Forex investments PAMM and MAM for Beginners, forex pamm investment.

Forex pamm investment

Profit is divided proportionally to deposits, like mutual funds, but a small percentage taken away from benefit - the commission of the trader.

Top forex bonus promo

To understand what a PAMM account is and how it works, consider examples and details. It trades on the currency exchange and has its profitability statistics. If the profitability level you like, you can invest money. Each trader has his conditions - an offer, according to which there are conditions for the distribution of profit, most often managers take 20-50% of the profit. PAMM accounts have a single manager (trader) who trades on the currency exchange with their own money and investor funds. The main feature of such a trading account is that the trader manages the total cash, and the accounting system automatically distributes profit or loss between all participants in proportion to the size of the investment.

Forex investments PAMM and MAM for beginners

Many people think about trading. It is an excellent option for making money. The main plus is that you do not have to do it personally. You can conclude a contract with the manager, and give your money to management. For this, you can use PAMM and MAM accounts. How to choose the most profitable option for a beginner? Let’s get it right.

What is PAMM?

A PAMM account is one of the forms of combined currency accounts that allows an investor to allocate his money from the main trading account to the qualified trader/manager. These traders/managers can accumulate on their account the funds of any number of investors, as well as their own money, using this capital to trade on the currency exchange.

If you try to explain in simple words, then a PAMM account is an open account of a trader, which is filled with investor funds and controlled by a broker.

PAMM accounts have a single manager (trader) who trades on the currency exchange with their own money and investor funds. The main feature of such a trading account is that the trader manages the total cash, and the accounting system automatically distributes profit or loss between all participants in proportion to the size of the investment.

What is a money manager?

PAMM accounts have a single manager (trader) who trades on the currency exchange with their own money and investor funds. The main feature of such a statement is that the trader manages the total cash, and the accounting system automatically distributes profit or loss between all participants in proportion to the size of the investment. In simple words, a PAMM account is a particular account of a trader in which investors can invest.

Profit is divided proportionally to deposits, like mutual funds, but a small percentage taken away from benefit - the commission of the trader. To understand what a PAMM account is and how it works, consider examples and details. It trades on the currency exchange and has its profitability statistics. If the profitability level you like, you can invest money. Each trader has his conditions - an offer, according to which there are conditions for the distribution of profit, most often managers take 20-50% of the profit.

The more money invested in the manager, the more money he will receive from the benefit; therefore, some fraudulent operation on the part of the manager cannot use in the PAMM account. In essence, both parties are equally interested in making a profit and successful work. An unlimited number of people can simultaneously invest in a PAMM account, and benefits will automatically distribute by the amount of each investor’s contribution.

What is MAM?

The abbreviation “MAM” stands for multi-account manager. The main feature of this technology is that the manager, through his trading terminal, can simultaneously manage many other accounts entrusted to him. For each, depending on the size of the deposit, he can set their lot sizes. The account management mechanism built into the meta trader trading terminal.

This mechanism is convenient for both managers and investors. The manager gets the opportunity to instantly open transactions on hundreds, or even thousands of client accounts. Investors are in complete control of their funds and, at any time, can take control of the trading account in their own hands. It is also worth noting that the manager does not have access to clients’ money - that is, he cannot withdraw them, transfer them to another account, etc.

Given all the advantages of this option, it is not surprising that MAM accounts are becoming more and more popular.

Benefits of using PAMM

PAMM accounts are beneficial for everyone. A skilled trader can make a lot more profit than managing his own money alone. The investor gets the opportunity to enter the highly profitable forex market with no experience at all and with minimal investment.

Work with PAMM accounts is transparent. Brokers provide accurate trader ratings, acting as an independent monitoring service. Therefore, if desired, the investor can find out the whole “ins and outs” of each manager.

- Effortless start. Registering with a broker and choosing a PAMM manager takes just a few minutes.

- The flexibility of investment management. Each PAMM account manager can set their requirements for the movement of resources. For example, some allow their investors to freely withdraw their deposit and interest after the conclusion of the transaction.

- Equal responsibility. The manager risks not only the money of investors but also his capital. Investors can learn the volume of this capital from the rating provided by the broker.

- Risk diversification. An investor can diversify risks by freely distributing capital between several accounts.

Benefits of using MAM accounts

Special software conducts trading and manages the funds of the MAM system. It allows the manager to see all investor accounts and perform trading operations, the available aggregate funds, or to distribute them among different types of trading directions. But at the same time, any transaction opened by the manager automatically breaks off on each slave account in proportion to the investor’s contribution to the overall balance of the MAM system.

If the investor does not agree to such simple copying of transactions, then, upon prior agreement with the manager, individual settings can be set on his slave account. For example, an investor may limit the maximum lot size for transactions in a group of metals or another trading instrument. Another variety of special conditions may be setting the maximum loss in absolute units or as a percentage of the size of the account. In this sense, the investor has more opportunities in terms of risk management in his trading account, given to the MAM structure.

How do investors’ select money managers?

To simplify the process of choosing a PAMM manager, the broker provides access to a particular rating. It contains a variety of information about the managers who are currently working. They arranged in the form of a table in which the leading indicators of each of the participants compared.

It is not difficult for an experienced investor to distinguish a promising account from a trash account. For beginners, in order not to make blunders at the very start, it is advisable to pay attention to the following nuances:

- The story of the manager. The best way to evaluate the profitability and risks of a manager is to analyze trading history. A standard rating of accounts will provide all the necessary data for analysis. The average profit for a month, quarter, half a year, and a year will tell about the dynamics of profitability. A flat line without sharp peaks may indicate that the trader has a working trading strategy and skillfully uses it.

- Capitalization. Total capitalization is another crucial detail that you should pay attention to before investing in a PAMM account. In this case, the number of deposits of all investors implied. The bigger it is the better. A fat deposit indicates investor confidence and a manager’s high motivation.

- The offer. When choosing an account, it is essential to study the conditions of the offer carefully. It contains a list of terms that govern the relationship between investors and the manager. It’s the period through which the investor will be able to withdraw profit or his contribution.

Conclusion

The main difference between the MAM system and the PAMM system increased reliability and investment protection since there is a strict system of regulation and contractual relations. MAM does not have the manager’s anonymity that is present in PAMM - in this system, there is a severe condition that requires the disclosure of complete information about yourself. Those, the manager will not be able to open a MAM account if it does not pass complete verification and, at the same time, does not provide all this data to investors! And since all developed countries have relatively strict legal standards in this regard, raising funds from investors is possible only using MAM technology.

How forex PAMM accounts work

Interested in trading foreign currency exchange markets but don't have the time or know-how to trade forex? Forex PAMM accounts may be a good choice for you. (related reading: introduction to currency trading)

What is a PAMM account?

Percentage allocation management module, also known as percentage allocation money management or PAMM, is a form of pooled money forex trading. An investor gets to allocate his or her money in desired proportion to the qualified trader(s)/money manager(s) of his or her choice. These traders/managers may manage multiple forex trading accounts using their own capital and such pooled moneys, with an aim to generate profits.

To demonstrate PAMM accounts further, let’s look at an example:

The participants in the PAMM account setup:

The investors (say peter, paul, and phil) are interested in reaping profits from forex trading, but they either don't have time to devote to trading activities or don’t have sufficient knowledge to trade forex. Enter the professional money managers (marcus and mathew), who have expertise in trading and managing other people’s money (like a mutual fund manager), along with their individual trading capital. The forex trading firm signs up marcus and mathew as money managers for managing other investors’ money. The investors (peter, paul and phil) also signup with limited power of attorney (LPOA). The crux of the signed agreement is that investors agree to take the risk for the forex trades, by giving their capital to their chosen money manager who will use the pooled money to trade forex per his trading style and strategy. It also states how much the money (or percentage) the manager will charge as his take for offering this service.

For simplicity of example, let’s assume that all three investors chose marcus to manage their share of money for forex trading and marcus charges 10% of the profit.

In terms of percentage contribution to the total pooled PAMM fund of $ 15,000, each investor has the following share:

Paul = $4,000 / $15,000 = 26.67% and similarly,

The PAMM service

The PAMM service is an original creation of alpari which has gained worldwide popularity. It brings traders and investors together under mutually beneficial terms.

PAMM accounts

The PAMM account is a unique product that allows investors to earn without having to trade. You can invest your funds in the accounts of traders, who receive a percentage of the profits they earn from trading with your funds as a reward.

PAMM portfolios

A PAMM portfolio is several PAMM accounts rolled into one. Thanks to the ability to select PAMM accounts with various risk profiles, this form of investment provides the perfect way to hedge your bets.

For investors

Return

The potential of the forex market is unlitmited. You can earn high returns by investing in a PAMM account or PAMM portfolio without being skilled at trading.

Transparency

The PAMM service has undergone a compliance check by an international auditing firm. You can see the results of the audit for yourself in myalpari.

Control

You can withdraw your profits, or all of your funds, at any moment via myalpari. You can also spread your risks by investing in several different PAMM accounts or a ready-made portfolio.

Alpari invest

Alpari invest

Investments forever at your fingertips

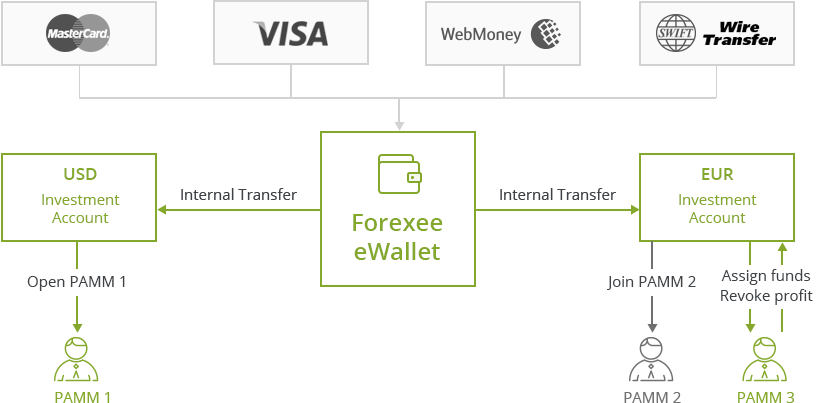

How to invest

Select a suitable PAMM account from the ratings

Register with myalpari and top up your transitory account however you find convenient

Invest and manage the funds on your investment account from myalpari

The best PAMM accounts

Check our analytical reviews of the best active PAMM accounts

For managers

Potential

Earn some extra income by successfully managing investor funds on a PAMM account and keeping a share of the profits as a reward. You can also assemble a PAMM portfolio to attract even more investments.

Objectivity

The best advertisement for your PAMM account is to maintain a high position in the independent ratings, whose authenticity has been verified by an international auditing company.

Security

All calculations concerning investors are carried out automatically. All your trades are securely protected from copying.

How to become a manager

Register with myalpari if you haven't already done so

Open a PAMM account, set the manager's capital, and transfer the respective amount from your transitory account

Set the terms of the proposal according to which you will be accepting investments on your PAMM account and start trading

Refer partners

If you need some help promoting your PAMM account you can always invite a partner to work with you. This may include an advertising specialist, an analyst, a manager, and so on. Any alpari client can be a partner, who will receive a certain amount of remuneration under certain conditions depending on the type of partner program selected.

Trading

Analysis

Other

© 1998-2021 alpari limited

This site is operated by AI accept solutions limited (registered at 17 ensign house, admirals way, canary wharf, london), a subsidiary of alpari limited.

The alpari brand:

Alpari limited, suite 305, griffith corporate centre, kingstown, saint vincent and the grenadines, is incorporated under registered number 20389 IBC 2012 by the registrar of international business companies, registered by the financial services authority of saint vincent and the grenadines.

Alpari is a member of the financial commission, an international organization engaged in the resolution of disputes within the financial services industry in the forex market.

Risk disclaimer: before trading, you should ensure that you've undergone sufficient preparation and fully understand the risks involved in margin trading.

This site is operated by AI accept solutions limited (registered at 17 ensign house, admirals way, canary wharf, london), a subsidiary of alpari limited.

Best PAMM forex brokers for 2021

Below you will find a list of forex brokers that provide an opportunity to open your own PAMM-account or choose one from the pool and invest into it. The percentage allocation money management (PAMM) is a form of integrated trading in exchange markets. You can either become an investor or money manager. The service is designed to benefit both sides. Some traders make profits from utilization of third-party capital, others allocate their funds and just monitor trading activity and check outgoing results. Thoughtful compilation of PAMM investment portfolio and its accurate maintenance may ensure good profitability and continuous capital increase.

Who is a PAMM forex broker? A PAMM forex broker is a brokerage platform that offers the passive investment model in forex that is known as the percentage allocation management module (PAMM). This is essentially a fund management system in forex which requires that the managing partner has a vested interest in the fund being managed. Essentially a PAMM account is setup by an individual who must generate sufficient profitable trading history. Based on this history, this individual can use the PAMM forex broker’s engine to make a call to other investors that have the funds but not the time or the skills to trade, to contribute money to a pooled fund for a share of any profits that accrue from the fund after a trading cycle is completed. All pooled funds are usually managed from a single PAMM account.

Profits and losses are shared in the same percentage as the pooled fund contributions from all investors. In addition, the manager of the fund (i.E. The one who trades the PAMM account actively) is entitled to a performance fee payment from every investor in the PAMM account fund.

How does a PAMM system work?

The PAMM system begins with the active trader that opens the PAMM account, commonly referred to as the master or the manager on many PAMM account broker platforms. The manager will first assign some capital and commit it to a trading process for a period of time, to show consistency and profitability.

Once some profit history has been generated, the manager will put out a proposal inviting investors to place funds with the PAMM account to benefit from his/her trading strategies. Payment cycles are decided, ratios are apportioned according to the equity stake of each investor in the fund, and the compensation of the manager from each investor’s profits is also decided. These are all referred to as the offer parameters. Once the offer parameters are all settled, trading can begin.

What to look for in a PAMM forex broker

Just as is the case with copy trading, there will usually be a lot of traders who advertise their services as potential managers of PAMM accounts. However, only few will be suitable PAMM managers. Therefore, a PAMM forex broker should be able to provide a solid ranking system that will enable investors to seek out the most suitable PAMM account managers for their business. The PAMM forex broker should also be able to provide a system that effectively ranks the performances of traders seeking to manage PAMM accounts.

A) account rankings

The PAMM account ranking refers to the systems used by PAMM forex brokers to rate the performance of active PAMM accounts. The rating system is usually based on performance over time. Ratings will display the best performing PAMM accounts, usually in descending order. Parameters that are used in the ranking system include the following:

- Total percentage gain on the PAMM account as at the time of viewing.

- The daily percentage gain/loss, which is usually calculated from the previous day’s profits or losses.

- Duration that the account has been in operation.

- Maximum drawdown percentage, which is the maximum loss (realized or unrealized) that the account has been made to face during the course of trading.

- Performance chart, which shows the performance of the PAMM account in graphical format. This chart is especially important as it shows the risk profile that the PAMM account manager is trading with, as well as the consistency of performance.

- Rate or return, which is the ratio of realized/unrealized profits or losses to the allocated capital.

The ranking of the best managers is not static, but changes according to performance changes.

B) follower rankings

For a potential PAMM investor, it is not enough to have the trade data mentioned above from the PAMM account; you would also want to know how investors are doing with various PAMM accounts. Therefore, a PAMM forex broker should be able to display the following information for PAMM investors:

- The date that the investor joined the PAMM account.

- The percentage gain/loss sustained by the investors

- The performance charts for investors following a particular PAMM account.

Depending on the PAMM forex broker, there may be provisions for more comprehensive analysis of PAMM accounts which will allow potential investors to get all the information that they need to make an informed choice.

Another aspect of the PAMM account system is the referral system, which allows those who refer investors to the PAMM forex brokerage system to earn from their affiliate work. Not all PAMM forex brokers will offer an affiliate system for this facility.

Other PAMM forex broker responsibilities

As the PAMM account system brings together different people who hardly know each other on a personal basis and therefore can make no guarantees on the honesty or trustworthiness of one other, it is the responsibility of PAMM forex brokers to ensure the safety and security of funds of all participants. Therefore, PAMM forex brokers generally have the following rules in place:

- The managers have no power to withdraw funds from the PAMM account once the system is in place. Only when agreements have been reached to dissolve the arrangement can the manager and other investors each get their money individually.

- Payment of performance fees for managers as well as profit/loss distribution to all investors are performed automatically by the PAMM forex brokers. Neither the manager nor the investors can perform this function. This function is done in a timely fashion, so that no one has to chase the other for payment of any profits or performance fees.

- The investors retain the right to assign and revoke funds to the PAMM account system. The investors also reserve the right to make offers to the managers with their own parameters.

- The selection process by which investors choose managers is made as simple and as transparent as possible via the provision of a comprehensive rating system.

- Performance charts can provide at a glance, critical information such as the risk setting and consistency of performance of a PAMM account. These charts are updated using specialized algorithms.

- All records are publicly available and can be viewed and confirmed by all vested parties.

The list below shows a list of PAMM forex brokers that we have assessed and found suitable for use by our readers. They are suitable for traders who want to become managers of the pooled funds and also great for investors who are looking for where they can get allocated returns in a safe and transparent setting. Are you an affiliate looking for how to earn from referring investors to the system? Some of these brokers provide affiliate payouts for PAMM account referrals as well.

This is a service that has the potential to benefit you in three ways. Feel free to make a choice from the PAMM forex brokers that are listed below and enjoy the best that percentage allocated money management has to offer.

Investments

PAMM service of accentforex it’s limitless possibilities for investor’s earnings. The forex market is very mobile and can change its direction several times a day. To extraction of profit from every movements, you need to clearly forecast the time and direction of each transaction. Thus, need to have a deep knowledge of the forex market. PAMM service opens the possibilities for customers who do not have such knowledge, but wishing to make a profit.

The benefits of investing:

You do not need to have experience a successful trade on the forex market

For investing enough to select a suitable account and make the transaction

For selection the appropriate PAMM-accounts, investors has access to PAMM-rating, which has full volume of statistical data for analysis

The investor is not limited by the number of PAMM-accounts and can transfer his/her investments between any accounts without restrictions

The investor can receive full information about his/her investments and profits through myprofile

One response to "investments"

I have a good experience with you! Great service

Information

- Open account

- FAQ

- Technical analysis of NZD/USD 08/30/2019

- Know your customer policy

- MT4 trading platform

- Open a demo account – free $10000!

- Сhoose trading account

- Download metatrader4

- Deposit and withdraw funds

- For beginners

- For PAMM-partner

- Profitability calculator for investor

- Regulation and licensing

- Forex news

- Forex analytics

- Economic calendar

- What is forex?

- Key terms list

- What is forex analytics?

- Privacy policy

- Deposit and withdraw policy

- Bitcoin transfer

- Neteller transfer

TRADING CONDITIONS

- Open account

- FAQ

- Technical analysis of NZD/USD 08/30/2019

- Know your customer policy

- MT4 trading platform

- Open a demo account – free $10000!

- Сhoose trading account

- Download metatrader4

- Deposit and withdraw funds

- For beginners

- Trader agreement

- Terms and definitions

- Customer maintenance rules

- Privacy policy

- Deposit and withdraw policy

- For PAMM-managers

- Regulation and licensing

- Forex news

- Forex analytics

- Economic calendar

- What is forex?

- Key terms list

- What is forex analytics?

- Bitcoin transfer

- Neteller transfer

FOREX NEWS

PROMO

- FAQ

- Know your customer policy

- MT4 trading platform

- Technical analysis of NZD/USD 08/30/2019

- Bitcoin transfer

- Neteller transfer

- Deposit and withdraw policy

- Privacy policy

- Deposit bonus 40%

- Cash bonus 35%

- Interest rate

- Contest MASTER SCALPER for demo accounts

- Economic calendar

- Forex analytics

- Forex news

- For beginners

- Key terms list

- What is forex analytics?

- What is forex?

POP SUPPLY

- FAQ

- Technical analysis of NZD/USD 08/30/2019

- Know your customer policy

- MT4 trading platform

- Trading account MICRO

- Trading account MINI

- Trading account profit

- Trading account STP

- Trading accounts SWAP free

- For PAMM-partner

- Profitability calculator for investor

- Regulation and licensing

- Forex news

- Forex analytics

- Economic calendar

- For beginners

- What is forex?

- Key terms list

- What is forex analytics?

- Privacy policy

- Deposit and withdraw policy

- Bitcoin transfer

- Neteller transfer

Accentforex do not offer contracts for difference to residents of some jurisdictions, such as united states of america, united kingdom and FATF blacklisted countries. Registered address of accent market group inc. Is T19, 1st floor, tana russet plaza, kumul highway, port villa, efate, vanuatu.

Attention!

- Investing into PAMM account or PAMM account portfolios is a unique set of the managing traders that is individual choice of the investor according to investor’s aims and liabilities.

- Profit extracted from the PAMM account in previous periods is not an assurance condition for future profit obtaining.

- Accentforex providing PAMM account service for investors/PAMM partners/managing traders does not take part in clients funds management investing in PAMM accounts.

Risk warning © 2021 reliable FOREX broker

PAMM account

FOREX.EE PAMM SERVICE

PAMM service is a software solution created for copying trades from master accounts to follower accounts and automatic distribution of profits and losses. How it works? Master opens a PAMM account and uses his own capital and the capital of followers to trade in the forex market, while followers can analyze its’ performance using special tools.

With forex.Ee PAMM service, masters can combine their knowledge and experience with the capital of followers to achieve mutually beneficial results.

Forex.Ee PAMM service offers the best advantages of both ECN and STP technologies, which allows masters to use the most appropriate trading strategies and thereby maximize profits. We do not set any restrictions on the trading strategies of masters: you are welcome use algorithmic trading, scalping or high-frequency trading.

Forex.Ee PAMM service provides special conditions for cryptocurrency traders. You can trade both fiat and cryptocurrency pairs and maximize your profitability using the most innovative financial instruments. Followers can open investor accounts nominated in the most popular cryptocurrencies and make deposits in bitcoin, completely avoiding conversion and deposit fees.

Another advantage of the service is the protection of followers’ funds from inappropriate actions of the master. This is achieved by keeping the funds on the followers’ own accounts instead of transferring them to the master account.

If you are a successful forex trader with significant trading experience, we invite you to open a master PAMM account. If you would like to use the experience and knowledge of successful traders to make a profit, please carefully study all the parameters of masters’ accounts and select one that has an acceptable level of risk and profitability.

One click trading level2 plugin

One click trading is a very important and useful tool developed on the basis of level2 application. One click trading makes it very easy to monitor the markets and react to the market changes on time. One click is enough to catch the best price and make a beneficial trade.

Installation and activation

To install OCTL2P you should download setup file to your computer and run it to start the installation. Click next in the installation dialog box. Before installing OCTL2P we suggest you close all running applications including MT4 terminals.

Read the license agreement, select the check box I accept the agreement and click next to proceed.

Indicate directory where you previously installed metatrader 4. To start the installation click install.

When the installation process is finished, the next button will be activated.

Click finish to close the installation dialog box. Activate launch MT terminal option if you want MT4 launched after you click finish.

Before you activate OCTL2P, please, check the settings: launch the MT4 trading platform, from main menu choose tools → options, in the opened window select the expert advisors tab and switch on the allow automated trading and allow DLL imports options and click OK.

To activate the expert advisor in the navigator window, click expert advisors. Installed EA should be seen in the list. Double-click on oneclicktradinglevel2 or simply drag and drop it onto the chart. Click OK.

If the EA is activated successfully, a smiley will be seen in the top right corner of the chart.

Trading platform metatrader 4

Metatrader 4 is a modern and easy-to-use trading platform for online trading. It ensures round-the-clock access to financial markets and market information as well as quick order execution. With metatrader 4 traders may take advantage of using expert advisors, indicators and develop their own trading strategies.

System requirements: microsoft® windows® XP or later.

Installation

To install trading platform forexee MT4 you should download setup file to your computer and run it to start the installation. Click next in the installation dialog box.

Read the license agreement, select the check box yes, I agree with all terms of this license agreement and click next to proceed.

Please indicate installation directory for metatrader4 and choose name for start menu folder start → all programs. We recommend using the default installation settings. Also select a relative check box if you want to create a desktop shortcut, оpen MQL5.Community website or launch program after successful installation. Click next.

Now the program is downloading all necessary files from our server and installing them on your PC. Click finish when installation is complete. Congratulations! MT4 has been successfully installed on your computer.

PAMM accounts – copy trading as an alternative investment

PAMM is a way for investors to put money to work by allocating a proportion of their account funds to other traders.

It’s similar to investing in a managed investment fund, however PAMM allocates capital directly to one or more independent traders on a percentage basis.

For the investor, it is passive. It doesn’t require any knowledge of trading, and there are no decisions to make other than which traders to allocate your money to.

What is a PAMM account?

Brokers originally offered PAMM accounts to allow ordinary investors to access a range of trading strategies and products that were not available through mutual funds. The risks in PAMM can be much higher but so can be the rewards.

PAMM – or it’s full name percentage allocation management module – is appealing to some as an alternative way to invest. The reasons are not difficult to see. Poor returns from the stock and bond markets, coupled with ultra-low interest rates have seen investors looking elsewhere for better yields – beyond the traditional offerings.

Many online brokers now offer investors online PAMM accounts in one form or another.

You’ll achieve the same profits or bear the same losses as the trader you copy over the period you invest.

As well as PAMM, there are other copy trading services such as zulutrade and etoro – but these work in a slightly different way to traditional PAMM.

How PAMM works

The way PAMM works is very straightforward. You decide how much you want to allocate, and to which traders. Once you’ve allocated that money, it’s added to the managing trader’s pot of capital. You’ll achieve the same profits – or bear the same losses as the trader – over the period you invest, on a percentage basis.

You don’t need to do anything else other than monitor what’s going on.

Let’s consider an example. Say you invest $100 in a trader, and say he or she makes a 25% profit in the first week. After the first week, your capital invested is now worth $125. Now suppose in the second week the trader makes a loss of 10%. Your capital now stands at $112.5.

Let’s say you decide to take profits and close the PAMM account with this trader. At this point, you need to pay the manager’s fee on your profits – suppose that’s 20%. Your final profit after 2 weeks would be 80% x $12.5 or $10.

PAMM trader selection – how to choose

If you’re planning on using a PAMM system as an investor, your biggest challenge is choosing which traders to invest in. Keep in mind the rule that past performance is not a reliable guide to future returns.

If a trader hasn’t much of his own money at stake, he has little to lose if things go wrong.

That said, it is wise not to ignore this information completely. A trader’s track record and trading strategy is clearly something that needs to be weighed-up when considering risk and deciding where to allocate funds.

Most PAMM systems allows you to invest in any number of traders. So you can spread your risk over different strategies and managers. A word of warning though about diversification. Diversification of copy traders is not as simple as it first seems.

Many factors influence a trader’s performance. Strong correlations exist in the currency markets and it’s a fact that many traders, by habit, use similar tools and signals. Whether those tools are manual or automated. The returns of such traders will often “move in tandem” with one another.

This is why it’s important to do a diligent analysis of your chosen group of traders before investing real money. Performance history as well as other metrics can be viewed for all of managers partaking in the PAMM system.

A few things to pay careful attention to are:

- Manager’s capital – how much of the trader’s own funds are at risk

- Manager’s fee (remuneration) – the fee paid on any profits – ranges from 20%-75%

- Maximum relative drawdown – peak-to-trough decline as percentage of the fund’s capital

- Leverage – the leverage ratio the trader is using – higher ratio means more risky

- Current profit – the total accumulated profit achieved to date

- Daily profit – average daily profit that the manager achieves

- Daily profit volatility – the standard deviation or “variability” in daily profits

- Recovery factor – ratio of total profit to maximum drawdown (higher is better)

- Time running – the trader’s performance track record

Fees don’t forget to check the manager’s fees. Sometimes this can be as high as 75%. If a trader is going to make a few thousand percent in profit over a year – which is not impossible when high leverage is used – then investors might not care about losing a big chunk of that on a management fee.

On the other hand, remember, the trader may have little to lose if things go wrong. Especially if he hasn’t much of his own money at stake. Because of the nature of PAMM it’s wise to be cautious of traders who’re investing very low amounts of their own capital.

Trade history most of the PAMM managers choose to hide their trade and order history. So you don’t have any way to see which instruments are being traded nor the trader’s underlying strategy. That means you have to place a lot of faith in the performance data that’s provided.

Not being able to view trading activities is not necessarily a bad thing. While it takes away the ability of seeing trades as they happen, it also removes the temptation to “interfere” with the trading plan.

There’s a body of evidence that shows people who are too “hands-on” in their investment efforts on the whole achieve poorer returns than those who don’t interfere and are more passive.

Maximum relative drawdown this will give you an idea of how risky the trader’s strategy is. Deep drawdowns – of more than 50% of capital – indicate a risky strategy and possibly poor money management as well.

Keep in mind that drawdown metrics are not fool proof. Traders often change their behavior and strategies over time and for differing markets. Also note that if the fund hasn’t been running for long, this data won’t tell you very much in any case.

“take profit” and “maximum drawdown”

These are two important settings you’ll want to familiarize yourself with. Firstly, the “take profits” lets you automatically close a PAMM copy when a trader achieves a profit target set by you. This is a useful way of locking in profits.

It’s especially handy if you feel the trader’s success may be short lived. For example if he or she is using an aggressive short-term strategy.

The second thing to configure is the “maximum drawdown” setting. Setting a maximum drawdown will protect – as far as practical – your capital from uncontrolled loses suffered by the trader. If your maximum drawdown level is breached, your PAMM account on that trader will be automatically closed at that point. So limiting your losses.

Tip it is best to have a maximum drawdown setting. Unless of course you’re willing to allow a total loss on the amount you’re investing with a given trader in return for potentially higher profits.

It’s better to set the value cautiously to start with, and widen it as you watch the trader’s activities and he or she makes a profit for you.

If you’re investing a relatively large amount, it is wise not to set a big drawdown value for a PAMM trader, at least until they’ve proven themselves.

Warning Keep in mind if you set the drawdown limit too tight it could cause otherwise profitable trades to close out prematurely due to floating losses.

Why use PAMM over copy trading?

1) the first advantage with PAMM the funds allocated by copiers becomes the “entire capital” of the trading account. This means there’s virtually no latency – or slippage when trading takes place. Trades aren’t replicated to followers but are executed once with the allocated capital from the investors.

The trader only has access to his own capital within the entire pool of funds – but his trade sizes are automatically “scaled-up” in exact proportion to the full amount that’s allocated to him by his copiers.

By contrast, what happens when you follow a trade signal say on zulutrade or through meta trader is that the trade is first executed remotely by the “supplying trader”. That trade instruction is then replicated a few instants later in your account. And because of that small delay, you’re unlikely to achieve the same entry or exit level as the trader you are following.

This latency is known as slippage. Cumulatively, slippage can cause significant reduction of performance. These amounts add-up over time and can severely cut into profits. It is not unknown for copy traders to make a loss even when the signal itself is profitable.

This is why it’s hard to replicate high-volume/small-profit strategies like forex scalping with a signal or through basic replicated copy trading.

The problem is worsened if you’re using an entirely different broker to the trader. Differences in spreads and quotes between brokers can mean you achieve overall a worse performance than the signal itself.

These slippage problems should not happen with PAMM, provided the system works.

2) the second advantage traders are typically only compensated on profits achieved for their copiers (investors). So when you close your PAMM account with a trader, his or her remuneration is calculated on the amount of profit you’ve made – not on the trade volume as with many forex copying services.

PAMM can work better when investing larger amounts – because the trader’s earnings are better aligned with the interests of their investors.

If you exit with a loss, or with no profit at all, the trader does not make anything either – or at least no more than “roll-over profits” which they realized during the time frame you invested.

That’s one of the reasons PAMM can work better when investing larger amounts – because the trader’s earnings are better aligned with the interests of their investors.

Does PAMM work as an investment?

PAMM and other copy trading schemes can make profitable and exciting alternative investments. However choosing the right PAMM broker and which traders to invest in is key to making money over the long-run. Due diligence is necessary since these systems are essentially unregulated with no pre-screening of traders or strategies.

When new to this area, it’s also wise to start small and build up as you gain more confidence and experience. PAMM investments should be considered as a medium to high-risk. It should therefore only make-up a small portion of an overall portfolio.

PAMM accounts allow you to begin investing with amounts as low as $10 per trader. This makes it useful for investing a small pot of risk capital.

PAMM ratings

In the ranking you see PAMM accounts of experienced forex traders. You can invest in PAMM-accounts via the internet and make money without trading personally.

Bag 76

борис гуликов

Simple rating

There ara PAMM-accounts of traders working in the foreign exchange market through the broker alpari. You can invest in a manager’s PAMM-account in order to earn on his trade.

What accounts are presented in the rating?

In the rating there are the most promising and safest alpari PAMM-accounts. Selection is made due to the manager’s experience, average return, use of the martingale, stop-losses, etc. A full list of accounts can be found in extended view.

Rating indicators

For every PAMM account risk and return rates are shown through the time. The period for which they are counted is also pointed out.

The return is net, taking into account manager’s fee payment. This is the average profit of an investor in the past. Note that this is not a guaranteed profit, but a probable one.

Risk is calculated by the maximum drawdown in the account history. 50% risk means that drawdown can reach a half of the invested amount. At this level, it is recommended to set a stop-loss.

How to choose a PAMM-account?

Above the rating table there are various filters. Choose the deposit amount, approximate horizon, currency and risk level, comfortable for you. The most suitable for you PAMM-accounts will be automatically found in the rating.

How to invest in PAMM-account?

You can start with a demo-investment in one PAMM-account or a portfolio of several. Demo-account allows you to monitor investments without risk to real money.

To invest real funds, you need to open an account with the broker. You can invest and manage investments online via the internet. The minimum deposit amount is $10 or 10 euro.

The psychology of successful investing in PAMM

Funds to invest

Sometimes potential investors assume that PAMM accounts require large investments. In fact, this is not the case. You can start earning with a small amount, gradually increasing it. Also, for some of them there is a problem to find funds that can be transferred to the manager account. But often it is enough only to revise your monthly expenses. It happens that a person has a kind of psychological installation: spend on daily needs, all available money. Just analyze your expenses once to see the source of funds for investments.

Excessive emotionality

Emotions are characteristic of each person. But if they exceed the legal limit, it will certainly lead to negative consequences. PAMM investing requires some emotional balance. Often increased level of anxiety forces the investor to constantly monitor the actions of the manager. And even with a very small drop in profits, the investor falls under the influence of panic sentiment. It takes up previously invested funds and thus deprives itself of profit in the future.

Psychological settings

Psychological settings act as a program. An investor who is influenced by them is not able to make optimal decisions. If he is initially convinced that a loss-making transaction is a disaster, then eventually his attempts to make money from PAMM investments will fail. To be successful, you need to get rid of all kinds of installations. And above all, it concerns the approach to possible losses. They are indeed a normal part of any trading process.

So, let's see, what we have: PAMM and MAM investing is an opportunity to receive passive profit. Having chosen a successful manager, you can count on dividends and an increase in the at forex pamm investment

Contents of the article

- Top forex bonus promo

- Forex investments PAMM and MAM for beginners

- What is PAMM?

- What is a money manager?

- What is MAM?

- Benefits of using PAMM

- Benefits of using MAM accounts

- How do investors’ select money managers?

- Conclusion

- How forex PAMM accounts work

- What is a PAMM account?

- The PAMM service

- For investors

- Alpari invest

- Alpari invest

- How to invest

- The best PAMM accounts

- For managers

- How to become a manager

- Refer partners

- Best PAMM forex brokers for 2021

- How does a PAMM system work?

- What to look for in a PAMM forex broker

- Other PAMM forex broker responsibilities

- Investments

- PAMM account

- FOREX.EE PAMM SERVICE

- One click trading level2 plugin

- Trading platform metatrader 4

- PAMM accounts – copy trading as an alternative investment

- What is a PAMM account?

- How PAMM works

- PAMM trader selection – how to choose

- “take profit” and “maximum drawdown”

- Why use PAMM over copy trading?

- Does PAMM work as an investment?

- PAMM ratings

- Simple rating

- What accounts are presented in the rating?

- Rating indicators

- How to choose a PAMM-account?

- How to invest in PAMM-account?

- The psychology of successful investing in PAMM

- Funds to invest

- Excessive emotionality

- Psychological settings

Comments

Post a Comment