1:3000 leverage meaning

1:3000 leverage meaning

FBS, alpari, and justforex offer the highest leverage in the industry, which is 1:3000, however, this kind of leverage is limited to some conditions.

Top forex bonus promo

You can still use that kind of high leverage forx brokers in some conditions.

1:3000 leverage meaning

The highest leverage reputable forex brokers in 2021

There are forex brokers in the industry offering very high leverage such as 1:1000, 1:2000, or even 1:3000. I’ve looked into more than 400 forex brokers in the industry to find the highest leverage among reputable forex brokers. After finding them, I examined their leverages from different angles.

Although you can find very high leverages such as 1:2000 or 1:3000 there are some limitations for such leverages. One of them is that the high leverage is limited to the size of your account; the larger size account is the lower leverage you get.

There are also some limitations for some countries regarding the regulation. Some regulatory bodies don’t allow brokers to offer high leverages.

Other than all that, very high leverages such as 1:1000 or above are not for all trading instruments and are mostly offered for major forex pairs.

So before introducing forex brokers offering the highest leverage, let’s talk about these limitations more.

You'll see in this article:

Forex brokers’ limitations on high leverage

As I mentioned earlier, offering high leverage by forex brokers doesn’t mean that forex brokers give such high leverages to everyone or in all situations. There are some exceptions that I’ve categorized them based on my experience and of course an extra study that I’ve done.

These are the areas that forex brokers may not offer their highest leverage:

Account size

When a broker offers 1:1000 or 1:2000 as leverage, it doesn’t mean that you can use such leverages with any size of accounts and there’s a leverage structure for that.

With larger size accounts, you receive lower leverage and the high leverage of brokers is offered to smaller size accounts.

For instance, up to $200, you can use a leverage of 1:3000. From $200 to $3000, a leverage of 1:2000 is available. From $3000 to $10000, you can use 1:1000 and so on.

This kind of structure is similar among all the highest leverage forex brokers to a great extent and you can’t find any broker that offers very high leverage to large size accounts, however, there are small differences.

For example, broker A offers a leverage of 1:2000 to the account size of up to $2000 while broker B offers the same leverage to traders who want to open an account of $3000 or less.

Given all that, you may want to check out the leverage structure of the brokers to pick the one that suits you the best.

Lot size (notional value)

Some forex brokers don’t consider the size of accounts as a factor for offering high leverage. Instead, they put limits on the lot size or the amount of money that you use for trades. They calculate that based on notional value.

For instance, if the notional value is less than 50000, you can use 1:2000 as leverage; between 50000 and 2000000, you can use 1:1000; and etc.

The notional value is calculated by this formula:

The contract size for one lot of forex pairs is 100000 — for mini lot is equal to 10000 and for micro lot, it’s 1000.

For CFD shares it’s normally 1 and for gold the contract size is usually 100.

Let’s clear that up with an example…

Let’s say that a forex broker offers a lever of 1:2000 if the notional value is up to 50000. You want to buy 2 mini lots (0.2 lots) of EUR/USD and the price of this pair is at 1.1755. According to the formula, the notional value here is:

Since 11755 type of account

As you might know, forex brokers offer different types of accounts such as micro, STP that has floating spread and no commission, fixed spread, ECN, and etc.

For example, a broker might offer 1:2000 as its maximum leverage to its STP or micro/cent account but the max leverage for its ECN type of account is 1:500.

So when you need very high leverage, you may want to choose the type of account that has the highest leverage.

Trading instruments

As you probably know, forex brokers don’t just offer forex or currency pairs. There are other trading instruments such as indices, shares or stocks, metals, cryptocurrencies, and etc.

Every type of trading instrument comes with different max leverage. Forex brokers don’t offer the same leverage even for all forex pairs. For instance, you can use the highest leverage for the major currency pairs and minor or exotic pairs are offered with lower leverage.

As a rule of thumb the more liquid and less volatile the higher leverage. In other words, you are offered the highest leverage for the pairs that are traded the most and aren’t too volatile, which means they don’t make large moves in a short period of time.

For instance, crypto currencies, exotic pairs, and CFD stocks are too volatile and are traded less so brokers offer lower leverage for them — normally lower than 1:10 or 1:20.

As a result, you should consider the brokers with the highest leverage on the trading instruments that you trade.

Regulation

The factors that we’ve talked about so far are related to the terms and conditions that forex brokers set for their high leverage offers but there’s an external factor that makes brokers decrease leverage for retail traders in some areas or countries.

Some forex financial bodies that regulate and watch forex brokers don’t allow them to offer high leverage to retail traders. The simple reason behind that is since trading on leverage can potentially make people lose a lot of money quickly and a majority of retail traders are prone to do so, therefore, lower leverage is in their best interest.

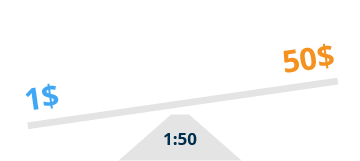

As a result, retail traders can’t use high leverage if they register with a broker or a branch of a broker that is registered under an EU regulatory body such as FCA (the UK regulator), cysec (the cyprus securities and exchange commission), or any other european regulators. It’s the same for US retail traders who want to open an account with a forex broker regulated in the USA by american regulatory bodies, CFTC and NFA.

The maximum leverage that you can get when you open an account with an EU regulated broker is 1:30 and it’s 1:50 if you’re an american retail trader using a US regulated broker.

The maximum leverage is a lot higher for the forex brokers regulated in other parts of the world. For instance, if you go with an ASIC (australian regulator) regulated broker, you can use a maximum leverage of 1:400 and if brokers are regulated by one of the international regulatory bodies, you can receive a very high leverage of 1:3000 from some of them.

OK, now you’re telling me that I can’t use high leverage if I’m an EU or a US resident?!

You can still use that kind of high leverage forx brokers in some conditions.

How can EU forex traders use high leverage?

As we already know, you can’t use higher than 1:30 as leverage if you are an EU resident having an account in a broker under an EU regulatory body.

The 1:30 is the maximum leverage that brokers can offer for major currency pairs (EURUSD, GBPUSD, USDCHF, USDJPY, NZDUSD, AUDUSD, and USDCAD) according to ESMA (the european securities and markets authority) measures on the provision of contracts for differences (cfds) and binary options to retail investors.

It’s even lower for non-major forex pairs or other trading instruments:

- 20:1 for non-major currency pairs, gold and major indices;

- 10:1 for commodities other than gold and non-major equity indices ;

- 5:1 for individual equities and other reference values;

- 2:1 for cryptocurrencies;

However, there are two ways that you can use very high leverage as an EU trader.

Become qualified as EPC

First, all that we’ve said so far are related to retail traders so what if you’re a professional trader? Are you still limited to 1:30 if you’re a professional trader?

The answer is no. EU regulators allow forex brokers to offer higher leverage to their professional clients, however, the leverage is not the highest ones — the max that I’ve seen is 1:500.

The question here is how you can qualify as a professional trader or EPC (elective professional clients)?

According to FCA, a trader is considered as EPC if he/she meets at least 2 of these 3 criteria:

- The client has carried out transactions, in significant size, on the relevant market at an average frequency of 10 per quarter over the previous four quarters

- The size of the client’s financial instrument portfolio, defined as including cash deposits and financial instruments, exceeds EUR 500,000

- The client works or has worked in the financial sector for at least one year in a professional position, which requires knowledge of the transactions or services envisaged

It basically means that you need to have a statement of 40 trades with large lot sizes in the past year and your investment must be at least € 500000 whether in forex or out of it such as stocks or savings — property portfolios are not included.

Well, as you can see this is not a viable option for many EU traders who want to use high leverage so if you’re one of them, you can pick the next option.

Use an offshore forex broker

The easiest way that you can apply to have access to high leverage as an EU or UK trader is to use an offshore forex broker or register under an offshore regulation of a broker.

Almost all the forex brokers that aren’t regulated or they have a regulation from agencies that have less strict regulations such as FSA (seychelles), IFSC (belize), BVIFSC (british virgin islands), and some others accept EU residents and allow them to use leverages like 1:1000, 2000, or even 3000.

There are even forex brokers that are regulated by some EU or UK regulators but since they are also regulated by offshore regulatory bodies, you can register with their offshore branch and use some offers such as the highest leverages.

For instance, you live in the UK and want to open an account with a forex broker that is regulated by both FCA and IFSC. If you register with their UK branch, you’re under the regulation of FCA so the maximum leverage that you can use is 1:30. On the other hand, if you open an account with their belize branch, you’re under the rules and regulation of IFSC that allows high leverage so you can use very high leverage such as 1:1000 and higher.

How can US forex traders use high leverage?

As it’s mentioned early on, the maximum leverage offered by US-regulated forex brokers, AKA NFA regulated brokers, is 1:50 which I think is more than enough for many traders. But you may want to need more leverage for any reason whether it’s because you open lots of positions at the same time or you use eas such as grid or martingale strategies, and etc.

For whatever reason that you need more leverage, your options are the same as EU traders which means either you need to be a professional trader or go offshore; however, your choices for offshore forex brokers are limited and are not as wide as EU traders.

There are lots of reputable offshore brokers for EU residents but when it comes to US residents, a handful of them accept US clients.

I’ve done a broad search and a comprehensive study on offshore forex brokers accepting US clients that you can find in this post.

Which forex broker has the highest leverage?

FBS, alpari, and justforex offer the highest leverage in the industry, which is 1:3000; however, this kind of leverage is limited to some conditions.

For instance, it’s available in FBS and justforex for the accounts with the equity of $200 or lower — above that amount, it will be adjusted and lowered. In alpari, you can use such a leverage with a maximum lot size of around one standard lot, more or less (see lot size section).

This condition is better when you want to use 1:2000 as leverage. Roboforex has the best situation in this case and you can use such a leverage for the accounts with the equity of up to $5000.

It’s worth noting that this kind of very high leverage is related to currency pairs, specifically major ones. For minor forex pairs or other trading instruments such as indices, CFD stocks, cryptos and etc.; the leverage is lower.

List of forex brokers with the highest leverage

In the following table, you can find all the reputable forex brokers offering the highest leverage in the industry.

There are some sections about the leverage of the brokers that we’ve talked about in detail in this article.

See the following sections for them:

STP,

ECN, copy trading,

fixed spread, islamic

What is 1:100 leverage meaning?

One can venture into the world of forex trading with limited investment. Some forex brokers even let their clients open an account with a minimum deposit as low as $100. Whether you have limited capital or not, everyone wants to use a higher sum than their actual investment to make more profits. This is possible with leverage.

Leverage plays a vital role in forex trading and is offered by the broker. Let’s explore the term, its advantages, and its disadvantages.

What is leverage in forex trading?

Leverage can use a small amount of capital in traders’ accounts controlling a larger amount in the market. Leverage is the ratio of the trader’s funds to the size of the broker’s credit. Brokerage accounts allow the use of leverage through margin trading, or in other words, brokers provide the borrowed funds to traders to increase trading positions. The leverage ratio can amplify both profits as well as losses.

For a layman, leverage would be a small thing that can be used for bigger purposes. In forex trading, it is the ratio at which a small investment in your trading account controls a larger investment that is operating in the market. This difference in the two capitals is also known as the trading on margin in the stocks or forex market. There is an interest charged on this margin in the stocks market, but such is not the case in the forex market. Traders are not required to pay any interest on this margin irrespective of your credit type and account type. Your forex broker will offer a margin to you that you can use to trade.

You can read more details about what is leverage in forex in our article.

What is instrument leverage 1:100?

So, leverage we can describe as the ability to control a large amount of money using very little of your own. But, what is 1:100 leverage meaning?

In the foreign exchange markets, the leverage ratio is commonly as high as 1:100. Leverage 1:100 means that for every $1,000 in the trading account, traders can trade in the market up to $100,000 in value.

What are the benefits of trading using leverage?

Leverage is an important feature offered by forex brokers. It helps you trade with higher capital and make more profits. For example, consider operating with a 1:100 leverage . This is the most common leverage in forex. It means that with an investment of $1, you will be operating investment of $100 in the market. $1 is your money, and $99 is the borrowed money, your leverage. Since your operating amount is $100, you will be able to make more profits. This borrowed money will be sponsored by your broker and needs to be repaid.

Before leverage was introduced in the forex market, a 10 % movement in the account for a year was something to look forward to. Everything was slow, but leverage has changed it. Thus, the benefit of leverage is that it allows you to quickly invest more money in the market to fetch more profits.

How to calculate leverage and trading margin?

The main leverage formula is:

margin-based leverage ratio = total value of transaction / margin required

In this case, if the margin-based leverage expressed ratio is 1:100, then the margin required of total transaction value will be 1.00%. The margin requirement for 2% is 1:50 leverage.

Different leverages

The brokers fix leverage amounts at their discretion. Different brokers have different ratios to offer to their clients. Their terms and conditions also vary. The most popular ones are explained below:

- 50:1 – this leverage is on the lower side and means that you can use $50 to place a trade in the market for every dollar in your account. For example, if you have a deposit of $100 with a broker, you can trade with an amount that 50 times higher. In this case, $5000.

- 100:1 – as mentioned earlier, this is the most popular leverage in forex trading and is usually offered to standard lot account holders. You get to trade $100 for every dollar in your account. As the minimum deposit amount for a standard account is typical $2000, you can trade with an amount equivalent to $200,000.

- 200:1 – this leverage amount is offered to mini account holders with a typical minimum deposit of $500. With this leverage, you can trade 200 times the amount in your account. If you only have a minimum deposit, you can still control $100,000 in the market.

- 400:1 – this leverage is on a higher side. All the brokers do not offer this leverage. You can usually get this if you are holding a mini account. As the minimum deposit is around $500, you can control a sum of $200,000 in the market.

How to handle leverage professionally

High leverage amounts do not blind professional traders. They generally use 20:1 or 10:1 leverage and make several small trades. This safeguards their capital. If you want to take full advantage of leverage, do not invest all the amount in one trade. Move gradually and aim for consistent returns rather than a miraculous one-time deal. These professional tricks followed by veteran traders and investors will help you establish yourself as a forex trader.

The best option for traders is to have brokers that can offer various leverages. In that case, the trader can change the leverage ratio in the broker’s website dashboard.

Leverage is nothing but borrowed money. You can make more profits with it, but it can take an ugly turn as well. It only promises extra investment, not profit. Many aspects govern whether there will be gains or losses. Many traders, especially the new ones, aim for higher leverage, like fx trading 400 leverage, with the hope of making more profits. Higher leverage does not necessarily translate into higher profits. It can lead to equally high losses. We would suggest you aim for the leverage that you can easily manage and keep in mind that the chances of making losses are real. Instead of having an optimist approach, have a realist approach towards leverage and forex trading.

Leverage of 1:3000

Yes, you have read that right. There is a broker with maximum leverage of 1:3000, I can not tell you the name because advertising is not allowed, but you will find it on google.

Would this much leverage not be very interesting for martingale trading for instance? One could take on much more martingale trades because of the low margin required , which would reduce the risk of getting wiped out.

What do you think about this, guys? Have you ever worked with this much leverage before?

Yes, you have read that right. There is a broker with maximum leverage of 1:3000, I can not tell you the name because advertising is not allowed, but you will find it on google.

Would this much leverage not be very interesting for martingale trading for instance? One could take on much more martingale trades because of the low margin required , which would reduce the risk of getting wiped out.

What do you think about this, guys? Have you ever worked with this much leverage before?

It won't reduce the risk!

If you have a good strategy then why you haven't try 1:500 or lower?

Mohammad soubra :

It won't reduce the risk!

If you have a good strategy then why you haven't try 1:500 or lower?

Of course you can still get wiped out very easily.

Imagine the following:

lets say you can take 10 losing martingale trades before you get wiped out on a 1:500 account.

With the 1:3000 account you could have position sizes six times as big which would mean that you could handle 12 losing martingale trades before the account blows up if you double on a loss.

There are two extra trades only because of the higher leverage and the lower margin associated with it, those two trades could make a difference in my opinion.

Tobiasbecker :

Of course you can still get wiped out very easily.

Imagine the following:

lets say you can take 10 losing martingale trades before you get wiped out on a 1:500 account.

With the 1:3000 account you could have position sizes six times as big which would mean that you could handle 12 losing martingale trades before the account blows up if you double on a loss.

There are two extra trades only because of the higher leverage and the lower margin associated with it, those two trades could make a difference in my opinion.

Yes, you have read that right. There is a broker with maximum leverage of 1:3000, I can not tell you the name because advertising is not allowed, but you will find it on google.

Would this much leverage not be very interesting for martingale trading for instance? One could take on much more martingale trades because of the low margin required , which would reduce the risk of getting wiped out.

What do you think about this, guys? Have you ever worked with this much leverage before?

Great, the easiest way to destroy your account!

1:3000 and martingale. Just add the free deposit bonus to the mix -which i am sure the broker offers- and you will end up with a nice juicy cocktail.

Just the hangover. The hangover :)

Would this much leverage not be very interesting for martingale trading for instance? One could take on much more martingale trades because of the low margin required , which would reduce the risk of getting wiped out.

What do you think about this, guys? Have you ever worked with this much leverage before?

Of course you can still get wiped out very easily.

Imagine the following:

lets say you can take 10 losing martingale trades before you get wiped out on a 1:500 account.

With the 1:3000 account you could have position sizes six times as big which would mean that you could handle 12 losing martingale trades before the account blows up if you double on a loss.

There are two extra trades only because of the higher leverage and the lower margin associated with it, those two trades could make a difference in my opinion.

I think you better do your math again! The risk or loss based on the stop size is irrespective of leverage or % margin.

If you lose 10 pips for 1 lot ($100 on "xxxusd") then that is 10 piplots ($100) whether that be on 1:100, 1:500 or 1:3000 - it makes no difference.

You will still blow your account in no time!

EDIT: people don't seem to realise that leverage or % margin just alters the maximum amount of volume you can open and order with, but once closed, the difference, whether that be profit or a loss is the same no matter what the leverage! That is why experienced traders always tell newbies to evaluate their risk calculation based on the stop size.

On a cent account, your gains are also in cents and therefore 100 times less that normal accounts but still limited by the same maximum number of lots that brokers allow (many have a limit of 100 lots and many others a limit of 50 lots).

The following table for a normal account shows how quickly it can "blow" your balance, trading for example on EUR/USD or GBP/USD or many other xxx/USD currency pairs:

Consecutive martingale orders lots 10 pips loss 100 pips loss 1 0.01 $1.00 $10.00 2 0.02 $2.00 $20.00 3 0.04 $4.00 $40.00 4 0.08 $8.00 $80.00 5 0.16 $16.00 $160.00 6 0.32 $32.00 $320.00 7 0.64 $64.00 $640.00 8 1.28 $128.00 $1,280.00 9 2.56 $256.00 $2,560.00 10 5.12 $512.00 $5,120.00 11 10.24 $1,024.00 $10,240.00 12 20.48 $2,048.00 $20,480.00 13 40.96 $4,096.00 $40,960.00 14 81.92 $8,192.00 $81,920.00 max lots (on many brokers) 100.00 $10,000.00 $100,000.00

PS! Actually my table is conservative, because losses are cumulative, so actual values are double the losses shown on this table!

5+ bset forex brokers with highest leverage | 1:3000 leverage

It is the power of leverage that makes it possible for forex traders to earn big from forex. There is only few forex brokers with highest leverage offer. Without leverage, small retail traders may not be able to build a full-time income trading forex.

As a forex trader, you need to be careful when choosing a broker. Not all brokers that offer high leverage can be trusted. That’s why we have put together a list of reputable forex brokers with highest leverage.

Minimum deposit: $1

Max.Leverage 1:3000

Spread from 0.1 pips

Head office: belize

What is leverage

Leverage is what allows you to trade large volumes in the forex market without having to provide it yourself. Using leverage, all you need to do is deposit a small amount and then you can trade up to a thousand times the amount you deposited.

How does forex brokers with highest leverage works

Let me show you a practical example. Say you have $200 in your account and you want to open a position worth 0.1 lot i.E. 10,000 units of currency. You will need the leverage of 1:50 to be able to do that. Depending on the currency pair you are trading, a 1 pip movement in your favor will give you $1. If you had opened that same position with only $200 (which I don’t think is possible) without any leverage, you would make $0.02 per pip, which is so little and isn’t worth your time.

That is the power of leverage. It helps amplify wins. It also amplifies losses too. Just as easily as you can make big profits using leverage, you can also make huge losses using leverage. So, be careful.

Advantages of highest leverage

Using leverage helps boost your profits from trading. With only $100, you can trade up to $1000, $10,000 or even $100,000! Currency pairs change in value ever so slightly. Leverage helps you capitalize on these minute price movements for profit. Using leverage, 1 pip will be worth a lot more.

Requires you to invest a little amount

Leverage lets you put up only a small fraction of what the position is worth. Meaning you don’t have to risk so much to get a huge return. This gives smaller retail traders a chance to make significant profits from trading forex.

Disadvantages of highest leverage

The power of using leverage cuts both ways. If you don’t apply proper risk management, you can quickly lose all your money. So, always protect the downside when using leverage.

There you have it guys, now you know what leverage is all about and how it works. If you want to get the most returns by using the power of leverage, then you should consider going for one of the forex brokers with highest leverage. Cheers.

1:3000 leverage meaning

We use cookies to give you a better online experience. By using our website you agree to our use of cookies in accordance with our privacy policy.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider

Concept of leverage explained

It is important for inexperienced traders and clients who are new to trading forex, or indeed new to trading on any financial markets, to completely understand the concepts of leverage and margin. Too often new traders are impatient to begin trading and fail to grasp the importance and impact these two critical success factors will have on the outcome of their potential success.

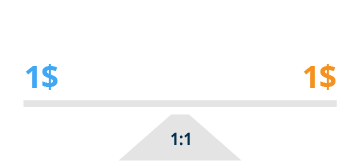

Leverage, as the term suggests, offers up the opportunity for traders to lever up the use of the actual money they have in their account and risked in the market, in order to potentially maximize any profit. In simple terms; if a trader uses leverage of 1:100 then every dollar they are actually committing to risk defectively controls 100 dollars in the market place. Investors and traders therefore use the concept of leverage to potentially increase their profits on any particular trade, or investment.

In forex trading, the leverage on offer is generally the highest available in the financial markets. Leverage levels are set by the forex broker and can vary, from: 1:1, 1:50, 1:100, or even higher. Brokers will allow traders to adjust leverage up or down, but will set limits. For example, at FXCC our maximum leverage (on our ECN standard account) is 1:300, but clients are free to select a lower leverage level.

With 1:1 leverage every dollar in your margin account controls 1 dollar of trading

With 1:50 leverage every dollar in your margin account controls 50 dollar of trading

With 1:100 leverage every dollar in your margin account controls 100 dollar of trading

What is margin?

Margin is best understood as a good faith deposit on behalf of a trader, a trader puts up collateral in terms of credit in their account, in order to hold open a position (or positions) in the market place, this is a requirement because most forex brokers do not offer credit.

When trading with margin and using leverage, the amount of margin required to hold open a position or positions is determined by the trade size. As trade size increases margin requirements increase. Simply put; margin is the amount required to hold the trade or trades open. Leverage is the multiple of exposure to account equity.

What is a margin call?

We have now explained that margin is the amount of account balance required in order to hold the trade open and we have explained that leverage is the multiple of exposure versus account equity. So let's use an example to explain how margin works and how a margin call might occur.

If a trader has an account with a value of £10,000 in it, but wants to buy 1 lot (a 100,000 contract) of EUR/GBP, they would need to put up £850 of margin in an account leaving £9,150 in usable margin (or free margin), this is based on one euro buying approx. 0.85 of a pound sterling. A broker needs to ensure that the trade or trades the trader is taking in the market place, are covered by the balance in their account. Margin could be regarded as a safety net, for both traders and brokers.

Traders should monitor the level of margin (balance) in their account at all times because they may be in profitable trades, or convinced that the position they are in will become profitable, but find their trade or trades are closed if their margin requirement is breached. If the margin drops below the required levels, FXCC may initiate what is known as a "margin call". In this scenario, FXCC will either advise the trader to deposit additional funds into their forex account, or close out some (or all) of the positions in order to limit the loss, to both trader and broker.

Creating trading plans, whilst ensuring trader discipline is always maintained, should determine the effective use of leverage and margin. A thorough, detailed, forex trading strategy, underpinned by a concrete trading plan, is one of the cornerstones of trading success. Combined with prudent use of trading stops and take profit limit orders, added to effective money management should encourage the successful use of leverage and margin, potentially allowing traders to flourish.

In summary, a situation where a margin call might occur is due to use of excessive use of leverage, with inadequate capital, whilst holding on to losing trades for too long, when they should be closed.

Finally, there are other ways to limit margin calls and by far the most effective is to trade by using stops. By using stops on each and every trade, your margin requirement is immediately re-calculated.

At FXCC, depending on the ECN account selected, clients can choose their required leverage, from 1:1 all the way up to 1:300. Clients looking to change their leverage levels can do so by submitting a request through their trader hub area or by email to: accounts@fxcc.Com

Leverage may increase your profits, but as well can magnify your losses. Please ensure that you understand the mechanics of leverage. Seek independent advice if necessary.

How leverage works in the forex market

Leverage is the use of borrowed money (called capital) to invest in a currency, stock, or security. The concept of leverage is very common in forex trading. By borrowing money from a broker, investors can trade larger positions in a currency. As a result, leverage magnifies the returns from favorable movements in a currency's exchange rate. However, leverage is a double-edged sword, meaning it can also magnify losses. It's important that forex traders learn how to manage leverage and employ risk management strategies to mitigate forex losses.

Key takeaways

- Leverage, which is the use of borrowed money to invest, is very common in forex trading.

- By borrowing money from a broker, investors can trade larger positions in a currency.

- However, leverage is a double-edged sword, meaning it can also magnify losses.

- Many brokers require a percentage of a trade to be held in cash as collateral, and that requirement can be higher for certain currencies.

Understanding leverage in the forex market

The forex market is the largest in the world with more than $5 trillion worth of currency exchanges occurring daily. Forex trading involves buying and selling the exchange rates of currencies with the goal that the rate will move in the trader’s favor. Forex currency rates are quoted or shown as bid and ask prices with the broker. If an investor wants to go long or buy a currency, they would be quoted the ask price, and when they want to sell the currency, they would be quoted the bid price.

For example, an investor might buy the euro versus the U.S. Dollar (EUR/USD), with the hope that the exchange rate will rise. The trader would buy the EUR/USD at the ask price of $1.10. Assuming the rate moved favorably, the trader would unwind the position a few hours later by selling the same amount of EUR/USD back to the broker using the bid price. The difference between the buy and sell exchange rates would represent the gain (or loss) on the trade.

Investors use leverage to enhance the profit from forex trading. The forex market offers one of the highest amounts of leverage available to investors. Leverage is essentially a loan that is provided to an investor from the broker. The trader's forex account is established to allow trading on margin or borrowed funds. Some brokers may limit the amount of leverage used initially with new traders. In most cases, traders can tailor the amount or size of the trade based on the leverage that they desire. However, the broker will require a percentage of the trade's notional amount to be held in the account as cash, which is called the initial margin.

Types of leverage ratios

The initial margin required by each broker can vary, depending on the size of the trade. If an investor buys $100,000 worth of EUR/USD, they might be required to hold $1,000 in the account as margin. In other words, the margin requirement would be 1% or ($1,000 / $100,000).

The leverage ratio shows how much the trade size is magnified as a result of the margin held by the broker. Using the initial margin example above, the leverage ratio for the trade would equal 100:1 ($100,000 / $1,000). In other words, for a $1,000 deposit, an investor can trade $100,000 in a particular currency pair.

Below are examples of margin requirements and the corresponding leverage ratios.

| Margin requirements and leverage ratios | |

|---|---|

| margin requirement | leverage ratio |

| 2% | 50:1 |

| 1% | 100:1 |

| .5% | 200:1 |

As we can see from the table above, the lower the margin requirement, the greater amount of leverage can be used on each trade. However, a broker may require higher margin requirements, depending on the particular currency being traded. For example, the exchange rate for the british pound versus japanese yen can be quite volatile, meaning it can fluctuate wildly leading to large swings in the rate. A broker may want more money held as collateral (i.E. 5%) for more volatile currencies and during volatile trading periods.

Forex leverage and trade size

A broker can require different margin requirements for larger trades versus smaller trades. As outlined in the table above, a 100:1 ratio means that the trader is required to have at least 1/100 = 1% of the total value of the trade as collateral in the trading account.

Standard trading is done on 100,000 units of currency, so for a trade of this size, the leverage provided might be 50:1 or 100:1. A higher leverage ratio, such as 200:1, is usually used for positions of $50,000 or less. Many brokers allow investors to execute smaller trades, such as $10,000 to $50,000 in which the margin might be lower. However, a new account probably won't qualify for 200:1 leverage.

It's fairly common for a broker to allow 50:1 leverage for a $50,000 trade. A 50:1 leverage ratio means that the minimum margin requirement for the trader is 1/50 = 2%. So, a $50,000 trade would require $1,000 as collateral. Please bear in mind that the margin requirement is going to fluctuate, depending on the leverage used for that currency and what the broker requires. Some brokers require a 10-15% margin requirement for emerging market currencies such as the mexican peso. However, the leverage allowed might only be 20:1, despite the increased amount of collateral.

Forex brokers have to manage their risk and in doing so, may increase a trader's margin requirement or reduce the leverage ratio and ultimately, the position size.

Leverage in the forex markets tends to be significantly larger than the 2:1 leverage commonly provided on equities and the 15:1 leverage provided in the futures market. Although 100:1 leverage may seem extremely risky, the risk is significantly less when you consider that currency prices usually change by less than 1% during intraday trading (trading within one day). If currencies fluctuated as much as equities, brokers would not be able to provide as much leverage.

The risks of leverage

Although the ability to earn significant profits by using leverage is substantial, leverage can also work against investors. For example, if the currency underlying one of your trades moves in the opposite direction of what you believed would happen, leverage will greatly amplify the potential losses. To avoid a catastrophe, forex traders usually implement a strict trading style that includes the use of stop-loss orders to control potential losses. A stop-loss is a trade order with the broker to exit a position at a certain price level. In this way, a trader can cap the losses on a trade.

Leverage in forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/foreign-currency-804917648-5ae5ef29ff1b780036736d7c.jpg)

Leverage is the ability to use something small to control something big. Specific to foreign exchange (forex or FX) trading, it means you can have a small amount of capital in your account, controlling a larger amount in the market.

Stock traders will call this trading on margin. In forex trading, there is no interest charged on the margin used, and it doesn't matter what kind of trader you are or what kind of credit you have. If you have an account and the broker offers margin, you can trade on it.

The apparent advantage of using leverage is that you can make a considerable amount of money with only a limited amount of capital. The problem is that you can also lose a considerable amount of money trading with leverage. It all depends on how wisely you use it and how conservative your risk management is.

You have more control than you think

Leverage makes a rather boring market incredibly exciting. But when your money is on the line, exciting is not always good, and that is what leverage has brought to FX.

Without leverage, traders would be surprised to see a 10% move in their account in one year. However, a trader using leverage can easily see a 10% move in one day.

But typical amounts of leverage tend to be too high, and it is important for you to know that much of the volatility you experience when trading is due more to the leverage on your trade than the move in the underlying asset.

Leverage amounts

Leverage is usually given in a fixed amount that can vary with different brokers. Each broker gives out leverage based on their rules and regulations. The amounts are typically 50:1, 100:1, 200:1, and 400:1.

- 50:1: fifty-to-one leverage means that for every $1 you have in your account, you can place a trade worth up to $50. As an example, if you deposited $500, you would be able to trade amounts up to $25,000 on the market.

- 100:1: one-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth up to $100. This ratio is a typical amount of leverage offered on a standard lot account. The typical $2,000 minimum deposit for a standard account would give you the ability to control $200,000.

- 200:1: two-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth up to $200. The 200:1 ratio is a typical amount of leverage offered on a mini lot account. The typical minimum deposit on such an account is around $300, with which you can trade up to $60,000.

- 400:1: four-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth $400. Some brokers offer 400:1 on mini lot accounts but beware of any broker who offers this type of leverage for a small account. Anyone making a $300 deposit into a forex account and trying to trade with 400:1 leverage could be wiped out in a matter of minutes.

Professional traders and leverage

Professional traders usually trade with very low leverage. Keeping your leverage lower protects your capital when you make trading mistakes and keeps your returns consistent.

Many professionals will use leverage amounts like 10:1 or 20:1. It's possible to trade with that type of leverage regardless of what the broker offers you. You have to deposit more money and make fewer trades.

No matter what your style, remember that just because the leverage is, there does not mean you have to use it. In general, the less leverage you use, the better. It takes the experience to really know when to use leverage and when not to. Staying cautious will keep you in the game for the long run.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

How much leverage is right for you in forex trades

Understanding how to trade foreign currencies requires detailed knowledge about the economies and political situations of individual countries, global macroeconomics, and the impact of volatility on specific markets. But the truth is, it isn’t usually economics or global finance that trip up first-time forex traders. Instead, a basic lack of knowledge on how to use leverage is often at the root of trading losses.

Data disclosed by the largest foreign-exchange brokerages as part of the dodd-frank wall street reform and consumer protection act indicates that a majority of retail forex customers lose money. The misuse of leverage is often viewed as the reason for these losses. this article explains the risks of high leverage in the forex markets, outlines ways to offset risky leverage levels, and educates readers on ways to pick the right level of exposure for their comfort.

Key takeaways

- Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone.

- Forex traders often use leverage to profit from relatively small price changes in currency pairs.

- Since leverage, can amplify both profits as well as losses, choosing the right amount is a key risk determination for traders.

- Leverage in the forex markets can be 50:1 to 100:1 or more, which is significantly larger than the 2:1 leverage commonly provided on equities and the 15:1 leverage provided in the futures market.

The risks of high leverage

Leverage is a process in which an investor borrows money in order to invest in or purchase something. In forex trading, capital is typically acquired from a broker. While forex traders are able to borrow significant amounts of capital on initial margin requirements, they can gain even more from successful trades.

In the past, many brokers had the ability to offer significant leverage ratios as high as 400:1. This means, that with only a $250 deposit, a trader could control roughly $100,000 in currency on the global forex markets. However, financial regulations in 2010 limited the leverage ratio that brokers could offer to U.S.-based traders to 50:1 (still a rather large amount). this means that with the same $250 deposit, traders can control $12,500 in currency.

So, should a new currency trader select a low level of leverage such as 5:1 or roll the dice and ratchet the ratio up to 50:1? Before answering, it’s important to take a look at examples showing the amount of money that can be gained or lost with various levels of leverage.

Example using maximum leverage

Imagine trader A has an account with $10,000 cash. He decides to use the 50:1 leverage, which means that he can trade up to $500,000. In the world of forex, this represents five standard lots. There are three basic trade sizes in forex: a standard lot (100,000 units of quote currency), a mini lot (10,000 units of the base currency), and a micro lot (1,000 units of quote currency). Movements are measured in pips. Each one-pip movement in a standard lot is a 10 unit change.

Because the trader purchased five standard lots, each one-pip movement will cost $50 ($10 change / standard lot x 5 standard lots). If the trade goes against the investor by 50 pips, the investor would lose 50 pips x $50 = $2,500. This is 25% of the total $10,000 trading account.

Example using less leverage

Let’s move on to trader B. Instead of maxing out leverage at 50:1, she chooses a more conservative leverage of 5:1. If trader B has an account with $10,000 cash, she will be able to trade $50,000 of currency. Each mini-lot would cost $10,000. In a mini lot, each pip is a $1 change. Since trader B has 5 mini lots, each pip is a $5 change.

Should the investment fall that same amount, by 50 pips, then the trader would lose 50 pips x $5 = $250. This is just 2.5% of the total position.

How to pick the right leverage level

There are widely accepted rules that investors should review before selecting a leverage level. The easiest three rules of leverage are as follows:

- Maintain low levels of leverage.

- Use trailing stops to reduce downside and protect capital.

- Limit capital to 1% to 2% of total trading capital on each position taken.

Forex traders should choose the level of leverage that makes them most comfortable. If you are conservative and don’t like taking many risks, or if you’re still learning how to trade currencies, a lower level of leverage like 5:1 or 10:1 might be more appropriate.

Trailing or limit stops provide investors with a reliable way to reduce their losses when a trade goes in the wrong direction. By using limit stops, investors can ensure that they can continue to learn how to trade currencies but limit potential losses if a trade fails. These stops are also important because they help reduce the emotion of trading and allow individuals to pull themselves away from their trading desks without emotion.

The bottom line

Selecting the right forex leverage level depends on a trader’s experience, risk tolerance, and comfort when operating in the global currency markets. New traders should familiarize themselves with the terminology and remain conservative as they learn how to trade and build experience. Using trailing stops, keeping positions small, and limiting the amount of capital for each position is a good start to learning the proper way to manage leverage.

How to calculate leverage, margin, and pip values in forex

Although most trading platforms calculate profits and losses, used margin and useable margin, and account totals, it helps to understand these calculations so that you can plan transactions and determine potential profits or losses.

Important note! The exchange rates used in this article are for illustrative purposes, so the exchange rates themselves are not updated, since it serves no pedagogical purpose. Foreign exchange rates vary continuously, so current exchange rates may deviate largely from what is presented here. Nonetheless, the exchange rates were accurate when the article was written, and regardless of the current rates, the exchange rates used here still illustrate the principles presented in this article, which do not change.

Leverage and margin

Most forex brokers allow a very high leverage ratio, or, to put it differently, have very low margin requirements. This is why profits and losses vary greatly in forex trading even though currency prices do not change all that much — certainly not like stocks. Stocks can double or triple in price, or fall to zero; currency never does. Because currency prices do not vary substantially, much lower margin requirements are less risky than it would be for stocks. Note, however, that there is considerable risk in forex trading, so you may be subject to margin calls when currency exchange rates change rapidly.

The margin in a forex account is often called a performance bond, because it is not borrowed money but only the equity needed to ensure that you can cover your losses. In most forex transactions, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. Thus, no interest is charged for using leverage. So if you buy $100,000 worth of currency, you are not depositing $2,000 and borrowing $98,000 for the purchase. The $2,000 is to cover your losses. Thus, buying or selling currency is like buying or selling futures rather than stocks.

The margin requirement can be met not only with money, but also with profitable open positions. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions.

Total equity = cash + open position profits - open position losses

Your total equity determines how much margin you have left, and if you have open positions, total equity will vary continuously as market prices change. Thus, it is never wise to use 100% of your margin for trades — otherwise, you may be subject to a margin call. Instead of a margin call, the broker may simply close out your largest money-losing positions until the required margin has been restored.

Leverage = 1/margin = 100/margin percentage

To calculate the amount of margin used, multiply the size of the trade by the margin percentage. Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left.

To calculate the margin for a given trade:

Margin requirement = current price × units traded × margin

Example: calculating margin requirements for a trade and the remaining account equity

Required margin = 100,000 × 1.35 × 0.02 = $2,700.00 USD.

Before this purchase, you had $3,000 in your account. How many more euros could you buy?

Remaining equity = $3,000 - $2,700 = $300

Since your leverage is 50 , you can buy an additional $15,000 ( $300 × 50 ) worth of euros:

To verify, note that if you had used all of your margin in your initial purchase, then, since $3,000 gives you $150,000 of buying power:

Total euros purchased with $150,000 USD = 150,000 / 1.35 ≈ 111,111 EUR

Pip values

Because the quote currency of a currency pair is the quoted price (hence, the name), the value of the pip is in the quote currency. So, for instance, for EUR/USD, the pip = 0.0001 USD, but for USD/EUR, the pip = 0.0001 euro. If the conversion rate for euros to dollars is 1.35, then a euro pip = 0.000135 dollars.

Converting profits and losses in pips to native currency

To calculate your profits and losses in pips to your native currency, you must convert the pip value to your native currency.

When you close a trade, the profit or loss is initially expressed in the pip value of the quote currency. To determine the total profit or loss, multiply the pip difference between the open price and closing price by the number of units of currency traded. This yields the total pip difference between the opening and closing transaction.

If the pip value is in your native currency, then no further calculations are needed to find your profit or loss, but if the pip value is not in your native currency, then it must be converted. There are several ways to convert your profit or loss from the quote currency to your native currency. If you have a currency quote where your native currency is the base currency, then you divide the pip value by the exchange rate; if the other currency is the base currency, then you multiply the pip value by the exchange rate.

Example: converting CAD pip values to USD

100,000 CAD × 200 pips = 20,000,000 pips total. Since 20,000,000 pips = 2,000 canadian dollars , your profit in USD is 2,000 / 1.1 = 1,818.18 USD.

However, if you have a quote for CAD/USD , which = 1/ 1.1 = 0.90909 , then your profit is calculated thus: 2000 × 0.90909 = 1,818.18 USD, the same result obtained above.

For a cross currency pair not involving USD, the pip value must be converted by the rate that was applicable at the time of the closing transaction. To find that rate, you would look at the quote for the USD/pip currency pair, then multiply the pip value by this rate, or if you only have the quote for the pip currency/USD, then you divide by the rate.

Example: calculating profits for a cross currency pair

You buy 100,000 units of EUR/JPY = 164.09 and sell when EUR/JPY = 164.10 , and USD/JPY = 121.35 .

Profit in JPY pips = 164.10 – 164.09 = .01 yen = 1 pip (remember the yen exception: 1 JPY pip = .01 yen .)

Total profit in JPY pips = 1 × 100,000 = 100,000 pips .

Total profit in yen = 100,000 pips / 100 = 1,000 yen

Because you only have the quote for USD/JPY = 121.35 , to get profit in USD, you divide by the quote currency's conversion rate:

Total profit in USD = 1,000 / 121.35 = 8.24 USD.

If you only have this quote, JPY/USD = 0.00824 , equivalent to USD/JPY = 121.35 , the following formula converts pips in yen to domestic currency:

Total profit in USD = 1,000 × 0.00824 = 8.24 USD.

The pauper's money book shows how you can manage your money to greatly increase your standard of living.

- Save, invest, and earn more money.

- Get out of debt.

- Increase your credit score.

- Learn to negotiate successfully.

- Manage time effectively.

- Invest for maximum results with a minimum of risk.

- Minimize taxes.

- Earn tax-free income.

- Earn more from a career or from running a business.

Guide to leverage

Guide to leverage

What is leverage in trading?

Leveraged trading is a powerful tool for CFD traders. It can help investors to maximise returns on even small price changes, to grow their capital exponentially, and increase their exposure to their desired markets. But it is worth noting that leverage can work for or against you. While you stand to earn magnified profits when asset prices go your way, you also suffer amplified losses when prices move against you

When you are trading with leverage, you put a ‘small amount’ down, but you get the chance to control a much larger trade position in the market. The small amount is what is referred to as ‘margin’. The amount of leverage a broker offers depends on the regulatory conditions that it complies with, in any/all of the jurisdictions it is allowed to offer trading services in.

With leveraged trading, the trader need only invest a certain percentage of the whole position. This can change depending on how much leverage the broker offers, how much leverage the trader would like to implement, and it also relies heavily on the regulatory authorities which are tasked with overseeing the online trading industry in that jurisdiction.

Also, traders use leverage depending on their level of experience, investing goals, their appetite for risk, as well as the underlying market they are trading. In most cases, it is professional traders that tend to use leverage more aggressively, whereas new and less experienced traders are generally advised to use leverage with caution. Also, conservative traders will tend to use the minimum level of leverage possible, whereas traders with a high appetite for risk can use leverage flexibly.

The type of market traded can also dictate the amount of leverage traders can use. Volatile markets, such as gold and bitcoin, should be traded with minimal leverage, whereas less volatile assets that do not post wide price fluctuations, such as the EURCHF pair, can be traded with higher leverage levels.

The leverage ratio is a representation of the position value in relation to the investment amount required. At avatrade, forex traders can trade with a leverage of up to . This however, varies depending on your jurisdiction as well as the asset class you are trading.

Consider this: with leverage of 400:1; you can control a $100,000 trade position in the market with just $250! This would mean that a 1% positive price change in the market will result in a profit of $1,000 (1% of $100,000). Without leverage, a 1% positive price movement will result in a profit of only $2.5 (1% of $250). This means that your trade positions and the resulting profits/losses are multiplied 400 times. This is why it is often stated that leverage is a double-edged sword. With trading leverage, profits are magnified, but losses can equally be devastating.

When trading with high leverage, it is very easy to lose more than your capital. But at avatrade, we offer guaranteed negative balance protection which means that you can never lose more than you have in your trading account balance.

What is margin trading?

As explained above, ‘margin’ is the amount of money a broker allows a trader to put down to trade a much bigger position in the market. It is essentially a security deposit held by the broker. When holding trading positions, price changes in the market will lead to changing margin conditions as well. On most platforms, information on the varying margin conditions will be displayed in your trading account. Here are what the various margin definitions and other terminologies mean:

- Account balance

This is the total amount available in your account as your trading capital. It is essentially your trading bankroll.

- Margin requirement

This is what we have discussed above as the amount your broker requires you to put down as a ‘security deposit’ to control a trade position in the market. It is often expressed as a percentage. For instance, if you use a leverage level of 100:1, your margin requirement is 1%. If you use leverage of 400:1, your margin requirement is 0.25%.

- Used margin

This is the amount of money held as ‘security’ by your broker so that you can keep your open trade positions running. The money is still theoretically yours, but you can only access it after the open positions are closed.

- Usable margin

This is the money in your trading account available for opening new trade positions in the market.

- Margin call

A margin call is a notification by your broker that your margin level has fallen below the required level. This is a dreaded call (notification) for traders. A margin call occurs when losses of an open trade position exceed (or are about to exceed) your used margin. When you receive a margin call, you are essentially being asked to add more funds to your trading account to sustain open trades, failing which the broker will proceed to automatically close the open position. For instance, a margin call level of 20% means that your broker will send the margin call notification when your open trades have sustained losses of over 80% of your account balance.

Open your leveraged trading account at avatrade or try our risk-free demo account!

Pros and cons of leveraged trading

Pros of leverage

- Boosts capital. Leverage boosts the capital available to invest in various markets. For instance, with a 100:1 leverage, you effectively have control of $100,000 in trading capital with only $1,000. This means that you can allocate meaningful amounts to various trade positions in your portfolio.

- Interest-free loan. Leverage is essentially a loan provided by your broker to allow you to take a bigger position in the market. However, this ‘loan’ does not come with any obligations in the form of interest or commission and you can utilise it in any manner that you wish when trading.

- Magnified profits. Leveraged trading allows traders to earn magnified profits from trades that go in their favour. Profits are earned out of the trade position controlled and not the margin put down. This also means that traders can earn substantial profits even if underlying assets make marginal price movements.

- Mitigating against low volatility. Price changes in the markets usually occur in cycles of high and low volatility. Most traders like trading highly volatile markets because money is made out of price movements. This means that periods of low volatility can be particularly frustrating for traders because of the little price action that occurs. Thankfully, with leveraged trading, traders can potentially bank bigger profits even during these seemingly ‘dull’ moments of low volatility.

- Trading premium markets. Leverage makes it possible for traders to trade instruments that are considered to be more expensive or prestigious. Some instruments are priced at a premium and this can lock out many retail investors. But with leverage, such markets or assets can be traded and expose the average retail investor to the many trading opportunities they present.

Cons of leverage

- Amplified losses. The biggest risk when trading with leverage is that, like profit, losses are also amplified when the market goes against you. Leverage may require minimal capital outlay, but because trading results are based on the total position size you are controlling, losses can be substantial.

- Margin call risk. The dreaded ‘margin call’ from your broker occurs when floating losses surpass your used margin. Because leverage amplifies losses, there will always be an ever-present ‘margin call’ risk when you have open trading positions in the fast and dynamic financial markets.

Example of leverage trading – retail clients

Let’s look at another example, this time with gold. The price of one troy ounce of gold is $1,327. The trader believes the price is going rise and wishes to open a large buying position for 10 units.

The full price for this position will be $13,270, which is not only a large amount to risk, but many traders do not possess such amounts.

With a 20:1 leverage offered by avatrade, or a 5.00% margin, the amount will decrease substantially. Meaning that for every $20 of worth in the position, the trader will need to invest $1 out of his account, which comes to $663.5 only.

Open your leveraged trading account at avatrade or try our risk-free demo account!

Margin call – how it works

In order to employ leverage, a trader must have sufficient funds in his account to cover possible losses. Each broker has different requirements. Avatrade requires a retail trader to possess equity of at least 50% of his used margin for metatrader 4 and avaoptions accounts.

Going back to the example above, the position’s original value is $13,270; for both metatrader 4 and FX options trading accounts. With leverage, the trader invests $663.5 of his capital, and if he has 50% of this used margin in equity, i.E. $331.75, his positions will be kept opened.

If, however, the trader has losses and his equity drops below 50% of used margin on metatrader 4 and avaoptions accounts, the broker will shut down the client’s position(s), in a “margin call”.

On avaoptions all the client’s positions will be closed, while metatrader 4 will shut down the largest losing position first, and will continue to close positions until the equity level returns above 50% of the used margin.

Example of leverage trading – pro/non EU clients

In this example, we’ll take the price of one troy ounce of gold at $1,327. The trader believes the price is going to rise and wishes to open a large buying position for 10 units. The full price for this position would be $13,270, which is not only a large amount to risk, but many traders may not possess such amounts. Using the 200:1 leverage offered by avatrade, or a 0.50% margin, the amount will decrease substantially. Meaning that for every $200 of worth in the position, the trader will need to invest $1 out of his account, which comes to just $66.35.

Margin call – pro/non EU clients

In order to employ leverage, a trader needs to have sufficient funds in his account to cover possible losses. Each broker has different requirements, and avatrade requires a pro/non – EU trader to possess equity of at least 10% of his used margin for metatrader 4 and avaoptions accounts.

Going back to the example above, the position’s original value is $13,270 for both metatrader 4 and FX options trading accounts.

With leverage the trader invests $66.35 of his capital, and if he has 10% of this used margin in equity, i.E. $6.64, his positions will be kept opened.

If, however, the trader has losses and his equity drops below 10% of used margin on metatrader 4 and avaoptions accounts, the broker will shut down the client’s positions.

On avaoptions all the client’s positions will be closed simultaneously, while metatrader 4 will shut down the largest losing position first, and will continue to close positions until the equity level returns above 10% of the used margin.

Leverage trading with avatrade

Avatrade offers many instruments, and each has a different leverage available which can also change based on the trading platform you choose to work with. It is important to make sure you know the available leverage before you start trading.

In order to avoid a margin call always make sure you have enough equity in your account’s balance so you can continue your trades undisturbed.

Finally, it’s worth trying out our avaprotect feature. It is a risk management tool that protects your open positionsif you set it up before you open the trade.

It lasts as long as you want it to, and if your trade is losing upon expiry, you will get all the money back into your account, minus the fee you paid for the avaprotect™ facility.

Leverage main faqs

Because avatrade uses a 50% margin requirement and the use of the margin call your risk of excessive trading losses that exceed the total balance of your account is minimized, but it is not eliminated completely. During a period of extreme volatility, it is possible that a position could move so rapidly against you that it is not possible to liquidate a losing position in time to keep your account balance from going negative. To avoid this, we strongly recommend that you manage your use of leverage wisely.

While leverage and margin are closely interconnected, they are not the same thing. Both do involve borrowing in order to trade in the financial markets, however leverage refers to the act of taking on debt, while margin is the actual money or debt that the trader has taken on to invest in financial markets. So, leverage is referred to as a ration, such as 1:30 or 1:100, which indicates how much debt can be taken on to open a position, while margin is referred to as the actual amount borrowed to create the leverage. For example, with 1:100 leverage you can control $100 of an asset with only $1 in margin.

Leverage is a very complex financial tool and should be respected as such. While it sounds fantastic in theory, the reality can be quite different once traders come to realize that leverage doesn’t only magnify gains, but it also magnifies losses. Any trade using leverage that moves against the trader is going to create a loss that is much larger than it would have been without the use of leverage. This is why caution is recommended until more experience with leverage is gained. This can lead to a longer and more prosperous trading career.

Open your leveraged trading account at avatrade or try our risk-free demo account!

We recommend you to visit our trading for beginners section for more articles on how to trade forex and cfds.

So, let's see, what we have: after examining more than 400 forex brokers, I found the brokers with the highest leverage. See brokers with a leverage of 1000, 2000, and even 3000. At 1:3000 leverage meaning

Contents of the article

- Top forex bonus promo

- 1:3000 leverage meaning

- The highest leverage reputable forex brokers in 2021

- Forex brokers’ limitations on high leverage

- How can EU forex traders use high leverage?

- How can US forex traders use high leverage?

- Which forex broker has the highest leverage?

- List of forex brokers with the highest leverage

- What is 1:100 leverage meaning?

- Leverage of 1:3000

- 5+ bset forex brokers with highest leverage | 1:3000...

- What is leverage

- How does forex brokers with highest leverage works

- Advantages of highest leverage

- Disadvantages of highest leverage

- 1:3000 leverage meaning

- Concept of leverage explained

- What is margin?

- What is a margin call?

- How leverage works in the forex market

- Understanding leverage in the forex market

- Types of leverage ratios

- Forex leverage and trade size

- The risks of leverage

- Leverage in forex trading

- You have more control than you think

- Leverage amounts

- Professional traders and leverage

- How much leverage is right for you in forex trades

- The risks of high leverage

- Example using maximum leverage

- Example using less leverage

- How to pick the right leverage level

- The bottom line

- How to calculate leverage, margin, and pip values in forex

- Leverage and margin

- Pip values

- Converting profits and losses in pips to native currency

- Guide to leverage

- Guide to leverage

- What is leverage in trading?

- What is margin trading?

- Pros and cons of leveraged trading

- Margin call – how it works

- Leverage trading with avatrade

Comments

Post a Comment