How to Make Money With Forex, make money forex trading.

Make money forex trading

Firstly, choose the currency pair. Pick it from the market you know, for instance, avoid currencies from exotic countries if you don’t know them well.

Top forex bonus promo

If you trade only one currency pair you’ll have better chances to recognize trading signals . Also, your position size will determine the risk you are willing to take in every single position.

Further, find when to set your entry, will you go short or long. Never forget to set the exit level. You must know when to exit the position to maximize your profit and minimize potential losses.

Find when and how to buy or sell your currency pair. For example, you notice that the EUR/USD currency pair will rebound from a current support or resistance level. Your first strategy should be to take the benefit of this trend. Later, you can adjust this first strategy by adding some details that will improve efficiency. For example, set a stop-loss when the price goes down to a particular percentage or number of pips to exit the position.

How to make money with forex?

When am I ready to profit with forex?

Forex market is like any other market where instead of stocks or bonds people trade currencies and make money.

Trading in forex is popular low capital trading but you have to know how to make money with forex. The truth is that you don’t need a huge capital to get started. Also, the forex market is available 24 hours during working days, but you can’t trade over weekends. Maybe the most common truth about every single person that enters the forex market is that they are excited, eager to earn a lot, and fast, but only a few of them know how to make money with forex.

How beginners in forex trading look like?

They are excited by the possibility of quick money earning and becoming rich. Beginners will easily sign up on some platforms without doing the necessary research. They are entering a position like gambling putting money somewhere and somehow, random, without a strategy. Even more, they don’t know how to place a trade, when to enter the position, where to set stop-loss orders or limits, or take profit. Actually they know nothing. And what happens? After several days when everything invested is lost, they will conclude the forex is fraud and it is impossible to make money there. For them it is completely the truth. With this approach, they will never earn because they don’t know how to make money with forex.

The other side of the forex rainbow

Beginners could see successful forex traders. But they are using tested and well-checked strategies. The strategies that they have developed or discovered thanks to a lot of trials and errors made for a long time. Yes, that’s the way! You’ll have to make many trials and mistakes to understand forex trading and understand how to make money with forex.

Forex traders have a unique trading style, a unique system, and their own strategy. But they came up to them after deep research, hundreds of attempts, losing a lot of money before they found a profitable strategy that works for them and became successful traders. Well, we are sure that the most successful traders will never talk about their failures but now and then you can find someone ready to share that unpleasant experience. On the other hand, you’ll find a lot of them sharing their great stories about winning trades. Learn from them. Only the knowledge will allow you to make the proper strategy, consistent profits on it every single day. That is possible, of course. But you have to learn how to make money with forex. And here are some hints.

How to make money with forex?

If you are a complete beginner without knowledge but willing to start forex trading and make money from it, the first thing you have to do is to read reputable books. Sorry folks, but knowledge is MUST. The point with reading books is that you’ll obtain theoretical knowledge. It is extremely important to understand the financial markets, otherwise, you’re not able to trade them especially if you want to stay there for the long run.

Good places for sharing knowledge are social networks. Join as many groups as you can and start the conversation. Don’t be shy to ask whatever you need to get better knowledge. Professional traders are also members of such groups and often, they’ll be glad to answer you. Also, interact with other rookies and share your knowledge but dilemmas also. Ask elite traders about the effects of leverage. That could be a very interesting conversation where you could find that trading with excessive leverage could be dangerous. You don’t believe it? Well, using leverage is good but if you use excessive leverage in your trading strategy that can end up as a failure. Using excessive leverage might mean that you are not realistic in expected returns on your investments.

What is leverage in forex trading, in the first place?

In general, leverage enables you to increase the result of your trading efforts but without developing your resources. Leverage in forex will simply boost your account while you actually don’t have that money. You are borrowing it to trade with even 1.000 times greater amount than your capital is. That is giving you access to the larger volumes than it is possible with your initial capital.

We are sure that you noticed banners on the trading websites that offer trading with 500:1 leverage. Well, it’s time to explain this in more detail. As we said, leverage is a kind of loan that a broker gives you. You use leverage in margin trading. And here we come to an important point. But leverage isn’t quite a loan even if it is one of the highest that traders can take.

This thing goes right this way

When you enter the forex market, the first thing you have to do is to open a margin account with your broker. Depending on the broker, the amount of leverage can be 20:1, 50:1, 200:1, 500:1 even more. Also, the amount of leverage will depend on your position size. For example, a 100:1 leverage ratio indicates that you have to deposit on your margin account, let’s say, $1.000 to be able to trade $100.000 of currency. These 100:1 leverage or 50:1 are for the standard lot size . If your position is at $50,000 or less the leverage would usually be 200:1.

But compare these leverages with, for example, the 15:1 leverage in the futures market. Well, you might think this forex leverage is too risky. Keep in mind that currency values normally switch by less than 1% within one-day trading. So, this huge leverage is possible because of small changes in the prices of currencies. If currencies are changing more in price, the broker would never give you that much leverage.

More math on how does forex leverage work

Assume you have a small account with $1.000. A standard lot is 100.000 currency units. If you want to trade mini or micro-lots, this deposit size would allow you to open micro-lots. That is 0.01 of a single lot or 1.000 currency units with no leverage set in place. Nevertheless, you’re looking for a 2% return per trade, which is $20.

So, you decide to employ financial leverage to trade big. Your broker is giving you a leverage 200:1. This means you can open a position as large as 2 lots. To make the long story shorter, let’s do some math .

$1.000 x 200 leverage = $200.000

This equitation shows that you actually have a maximum size position of $200.000. That is 200 times the size of your deposit. So, instead of earning $1, you’ll earn $200. Also, you can lose even faster.

Let’s follow our example, and assume you opened an order with a 1.00 lot. What will happen if the market goes against you? You will have minus 100 pips and lose $1000. Your order will be automatically closed. So, you will lose only your total deposit but you’ll not have money to continue. That’s why it is better to trade a smaller position to reduce the risks.

Use a stop-loss order to reduce risk

This one is probably most important. You can find hundreds of forex courses on the internet that promise you a strategy that will show you how to make money with forex every day. A lot of them are scammers, trust us. They just want your money for the low-quality courses. The better way is to start with some simple and easy strategy . It’s not hard to build a suitable strategy.

For example, you notice that the EUR/USD currency pair will rebound from a current support or resistance level. Your first strategy should be to take the benefit of this trend. Later, you can adjust this first strategy by adding some details that will improve efficiency. For example, set a stop-loss when the price goes down to a particular percentage or number of pips to exit the position.

Here is what you have to look out when creating a forex trading strategy.

Firstly, choose the currency pair. Pick it from the market you know, for instance, avoid currencies from exotic countries if you don’t know them well. If you trade only one currency pair you’ll have better chances to recognize trading signals . Also, your position size will determine the risk you are willing to take in every single position.

Further, find when to set your entry, will you go short or long. Never forget to set the exit level. You must know when to exit the position to maximize your profit and minimize potential losses.

Find when and how to buy or sell your currency pair.

Can you become rich with forex trading?

Some will tell you that it is impossible. And they would be right. The others will tell of course, and they would be right, also. The truth is that the forex market may give you a chance to earn a lot. This market is much bigger than the stock market, for example. Also, it offers the highest leverage possible in any market. Also, you can trade every day. In essence, the forex market is a place where small investors with small capital have a real chance to make fortune.

Trading forex is easy, but trading it with constant profit is difficult.

Opposite to what you’ve heard or read forex trading will not turn your $1.000 account into $1 million. The amount you can earn is determined by how much risk you want to take. If you want to know how to make money with forex, start with education. Sorry guys, it is necessary. When you learn the basics you can develop your skills further and you’ll start to make money for living by trading forex.

There are traders that are targeting even 100% profit per month. Yes, but the risk they are taking on is almost the same as the profit they are aiming for. In short, if you want to make a 100% profit per year, it’s possible to have a loss of 100% per year. Even if you are trading with an edge your profits will be small without leverage. On the other hand, with leverage, you can profit a lot, but you can produce extreme losses. The main point in forex trading is to buy a currency pair at a lower price and sell it at a higher price. The difference between is your profit.

For example, you have $1000 on your trading account and want to trade the EUR/USD pair with the exchange rate at 1.25. That means that for 1 euro you’ll take $1.25. Keep in mind that the prices are changing every day, from minute to minute. But you believe that EUR will increase versus the dollar.

Let’s assume, you buy 800 euros for your $1000. And the exchange rate changed from 1.25 to 1.35. That’s good for you, and you close the trade at this level and you can exchange your 800 EUR back to $1.080, and your profit is $80. But, if you used the leverage of 1:3000 you would get $24.000 in one single trade. So, you invest $1000 and trade $3.000 000! Pretty good!

Always keep in mind, if you want the higher profits you’ll have to take the higher risks.

Bottom line

One thing is completely true. If you never try you’ll never know how to make money with forex. With an account with just $1.000 and leverage of 1:100, it is possible to make a lot of money in a single trade. All you have to do is to have at least 1% of the trade on your margin account to use this leverage which is one of the most profitable. That is how to make money with forex.

How to make money in forex trading: A complete guide for beginners

The foreign exchange market is the world’s most liquid market, with more than 5-trillion a day exchanging hands. The market is liquid 24-hours a day, 5-days a week, opening in the evening on sunday during north american trading hours and closing at 5-pm on friday evening during the same time zone. If you are a beginner and just dipping your toe into trading the forex markets, you should consider following the market and increasing your understanding of why exchange rates move before risking your hard-earned capital.

Learn about the financial markets

The financial markets allow investors, businesses, governments and central banks a place to transact in an open market, exchanging their risks to meet their financial needs. A corporate treasurer might need to exchange profits in euros into dollars, just as a speculator believes that the EUR/USD will rise. There are thousands of reasons why exchange rates and prices moved over a short-period of time, generating noise as participants look for an optimal price to enter or exit a position.

Before you start trading, you should learn about the different types of markets available to trade, and which one you are most interested in following. In addition to trading forex, you can also consider trading commodities, indices, and shares. The best way to learn about a market is to read about why others believe it’s moving and the different catalysts that might drive the price or exchange rate in a specific direction. For example, you might start with looking for a style of analysis that is generally provided by reputable brokers such as alpari. Your goal is to see what type of analysis they offer and what type of actionable ideas come from the analysis they provide. You can also look through a broker’s education section and see if they provide information about why the markets move. In addition to looking at a broker’s education section, you can scan the markets for websites that focus on financial markets education.

Learn to do your own analysis

There are two main types of analysis that forex traders generally focus on, which include fundamental and technical analysis. Fundamental analysis is the study of macro events that will alter the course of a currency pair. Technical analysis is the study of price action, including looking at momentum, trends and reversal patterns.

Fundamental analysis

The fundamentals surrounding the forex markets is based on the interest rates markets of each of the currencies that make up an exchange rate. For example, if you plan on trading the EUR/USD you want to have a gauge of where interest rates are likely going in the eurozone as well as the united states. In general, the stronger an economy, the more likely the central bank is to raise interest rates, which help drive up market interest rates. The reverse is also the case for a weaker economy where the central bank and market forces will likely drive interest rates lower.

The best way to determine if an economy is strong is to be able to evaluate countries financial information. This could include their employment information, their GDP, as well as inflation information such as the consumer price index. Most reputable brokers will provide you with a forex economic calendar where you can see what economists expect relative to history as well as the actual release. What is important about fundamentals is that each new piece of information can alter the direction of an exchange rate. If the economic data is greater than or worse than expected, an exchange rate will move to reflect the new information.

Technical analysis

Technical analysis is the study of historical prices. Although the past is not always a predictor of the future, different changes following specific studies can give you a gauge of where prices might move in the futures. Some of the more popular technical analysis studies include evaluating momentum. Momentum is the acceleration or deceleration of price changes. If you are interested in learning about technical analysis, you can look at your broker’s education section, or follow their technical analysis forecasts. There are also several websites that will provide you with education on different types of technical analysis tools. Some of the more popular include the MACD, the RSI, and stochastics.

Find good broker

Your forex broker facilitates the execution of transactions. While this is their most important function, there are many features a broker like alpari brings to the table which you should be aware of prior to depositing funds at that broker. First, do some due diligence. Look up reviews by your prospective broker and make sure there are no red flags. Fraud alerts or issues with withdrawing funds are the most important. You also want to make sure there is efficient customer service. You do not want to frustrate yourself by finding a broker who will not answer questions.

The next step is to evaluate the platform. Does the broker have an education section or generate technical analysis forecasts? Additionally, you want to make sure that your broker offers clients a financial calendar. Additionally, you want to find out about the leverage they provide to clients. Higher levels of margin will provide you the option to generate more revenue.

Start with a demo account

Most reputable brokers will offer you real-money accounts as well as demonstration accounts. A demo account is one where you are trading paper money, not real capital. Most good demonstration accounts offer nearly all the products that are available to trade will a real-money account. The prices will likely be in real-time or close to real-time. In addition, you will have access to most of the education and forecasting information your broker provides to real-money clients. Once you feel like you’re ready for a real-money account you can make the switch from a demo account to real funds.

Summary

There are several steps you should take before you start transacting in the forex market. You need to first learn about the financial markets and the type of information you can learn about prior to trading. Try to learn about both fundamental and technical analysis. Find a forex broker that you believe is trustworthy and provides a plethora of information. Lastly, use a demo account before you begin to risk real money.

Make money forex trading

Trading currency is one of the main market trading options, along with stocks, commodities, and real estate. Each of these is unique in some way, but what unites them all is that there’s a buyer, a seller, and a market where the exchange takes place. In this post, we will go over the main things to consider if you want to get into currency trading.

The basics of making money through forex trading

Trading in foreign currencies on the foreign exchange market (forex) is popular with many people who are looking for low capital trading. There is no need to have a massive investment to get started. It’s also convenient to trade forex (FX) because a forex trading day lasts for 24 hours (no trading during weekends, though).

That said, the lifecycle of a typical forex beginner goes something like this.

- Get excited by a course that promises quick money and comfortable living.

- Sign up for a forex broker without ever doing any further research.

- Blow through a large amount of money in a short amount of days.

- Conclude forex is a scam, and no one makes money.

On the other hand, the top forex traders are using tried and true systems that they slowly developed or learned through much trial and error. This allows them to make consistent profits on them every single day. However, even these top performers experience slippage at some point. It’s a common problem when currency markets are fast-moving.

Slippage happens when losses are more substantial than expected. To account for this, successful forex traders reduce calculated net profits by 10%.

The difference between successful traders and those that don’t succeed is what separates any successful and unsuccessful person. Those people that are ultimately successful have typically tried a million things and lost a lot of money and time in the process. The only way they were able to discover something profitable that worked for them was by trying things over and over again until they found something that works.

Sure, they don’t go out there preaching about all of their failed systems and all the times they lost money, but who would be?

How to start with forex?

If I were to start over trading in financial markets with no knowledge, there are a few key places I would start.

- First, I would begin by reading books. They teach the theory behind trading in financial markets, which is key to successful long-term trading.

- Second, I would join every facebook group or reddit thread that talked about forex. Then I would ask questions in those groups. In addition to staying respectful, I’d try to help out by answering any questions that I could to those that knew even less than me.

- Next, I would understand that leverage can be a double-edged sword. Using excessive leverage can seriously damage what could otherwise be a successful forex trading strategy. A big part of not using excessive leverage is being realistic about expectations of the return on investment. At this point I’d also learn how to use a “stop-loss order”, which is essential to risk management.

- Finally, I would find people I trust and ask them for reputable brokers and courses that I could take. This one is probably the biggest key. There are probably hundreds of forex courses online that guarantee you a system that will make you money from day one. As with anything of that nature, a lot of them are scams. They are taught by people that learned how to trade forex, couldn’t succeed at it, and ended up just selling courses to make money.

Recommended forex posts:

Forex trading: demo account vs. Real-money trading account

Now, let’s get to the meat of the whole process-opening a forex account.

After you’ve done your reading, watched relevant videos, asked questions, and got the answers to as many unknowns as you could, you can open a demo account and put your knowledge to the test.

If you are not familiar with the term, a demo account is a practice account where you trade with pretend money. The obvious main benefit of starting your forex trading journey with a practice account is that should you slip up, you won’t lose actual money.

But there are other advantages as well. With a demo account you can:

- Watch the forex market move in real-time.

- Learn the industry jargon and how trading platforms work.

- Test out your knowledge and go crazy testing your theories.

- Try different currency pairs to find which ones will yield the best results for you.

- Compare various trading platforms and pick the one/s that you feel most comfortable to use.

There are more benefits to demo accounts; however, there’s something to keep in mind.

Only because a practice account uses pretend money doesn’t mean you should get sloppy with your practice currency trading. Think of it as a fire drill—there might not be a real emergency, but keeping it serious will help you in case things actually go south. In other words, once you’ve played around with your pretend money enough to know what works for you, treat your demo account as if you are trading with real money. This will give you a more realistic idea of what to expect once you dip your toes in the real-money forex pool.

Granted, not all forex trading platforms are the same. Go for reputable and secure ones, that also let you open demo accounts with real-time market data.

Technical analysis vs. Fundamental analysis

Just like you’d do when trading stocks, currency trading gets more precise when you know how to read charts. While it’s not the most exciting part of trading, going through numbers is key to a successful trade. Without it, all you do is gamble.

Again like with stock trading, traders go through technical and fundamental analysis upon which they base their trading strategy. Let’s quickly go over the difference between the two.

To do technical analysis, you would look at the past performance of the exchange rate of currency pairs. Technical analysis is what you typically see in movies about stock traders where they look at lines that go up and down. This is the market fluctuation, and the purpose of technical analysis is to predict where the market will go based on past performance.

Fundamental analysis is concerned with a country’s performance economy wise as shown by economic data such as GDP, employment, and inflation. Of course, other indicators come at play such as government stability, and the country’s international political and trade relations. All in all, the fundamental analysis approach attempts to predict a country’s currency value by assessing the country’s wellbeing.

So, which approach of the two should you pick? It might come as no surprise that it’d be best to learn both methods. What you can do is learn how to do both and, using a demo account, test them separately and together.

How to make money with forex fast?

Finally, let’s address the two questions that bug the most newcomers to the forex world.

The two things that new FX trader will ask is, “how much money will I make from the forex market?” and “how to make money fast on forex?”. The saying goes that the easiest way to get $1,000 in forex is to start with $5,000. This is a tongue-in-cheek answer but points to an issue that is not a joke. Many traders do lose money on forex.

Nevertheless, it is indeed possible to make money trading forex. In fact, plenty of people manage to make a consistent income trading forex daily, especially if they have an effective forex day trading strategy in place.

The fallacy is that it is easy money. Typically, when someone signs up to start trading forex, they do so under the false illusion that it is an easy way to make money. They are sold on expensive courses that feature wealthy millionaires in their yachts talking about how they do no work but make lots of money.

That very well may be so. But it is highly doubtful that those same wealthy millionaires weren’t working their butts off at some point in their life. It is also highly likely that those millionaires have lost a huge amount of money when starting trading forex and learning how to succeed in what they do. That is the nature of the game.

Bottom line, yes, forex traders really make money. People also lose money on forex. It all comes down to your mindset. Those that make money understand forex is a business and a hard one at that. They don’t have an “easy money” mentality.

The most important thing to remember can be summarized by jack D. Schwager-a US trader and author of the little book of market wizards where he writes: “there is no single market secret to discover, no single correct way to trade the markets. Those seeking the one true answer to the markets haven’t even gotten as far as asking the right question, let alone getting the right answer.”

Exclusive bonus: before investing in forex check out our report on 70+ forex brokers. Find out which brokers you need to avoid. Receive our exclusive report for free today.

Make money forex trading

So how do you actually make money in forex?

You make money in forex by profiting on the fluctuation of the exchange rate between two currencies. This is why you are always trading currency pairs and not just a single currency. The first thing that you need to understand is that you are always buying one currency and selling the other in order to trade their exchange rate. So let’s take a look at the GBP/USD as a symbol name to explain further.

If you buy GBP/USD = you are buying the GBP and selling the USD at the same time. (a.K.A going long)

if you sell GBP/USD = you are selling the GBP and buying the USD at the same time. (a.K.A going short)

The first currency displayed is known as the base currency and the second is the quote currency.

GBP/USD = GBP is the base currency

GBP/USD = USD is the quote currency

So what is a pip?

Many years ago a pip was simply the last decimal place that you could see on your chart. As time has progressed most brokers now display everything an extra decimal point which is essentially 1/10th of a pip. For many currencies this means that we have now gone to a 5th decimal place but for others it means we have gone to a 3rd decimal place. It might sound a little confusing at first but it isn’t that hard to get your head around. All you really need to know is that on any currency pair you see displayed to the 5th decimal place, it is the 4th decimal place where you start to measure pips. On any currency pair that you see displayed to the 3rd decimal place, it is the 2nd decimal place that you start to measure pips. Here are some examples to help make this clear.

If the GBP/USD changes from 1.65000 to 1.65010 = the exchange rate has moved by 1 pip.

If the EUR/JPY changes from 144.000 to 144.010 = the exchange rate has moved by 1 pip.

If the GBP/USD changes from 1.65000 to 1.66000 = the exchange rate has moved by 100 pips.

If the EUR/JPY changes from 144.000 to 145.000 = the exchange rate has moved by 100 pips.

So how is a pip valued?

There is a simple formula that you can follow to determine the value of a pip in either the base or quote currency of the pair you are trading.

(1 pip ÷ exchange rate) x trade size = value per pip in base currency

value per pip in base currency x exchange rate = pip value in quote currency

Let’s take a look at the GBP/USD and determine the value of 1 pip if the exchange rate is 1.65000 and we trade £10,000.

(0.0001 ÷ 1.65000) x 10,000 = £0.60606060

£0.60606060 x 1.65000 = $1

Let’s take a look at the EURJPY and determine the value of 1 pip if the exchange rate is 145.000 and we trade €10,000.

(0.01 ÷ 145.000) x 10,000 = €0.68965517

€0.68965517 x 1.65000 = ¥100

You can multiply the value per pip in base currency by the exchange rate of any currency you like. If we wanted to know our EURJPY pip value in USD then we can simply do this: €0.68965517 x current EURUSD rate.

So what is spread? Or the bid/ask?

Spread is the difference in pips that you will pay when you enter an order. To put that another way, the spread is the difference between the buy (ask) price and sell (bid) price. When trading the major currency pairs most brokers will offer a spread of 1-3 pips on their standard accounts. This means that if the exchange rate on the GBP/USD reads 1.6500 and you wanted to buy, then your entry price will be between 1.6501-1.6503, depending on what the spread was at the second you entered the trade. Spreads will vary from broker to broker and they will also vary within each broker, especially when moving between low and high volume trading times. A different type of account many brokers offer is called an ECN (electronic communications network). Spreads on these accounts will be very low and you will pay commissions on your trades instead. You can look at the commission as your minimum spread, plus whatever very small spread you actually get. ECN accounts generally work out to be the cheaper way to trade when you break it down. You must, however, take care around major news events as the spreads are known to spike in size.

So what is leverage?

In the examples above to calculate the value of a pip, £10,000 and €10,000 were used as our trade size. You are probably thinking that you don’t really want to risk that much to start and I don’t blame you. Fortunately, trading forex opens the doors for you to trade with high leverage. You can actually buy or sell £10,000 by using a much smaller amount by using leverage. If you are a US resident you are limited to 50:1 leverage on your account. Your options to get around that are very limited but they do exist. If you live in europe then you are limited to 30:1 leverage but it is easy to get around it. To get up to 500:1 leverage, no matter where you live, check my ECN style brokers page. If you live anywhere else there are brokers out there offering up to 888:1! Let’s take a quick look at both extremes.

If you have a £2,000 account with 50:1 leverage.

You can buy or sell £10,000 worth for just £200.

If you have a £2,000 account with 888:1 leverage.

You can buy or sell £10,000 worth for just £11.26.

The latter example is very extreme and usually, 500:1 is the average top end. Once you have chosen a broker you will be able to select your leverage as you sign up. You could choose 100:1 or 200:1 for example. Most brokers will allow you to change your leverage as and if you want. Either way you can buy or sell a whole lot more than you actually have and that is why you are just a speculator.

So what is a margin call?

High leverage can be a big plus when used intelligently but before you getting too excited just remember one thing. Even though you can enter a large position using a very small portion of your account, the value of each pip still is in relation to the size of the position. This is where lack of experience results in margin calls. This is however easy to avoid if you have done your reading first. Let’s take a look at an extreme example so you can understand the math.

If you have a £2,000 account with 500:1 leverage you can buy or sell £500,000 on the GBPUSD using just £1000 of your account. If we stick with 1.65000 as the current exchange rate; the problem is that every pip the market moves against you it will use £30.30303030 of your remaining £1000. That means that with a 33 pip against you it’s game over. A 33 pip move against you is not uncommon and it can be very fast also. Furthermore, most brokers will exit your positions if you are using up 30% or 50% of your account. Always check your broker conditions so you know your limits.

That was an extreme example but the point is clear; high leverage can be used to barely use any of your account to be in a position. You need to be smart about your lot size and you should never risk anywhere near that much of your account on a single trade.

So what are lots?

The final part for you to understand are these ‘lots’ that you keep hearing about. The best way to start off this explanation is with a table. The lot size that you trade will determine your actual trade size. In the examples above we have been using what are known as mini lots (10,000 of the base currency).

| Common lot size name | base currency trade size | trading software lot size |

|---|---|---|

| standard | 100,000 | 1.0 |

| mini | 10,000 | 0.1 |

| micro | 1,000 | 0.01 |

Try not to think about the money when you are trading, just make sure your math is correct and that you are trading the right lot sizes for your account regardless of your leverage. Leverage should only be used so that any position you are in is not using much of your account.

Making money in forex is easy if you know how the bankers trade!

How to make money in forex?

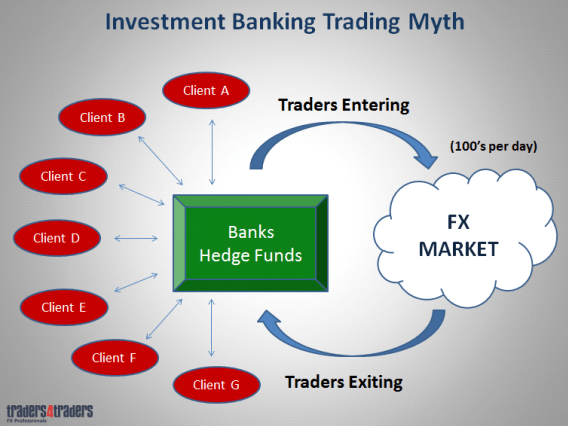

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a chief trader its second knowledge how to extract cash out of the market. It all comes down to understanding how the traders at the banks execute and make trading decisions.

Why? Bank traders only make up 5% of the total number of forex traders with speculators accounting for the other 95%, but more importantly that 5% of bank traders account for 92% of all forex volumes. So if you don’t know how they trade, then you’re simply guessing. First let me bust the first myth about forex traders in institutions. They don’t sit there all day banging away making proprietary trading decisions. Most of the time they are simply transacting on behalf of the banks customers. It’s commonly referred to as ‘clearing the flow”. They may perform a few thousand trades a day but none of these are for their proprietary book

How do banks trade forex?

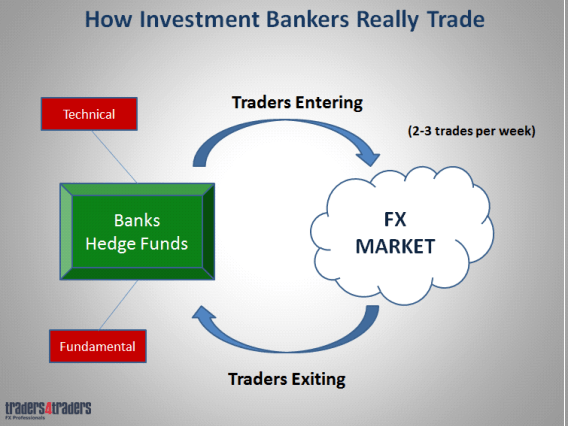

They actually only perform 2-3 trades a week for their own trading account. These trades are the ones they are judged on at the end of the year to see whether they deserve an additional bonus or not.

So as you can see traders at the banks don’t sit there all day trading randomly ‘scalping’ trying to make their budgets. They are extremely methodical in their approach and make trading decisions when everything lines up, technically and fundamentally. That’s what you need to know!

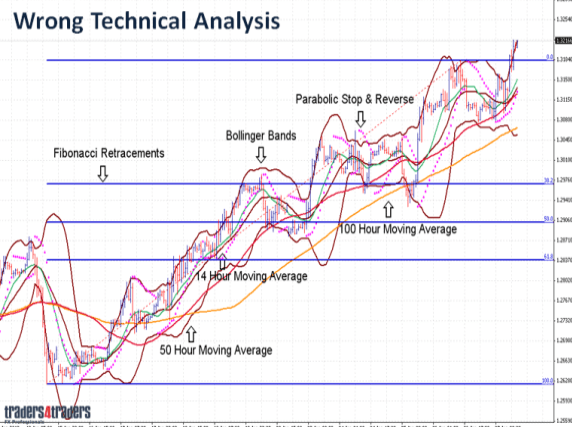

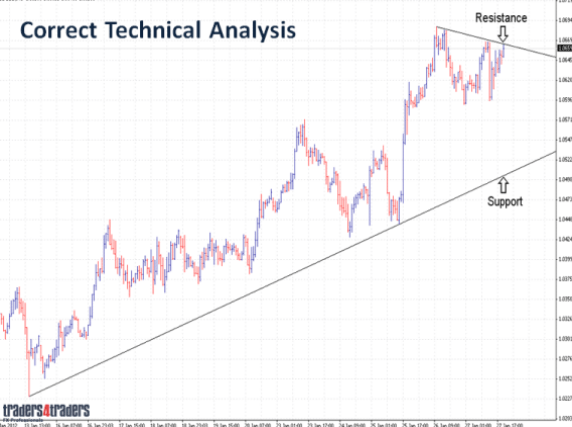

As far as technical analysis goes it is extremely simple. I am often dumbfounded by our client’s charts when they first come to us. They are often littered with mathematical indicators which not only have significant 3-4 hour time lags but also often contradict each other. Trading with these indicators and this approach is the quickest way to rip through your trading capital.

Bank trader’s charts look nothing like this. In fact they are completely the opposite. All they want to know is where the key critical levels. Don’t forget these indicators were developed to try and predict where the market is going. The bank traders are the market. If you understand how they trade then you don’t need any indicators. They make split second decisions based on key technical and fundamental changes. Understanding their technical analysis is the first step to becoming a successful trader. You’ll be trading with the market not against it.

What it all comes down to is simple support and resistance. No clutter, nothing to alter their trading decisions. Simple, effective and highlighting the key levels. I’m not going to go into the ins and outs of where they actually enter the market, but let me say this: it’s not where you think. The trendlines are simply there to indicate key support and resistance. Entering the market is another discussion all together.

How to make money in forex?

The key aspect to their trading decisions is derived from the economic fundamentals. The fundamental backdrop of the market consists of three major areas and that’s why it’s hard to pin point currency direction sometimes.

When you have the political situation countering the central bank announcements currency direction is somewhat disjointed. But when there are no political issues and formulated central bank policy acting in accordance with the economic data, that’s when we get pure currency direction and the big trends emerge. This is what bank traders wait for.

The fundamental aspect of the market is extremely complex and it can take years to master them. This is a major area we concentrate on during our two day workshop to ensure traders have a complete understanding of each area. If you understand them you are set up for long term success as this is where currency direction comes from.

There is a lot of money to be made from trading the economic data releases. The key to trading the releases is twofold. First, having an excellent understanding of the fundamentals and how the various releases impact the market. Secondly, knowing how to execute the trades with precision and without hesitation. If you can get a control of this aspect of trading and have the confidence to trade the events then you’re truly set up to make huge capital advances. After all it is these economic releases which really direct the currencies. These are the same economic releases that central banks formulate policy around. So by following the releases and trading them you not only know what’s going on with regards central bank policy but you’ll also be building your capital at the same time.

Now to be truly successful you need an extremely comprehensive capital management system that not only protects you during periods of uncertainty but also pushes you forward to experience capital expansion. This is your entire business plan so it’s important you get this down pat first.

Our stringent capital management system perfectly encompasses your risk to rewards ratios, capital controls as well as our trade plan – entry and exits. This way when you’re trading, all your concerned about is finding entry levels. Having such a system in place will also alleviate the stresses of trading and allow you to go about your day without spending endless hours monitoring the market.

I can tell you most traders at banks spend most of the day wandering around the dealing room chatting to other traders or going to lunches with brokers. Rarely are they in front of the computer for more than a few hours. You should be taking the same approach. If you understand the technical and fundamental aspects of the market and have a comprehensive professional capital management system then you can.

From here it just takes a simple understanding of the key strategies to apply and where to apply them and away you go. Trust me you will experience more capital growth then you ever have before if you know how the bank traders trade. Many traders have tried to replicate their methods and I’ve seen numerous books on “how to beat the bankers”. But the point is you don’t want to be beating them but joining them. That way you will be trading with the market not against it.

So to conclude let me say this: there are no miraculous secrets to trading forex. There are no special indicators or robots that can mimic the dynamic forex market. You simply need to understand how the major players (bankers) trade and analyse the market. If you get these aspects right then your well on the way to success.

The risk of loss in forex trading can be substantial. You should, therefore, carefully consider whether such trading is suitable for you in the light of your financial condition. The high degree of leverage that is often obtainable in forex trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Past performance is not indicative of future results.

How to make money trading - 2 keys to success

How do you make money trading? Which assets are the best to start with? By the end of this guide, you'll have everything you need to know to get started trading. Our team at trading strategy guides understands that each asset class or instrument you’re trading (FX currencies, stocks, bitcoin, cryptocurrencies, commodities) comes with its own opportunities to make money.

There are many ways to skin a cat and there are different ways to learn how to make money trading. There are short-term trading strategies like the best short term trading strategy – profitable short term trading tips which will allow you to make money fast and there are long-term trading strategies like the MACD trend following strategy- simple to learn trading strategy which will allow you to make money in the long run. No matter which approach you adopt you’ll have to make sure you choose the trading strategy that fits your own personality.

How to make money trading will be the theme of this article.

The starting point to learn how to make money in general not just from trading is to have a strategy. It might be obvious, but there are many traders out there who are merely guessing when trading and not have a strict trading strategy.

Develop your edge and trading strategy

Our team at trading strategy guides has put a lot of time and effort into developing trading strategies with proven trading edges and trading strategies that work in different trading environments. The difference between trading with a strategy and trading without a plan is the difference between making money and losing money.

You can find plenty of evidence on our blog about what a good trading strategy should really look like, but more importantly, what you can really learn is how to make money trading.

Our trading strategies are suitable for trading multiple asset classes but are more focused on the forex currency market. However, from time to time we might focus on strategies that are particular to one instrument like our article on how to trade stock options for beginners – best options trading strategy.

How to make money trading

In order to make money on the forex market or any other market, all you really have to do is to buy low and sell high. Pretty simple wouldn’t you say?

Let’s take a look at an example: how much money can you theoretically make by trading forex currencies?

Let’s assume that you have a $10,000 account balance and the current EUR/USD exchange rate is 1.1500. In other words, for 1 euro you get 1.25 US dollars. You forecast that during the current trading session the EUR/USD exchange rate will rise and based on this forecast, you buy around €8700 for your $10,000.

Your forecast is correct! The EUR/USD exchange rate rises from 1.1500 to 1.1600. Being in the profit you decide to close the trade and exchange your €8700 back to $10,092. Your profit from this trade is $92.

Would it be possible to increase your profits? To learn how to make money or to maximize your trading potential, you can use leverage which can be up to 500 times more than your initial capital, which also increases your profit potential 500 times.

However, we have to keep in mind that leverage is a double-edged sword and while it increases the money you can make, it also means you can lose more money. The partial answer to the question: how to make money trading is through the use of leverage.

How to make money fast

We all love to make money, but unfortunately, life is too short and this begs the question: how do I make money fast? There is no correct answer as there are many approaches that can help you make money fast.

Being in and out of the market is the most common trading approach that can give you instant gratification and fast money. You can use our powerful scalping strategy simple scalping strategy: the best scalping system which can help you make money fast.

You can fine-tune the price at which you buy and sell forex currency pairs by using the most popular trading approaches like support and resistance trading.

You have to be disciplined and manage your risk. Money management is a key part to making money trading. Understanding the risk associated with trading and the reward that the market might provide to you can help you make money faster.

In conclusion, if you’re good at short-term trading and you have the specific trading profile, you have to be glued to the trading screen and constantly monitoring the market in order to make money fast.

Trading for a living: can it be done?

Our team at trading strategy guides thinks that you can certainly make a living by trading as we have seen many traders succeed. However, trading for a living is not easy. You need to be absorbed by the market and spend a lot of time and effort in understanding the particular instrument they’re trading.

On the flip side, if you don’t put any efforts whatsoever, then the probability to make money trading is diminishing.

The secret to how to make money and build your wealth is through COMPOUNDING!

Let’s get straight to the point and see how compounding can help you make money.

How to make money through compounding

The most important ally you have as a trader is compounding. You may have heard that albert einstein describes compound interest as “the most powerful force in the universe.” the force of compounding can produce pretty spectacular returns for traders.

But what exactly does compounding means and how it can help you make profits trading?

Basically, compounding means reinvesting your previous profits and using those profits to generate more profits. Compounding is a long-term trading strategy that can help you make more profits as time goes by.

Let’s look at an example:

We’re going to start with a $10,000 trading account, and on average our trading strategy produces a 10% return per month. This means that in 24 months or two years by reinvesting the previous profits through the power of compounding you end up with an amazing profit of $98,497.33.

Show me any other investment strategy that can do that.

If you want to have a detailed overview of the power of compounding and examine how to make money through reinvesting the previous profits, please take a look at the below figures which breaks down a list of the potential profits you can make each month:

We can easily see how each month our account steadily grows.

Because of the way compounding works, it’s the later months or years that really build your trading account in a big way. So, staying focused on the long-term is critical. If you reinvest all your profits and you make regular contributions to your portfolio, compounding will produce even more amazing results.

You don’t need to be an einstein to appreciate compounding.

Conclusion - how to make money trading

Learning how to make money trading is no easy endeavor. That said if you equip yourself with the right trading strategy and the right mindset great things can be achieved. If you want to learn how to make money fast you need to adopt a short-term trading strategy that will give you many more opportunities to make money. You may also be interested in the best forex trading strategies article.

The two keys to making money trading are leverage and compounding which will help you making money in forex trading.

In the end, the more trading skills you acquire, and the more discipline you exercise, the more money you’ll make. Remember, trading is not a "one size fits all" scenario, but hard work and dedication will ultimately pay off. If you want to learn about how to make money and discover the secrets behind the scenes of trading, don’t miss our previous article: how to profit from trading- make money trading today!

Thank you for your time.

Please leave a comment below if you have any questions on how to make money trading!

Also, please give this strategy 5 stars if you enjoyed it!

5 harsh realities of making money in forex

Are you sick and tired of self-proclaimed trading experts (internet marketers) telling you how easy it is to make money from forex?

You know that forex is not easy.

The problem is that most sites wont tell you how hard forex can be. In fact most sites say forex is easy. Most forex websites do not tell you the truth about forex.

Harsh reality 1: forex is never quick and easy

Most new traders think forex will be easy.

They see advertisements promising quick and automated riches with a forex robot or something equally irresistible. They dive right in blind to the dangers and they get hurt.

Big surprise….. FOREX IS NOT EASY!

In fact anybody who tells you forex is easy is lying. Check out this ad below:

Would you buy this product?

You could be a lawyer in 30 days, you could work for a prestigious law firm earning a six figure income.

You would not buy the product because you know its a lie. Getting a law degree requires half a decade of study. There is no way you can become a master lawyer in under a month.

Forex might not be as hard as law but the same concept holds true. No product is going to make you a master trader in a few weeks. No EA (forex robot) is going to make you consistent profits while you sleep. Forex just isn’t that easy!

If you are here for easy riches, got to a casino, you will have better chances there!

Harsh reality 2: most systems are useless

Most traders waste time searching for the perfect trading system.

When looking for a system the first stop is usually popular forex forums. If you see a system with great feedback and many users it must work right?

Most trading systems on popular forex forums are created by inexperienced traders. The systems may work well for a few weeks, or even for a few months, but they fail in the long run.

This is especially true of indicator based systems. Indicators are sensitive to changes in market conditions. Some indicator based systems give amazing signals in trending markets but fail in ranging markets. The problem is that most indicator based systems are not adaptable to changing market conditions. So a system that works this week might not work next week. If a trading system has not been forward tested for over a year you cannot trust its effectiveness.

If you go down the path of hunting for forex systems you have already failed. You will embark on a long, fruitless search and find nothing.

My advice is to start with the basics, learn how to read price action and how to place support and resistance areas. Once you learn those two things you will not need to find a trading system.

Harsh reality 3: demo trading won’t prepare you for live trading

Imagine a mean looking, tattooed biker approaches you. He pulls out a shotgun, points it at your chest and demands your wallet. What would you do? Chances are you would probably hand over your wallet pretty quickly.

Now imagine an scrawny little eight year old kid approaches you. He pulls out a water pistol, points it at you and asks for your wallet. What would you do? You would probably laugh.

This may sound absurd but there is a correlation. When you trade a demo account you are not using real money. So the fear and apprehension of risking real money does not impact your performance.

A demo account is like the little kid above, it is play money, you can laugh it off and move on.

A real account is like the biker above, the fear and the intimidation of trading real money impacts your actions.

Psychological factors may seem insignificant but they are very significant. Most new traders perform extremely well on demo accounts but fail abysmally on live accounts. Psychology matters and demo accounts do not prepare you for real trading.

Demo accounts do have their use. They are great for familiarizing yourself with a trading platform and learning basic trading concepts. They are also good for basic testing of a trading system.

Harsh reality 4: you need time

So many websites tell you that you can trade forex successfully with less than one hour of work per week.

The reality is that you need to invest a lot of time into becoming a profitable trader. If you can only find a few hours each week to dedicate to forex you should probably give up.

Learning to become a consistently profitable trader takes a lot of time. You need to be prepared to set aside several hours a week to study forex. According to scientists it takes 10,000 hours of practice to master something. I doubt you need 10,000 hours to become a profitable trader. However, you will need more than two hours per week.

The good news is that once you are profitable it is possible to cut your trading time down to a few hours per week. Currently I trade around two hours per day four days a week.

Harsh reality 5: adapt or die

The forex market is constantly changing. You need to be able to adapt or you will never make it.

With a constantly changing market a trader need to be able to make changes on the fly and adapt to current situations. So, a good trade knows how to adapt quickly to a changing market.

When the market throws something unexpected at you, you need to be able to analyse the best course of action and make a decision quickly.

My trading method is based on price action. Right now I concentrate almost exclusively on reversal trading. This is because since 2010 the average daily range of forex pairs has dropped. GBP/JPY used to range 280 pips per day and know it ranges 120 pips.

When markets are not ranging breakout trading becomes hard. My trading method was adapted from trading breakouts to trading reversals in 2010. When pairs start to range again I will probably adapt to market conditions and begin to trade breakouts.

A good trader needs to be ready to adapt quickly to changing markets.

So, should you bother trading forex?

Well, that is up to you. We all know that the vast majority of new traders fail. They fail because they expect no stress, fast and easy riches.

You cannot change the harsh realities above. However, you can accept them and get on with it anyway.

Trading is tough but you need to be tougher. You need to work hard and you need to persevere.

Can you make it a little easier? Yes…….

The next step

The reason I first started www.Forex4noobs.Com was to help new traders become professional traders. That is why this site is packed with stuff to help you along the road from beginner to pro. So if you want to get on the right path take a look around the site.

If you are completely new to forex you should start with or basic forex education section.

If you know the basics you should check out our free forex course. In the video course I show you many important things you wont learn anywhere else. I show you how to put together a highly effective trading plan, money management plan and trading diary. I even explain how to put together a trading strategy.

For free analysis and trade ideas check in to this blog regularly.

Finally if you want a proven trading strategy along with a private members forum where we discuss trades check out the advanced forex price action course. It is closed to new members right now but if you throw your email in I will contact you in the next few weeks about getting access.

3 things I wish I knew when I started trading forex

Trading forex - what I learned

- Trading forex is not a shortcut to instant wealth.

- Excessive leverage can turn winning strategies into losing ones.

- Retail sentiment can act as a powerful trading filter.

Everyone comes to the forex market for a reason, ranging between solely for entertainment to becoming a professional trader. I started out aspiring to be a full-time, self-sufficient forex trader. I had been taught the 'perfect' strategy . I spent months testing it and backtests showed how I could make $25,000-$35,000 a year off of a $10,000 account. My plan was to trade forex for a living and let my account compound until I was so well off, I wouldn't have to work again in my life. I was dedicated and I committed myself to the plan 100%.

Sparing you the details, my plan failed. It turns out that trading 300k lots on a $10,000 account is not very forgiving. I lost 20% of my account in three weeks. I didn't know what hit me. Something was wrong. Luckily, I stopped trading at that point and was fortunate enough to land a job with a forex broker. I spent the next couple of years working with traders around the world and continued to educate myself about the forex market. It played a huge role in my development to be the trader I am today. Three years of profitable trading later, it's been my pleasure to join the team at dailyfx and help people become successful or more successful traders.

The point of me telling this story is because I think many traders can relate to starting off in this market, not seeing the results that they expected and not understanding why. These are the three things I wish I knew when I started trading forex.

1) forex is not a get rick quick opportunity

Contrary to what you’ve read on many websites across the web, forex trading is not going to take your $10,000 account and turn it into $1 million. The amount we can earn is determined more by the amount of money we are risking rather than how good our strategy is. The old saying “it takes money to make money” is an accurate one, forex trading included.

But that doesn’t mean it is not a worthwhile endeavor; after all, there are many successful forex traders out there that trade for a living. The difference is that they have slowly developed over time and increased their account to a level that can create sustainable income.

I hear about traders all the time targeting 50%, 60% or 100% profit per year, or even per month, but the risk they are taking on is going to be pretty similar to the profit they are targeting. In other words, in order to attempt to make 60% profit in a year, it's not unreasonable to see a loss of around 60% of your account in a given year.

"but rob, I am trading with an edge, so I am not risking as much as I could potentially earn" you might say. That's a true statement if you have a strategy with a trading edge. Your expected return should be positive, but without leverage, it is going to be a relatively tiny amount. And during times of bad luck, we can still have losing streaks. When we throw leverage into the mix, that's how traders attempt to target those excessive gains. Which in turn is how traders can produce excessive losses. Leverage is beneficial up to point, but not when it can turn a winning strategy into a loser.

Make money forex trading

Trading currency is one of the main market trading options, along with stocks, commodities, and real estate. Each of these is unique in some way, but what unites them all is that there’s a buyer, a seller, and a market where the exchange takes place. In this post, we will go over the main things to consider if you want to get into currency trading.

The basics of making money through forex trading

Trading in foreign currencies on the foreign exchange market (forex) is popular with many people who are looking for low capital trading. There is no need to have a massive investment to get started. It’s also convenient to trade forex (FX) because a forex trading day lasts for 24 hours (no trading during weekends, though).

That said, the lifecycle of a typical forex beginner goes something like this.

- Get excited by a course that promises quick money and comfortable living.

- Sign up for a forex broker without ever doing any further research.

- Blow through a large amount of money in a short amount of days.

- Conclude forex is a scam, and no one makes money.

On the other hand, the top forex traders are using tried and true systems that they slowly developed or learned through much trial and error. This allows them to make consistent profits on them every single day. However, even these top performers experience slippage at some point. It’s a common problem when currency markets are fast-moving.

Slippage happens when losses are more substantial than expected. To account for this, successful forex traders reduce calculated net profits by 10%.

The difference between successful traders and those that don’t succeed is what separates any successful and unsuccessful person. Those people that are ultimately successful have typically tried a million things and lost a lot of money and time in the process. The only way they were able to discover something profitable that worked for them was by trying things over and over again until they found something that works.

Sure, they don’t go out there preaching about all of their failed systems and all the times they lost money, but who would be?

How to start with forex?

If I were to start over trading in financial markets with no knowledge, there are a few key places I would start.

- First, I would begin by reading books. They teach the theory behind trading in financial markets, which is key to successful long-term trading.

- Second, I would join every facebook group or reddit thread that talked about forex. Then I would ask questions in those groups. In addition to staying respectful, I’d try to help out by answering any questions that I could to those that knew even less than me.

- Next, I would understand that leverage can be a double-edged sword. Using excessive leverage can seriously damage what could otherwise be a successful forex trading strategy. A big part of not using excessive leverage is being realistic about expectations of the return on investment. At this point I’d also learn how to use a “stop-loss order”, which is essential to risk management.

- Finally, I would find people I trust and ask them for reputable brokers and courses that I could take. This one is probably the biggest key. There are probably hundreds of forex courses online that guarantee you a system that will make you money from day one. As with anything of that nature, a lot of them are scams. They are taught by people that learned how to trade forex, couldn’t succeed at it, and ended up just selling courses to make money.

Recommended forex posts:

Forex trading: demo account vs. Real-money trading account

Now, let’s get to the meat of the whole process-opening a forex account.

After you’ve done your reading, watched relevant videos, asked questions, and got the answers to as many unknowns as you could, you can open a demo account and put your knowledge to the test.

If you are not familiar with the term, a demo account is a practice account where you trade with pretend money. The obvious main benefit of starting your forex trading journey with a practice account is that should you slip up, you won’t lose actual money.

But there are other advantages as well. With a demo account you can:

- Watch the forex market move in real-time.

- Learn the industry jargon and how trading platforms work.

- Test out your knowledge and go crazy testing your theories.

- Try different currency pairs to find which ones will yield the best results for you.

- Compare various trading platforms and pick the one/s that you feel most comfortable to use.

There are more benefits to demo accounts; however, there’s something to keep in mind.

Only because a practice account uses pretend money doesn’t mean you should get sloppy with your practice currency trading. Think of it as a fire drill—there might not be a real emergency, but keeping it serious will help you in case things actually go south. In other words, once you’ve played around with your pretend money enough to know what works for you, treat your demo account as if you are trading with real money. This will give you a more realistic idea of what to expect once you dip your toes in the real-money forex pool.

Granted, not all forex trading platforms are the same. Go for reputable and secure ones, that also let you open demo accounts with real-time market data.

Technical analysis vs. Fundamental analysis

Just like you’d do when trading stocks, currency trading gets more precise when you know how to read charts. While it’s not the most exciting part of trading, going through numbers is key to a successful trade. Without it, all you do is gamble.

Again like with stock trading, traders go through technical and fundamental analysis upon which they base their trading strategy. Let’s quickly go over the difference between the two.

To do technical analysis, you would look at the past performance of the exchange rate of currency pairs. Technical analysis is what you typically see in movies about stock traders where they look at lines that go up and down. This is the market fluctuation, and the purpose of technical analysis is to predict where the market will go based on past performance.

Fundamental analysis is concerned with a country’s performance economy wise as shown by economic data such as GDP, employment, and inflation. Of course, other indicators come at play such as government stability, and the country’s international political and trade relations. All in all, the fundamental analysis approach attempts to predict a country’s currency value by assessing the country’s wellbeing.

So, which approach of the two should you pick? It might come as no surprise that it’d be best to learn both methods. What you can do is learn how to do both and, using a demo account, test them separately and together.

How to make money with forex fast?

Finally, let’s address the two questions that bug the most newcomers to the forex world.

The two things that new FX trader will ask is, “how much money will I make from the forex market?” and “how to make money fast on forex?”. The saying goes that the easiest way to get $1,000 in forex is to start with $5,000. This is a tongue-in-cheek answer but points to an issue that is not a joke. Many traders do lose money on forex.

Nevertheless, it is indeed possible to make money trading forex. In fact, plenty of people manage to make a consistent income trading forex daily, especially if they have an effective forex day trading strategy in place.

The fallacy is that it is easy money. Typically, when someone signs up to start trading forex, they do so under the false illusion that it is an easy way to make money. They are sold on expensive courses that feature wealthy millionaires in their yachts talking about how they do no work but make lots of money.

That very well may be so. But it is highly doubtful that those same wealthy millionaires weren’t working their butts off at some point in their life. It is also highly likely that those millionaires have lost a huge amount of money when starting trading forex and learning how to succeed in what they do. That is the nature of the game.

Bottom line, yes, forex traders really make money. People also lose money on forex. It all comes down to your mindset. Those that make money understand forex is a business and a hard one at that. They don’t have an “easy money” mentality.

The most important thing to remember can be summarized by jack D. Schwager-a US trader and author of the little book of market wizards where he writes: “there is no single market secret to discover, no single correct way to trade the markets. Those seeking the one true answer to the markets haven’t even gotten as far as asking the right question, let alone getting the right answer.”

Exclusive bonus: before investing in forex check out our report on 70+ forex brokers. Find out which brokers you need to avoid. Receive our exclusive report for free today.

So, let's see, what we have: how to make money with forex? Can you become rich with forex trading? If you use leverage it is possible to make a lot of money trading forex. But be fully aware to the risks: at make money forex trading

Contents of the article

- Top forex bonus promo

- How to make money with forex?

- When am I ready to profit with forex?

- How beginners in forex trading look like?

- How to make money with forex?

- What is leverage in forex trading, in the first...

- Use a stop-loss order to reduce risk

- Can you become rich with forex trading?

- How to make money in forex trading: A complete guide for...

- Learn about the financial markets

- Learn to do your own analysis

- Find good broker

- Start with a demo account

- Summary

- Make money forex trading

- The basics of making money through forex trading

- How to start with forex?

- Recommended forex posts:

- Forex trading: demo account vs. Real-money trading account

- Technical analysis vs. Fundamental analysis

- How to make money with forex fast?

- Make money forex trading

- So how do you actually make money in forex?

- So what is a pip?

- So how is a pip valued?

- So what is spread? Or the bid/ask?

- So what is leverage?

- So what is a margin call?

- So what are lots?

- Making money in forex is easy if you know how the bankers...

- How to make money in forex?

- How do banks trade forex?

- How to make money in forex?

- How to make money trading - 2 keys to success

- Develop your edge and trading strategy

- How to make money trading

- How to make money fast

- Trading for a living: can it be done?

- How to make money through compounding

- 5 harsh realities of making money in forex

- Harsh reality 1: forex is never quick and easy

- Harsh reality 2: most systems are useless

- Harsh reality 3: demo trading won’t prepare you for live...

- Harsh reality 4: you need time

- Harsh reality 5: adapt or die

- So, should you bother trading forex?

- The next step

- 3 things I wish I knew when I started trading forex

- Trading forex - what I learned

- 1) forex is not a get rick quick opportunity

- Make money forex trading

- The basics of making money through forex trading

- How to start with forex?

- Recommended forex posts:

- Forex trading: demo account vs. Real-money trading account

- Technical analysis vs. Fundamental analysis

- How to make money with forex fast?

Comments

Post a Comment