How to withdraw money from tickmill bonus account, how to withdraw money from tickmill bonus account.

How to withdraw money from tickmill bonus account

Is hotforex rescue bonus a "deposit bonus" for MT4?

Top forex bonus promo

How does it work? Other than the welcome account, you also need to register a client area account, using the same information provided during the welcome account registration (name, surname, email, date of birth, etc.).

How to withdraw money from tickmill bonus account

Top pages

- How to withdraw tickmill $30 no deposit bonus on MT4? What's the requirement/conditions?

- What happens if I withdraw funds from XM $30 bonus account?

- Octafx $1,000 instagram contest

- Completed the verification but I didn't get XM's $30 bonus. Why is that?

- Verified my account but I can't get XM $30 bonus. Why is that?

- XM 100% deposit bonus

- Fxgiants $70 no deposit bonus

- Instaforex $1000 no deposit bonus

- Hotforex MT4 christmas & new year holiday market hours

- Trade stocks & metals with "$50 no deposit bonus" by xtrade

The bonus amount itself (30 USD of tickmill’s welcome account) cannot be withdrawn .

You can only withdraw profit from the ‘welcome account’ by meeting the following requirements.

Profit amount reaching 30 USD

The available profit withdrawal amount is from 30 – 100 USD.

The profit can be transferred from the welcome account to a live MT4 trading account (classic, pro or VIP account type) with tickmill ltd (FSA SC regulated).

Complete online registration & verification

Other than the welcome account, you also need to register a client area account, using the same information provided during the welcome account registration (name, surname, email, date of birth, etc.).

Also, you need to provide the necessary identification documents required to validate the client area account;

Deposit at least 100 USD

Once you opened a live MT4 trading account inside the client area, you need to deposit a minimum of $100 (or equivalent in other currencies).

After a deposit is made to a live MT4 account, please contact tickmill support via e-mail and request a transfer of profit from the welcome account to the live MT4 account.

The profit of the welcome account will be added to the balance of the live trading account with tickmill ltd (FSA SC regulated) and can be withdrawn immediately by using any of the available withdrawal options available in the client area.

Restricted trading strategies on tickmill MT4 (welcome account)

While trading in tickmill’s 30 USD welcome account, you must make sure that you are not violating any of their T&C.

Here are 3 main restricted trading strategies on the welcome account.

- Use of expert advisors (eas)

- Hedging trading positions internally (using other trading accounts held with tickmill) or externally (using other trading accounts held with other brokers) and thus avoiding market risk, is considered to be an abuse

- Using the failures in the quote flow for getting guaranteed profit or any other form of fraudulent activities are considered to be an abuse

For more information or inquiries regarding to the promotion, please contact support team from tickmill official website.

Posted by FXBONUS.Info

Please check tickmill official website or contact the customer support with regard to the latest information and more accurate details.

Tickmill official website is here.

Please click "introduction of tickmill", if you want to know the details and the company information of tickmill.

Post tags

Related

Other faqs

Related articles

What is technical analysis?

Is hotforex rescue bonus a "deposit bonus" for MT4? How does it work?

Why I don't see any of hotforex's bonus promotions in the official website?

What's the withdrawal condition of fxopen's cash back rebate bonus?

What is margin? What is leverage?

Page navigation

Recent comments

Comment by trust

I come here as a XM client ,I have created an account but I didn't not get my bonus

Comment by amas

My experience with xtrade was terrible. Fbs is great because I manage my bonus online everything is smooth.

Comment by fraz

Great tool for forex! Love how easy market help us trade to profit so i recomend easy market for you

Comment by ramsy

I login but no place to request bonus for free. Why is that. How to get no deposit bonus?

Comment by purple

Everyone your fbs loyalty points expires in a month so be careful. Better use it now than later.

Comment by dan

WCX possible fraud! WCX does not allow payouts (disable account). We have deposited our funds, traded them (30 BTC)! When trying to withdrawal we lost the welcome bonus accor.

Forex brokers

Here you can find the list of online forex & CFD brokers which run bonus promotions.

Tickmill withdrawal bonus

When you want to be able to have a top-class experience regarding what is considered to be one of the most optimal trading platforms within the industry of trading that will be will an opportunity that is free of risk, this can become your reality when you get the thirty dollars welcome account that is offered by tickmill at no cost to you. It is absolutely free. However, it is to be noted that when you use the tickmill trading platform as a new trader, there is no provision of access to a tickmill withdrawal bonus.

IF you get a $30 free trading bonus from tickmill, no deposit bonus can be withdrawn. A trader can withdraw only the profit that he made without a bonus amount. You can easily transfer profit from $30 to $100. Money needs to be transferred from a welcome account to a new live account by email or chat support request.

To take advantage of the free offer, it is certainly understood that you must engage in the opening of an account with the tickmill trading platform. The good news is that this free welcome offer is provided as a terrific opportunity for all traders. Therefore, this means that there are no limitations placed on who may participate in this awesome free offer that surely prevents a great level of risk for those who would like to try their hand at trading on the tickmill platform.

Tickmill is rather generous by grating the starting point of thirty dollars for free to welcome new traders to the platform. Therefore, it is noted that the funds associated with this endeavor are provided in US dollars. This money will allow traders to commence engaging in the conducting of trades via the forex market, which is done online.

While this welcome package from the tickmill platform is highly alluring, it is to be noted that each person who wishes to try this package for the sake of conducting trades on forex via this platform with no risk involved can only open this type of account one time. This means that they cannot have access to more than one such free welcome account of thirty dollars in US funds with this trading platform.

The good news is that the truth is presented right at the onset that there are no risks to those who get the thirty-dollar welcome package from this platform for free. This means that there are no snares to trap you slyly, and unexpectedly that can sometimes happen with some platforms that may not demonstrate high integrity levels toward traders. There are no extra costs with this platform when you engage in using this type of welcome package. It is also nice to realize that there are no hidden commission costs that are tagged onto this type of welcome package offered via this trading platform.

When someone is coming to the platform as a new investor, the person will need to commence with a welcome account on the tickmill platform. Then the person will be granted credentials for the sake of being able to login into the designated MT4 account.

The person can then commence engaging in the conducting of trades on the forex market by using the provision of the free funds in USD without the need to engage in the risk of using his or her own finances. If the person is successful in making a positive profit via the conducting of trade, the person is thus permitted to make a withdrawal of the profit in the amount of thirty to one hundred US dollars in such cases that the new trader complies with meeting the essential criteria for this type of transaction on this trading platform.

Therefore, if this trading platform by tickmill that is offering this amazing promotion gains your interest and curiosity, you will likely want to then make your way over to the promotion page hosted on the official website of tickmill. Once you arrive at the site, you will want to find FSA SC, then promotions, and the $30 welcome account.

It will then be needful to fill out the application form provided directly on the page of the promotion for the welcome account. When your application has been granted approval by the tickmill trading platform, your welcome account will be formulated, and t. Details that will enable you to log onto the trading platform will be delivered to the email address that you provide. Do note that these credentials are deemed only as valid for the sake of being able to provide access to the welcome account and do not provide you with any leverage of access to the client area of this trading platform.

You will then be able to enjoy commencing in the conducting of trades with this welcome account. You will need to be sure to engage in downloading the MT4, which refers to the metatrader4. Or you may decide to engage in accessing the platform via the web directly through the official website of tickmill. Another plus is the fact that you can engage in downloading applications for mobile devices as well, such as for ios devices and android devices.

When you are making efforts to conduct trades via the usage of the welcome account provided by tickmill with the provision of thirty US dollars at no cost to you, it is important to realize that there are some things to keep in mind. It is forbidden for you to engage in expert advisors’ usage when you are using a welcome account. Also, it is not permitted for you to apply a strategy that entails arbitrage trading when you use this type of trading account. This means that you are not allowed to engage in the hedging of trading positions at an internal level, such as using other designated accounts that you may have tickmill is holding that. It is also forbidden to engage in the usage of other accounts that are under the holding power of other brokers for trading purposes. It is also strictly prohibited to apply the usage of failures that are noted in the quote flow for the sake of obtaining a guaranteed profit.

Tickmill 30$ welcome bonus (no deposit required)

Tickmill, authorized by the FSA and FCA, is offering an opportunity to all its new clients to open a welcome trading account and receive a $30 free welcome bonus for trading. The traders can use the bonus and earn up to $100 profits!

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The clients must meet all the required conditions such as registration (providing personal documents), opening a live MT4 trading account, and making a $100 deposit (can be withdrawn with no limitation) to withdraw the profits. Then, they should notify the tickmill support department via an email. Afterward, both the deposit and profits can be withdrawn.

How to get the tickmill $30 no deposit bonus:

the new customers should go to the tickmill official website and register for a welcome account. Afterward, the bonus will be automatically transferred to the accounts. It can be used for trading and turning into profits.

Certain conditions:

this bonus is offered once per client.

The profits can be withdrawn only once (min $30, max $100).

The terms & conditions of this bonus are similar to those of live pro account.

The leverage can be adjusted according to your needs.

The bonus amount cannot be transferred or withdrawn.

Tickmill – $30 welcome bonus

Tickmill

Promotion name: welcome bonus

Note: this promotion is available to clients of tickmill ltd (FSA SC regulated) only.

How to get:

1. Start registering your client area at tickmill.

2. Tick the “yes” box to the welcome account question.

3. Click the validation link you’ll receive via email.

4. Enjoy trading on your welcome account.

Withdrawal requirements:

you can withdraw 30-100 USD of profits after you pass verification process and make at least $100 deposit.

More information:

welcome bonus is not available in algeria, armenia, australia, azerbaijan, belarus, bulgaria, columbia, georgia, hong kong, iceland, israel, kazakhstan, liechtenstein, macau, moldova, morocco, norway, state of palestine, switzerland, taiwan, tunisia, yemen, north korea, iran, USA, indonesia, venezuela, vietnam, lesotho, pakistan, bangladesh, ghana, egypt, russia, ukraine, uzbekistan, kyrgyzstan, tajikistan, turkmenistan, kenya and european union countries. This no-deposit promotion is available to new clients. Hedging trading is prohibited.

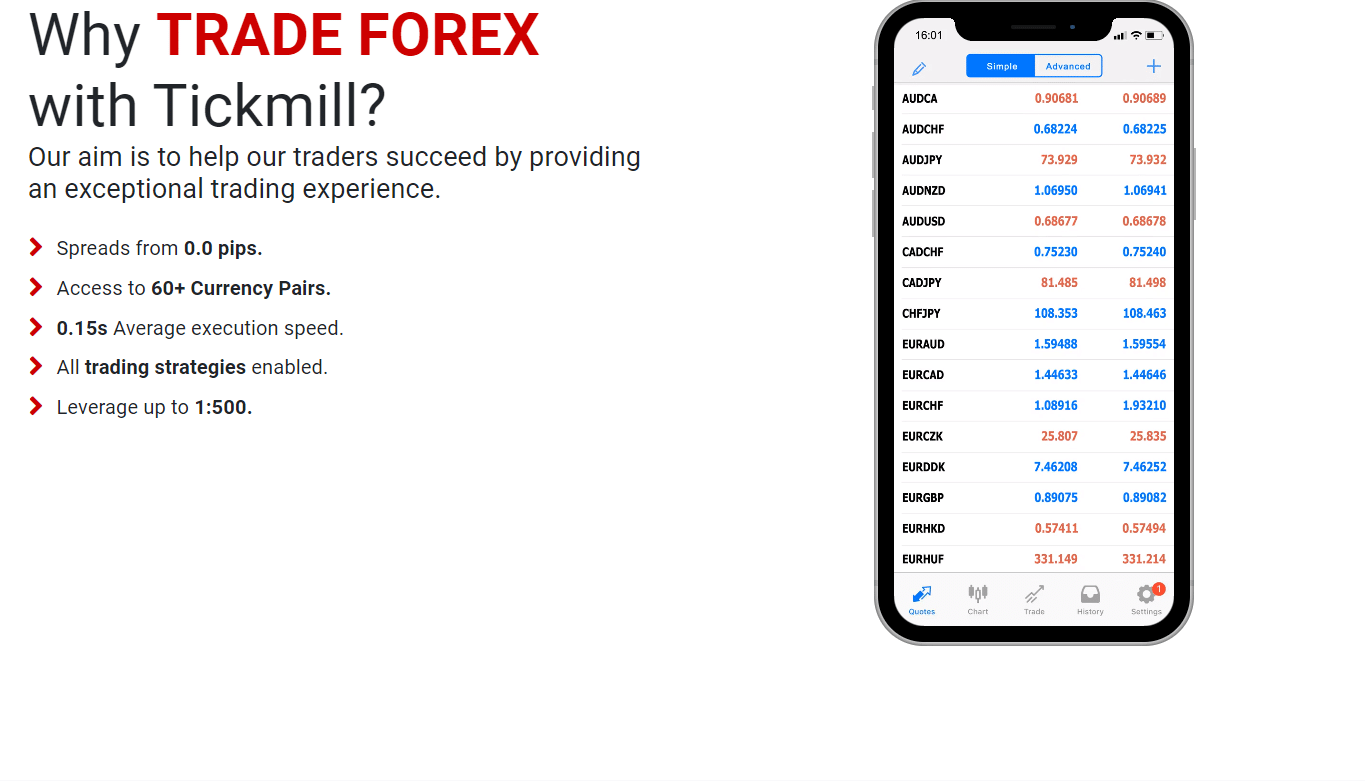

Information about the broker:

tickmill is a forex broker operated by tickmill ltd. Located in seychelles and regulated by the financial services authority of seychelles. Tickmill is also a trading name of tmill UK limited a company regulated by the financial conduct authority (FCA). Broker offers classic, ECN pro and VIP accounts. The minimum starting deposit is $€£100, spreads start from 0.0 pips, maximum leverage is 1:500. Broker review.

A comprehensive tickmill review – is this broker trustworthy?

Minimum deposit

Bonus

Maximum leverage

Year founded

Regulation

Trading platform

When setting out to start trading forex, stocks, or other tradable assets, one of the first things every trader should think about is a broker. The internet is full of scam brokerages that you absolutely need to stay away from, however, given how skilled they are at tricking potential customers, it may not be as easy to spot hidden flaws under their platform.

But it doesn’t mean that you have no means of distinguishing legitimate brokers from fraudulent ones. It just takes a little effort and research into the broker’s offerings to assess their credibility and make the right decision.

On forex trading bonus, we’re trying to make the broker selection process a little bit easier by offering our comprehensive reviews about them. And today, we’ll do the same for the tickmill forex broker.

In order to determine whether tickmill is a trustworthy broker or a scam, we will take a look at its website and software support, then move to the licensing, and finish off by talking about the actual trading conditions. So, let’s get started.

Initial overview

Tickmill is a forex broker established in 2015 in seychelles. The broker brings together a team of professional traders whose experience in this field has started off back in the 80s, therefore, the new clients of tickmill are already in good hands.

While the main focus of tickmil forex broker can be gathered from what we’ve just said – forex trading, the broker also offers many other instruments to its traders: stocks, indices, commodities, and bonds. But before we delve deeper into these instruments and what the actual conditions on them are, let’s do a brief overview of everything we’ll talk about in this article.

A brief tickmill.Com review

When you go to tickmill’s website, the first thing you’re going to notice is how slender and simplistic the interface looks. One image here or there, several visual effects, and very decent font make up a visual that is hardly ever distracting the visitor from getting the information.

And information is certainly there. We have seen websites with decent thematic separation but what we saw on tickmill was something else: the broker has divided the website into the sections that answer all the questions effortlessly. For instance, want to know the conditions for spreads? Go to the spreads & swaps section and find out everything about it.

This level of simplicity is definitely an advantage that we will take into account when making a final tickmill rating.

We were also pretty pleased when we came across 5 different account types on the website. All of them are designed for specific users and make trading a once-in-a-lifetime experience for them.

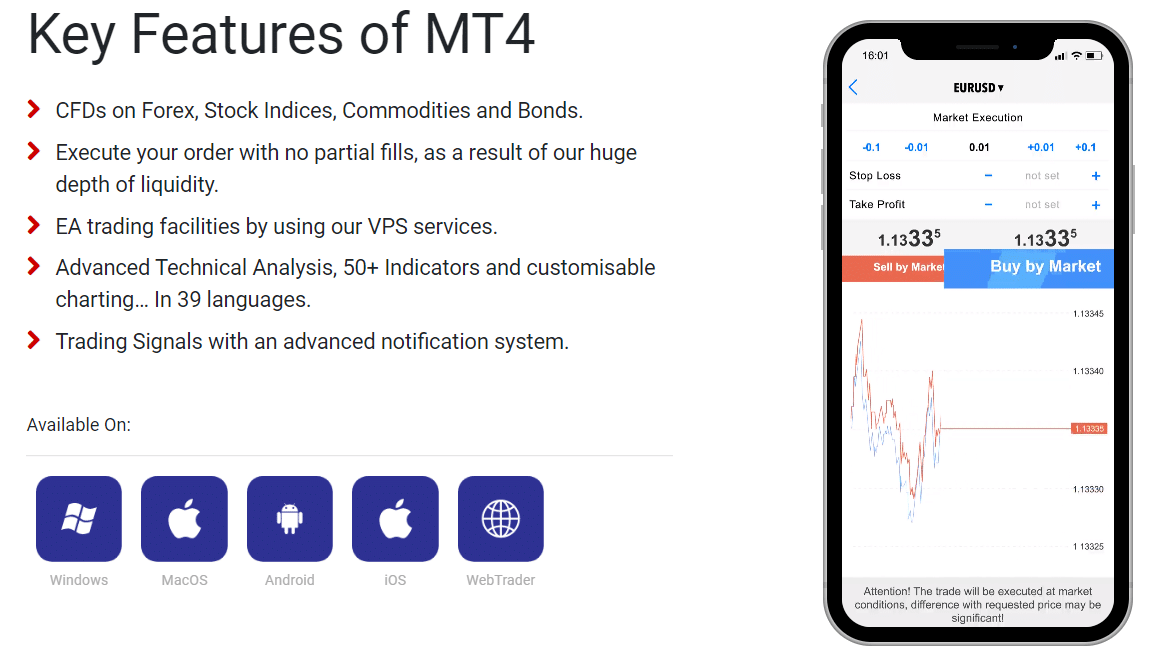

As for trading platforms, tickmill definitely doesn’t invent a bicycle here: it uses metatrader 4 and webtrader for all the trading executions. And to be fair, it doesn’t need to be original because these pieces of software have proven to be the most effective and efficient in this industry.

The license

Next up, we will take a look at the broker’s licensing material. This is the part that actually reveals a lot about the broker’s code of conduct and its legitimacy issues.

So, the very first line that you read when entering the website is this: “authorised and regulated: FSA SC, FCA UK, cysec.” this means that the broker has regulatory obligations to three separate countries and their financial institutions.

And actually going through these institutions can reveal a lot. For instance, when seeing that one of the main regulators of tickmill is the UK’s financial conduct authority, all the tickmill scam suspicions or suggestions are instantly dissipated for us. There’s just no way of being a scam and having this level of regulatory oversight monitoring your activities.

We will talk about this section more further down below.

Actual tickmill promotions

At last, we’ll discuss every important trading condition available on tickmill. We’ll start with the leverage and spreads. On the broker’s website, we can see that the maximum leverage ratio that the traders can use is 1:500, which is definitely a lucrative offering.

As for spreads, the broker offers two different levels of bid-ask price differences on forex pairs: 1.6 pips for classic account and 0 pips for pro and VIP accounts. Both conditions are pretty decent, although, as you can imagine, the 0-pip offering is far more attractive.

As for the tickmill bonus, the broker offers multiple promotions to its clients, ranging from the $30 welcome account, trader of the month, and many more. These bonuses give additional trading funds to the lucky winners who also can withdraw the bonus money to their personal account.

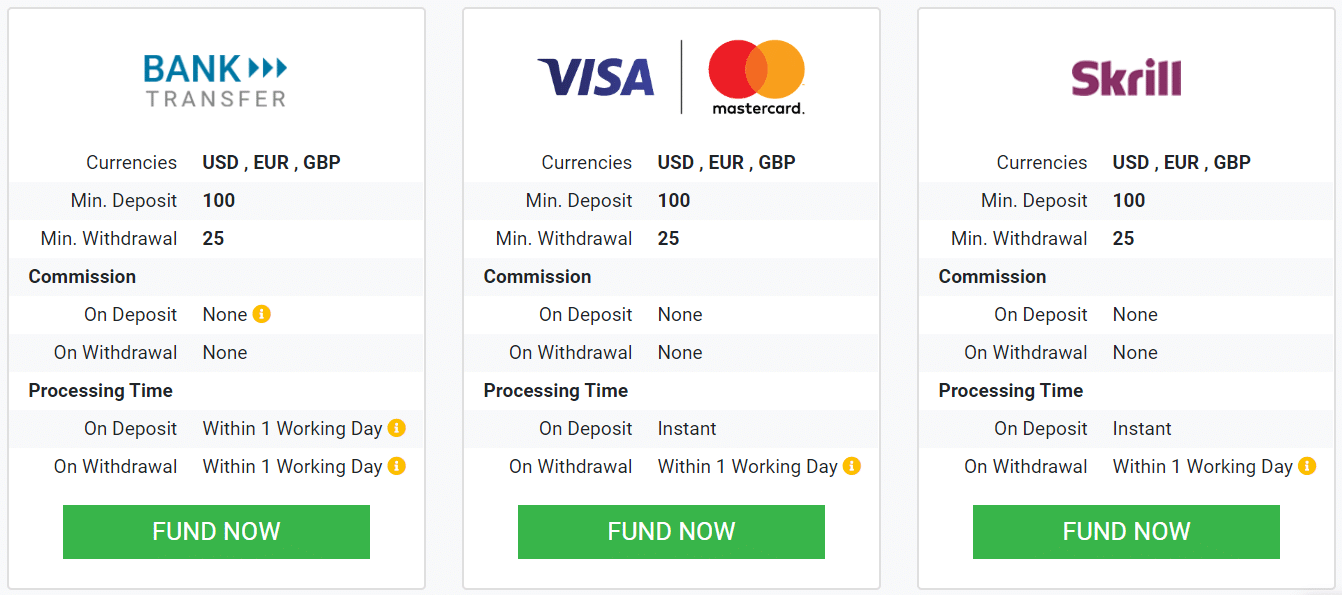

Finally, we’ll take a look at the minimum deposit requirement, as well as how you can make that deposit, as well as withdrawal. On tickmill, the minimum amount you need to deposit in order to set up a classic account is $100. As for financial platforms, the broker supports bank wire, credit/debit cards, as well as many e-wallets like neteller, skrill, etc.

In short, we think that tickmill is a trustworthy brokerage that offers quite impressive trading conditions to its clients. Now, let’s review each of the above-mentioned points more closely.

What’s the software experience like on tickmill?

As per usual, we’ll begin with the website. As we noted earlier, the visual side of the website is pretty spot-on: it’s not overburdened with unnecessary imagery or transition effects; everything is used moderately and adequately. What this achieves is it makes the navigation through the website much easier.

When it comes to finding the actual information on this website, it’s safe to say that all you need is one mouse click to go where you want. The website is separated into six different sections: trading, platforms, clients tools, promotions, partnerships, and about us. Within those sections, you can find anything about the broker’s regulatory measures, trading numbers, platforms, and payment methods.

As for the account types, there are five different packages that fulfill the demand coming from every type of trader: there are three live accounts (classic, pro, and VIP), one islamic, and one demo account. And all of them are special in their own way; some have lower spreads but higher minimum deposit requirements, some come with no swaps, etc. All in all, these accounts are perfect for specific users.

The last point of this section is trading software. Instead of going all fancy and offering proprietary trading software, tickmill chose a safer and more trustworthy route and gone with metatrader 4. MT4 is a well-tested and widely-used platform that has proven to be the most effective software across the board. What’s more, the broker also offers the MT4-based webtrader that works on all major web browsers.

Is tickmill legit?

Moving on, let’s talk about how legit the broker is based on its licensing materials. As we have already mentioned earlier, there are three separate regulatory pieces that monitor and even direct the broker’s financial activities, and all of them are pretty significant.

These licenses include: FSA from seychelles, FCA from the UK, and cysec from cyprus. Now, if there only was the FSA license, we would at least acknowledge the legitimacy of the tickmill scam suspicions. That’s because for some traders, seychelles isn’t the country with the biggest political or economic prowess to hold the broker accountable for its actions.

However, when we see the licensing materials from the UK and cyprus, all the suspicions are instantly dissipated. Just take a look at the FCA from the UK. Do you think that any brokerage would engage in fraudulent activity and be forgiven by this institution? We certainly don’t think that.

And then there’s the cysec license as some sort of cherry topping as it’s also a very strong licensing material from within the EU. In short, all three of the licenses make sure that the broker abides by the strictest financial rules.

Trading terms and conditions

Finally, let’s talk about what the actual offerings on tickmill are. As noted earlier, the leverage goes as high as 1:500, which is a very impressive and lucrative offering. With it, traders can increase their initial deposits by x500 times, increasing profits by the same multiplication rate.

As for the spreads, the bid-ask price difference for forex pairs is different on different account but the minimum spread can go as low as 0 pips, meaning there’s no actual price difference and traders can buy the same amount of assets as they sell.

When it comes to the bonuses, tickmill FX brokerage offers at least five different promotions: the trader of the month, tickmill’s NFP machine, $30 welcome account, IB contest, and rebate promotion. All of them offer money prizes to the traders, making the experience on tickmill so much better.

And finally, let’s talk about the minimum deposit requirements and financial platforms backing those deposits. On tickmill, the least amount of money you can deposit to your account is $100. This means that even the beginner traders can fire off their career on tickmill without breaking the bank.

The payment platforms that drive those deposits, as well as withdrawals, are also very attractive: the broker offers both traditional (bank wire, debit/credit cards) and e-wallet platforms (neteller, skrill, fasapay, etc). As for tickmill withdrawals, the same platforms can be used for taking out the money you have earned. And transactions are secured with the SSL protocol, which is the highest security standard in the industry.

Should you trade with tickmill?

So, what is our final tickmill opinion? Should you use its services and platforms to trade forex, stocks, and commodities?

Judging from what we’ve just said in this review, it is safe to say that the broker offers some of the most exciting trading conditions you can find on the market right now. Whether you want to leverage large trading positions with fewer of your own money, shallow spreads, or sophisticated financial mechanisms, you can never go wrong by choosing tickmill.

Besides, the broker has three separate licensing materials that ensure that there’s no tickmill fraud going on. In short, we freely recommend this broker with all its offerings and requirements.

Deposit and withdrawals

Add, transfer or withdraw funds with ease, using the payment method that's most convenient for you.

Control

your account

Being able to make a deposit or withdrawal on your own terms is so important to your trading experience. At tickmill we think it’s crucial that you’re able to manage your funds effectively. So, we provide a range of secure, instant and easy to use deposit and withdrawal options.

All deposits starting from 5,000 USD or equivalent, processed in one transaction by bank wire transfer, are included in our zero fees policy. *

We will cover your transaction fees up to 100 USD or equivalent. Just email a copy of your bank statement or any other confirmation document for the transferred deposit to our support team. Within one calendar month after the deposit was made we will compensate your fee.

*we reserve the right to charge a maintenance fee where there is a lack of trading activity.

Deposit / withdrawal methods

Some options are only available to residents of certain countries. Also note that, when you request a withdrawal from your client area, the withdrawal will be in the base currency of your trading account. E.G. If your trading account is in USD, then your withdrawal will be processed in USD.

| Currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | within 1 working day |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | PLN , USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | via alternative methods |

| currencies | EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | EUR , PLN , GBP , USD |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | during 1 working day |

| currencies | USD , EUR , GBP , PLN |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | within 1 working day |

Deposit and withdrawal conditions

Simply login to your client area and click on the green ‘deposit’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to deposit in. Step 2, will then automatically appear below.

Step 2: you then select the payment method using the buttons on the right of the payment method table. Step 3 will then automatically appear below.

Step 3: state how much you would like to deposit into your account.

You may also be prompted to enter the currency in which you’d like to make the deposit and some other options.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

We do not accept any payments made via a third-party source.

You must only use payment methods that are under your name and lawfully belong to you.

We reserve the right to require proof from you at any time. Failure to comply with this, will result in your payment getting frozen or being refunded.

We reserve the right to apply a penalty processing fee if a third-party payment is made.

If you use a credit/debit card to deposit, we may require scanned colour copies of both sides of your card to combat fraud. But, please do NOT send us any copies if we didn’t ask for them.

– upon receiving our request and before sending any copies to us, please cover (black-out) all digits except the last 4 on the front side of your card for security purposes.

– please also cover (black-out) the CVV code on the back of your card.

– all other details must be clear and visible.

– your card must be signed, and your signature must be clear and readable.

Please be informed that we will NEVER ask you for any sensitive card details (such as your full card number, CVV code, 3D-secure code, PIN code, etc.). If you received a suspicious request for any sensitive details from an unclear source, please contact us immediately.

If your credit/debit card deposit was unsuccessful, please try depositing again, while checking if:

– you have entered your card details correctly.

– you’re using a valid (not expired) card.

– you have sufficient funds on your card.

– if all of the above is fine, but your card deposit is still unsuccessful, it may mean that your issuing bank does not authorise your card to make the deposit. In that case, please use another card or any other payment method available in your trading account.

Simply login to your client area and click on the ‘withdrawal’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to withdraw from. Step 2, will then automatically appear below.

Step 2: you then select the method of withdrawal using the buttons on the right of the table. Step 3 will then automatically appear below.

Step 3: state how much you would like to withdraw from your account. Depending on the withdrawal method, you may have to enter more information related to the withdrawal type.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

As a general rule, we only process withdrawals back to the payment method you originally used for depositing.

For credit cards ONLY:

– if you use a credit/debit card to deposit, we will always send the same total amount of withdrawals equal to your total deposits back to your card. Any remaining withdrawal amount which is above the deposited amount, will be processed to the payment method of your choice.

Example: if you deposited $100 by credit/debit card, earned a profit of $1,000 and requested a withdrawal of $1,000, you will get $100 back to your card and the remaining $900 to the payment method of your choice.

Alternative payment methods:

– if you use a credit/debit card and another method (e.G.: skrill ewallet) to deposit, your withdrawal will first be processed back to your card and any remaining withdrawal amount will be sent back to the other method used (e.G.: skrill ewallet).

Example: if you deposited $100 by skrill and $50 by credit/debit card, and requested a withdrawal of $90, you will get $50 back to your card and $40 to your ewallet.

Internal transfers from an MT4 account to another MT4 account are instant when the base currencies of both accounts are the same.

If the base currencies of the MT4 accounts are different, such internal transfers should be requested manually by sending an email to [email protected] .

Please familiarise yourself with our general terms & conditions found on our website. Our customer support team is available monday – friday 07:00 am – 20:00 pm GMT to assist you if you need any help with making your payments.

It’s also important to note that, should we become aware that you’re purposely abusing our payment methods, we reserve the right to close your account and also charge you all applicable transfer and refund fees incurred on our side.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

Forex & cfds

Futures

TRADING CONDITIONS

Forex & cfds

Futures

TRADING ACCOUNTS

Forex & cfds

Futures

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

ABOUT US

SUPPORT

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ. Authorised and regulated by the financial conduct authority. FCA register number: 717270.

Clients must be at least 18 years old to use the services of tickmill UK ltd.

Risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading cfds or our other products and seek advice from an independent adviser if you have any doubts. Past performance is not indicative of future results. Please refer to the summary risk disclosure.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Free $30 tickmill special welcome bonus

Hello beginners! Want to start trading without deposit your money? The tickmill broker offers a free $30 no deposit welcome bonus to all new clients. The tickmill offers the bonus to kick the bad broker or demo account. Start risk free live trading with earning profit.

How to join:

Get a free $30 and start trading

Valid: unlimited time

Withdrawal: yes profit can be withdrawn

Terms and conditions:

You need to verify your account completely.

Need a unique IP and device to get the bonus.

The welcome account is not available for all countries, check before apply.

You can trade up to 60 days

The trading platform is MT4

General terms and conditions apply.

RELATED ARTICLESMORE FROM AUTHOR

$25 USD N0 deposit bonus – tiomarkets

Fortfs team welcomes new traders 35 USD

$25 no deposit bonus (welcome) – xtreamforex

31 COMMENTS

I have liked these website and it us a very good website

I have really liked this site and I my self am having abussiness of selling agricultural out puts and am also looking for support from you, now how can I do that?

I started with them two years ago and the services have been good so far until june last year when their services went bad. Initially, I noticed the charts became unstable. Also, the stop loss was not really effective as it used to be. After I lost 50% of my money, I requested for withdrawal in september but they kept using delay tactics by requesting for unnecessary documents. I was also billed to pay for withdrawal fee. It was in january I noticed my account was no longer accessible and I realised they were trying to play a fast one on me. Immediately, I contacted:

chancynthia086@gmail. Com

I followed as instructed and I’m happy to say I got my money back. I really hope they can improve on their services like it was before.

This is a good one for me, it’s helpful for my business

Tickmill 30$ welcome bonus (no deposit required)

Tickmill, authorized by the FSA and FCA, is offering an opportunity to all its new clients to open a welcome trading account and receive a $30 free welcome bonus for trading. The traders can use the bonus and earn up to $100 profits!

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The newly registered clients are required to open a welcome account at the tickmill broker to apply for this promotion. The bonus can be used for three months (non-withdrawable) after which the account can only be accessed for 30 days to claim the profits.

The clients must meet all the required conditions such as registration (providing personal documents), opening a live MT4 trading account, and making a $100 deposit (can be withdrawn with no limitation) to withdraw the profits. Then, they should notify the tickmill support department via an email. Afterward, both the deposit and profits can be withdrawn.

How to get the tickmill $30 no deposit bonus:

the new customers should go to the tickmill official website and register for a welcome account. Afterward, the bonus will be automatically transferred to the accounts. It can be used for trading and turning into profits.

Certain conditions:

this bonus is offered once per client.

The profits can be withdrawn only once (min $30, max $100).

The terms & conditions of this bonus are similar to those of live pro account.

The leverage can be adjusted according to your needs.

The bonus amount cannot be transferred or withdrawn.

Making a withdrawal from your savings

We’re much busier than usual, so if you post us a withdrawal form it could take us up to 2 weeks to make your payment.

Also, there are delays to UK postal services, so please allow extra time when you're sending or expecting to receive something.

It’s much quicker to do it online if you have an online account with us.

How to take money out

Premium bonds

You can cash in all or part of your bonds at any time.

If you’re registered to manage your savings online or by phone, simply log in or call us.

Not registered? You can easily withdraw money from yours or your child’s premium bonds without needing to create an online profile. All you need to do is fill out a quick online form. Make sure you have your account details to hand.

Please note: you must be the person responsible for the child’s premium bonds in order to withdraw them or close the account.

Want to cash in specific bonds?

If you’d like to take money out of premium bonds, but make sure that certain bonds are kept in the draw, you can do this online using a form.

You can also download, print and complete a cashing in form. Then post your completed form to us together with the bond certificates to be cashed in (if you have them).

Don’t have access to a printer? Call us and we’ll send you a copy of the form.

Find out how long it takes to receive your payment using the calculator below

Direct saver

Find out how long it takes to receive your payment using the calculator below

Direct ISA

Find out how long it takes to receive your payment using the calculator below

Income bonds

You can cash in all or part of your income bonds amount at any time. The minimum you can take out is £500. At least £500 must stay in your account to keep it open.

If you’re registered to manage your savings online or by phone, simply log in or call us.

Not registered? You can easily withdraw money from your income bonds without needing to create an online profile. All you need to do is fill out a quick online form. Make sure you have your account details to hand.

You can also download, print and complete a cashing in form. Then post your completed form to us.

Don’t have access to a printer? Call us and we’ll send you a copy of the form.

Find out how long it takes to receive your payment using the calculator below

Junior ISA

You can't make withdrawals from a junior ISA. On the child’s 18th birthday, we’ll automatically transfer the money to an adult cash ISA from NS&I. The child will then be able to withdraw money. We’ll contact the person who looks after the account about a month before the transfer happens.

Investment account

The minimum you can withdraw is £1 and at least £1 must remain in your account to keep it open.

You can easily withdraw money from your investment account without needing to create an online profile. All you need to do is fill out a quick online form. Make sure you have your account details to hand.

It will take a bit longer, but you can also complete a withdrawal form and send it to us.

Don’t have access to a printer? Call us and we’ll send you a copy of the form.

Find out how long it takes to receive your payment using the calculator below

Guaranteed growth bonds

Bonds that started on or before 30 april 2019

You can cash in your bond at the end of your chosen term with no penalty.

You can also cash in before that, but we will deduct a penalty from your payment equivalent to 90 days’ interest on the amount cashed in. Bear in mind that if you cash in all of your bond within 90 days of investing, you will get back less than you invested.

When you cash in part of a bond, at least £500 must remain in the bond to keep it open.

How to cash in

Log in or call us at any time with your NS&I number and password to hand.

Or complete a cashing in form and send it to us.

Find out how long it takes to receive your payment using the calculator below

Bonds that started on or after 1 may 2019

You have to keep your bond for the whole of the chosen term – you can’t cash it in before then.

Guaranteed income bonds

Bonds that started on or before 30 april 2019

You can cash in your bond at the end of your chosen term with no penalty.

You can also cash in before that, but we will deduct a penalty from your payment equivalent to 90 days’ interest on the amount cashed in. Bear in mind that if you cash in all of your bond within 90 days of investing, you will get back less than you invested.

When you cash in part of a bond, at least £500 must remain in the bond to keep it open.

How to cash in

Log in or call us at any time with your NS&I number and password to hand.

Or complete a cashing in form and send it to us.

Find out how long it takes to receive your payment using the calculator below

Bonds that started on or after 1 may 2019

You have to keep your bond for the whole of the chosen term – you can’t cash it in before then.

Index-linked savings certificates

Cashing in early

Index-linked savings certificates are designed to be held for the whole of your chosen investment term. You can cash in at the end of a term with no penalty or loss of interest.

If you cash in early we will deduct a penalty from your payment, equivalent to 90 days’ interest on the amount cashed in. And you’ll lose the index-linking on your whole certificate for that investment year.

Bear in mind that if you cash in all of your certificate within 90 days of renewing, you will get back less than your renewal value.

When you cash in part of a certificate, at least £100 must remain in the certificate to keep it open.

How to cash in

Registered for our online and phone service? Log in or call us at any time with your NS&I number and password to hand.

Find out how long it takes to receive your payment using the calculator below

Fixed interest savings certificates

Fixed interest savings certificates are designed to be held for the whole of your chosen investment term. You can cash in at the end of a term with no penalty or loss of interest.

If you cash in early we will deduct a penalty from your payment, equivalent to 90 days’ interest on the amount cashed in.

When you cash in part of a certificate, at least £100 must remain in the certificate to keep it open.

Bear in mind that if you cash in all of your certificate within 90 days of renewing, you will get back less than your renewal value.

How to cash in

Registered for our online and phone service? Log in or call us at any time with your NS&I number and password to hand.

Or complete a cashing in form and send it to us.

Find out how long it takes to receive your payment using the calculator below

Investment guaranteed growth bonds

Cashing in early

Investment guaranteed growth bonds are designed to be held for the whole of the 3-year investment term. You can cash in your bond at the end of the 3-year term with no penalty.

You can also cash in before that, but we will deduct a penalty from your payment equivalent to 90 days’ interest on the amount cashed in.

When you cash in part of a bond, at least £100 must remain in the bond to keep it open.

How to cash in

Log in at any time with your NS&I number and password to hand.

How long will it take?

We’ll send your payment within three working days.

Children's bonds

Cashing in early

Children’s bonds are designed to be held for the whole of the 5-year term. The person who looks after the bond can cash in at the end of a term with no penalty.

You can also cash in before that, but we will deduct a penalty from the payment equivalent to 90 days’ interest on the amount cashed in.

When you cash in part of a bond, at least £25 must remain in the bond to keep it open until maturity.

Bear in mind that if you cash in all of a bond within 90 days of renewing, you will get back less than the renewal value.

How to cash in

If you’re registered to manage your savings online or by phone, simply log in or call us.

Not registered? You can easily withdraw money from your children’s bonds without needing to create an online profile. All you need to do is fill out a quick online form. Make sure you have your account details to hand.

It will take a bit longer, but you can also download, print and complete a cashing in form. Then post your completed form to us.

Don’t have access to a printer? Call us and we’ll send you a copy of the form.

Find out how long it takes to receive your payment using the calculator below

The time it takes to receive a withdrawal depends on which NS&I account you have, how much you want to take out and how you give us your withdrawal instruction. The quickest way to get your money is to tell us online or by phone. Use our calculator below to find out when you'd receive your payment.

Payment timeline calculator

The calculator is designed to tell you when you would receive a single withdrawal from one account. If you’re making more than one withdrawal on the same day, or want full details of our withdrawal timescales, please see below.

Withdrawal faqs

Withdrawals from your direct ISA, direct saver, income bonds or investment account up to £50,000

Online and phone

The payment will normally reach your account by the end of the first banking day after the day we receive your instruction.

If we get your instruction on a banking day before 13:00, we'll process it on the next banking day. The payment will normally reach your account on the banking day after that. If we get your instruction after 13:00 on a banking day, or on a weekend or bank holiday, we'll act as if we received it on the following banking day.

The same timescales apply to further withdrawals from any of these accounts on the same day, as long as the total you withdraw is no more than £50,000.

Multiple withdrawals from your direct ISA, direct saver, income bonds and investment account totalling more than £50,000 in one day

If a withdrawal from one of these accounts takes your combined daily withdrawal total above £50,000, the following timescales will apply:

Online and phone

When we get your instruction on a banking day before 20:00, we’ll process it that day. The payment will normally reach your account two banking days after that. If we receive your instruction after 20:00 on a banking day, or on a weekend or bank holiday, we'll act as if we received it on the following banking day.

When we get your instruction on a banking day before 13:00 we'll process it on the next banking day. The payment will normally reach your account two banking days after that. If we get your instruction after 13:00 on a banking day, or on a weekend or bank holiday, we'll act as if we received it on the following banking day.

The same timescales apply to further withdrawals from any of these accounts on the same day.

Withdrawals from other NS&I accounts and all withdrawals above £50,000

Online and phone

When we get your instruction on a banking day before 20:00, we’ll process it that day. The payment will normally reach your account two banking days after that. If we get your instruction after 20:00 on a banking day, or on a weekend or bank holiday, we'll act as if we received it on the following banking day.

When we get your instruction on a banking day before 13:00 we'll process it on the next banking day. The payment will normally reach your account two banking days after that. If we get your instruction after 13:00 on a banking day, or on a weekend or bank holiday, we'll act as if we received it on the following banking day.

So, let's see, what we have: the bonus amount itself (30 USD of tickmill's welcome account) cannot be withdrawn. You can only withdraw profit from the 'welcome account' by meetin... At how to withdraw money from tickmill bonus account

Contents of the article

- Top forex bonus promo

- How to withdraw money from tickmill bonus account

- Restricted trading strategies on tickmill MT4 (welcome...

- Posted by FXBONUS.Info

- Page navigation

- Recent comments

- Forex brokers

- Tickmill withdrawal bonus

- Tickmill 30$ welcome bonus (no deposit required)

- Tickmill – $30 welcome bonus

- Tickmill

- A comprehensive tickmill review – is this broker...

- Initial overview

- What’s the software experience like on tickmill?

- Is tickmill legit?

- Trading terms and conditions

- Should you trade with tickmill?

- Deposit and withdrawals

- Control your account

- Deposit / withdrawal methods

- Deposit and withdrawal conditions

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- Forex & cfds

- Futures

- TRADING CONDITIONS

- Forex & cfds

- Futures

- TRADING ACCOUNTS

- Forex & cfds

- Futures

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Free $30 tickmill special welcome bonus

- RELATED ARTICLESMORE FROM AUTHOR

- $25 USD N0 deposit bonus – tiomarkets

- Fortfs team welcomes new traders 35 USD

- $25 no deposit bonus (welcome) – xtreamforex

- Tickmill 30$ welcome bonus (no deposit required)

- Making a withdrawal from your savings

- How to take money out

- Premium bonds

- Direct saver

- Direct ISA

- Income bonds

- Junior ISA

- Investment account

- Guaranteed growth bonds

- Guaranteed income bonds

- Index-linked savings certificates

- Fixed interest savings certificates

- Investment guaranteed growth bonds

- Children's bonds

- Payment timeline calculator

- Withdrawal faqs

- Withdrawals from your direct ISA, direct saver, income...

- Multiple withdrawals from your direct ISA, direct saver,...

- Withdrawals from other NS&I accounts and all withdrawals...

Comments

Post a Comment