Can you start forex with 100 dollars, can you start forex with 100 dollars.

Can you start forex with 100 dollars

What can you do with $100 in your forex account? This means that you have to be super-selective of your trades.

Top forex bonus promo

Only enter into trades where there is a high chance of winning, and use well-defined parameters of support and resistance to target your setups. Fortunately, some chart patterns such as the flag and pennant have standardized profit targets, and the pattern boundaries can also help define the stop loss.

Fxdailyreport.Com

Unlike the futures or options markets, you can actually start trading with as low as $100 in the forex market. Forex is a leveraged market, which means you can use a little money to trade up to 20 or 30 times the amount you will be required to stake in a trade (UK and europe), and sometimes even as much as 500 times your required investment amount (known as the margin). This makes the idea of trading forex quite interesting to many. However, trading with $100 in the forex market, even if you have access to a leverage of as high as 1:500, comes with its own set of challenges and rules. This is what this article is all about.

What can’t you do with $100 in your forex account?

Here are some things a $100 forex account cannot do for you.

- It will not enable you to quit your job to start trading full-time. There are countries on this earth where $100 is the equivalent of one day’s rent. It is simply impossible to make $100 a day from $100 capital to survive in such places. Of course, other personal and household bills have not been added to the mix yet.

- You will not become the next warren buffett or george soros overnight. You cannot start trading with $100 and expect to start rubbing shoulders with these guys in terms of monthly earnings from trading.

- You will not grow to $10,000 or $100,000 in a month. We have been seeing such ads coming from advertisers of forex robots and other affiliated software. We also see such ads in the binary options market, as many traders were told that they could achieve this using the short term expiry trades. Forget it: it will not happen.

What can you do with $100 in your forex account?

However, there are positive things you can do with your $100 forex account. You will be able to do the following:

- Learn vital lessons about money management. Since you already have restricted capital, you will learn how to use the little you have very wisely. Most responsible people who are down to their last $100 in the real world will certainly not use it to go gambling or plunge the money into some crazy stuff. They are more likely to use it very wisely and judiciously. So why can such attitudes not be brought into the world of forex trading?

- You can use your $100 forex account to make a smoother transition from the world of virtual trading to the world of live trading. Many people make the mistake of switching from a demo account to a heavily funded live account. This is not a good way to make the transition. Conditions in a live account are very different from the world of demo trading. A live account will mean you are now trading at the level of the broker’s dealing desk with real money. The brokers are also reselling positions to you that were acquired from the interbank market with real money. You can never compare shooting practice with blanks to live fire in a real war situation. That is why soldiers are first started off with blanks and proceed to live fire training before being deployed to a hot zone. Any soldier can relate to this. It’s the same process in forex trading.

- Emotional control is a lesson you can learn from a $100 account. Learn to trade with real money, but not so much as to make you lose sleep. That way, you can condition yourself to what the real money trading situation will bring.

How to start forex trading with $100

These days, the process of opening and funding a forex account has been made very easy. You can do this in a matter of minutes using any of the payment methods available from the broker. After funding your account, you can then trade forex with $100 following these rules.

Rule 1: money management

The first method is to trade with money management as the number 1 focus. This money management-focused method means that you will trade with no more than 3% of this money in total market exposure. This means you can only trade micro-lots ($1000 minimum position size). If you hold an account with a UK or EU broker, you can only use a maximum leverage of 1:30. With a margin of 3.33%, this means that you cannot trade within the boundaries of risk management with an EU broker, as you will need at least $33 to trade 1 micro-lot. However, a brokerage in australia, south africa or any of the other popular offshore jurisdictions still offer leverage of up to 1:500. A micro-lot would therefore need just $2 commitment from the trader, which keeps the position within allowable risk management limits.

Rule 2: risk-reward ratios

The next rule has to do with risk and reward. Risk refers to the stop loss (SL) you will use, and reward has to do with the take profit (TP) setting. You should target to make 3 pips in profit for any 1 pip risked as stop loss. Using your allowable money management that restricts you to 1 micro-lot positions, this means that you should be prepared to target $6 for every $2 used in the stop loss. This translates to at least 60 pips TP, and 20 pips SL.

This means that you have to be super-selective of your trades. Only enter into trades where there is a high chance of winning, and use well-defined parameters of support and resistance to target your setups. Fortunately, some chart patterns such as the flag and pennant have standardized profit targets, and the pattern boundaries can also help define the stop loss.

Rule 3: avoid the news spikes

News trades are highly unpredictable, especially within the first few minutes of a news release. The spikes and whipsaws can easily stop your trades out. With such limited capital, you should avoid news trades like a plague.

Ultimately, you will need to work on getting more capital, but by the time you do, your $100 journey in forex trading would have prepared you adequately to trade larger capital responsibly.

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

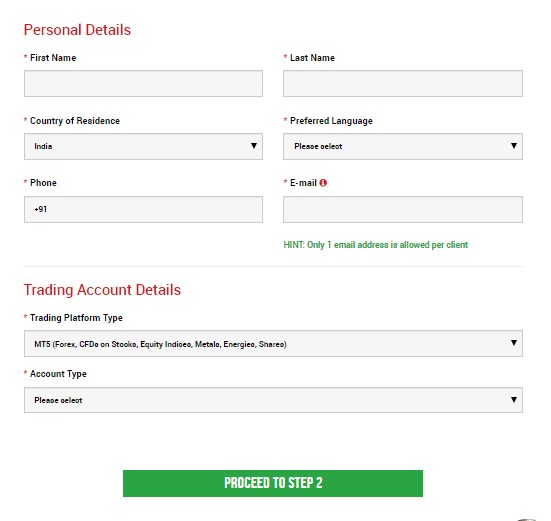

Step 2: filling the personal details

Fill all the box with accurate details

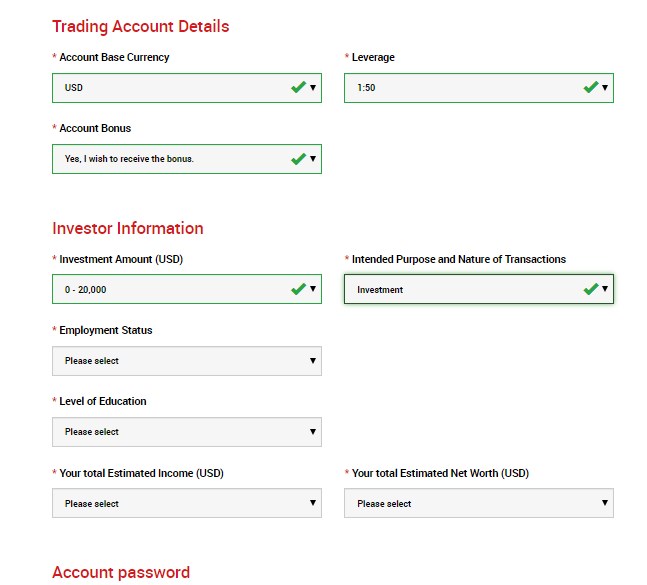

Step 3: investor information & trading account details

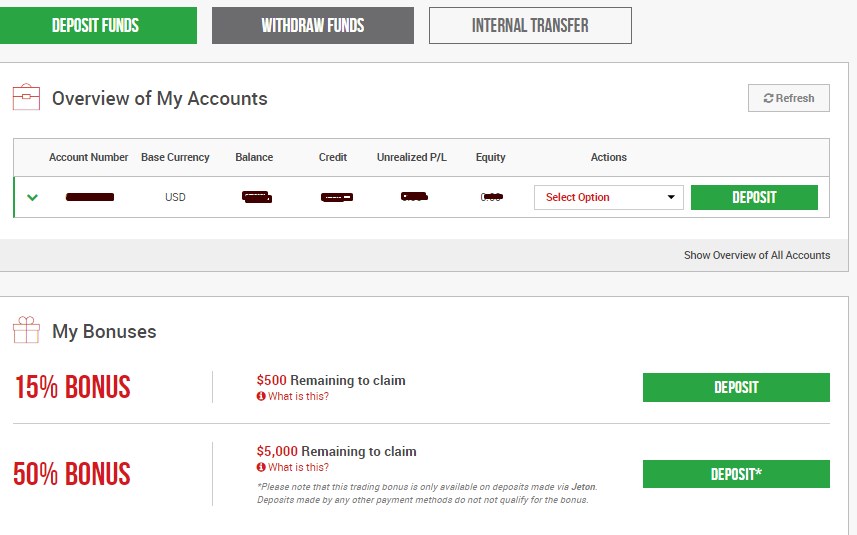

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

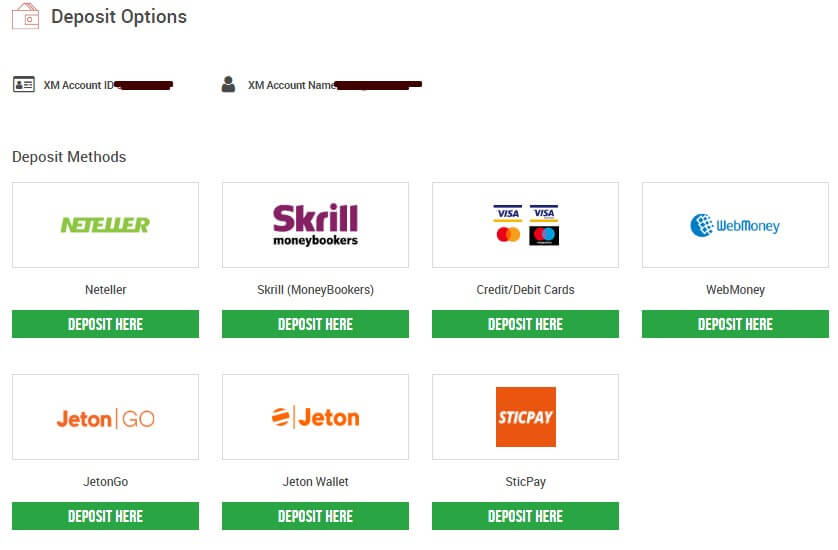

Click deposit button

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

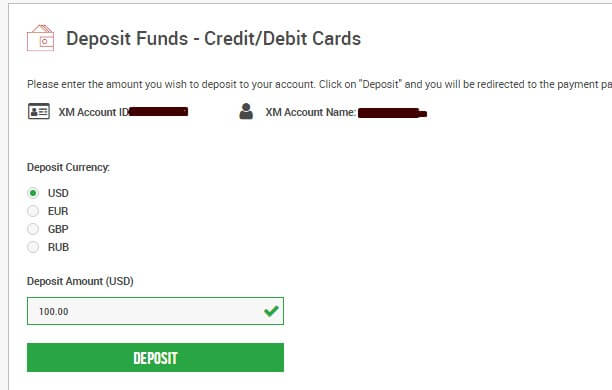

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

Trading scenario: what happens if you trade with just $100?

What happens if you open a trading account with just $100?

Or €100? Or £100?

Since margin trading allows you to open trades with just a small amount of money, it’s certainly possible to start trading forex with a $100 deposit.

But should you?

Let’s see what can happen if you do.

In this trading scenario, your retail forex broker has a margin call level at 100% and a stop out level at 20%.

Now that we know what the margin call and stop out levels are, let’s find out if trading with $100 is doable.

If you have not read our lessons on margin call and stop out levels, hit pause on this lesson and start here first!

Step 1: deposit funds into trading account

You now have an account balance of $100.

This is how it’d look in your trading account:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – |

Step 2: calculate required margin

You want to go short EUR/USD at 1.20000 and want to open 5 micro lots (1,000 units x 5) position. The margin requirement is 1%.

How much margin (“required margin“) will you need to open the position?

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,000.

Now we can calculate the required margin:

Assuming your trading account is denominated in USD, since the margin requirement is 1%, the required margin will be $60.

Step 3: calculate used margin

Since we just have a SINGLE position open, the used margin will be the same as required margin.

Step 4: calculate equity

Let’s assume that the price has moved slightly in your favor and your position is now trading at breakeven.

This means that your floating P/L is $0.

Let’s calculate your equity:

The equity in your account is now $100.

Step 5: calculate free margin

Now that we know the equity, we can now calculate the free margin:

The free margin is $40.

Step 6: calculate margin level

Now that we know the equity, we can now calculate the margin level:

The margin level is 167%.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | – | $100 | – | |||||

| short | EUR/USD | 6,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

EUR/USD rises 80 pips!

EUR/USD rises 80 pips and is now trading at 1.2080.

Used margin

You’ll notice that the used margin has changed.

Because the exchange rate has changed, the notional value of the position has changed.

This requires recalculating the required margin.

Whenever there’s a change in the price for EUR/USD, the required margin changes!

With EUR/USD now trading at 1.20800 (instead of 1.20000), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,040.

Previously, the notional value was $6,000. Since EUR/USD has risen, this means that EUR has strengthened. And since your account is denominated in USD, this causes the position’s notional value to increase.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Since the margin requirement is 1%, the required margin will be $60.40.

Previously, the required margin was $60.00 (when EUR/USD was trading at 1.20000).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has risen from 1.20000 to 1.2080, a difference of 80 pips.

Since you’re trading micro lots, a 1 pip move equals $0.10 per micro lot.

Your position is 5 micro lots, a 1 pip move equals $0.50.

Since you’re short EUR/USD, this means that you have a floating loss of $40.

Equity

Your equity is now $60.

Free margin

Your free margin is now $0.

Margin level

Your margin level has decreased to 99%.

The margin call level is when margin level is 100%.

Your margin level is still now below 100%!

At this point, you will receive a margin call, which is a WARNING.

Your positions will remain open BUT…

You will NOT be able to open new positions as long unless the margin level rises above 100%.

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.2080 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

EUR/USD rises another 96 pips!

EUR/USD rises another 96 pips and is now trading at 1.2176.

Used margin

With EUR/USD now trading at 1.21760 (instead of 1.20800), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,088.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Previously, the required margin was $60.40 (when EUR/USD was trading at 1.20800).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has now risen from 1.20000 to 1.217600, a difference of 176 pips.

Since you’re trading 5 micro lots, a 1 pip move equals $0.50.

Due to your short position, this means that you have a floating loss of $88.

Equity

Your equity is now $12.

Free margin

Your free margin is now –$48.88.

Margin level

Your margin level has decreased to 20%.

At this point, your margin level is now below the stop out level!

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

Stop out!

The stop out level is when the margin level falls to 20%.

At this point, your margin level reached the stop out level!

Your trading platform will automatically execute a stop out.

This means that your trade will be automatically closed at market price and two things will happen:

- Your used margin will be “released”.

- Your floating loss will be “realized”.

Your balance will be updated to reflect the realized loss.

Now that your account has no open positions and is “flat”, your free margin, equity, and balance will be the same.

There is no margin level or floating P/L because there are no open positions.

Let’s see how your trading account changed from start to finish.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $10,000 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

| – | $12 | – | $12 | $12 | – |

Before the trade, you had $100 in cash.

Now after just a SINGLE TRADE, you’re left with $12!

Not even enough to pay for one month of netflix!

You’ve lost 88% of your capital.

And with EUR/USD moving just 176 pips!

Moving 176 pips is nothing. EUR/USD can easily move that much in a day or two. (see real-time EUR/USD volatility on marketmilk™)

Congratulations! You just blew your account! ��

Since your account balance is too low to open any new trades, your trading account is pretty much dead.

How to trade forex with $100

How to trade forex with $100 to earn more than $10000

It seems most of the investors are afraid to go for a huge amount of trades other than a few dollars. Actually, we cannot exactly say that there is no risk of investing more than a hundred dollars. That is why we decided to offer this info on the secrets of how to trade forex with $100.

Forex is one of the most reliable online trading methods. A number of investors are working on this platform to have a remarkable profit at the end of the mission.

However, getting into the system by focusing on profit is a different strategy. So, the beginning level of the system is a somewhat complex task for the newcomers.

But, after a certain period of training, they can get an idea of the real-time, the reliable investing amount, and the future patterns of the trade. Hence, they can easily work on a winning path.

Six steps to start forex with 100 dollars

- Start to invest your money

- The margin calculation takes place

- Calculate the margin that you have already used

- Find the equity

- Explore your free margin

- Finally, obtain the margin level

Trading to have a big profit is not a reliable goal as the word sounds. But, if you use strategies as it, you can achieve your daily target of gaining more than five percent of the profit from the investment amount.

Well, now we are going to invest $100 for the next trade. Keep in mind that we do not go to become a loser again. This is the ideal step to have more than ten thousand dollars within about three months.

1.Start to invest your money

Once you deposit $100 into your current forex account, you can start this journey.

2.The margin calculation takes place

This step is a battle of calculating hacks in between two leading financial units known as euro or USD.

Probably, we invest money using the USD. So, in order to take the final required marginal values, we must explore by going through euros.

You have to work on five micro-lots and the marginal value of one percent. So, the final value may be around sixty dollars.

3.Now, calculate the margin that you have already used

Since this is the one and only trade we are going to place, this value may be the same as the above-obtained one.

4.Find the equity

Check your current position and floating in accordance with it. Now, the equity is equal to the sum of these two values.

5.Explore your free margin

Currently, you have all the data to analyze this. The free marginal value is the amount obtaining through subtracting the used marginal value from the calculated equity.

Now, we have finished almost all the steps in this trading process and there are only two remainings.

6.Finally, obtain the margin level

The level of the margin comes as a percentage and it will decide your future trading outcomes.

So, once you complete all these six steps carefully observe what will happen for your account at the last step. You will notice a profitable change at the end.

The final lines for you..

If you find all these in the correct way by referring further pieces of evidence, you can work on next wining path. So, do not forget that “how to trade forex with $100” is not an unreliable methodology.

But, you have to be strategic to save the invested amount. We hope to meet you with more details. Until that, you can keep engaging with us.

Can I start forex trading with $100?

Can I start forex trading with $100?

Absolutely! With the introduction of micro accounts by forex brokers several years ago you can now open an account with no cash and start trading with as little as $100. But just because you can doesn’t mean you should. In fact, if you do, I think you’ll find your forex trading experience a very short one.

I personally think the regulators need to step in and get some sanity back in the market place because if you start trading forex with $100 it is simply crazy. Let me explain why?

The forex brokers make money from volume turnover by their clients otherwise known as brokerage fees. They’ll take money from anyone in order to make a buck. They know there are millions of traders out there with $100 and they are all potential clients. So, to get the ‘punters’ in they offer 400:1 leverage. That means you can ‘fictitiously’ turn your $100 into $4,000 buying power. Which means you can trade 4 lots (or $400,000) with your $100 capital. Sounds awesome right, especially if you don’t have much money. Wrong!!

Brokerage fees and spreads

Let me explain what’s going to happen to your $100 when you trade 4 lots. As soon as you place a trade, you’ll pay approximately $30/40 in brokerage fees, leaving you with $60-70 as collateral. If the market moves against you by 2 pips, you would lose your account balance and your position would be automatically closed out. The market spread for the major currency pairs is on average 0.3-0.5 pips so in fact, if the market moved 1 pip against you your position would be closed out and your account left empty!

Even if you traded 1 lot with your $100 the most you could afford the market to move against you is 6-7 pips. Don’t forget your brokerage costs took the other $30.

Now before you say ‘hey I could trade micro lots’ and last longer. That’s true, you could, but once again how much money are you going to make trading 0.01 lots? If the market moved 100 pips, you’d be up $10. Now that’s not going to make you rich anytime this millennium.

So, to answer the question “can you start trading forex with $100” the answer is yes, you can, but you sure as hell shouldn’t. You’re basically throwing your money away!

Trading under capitalized leads to high risk and high failure rate

This comes back to the biggest reason why most retail traders are not successful, in my opinion, is because they are undercapitalized. With very little cash in your account you don’t even have a chance to build any significant capital. You pay your brokerage fees and then get whipped out of a position before you have time to blink.

If you did manage to survive the first trade, then it may take you 2 years to double the account to $200 trading micro lots. Now I’m sure that’s not part of the plan. The journey for most new traders is they start with $100 then add another $100 then another $100 then $1,000 and then another $1,000 until they bleed their savings account dry.

The smart decision is to invest in yourself and get some proper training or join a funded trader programme and use that company’s capital to trade. You can find several company’s offering funded programs and they usually start from around $100-150. Just be careful and check the programme structure. The last thing you need is paying monthly subscriptions or hidden fees for additional resources.

So how much money do you need to start trading forex?

In my opinion when you start trading forex the minimum starting balance is $10,000. Anything less than that and you are going to be under pressure from day 1 when you open the account. Now I’m not saying you’re risking the whole $10,000, far from it, in fact you shouldn’t be risking more than 20% of that capital, that’s $2,000, and that’s with an aggressive approach.

Having the $10,000 in the account is to make you relaxed and comfortable and allow you to access some of the leverage available to you.

So, if I’m only risking $2,000 why put in $10,000?

Trading is all about psychology and managing your emotions. If you start with $2,000 and trade the same level of risk as you would with $10,000 in your account you would be thinking every trade, ‘oh no I’m going to lose all my money’. One bad trade and your close to what we call the ‘back door’, an empty account. You won’t be able to relax and straight away you’re trading from a negative space and trading ‘defensively’ is a recipe for disaster. You’ll be trading not to lose instead of trading to win!

Now if you start with $10,000 in your account you’ll be relaxed and calm. You know your maximum drawdown is $2,000 and the chance of you losing all your cash is close to zero. So, you start trading to make money and you’re not worried about a loss. Confidence is a powerful emotion and will often determine your actions. Trading with confidence is an absolute must.

So how much leverage do I need?

There is no need to trade with anything more than 10:1 leverage. The brokerage firms only set up micro leveraged accounts with 500:1 leverage to sucker people in who only have a small amount of money. The banks and hedge funds would even go close to 10:1 leverage. If you have $10,000 in your trading account, you can trade 1 lot and that’s more than enough to make money with.

If you join a funded trader programme with a $100,000 account, you could trade 10 lots and now you really have the chance to make serious money! A move of 30 pips will net you $3,000 USD and that’s a far cry from trading a micro lot and making $3 USD. So, before you open a brokerage account and fund it with your $100 think of your options.

Be realistic with your expectations

It’s imperative you have realistic expectations before you start trading. Don’t believe the hype that you can turn $100 into $100,000, because it just isn’t going to happen. How much money you deposit into your account plays a major role in how much money you’re going to make and that’s why I say investing $10,000 as a minimum is the way to go. You can double your $10,000 in a matter of 2-6 months with proper capital management and trending markets and that will provide the foundations for a long-term trading career. If you don’t have the $10,000 then I’d suggest you invest your cash in a reputable funded trader programme where you can at least leverage up someone else’s money and trade risk free!

How to trade forex with $100

How to trade forex with $100 to earn more than $10000

It seems most of the investors are afraid to go for a huge amount of trades other than a few dollars. Actually, we cannot exactly say that there is no risk of investing more than a hundred dollars. That is why we decided to offer this info on the secrets of how to trade forex with $100.

Forex is one of the most reliable online trading methods. A number of investors are working on this platform to have a remarkable profit at the end of the mission.

However, getting into the system by focusing on profit is a different strategy. So, the beginning level of the system is a somewhat complex task for the newcomers.

But, after a certain period of training, they can get an idea of the real-time, the reliable investing amount, and the future patterns of the trade. Hence, they can easily work on a winning path.

Six steps to start forex with 100 dollars

- Start to invest your money

- The margin calculation takes place

- Calculate the margin that you have already used

- Find the equity

- Explore your free margin

- Finally, obtain the margin level

Trading to have a big profit is not a reliable goal as the word sounds. But, if you use strategies as it, you can achieve your daily target of gaining more than five percent of the profit from the investment amount.

Well, now we are going to invest $100 for the next trade. Keep in mind that we do not go to become a loser again. This is the ideal step to have more than ten thousand dollars within about three months.

1.Start to invest your money

Once you deposit $100 into your current forex account, you can start this journey.

2.The margin calculation takes place

This step is a battle of calculating hacks in between two leading financial units known as euro or USD.

Probably, we invest money using the USD. So, in order to take the final required marginal values, we must explore by going through euros.

You have to work on five micro-lots and the marginal value of one percent. So, the final value may be around sixty dollars.

3.Now, calculate the margin that you have already used

Since this is the one and only trade we are going to place, this value may be the same as the above-obtained one.

4.Find the equity

Check your current position and floating in accordance with it. Now, the equity is equal to the sum of these two values.

5.Explore your free margin

Currently, you have all the data to analyze this. The free marginal value is the amount obtaining through subtracting the used marginal value from the calculated equity.

Now, we have finished almost all the steps in this trading process and there are only two remainings.

6.Finally, obtain the margin level

The level of the margin comes as a percentage and it will decide your future trading outcomes.

So, once you complete all these six steps carefully observe what will happen for your account at the last step. You will notice a profitable change at the end.

The final lines for you..

If you find all these in the correct way by referring further pieces of evidence, you can work on next wining path. So, do not forget that “how to trade forex with $100” is not an unreliable methodology.

But, you have to be strategic to save the invested amount. We hope to meet you with more details. Until that, you can keep engaging with us.

Can you start forex with 100 dollars

How to turn $100 to $1000 or more trading forex

Turning $100 to $1000 or more trading forex

To be a successful trader, you need to understand how leverage works . It is very essential. You’ll be in for a disaster if you trade ignorantly with leverage.

Trading far beyond the amount of money you can comfortably risk can lead you to point of no return. Although, if the trade works to your favor, you can gain significantly.

- You must always remember not to invest or open trades beyond your risk limit.

- The amount of money you invest in forex must never be large enough that it will halt your life when things go wrong.

- Your forex trading capital or investment must not interfere with your day to day’s financial responsibilities.

This is not a get rich quick strategy. We are simply making the argument that its POSSIBLE to turn $100 to $1000 or more trading forex. Its “possible” but not easy! And is always risky.

Leverage is like a double-edged sword. It can potentially boost your profits considerably.

It can also boost your risks and plunge you down into the abyss. When the trade moves in the negative direction, leverage will magnify your potential losses.

Trading with a leverage of 100:1, allows you to enter a trade for up to $10,000 for every $100 in your account.

Again another example, with a leverage of 100:1, you can trade up to $100,000 when you have the margin of $1,000 in your account.

That means with the leverage you can earn profits equivalent to having as much as $100,000 in your trading account.

On the other hand, it also means the leverage exposes you to a loss equivalent to having $100,000 in your trading account.

Possibility vs. Probability

In forex trading, theoretically, any pattern of gain or loss is almost possible.

If something is possible, doesn’t mean you need to implement it. That is why to always remain safe, you should be careful while trading with leverage.

In this article, we are going to illustrate how you can realistically turn 100 dollars into more than 1000 dollars trading forex long term.

How and why it is possible!

Almost all forex brokers provide traders with a minimum leverage of 50:1.

This gives traders the opportunity to trade forex with funds up to 50 times the funds in their account.

100:1 = 100 times the funds in your account

200:1 = 200 times the funds in your account and so on..

Trading forex this way is referred to as trading on margin.

The funds you have in your account is referred to as margin, while the amount you trade in excess of what you have in your trading account is borrowed from your broker.

SOME forex brokers do not ask for a minimum deposit. Thus, if you have just 100 dollars in your account, you’ll be able to trade up to 5,000 units (with 50:1 leverage applied), which is more than sufficient to start trading forex profitably.

If you implement leverage on the EUR/USD currency pair, for instance, trading with 5,000 units is equivalent to trading with 5,000 dollars and every pip is equal to 0.50 dollars or 50 cents.

Although this may look small, if you are making a profit of 100 pips, it would be equivalent to $50 profit or a 50 percent increase!

However, you must remember that trading forex on leverage can boost your potential gain or loss.

If you trade with a 50:1 leverage, a loss of 100 pips would eliminate 50 percent of your trading account and leave you with only $50.

This is why trading with high leverage is one of the main reasons most forex traders lose their money.

The second reason forex traders lose their money is that they day-trade forex. There are reasons why day trading is not a sustainable strategy and may not be the best choice, but that’s beyond the scope of this article.

How to turn $100 to $1000 or more

Now, returning back to the topic at hand, there are a lot of things you must do to be successful as a forex trader. The key ones among them are:

- Trading with low leverage

- Engaging in long-term trading.

We are going to use a low leverage of 15:1 to illustrate that you can turn $100 into $1000 or more by trading long term.

If you are trading with a leverage of 50:1, trading with 30 percent of the money in your account as margin would be similar to trading the whole money in your account with a leverage of 15:1.

Initiating trade with just $100 would make your initial trade size equal to:

- 100 dollar x 15 = 1,500 units when you trade with 100 percent of the fund you have at 15:1 leverage.

On the other hand, when you trade with 30% of your entire fund with the leverage of 50:1, your trade size would be equivalent to:

- 30 dollars x 50 = 1,500 units (30 percent of your funds at 50:1 leverage)

This means trading the entire 100 dollars with leverage of 1:15 amounts to the same trade volume as trading 30 percent of 100 dollars with the leverage of 50:1.

If you are wondering how you can trade 1,500 units with standard lot sizes, you may need to use brokers that make that possible like OANDA , easymarkets and XM .

If for instance, we make 10 pips daily, then our profit would average 200 pips monthly. At the end of each month, your total account size will be roughly $130.

- $0.15 per pip x 200 pips = $30 profit

By standard, forex brokers incorporate your non attained profit when estimating accessible margin. Thus, after one month, you’ll have 30 dollars utilized margin, 70 dollars non utilized margin, and an extra 30 dollars in non attained profit.

To the broker, it will seem that you have 100 dollars margin available. That is 70 dollars non-utilized margin plus 30 dollars non attained profit, which implies that you can make extra trades in a pyramid manner.

If you only have 100 dollars to start trade without the leverage offer, then your subsequent trade volume would be very small because it implies you’ll be using only 30% of your no attained profit for a subsequent trade:

- 30 dollars x 0.3 = 9 dollars

- 9 dollars x 50 = 450 units

This would be the case if the only thing you have is 30 dollars in non attained profit. That means your subsequent trade size will merely be using 9 dollars as margin.

But with the leverage, you’ll have for your first trade 1,500 units which returned 200 pips gain and you just added extra trade of 450 units.

This may not appear significant, but it actually means, you are currently attaining roughly a 30 percent boost monthly. This can help you turn $100 to over $1000 and may help you get to one million dollars in three years!

Again, assuming you had $10,000 to trade, your first trade size would be equivalent to 150,000 units at the rate of $15 per pip.

Thus, your first month of profit would be roughly $3,000, and your subsequent trade size would be 45,000 units at the rate of $4.50 per pip.

Forex trading: see how much you need to start

Beginners, who have just started or are planning to get their hands to the foreign exchange market are concerned about millions of things. The most important question is how much money is needed to start trading on forex. In this post, we will help determine the minimum deposit for forex trading and conditions for cooperation with different brokers. Keep reading to know the basic rule of money maintenance as well as risk management.

Start-up capital

There is no single answer to this question. The min deposit for brokers can be from 10 to 500 dollars, depending on the type of financial account and commissions charged by an exchange. The minimum deposit sufficient to work with starts at $10, but this does not mean that you can earn a lot with that initial budget. Understanding the min sum you need to trade forex stocks also depends on the lot size that you enter into the transaction. The higher the lot is, the larger the deposit should be.

This is due to the broker’s requirements for collateral. For example, to open a transaction for 0.1 lots with a leverage of 1: 500, you need a deposit of 23 dollars. That is why the minimum deposits with brokers often start at $300 so that the client does not risk all the money in the first transaction.

Minimum deposits

Deposit requirements depend on the platform or broker you choose. Some brokers might have several requirements for deposits and risks. However, some other platforms, such as alpari, found a way out. A thing to know is that the minimum deposit limit, as a rule, only applies when opening an account. Therefore, if you do not want to trade in significant funds on alpari, it is quite possible to deposit the amount required by the broker and cash out part of the invested sum two or three days later.

Let’s determine what minimum amount you can trade with on forex under different conditions.

If you prefer a medium-term and long-term strategy, the deposit should be sufficient to wait for possible drawdowns. Determine where to put stop loss, calculate the possible loss in dollars when it triggers, and multiply by 5.

When working with several pairs at the same time, do not forget to take them into account.

For work only for one day, the deposit can be small, from 300-500 dollars. This will allow you to start trading using one instrument, that is, do not open deals simultaneously on different assets.

If you want to “rock” the deposit, the size of the deposit does not matter too much. The main thing here is to correctly calculate the risks.

Minimum deposit for intraday trading

As already mentioned, you can count on a small deposit of 300 – 500 dollars in case you want to run intraday trading. When determining how much money is needed for intraday trading on forex, you ought to keep in mind that only a novice trader can afford not a large deposit. For serious trading, it is sometimes necessary to run several transactions at the same time. Intraday trading at a leverage of 1:500 can be very profitable.

Ideally, the loss limit should be at the level of 1% of the deposit. But even trading with minimal lots will require a deposit of 2,000 to fulfill this “rule.” if you are just starting to trade, then you should not rely on professional risk restrictions since your risk will always be higher — you are just starting. Keep it in mind. Therefore, regardless of your deposit size, just buy the minimum lots. As soon as you feel confident, you can increase your deposit and raise the volume of transactions.

Top trading directory

Can you start trading FOREX with only $100 dollars | lets find out.

So for anyone looking to get into trading i will be shearing and answering all i can. By no mean am a pro but I believe I can add some value. We will be trading …

Related trading articles

- How to trade multiple time frames like professional traders (the triple screen system) in this video you'll discover: • how to trade using multiple time frames on forex, stock market or any other financial market • how to use multiple time frames in .

- Forex leverage explained for beginners & everyone else! Forex leverage explained for beginners & everyone else! Subscribe to the channel: in this forex trading vlog, I discuss a question I .

- Stop loss take profit | beginners learning how to trade forex learn how to calculate your own stop loss and take profit according to our highly successful long-term trading strategy! Blog article : .

- HOW TO TRADE GOLD IN FOREX | BEST FOREX GOLD STRATEGY | FOREX TRADING 2020 hey family, this video is all about how to trade gold in forex. I share the best forex gold strategy and also share howi caught 6000 pips on gold in 2 days .

- How I got my first $50,000 to trade forex | secret for traders to getting financing easily! How I got my first $50000 to trade forex | secret for traders to get financing! FREE complete price action strategy checklist: .

- How to trade forex news using forex factory this simple video show how to use forex factory and my fx book to now which currency pairs ill be affected by global news, and the days and times they will be .

- How to trade forex for beginners in 2020 want to learn forex trading? Don't know where to start? You've seen too many "gurus" out there preaching a million ways to do it? Don't worry. In this video I .

- How to flip your FOREX ACCOUNT in 2020 | forex UK hey fam, I'm a UK forex trader. In this video I share how to flip your FOREX TRADING ACCOUNT IN 24 HOURS TRADING FOREX. If you have a small forex .

- How to trade the forex weekend gaps weekend gap trading is one popular trading strategy with foreign exchange, or forex, traders. While technically speaking, the currency markets trade .

- Lesson 14: what are the best times of day for trading forex? Get more information about IG US by visiting their website: get my trading strategies here: .

22 thoughts on “can you start trading FOREX with only $100 dollars | lets find out.”

Mr elton jonathan is indeed an amazing trader, trading with him has been the best thing that has happened to me in a while

It's all about the strategy not a strategy you can make millions if you know what you're doing.

Bro have u been making money consistently or you are just saying something that u have been thought ?

All the others come across like liars but its rare to find someone honest

It's possible! This was my initial capital when I started trading with freshforex. I used their 1:500 leverage. I was able to double it within a month, a but greed came in and I blew up my account. I have learned my lessons now though.

This guy wll demotivate u big tym , gyz u can do it in forex pliiiiiz

From 180$ to 2188$ in 2 week. So you can.

L myself saw my bro change $100 to a thousand twice , the reason y many people fail iz coz they tend not to strategise the just have tt 100-$10 000 in their minds

I was looking for suggestions of brokers to start small. . I know not all brokers allow you to start with $100. A real useful asset in a video like this would be to give us which broker to start with. And what main strategies to use . . Probably scalping? There are so many dishonest brokers only a few acceptable . .

Hi. Please help, does it matter whether it's a standard account, or a micro account for $50? All I'm trying to do is trade 10 cents per pip

So aellis what advice would you give to someone who want to be a day trader but know nothin bout trading forex?

Which course should learn from ?

If you would start all over…how would you manage from zero to where you are now?

I'm starting currently with no deposit bonuses offers by forex brokers since i lost my $12k scalping like a pro using like 300 lots in GBP/USD in released news making $3000 in minutes and losing it in a pullback/ false breakout xd! I'm going to start risk manage my portfolio by starting not with my own money but by brokers even though they offer large requirements of lots for withdrawing funds it would just only take 2-3 months at max to withdraw your profits in all different brokers, I'm not only using one but prolly a dozen or more.

The industry’s most powerful trading platforms to trade forex and CFD's. FP markets provides some of the most technologically advanced trading platforms for all levels of trader, including metatrader 4, webtrader, apps for iphone and android as well as IRESS. Start as apprentice, become a master == ( http://go.Trustbucks.Com/aff_c?Offer_id=93&aff_id=1128 ) for more info contact me keelinhays@gmail.Com.

I joined #dmitryvladislav to start learning how to trade more aggressively in binary options and start off smashing profits daily. I really like the idea of having a set it and forgot it on auto trader using blended model strategy.

Of course you can. I started with $100. It does take some time but it is possible. I was scalping a few times a day and getting maybe 20 -30 dollars a week. Doesn't sound like a lot, and it really isn't. Especially you are trying to get rich quick. But in a few weeks I brought my account up to $250 and that enabled me to put bigger lot sizes which made bigger profits and then it turns into a continuous cycle. Yes it would be better to start off with way more than that but it is still possible with patience

Bruhh u are u relared to nate from nateslife? U look jus like him��

The minimum capital required to start day trading forex

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/486965081-56a22da85f9b58b7d0c784b7.jpg)

Martin child / getty images

It's easy to start day trading currencies because the foreign exchange (forex) market is one of the most accessible financial markets. Some forex brokers require a minimum initial deposit of only $50 to open an account and some accounts can be opened with an initial deposit of $0.

And unlike the stock market, for which the securities and exchange commission requires day traders to maintain an account with $25,000 in assets, there is no legal minimum amount required for forex trading.

But just because you could start with as little as $50 doesn't mean that's the amount you should start with. You may want to consider some scenarios involving the potential risks and rewards of various investment amounts before determining how much money to put in your forex trading account.

Risk management

Day traders shouldn't risk more than 1% of their forex account on a single trade. You should make that a hard and fast rule. That means, if your account contains $1,000, then the most you'll want to risk on a trade is $10. If your account contains $10,000, you shouldn't risk more than $100 per trade.

Even great traders have strings of losses; if you keep the risk on each trade small, a losing streak can't significantly deplete your capital. Risk is determined by the difference between your entry price and the price at which your stop-loss order goes into effect, multiplied by the position size and the pip value.

:max_bytes(150000):strip_icc()/minimum-capital-required-to-start-day-trading-forex-1031370_FINAL1-0fd72348a80a4951b802a7df8b988713.png)

Pip values and trading lots

The forex market moves in pips. Let's say the euro-U.S. Dollar (EUR/USD) currency pair is priced at 1.3025. That means the value of one euro, the first currency in the pair, which is known as the base currency, is $1.3025.

For most currency pairs, a pip is 0.0001, which is equivalent to 1/100th of a percent. If the EUR/USD price changes to 1.3026, that's a one pip move. If it changes to 1.3125, that's a 100 pip move. An exception to the pip value "rule" is made for the japanese yen. A pip for currency pairs in which is the yen is the second currency—called the quote currency—is 0.01, which is equivalent to 1 percent.

Forex pairs trade in units of 1,000, 10,000 or 100,000, called micro, mini, and standard lots.

When USD is listed second in the pair, as in EUR/USD or AUD/USD (australian dollar-U.S. Dollar), and your account is funded with U.S. Dollars, the value of the pip per type of lot is fixed. If you hold a micro lot of 1,000 units, each pip movement is worth $0.10. If you hold a mini lot of 10,000, then each pip move is $1. if you hold a standard lot of 100,000, then each pip move is $10. Pip values can vary by price and pair, so knowing the pip value of the pair you're trading is critical in determining position size and risk.

Stop-loss orders

When trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your bet. A simple stop-loss order would be 10 pips below the current price when you expect the price to rise or 10 pips above the current price when you expect the price to fall.

Capital scenarios

$100 in the account

Assume you open an account for $100. You will want to limit your risk on each trade to $1 (1% of $100).

If you place a trade in EUR/USD, buying or selling one micro lot, your stop-loss order must be within 10 pips of your entry price. Since each pip is worth $0.10, if your stop loss were 11 pips away, your risk would be $1.10 (11 x $0.10), which is more risk than you want.

You can see how opening an account with only $100 severely limits how you can trade. Also, if you are risking a very small dollar amount on each trade, by extension you're going to be making only small gains when you bet correctly. To make bigger gains—and possibly derive a reasonable amount of income from your trading activity—you will require more capital.

$500 in the account

Now assume you open an account with $500. You can risk up to $5 per trade and buy multiple lots. For example, you can set a stop loss 10 pips away from your entry price and buy five micro lots and still be within your risk limit (because 10 pips x $0.10 x 5 micro lots = $5 at risk).

Or if you choose to place a stop loss 25 pips away from the entry price, you can buy two micro lots to keep the risk on the trade below 1% of the account. You would buy only two micro lots because 25 pips x $0.10 x 2 micro lots = $5.

Starting with $500 will provide greater trading flexibility and produce more daily income than starting with $100. But most day traders will still be able to make only $5 to $15 per day off this amount with any regularity.

$5,000 in the account

If you start with $5,000, you have even more flexibility and can trade mini lots as well as micro lots. If you buy the EUR/USD at 1.3025 and place a stop loss at 1.3017 (eight pips of risk), you could buy 6 mini lots and 2 micro lots.

Your maximum risk is $50 (1% of $5,000), and you can trade in mini lots because each pip is worth $1 and you've chosen an 8 pip stop-loss. Divide the risk ($50) by (8 pips x $1) to get 6.25 for the number of mini lots you could buy without exceeding your risk. You would break up 6.25 mini lots into 6 mini lots (6 x $1 x 8 pips = $48) and 2 micro lots (2 x $0.10 x 8 pips = $1.60), which puts a total of only $49.60 at risk.

With this amount of capital and the ability to risk $50 on each trade, the income potential moves up, and traders can potentially make $50 to $150 a day, or more, depending on their forex strategy.

Recommended capital

Starting out with at least $500 gives you flexibility in how you can trade that an account with only $100 in it does not have. Starting with $5,000 or more is even better because it can help you produce a reasonable amount of income that will compensate you for the time you're spending on trading.

So, let's see, what we have: fxdailyreport.Com unlike the futures or options markets, you can actually start trading with as low as $100 in the forex market. Forex is a leveraged market, which means you can use a little at can you start forex with 100 dollars

Contents of the article

- Top forex bonus promo

- Fxdailyreport.Com

- How to start forex trading with $100

- How to trade forex with $100 in just 5 minutes january, 2021

- Reliable steps to trade forex with $100 january,...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account details

- Step 4: depositing $100 to trade

- Most important point after opening trading account...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- Trading scenario: what happens if you trade with just $100?

- Step 1: deposit funds into trading account

- Step 2: calculate required margin

- Step 3: calculate used margin

- Step 4: calculate equity

- Step 5: calculate free margin

- Step 6: calculate margin level

- EUR/USD rises 80 pips!

- EUR/USD rises another 96 pips!

- Stop out!

- How to trade forex with $100

- How to trade forex with $100 to earn more than...

- Six steps to start forex with 100 dollars

- 1.Start to invest your money

- 2.The margin calculation takes place

- 3.Now, calculate the margin that you have already...

- 4.Find the equity

- 5.Explore your free margin

- 6.Finally, obtain the margin level

- Can I start forex trading with $100?

- Can I start forex trading with $100?

- Brokerage fees and spreads

- Trading under capitalized leads to high risk and...

- So how much money do you need to start trading...

- So, if I’m only risking $2,000 why put in...

- So how much leverage do I need?

- Be realistic with your expectations

- How to trade forex with $100

- How to trade forex with $100 to earn more than...

- Six steps to start forex with 100 dollars

- 1.Start to invest your money

- 2.The margin calculation takes place

- 3.Now, calculate the margin that you have already...

- 4.Find the equity

- 5.Explore your free margin

- 6.Finally, obtain the margin level

- Can you start forex with 100 dollars

- Turning $100 to $1000 or more trading forex

- Forex trading: see how much you need to start

- Start-up capital

- Minimum deposits

- Top trading directory

- Can you start trading FOREX with only $100 dollars | lets...

- 22 thoughts on “can you start trading FOREX with only $100...

- The minimum capital required to start day trading forex

- Risk management

- Pip values and trading lots

- Stop-loss orders

- Capital scenarios

- Recommended capital

Comments

Post a Comment