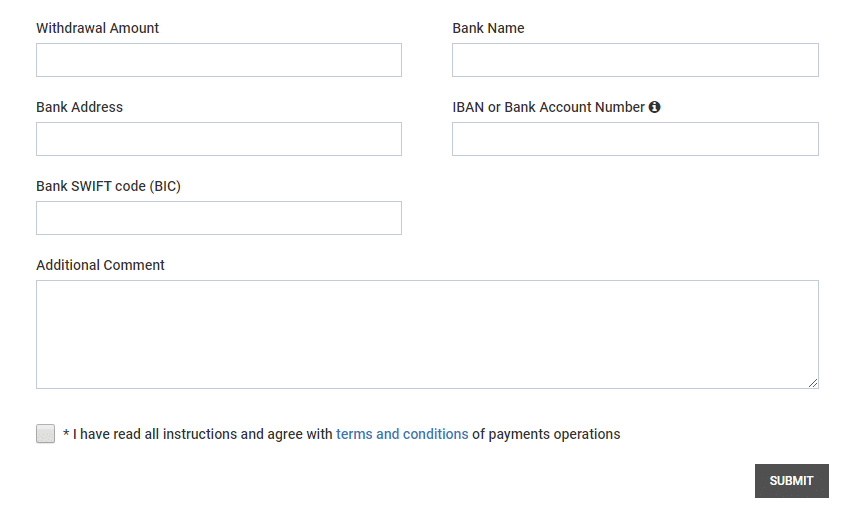

Step 4: choose the withdrawal amount

Now you have to insert your payment details (see the picture below) and the withdrawal amount. Then you can submit the payment. Make sure that the data is correct. If the data is not correct the broker will inform you.

Insert your tickmill withdrawal methods

Step 5: wait till the withdrawal is processed

As mentioned before tickmill will inform you with an email when the withdrawal is processed. The normal withdrawal duration is 1 working day. The support team is working monday till friday. On the weekends the withdrawals are not processed.

Problems with the withdrawal

Sometimes there can be a problem with your withdrawal. That is why we repeat it: you should verify your account correctly in order to trade real money and do correct withdrawals. In addition, tickmill can require additional documents from you. It is very important to follow the advice.

Moreover, the withdrawal details should match exactly your personal data. You can not a withdrawal to a foreign bank account or credit card. Tickmill only processes withdrawals to payment accounts which are belonging to your identity. This is a very important safety feature. Even hackers can not steal your money.

To do a successfull withdrawal you should:

- Verify your account

- Insert the right personal data and payment details

- Follow the brokers instructions

Conclusion: tickmill withdrawals are working without a problem

In conclusion, tickmill is a trusted forex broker who threats the funds of clients very well. As we showed in our screenshot the payments are processed within one day. There are many payment methods for everyone. And the biggest advantage is you do not pay any fees for withdrawals. All in all, we can recommend trading with tickmill. It is very easy to do the withdrawal of profits.

The advantages:

- More than 10 different payment methods

- Payments are processed within one working day

- No fees for your payments.

- Minimum withdrawal amount only $10

As we showed on this website the withdrawals with tickmill are working very fast and without any fees.

How to withdraw from tickmill

We do not support broker to broker transfer, we only offer our standard payment methods.

How do I deposit funds to my account?

You can make a deposit inside your client area using a funding option that suits you best. There are no fees on deposits.

What is the minimum deposit?

The minimum deposit for all account types is $100. However, to get a VIP account, you have to reach a balance of minimum $50,000.

How do I withdraw funds from my account?

Log in to your client area and fill in the respective withdrawal form. There are no fees on withdrawals.

Do you have any charges on deposits and withdrawals?

Tickmill has a zero fees policy on deposits and withdrawals.

How fast do you process my withdrawals?

We process all withdrawal requests within one working day.

How long does it take for funds to reach my bank account?

We process all withdrawal requests within one working day. The time necessary for the funds to reach your bank account depends on your bank’s policy. Bank withdrawals can take 3-7 working days to be seen on the client’s account. Credit/debit card withdrawals can take up to 8 working days to be seen on the client’s account.

Can I withdraw via a different payment method from the one I used to deposit?

Tickmill’s policy is to process withdrawals via the same method that you used to deposit. For example, if you deposited using a credit card, the card will be credited with the amount equal to the deposit amount. Upon request, we can send any profits via other payment methods under your name.

Can I withdraw my money if I have an open position(s)?

Yes, you can. However, at the moment of withdrawal processing, your free margin must exceed the amount specified in the withdrawal instruction including all payment charges. Free margin is calculated as equity minus the necessary margin (which is required to maintain an open position).

If you do not have sufficient free margin on your trading account, we will not carry out the withdrawal request until you submit a corrected withdrawal form and/or close the open positions on your account.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

How to withdraw from tickmill

We do offer an IB programme. Here is how it works:

- Open an account in the client area. If you are an existing client, please insert your account number.

- Agree to the terms and conditions in the client area - IB room.

- Promote our services to potential clients who may wish to open an account and start trading with us.

- Start receiving IB commissions.

If you want to share your IB link with your clients, then please note that the URL link contains cookies. Cookies will save your IB information. When your client completes the registration form in the client area and opens an MT4 account, then your IB code will be provided by default as main IB.

Our IB compensation scheme:

- Classic account- IB gets $10 per lot, round turn.

- Pro account- IB gets $2 per lot, round turn. All new clients introduced by you will get automatically a 5% discount on commission.

- VIP account - IB gets $2 per lot, round turn.

Tickmill’s IB programme is a unique opportunity to earn income, without any investment from your side. Even if you invite only one client, you will get rewarded for every trade he / she places.

Our IB programme has no hidden limitations:

- No limits for the duration of trades.

- No limits for the number of trades.

- No limits for the volume of trades.

- No limits related to the difference between an open price and close price.

- No limits for the number of new clients you bring during a certain period.

We offer special marketing tools that will help you get new clients simply and efficiently. Thanks to our transparent programme, you will be able to check and monitor each client and each trade that brought you a commission.

For more information and to register, please visit our IB page by clicking here.

How can I withdraw my IB commissions?

You can withdraw your IB commission anytime you want by filling in a withdrawal form inside the client area. You can transfer the funds to your tickmill live account or withdraw them to your bank account, skrill, neteller or any other available payment solution.

How are the IB commissions added to my account?

Whenever your client makes a trade, it will be shown automatically in your IB room with the calculated commission. The weekly IB commissions are added to your IB balance every weekend and can then be immediately withdrawable.

How can I attach clients to my IB account?

There are two ways a client can be attached to your IB account:

- You provide your clients with a unique IB referral link. Whenever a new client goes to our website using that link, registers his client area and opens a live account, you immediately see him being attached to your IB account.

- We can add an existing client under your IB account upon a written request from the client.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill withdrawal proof & tutorial

Many traders are worried about withdrawals with forex brokers because on the internet you will find a lot of claims about bad brokers. But with tickmill you will trade with a serious and trusted forex broker. How to do a withdrawal with tickmill? – on this page, we will show you an exact tutorial on how to do it and our personal withdrawal proof with tickmill. Inform you about the methods and processes.

Tickmill withdrawal proof with neteller

As you see in the picture above the withdrawal with tickmill is done in less than 3 days (1 day on our example). The following steps will show you exactly how to do a withdrawal and in the next section, we will go in detail.

How to do the withdrawal:

- Be sure your trading account is fully verified

- Select your trading account

- Select the payment method

- Choose the amount and submit the withdrawal

- You will get an email when the withdrawal is processed

There are no withdrawal fees

(note: get 5% commission rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Step 1: an verified trading account is important

Tickmill is a regulated forex broker who is acting under strict laws and rules. The company has to verify your identity and trading account in order to confirm your payments. Also, trading with real money is not possible with a non verified account under the FCA or cysec regulation. The broker will always ask you for the real documents.

The documents will be verified in a few hours. Just upload a picture or scan of the required identity check. After you did it you can use all the functions of the tickmill trading account and very fast withdrawal.

Step 2: select your tickmill trading account

To do the withdrawal you have to select your trading account. You directly see your account balance that you can withdrawal.

Select your tickmill trading account for the withdrawal

Step 3: select the payment method

Tickmill offers more than 10 different payment methods for money transactions. You can use the method which you want in order to do the withdrawal or deposit. Electronic methods like neteller are very fast (in our withdrawal test only 1 day duration). Generally, tickmill confirm your payment within 1 working day.

The payment methods are depending on your country of residence and the regulation.

Select your payment method

Payment methods:

- Bank transfer

- Credit cards

- Skrill

- Neteller

- Sticpay

- Fasapay

- Unionpay

- Nganluong.Vn

- Qiwi

- Webmoney

Step 4: choose the withdrawal amount

Now you have to insert your payment details (see the picture below) and the withdrawal amount. Then you can submit the payment. Make sure that the data is correct. If the data is not correct the broker will inform you.

Insert your tickmill withdrawal methods

Step 5: wait till the withdrawal is processed

As mentioned before tickmill will inform you with an email when the withdrawal is processed. The normal withdrawal duration is 1 working day. The support team is working monday till friday. On the weekends the withdrawals are not processed.

Problems with the withdrawal

Sometimes there can be a problem with your withdrawal. That is why we repeat it: you should verify your account correctly in order to trade real money and do correct withdrawals. In addition, tickmill can require additional documents from you. It is very important to follow the advice.

Moreover, the withdrawal details should match exactly your personal data. You can not a withdrawal to a foreign bank account or credit card. Tickmill only processes withdrawals to payment accounts which are belonging to your identity. This is a very important safety feature. Even hackers can not steal your money.

To do a successfull withdrawal you should:

- Verify your account

- Insert the right personal data and payment details

- Follow the brokers instructions

Conclusion: tickmill withdrawals are working without a problem

In conclusion, tickmill is a trusted forex broker who threats the funds of clients very well. As we showed in our screenshot the payments are processed within one day. There are many payment methods for everyone. And the biggest advantage is you do not pay any fees for withdrawals. All in all, we can recommend trading with tickmill. It is very easy to do the withdrawal of profits.

The advantages:

- More than 10 different payment methods

- Payments are processed within one working day

- No fees for your payments.

- Minimum withdrawal amount only $10

As we showed on this website the withdrawals with tickmill are working very fast and without any fees.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

How to withdraw from tickmill

Tickmill ltd is regulated as a securities dealer by the seychelles financial services authority (FSA). As such, our internal systems are in compliance with the FSA regulations, which means that your funds are held in segregated accounts to protect your assets.

What are the advantages of trading with tickmill?

Tickmill provides you with low spreads starting from 0.0 pips and ultra-fast execution speed of 0.15 second on average. Skrill, neteller, fasapay, unionpay and credit card deposits are processed instantly while withdrawals are processed within one working day. We are proud that we have no restrictions on trading and no requotes. We also allow scalping, hedging, arbitrage, eas and algorithms.

Where is tickmill regulated?

Tickmill is a trading name of tickmill ltd, which is regulated by the seychelles financial services authority (FSA).

Tickmill is also a trading name of tickmill UK ltd, which is authorised and regulated by the financial conduct authority (FCA) of the united kingdom, of tickmill europe ltd which is authorised and regulated by the cyprus securities and exchange commission (cysec), of tickmill asia ltd, which is authorised and regulated by the labuan financial services authority and of tickmill south africa (pty) ltd, which is authorised and regulated by the financial sector conduct authority (FSCA).

How do I deposit funds to my account?

You can make a deposit inside your client area using a funding option that suits you best. There are no fees on deposits.

Does tickmill offer cash or future cfds?

We do offer cash cfds that allow you to trade with a continuous price that isn’t subject to an expiration date. The cash CFD price is derived from the underlying futures contracts.

How do I open a metatrader 4 account?

You can open an account in the client area, efficiently and securely. Click here to open an account with us.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill 30$ welcome bonus (no deposit required)

Tickmill, authorized by the FSA and FCA, is offering an opportunity to all its new clients to open a welcome trading account and receive a $30 free welcome bonus for trading. The traders can use the bonus and earn up to $100 profits!

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The clients must meet all the required conditions such as registration (providing personal documents), opening a live MT4 trading account, and making a $100 deposit (can be withdrawn with no limitation) to withdraw the profits. Then, they should notify the tickmill support department via an email. Afterward, both the deposit and profits can be withdrawn.

How to get the tickmill $30 no deposit bonus:

the new customers should go to the tickmill official website and register for a welcome account. Afterward, the bonus will be automatically transferred to the accounts. It can be used for trading and turning into profits.

Certain conditions:

this bonus is offered once per client.

The profits can be withdrawn only once (min $30, max $100).

The terms & conditions of this bonus are similar to those of live pro account.

The leverage can be adjusted according to your needs.

The bonus amount cannot be transferred or withdrawn.

Tickmill – $30 welcome bonus

Tickmill

Promotion name: welcome bonus

Note: this promotion is available to clients of tickmill ltd (FSA SC regulated) only.

How to get:

1. Start registering your client area at tickmill.

2. Tick the “yes” box to the welcome account question.

3. Click the validation link you’ll receive via email.

4. Enjoy trading on your welcome account.

Withdrawal requirements:

you can withdraw 30-100 USD of profits after you pass verification process and make at least $100 deposit.

More information:

welcome bonus is not available in algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan, kenya and european union countries. This no-deposit promotion is available to new clients. Hedging trading is prohibited.

Information about the broker:

tickmill is a forex broker operated by tickmill ltd. Located in seychelles and regulated by the financial services authority of seychelles. Tickmill is also a trading name of tmill UK limited a company regulated by the financial conduct authority (FCA). Broker offers classic, ECN pro and VIP accounts. The minimum starting deposit is $€£100, spreads start from 0.0 pips, maximum leverage is 1:500. Broker review.

Tickmill review and tutorial

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the metatrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a tickmill account.

- Tickmill company summary

- Trading platforms

- MT4 platform

- Webtrader platform

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- FAQ

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

Tickmill company summary

Tickmill ltd is a member of the global tickmill group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in london but the company has multiple offices worldwide and its clients can be found everywhere from indonesia, south africa, and tanzania, to vietnam, estonia, australia, and malaysia.

Also part of the tickmill group ltd is tickmill prime and tickmill UK, registered in the isle of man.

Trading platforms

MT4 platform

Hugely popular due to its ease of navigation, dashboard customization, and a suite of features, MT4 is the leading forex trading platform.

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

Webtrader platform

As an online platform, the web-based interface doesn’t require a software download.

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Assets

Clients have access to a range of tradeable instruments:

- Forex – trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – access 14+ indices including the FTSE, DAX, dow jones (US30), and NASDAQ (nas100)

- Commodities – trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – trade a selection of german bonds

Spreads & fees

The tickmill classic account is commission-free with variable spreads starting from 1.6 pips. For pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the tickmill website.

Mobile app

Mobile trading is available on android (APK) and apple (ios) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment methods

Accepted payment methods include bank transfer, visa/mastercard, skrill, neteller and QIWI. The minimum deposit for classic and pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the client area. Customer reviews of the payment process are generally positive.

Demo account

The broker offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies, and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & promotions

Four promotional offers are available:

- $30 welcome bonus – set up and login to your account to withdraw your welcome bonus

- Trader of the month – the top-performing trader earns a $1,000 free trading bonus

- Rebate promotion – earn cash rebates on your trades

- Predict the NFP – win $500

For any issues claiming your deposit bonuses, see full bonus terms and conditions under the ‘promotions’ tab. The customer support team can also assist with bonus queries.

Note, deals may not be available to all account holders and in all jurisdictions.

Regulation & licensing

Tickmill ltd is regulated by the seychelles financial services authority (FSA). Tickmill UK ltd is authorised by the financial conduct authority (FCA). Tickmill europe ltd is regulated by the cyprus securities and exchange commission (cysec). These are reputable regulatory agencies and help contribute to the broker’s high trust rating.

Additional features

The broker offers multiple additional features to assist traders, including:

- Free VPS

- News blog

- Copytrade

- Tradingview

- Economic calendar

- One-click (EA) trading

- Video tutorials & seminars

- Forex & pip calculators

Account types

Tickmill offers three account types:

- Classic – trade cfds on 62 currency pairs, major indices, bonds and commodities. Variable spreads start from 1.6 pips and there are no commissions. A classic account is suitable for both beginners and experienced traders.

- Pro – aimed at experienced traders. Spreads from zero pips, commission payable on 2 currency units per side per lot (0.0020% notional). Stop and limit levels are 0. No commission on stock indices, oil and bonds.

- VIP – an exclusive account for high volume traders. Commission payable on 1 currency unit per side per lot. No commission on cfds, stock indices, oil and bonds. Spreads from zero pips, minimum deposit $50,000.

An islamic trading account is also available.

For issues regarding invalid account requests, check the list of accepted countries below or contact the customer support team.

Benefits

Advantages of trading with tickmill include:

- Demo account

- Hedging & scalping

- Straightforward login

- Multiple promotional offers

- Competitive average spreads

- A good range of educational tools

Drawbacks

Disadvantages of trading with tickmill include:

- No cent or micro account

- Spread betting unavailable

- No metatrader 5 (MT5) platform

- No cryptocurrency and bitcoin trading

- Services not available to clients from the US, japan, or canada

Trading hours

FX trading is available 24 hours, 5 days a week. German bonds can be traded between 00:00 to 23:00 GMT. Gold markets are open from monday to friday, 01:02 to 23:57 GMT and silver monday to thursday from 01:00-24:00 GMT, and friday 01:00 to 23:57 GMT.

Opening times for cfds will depend on their respective market. Head to the official tickmill website for more information. Trading hours can also be viewed in the MT4 terminal.

Customer support

Customer support is available monday to friday 7:00 – 16:00 GMT via:

- Phone – +852 5808 2921

- Email –[email protected]

- Live chat – chat logo on the right of the homepage

The support team can help with a range of queries, from registration and verification documents to swap-free conditions, forgotten passwords, and account faqs.

Additional information can be found on tickmill’s linkedin and youtube platforms.

Security

Their internal systems are FSA compliant, so client funds are held in segregated accounts. The broker adheres to industry safety standards and only offers secure deposit and withdrawal options. Negative balance protection is available to all clients.

Tickmill verdict

Tickmill is a regulated broker offering the MT4 trading platform, a suite of additional resources, plus multiple account options. Take tickmill’s services vs pepperstone, XM, zulutrade, or IC markets, and traders benefit from competitive fees but sacrifice such a diverse product list.

Accepted countries

Tickmill accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

But traders from united states, canada, japan, bangladesh, nigeria, pakistan, kenya are not allowed by the broker.

Does tickmill offer an islamic account?

Yes, tickmill offers a swap-free account, compliant with sharia law. See the broker’s website for instructions on how to open an account.

Is tickmill a true ECN broker?

Yes, tickmill is an ECN broker and not a market maker. This arguably means clients benefit from lower fees and operate in a more transparent trading environment.

Is tickmill available to US clients?

No, services are not available to those from the US. Traders from canada, japan and some other countries are also unable to open real-money trading accounts.

Is tickmill a good broker?

Tickmill is a highly regulated and well-established broker, offering the popular MT4 platform. With decent welcome bonuses and customer support also available, tickmill a solid online broker.

Does tickmill have the NASDAQ?

Yes, clients can trade on the NASDAQ. Tickmill traders also have access to a dozen or so other stock indices, plus 62 currency pairs, commodities, and german bonds.

| Tickmill is FCA & cysec regulated and offers trading in cfds, FX and commodities |

Axi offers forex and CFD trading to retail and professional traders. Our review includes all you need to know, from read more

The last twenty years have seen US-headquartered oanda, grow into an established player on the global online broker stage. Today read more

Eaglefx offers FX and CFD trading on the MT4 platform, including indices and cryptocurrencies. Follow this review for a breakdown read more

Liteforex limited is an established CFD and forex broker. Clients can trade on the metatrader 4 (MT4) and metatrader 5 read more

Vincent nyagaka is a professional trader, analyst &. He has been actively engaged in market analysis for the past 7 years. He has a monthly readership of 100,000+ traders and has taught over 1,000 students since 2014. Vincent is also an experienced instructor and public speaker. Checkout vincent’s professional trading course here.

So, let's see, what we have: how to do a withdrawal on tickmill and how long does it take? ✔ methods and tutorial for traders in 2021 ➜ read more about it at how to withdraw from tickmill

Contents of the article

- Top forex bonus promo

- Tickmill withdrawal proof & tutorial

- How to do the withdrawal:

- Step 1: an verified trading account is important

- Step 2: select your tickmill trading account

- Step 3: select the payment method

- Step 4: choose the withdrawal amount

- Step 5: wait till the withdrawal is processed

- Problems with the withdrawal

- Conclusion: tickmill withdrawals are working without a...

- How to withdraw from tickmill

- How do I deposit funds to my account?

- What is the minimum deposit?

- How do I withdraw funds from my account?

- Do you have any charges on deposits and withdrawals?

- How fast do you process my withdrawals?

- How long does it take for funds to reach my bank account?

- Can I withdraw via a different payment method from the one...

- Can I withdraw my money if I have an open position(s)?

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- How to withdraw from tickmill

- How can I withdraw my IB commissions?

- How are the IB commissions added to my account?

- How can I attach clients to my IB account?

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Tickmill withdrawal proof & tutorial

- How to do the withdrawal:

- Step 1: an verified trading account is important

- Step 2: select your tickmill trading account

- Step 3: select the payment method

- Step 4: choose the withdrawal amount

- Step 5: wait till the withdrawal is processed

- Problems with the withdrawal

- Conclusion: tickmill withdrawals are working without a...

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- How to withdraw from tickmill

- What are the advantages of trading with tickmill?

- Where is tickmill regulated?

- How do I deposit funds to my account?

- Does tickmill offer cash or future cfds?

- How do I open a metatrader 4 account?

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- Tickmill 30$ welcome bonus (no deposit required)

- Tickmill – $30 welcome bonus

- Tickmill

- Tickmill review and tutorial

- Tickmill company summary

- Trading platforms

- Assets

- Spreads & fees

- Leverage

- Mobile app

- Payment methods

- Demo account

- Deals & promotions

- Regulation & licensing

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Tickmill verdict

- Accepted countries

- Does tickmill offer an islamic account?

- Is tickmill a true ECN broker?

- Is tickmill available to US clients?

- Is tickmill a good broker?

- Does tickmill have the NASDAQ?

Comments

Post a Comment