The 10 best Forex Broker with Zero (no) Spread accounts, forex zero spread.

Forex zero spread

There is no conflict of interest between the forex broker and the trader. It does not matter if you make a loss or winning trades.

Top forex bonus promo

The broker earns only money by the commissions. Successful traders are welcome because the broker will earn more money in the long run. You can be sure that your funds and investments are safe when the broker got an official dealer license.

- Official regulation

- Official dealer license

- Free demo account

- Low minimum deposit

- Professional support

- Reliable trading platform

- Fast execution

- Low trading fees

The 10 best forex broker with zero (no) spread accounts

Do you want to pay less trading fees when investing in currency pairs? – then you should choose zero or no spread forex broker. On this page, we will show you the top 10 companies which are offering trading with starting pips at 0.1. Trading fees can be very expensive when you are doing scalping or high volume trading. By choosing one of our recommended forex brokers you can save a lot of money. In addition, we will provide you detailed information about zero spread trading.

| Broker: | review: | spreads and fees: | regulation: | advantages: | open account: |

|---|---|---|---|---|---|

1. IQ option  | ➜ read the review | starting 0.0 pips + NO COMMISSION ($ 10 deposit) – only on main market hours | cysec (EU) | + leverage up to 1:1000 + personal service + best platform |

Save trading fees by using a low spread forex broker

Overall, we tested more than 50 forex brokers in 7 years of trading time and trading fees are very important to check. Most brokers are offering spread-based account types and a few are offering a zero spread account in addition. Sometimes you can switch between a spread or a zero spread account. If you do a calculation between these two account types you will always see that the zero (no) spread account is cheaper for you. Less trading fees will bring you a higher profit.

Comparison between a spread and zero (no) spread account:

For example, you want to trade 1 lot with the EUR/USD asset. On the spread account, you got a 1.0 pip spread. The pip value is $10. That means you are paying a fee of $10 by opening and closing the trade. The value of the fees is depending on the asset.

Spread account: 1 lot EUR/USD with 1.0 pip spread = $10 spread fee

On a zero (no) spread account you are paying the most of the time $3.5 per 1 lot trading (commission)

Zero spread account: 1 lot EUR/USD with 0.0 pip spread = $3.5 spread fee

In conclusion, the zero spread account is 65% – 50% cheaper than a normal spread account. So you should definitely use a zero spread account to pay fewer fees.

Advantage of a 0.0 pip account:

The calculation above shows us that a zero spread account is cheaper than other accounts. That is the main reason why you should use it. In addition, it is better for certain strategies like scalping where traders only trade small trading movements. The real market prices are traded by the broker. Overall, the trading with a 0.0 pip account is more transparent.

- Payless trading fees

- Better trade execution

- Real market prices

- Transparent trading

- Best for scalping

Disadvantages of a 0.0 pip account:

There is only one disadvantage of a 0.0 pip account. Some forex brokers got no negative balance protection. Forex trading is leveraged trading which implies high risk. There are some market situations where the broker can not close your position (big news event overnight). If you got bad luck and you are trading with a too big trading volume your account balance can become negative. But this is nearly impossible.

Our values to find a good online partner

For traders, it is hard to find a reliable and trusted online forex broker. As experienced traders, we know how to check a partner by certain criteria. Before signing up with a forex broker you should check the homepage to find important information to avoid fraud. There are some fake brokers who are scamming clients all over the world. That should not happen to you so definitely check the regulation of the company. A regulated forex broker is showing the license and regulation on the webpage.

In the following list and video, you will find our full criteria and comparison to find a reliable partner to trade forex. Regulation, the security of funds, and trade execution are very important to us and these are the key factors to trade like a professional.

Criteria for a good forex broker:

- Official regulation

- Official dealer license

- Free demo account

- Low minimum deposit

- Professional support

- Reliable trading platform

- Fast execution

- Low trading fees

How does a 0.0 pip forex spread broker earn money?

In the zero spread account, an additional spread is not charged but the broker will charge a fixed commission. This is depending on the trading volume of the position. Most brokers will show you a commission per 1 lot (100.000) trade. If the commission is $6 per 1 lot trade you will pay a commission of $0.06 if you are trading 0.01 lot.

In conclusion, the forex broker always earns money because of the additional spread or commission. If you are a high volume trader the broker will earn more money and sometimes the company will give you a rebate so that you pay fewer fees because of the high trading volume.

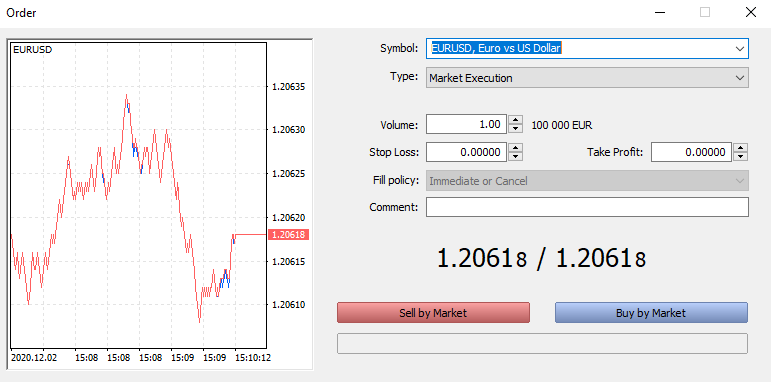

See the picture of 0.0 pips spread in EUR/USD trading here:

How does the no spread account really work?

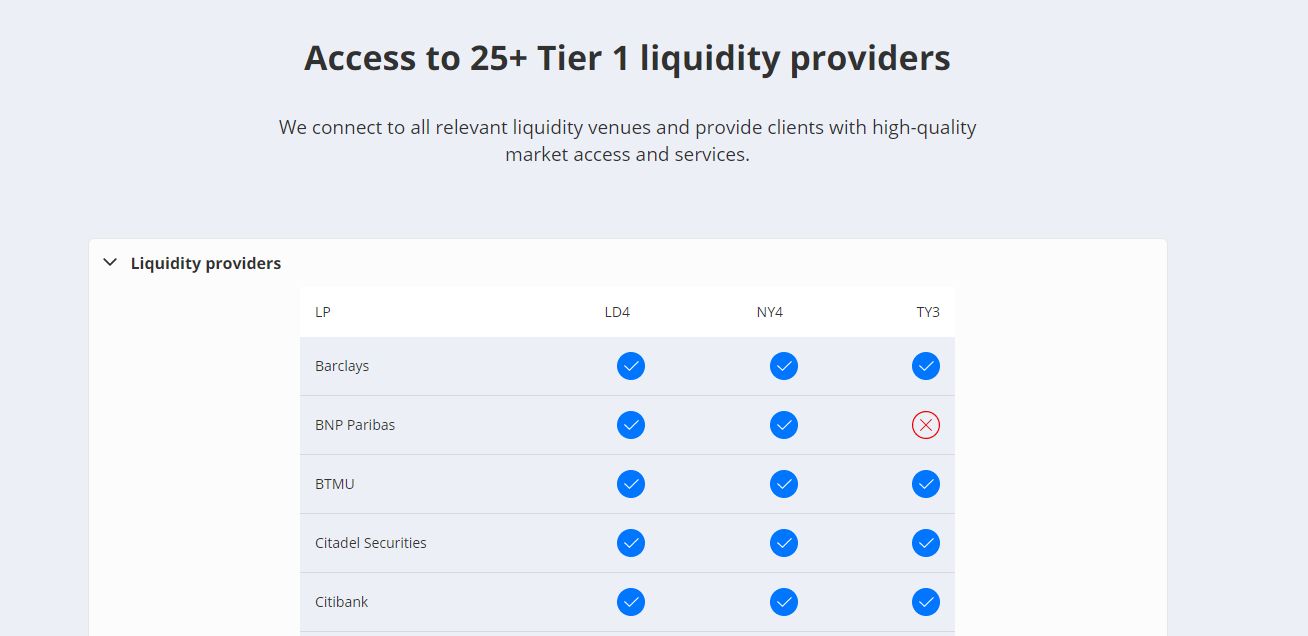

In the following, we will show you exactly how it works behind the scenes. The most forex brokers getting liquidity by a “market maker” called “liquidity provider” and some companies are making it by themself. Around the world, there are big liquidity providers like banks (goldman sachs, barclays, citibank, and more). These banks are giving direct market liquidity to the forex brokers.

Forex broker liquidity providers

The orders are matched by the “spot market” and not traded on a real stock exchange like stocks or futures.

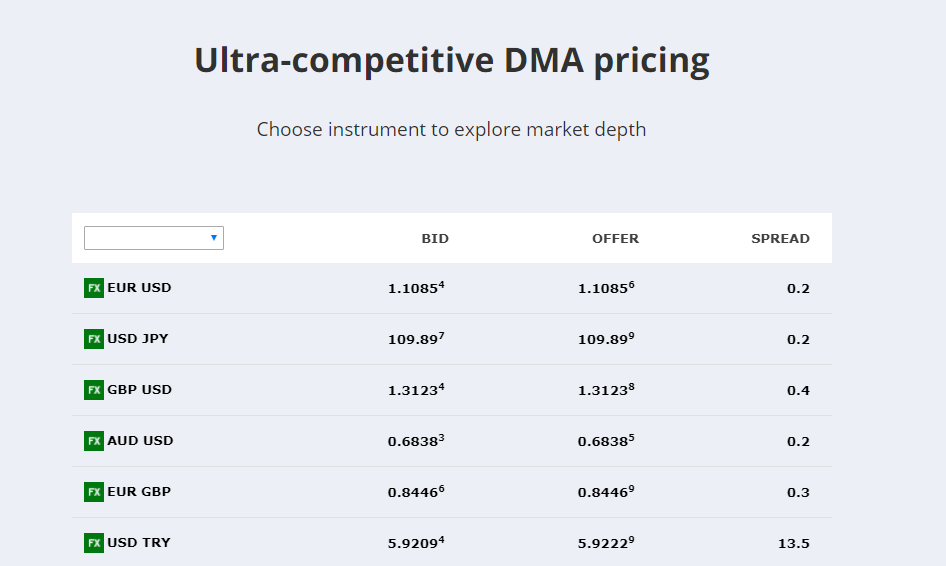

Get direct market spreads

With a zero spread account, you get direct market access and real original prices. Most forex brokers show you the liquidity in the trading platform. You can see the market depth and how much liquidity is there. In our opinion, no spread accounts are more transparent than spread accounts.

Direct spreads from liquidity providers

See the market liquidity

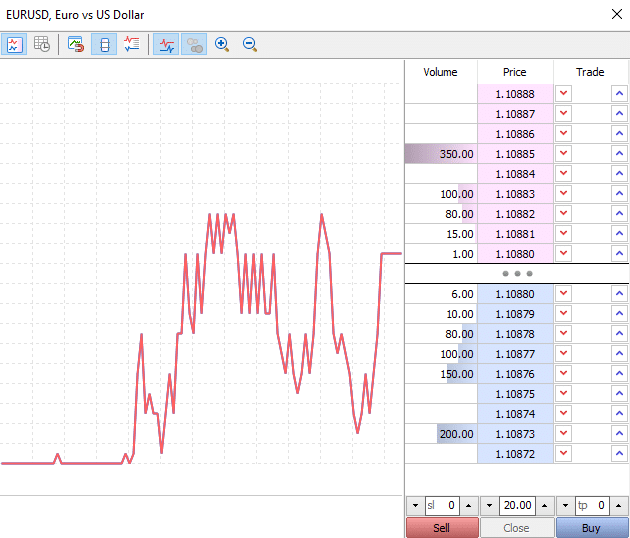

The most no spread brokers are ECN or no dealing desk brokers. You can see the market liquidity in your trading platform. The most popular platform is metatrader. If you click on “depth on market” you will see the order book (picture below).

Orderbook for no spread accounts

On the prices, you see the lots based on the liquidity. Liquidity can change very millisecond. We do not recommend trade with order book strategies in the forex market because the numbers are changing too fast.

No conflict of interest

There is no conflict of interest between the forex broker and the trader. It does not matter if you make a loss or winning trades. The broker earns only money by the commissions. Successful traders are welcome because the broker will earn more money in the long run. You can be sure that your funds and investments are safe when the broker got an official dealer license.

Be careful: slippage can happen on market events

Always be careful by trading forex. The 0.0 pip spreads are not fixed. On market events, there can be slippage and you get a bad execution. This also applies to normal spread accounts. It means the market is too fast and there is low liquidity. A lot of traders are closing their limit orders when a market news event happens. So the liquidity is small.

We do not recommend to trade on market news because of the high risk. The volatility can be very high and the movements are not predictable. So be careful when you trade forex. It is not without risk. On the economic calendar, you can see the market events for your forex pairs.

Conclusion: you should use a 0.0 pip forex trading account

On this page, we showed you detailed information about the zero spread account for forex trading. Nowadays, a lot of brokers are offering this account type. The minimum deposit is different from broker to broker. Sometimes you have to invest more than $1,000 into your account to get 0.0 pips spread.

The forex broker is earning money by an additional trading commission fee which you are paying each trade. Bdswiss is an exception with the monthly fee account. The commission is depending on your trading platform and trading asset. As you saw in our calculation you can save more than 60% of trading fees if you are switching to a no spread account.

With a regulated broker, you can be sure that there is no scam or fraud. The companies which we present on this page are tested with real money. To get a closer look at a forex broker you can read the full and detailed reviews. The winner is clearly tickmill because the commissions are the lowest.

Our reviews:

- IQ option

- IC markets

- Tickmill

- XTB

- Bdswiss

- XM

- Roboforex

- Vantage FX

- Admiral markets

- Blackbull markets

The zero (no) spread account is the best way for traders to save trading fees. It is cheap trading with direct market liquidity.

Top zero spread accounts for 2021

We found 11 online brokers that are appropriate for trading zero spread accounts.

Best zero spread accounts guide

Zero spread accounts

When trading foreign exchange markets the variation between the ASK and BID price is known as a spread. The spread represents brokerage costs and typically replaces broker commission and fees when trading.

With a zero spread account the broker offers an account that has no deviation in the ask and bid price. They are the same.

It said by some trading experts in the forex industry that if you are dealing in ‘day-trading’ or ‘high-frequency scalping,’ it is better to opt for brokers that offer for zero spread accounts.

Zero spread accounts let you know your entry and exit levels before opening a trading position. Because with zero spread accounts the bid and ask price are the same.

What are zero spread accounts

Lets understand zero spread accounts before discussing the advantages and disadvantages of trading with a zero spread broker account. Zero spread accounts are offered by many brokers and are similar to basic trading accounts but without any difference between the 'ask price' and 'bid price.' zero spread accounts have the same ask and bid price. These accounts are helpful when you want to know calculate the non-trading losses. One of the important non-trading losses is the slippage.

Before the birth of STP brokers and ECN brokers, all brokers claimed to offer low commission rates or low spreads, but with the advent of new technologies, zero spread accounts were introduced to offer traders the better trading prices. Many brokers adopted zero spread accounts to allow them to remain competitive against other brokerages.

Advantages of zero spread accounts

Zero spread accounts offer low commission fees and low spreads. Zero spread accounts are suitable for day trading and high frequency scalping trading.

Zero spread accounts allows traders to gain access to the live market spreads without any additional mark up on the spread by your broker.

If you are a small trader and don't like to widen your spreads, zero spread accounts are a good choice. If you place your bid on the wrong side, you can change the trade bias and there will be no more damage to your account by the spread.

With zero spread accounts pricing is sourced from several liquidity providers. Commencing a trade at the order price is essentially assured.

Disadvantages of zero spread accounts

Be aware that brokers don't make much money from your zero spread accounts and so they may try other ways to make money from you.

A broker may require a smaller or higher leverage when trading. Zero spread accounts often have higher minimum deposits required by the broker before trading can commence. Some brokers may not apply negative balance protection on zero spread accounts. Zero spread accounts will often have tighter stop loss levels and margins make sure you check with your broker before making any deposits.

Zero spread accounts brokers’ comparisons

The first and foremost thing to look at is the commission a zero spread accounts broker is charging from you. Usually, it may be a nominal fee or commission and added to it would be a small markup.

You may also find some brokers who may not charge any commission. In such a condition, your position may not be sent to the liquidity providers.

Zero spread accounts verdict

Zero spread accounts are gaining popularity lately due to the many features which are suited towards beginners. Brokers offer zero spread are attracting traders who want to experience forex trading without taking much risk with low transaction costs.

However, be aware that nothing comes for free in this world even if a broker says the zero spread accounts offered are free of any commission or fee. Traders are urged to examine the fees or commission as well as the tactics employed by the broker to make money from you.

We've collected thousands of datapoints and written a guide to help you find the best zero spread accounts for you. We hope this guide helps you find a reputable broker that matches what you need. We list the what we think are the best zero spread accounts below. You can go straight to the broker list here.

Reputable zero spread accounts checklist

There are a number of important factors to consider when picking an online zero spread accounts trading brokerage.

- Check your zero spread accounts broker has a history of at least 2 years.

- Check your zero spread accounts broker has a reasonable sized customer support of at least 15.

- Does the zero spread accounts broker fall under regulation from a jurisdiction that can hold a broker responsible for its misgivings; or at best play an arbitration role in case of bigger disputes.

- Check your zero spread accounts broker has the ability to get deposits and withdrawals processed within 2 to 3 days. This is important when withdrawing funds.

- Does your zero spread accounts broker have an international presence in multiple countries. This includes local seminar presentations and training.

- Make sure your zero spread accounts can hire people from various locations in the world who can better communicate in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Our brokerage comparison table below allows you to compare the below features for brokers offering zero spread accounts.

We compare these features to make it easier for you to make a more informed choice.

- Minimum deposit to open an account.

- Available funding methods for the below zero spread accounts.

- What you are able to trade with each brokerage.

- Trading platforms offered by these brokers.

- Spread type (if applicable) for each brokerage.

- Customer support levels offered.

- We show if each brokerage offers micro, standard, VIP and islamic accounts.

Top 15 zero spread accounts of 2021 compared

Here are the top zero spread accounts.

Compare zero spread accounts min deposits, regulation, headquarters, benefits, funding methods and fees side by side.

All brokers below are zero spread accounts. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more zero spread accounts that accept zero spread accounts clients

Zero spread forex brokers 2021: most trusted brokers zero spread

Getting a good forex broker is crucial. As you know to start trading forex. For those new to forex trading, a broker is your connection to the foreign exchange market, and they will provide you with the essential coverage to trade with margins. If you read this article, it is looking for a good zero spread forex broker.

Zero spreads accounts are trading accounts offered by forex brokers that have no difference between the price offered and the price asked. Zero spreads accounts allow traders to know in advance what their entry and exit levels are when they open positions.

Here is a reading of the best zero spread forex broker, to trade one in a good trading environment:

- XM – 0.0 spreads as low a 0 pips.

- Hotforex – wide choice of platforms, great trading conditions.

- FXTM– the wide range of tradable instruments, the multiple online trading platforms

- Exness – multiple account types and execution methods

- XTB – low min deposit

1. XM

XM is a forex broker that gives traders the opportunity to trade

Forex & cfd trading on stocks, indices, gold, oil. Founded in 2009 it is well known for its trading conditions, commercial transparency and customer service.

They provide two trading platforms, metatrader 4 and metatrader 5, which open, close, trade and manage positions in the foreign exchange market.

Their main platform metatraders 4 offers traders the possibility to trade without re-listing, without rejection and with a flexible leverage ratio ranging from 1:1 to 888 . They also offer single connection access to 8 platforms, the availability of a micro-lot account, offers 0 pips to spread and have the ability to trade more than 700 instruments.

Good reputation and word of mouth from XM

Regulated: cysec, IFSC, ASIC,

platforms: MT4, MT5

spreads: as low as 0.6 pips

max leverage: 1:888

min deposit: $50 (XM ultra low), $5( micro and standard accounts)

minimum trade size: 0.01 lots

headquarters: australia, belize, cyprus

2. Hotforex

hotforex is an online zero spread forex broker that provides good trading tools, efficient trading accounts and a trading platform to facilitate trading in instruments such as commodities, precious metals, energy, equities, indices, cfds, crypto currencies, bonds and forex. The company offers comfortable trading conditions with a wide range of spreads, zero accounts are very popular among the latest with only a minimum deposit of $100 of zero pips press spreads, and offers a leverage of 1:1000 depending on your trading accounts and countries. Global hotforex can be considered an ideal good choice for beginner and advanced traders opening VIP accounts.

Regulated: FCA, cysec, DFSA, FSCA, FSA

platforms: MT4, MT5

spreads: from 0 on forex

max leverage: 1:50

min deposit: $200

minimum trade size: 0.01 lots

headquarters: mauritius

3. Exness

exness is a popular forex broker that has been offering trading services since 2008. Exness offers 4 types of trading accounts: mini, cent, classic and ecn. There is no minimum spot requirement to open an account with exness.

They offer two trading platforms that are the most used platforms in the industry metatrader 4 and metatrader 5, which are available on the desktop, mobile and also offers a web trading platform. Traders who want to use a VPS forex service can also use this feature with exness.

Like most forex brokers, exness offers low spreads, which makes it popular among traders. However, ecn exchanges involve a minimum excess commission of $25 per 100 lots.

Regulated: ASIC, cysec,

platforms: MT4, MT5

spreads: as low as 0.3 pips

max leverage: 1:2000

min deposit:$1

minimum trade size: 0.01 lots

headquarters: CYPRUS

4. FXTM

FXTM is a broker that has built a reputation in the industry quickly and won many awards. Founded in 2011 they offer an intuitive trading platform based on metatrader 4 and metatrader 5, they offer a wider range of trading instruments, such as forex, crypto-currencies, cfds for indices and commodities, spot metals and equity cfds.

FXTM is known in the industry for offering competitive spreads, fast execution and availability of micro and mini lots, a floating leverage effect that can reach 1:1000 depending on your trading account and country. Spreads can reach 0.1 pips depending on market conditions and account type.

Regulated: FCA, FSCA, commission des services financiers (FSC)

platforms: MT4, MT5

spreads:

max leverage: 1:1000

min deposit:$200

minimum trade size: 0.01 lots

headquarters: cyprus

5. XTB

xtb is a broker that offers to trade several trading instruments such as: currency pairs, commodities, cfds on equities, indices,…

They offer several trading platforms and like the standard trading platform 4. Spreads are low 0.9 pips for standard accounts and 0.28 pips for pro accounts with per batch traded.

When to trading accounts they offer two types of trading account, with minimum deposit $10. Leverage can reach 1:200 and the minimum transaction size is 0.01.

The broker offers a large customer support team, with more than 14 offices around the world, you can reach support in several. Support is available 24/5 by email, phone, and direct chat.

Regulated: FCA, cysec, KNF, IFSC, CMB

platforms: MT4, xstation 5

spreads: low spreads from 0.1 pips

max leverage:1: 200

min deposit:$250

minimum trade size: 0.01 lots

headquarters: poland

Zero spread brokers

What is a zero spread account and which forex broker is a zero spread brokers, this is the question arise in every trader’s mind.

Spread is the difference between a bid price and an asking price. This difference is an actual broker commission. Not many brokers offer accounts without spreads, but those who do can usually compare by commission (or fee) they charge per execution of one standard lot. Traders should favour brokers with the lowest commission. Unfortunately, such brokers also have high minimum account size associated with no-spread accounts.

As per the financial dictionary, “spread” is the difference between bid and ask price of a currency pair.

Trading forex without spreads offers an opportunity to know your entry and exit levels precisely. Here is a list of brokers who provide zero spread account.

Zero spread brokers list

| title | minimum deposit | min.Position size |

|---|---|---|

| hotforex review | $1 | 0.01 |

| XM.COM review | $5 | 0.01 |

| forex club | $1 | 0.01 |

| freshforex | $1 | 0.01 |

| instaforex | $1 | 0.01 |

| ironfx | $500 | 0.01 |

| PFD | $1 | 0.01 |

| roboforex | $1 | 0.01 |

Start your trading with zero spread account

Among those choices of a broker that you can find today. Some of them will offer you with zero spread. Hence, those broker with this offer is known as zero spread brokers. Therefore, this is an option of a broker that you can find with a different feature offered. It comes with zero spread which considers as one of the best features from brokers. Some brokers come with this kind of functionality. However, there are still further details that you need to know about this feature since every broker comes with a different rule. It is essential to understand those rules so that you will not find any broker in which you don’t know how their feature will work for you.

Facts about zero spread account

- Zero spread brokers are cheaper than the trading with the spread.

- Also, traders has direct access to the market and deep liquidity.

- Furthermore, brokers ask trading costs as the fixed commission per trade for zero spread account.

Know more about zero spread

This term is quite familiar in trading since the spread is the term to define the difference of the bid price and ask when a trader make a transaction. This different may widen or narrow depending on the volatility of the pair. This spread will charge with a certain number that has been calculated by each broker. The more widen the spread; the cost will also be higher. For this reason, some traders might not prefer the broker with this kind of spread rule to let them trade. Therefore, this problem comes with the solution for those brokers that come with zero spread.

This kind of service of the feature will provide up to zero spread just like what it calls. However, it doesn’t mean that every trader will not charge at all. On the other side, the broker will determine a particular charge. Some other brokers will also use a specific type of zero spread that comes with a specific range. Despite the benefit that you can find from zero spread broker, there is also the other side that might still charge for individual cost needed for your spread with a different term.

Advantage and disadvantage of zero spread

Like every other entity in this world, zero spread brokers and zero spread accounts also have some advantages and disadvantages. Here is the pros and cons of a zero spread account.

Zero spread forex broker

What is a zero spread forex broker and how can it help?

Finding the right zero spread forex broker is very important if you want to generate a good profit. And there’s a reason for that. Lots of brokers try to offer affordable solutions that deliver extraordinary quality and value. The thing to keep in mind here is that the zero spread forex brokers are ECN, STP and NDD companies that offer great liquidity and direct market access as well. On the market, you will always have products in high demand and some less so.

That’s why the spreads or even the difference can go to 0. The zero spread broker will basically start the spreads from 0 pips and then the trading costs will be charged with the regular commission.

What this means is that the zero spread reduces the trading costs. As a result, this is great for high volume traders in particular, but just about anyone that is very interested in lots of trading.

What is the zero spread forex broker suitable for?

If you want to do forex trading or CFD trading, this is the best option to focus on. But on the other hand, if you want to share dealing, social trading or spread betting, the 0 spread forex broker is not the one you want.

Normally the zero spread broker will require a minimum deposit of $1, sometimes more depending on the broker.

However, you get access to the right amount of liquidity without having to worry about downsides, and that’s a great thing to have.

Do you need zero spread accounts?

These accounts allow you to know the entry and exit levels beforehand. As a result, you get to have a plan when it comes to losing and anything like that.

If you want to go with day trading or high-frequency scalping, this may very well work towards your advantage. However, when you find a zero spread forex broker, you will notice that they have low commission rates and the spreads are pretty low too.

Thankfully, most brokers tend to deliver this type of account because it’s a wonderful marketing tool and it also provides great results for customers.

The benefits of using a zero spread forex broker

Maybe the best thing about the zero spread forex broker is the ability to compute executions quickly and with great success. You can also keep the spreads under control this way, which is a plus. If there are any spikes in the forex spread, you get to have all of this under control. And since there are fixed commissions here, you do know the amount you are going to win too, which is always a plus.

Even if the zero spread forex broker accounts are a bit of a novelty in the trading world, they are quite popular, and a lot of people started to use them.

The risks are lower and the benefits are outstanding, so you do have a great solution here. While it’s definitely not foolproof and you can still lose, it’s safe to say that the zero spread forex broker option is a lot safer and that’s why plenty of people gravitate towards it nowadays!

Email was send successfully!

Please check your inbox for

our authentication email.

Thank you for registering

to finance magnates.

Please open the email we

sent you and click on the

link to verify your account.

Beware of brokers offering zero spread!

Newfx pulppromotion– trade with ZERO spread AND ZERO margin. Opa! So you are asking yourself what’s wrong with not paying

So you are asking yourself what’s wrong with not paying for trading? The answer is simple: everything is wrong. In this cruel and competitive brokers’ world – nothing is for free, so if something is offered completely for free you should ask yourself why?

The answer is given by FX pulp right away: we are the only broker that lets you gamble with your money AND lose more than you invested. Yes that’s what ZERO margin means my friends: “we give YOU the opportunity to be left with ZERO money and pay ZERO commission for that opportunity ;)”…

ZERO spread also means that the broker makes money in other ways: FX pulp to the best of my knowledge is a market maker, therefore it makes money from trader losses as well (nothing wrong with that in general: it’s legal everywhere including the US, but that’s something you should know).

Not only that, FX pulp is also limiting the profit you can make: no less than 35 pips and no more than 100 for major currencies, so that means you’ll need to leave the position open until you are in that range = more chances to lose it all…

Here’s the full “promotion”:

ZERO margin requirements,

Suggested articles

Understanding the gaps in forex tradinggo to article >>

Our basic philosophy in zero accounts is to reduce trading costs to the minimum, or shall we say to zero, and the spread was one of the main challenges that FXPULP experts faced. Taking the spreads to 3 pips, 2 or even 1 pip sounds good at first… but how about taking it completely down to zero. Yes imagine you are trading FOREX with ZERO SPREAD the main objective from taking the spread to as low as nothing is for you dear investor, enabling you to take advantage from every pip in the market, the profits start from the first pip, you don’t need some points to cover your spreads and others for the commissions, what you get is each and every pip the market gives.

What are ZERO margin requirements?

A margin is an amount held and blocked from your account equity in order to be able to place your trades in the market.Zero margin requirements means that no money will be held and blocked in your account as margin for the trades you place; and you will be able to invest in the financial market even if your account balance is less than what is required to cover your trades as margin. We will provide you with the margin you need to take as much positions as you want; you only have to pay to cover any losses resulting from the given trades, or get paid for the resulted profits.

Normally; investors deposit money in the trading accounts which will be blocked for each trade according to the size, and the required margin, usually determined by the leverage that the broker offers.

The below table demonstrates the customary required margins:

| Leverage | required margin per contract |

| 1:100 | 1000$ |

| 1:200 | 500$ |

| 1:400 | 250$ |

| 1:500 | 200$ |

Fxpulp has provided investors a cutting edge revolutionary offer: unlimited leverage

Do you know what does this mean??

It means you don’t have to deposit money to be able to trade or to avoid a margin call, all you have to do is to send the money you are willing to risk and that’s it, and you will be able to trade freely whatever product you want, with the size you want, and you don’t need a penny to cover it.

We at FXPULP believe that taking a good investment decision and make some money out of it is a very difficult thing to do in these markets; it needs a lot of reading, following up and analysis, which is why we believe that the profits you make are yours, and it’s not for anyone else to share with you, you bear all the risk, and that’s why you should enjoy all the profits…that was the idea when we eliminated all the costs, from commissions to swaps and hidden fees, we just swept them all away so you can take all your profits, each and every pip you make in this market is yours and yours only…

What is ZERO liquidation?

Liquidation means closing all open positions when your equity goes below a certain level…your positions get liquidated when your margin level drops below 100% or 50% or any other level that brokers impose on you, which makes the chances hard for investors to benefit if the market moved back in their favor, and that’s why we offered to take this percentage to zero, so your positions stay open until your account equity drops down to zero, which will give you the full chance to benefit from your investment.

The ZERO account will set your investments free and open new horizons, ones that didn’t even exist before in the FOREX market.

- Trade freely with no restrictions.

- Your total freedom from spreads.

- Your total freedom from margin requirements.

- Your total freedom from added commissions and costs.

- Your total freedom from the fear of liquidation.

Fxpulp zero accounts trading rules & policies:

Zero spread brokers

What is a zero spread account and which forex broker is a zero spread brokers, this is the question arise in every trader’s mind.

Spread is the difference between a bid price and an asking price. This difference is an actual broker commission. Not many brokers offer accounts without spreads, but those who do can usually compare by commission (or fee) they charge per execution of one standard lot. Traders should favour brokers with the lowest commission. Unfortunately, such brokers also have high minimum account size associated with no-spread accounts.

As per the financial dictionary, “spread” is the difference between bid and ask price of a currency pair.

Trading forex without spreads offers an opportunity to know your entry and exit levels precisely. Here is a list of brokers who provide zero spread account.

Zero spread brokers list

| title | minimum deposit | min.Position size |

|---|---|---|

| hotforex review | $1 | 0.01 |

| XM.COM review | $5 | 0.01 |

| forex club | $1 | 0.01 |

| freshforex | $1 | 0.01 |

| instaforex | $1 | 0.01 |

| ironfx | $500 | 0.01 |

| PFD | $1 | 0.01 |

| roboforex | $1 | 0.01 |

Start your trading with zero spread account

Among those choices of a broker that you can find today. Some of them will offer you with zero spread. Hence, those broker with this offer is known as zero spread brokers. Therefore, this is an option of a broker that you can find with a different feature offered. It comes with zero spread which considers as one of the best features from brokers. Some brokers come with this kind of functionality. However, there are still further details that you need to know about this feature since every broker comes with a different rule. It is essential to understand those rules so that you will not find any broker in which you don’t know how their feature will work for you.

Facts about zero spread account

- Zero spread brokers are cheaper than the trading with the spread.

- Also, traders has direct access to the market and deep liquidity.

- Furthermore, brokers ask trading costs as the fixed commission per trade for zero spread account.

Know more about zero spread

This term is quite familiar in trading since the spread is the term to define the difference of the bid price and ask when a trader make a transaction. This different may widen or narrow depending on the volatility of the pair. This spread will charge with a certain number that has been calculated by each broker. The more widen the spread; the cost will also be higher. For this reason, some traders might not prefer the broker with this kind of spread rule to let them trade. Therefore, this problem comes with the solution for those brokers that come with zero spread.

This kind of service of the feature will provide up to zero spread just like what it calls. However, it doesn’t mean that every trader will not charge at all. On the other side, the broker will determine a particular charge. Some other brokers will also use a specific type of zero spread that comes with a specific range. Despite the benefit that you can find from zero spread broker, there is also the other side that might still charge for individual cost needed for your spread with a different term.

Advantage and disadvantage of zero spread

Like every other entity in this world, zero spread brokers and zero spread accounts also have some advantages and disadvantages. Here is the pros and cons of a zero spread account.

Introducing digitex forex, zero fees & no spread

If you’ve been paying attention to the testnet, you’ll see that we’ve already added our first two forex markets, EURUSD and USDJPY. These are the most popular trading pairs in the retail forex market and soon you’ll be able to realize profits on them with zero fees and no spread, taking advantage of 100x leverage to maximize your gains.

Trading forex futures

The global forex market is easily the largest financial market in the world, accounting for around $6.6 trillion in daily trading volume. Within this behemoth market, forex futures is also growing, currently representing around $112 billion a day.

Traders engage in forex futures either for speculative purposes using high leverage to swing and scalp trade and realize enhanced profits, or to hedge their risk. If, for example, they believe the underlying asset, say the USD, will continue to decline, they can lock in its future value using forex futures contracts.

For experienced traders, trading forex futures can be extremely lucrative especially with all the volatility surrounding the USD lately. The economic fallout from the pandemic, the tensions between global superpowers, and, of course, the upcoming U.S. Presidential election, give traders a chance to capitalize on the sudden surges and drops of the USD against other currencies. So, watch out for the EURUSD market hitting the mainnet soon allowing you to take advantage of this particularly volatile time. And below, you can see a sneak peek of how the forex markets will look in digitex city.

The significance of a zero-fee no-spread forex exchange

As the world’s busiest and most popular financial market, the forex space is also the most corrupt. Traders are subject to the most abysmal conditions in which the house almost always wins. In fact, retail forex trading is characterized by traders trading against a house that feeds them the prices, forcing them to buy at the worst higher price, and sell at the worst lower price.

Because traders take money directly from the house when they win, the system is deeply rigged in favor of the house, incentivized to see traders lose. Digitex forex with zero fees and no spread will finally allow traders to make consistent gains without getting punished by high commissions or robbed blindly by an unreasonable spread.

If the wildly unfair trading environment wasn’t enough, there’s also the constant uncertainty of whether traders can withdraw from all the offshore retail brokers in question. In short? Retail forex is corrupt, unfair, and hampered with inefficiencies just waiting to be disrupted.

Digitex forex – no fees & no spread

That’s what makes us so different. Since digitex forex is peer-to-peer, traders can buy and sell at their desired prices and we, the house, have no vested interest in whether they win or lose because we aren’t making any profit from it. This means that, for the first time, we’re offering a level playing field that is not working against traders–and traders can withdraw their funds in a matter of minutes.

These propositions make digitex forex extremely attractive to retail traders who are fed up with always being on the wrong side of the spread. If we can capture even the smallest slice of this gigantic multi-trillion-dollar market, we can send liquidity and userbase through the roof, while also getting new eyes on our flagship DFE and attracting traditional forex traders to crypto.

Very few cryptocurrency exchanges offer both crypto and forex trading. Digitex’s zero-fee model means that we can easily diversify to add all kinds of popular markets rather than purely cryptocurrency pairs. Digitex forex has the potential to be absolutely massive, which is why we’re thundering ahead with its development, already adding the first two markets on the testnet to get a headstart on both testing and marketing.

Digitex is creating a trading ecosystem to be a trader’s paradise–where any trader can have access to all kinds of popular markets trading on a level playing field with an actual chance of winning. So go ahead and check out these latest markets to hit the testnet and keep your eyes on our socials, as we’ll be asking for your feedback!

If you haven’t signed up for an account on the digitex exchange yet, you can easily do so here. With no hassle, fuss, or KYC, simply load your account with DGTX and trade your favorite markets commission-free!

Understanding the forex spread

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-168304532-5902254b5f9b5810dc944eff.jpg)

Filadendron / getty images

To better understand the forex spread and how it affects you, you must understand the general structure of any forex trade. One way of looking at the trade structure is that all trades are conducted through intermediaries who charge for their services. This charge—which is the trade's difference between the bidding and the asking price—is called the spread.

The bid-ask spread defined

The forex spread represents two prices: the buying (bid) price for a given currency pair, and the selling (ask) price. Traders pay a certain price to buy the currency and have to sell it for less if they want to sell back it right away.

For a simple analogy, consider that when you purchase a brand-new car, you pay the market price for it. The minute you drive it off the lot, the car depreciates, and if you wanted to turn around and sell it right back to the dealer, you would have to take less money for it. Depreciation accounts for the difference in the car example, while the dealer's profit accounts for the difference in a forex trade.

Forex market makers determine the spread

The forex market differs from the new york stock exchange, where trading historically took place in a physical space. The forex market has always been virtual and functions more like the over-the-counter market for smaller stocks, where trades are facilitated by specialists called market makers. The buyer may be in london, and the seller may be in tokyo.

The specialist, one of several who facilitates a particular currency trade, may even be in a third city. His responsibilities are to assure an orderly flow of buy and sell orders for those currencies, which involves finding a seller for every buyer and vice versa.

In practice, the specialist's work involves some degree of risk. It can happen, for example, that the specialist accepts a bid or buy order at a given price, but before finding a seller, the currency's value increases. He is still responsible for filling the accepted buy order and may have to accept a sell order that is higher than the buy order he has committed to filling.

In most cases, the change in value will be slight, and he will still make a profit. But, as a result of accepting risk and facilitating the trade, the market maker retains a part of every trade. The portion they retain is called the spread.

A sample calculation

Every forex trade involves two currencies called a currency pair. This example uses the british pound (GBP) and the U.S. Dollar (USD)—or the GBP/USD currency pair. Say that, at a given time, the GBP is worth 1.1532 times the USD. You may believe the GBP will rise against the dollar, so you buy the GBP/USD pair at the asking price.

The asking price for the currency pair won't exactly be 1.1532. It will be a little more, perhaps 1.1534—which is the price you will pay for the trade. Meanwhile, the seller on the other side of the trade won't receive the full 1.1532 either. They will get a little less, perhaps 1.530. The difference between the bid and ask prices—in this instance, 0.0004—is the spread. That's the profit that the specialist keeps for taking the risk and facilitating the trade.

The cost of the spread

Using the example above, the spread of 0.0004 british pound (GBP) doesn't sound like much, but as a trade gets larger, even a small spread quickly adds up. Currency trades in forex typically involve larger amounts of money. As a retail trader, you may be trading only one 10,000-unit lot of GBP/USD. But the average trade is much larger, around one million units of GBP/USD. The 0.0004 spread in this larger trade is 400 GBP, which is a much more significant commission.

How to manage and minimize the spread

You have two ways of minimizing the cost of these spreads:

Trade only during the most favorable trading hours, when many buyers and sellers are in the market. As the number of buyers and sellers for a given currency pair increases, competition and demand for the business increase, and market makers often narrow their spreads to capture it.

Avoid buying or selling thinly traded currencies. Multiple market makers compete for business when you trade popular currencies, such as the GBP/USD pair. If you trade a thinly traded currency pair, there may be only a few market makers to accept the trade. Reflecting on the lessened competition, they will maintain a wider spread.

So, let's see, what we have: find the best forex broker with zero (no) spreads for trading ✅ trusted review & comparison ✔ trading details & conditions ➜ read more at forex zero spread

Contents of the article

- Top forex bonus promo

- The 10 best forex broker with zero (no) spread accounts

- Save trading fees by using a low spread forex broker

- Comparison between a spread and zero (no) spread account:

- Advantage of a 0.0 pip account:

- Disadvantages of a 0.0 pip account:

- Our values to find a good online partner

- How does a 0.0 pip forex spread broker earn money?

- How does the no spread account really work?

- Get direct market spreads

- See the market liquidity

- No conflict of interest

- Be careful: slippage can happen on market events

- Conclusion: you should use a 0.0 pip forex trading account

- Top zero spread accounts for 2021

- Best zero spread accounts guide

- Zero spread accounts

- What are zero spread accounts

- Advantages of zero spread accounts

- Disadvantages of zero spread accounts

- Zero spread accounts brokers’ comparisons

- Zero spread accounts verdict

- Reputable zero spread accounts checklist

- Top 15 zero spread accounts of 2021 compared

- Zero spread forex brokers 2021: most trusted brokers zero...

- Zero spread brokers

- Zero spread brokers list

- Start your trading with zero spread account

- Facts about zero spread account

- Advantage and disadvantage of zero spread

- Zero spread forex broker

- What is a zero spread forex broker and how can it...

- Beware of brokers offering zero spread!

- Newfx pulppromotion– trade with ZERO spread AND ZERO...

- Suggested articles

- Zero spread brokers

- Zero spread brokers list

- Start your trading with zero spread account

- Facts about zero spread account

- Advantage and disadvantage of zero spread

- Introducing digitex forex, zero fees & no spread

- Trading forex futures

- The significance of a zero-fee no-spread forex exchange

- Digitex forex – no fees & no spread

- Understanding the forex spread

- The bid-ask spread defined

- Forex market makers determine the spread

- A sample calculation

- The cost of the spread

- How to manage and minimize the spread

Comments

Post a Comment