Oxta fx

Oxta fx

Octafx - one of the best forex brokers on the market, for traders all round the world. Octafx offers access to CFD trading, commodity trading and indices trading with award-winning forex trading conditions.

Top forex bonus promo

As well as access to the forex market, octafx offers a variety of promotions that can help you: octafx forex broker ensures reliable forex trading conditions to provide traders of all skill levels with an opportunity to earn more. This is possible due to:

Oxta fx

- Language support: bengali, chinese, english, hindi, indonesian, malay, portuguese, spanish, thai

- Create trading accounts, modify leverage, enable swap-free options, edit and restore passwords

- Make deposits and withdrawals using the most popular payment options

- View your detailed overall or account operation history, apply convenient filters to it and cancel your previous deposit

- Start trading in a compatible trading platform app

- Top up your demo account

- View contest statistics and access your contest accounts

- Activate bonuses and view statistics on active and completed bonuses

get it on

Forex trading accessibility for everyone

Octafx - one of the best forex brokers on the market, for traders all round the world. Octafx offers access to CFD trading, commodity trading and indices trading with award-winning forex trading conditions. As well as access to the forex market, octafx offers a variety of promotions that can help you:

50% bonus on deposit

Negative balance protection

Why choose forex trading with octafx

Octafx forex broker ensures reliable forex trading conditions to provide traders of all skill levels with an opportunity to earn more. This is possible due to:

- No commissions on deposits and withdrawals

- No swaps

- No slippage

- No delays

Metatrader 4 free trading software

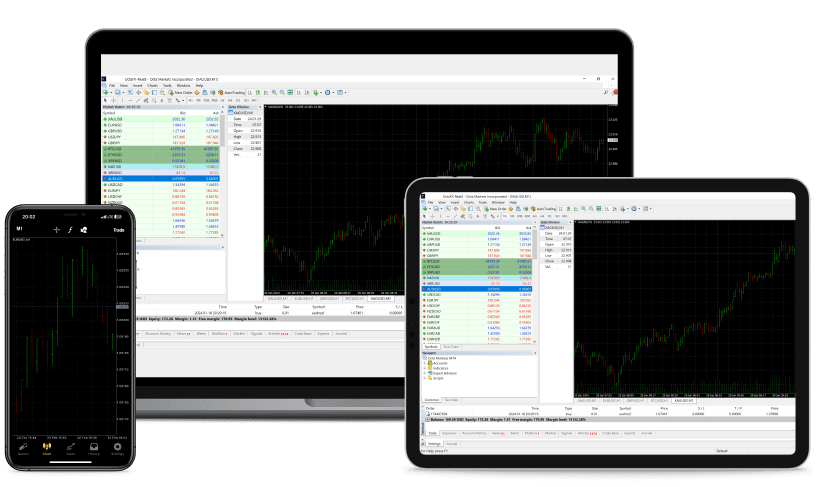

Download metatrader 4 for all device versions

Download metatrader 4 on your phone

Metatrader 4 web-platform

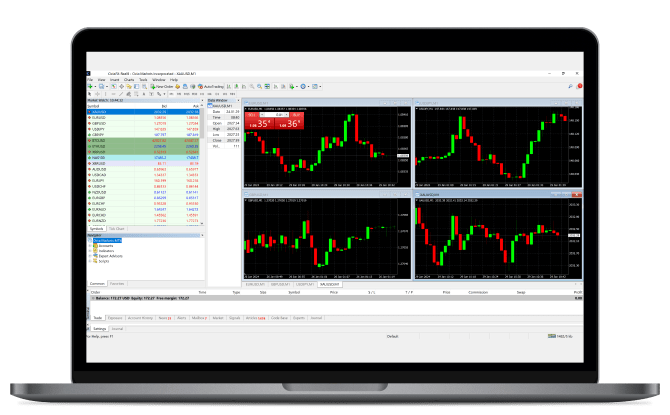

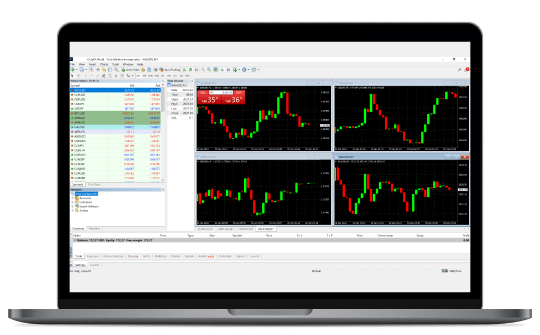

MT4 web platform allows you to trade from any browser on any operating system with a well-known interface of a desktop platform. All major tools are available including one click trading and chart trading.

Metatrader 4 desktop

Metatrader 4 is highly customisable. It includes charting tools, market indicators, scripts and eas, advanced risk management, real time market execution and more.

Metatrader 4 android

Enjoy a complete set of trade orders, trading history, interactive charts and the widest variety of supported devices - all that is metatrader 4 for android. Wherever you are and whatever you do, forex will always be with you!

Metatrader 4 ios

Widespread trading software is now available for your iphone/ipad. Login to your account and have the opportunity to trade on metatrader 4 from anywhere in the world via your ios device.

THE MOST POPULAR FOREX TRADING PLATFORM

Metatrader 4 (MT4) provides robust technology and high security to enable traders to choose forex or CFD positions without worrying about the stability of the platform. It offers instruments to follow price fluctuations, identify trend patterns through charts and graphs, and also deploy automated trading techniques to manage trades.

Why choose metatrader 4?

This electronic trading platform is used by new and experienced traders alike. It’s trusted by individual traders as well as large introducing brokers and trading companies. It offers excellent trading and analytical tools, and is flexible enough to implement simple as well as highly complex trading strategies. The platform supports trading in forex, cfds and cryptocurrencies.

At octafx, we provide our clients with the MT4 platform to enable them to carry out their trading activities efficiently and with complete peace of mind. We also offer educational material, as well as MT4 demo accounts, so they can practice risk-free trading.

Easier trading with metatrader 4

- Flexibility: there are several choices of currency pairs to trade in, as well as cryptocurrencies and cfds.

- User-friendly: MT4 has a user-friendly interface that is suitable for traders of all levels.

- Customisation: develop your own expert advisors (eas) and technical indicators on metatrader 4, to match your trading needs and practices. Windows and charts can be arranged for each profile according to your preferences.

- Efficiency: MT4 doesn’t slow down the performance of your PC or mobile, keeping disruption to a minimum.

- Charting tools: advanced charting tools help analyze the technical aspects of the market.

- Expert advisors: trading robots enable the automation of trades and access to the platform’s algorithmic trading benefits.

- Language: the platform is available in multiple languages.

Learn how to start forex trading in 4 easy steps

learn how to start trading on MT4

Metatrader 4 offers enhanced security

The MT4 platform offers the highest security standards to protect traders’ funds. The client terminal and platform servers exchange data through encrypted servers, and the platform uses RSA digital signatures. Your IP address also remains protected.

Moreover, alongside metatrader 4 security, octafx provides it’s own measures taking fund security to the next level:

- Segregated accounts: as per international regulatory standards, octafx keeps customers' funds separate from the company's balance sheets.

- SSL-protected personal area: customers’ personal data and financial transactions are protected with 128-bit encryption, making browsing safe and client data inaccessible to any third party.

- Account verification: octafx encourages customers to verify their account by submitting a personal ID scan and proof of address to ensure transactions are authorised and secured.

- Secure withdrawal rules: withdrawals require email confirmation and customers are encouraged to use the same payment details for both deposits and withdrawals.

- 3D secure visa authorisation: 3D secure technology is used for processing credit and debit cards.

- Advanced protection: octafx ensures the technical environment is monitored 24/7 by a dedicated team of security engineers and technical specialists.

Metatrader 4: OS and device compatibility

Metatrader 4 is available as a web platform that’s compatible with windows, linux and mac OS. MT4 can also be accessed from a smartphone or tablet, whether it has an ios or android operating system. Trade anytime and anywhere, and have access to trading information 24 hours a day, even while you’re traveling or on vacation. It is super-easy to download and install the terminal on any compatible device.

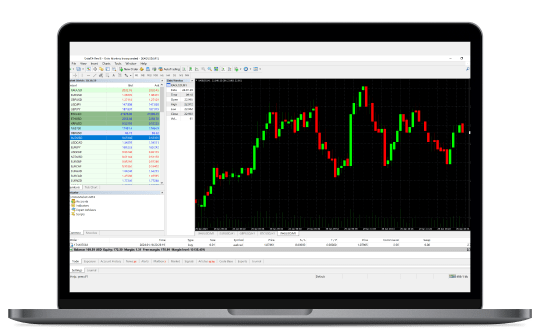

Metatrader 4: trade execution modes

An order is an instruction to perform a trade. There are three trade execution modes on the MT4 platform:

- Execution by market: your order opens a position at the latest price, even if there’s a deviation from what is visible on the platform. This results in much faster execution of orders, as it doesn’t involve requotes. *

* supported by octafx - Instant execution: the system tries to execute your order using the current price on the platform. If the exchange rate changes while the order is being processed, a requote option becomes available, which the trader can accept or reject.

- Execution on request: prices are requested before the order is placed. Once the exchange rates come in, order execution can be confirmed or rejected.

Metatrader 4: сharting tools for technical analysis

Metatrader 4 offers advanced charting capabilities to determine entry and exit points with technical analysis, which uses historical price and volume data to help make predictions. It’s also possible to send trading orders straight from the chart.

By default, MT4 opens with four charts, each representing a unique currency pair. On the left of the charts is the market watch window, with two tabs. The symbols tab shows a list of currency pairs with their bid and ask prices, while the tick charts tab shows the real-time price activity of chosen currency pairs. Below this is the navigator window, where traders can view their account(s), indicators and expert advisors.

The appearance of the charts can be customised. Each currency pair on the chart can be seen in nine different timeframes (including one minute, five minutes, one hour, daily, weekly, monthly). Graphical objects can be included in the charts, such as shapes (rectangle, triangle, ellipse), arrows and text.

Customer agreement

1. Subject of the agreement

- 1.1. This client agreement is entered into by octa markets incorporated (hereinafter referred to as “company”) and the client who submitted a registration form at www.Octafx.Com (hereinafter referred to as “client”).

- 1.2. The company is registered and regulated and governed by the law of saint-vincent and the grenadines. Any legal claims will be a subject of the court hearings. Company’s legal address is suite 305, griffith corporate centre, beachmont, kingstown, st. Vincent and the grenadines.

- 1.3. The agreement sets forth the relationship between the client and the company including but not limited to: orders’ execution, client policies, payments and/or payouts, claims resolution, fraud prevention, communication and other aspects.

- 1.4. Any possible arguments between the client and the company will be settled in compliance with the agreement unless stated otherwise.

- 1.5. By entering into the agreement the client guarantees that he/she is a person of a legal age. In case the client is a legal entity, it guarantees the entity is capable and no other parties are eligible to perform any actions, claims, demands, requests, etc in respect to the client’s trading account.

- 1.6. All the operations on and with the client’s trading account are performed in full compliance with this agreement unless stated otherwise

- 1.7. The client has no right to bypass fully or partially his/her obligations by the agreement on the basis that it is a distance contract.

2. Terms definition

- 2.1. “access data” denotes all the access logins and passwords related to client’s trading account(s), personal area, or any other data providing access to any other company’s services.

- 2.2. “ask” denotes the higher price in the quote at which the client may open a “buy” order.

- 2.3. "autotrading software" - denotes an expert advisor or a cbot, that is, a piece of software which performs trading operations automatically or semi-automatically without interference (or with a partial or occasional interference) of a human.

- 2.4. “balance” denotes the total of all the closed orders (including deposits and withdrawals) in the client’s trading account at a given time.

- 2.5. “base currency” denotes the first currency in the currency pair.

- 2.6. “bid” denotes the lower price in the quote at which the client may open a “sell” order.

- 2.7. “business day” denotes any day between monday and friday, inclusive, except any official or non-official holidays announced by the company

- 2.8. “client terminal” denotes metatrader 4, metatrader 5, ctrader or any other software in all its versions, which is used by the client to obtain information of financial markets in real-time, perform different kinds of market analysis and research, perform/open/close/ modify/delete orders, receive notifications from the company.

- 2.9. “company news page” denotes the section of the company’s website where the news is published.

- 2.10. “currency of the trading account” denotes the currency that the trading account is denominated in; all the account’s calculations and operations are performed in this currency.

- 2.11. “currency pair” denotes the object of a transaction based on the change in the value of one currency against the other.

- 2.12. “client information” denotes any information that the company receives from the client (or in other ways) related to him/her, his /her trading account, etc.

- 2.13. “dispute” denotes either:

- 2.13.1. Any argument between the client and the company, where the client has reasons to assume that the company as a result of any action or failure to act breached one or more terms of the agreement; or

- 2.13.2. Any argument between the client and the company, where the company has reasons to assume that the client as a result of any action or failure to act breached one or more terms of the agreement;

- 2.14. "energy" — energy denotes spot west texas intermediate crude oil or spot brent crude oil

- 2.15. “floating profit/loss” denotes current profit/loss on open positions calculated at the current price.

- 2.16. “force majeure event” denotes any of the following events:

- 2.16.1. Any act, event or occurrence (including, without limitation, any strike, riot or civil commotion, terrorism, war, act of god, accident, fire, flood, storm, electronic, communication equipment or supplier failure, interruption of power supply, civil unrest, statutory provisions, lock-outs) which, in the company’s reasonable opinion, prevents the company from maintaining an orderly market in one or more of the instruments;

- 2.16.2. The suspension, liquidation or closure of any market or the abandonment or failure of any event to which the company relates its quotes, or the imposition of limits or special or unusual terms on the trading in any such market or on any such event.

- 2.17. “free margin” denotes funds in the client’s account, which may be used to open a position. Free margin is calculated in the following way:

Free margin = equity - required margin.

- 2.18. “IB” denotes the client whose application for the IB status submitted via the company’s website was approved by the company.

- 2.19. "index CFD" denotes a contract for difference by reference to the fluctuations in the price of the underlying stock index.

- 2.20. “indicative quote” denotes a price or a quote at which the company has the right not to accept or execute any orders or perform any modifications to the orders.

- 2.21. “initial margin” denotes the required margin to open a position. It can be viewed in the trader’s calculator.

- 2.22. “instruction” denotes an instruction from the client to open/ close a position or to place/modify/delete an order.

- 2.23. “instrument” denotes any currency pair, metal, energy or index CFD. It can be also referred to as “trading instrument” or “trading tool”

- 2.24. “leverage” denotes the virtual credit given to the client by the company. E.G., 1:500 leverage means that initial margin for the client will be 500 times less than the transaction size.

- 2.25. “long position” denotes a buy order, that is, buying the base currency against the quote currency.

- 2.26. "lot" denotes 100000 units of the base currency, 1000 barrels of crude oil or any other number of contracts or troy oz. Described in the contract specifications.

- 2.27. “lot size” denotes the number of units of base currency or troy oz. Of metal defined in the contract specifications.

- 2.28. “margin” denotes the amount of funds required to maintain open positions, as determined in the contract specifications for each instrument.

- 2.29. “margin level” denotes the percentage equity to required margin ratio. It is calculated in the following way:

Margin level = (equity /required margin) * 100%.

Earn by copying the success of pro traders

Octafx copytrading offers an opportunity to automatically copy leading traders and forget about long hours of building your own trading strategy. Choose from the best masters of forex and diversify your trading portfolio.

How it works

Sign up in one easy step and make a deposit to your wallet via any payment method you like. If you already have funds in your trading account at octafx, you can add money to your wallet from it using internal transfer. Your wallet balance shows your uninvested funds.

Find masters you want to follow and click ‘copy’. Their positions will be copied automatically. The deposit percentage setting will help you manage your portfolio. Try copying different strategies to decide which of them work best for you!

With an unlimited number of masters to copy you can create a balanced and diversified trading portfolio and receive a stable income. You also have full control over the process and can modify/stop copying trades at any given time. You can view detailed trading statistics for copied master traders in your copier area.

This is a new tool that helps traders earn additional stable income by copying more experienced traders.

Learn from the best

Easy entrance to the forex market for newbies.

Diversify your portfolio

Choose master traders to follow from a large number of professionals.

Enjoy fast order execution

Your order is executed less than 5ms after the original one.

Keep everything under control

You can stop copying, unsubscribe, or close a trade anytime.

Set it running in a few quick steps

No additional verification required.

Invest and withdraw funds quickly and securely

Many popular payment methods to choose from.

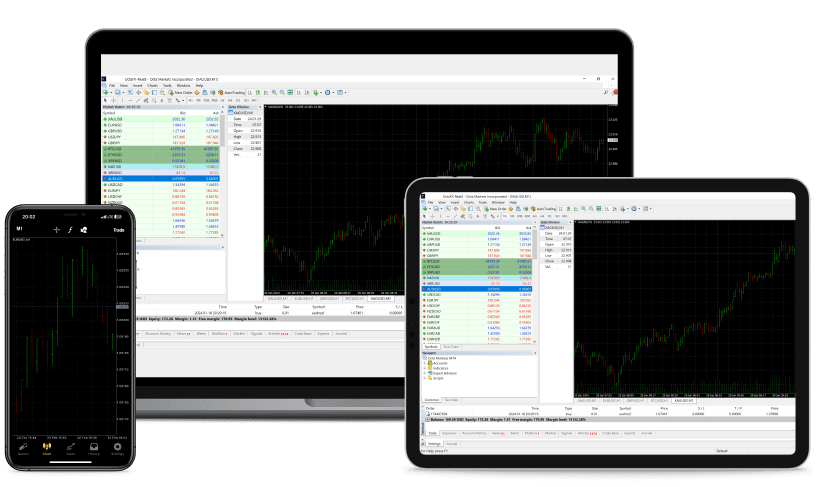

All benefits of copy trading in the mobile app!

- Focus on investing with a convenient octafx copytrading app

- Control your portfolio and investments on the go

- Track master traders and their performance live for smart investing

- View how your funds are invested and manage risks in real time

How do I choose master traders to copy?

Master stats include gain and number of copiers, commission, trading pairs the master uses, profit factor and order directions as well as many other factors that you can review before making your decision to copy someone. Before copying starts, you set a deposit percentage and choose the amount of funds to invest in a specific master.

How does copying work in terms of volume and leverage differences?

The volume of the copied trade depends on both master and copier accounts’ leverage and equity, and is calculated as: volume (copied trade) = equity (copier)/equity (master) × leverage (copier)/leverage (master) × volume(master).

Example: master account equity is $500 and leverage is 1:200, copier account equity is $200 and leverage is 1:100. 1 lot trade is opened on the master account. The volume of the copied trade will be: 200/500 × 100/200 × 1 = 0.2 lot.

Do you charge any commission for copying masters?

Octafx doesn’t charge any additional commissions—the only commision you pay is master’s commission, which is specified individually and is charged in $ per lot of traded volume.

What is a deposit percentage?

Deposit percentage is an option that you set prior to copying that helps you to control your risks. It can equal any percentage from 1% to 100%. You set this parameter and new trades won’t be copied if the current equity goes down by a set amount (20%) from your balance according to the following formula:

Oxta fx

- Kini aplikasi ini menyokong bahasa melayu

- Buat akaun dagangan, ubah suai leveraj, dayakan pilihan tanpa swap, edit dan pulihkan kata laluan

- Buat deposit dan pengeluaran menggunakan pilihan pembayaran paling popular

- Lihat sejarah keseluruhan terperinci atau operasi akaun anda, gunakan penapis mudah dan batalkan deposit anda sebelum ini

- Mula berdagang dalam aplikasi platform dagangan yang serasi

- Tingkatkan akaun demo anda

- Lihat statistik pertandingan dan akses akaun pertandingan anda

- Aktifkan bonus dan lihat statistik mengenai bonus aktif dan lengkap

dapatkan di

Kebolehcapaian dagangan forex untuk semua

Octafx - salah satu daripada broker forex terbaik di pasaran, untuk pedagang di seluruh dunia. Octafx menawarkan akses kepada dagangan CFD, dagangan komoditi dan dagangan indeks dengan syarat dagangan forex yang memenangi anugerah. Selain daripada akses kepada pasaran forex, octafx turut menawarkan pelbagai promosi menarik yang dapat membantu anda untuk:

Bonus 50% untuk deposit

Perlindungan baki negatif

Mengapa memilih dagangan forex dengan octafx

Broker forex octafx memastikan syarat dagangan forex boleh dipercayai dalam membekalkan pedagang dari semua tahap kemahiran dengan peluang untuk menjana lebih banyak keuntungan. Hal ini boleh dilaksanakan berikutan:

- Tiada komisen untuk deposit dan pengeluaran

- Tiada swap

- Tiada gelinciran

- Tiada kelewatan

Octafx: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

Octatfx has a highly informative and accessible website that aims to promote their services in layman terms. And it achieves that, yet can it can it practice what it preaches?

The broker website is operated by the following companies:

Octa markets cyprus ltd is tightly regulated by the cyprus securities and exchange commission (cysec), carrying all necessary investigations in order to ensure fraud-free market operations. As regulated by cysec, OCTAFX is part of the ICF allowing for a compensation of up to €20 000 to be attributed to clients, if the broker fails or becomes insolvent.

Octa markets incorporated is regulated by the FSA SVG in st. Vincent and the grenadines. This body’s main duties are to ensure that financial institutions are well supervised and that all threats are acted upon with the appropriate force of action. Unlike cysec, this license issuer has no reimbursement scheme to speak of. Another significant drawback is that there is no regulation dedicated to foreign exchange (forex) trading and cryptocurrency, nor are there licenses issued for these two assets:

Spreads depend on the account the client has chosen. So for the MICRO account the EUR/USD spread is 1.1 pips, for the PRO it’s 0.8-1.1 pips, and for the ECN account it’s typically 0.7-0.8 pips. We would like to remind readers that in the UK and EU the current imposed maximum spread limit is 1:30. For those outside the jurisdiction of ESMA the spread reaches 1:500.

Currently, octatfx offers the following assets to trade with: forex pairs, cryptocurrencies, commodities, stocks. In the bustling, competitive world of forex today, this number of assets is considered low.

The broker is available in the following languages: english, spanish, arabic, indonesian, thai, vietnamese, chinese, german, malay, bengali, portuguese and hindi.

OCTAFX LOGIN

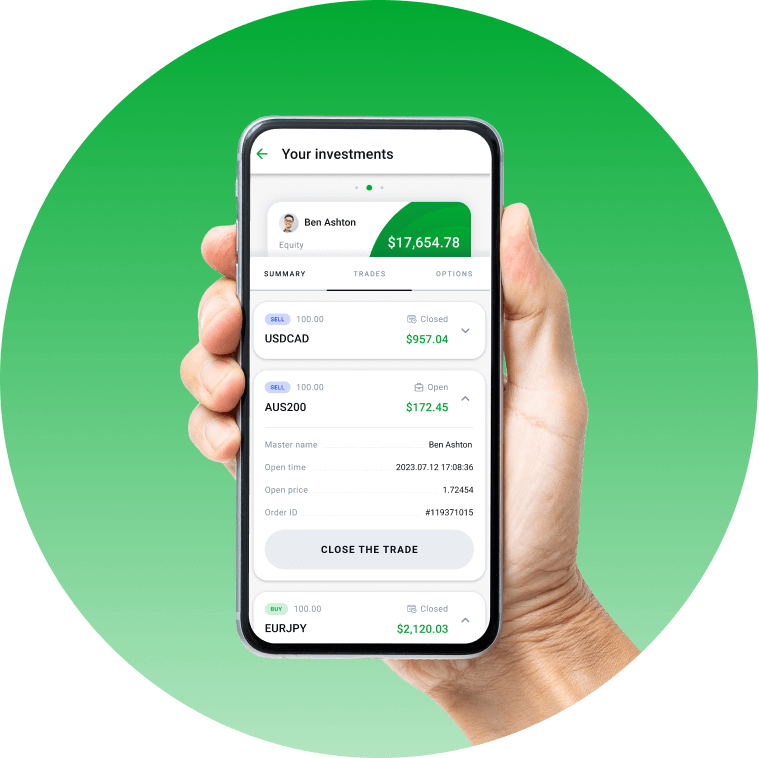

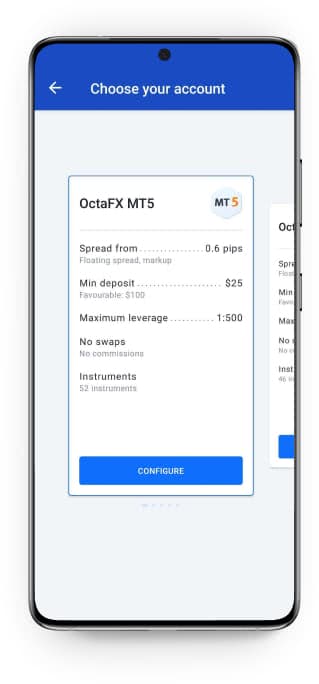

Octatfx offers three platform for trade: MT4, MT5 and ctrader. What’s interesting is that each platform acts also as a separate account.

METATRADER 4

Here we are again with this renowned platform, and for a reason! MT4 stands tall against other trading terminals. Consider using expert advisors to set your automated trading while you do other business, or take full advantage of what MT4 has to offer: multiple chart management, trading directly from the chart, customized trading indicators, huge selection of trading options and much more.

The MT4 acts as the MICRO account type. So, the spread for EUR/USD 1.1 pips, while the leverage for the EU/UK is 1:30 (due to ESMA), and reaches 1:500 for those outside these zones.

There are no commissions attached to this account.

MT4 is available on smartphones (iphone, android), on any browser and as a standalone desktop version.

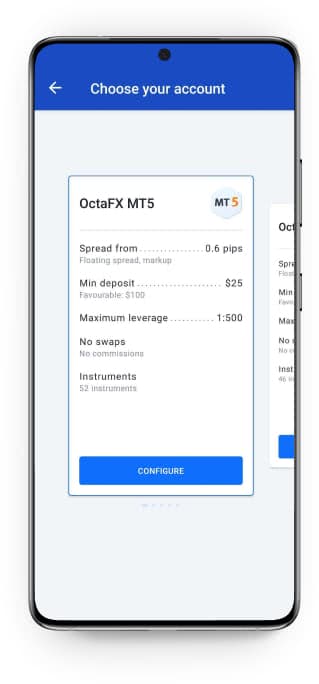

METATRADER 5

MT5 strives to replace MT4 but fails to do so, not because it’s inferior but because most brokers nowadays use MT4 as the default terminal. Nevertheless, MT5 comes with new and handy features that traders will surely find useful. There are auto trading bots, plus VPS (same as MT4).

The MT5 acts as the PRO account type. So, the spread for EUR/USD 0.8-1.1 pips, while the leverage for the EU/UK is 1:30 (due to ESMA), and reaches to 1:500 for those outside these zones.

The are no commissions attached to this account.

MT5 is available on smartphones, on any browser and as a standalone desktop version.

The functional ctrader has been included by octafx. This platform handles with ease and possesses a much better visual style than both MT4/5. The interface is highly customizable, giving end users a much needed aesthetic touch of their own. One of the main features of ctrader is the ability for traders to access provider’s liquidity making room for better pricing and lower spreads. There is also automated trading, and great back testing facilities.

Ctrader acts as the ECN account type. So, the spread for EUR/USD 0.7-0.8 pips, while the leverage for the EU/UK is 1:30 (due to ESMA), and reaches to 1:500 for those outside these zones.

Ctrader has a commission structure attached to it. For one standard lot a round turnof $6 will be feed. So this changes the EUR/USD spread from 0.7-0.8 pips to 1.3-1.4 pips.

Ctrader is available: for download as a standalone software for desktop, to mobile users, and can be accessed via a browser.

COPYTRADING

The broker offers for the opportunity to copy expert traders, automatically, without spending time on building a strategy or being constantly glued to a screen. This is a superb opportunity for those who do not have the time, or have little of it, to dedicate to online trading. To start, just browse through the many expert traders, set your preferences, invest and voila! Note that, even if the trader dealing for you gets a bonus if your investment turns to profit, this system does not guarantee 100% wins all of the time.

OCTAFX MINIMUM DEPOSIT

The minimum deposit is $50, immediately making room for smaller or casual traders. Typically, a higher minimum deposit limit has the ability to intimidate many novice traders.

The methods for depositing are: neteller, skrill and bitcoin. In this day and age of online currency and cfds trading these options are significantly low than bar. When considering the instruments in circulation by admiral markets and, especially, FX choice, the assortment that this here broker has seems laughable in comparison.

The base currencies are limited to only EUR and USD. The same comment as above can be applied here. A global broker should include more base currencies.

All methods of funding are instant. Here, however, octafx shines, as it falls in the niche of swift deposit methods, a niche that grows ever so tighter.

There are no fees attached. Fees commissioned by thirds parties will be covered by octafx.

OCTAFX WITHDRAWAL TIME AND FEES

Cysec regulation reassures that no harm will come to clients withdrawals.

The withdrawal methods are: neteller, skrill and bitcoin. Again, significantly fewer withdrawal methods that your standard broker.

Withdrawals are instant. This is a rare sight to see in an industry of long process times, and unexpected delays.

There are no fees attached to withdrawal. Fees commissioned by thirds parties will be covered by octafx. This makes us even more agitated at the fact that octafx has not included more payment options.

The minimum withdrawal amount is $5.

BONUSES AND PROMOTIONS

Bonuses are solely offered by octatfx’s offshore entity, due to cysec banning them in europe.

There is a 50% bonus with every deposit.

The most active and successful traders will have the opportunity to win smartphones/smartwatches, as well as a 3 luxury cars at the end of the year.

There is the opportunity to win $500 while trading with your DEMO account.

Trade suing a ctrader DEMO account, and finish with the highest profit at the end of the week to get $150.

BOTTOM LINE

First and foremost, octafx is regulated by one of the best institutes for the job in the world (cysec), as well as one of the shadier ones where many suspicious brokers get their licenses from- FSA SVG, making things rather ambiguous.

Second, there is a very limited number of payment methods, which in this day and age of online trading is unsatisfactory. However, there are no fees attached to said methods, and to top that the broker offers great and detailed trading platforms.

Octafx

Faster, free and saving data!

The description of octafx

Octafx 3.0 update

Additional information

Publish date: 2020-01-01

Uploaded by: ayon barui

Latest version: 3.0

Available on:

Requirements: android 4.4W+

Update on: 2020-01-10

Uploaded by: ayon barui

Requires android: android 4.4W+ (kitkat watch, API 20)

Signature: 2afec4c8440e597e2fc97823a0631077483def99

DPI: 120-640dpi

Arch: universal

File SHA1: da80144f9fd2cae245c3313812b449052a4797db

File size: 5.5 MB

What's new:

Update on: 2019-12-16

Uploaded by: ayon barui

Requires android: android 4.1+ (jelly bean, API 16)

Signature: 2afec4c8440e597e2fc97823a0631077483def99

DPI: 120-640dpi

Arch: universal

File SHA1: 56f3d5997aae25b3918674cec61fd7a6c7c84a22

Oxta fx

- Kini aplikasi ini menyokong bahasa melayu

- Buat akaun dagangan, ubah suai leveraj, dayakan pilihan tanpa swap, edit dan pulihkan kata laluan

- Buat deposit dan pengeluaran menggunakan pilihan pembayaran paling popular

- Lihat sejarah keseluruhan terperinci atau operasi akaun anda, gunakan penapis mudah dan batalkan deposit anda sebelum ini

- Mula berdagang dalam aplikasi platform dagangan yang serasi

- Tingkatkan akaun demo anda

- Lihat statistik pertandingan dan akses akaun pertandingan anda

- Aktifkan bonus dan lihat statistik mengenai bonus aktif dan lengkap

dapatkan di

Kebolehcapaian dagangan forex untuk semua

Octafx - salah satu daripada broker forex terbaik di pasaran, untuk pedagang di seluruh dunia. Octafx menawarkan akses kepada dagangan CFD, dagangan komoditi dan dagangan indeks dengan syarat dagangan forex yang memenangi anugerah. Selain daripada akses kepada pasaran forex, octafx turut menawarkan pelbagai promosi menarik yang dapat membantu anda untuk:

Bonus 50% untuk deposit

Perlindungan baki negatif

Mengapa memilih dagangan forex dengan octafx

Broker forex octafx memastikan syarat dagangan forex boleh dipercayai dalam membekalkan pedagang dari semua tahap kemahiran dengan peluang untuk menjana lebih banyak keuntungan. Hal ini boleh dilaksanakan berikutan:

- Tiada komisen untuk deposit dan pengeluaran

- Tiada swap

- Tiada gelinciran

- Tiada kelewatan

Fxdailyreport.Com

When trading currencies in international markets, it is crucial that you choose a reliable forex broker to succeed. Make sure to choose a forex broker that combines value trading with the right selection and state-of-the-art tools. Here are a few tips to help you choose the best forex brokers accepting US clients:

The first and most important factor to consider when choosing a forex broker to trade with is security. Some of the factors to consider to ensure your money is safe includes;

You want your trading capital to be safely deposited and handled with a forex broker that is overseen by a relevant financial authority. In the US, find a broker that is regulated by the national futures association (NFA): the NFA is the main regulatory agency responsible for regulating forex trading. It oversees the regulation and supervision of all fx brokers in the US. The broker should also be registered with the US commodity futures trading commission (CFTC) as a retail foreign exchange dealer and futures commission merchant.

Check the broker’s regulatory body on their website before doing any other thing. Working with a regulated broker also ensures that your withdrawal or deposit request fast and hassle-free.

Recommended US forex brokers regulated by NFA and CFTC

FOREX.Com

Make sure to choose a forex broker whose domicile is in a country with a well-developed financial regulation. This legal structure can help you recover funds if an issue arises. So, ensure that you check the domicile of the company even if the firm looks reputable. Otherwise, choosing an online broker based in a poorly regulated country may not be in your best interest. Trying to exert your legal rights in a foreign jurisdiction can prove a daunting task as there is no regulatory oversight in the background to support your effort.

Always check the broker’s financial security before hiring as you want to choose one with great financial backing. Choose a online forex broker that is well funded or has a trusted owner or parent company. You can find this information on the broker’s official website on tabs like “about us” or “press releases.” you can also check on the regulatory body’s website.

- Transparent and low commission structures

The costs associated with forex trading can be hard to analyze. Also, they can impact a trader’s returns significantly over the long term, especially if your trading strategy calls for frequent trading. Therefore, it is crucial that you deal with an fx trader with a transparent and low commission structure.

However, it is important to note that while a trader with low marginal costs may save you some money in the long term, more expensive traders tend to offer better customer service among other helpful services, including educational materials, trading tools, and market analysis.

- Suitable and reliable trading platform

Another important consideration to make is the trading platform that the potential forex broker works with. This is because the trading platform will be your interface with the market. Therefore, it needs to be intuitive and easy to use. It should also have high speeds to allow for quick execution and enable you to react promptly to any market changes.

Always make sure that your broker offers you a platform that best suits your needs. For instance, if you are always on the move, you should look for a broker whose platform has a mobile app to allow you to manage your trades.

Finally, always choose a broker with top-notch customer service. Since forex trading takes place 24 hours a day, you need to find a broker who offers customer service 24/7. Check to see whether their support is offered as one on one or through automated responses. We highly recommend a broker that offers one on one support as opposed to automated since they may not address your needs adequately.

Call the brokers directly to see who will pick your call promptly and the quality of customer service they will offer. If you are dissatisfied with the level of services offered by a particular broker, move on to the next and settle for the one who will offer quality and satisfactory service.

As a trader, it is crucial that you vet as many forex brokers as possible before arriving at a final decision. This will help you choose a broker that offers exceptional services that match your expectations.

So, let's see, what we have: trade with reliable broker and best conditions: low spreads, no swaps, no commissions. Claim and withdraw 50% deposit bonus! At oxta fx

Contents of the article

- Top forex bonus promo

- Oxta fx

- Forex trading accessibility for everyone

- Why choose forex trading with octafx

- Metatrader 4 free trading software

- Download metatrader 4 for all device versions

- Download metatrader 4 on your phone

- THE MOST POPULAR FOREX TRADING PLATFORM

- Why choose metatrader 4?

- Easier trading with metatrader 4

- Metatrader 4 offers enhanced security

- Metatrader 4: OS and device compatibility

- Metatrader 4: trade execution modes

- Metatrader 4: сharting tools for technical analysis

- Customer agreement

- Earn by copying the success of pro traders

- How it works

- This is a new tool that helps traders earn additional...

- Learn from the best

- Diversify your portfolio

- Enjoy fast order execution

- Keep everything under control

- Set it running in a few quick steps

- Invest and withdraw funds quickly and securely

- All benefits of copy trading in the mobile app!

- How do I choose master traders to copy?

- How does copying work in terms of volume and leverage...

- Do you charge any commission for copying masters?

- What is a deposit percentage?

- Oxta fx

- Kebolehcapaian dagangan forex untuk semua

- Mengapa memilih dagangan forex dengan octafx

- Octafx: login, minimum deposit, withdrawal time?

- RECOMMENDED FOREX BROKERS

- OCTAFX LOGIN

- OCTAFX MINIMUM DEPOSIT

- OCTAFX WITHDRAWAL TIME AND FEES

- BONUSES AND PROMOTIONS

- BOTTOM LINE

- Octafx

- The description of octafx

- Octafx 3.0 update

- Additional information

- Oxta fx

- Kebolehcapaian dagangan forex untuk semua

- Mengapa memilih dagangan forex dengan octafx

- Fxdailyreport.Com

- Recommended US forex brokers regulated by NFA and CFTC

Comments

Post a Comment