Trade Working Capital, get trading capital.

Get trading capital

If a company generates positive working capital, meaning it has enough easily accessible funds to meet its short-term obligations, it has greater scope to invest in new assets that produce extra revenues and profit (and return money to shareholders).

Top forex bonus promo

Alternatively, if current liabilities exceed current assets, there’s a risk that the company might be forced to turn to a bank or financial markets to raise additional capital (or face defaulting on its bills and going bankrupt). $10,000 + $2,000 - $5,000 = $7,000.

Trade working capital

What is trade working capital?

Trade working capital is the difference between current assets and current liabilities directly associated with everyday business operations.

Understanding trade working capital

Working capital, the amount of money available to fund a company’s day-to-day operations, is one of the first things that investors choose to analyze when weighing deciding if a stock is worth buying. By simply subtracting current liabilities—all debts due within the next 12 months—from current assets—resources that are expected to be converted to cash within a year—on the balance sheet one can immediately learn how much money would remain if a company used all of its liquid possessions to pay off all the money it owes to its creditors.

Key takeaways

- Trade working capital is the difference between current assets and current liabilities directly associated with everyday business operations.

- It defines working capital, which takes into account all current assets and liabilities, more narrowly to determine if a company has enough cash on hand to manage its short-term commitments.

- Usually, trade working capital is calculated by adding together inventories and accounts receivable (AR) and then subtracting accounts payable (AP).

If a company generates positive working capital, meaning it has enough easily accessible funds to meet its short-term obligations, it has greater scope to invest in new assets that produce extra revenues and profit (and return money to shareholders). Alternatively, if current liabilities exceed current assets, there’s a risk that the company might be forced to turn to a bank or financial markets to raise additional capital (or face defaulting on its bills and going bankrupt).

Working capital

Trade working capital vs. Working capital

When investors examine current assets and liabilities to determine if a company has enough cash on hand to manage its short-term commitments, they occasionally elect to refine their search criteria. Investors may decide to omit some resources and obligations from the equation because they are deemed to be less representative of a company’s short-term liquidity than others.

Working capital takes into account all current assets, including cash, marketable securities, accounts receivable (AR), prepaid expenses and inventories, as well as all current liabilities, including accounts payable (AP), taxes payable, interest payable and accrued expenses. Trade working capital, meanwhile, differs by only considering current assets and liabilities that are related to daily operations.

Important

Trade working capital is a narrower definition of working capital and, as a result, can be viewed as a more stringent measure of a company's short-term liquidity.

Calculating trade working capital

Usually, trade working capital is calculated by taking the number for inventories—the collection of unsold products waiting to be sold—adding the AR, or trade receivables—the balance of money due to a company for goods or services delivered or used but not yet paid for by customers—and then subtracting the AP, or trade payables—the amount a company owes its vendors for inventory-related goods, such as business supplies or materials. Together, these items are viewed as the key drivers of a company’s working capital.

Example of trade working capital

If a company has $10,000 in AR, or trades receivables, associated with everyday operations, $2,000 in inventories and $5,000 in AP, or trades payable, associated with everyday operations, then its trade working capital is:

$10,000 + $2,000 - $5,000 = $7,000.

Special considerations

Determining what is an acceptable amount of trade working capital depends on the type of company. For instance, it might be less of a cause for concern if certain very large companies display negative trade working capital because they are generally better equipped to generate additional funds swiftly, either by moving money around, through the acquisition of long-term debt or by leveraging their strong brand recognition and selling power.

It’s also worth pointing out that an extremely high trade working capital could be a red flag. In some cases, this may indicate that a company is not investing its excess cash optimally, or is neglecting growth opportunities in favor of maximum liquidity. By not putting its capital to good use, the company can be accused of doing its shareholders a disservice.

Trade with confidence on the world's leading social trading platform

Join millions who've already discovered smarter investing in multiple types of assets. Choose an investment product to start with.

Choose an investment product to get started and discover why over 10 million users trust etoro

Stocks & etfs

0% commission means thereвђ™s no markup on stocks & etfs вђ“ no matter how much you invest

Cryptocurrencies

Buy, sell and store bitcoin and other leading cryptos with ease

CFD trading

Go long or short on FX from just 1 pip. Trade commodities and indices with flexible leverage.

Invest commission free

No markup on stocks & etfs from leading exchanges вђ“ no matter how much you invest

Buy & sell cryptocurrencies

Buy, sell and store bitcoin and other leading cryptos with ease

Advanced trading, more opportunities

Go long or short on FX, commodities and indices with flexible leverage

New to trading?

Discover copytrader™: replicate the trading strategies of top-performing traders

100% stocks, 0% commission

Join the social trading revolution. Connect with other traders, discuss trading strategies, and use our patented copytraderв„ў technology to automatically copy their trading portfolio performance.

Meet our popular investors

Etoroвђ™s popular investor program recognises talented, savvy, responsible traders who share their knowledge. Our top-tier popular investors earn up to 2% annually on their assets under management.

Meet our popular investors

Etoroвђ™s popular investor program recognises talented, savvy, responsible traders who share their knowledge. Our top-tier popular investors earn up to 2% annually on their assets under management.

Meet our popular investors

Etoroвђ™s popular investor program recognises talented, savvy, responsible traders who share their knowledge. Our top-tier popular investors earn up to 2% annually on their assets under management.

Meet our popular investors

Etoroвђ™s popular investor program recognises talented, savvy, responsible traders who share their knowledge. Our top-tier popular investors earn up to 2% annually on their assets under management.

Etoro is a fantastic trading platform, both from an ease of use and technical perspective.

It provides a huge variety of investments and a great community of traders.

Great platform for starting traders. Great selection and transparent fee system! .

Etoro has been making my trading experience enjoyable and secure.

Great service. Fast feedback. Social forum give a lot of info.

I am very satisfied with the services etoro platform provides.

The global leader of social trading

Discover why millions of users from over 140 countries choose to trade with etoro

Regulated

Our company is regulated by the FCA and cysec

Security

Your funds are protected by industry-leading security protocols

Privacy

We will never share your private data without your permission

In the press

See what the media has to say about etoroвђ™s trading and investing platform

Those with less expertise might like to try a platform called etoro, which allows customers to copy вђњstar tradersвђќ directly, and can make traders of even the least informed of punters.

The best returns occur when investors are plugged into diverse social groups that enable them to collide with information from multiple networks. In the social media world, as in real life, it pays to hover on the edge of cliques вђ“ but not get slavishly sucked into just one.

Internet social networks that let users follow investments the way they track status updates on facebook are attracting record interest, turning top performers into market stars for individual investors.

A recent research we carried out with the massachusetts institute of technology has shown that copy trading, where traders watch the trading activity of other people and make their decisions accordingly, performs significantly better than manual trading.

Etoro is the worldвђ™s leading social trading platform, which offers both investing in stocks and cryptocurrencies, as well as trading CFD with different underlying assets.

Top instruments

Support

Learn more

Find us on

About us

Privacy and regulation

Partners and promotions

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money.

Etoro (europe) ltd., a financial services company authorised and regulated by the cyprus securities exchange commission (cysec) under the license # 109/10.

Etoro (UK) ltd, a financial services company authorised and regulated by the financial conduct authority (FCA) under the license FRN 583263.

Etoro AUS capital pty ltd. Is authorised by the australian securities and investments commission (ASIC) to provide financial services under australian financial services licensce 491139

Past performance is not an indication of future results

general risk disclosure | terms & conditions

You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before you decide to trade. Under no circumstances shall etoro have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to cfds or (b) any direct, indirect, special, consequential or incidental damages whatsoever. Cryptocurrencies markets are unregulated services which are not governed by any specific european regulatory framework (including mifid). Therefore when using our cryptocurrencies trading service you will not benefit from the protections available to clients receiving mifid regulated investment services, such as access to the cyprus investor compensation fund (ICF)/the financial services compensation scheme (FSCS) and the financial ombudsman service for dispute resolution. Trading with etoro by following and/or copying or replicating the trades of other traders involves a high level of risks, even when following and/or copying or replicating the top-performing traders. Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders, or traders whose ultimate purpose or intention, or financial status may differ from yours. Past performance of an etoro community member is not a reliable indicator of his future performance. Content on etoro's social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of etoro - your social investment network.

Copyright В© 2006-2021 etoro - your social investment network, all rights reserved.

Trading taxes in the UK

UK trading taxes are a minefield. Whether you are day trading cfds, bitcoin, stocks, futures, or forex, there is a distinct lack of clarity, as to how taxes on losses and profits should be applied.

However, with day trading promising an enticing lifestyle and significant profit potential, you shouldn’t let the UK’s obscure tax rules deter you. This page will break down how trading taxes are exercised, with reference to a landmark case. Finally it will conclude by offering useful tips for meeting your tax obligations.

Tax classifications

Part of the confusion around HMRC day trading taxes comes because everyone’s activities are different. Some who trade forex will be given a tax exemption by HMRC, whereas others will face expensive obligations.

UK tax implications are equally as concerned with how you approach your trading activities as to what it is you’re trading. The instrument is just one factor in your tax status. However, case law and regulations have settled on breaking trading activity into three distinct categories, for the purpose of taxation.

1. Speculative

The first category is speculative in nature and similar to gambling activities. If you fall under this bracket any day trading profits are free from income tax, business tax, and capital gains tax. As you can probably imagine, falling into this category isn’t a walk in the park (more on that later).

2. Self-employed

The second category taxes trading activity in precisely the same way a normal self-employed individual undergoing business activity is taxed. You will be liable to pay business tax, or the obligations of those who fall under the third tax bracket.

3. Private investor

If you are classed as a private investor your gains and losses fall under the capital gains tax regime. The benefits and drawbacks of which are detailed further below.

It’s worth bearing in mind that because trading activity fluctuates, you could well fall within any and all of these three categories over a given period.

Day trader vs investor status

Whether you’re classed as a day trader or an investor could make a serious difference to your tax obligations.

The difference

The crucial distinction is that a ‘trader’ will hold shares as his stock like a hardware store holds power tools. Whereas, an investor, will hold shares for use as assets to then generate income, dividend income, for example.

This is important because a share trader will pay income tax, whilst an investor will pay capital gains tax.

Which classification is advantageous?

Prior to 2008, there were no substantial differences between each status.

If you were classed as a trader you were able to offset more expenses. Share investors, however, allowed for tapered relief and your annual exemption to be offset. Consider that many currency, options, and stock speculators only hold onto assets for a short period of time, this means for both investors and traders the tax rate could be 40% (assuming they were both higher rate taxpayers).

Having said that, there were genuine investors who held onto shares and assets for a long period of time. This qualified them for a more beneficial capital gains tax rate of 24%, or just 10% if they invested in AIM shares.

However, april 2008 brought with it change. Gone was tapered relief and in its place, a fixed 18% capital gains tax rate was introduced. This gives the majority of investors a substantial tax advantage over traders. The additional tax relief on expenses probably would not make up for the significant reduction in the tax rate for investors.

Fortunately, it’s not all bad news. As a trader, you have more flexibility in regard to the treatment of losses. Instead of being carried forward to be offset against further capital gains, you can offset the loss against any other income for the tax year of the loss. So, if day trading isn’t your only course of income, you could potentially offset losses against employment income and interest income, for example.

It’s worth noting that if you claim a trader status to benefit from loss relief, HMRC often take a closer look. Due to this supposed advantage of investor status, day trading tax rules in the UK may toughen up in coming years.

Classification process

HMRC consider the ‘badges of trade’ in order to determine whether you’re activity will be classed as trading or investment in nature.

Whilst tax rules and regulations remain somewhat grey, judicial decisions and best practice have clarified certain criteria and factors.

Motivation

Despite being one of the hardest areas to make an accurate determination on, this is a vital component.

If HMRC believes your motivation for trading is to generate profits, this will impact on whether they consider your activity as trading for the purposes of taxation.

Of course, they do not simply take your word for it. Instead, they look at the facts surrounding your transactions. They consider the following:

- Was it a one-off trade? Alternatively, have there been numerous trades of the same nature, carried out in a similar manner to ordinary traders?

- Is this your sole occupation? Alternatively, do you have other employment, suggesting you don’t trade purely to make a living?

- What do you do with your profits? Do you re-invest them into more trading activity?

Transaction

HMRC can examine the circumstances surrounding the transaction to identify a trading motive. They will consider the following:

- How you acquired the shares – did you purchase or inherit them? If you sold inherited shares you would obviously be less likely to be classed as trading, and it’s more likely to be considered investment activity.

- Timing – what was the length of time between the purchase and sale date?

- Means – did you use finance to buy your instrument?

- Cause – did a sale take place in an emergency? If so, it’s less likely to be considered as trading.

- Frequency – is there evidence of a pattern of trading behaviour? Are you regularly buying and selling in your chosen instrument? This is one of the most important areas of consideration.

Whilst all of the above factors are taken into account to determine your financial trading tax obligations in the UK, on the whole, instruments that generate an income are classed as investment assets.

Stock taxes

In particular, stock trading tax in the UK is more straightforward. This is because there is a higher chance share trading by its very nature will be classed as investments.

A judge highlighted the point by stating, “where the question is whether an individual engaged in speculative dealings in securities is carrying on a trade, the prima facie presumption would be … that he is not.”

Having said this, a frequent pattern of buying and selling shares will lead the HMRC to take a closer look and consider the argument for ‘trading’.

So, stocks do bring with them some advantages in comparison to options trading taxes, for example.

A ali v HMRC

The case brought by mr. Akhta ali was a defining case in UK trading taxes. After mr. Akhta ali successfully appealed a decision brought by HMRC, a number of common misconceptions were put straight. The case brought much-needed clarity in considerations around day trading profits and losses, in particular.

What he won, was the right to treat his profits and losses from day trading as ‘trading’ profits and losses. This meant they would be subjected to the same sole trader tax rate as ordinary businesses in the UK.

His losses which were in the hundreds of thousands of pounds were allowed to be offset against the profits earned by his other business. This resulted in significant deductions in his overall tax liability. In fact, in a number of preceding years a tax calculator established his liability has virtually zero.

The facts

Mr. Ali ran a successful pharmacy business. He wanted to day trade shares as a second legitimate business. Between the years 1995 and 2002, he considered himself as an ‘investor’. Then, between 2000 and 2005 his activities changed from ‘investing’ to ‘trading’. So, whilst investing his shares he reported the profits and losses in line with capital gains regulations.

In 2005 he decided he was now a day trader. He argued his activities were done with the intention to generate income. He, therefore, believed he was carrying on a trade and any profits and losses should now fall under the business tax rules instead.

The HMRC ruling was in line with what many believed at the time. This was that losses would often exceed profits for day traders and therefore they were hesitant about classing day traders as self-employed.

Final verdict

The 2016 ruling meant HMRC will now have to sacrifice the considerable tax revenues they had previously generated from losses, as day traders can now simply offset these losses against other forms of income.

It’s easy to see why HMRC were unwilling to accept such a seamless transaction from investor to trader. The lines are difficult to draw and will likely lead to less revenue for the tax man.

The simple truth is the diversity of a day trader’s activities doesn’t fit within a one-size-fits-all approach. So, what should you take from the case? Mainly, that getting into a disagreement with HMRC can be a long-winded and expensive process. If mr. Ali had asked permission beforehand, instead of seeking forgiveness afterwards, this whole episode could have been avoided.

The solution then – always query with HMRC and seek advice first. It could save you considerable time and significant money.

Different instruments, different taxes?

As you may have already gathered from this page, CFD trading tax implications in the UK will be the same as those interested in FX, binary, bitcoin, and commodity trading taxes. HMRC is less concerned with what you’re trading, and more interested in how you’re trading it. Share trading tax implications will follow the same guidelines as currency trading taxes in the UK, for example.

I hate to be the bearer of bad news, but those hoping to start trading forex tax-free aren’t going to have much luck either. Forex trading tax laws in the UK are in line with rules around other instruments, despite you buying and selling foreign currency.

However, if you remain unsure about tax laws surrounding your specific instrument, seek professional tax advice.

Tax tips

Even with all the information at your disposal, day trading and UK tax is still an unsteady tightrope to walk. That’s why you need to act sensibly. Fortunately, there are two main tips to follow.

1. Keep A record

Your trading activity over the course of a year can vary between ‘speculative’, ‘self-employed’ and ‘investing’ activity. That means when it comes to filing your tax returns you need a detailed account of all your trading activity. You should keep an account of the following:

- Instrument

- Purchase and sale date

- Price

- Entry & exit points

With this information to hand, you’ll save yourself a large headache when you file your tax returns.

You can also get your hands on software which makes this process hassle-free. Taxes on day trading bitcoin can be automatically identified if software has access to your trade history, for example.

2. Seek advice

With so much capital on the line, is it really worth risking any mistakes? If you are unsure you can always contact HMRC to seek clarification. There are also numerous tax advisors that specialise in tax for day traders. It’s easy to think you don’t want to fork out the extra cash, but you may find they can save you sizeable sums.

Key points

UK taxes on forex, stocks, options, and currency day trading are not crystal clear. You will need to carefully consider where your activities fit into the categories above. It’s also worth bearing in mind that failure to meet your tax obligations can land you in extremely expensive hot water, and even prison. So, if you want to stay in the black, take taxes seriously.

This page is not trying to give you tax advice. It simply looks to paint a clearer picture of HMRC’s approach to trading activity. Finally, before you file your tax returns, it’s always advisable to seek professional tax advice.

Trade capital review

Trade capital is an unlicensed forex / bitcoin broker, which opened in april 2018. Their website is not working!

Complaints and withdrawal issues you can read about here.

Trade capital reviews

The crypto / forex trading software that you see at trade capital, is made by the company airsoft. It is a web based CFD platform, with no ability to use the classic MT4 software or any mobile trading app. Look at the screenshot below to see how the software looks. More than 100 underlying assets are available, including bitcoin, ethereum, currency pairs, stocks, commodities and market indexes.

Trade capital’s website and trading platform is available in english, german, italian and spanish. To start trading, they require you deposit a minimum of $220. You can deposit money with a credit card or you can deposit with bitcoin, bitcoin cash and ethereum.

Scam trading software like the bitcoin revolution you saw advertised, are actually fake news . They are using the images and logo from dragons den illegally. Therefore, before falling victim of one of those scams, read this.

Trade capital license check

Scam broker investigator uses a simple method to determine if a new crypto currency broker is legal or just another scam broker. We look to see if the broker is licensed and regulated by anyone of these regulators; MNB hungary, the FCA united kingdom or ASIC australia.

Trade capital is not a licensed broker, and on october 31, 2018 the FCA warned investors about using this broker, s ee her e.

This broker claims to be owned by a company named; trade capital investments LLC, and located at: cours de rive 6, 1204 genève, switzerland. Contact phone number is in england: +44 203 6958593, and their email address is: [email protected] official website: https://tradecapital.Com/.

You should look at the popular bitcoin brokers which are regulated, look here.

ASIC australia warning!

“ASIC urges all investors considering trading in forex to check they are dealing with an entity that holds an australian financial services licence.”

Compare trade capital

There are hundreds of crypto and bitcoin CFD brokers to choose from online, so first look at the best brokers.

Pepperstone is a popular broker that is licensed in united kingdom & australia, offering tight spreads on bitcoin, see here.

Go start with a free demo accounts, and experience the difference, signup here.

Are you an existing client of this broker, please share your experience with the other investors reading this review, in the comments section below.

How to get funding for your trading strategy?

So, it’s been some time since you’ve been thinking of making more money out of your successful trading strategy. And why should you not? After all, you’ve worked hard for it and there is only a small % of people who are successful in this business. The idea is to add more funds to your trading strategy and get more profits.

So how do you go about finding more money? Do you ask your family, your friends or vcs? Well, you can do that but it’s slightly more complicated than that. I will try to cover the various options, their intricate nature and all the things you would need apart from your trading strategy to make someone finance your trading.

What you’d need to be ready with?

Before you go asking for money, I'd like you to be ready with some things that will make you look like a serious trader who means business.

1. A good track record

Your strategy has been making money for you. But since when? 3 months? 6 months? And how have you been tracking the performance? What format? Excel sheet? Your handbook? On your broker’s software?. If you’re looking to get serious money from anyone, you’ll need to have at least 2 year’s worth of consistent profitable track record. This is because many people get lucky and are able to have profits for a few months, this doesn’t guarantee that their strategy will work for a longer period.

Anyone who’s going to invest money into something will always be extra cautious. So your track record has to be from a trusted source, here are some online services that you can make use of for keeping a journal of your trades.

Easy to use, trusted by many traders and provides good analytics for your trades and their performance.

Supports a wide variety of brokers based on MT4 platform. Offers decent analytics.

2. Tune it!

If your strategy has made a lot of profits in a relatively short time then probably it also means that your strategy has a larger risk appetite. This is something investors try to avoid, they like to have their money in relatively stable assets. So you’re good, even if you’re able to get consistent single digit % profit year on year with relatively low risk. So tune your strategy to reduce the risk as much as possible.

It is possible that the core or nature of your strategy doesn’t allow you to reduce the risk, that’s also fine, but in this case, it’s a little difficult to get external funding, you’re better off on your own money.

Funding avenues

Now that you have a good track record and have tuned your strategy to get the investment, where do you get your funds from? Here are some ways

Social trading

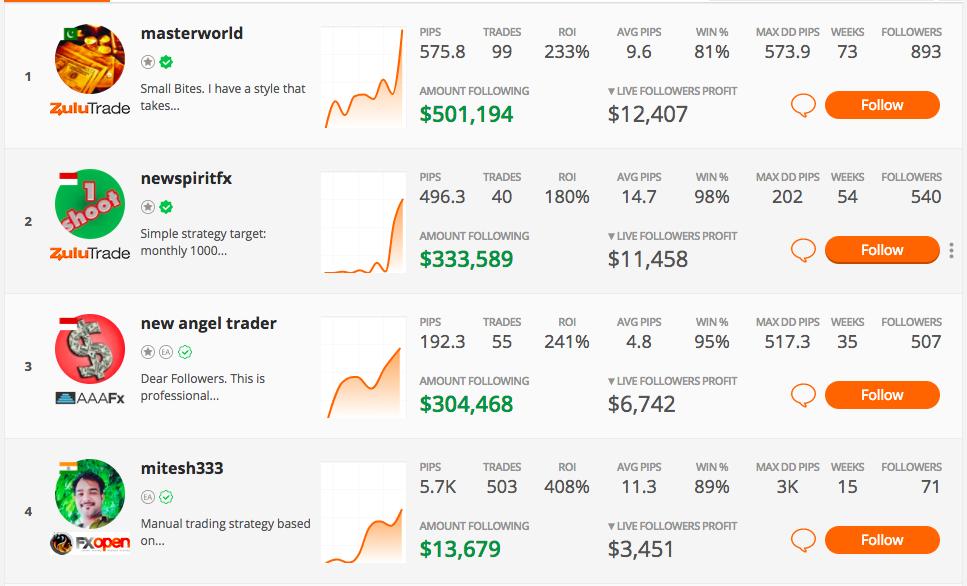

A lot of social networks related to trading have started in recent years. Many of these networks have functionality to let other people follow you and invest in your trading strategy, what you get out of it is part of the profit or fees from the platform. This could be a good way for you to earn more money out of your successful trading strategy. Here are some of the famous social trading platforms,

Etoro is a global investor community with a significant number of active people. This is like a facebook but for traders. Etoro offers something called as ‘copy people’ , this feature lets other people copy your trading strategy, the platform automatically executes trades for your followers same as your trades just the proportion of position size varies based on the amount of money your followers have put in, the platform also manages risk and exposure based on your strategy.

Here’s a screenshot of how the copy people interface looks like.

Your followers can see all the information they’d require to make an informed decision on whether to follow you or not. This information includes your account’s month of month performance, the average risk taken, the total number of people who copy your strategy, total trades, your portfolio of instruments, average holding time, trades per week etc.

Etoro pays you a certain fee for every follower (or copier in this case) you have.

Started in 2007, zulutrade has always put emphasis on social trading, especially in forex social trading. Equipped with thousands of signal providers with a professional and advanced search tool, your followers can analyze your strategy in minute detail, and they can replicate your performance. The best feature would be the ability to customize risk and money management.

Here’s how their social trading platform looks like. It provides all sorts of details one would require to make a trading decision.

The idea is to get as many live followers as you can and when they trade using your strategy you get a cut from zulutrade. The commission starts from $5 per $100k traded in total by your live followers. Pretty decent, eh? Here are more details on their partner program, if you wish to know.

Other benefits of social trading is that you become popular. And popularity has its own value that you can monetize. A popular trader is also an influencer who can tie up with brokers, data-providers, exchanges and other trading services to help these organizations reach out to more people and in turn help you make money outside of your trading. Becoming an influencer is a whole different ballgame maybe we’ll cover that topic separately.

Here are some other social trading platforms - alpari, ayondo, tradeo, darwinex etc. They all offer similar services with similar fees structure. Go ahead, explore!

Compete and win!

If you’re not too keen on social trading, you can look at participating in competitions that allocate huge capital to top performing strategies. Let’s look at some,

Quantiacs holds a competition worth $2.25 million every quarter. Quantiacs is a marketplace for user-generated trading algorithms. They connect trading systems with external capital from institutional investors. Quantiacs is quite well-known in quant community and winning a competition here will surely make you famous. Quantiacs offers toolbox for python and MATLAB to create and backtest your trading systems.

Here’s a screenshot of the currently on-going competition.

There are other similar projects as well, quantconnect and quantopian are such examples. Quantopian has a strong community of quants, a lot of useful discussions happen on the community forum.

All of these sites will offer you a platform either supported by python or MATLAB to help you get your strategy on-board. These platforms will also equip you with historical data, bevy of indicators and economical data to get you started with. You can check them out here quantopian & quantconnect.

Prove your strategy and get funds, simple!

If you think, getting people to follow you and copy your strategy isn’t your cup of tea and you’d rather prefer a direct platform where you just throw numbers and get direct funding. Or you just don’t want to reveal your strategy/trades because it’s the holy grail, well, then that’s possible too.

Here are some platforms that are direct and would be happy to fund your strategy -

Since there are so many of them, I will just focus on the most prominent ones, you can explore the rest in your own sweet off market hours.

Oneup trader focuses on simplifying the funding process. A good platform to connect with investors who are looking to put their money in traders who have proved their worth. Oneup trader works on a monthly fees basis along with profit sharing scheme with investors. State of the art analytics, a community of traders, free data fees and vast funding network are some of their selling points.

With more than 27,000 trading accounts, psyquation has become popular among traders who are looking to step up their game. With its wide investor network, the available capital for funding is quite huge. They have also tied up with a large pool of brokers to provide a seamless trading interface.

Psyquation boasts about their analytics platform that gives you a research based advice. Here’s an overlook of their leaderboard.

Other fundraising platforms:

Next steps

In case you are not looking to get funding for your trading strategy but want to venture as an entrepreneur in this field we have the perfect success story to inspire you. This case study talks about derek and maxime, finance experts from two different nationalities who were connected during quantinsti’s executive programme in algorithmic trading and started their own firm in algorithmic trading domain. Click here to read the story.

Route to sustainable financial freedom.

New partnerships . New opportunities . New MBA .

Sign up

Register an account and fill in necessary information.

Fund your wallet

Fund your wallet using your local bank card.

Invest

Invest preferred amount from your funded wallet

Withdraw or rollover

Withdraw accrued rois to your bank account.

About us

MBA trading and capital investment limited is a world class forex training and capital investment company, established with the vision of impacting the general populace with the knowledge of trading forex and creating platforms that will bring about sustainable financial freedom.

With over 10 thousand active investors, more than 10 business locations in nigeria and our new offices in the united arab emirates (UAE) and the united kingdom (UK), we are determined to provide an all-encompassing investment service to our clients that accommodate their various needs.

We are here to liberate you

These are some of the reasons

people choose us.

Safe and secure

Our payment gateway is secured with military grade encryption with powerful COMODO SSL.

Financial freedom

Our customers have since being part of us, became financially free with a steady income source.

Payment options

Our payment system supports local banks, deposits and withdrawals are fully automated.

Mobile app

For quicker access, mbatrading has an app for both android and IOS platform .

Mouthwatering ROI

ROI offered by mbatrading can't be matched by any bank while still enjoying full coverage of insurance.

Powerful dashboard

Manage multiple investments using our powerful cutting-edge dashboard built on modern technology.

Learn how to trade on your own from experts

Our institute is the training arm of the organization that trains students on how to navigate the forex market for profitability. It also offers a free three months mentorship for graduates of the institute to ensure their success in the forex market.

New partnership new features.

Exciting new partnership announcement for MES capital & oneup trader.

We are pleased to announce that MES capital has officially joined oneup trader. Together, we are bigger, stronger, and better positioned to provide innovative solutions, enhanced services that improve the quality of trader evaluations and funding.

Oneup trader will provide technical, comprehensive and innovative tools to all prospective traders seeking funding and to facilitate their pursuit of financial and professional independence

With this announcement, we would like to inform you that effective december 29, 2016, MES capital will no longer offer evaluation accounts and all future evaluations must be submitted through oneup trader starting june 12, 2017.

Oneup trader new features

Account options

Your account, your choice. Choose from a variety of trading accounts, from $25,000 to $250,000.

Simplified funding

Fair, attainable, and simplified funding goals. No grey areas, offering the fairest seeding program in the industry

Analytics that matter

Advanced reports, performance analysis tools, so you can better adjust your trading for maximum performance

Community integration

Discuss, collaborate and share ideas. Comprehend and utilise the wisdom of the trading crowd!

Launched june 12, 2017

To learn more, visit the oneup trader website or get notified by joining our mailing list

Effective december 29, 2016, MES capital will no longer offer evaluation accounts. We partnered with oneup trader to bring traders an enhanced user experience with a multitude of options. All future evaluations must be submitted through oneup trader starting june 12, 2017

All current traders participating in an MES capital evaluation will not be affected and will be reviewed for funding upon completion

Easy way to deposits & withdrawals

SWAP free account available

Get upto 40% deposit bonus

Trading currencies,

commodities (gold, silver) & crude oil

Partner with getzcapital

Trade forex anywhere and

anytime using our

getzcapital mobile platform -->

Getzcapital

As the world’s most-traded financial market, foreign exchange presents a wealth of opportunities for those who can harness its inherent volatility. Open a forex trading account with the no.1 retail provider and use our range of powerful platforms to take advantage of movements in currency prices.

Execution transparency

It is our mission to provide you with the best trading experience. Explore our quality pricing, transparency and execution services.

Trading station

Our proprietary trading platform provides powerful analytics tools for chart traders and straightforward capabilities for new traders.

Why us

Accessible

easy-to-use platform

Fast charts as

standard

Open an account

quickly and easily

Best -in- class

Tier 1 liquidity

To provide you with the best price possible, we derive our prices from a broad range of tier 1 institutions. These include banks, ecns and market-making firms with unique liquidity.

Significant price improvements

Our fully customised orders offer you greater control over your trading. With no asymmetric slippage, you could benefit from significant price improvements on every trade.

Full transparency of execution statistics

We fully disclose our dealing practices and never trade against you in the market. Our commitment to transparency shows that our interests are aligned with yours.

Start trading

Open a live trading account

Choose between MT5 on either our micro, standard account or premium account and get the most out of your trading.

Fund your new account

Get your account started with minimum deposits from as little as $100. Funding is easy and can be done through the client portal.

Start trading

Place your first trades on the markets! Remember, if you’re a first-time trader, we also offer plenty of free educational services to help you.

Start your trading plan here

Account types

MICRO

STANDARD

PREMIUM/ECN

Additional features

| add ons |

|---|

| basic changes plan 12 month term |

| classic changes plan 12 month term (- set changes type (consider per change type, or per hour) |

| advanced changes plan |

| hosting package – domain registration, server configuration, transfer |

| E-commerce – store, shopping cart, checkout |

| SEO optimization |

| EMAIL marketing |

| social media marketing |

| FB/google marketing – adwords, fb blast, give pricing |

| price |

|---|

| $20/2 hours per month – time bucket |

| $50/5 hours per month |

| $100/10 per month |

| $50 per month |

| $300 |

| $100 |

| $100 per month x 5 emails |

| $50 per account per month, choose accounts |

| analytics $20 / month |

Trading platform

Powerful trading features

From a trade ticket engineered for speed and efficiency to automated trade signals from autochartist - we offer an extensive list of advanced features.

Wide product range

We provide all major forex and cfds pairs with tight spread and with best in class order execution speed

Advanced trading features

Algorithmic orders, one-click trading, options chains and charting packages are just some of the features on our most advanced platform.

Here you can download the metatrader5 trading platform for any OS

Introducing broker

Our introducing broker program rewards individuals and businesses who refer new customers to our getzcapital. Simply introduce customers to us using your own contacts or marketing efforts and we'll do the rest. Our introducing broker program is our most straightforward type of partnership. Joining is quick and easy, requires no upfront investment or complex integration. Hundreds of partners are already introducing in this way, simply contact us to get started.

PROMOTE

Promote FX and cfds to your customer

INTRODUCE

Customer applies online trading account opening

EARN

Earn as your customers trade

TRACK

See your revenue grow using our partner portal

Contact us

First floor, first st vincent bank LLC building, james street,

kingstown, st. Vincent & the grenadines

Getzcapital (getzcapital LLC) incorporated under registered number 5502016 by the registrar of international business companies, regulated by the financial services authority of saint vincent and the grenadines.

Risk disclosure: trading contracts for difference on margin carries a high level of risk, and may not be suitable for all investors. By trading contracts for difference, you could sustain a loss in excess of your deposited funds. GETZCAPITAL makes no recommendations as to the merits of any financial product referred to on our website, emails, or related material(s). The information contained on our website, emails, or related material(s) does not take into consideration prospective clients' trading objectives, financial situations, or investment needs. Before deciding to trade the contracts for difference offered by GETZCAPITAL, please ensure that you have read our legal documentation, and have sought independent professional financial advice to ensure you fully understand the risk involved before trading.

Copyright © 2020 getzcapital. All rights reserved

Trade with confidence on the world's leading social trading platform

Join millions who've already discovered smarter investing in multiple types of assets. Choose an investment product to start with.

Choose an investment product to get started and discover why over 10 million users trust etoro

Stocks & etfs

0% commission means thereвђ™s no markup on stocks & etfs вђ“ no matter how much you invest

Cryptocurrencies

Buy, sell and store bitcoin and other leading cryptos with ease

CFD trading

Go long or short on FX from just 1 pip. Trade commodities and indices with flexible leverage.

Invest commission free

No markup on stocks & etfs from leading exchanges вђ“ no matter how much you invest

Buy & sell cryptocurrencies

Buy, sell and store bitcoin and other leading cryptos with ease

Advanced trading, more opportunities

Go long or short on FX, commodities and indices with flexible leverage

New to trading?

Discover copytrader™: replicate the trading strategies of top-performing traders

100% stocks, 0% commission

Join the social trading revolution. Connect with other traders, discuss trading strategies, and use our patented copytraderв„ў technology to automatically copy their trading portfolio performance.

Meet our popular investors

Etoroвђ™s popular investor program recognises talented, savvy, responsible traders who share their knowledge. Our top-tier popular investors earn up to 2% annually on their assets under management.

Meet our popular investors

Etoroвђ™s popular investor program recognises talented, savvy, responsible traders who share their knowledge. Our top-tier popular investors earn up to 2% annually on their assets under management.

Meet our popular investors

Etoroвђ™s popular investor program recognises talented, savvy, responsible traders who share their knowledge. Our top-tier popular investors earn up to 2% annually on their assets under management.

Meet our popular investors

Etoroвђ™s popular investor program recognises talented, savvy, responsible traders who share their knowledge. Our top-tier popular investors earn up to 2% annually on their assets under management.

Etoro is a fantastic trading platform, both from an ease of use and technical perspective.

It provides a huge variety of investments and a great community of traders.

Great platform for starting traders. Great selection and transparent fee system! .

Etoro has been making my trading experience enjoyable and secure.

Great service. Fast feedback. Social forum give a lot of info.

I am very satisfied with the services etoro platform provides.

The global leader of social trading

Discover why millions of users from over 140 countries choose to trade with etoro

Regulated

Our company is regulated by the FCA and cysec

Security

Your funds are protected by industry-leading security protocols

Privacy

We will never share your private data without your permission

In the press

See what the media has to say about etoroвђ™s trading and investing platform

Those with less expertise might like to try a platform called etoro, which allows customers to copy вђњstar tradersвђќ directly, and can make traders of even the least informed of punters.

The best returns occur when investors are plugged into diverse social groups that enable them to collide with information from multiple networks. In the social media world, as in real life, it pays to hover on the edge of cliques вђ“ but not get slavishly sucked into just one.

Internet social networks that let users follow investments the way they track status updates on facebook are attracting record interest, turning top performers into market stars for individual investors.

A recent research we carried out with the massachusetts institute of technology has shown that copy trading, where traders watch the trading activity of other people and make their decisions accordingly, performs significantly better than manual trading.

Etoro is the worldвђ™s leading social trading platform, which offers both investing in stocks and cryptocurrencies, as well as trading CFD with different underlying assets.

Top instruments

Support

Learn more

Find us on

About us

Privacy and regulation

Partners and promotions

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money.

Etoro (europe) ltd., a financial services company authorised and regulated by the cyprus securities exchange commission (cysec) under the license # 109/10.

Etoro (UK) ltd, a financial services company authorised and regulated by the financial conduct authority (FCA) under the license FRN 583263.

Etoro AUS capital pty ltd. Is authorised by the australian securities and investments commission (ASIC) to provide financial services under australian financial services licensce 491139

Past performance is not an indication of future results

general risk disclosure | terms & conditions

You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before you decide to trade. Under no circumstances shall etoro have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to cfds or (b) any direct, indirect, special, consequential or incidental damages whatsoever. Cryptocurrencies markets are unregulated services which are not governed by any specific european regulatory framework (including mifid). Therefore when using our cryptocurrencies trading service you will not benefit from the protections available to clients receiving mifid regulated investment services, such as access to the cyprus investor compensation fund (ICF)/the financial services compensation scheme (FSCS) and the financial ombudsman service for dispute resolution. Trading with etoro by following and/or copying or replicating the trades of other traders involves a high level of risks, even when following and/or copying or replicating the top-performing traders. Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders, or traders whose ultimate purpose or intention, or financial status may differ from yours. Past performance of an etoro community member is not a reliable indicator of his future performance. Content on etoro's social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of etoro - your social investment network.

Copyright В© 2006-2021 etoro - your social investment network, all rights reserved.

So, let's see, what we have: trade working capital is the difference between current assets and current liabilities directly associated with everyday business operations. At get trading capital

Contents of the article

- Top forex bonus promo

- Trade working capital

- What is trade working capital?

- Understanding trade working capital

- Trade working capital vs. Working capital

- Calculating trade working capital

- Example of trade working capital

- Special considerations

- Trade with confidence on the world's leading social trading...

- Choose an investment product to get...

- Stocks & etfs

- Cryptocurrencies

- CFD trading

- New to trading?

- 100% stocks, 0% commission

- Join the social trading revolution. Connect with other...

- Meet our popular investors

- Meet our popular investors

- Meet our popular investors

- Meet our popular investors

- The global leader of social trading

- In the press

- Top instruments

- Support

- Learn more

- Find us on

- About us

- Privacy and regulation

- Partners and promotions

- Trading taxes in the UK

- Tax classifications

- Day trader vs investor status

- Stock taxes

- A ali v HMRC

- Different instruments, different taxes?

- Tax tips

- Key points

- Trade capital review

- Trade capital reviews

- Trade capital license check

- Compare trade capital

- How to get funding for your trading strategy?

- Route to sustainable financial freedom.

- About us

- These are some of the reasons people choose us.

- Learn how to trade on your own from experts

- New partnership new features.

- Oneup trader new features

- Account options

- Simplified funding

- Analytics that matter

- Community integration

- Launched june 12, 2017

- Easy way to deposits & withdrawals

- SWAP free account available

- Trading currencies, commodities (gold, silver) &...

- Trade forex anywhere and anytime using our

- Getzcapital

- Why us

- Best -in- class

- Start trading

- Start your trading plan here

- Account types

- MICRO

- STANDARD

- PREMIUM/ECN

- Additional features

- Trading platform

- Powerful trading features

- Wide product range

- Advanced trading features

- Here you can download the metatrader5 trading platform...

- Introducing broker

- Contact us

- Trade with confidence on the world's leading social trading...

- Choose an investment product to get...

- Stocks & etfs

- Cryptocurrencies

- CFD trading

- New to trading?

- 100% stocks, 0% commission

- Join the social trading revolution. Connect with other...

- Meet our popular investors

- Meet our popular investors

- Meet our popular investors

- Meet our popular investors

- The global leader of social trading

- In the press

- Top instruments

- Support

- Learn more

- Find us on

- About us

- Privacy and regulation

- Partners and promotions

Comments

Post a Comment