Reliable forex brokers, reliable forex brokers.

Reliable forex brokers

Therefore, in order to trade fx you should be authorized dealer to do so, as well as operate a quite sufficient amount so before forex brokers were introduced to retail traders and global community it was not possible for trade markets.Top forex bonus promo

For this reason, forex trading brokers are the companies or agent if you like that gives retail forex traders access through its platform to operate forex market and trade various markets including commodity futures, indices, bonds, etc. In order to check if broker is regulated or not, you should verify this information through the official brokers’ website first, as regulated companies always provide its licenses. And the next step is to verify a license through the official regulatory website. However, in our forex broker review you will find all the necessary information and license check as well.

Brokers

Regulated forex brokers

When viewing the forex broker or a trading platform, it is the paramount priority to choose from the hundreds the most reliable one and the best forex provider, as it will determine the whole trading experience. Indeed, doing research and compare the vast number of forex brokers with many aspects to consider, maybe not an easy choice, as well time-consuming. So here we are ready to assist your selection and answer the most common questions.

Can I trade forex without a broker?

This may be the first question you would ask, as indeed forex market, FX or currency market is the largest global non-centralized exchange where trading process performed electronically via networks. While main forex participants are international banks and financial institutions operating huge volumes through a need to exchange currencies, presented as currency pairs, and assist international business with the conversion which is known as the interbank market.

Therefore, in order to trade fx you should be authorized dealer to do so, as well as operate a quite sufficient amount so before forex brokers were introduced to retail traders and global community it was not possible for trade markets. For this reason, forex trading brokers are the companies or agent if you like that gives retail forex traders access through its platform to operate forex market and trade various markets including commodity futures, indices, bonds, etc.

Do I need license to trade forex?

So this is another pleasant and great opportunity which is given by forex brokers, as you may access trading without financial or dealer license. Moreover, there are hundreds of opportunities with a relatively small investment which allows you to trade forex, do technical analysis and analyze markets almost instantly.

Are forex brokers regulated?

And now we will check the most crucial question if forex broker can be regulated, since the market is decentralized, and is it safe to trade forex? Obviously, this is the biggest trump you may fall as a retail trader if you choose a non-reliable, mainly non-regulated or offshore firm without a proper license you may easily fall into a scam and lose money.

So due to increasing demand and mainly that traders got no easy access to trading or financial education, the world countries established particular organizations or authorities in order to oversee the market proposals and regulate forex broker firms. So yes, forex brokers are regulated while holding a license from a local authority alike world known FCA in the UK, ASIC in australia, commodity futures trading commission CFTC in the USA, MAS in singapore and more.

What does a regulated broker mean?

The whole concept of regulation is to oversee forex business in a particular country or region, protect clients and ensure safe conditions while trading forex. So in simple words, regulated broker means a safe and legit broker that is compliant to various rules and criteria set by the international authority with the purpose to provide secure trading and good customer service. So its trading environment and provided services like technical analysis, education and tools are also aligned to the best practices.

In addition to its constant check on the service providing, authorities protecting clients throughout compensation schemes and other security checks, however, these conditions may vary from the regulator to another.

How do I know if my forex broker is regulated?

In order to check if broker is regulated or not, you should verify this information through the official brokers’ website first, as regulated companies always provide its licenses. And the next step is to verify a license through the official regulatory website. However, in our forex broker review you will find all the necessary information and license check as well.

It is a fact, unscrupulous brokers may easily fake information and assure you of its license while its not true, so always verify information through the official source. As well, adhere to trade with brokers regulated in serious jurisdictions, not the offshore once, as they luck of strong regulation, requirements and necessary safety measures. Read more by the link why avoid brokers from st vincent & the grenadines.

How to choose best forex broker?

Security of funds is always first in forex trading, for that reason, we recall your attention to open an account with regulated brokers only. Making it simple, regulated broker means that you will trade forex with proper security of funds and investment itself, so first of all good broker is a sharply regulated broker.

Further on, you should also check the necessary conditions and select offer suitable for you and trading strategy you deploy.

For this reason, we assist your selection and provide an assortment of efficient regulated brokers with updated on a weekly basis in-depth forex broker list. A professional detailed analysis with trading fees account overview, platform breakdowns while sorted by regulation, country or trading conditions, along with traders comments so smarter decision is easier now.

How to find a reliable forex broker

Reliable forex signals

Are you baffled by the sheer number of options there is out there for choosing a forex broker or reliable forex brokers. There are dozens of major forex brokers to choose from and it can be very difficult to decide which one you want and which you should trust. A foreign exchange broker will affect every trade you make — and some brokers simply aren’t trustworthy or even legitimate. Here are a few things that you can do to find the best and most reliable forex broker available.

You can usually determine a fake review in a few ways: they will all be fairly similar, the reviewers will have only posted one review on the site, and they won’t mention anything negative about the particular forex broker at all. By the same token, remember that unhappy or inexperienced traders can write bad reviews just because they themselves had a negative trading experience. Bad reviews in and of themselves don’t necessarily indicate a bad FX broker.

What to look for in a reliable broker

Nearly every reputable forex broker out there will let you open an demo account to test and practice on. This lets you see whether that broker is the right one for you. Here are a few other things that you should be looking for:

- Currency pairs. Most reliable brokers will carry all major currency pairs. However there are strategies that bank on trading less common currency pairs. If so, you need a broker that supports them. Only some bigger brokers support the more exotic pairings.

- Technology. Your broker should support multiple platforms for trading. Many of the leading brokerage firms have apps in addition to web-based platforms. You’ll have to access your brokerage from a variety of locations, so trading with a broker who caters to you technologically, is essential. The metatrader 4 is a very popular and super flexible platform to get started with. Us dollar

- Trade with our daily FX signals.

Avoiding bad forex brokers: signs to look out for

Some brokerages are just bad. They’re designed to drain money from you from every trade, which can ultimately sabotage even the most successful of strategies. These brokerages could also potentially disappear from the scene entirely.

Here are a few things you should look out for to avoid bad brokers: forex strategies

- New brokers. New brokers aren’t necessarily scams but they have less activity to judge them upon. A reliable/good broker should have at least a couple of years of experience within the industry. It’s better for those new to forex to stay with more established brokers. Trading signals

- Urgent deals. Is the brokerage offering you more leverage if you sign up in the next 24 hours? Is everything on their site geared towards getting you to sign up immediately? Brokers only use these tactics if they are trying to hook you before you’ve done your research: for instance, sending you a pop-up ad once you leave their site. Good brokers simply don’t need to resort to these tactics because they get their customers through word of mouth and quality of service.

- Bad support. If customer support is slow to respond or rude to you, you already know that you aren’t valued as a trader. If you run into serious issues down the line, it’s likely that you won’t have anyone to turn to. It’s better to go with a better supported broker even if fees are slightly more expensive. Try to contact support when signing up for an account to test out how well they support you. Fx news

Finding a reliable #account is essential

Finding the right broker is absolutely essential to your success as a trader for reliable forex broker. Your choice of forex broker will have an impact on every trade you open and close, and will be able to contribute to your financial gains through technology, support, and low overheads. The good news is that there are many reputable and responsible brokerages available, you just need to find the right one for you.

Remember that in all things, if it’s too good to be true, it usually is. Brokerage scams tend to bring in new investors by offering “too good to be true” promotions and deals. In trading, it’s good to be greedy — but only to a certain extent. Do your research and you should be able to protect yourself on this vital first step towards a profitable trading venture with a reliable forex broker.[/vc_column_text][/vc_column][/vc_row]

Reliable forex brokers

О рынке forex

Fortfs предлагает трейдинг на forex и других международных финансовых рынках. Торговля ведется в целях спекуляции и страхования финансовых активов. Например, производители и экспортеры таких товаров, как нефть, газ, золото, серебро, платина, палладий, пшеница, кофе, какао, соевые бобы и т.П. Ежеквартально инвестируют в соответствующие товарные контракты на фьючерсы и применяют опционы, либо производные CFD инструменты для ограничения влияния резких колебаний цен на свою прибыль. Следовательно, они обеспечивают защиту и приумножение активов своих компаний. Преимущества и различия CFD на фьючерсы от биржевых фьючерсов часто не остаются без внимания даже опытными хеджерами и инвесторами.

Fortfs отслеживает новые и наиболее перспективные тренды на мировых валютных и биржевых площадках. Так, одним из восходящих трендов в мире финансов стало инвестирование в ETF CFD контракты на целые экономические регионы: USA, азия, европа, африка, индия, латинская америка.

Компания использует сервисы не только для квалифицированных инвесторов, но также и для начинающих трейдеров с небольшим опытом на форекс. В основном они используют такие услуги fortfs, как счет для новичка, бонус без депозита (приветственный бонус), бонус на депозит и бонус, поддерживающий маржу (support margin bonus).

Брокер fortfs предоставляет инвестиционные сервисы для клиентов, желающих получать стабильный пассивный доход. S.T.A.R. И copytrading (копитрейдинг) востребованы опытными трейдерами, которые извлекают дополнительный доход, являясь управляющими фондов.

Регулярные торговые сигналы, уникальная аналитика, эксклюзивные биржевые обзоры и экономические новости, литература о FX, валютном трейдинге, обучающие материалы для новичков, аналитические и практические вебинары для трейдеров – вся совокупность информации об инвестировании и спекуляции на бирже широко представлена fortfs.

Мы стремимся не только расширять линейку своих программ и сервисов для клиентов, но также постоянно улучшаем качество предоставляемых услуг на рынке forex. Передовые алгоритмы обработки торговых ордеров и контракты с лучшими провайдерами ликвидности помогли завоевать fortfs международное признание в рейтинге (TOP 10) лучших брокеров ECN с NDD исполнением.

Fort financial services LTD,

registration number 25307 BC 2019

suite 305, griffith corporate centre

P.O. Box 1510, beachmont kingstown

st vincent and grenadines

Fort financial services LTD зарегистрирован на территории сент-винсента и гренадин как международная бизнес-компания с регистрационным номером 25307 BC 2019. Объектом деятельности компании является любая деятельность, разрешенная законом о международных коммерческих компаниях (включая внесенные поправки), главой 149 пересмотренных в 2009 году законов сент-винсента и гренадин, и включает в себя, не ограничиваясь, осуществление любых коммерческих, финансовых, кредитных операций, заимствования, торговлю, оказание услуг и участие в других предприятиях, а также предоставление брокерских услуг, обучение и управление счетами, торгующими валютой, сырьевыми товарами, индексами, CFD и финансовыми инструментами с использованием заемных средств.

Торговля на финансовых рынках сопряжена со значительными рисками, включая возможность полной потери инвестиционного капитала. Данный вид деятельности подходит не всем инвесторам. Высокое кредитное плечо увеличивает риск (уведомление о рисках).

Клиент имеет право отказаться от услуг компании. В этом случае возврат денежных средств осуществляется согласно клиентскому соглашению и политике возврата денежных средств.

Деятельность компании соответствует нормам международного законодательства по предотвращению преступной деятельности, отмыванию денег и финансированию терроризма (AML policy и политика "знай своего клиента").

Компания ERA TODAY ltd (agiou athanasiou, 74 agios athanasios, 4102 limassol, cyprus), AREA SOFT LLP заключила партнерское соглашение с fort financial services ltd.

Сервис недоступен гражданам и резидентам США, а также для любых общественно-политических деятелей.

Brokers

Regulated forex brokers

When viewing the forex broker or a trading platform, it is the paramount priority to choose from the hundreds the most reliable one and the best forex provider, as it will determine the whole trading experience. Indeed, doing research and compare the vast number of forex brokers with many aspects to consider, maybe not an easy choice, as well time-consuming. So here we are ready to assist your selection and answer the most common questions.

Can I trade forex without a broker?

This may be the first question you would ask, as indeed forex market, FX or currency market is the largest global non-centralized exchange where trading process performed electronically via networks. While main forex participants are international banks and financial institutions operating huge volumes through a need to exchange currencies, presented as currency pairs, and assist international business with the conversion which is known as the interbank market.

Therefore, in order to trade fx you should be authorized dealer to do so, as well as operate a quite sufficient amount so before forex brokers were introduced to retail traders and global community it was not possible for trade markets. For this reason, forex trading brokers are the companies or agent if you like that gives retail forex traders access through its platform to operate forex market and trade various markets including commodity futures, indices, bonds, etc.

Do I need license to trade forex?

So this is another pleasant and great opportunity which is given by forex brokers, as you may access trading without financial or dealer license. Moreover, there are hundreds of opportunities with a relatively small investment which allows you to trade forex, do technical analysis and analyze markets almost instantly.

Are forex brokers regulated?

And now we will check the most crucial question if forex broker can be regulated, since the market is decentralized, and is it safe to trade forex? Obviously, this is the biggest trump you may fall as a retail trader if you choose a non-reliable, mainly non-regulated or offshore firm without a proper license you may easily fall into a scam and lose money.

So due to increasing demand and mainly that traders got no easy access to trading or financial education, the world countries established particular organizations or authorities in order to oversee the market proposals and regulate forex broker firms. So yes, forex brokers are regulated while holding a license from a local authority alike world known FCA in the UK, ASIC in australia, commodity futures trading commission CFTC in the USA, MAS in singapore and more.

What does a regulated broker mean?

The whole concept of regulation is to oversee forex business in a particular country or region, protect clients and ensure safe conditions while trading forex. So in simple words, regulated broker means a safe and legit broker that is compliant to various rules and criteria set by the international authority with the purpose to provide secure trading and good customer service. So its trading environment and provided services like technical analysis, education and tools are also aligned to the best practices.

In addition to its constant check on the service providing, authorities protecting clients throughout compensation schemes and other security checks, however, these conditions may vary from the regulator to another.

How do I know if my forex broker is regulated?

In order to check if broker is regulated or not, you should verify this information through the official brokers’ website first, as regulated companies always provide its licenses. And the next step is to verify a license through the official regulatory website. However, in our forex broker review you will find all the necessary information and license check as well.

It is a fact, unscrupulous brokers may easily fake information and assure you of its license while its not true, so always verify information through the official source. As well, adhere to trade with brokers regulated in serious jurisdictions, not the offshore once, as they luck of strong regulation, requirements and necessary safety measures. Read more by the link why avoid brokers from st vincent & the grenadines.

How to choose best forex broker?

Security of funds is always first in forex trading, for that reason, we recall your attention to open an account with regulated brokers only. Making it simple, regulated broker means that you will trade forex with proper security of funds and investment itself, so first of all good broker is a sharply regulated broker.

Further on, you should also check the necessary conditions and select offer suitable for you and trading strategy you deploy.

For this reason, we assist your selection and provide an assortment of efficient regulated brokers with updated on a weekly basis in-depth forex broker list. A professional detailed analysis with trading fees account overview, platform breakdowns while sorted by regulation, country or trading conditions, along with traders comments so smarter decision is easier now.

Forex brokers in india

Get A call back from us

Start with 4 simple steps

Open your forex birds trading account today to discover what it’s like to trade with a broker flying by your side. Forex broker, forex trading, online forex trading, currency trading,trading account, best forex brokers,best forex trading platform 2020,top forex brokers, best forex brokers for beginners, trade, what is forex trading and how does it work?, FX trading, how to start forex trading?, how does forex trading works?, how to trade forex for beginners?, how do I start trading forex?, how to open forex account, how to open forex trading account?, forex demo account, what is the best forex broker for beginners?, reliable forex broker 2020 | online forex trading |fx market, forex brokers in india

Sign up with your email and mobile number

Upload documents to verify your identity

Deposit the fund you wish to trade

Open your live trading A/c and start trading

Works on any platform

Download MT4 on your iphone or android device and dive into the markets in a moment notice. Forex broker, forex trading, online forex trading, fx trading,trading account, best forex brokers,best forex trading platform 2020,top forex brokers, best forex brokers for beginners, trade, what is forex trading and how does it work? FX trading, how to start forex trading?, how does forex trading works?, how to trade forex for beginners?

- Search for "metatrader 4" in the app store or google play store.

- Download the mt4 software.

- Open the app and click on profile, now you can see + symbol, click on that symbol.

- In the find broker search feild, search for forex birds, choose demo or live account.

Download MT4

The metatrader 4 platform has an excellent interface. It is simple and easy to use for forex and futures traders. Forex broker, forex trading, online forex trading, fx market,trading account, best forex brokers,best forex trading platform 2020,top forex brokers, best forex brokers for beginners, trade, what is forex trading and how does it work? FX trading, how to start forex trading?, how does forex trading works?, how to trade forex for beginners?

- Download the terminal by clicking on download MT4 button below.

- Run the file after it has downloaded.

- When launching the program for the first time, you will see the login window.

- Enter your real or demo account login data.

Download MT4

Reliable forex brokers

О рынке forex

Fortfs предлагает трейдинг на forex и других международных финансовых рынках. Торговля ведется в целях спекуляции и страхования финансовых активов. Например, производители и экспортеры таких товаров, как нефть, газ, золото, серебро, платина, палладий, пшеница, кофе, какао, соевые бобы и т.П. Ежеквартально инвестируют в соответствующие товарные контракты на фьючерсы и применяют опционы, либо производные CFD инструменты для ограничения влияния резких колебаний цен на свою прибыль. Следовательно, они обеспечивают защиту и приумножение активов своих компаний. Преимущества и различия CFD на фьючерсы от биржевых фьючерсов часто не остаются без внимания даже опытными хеджерами и инвесторами.

Fortfs отслеживает новые и наиболее перспективные тренды на мировых валютных и биржевых площадках. Так, одним из восходящих трендов в мире финансов стало инвестирование в ETF CFD контракты на целые экономические регионы: USA, азия, европа, африка, индия, латинская америка.

Компания использует сервисы не только для квалифицированных инвесторов, но также и для начинающих трейдеров с небольшим опытом на форекс. В основном они используют такие услуги fortfs, как счет для новичка, бонус без депозита (приветственный бонус), бонус на депозит и бонус, поддерживающий маржу (support margin bonus).

Брокер fortfs предоставляет инвестиционные сервисы для клиентов, желающих получать стабильный пассивный доход. S.T.A.R. И copytrading (копитрейдинг) востребованы опытными трейдерами, которые извлекают дополнительный доход, являясь управляющими фондов.

Регулярные торговые сигналы, уникальная аналитика, эксклюзивные биржевые обзоры и экономические новости, литература о FX, валютном трейдинге, обучающие материалы для новичков, аналитические и практические вебинары для трейдеров – вся совокупность информации об инвестировании и спекуляции на бирже широко представлена fortfs.

Мы стремимся не только расширять линейку своих программ и сервисов для клиентов, но также постоянно улучшаем качество предоставляемых услуг на рынке forex. Передовые алгоритмы обработки торговых ордеров и контракты с лучшими провайдерами ликвидности помогли завоевать fortfs международное признание в рейтинге (TOP 10) лучших брокеров ECN с NDD исполнением.

Fort financial services LTD,

registration number 25307 BC 2019

suite 305, griffith corporate centre

P.O. Box 1510, beachmont kingstown

st vincent and grenadines

Fort financial services LTD зарегистрирован на территории сент-винсента и гренадин как международная бизнес-компания с регистрационным номером 25307 BC 2019. Объектом деятельности компании является любая деятельность, разрешенная законом о международных коммерческих компаниях (включая внесенные поправки), главой 149 пересмотренных в 2009 году законов сент-винсента и гренадин, и включает в себя, не ограничиваясь, осуществление любых коммерческих, финансовых, кредитных операций, заимствования, торговлю, оказание услуг и участие в других предприятиях, а также предоставление брокерских услуг, обучение и управление счетами, торгующими валютой, сырьевыми товарами, индексами, CFD и финансовыми инструментами с использованием заемных средств.

Торговля на финансовых рынках сопряжена со значительными рисками, включая возможность полной потери инвестиционного капитала. Данный вид деятельности подходит не всем инвесторам. Высокое кредитное плечо увеличивает риск (уведомление о рисках).

Клиент имеет право отказаться от услуг компании. В этом случае возврат денежных средств осуществляется согласно клиентскому соглашению и политике возврата денежных средств.

Деятельность компании соответствует нормам международного законодательства по предотвращению преступной деятельности, отмыванию денег и финансированию терроризма (AML policy и политика "знай своего клиента").

Компания ERA TODAY ltd (agiou athanasiou, 74 agios athanasios, 4102 limassol, cyprus), AREA SOFT LLP заключила партнерское соглашение с fort financial services ltd.

Сервис недоступен гражданам и резидентам США, а также для любых общественно-политических деятелей.

Best ECN forex broker

What is an ECN forex broker?

An ECN forex broker is an expert who uses electronic communications networks (ecns) to provide its forex trading clients direct access to other participants in the currency markets. Because an ECN forex broker consolidates price quotations from several market participants, it can generally offer its forex trading clients tighter bid/ask spreads than would be otherwise available to them.

Since an ECN broker only matches trades between forex market participants, it cannot trade against the client, which is an allegation that is often directed against some “market maker” retail forex brokers. Because ECN forex broker spreads are much smaller than those spreads used by everyday market maker brokers, ECN forex brokers charge clients a fixed commission per transaction. Even with commissions considered, trading with an ECN forex broker is less expensive and more reliable than using a market maker non-ECN forex broker.

An ECN forex broker allows people to open forex trading accounts and trade forex through the internet using a trading platform such as metatrader. You can begin by practising trading on a demo account and move over to a live trading account when you are ready.

There are plenty of forex brokers to choose from before you begin forex trading, so be sure to do your research and ensure that your chosen broker meets certain criteria. They should provide low spreads, low commissions, fast execution and no limitations on stops. ECN forex trading accounts form the ultimate trading environment for trading currencies, this is why it is highly recommended to choose an ECN forex broker.

A broker with an ECN/STP environment is your best choice as they will give you fast execution, little slippage, tight stops and tight spreads. I have thoroughly researched and tested many ECN forex brokers and recommend IC markets out of those that I have thoroughly analysed and determined IC markets provide excellent customer service whilst being the perfect true ECN forex broker.

What are the advantages of an ECN forex broker?

The type of broker that you choose to use can have a significant impact on your forex trading performance. If you opt to use a retail market maker forex broker that does not execute your trades on time and at the initial price that you wanted, what may have been an opportunity for a good trade can rapidly descend into an unexpected loss – through no fault of your own or due to your forex trading system but due to the impact of choosing an unreliable retail market maker forex broker.

Therefore, it is upmost importance that you carefully analyse the advantages and disadvantages of each forex broker before making a decision on which one you would like to open a forex trading account with and trade through. I highly recommend that you only consider using a true ECN forex broker for your forex trading for the best possible trading conditions and no conflict of interests, IC markets being my best forex broker recommendation.

True ECN forex broker pros:

- More often than not better bid/ask prices due to the fact that they are derived from multiple sources. You get the best bid and best ask prices at the time of trading.

- The possibility to trade forex on prices that have very small or even zero spreads at specific times.

- Real true ECN forex brokers do not trade against you as a market maker would, instead they will pass on your trade orders to a bank or another trader on the opposite side of your trade transaction.

- Prices can be more volatile, this is better for forex scalping systems.

- You have the ability to offer a price between the bid and ask.

- ECN forex trading is completely anonymous. This enables you to trade forex on neutral prices that are a reflection strictly of the real market conditions with no bias whatsoever against your trade direction/position.

- Instant trade execution on the best possible prices with immediate confirmation. There is no dealing desk to interfere so there are no re-quotes.

- Client-to-bank trading. Forex traders can trade directly on the global liquidity of the best banks and fully qualified/registered financial institutions. ECN forex brokers provide traders with direct access to market prices.

- Ideal conditions for automated forex trading systems (forex robots).

- Many ECN forex brokers have very low commissions along with the lowest (sometimes zero) spreads making trading costs and chances of being profitable much higher than using a non-ECN forex broker or market maker.

Best ECN forex broker

What is an electronic communication network (ECN)?

An electronic communication network (ECN) is an automated system that will match forex traders buy and sell orders. An ECN will connect to major forex brokerages worldwide and individual forex traders enabling them to trade directly between themselves without the need of going through a middleman (such as a market maker).

The ECN makes money by charging a small fee for each conducted transaction, known as a commission. Ecns give the possibility for forex traders in multiple different locations around the globe to trade with each other in a fast and efficient manner. The securities and exchange commission requires ecns to register as broker-dealers making them extremely reliable and completely transparent.

Ecns will display the best possible available bid/ask quotes from various market participants, then automatically match and execute the orders. Ecns allow the use of automated trading, passive order matching and fast execution. Ecns serve large institutional and retail forex traders. This makes ECN forex brokers the perfect solution for using forex robots.

How does an ECN work?

Ecns pass on all of the prices from multiple forex market participants, such as banks and market makers, along with other forex traders connected to the ECN. They display the best bid/ask quotes on their forex trading platforms based on these prices. ECN forex brokers also serve as counterparties to forex transactions, although they operate on a settlement, rather than a pricing basis.

Unlike fixed spreads that are offered by some market makers, the spreads of currency pairs do vary on ecns, dependant on that particular pair’s trading activity. Market makers can also increase the spreads making it more difficult for the forex trader to be profitable and so that they make more money for themselves by increasing the trade costs.

During trading periods of high activity, you will sometimes get zero ECN spread, particularly on the very liquid currency pairs like the majors (EUR/USD, USD/JPY, GBP/USD and USD/CHF) and also on other currency crosses.

Ecns make money by charging their customers a fixed commission for each trade transaction. Genuine ecns are not involved in making or deciding prices, which therefore significantly reduces the risks of price manipulation for retail forex traders. You can claim cash back forex rebates from the trade commission and spread costs.

As with market maker forex brokers, there are also two main types of ECN forex brokers, these being retail and institutional. Institutional ECN forex brokers give the best bid/ask from multiple institutional market makers such as banks, to other banks and institutions including hedge funds or large corporations. Retail ECN forex brokers will usually offer quotes from a few banks and other traders on the ECN to the retail forex trader. This gives you as the everyday normal person an excellent opportunity to gain access to trade on an ECN forex broker.

What is a market maker (dealing desk) non-ECN forex broker?

When using a non-ECN forex broker often referred to as a market maker, there is a usually a dealing desk used by the non-ECN forex broker that trades must pass through before completed execution which can lead to slippage (actual entry price different from initial quoted price) and higher spreads . Market makers add to liquidity by being ready to buy and sell designated currencies at any time during the trading day but make large profits from increased spreads and by taking the opposite side of your trade.

Market makers “make” or set both the bid and the ask prices on their systems and display them to the public on their on screen quotes. They are ready and prepared to conduct transactions at these prices with their retail forex traders. By doing this, market makers provide some liquidity to the forex market.

As they are a counterparty to each forex trading transaction in terms of pricing, market makers must take the opposite side of your trade as the retail forex trader. What this means is that whenever you place a sell trade, they must buy that currency pair from you, and vice versa. This can cause a conflict of interest as affectively when you make a successful trade the market maker makes a loss. They will often increase spreads and create additional slippage to make forex trading conditions more difficult for the retail forex trader.

The forex trading rates that market makers set are therefore based solely on their own personal best interests. They will make profits for themselves via their market-making activities through the spread that is charged to their customers and in some cases by artificially creating additional slippage so the retail trader gets a worse price than anticipated.

The forex spread is the difference between the bid and the ask price, and is more often than not fixed by each market maker. Usually, spreads are kept fairly reasonable as a result of the stiff competition between numerous market makers but this still does not compare to the real spreads provided by ECN forex brokers.

As a counterparty to forex retail traders, many of them will then try to hedge, or cover, your order by passing it on to someone else. There can be times in which market makers will decide to hold your order and trade against you.

There are primarily two main types of market makers which are retail and institutional. Institutional market makers can be banks or other large corporations that usually offer a bid/ask quote to other banks, institutions, ecns or even retail market makers.

Retail market makers are usually companies dedicated to offering retail forex trading services to individual traders which is why it is important to know the difference between a retail market maker forex broker and a true ECN forex broker – it can have a substantial impact on your forex trading costs and profitability.

- Retail market maker forex brokers can have a clear conflict of interest in your order execution (slippage) and spreads, because they may be trading against you.

- They can often display worse bid/ask prices than those of which you could get from a true ECN forex broker.

- They are able to manipulate currency prices to hit their customers stop loss or to prevent customers open trades reaching their profit objectives. Market makers also have the ability to move their forex quotes 10 to 15 pips away from other market rates.

- A large amount of slippage can happen when news is released. Market makers forex bid/ask quote display and trade placing systems may also hang up (freeze) when there are times of high market volatility.

- Most market makers do not like forex scalping systems will tend to put forex scalpers on manual execution, so that their trade orders do not get filled at the prices the scalper wanted.

IC markets review

True ECN forex broker vs market maker

Hopefully you have read through the detailed explanations describing true ECN forex brokers with market makers and now have a clear understanding of both. I am sure you will agree that trading on a true ECN forex broker is the best forex trading solution! IC markets is my top recommended ECN forex broker based on personal experience. I have a live account with them and have been very happy with them for years now.

How do I apply for a true ECN forex broker account?

When you are ready to open an ECN forex broker account visit IC markets and apply for your very own personal ECN forex trading account – they have various account options starting from just $100.Once you have had your application processed (usually within a day at the most) you are ready to start trading with good trading conditions. Please always conduct your own due diligence on all forex brokers.

Welcome to mitrade

- English

- Demo account

- Create account

- Log in

- 简体中文

- 繁体中文

- English

- ไทย

- Tiếng việt

- Bahasa melayu

- Markets

- Tools

- Trading platform

- Support

- Learn

- About us

- English

- Forexindicescommoditiessharescryptocurrencies

- Trading analysisforecasteconomic calendarnewsmarket datasentimentrisk management

- Faqhelp centrecontract specifications

- Basicseducationinsights

- About mitradeour awardsclient money protectionfees & chargesmitrade propromotionscontact us

- 简体中文繁体中文englishไทยtiếng việtbahasa melayu

Online trading forex, gold bitcoin and more

- 100+ popular financial markets

- Competitive spreads

- Relevant regulatory bodies regulated

- Zero commissions

Delving into the world of trading can be nerve-wracking and confusing for newcomers. Luckily, many forex brokers offer new members an initial bonus without a deposit, which can be used to start trading right away. You may have some questions, such as: how can I get a no deposit bonus to start trading? Which brokers can I trust with my money? And how can I be sure it’s not a scam?

We’re here to quash your fears and give you confidence in your upcoming trades. Continue reading to learn more about our research on certain forex brokers with a no deposit bonus for malaysian traders in 2020.

Let’s start with the most important question: which forex brokers have a no deposit bonus for malaysian traders?

* kindly note that this information is accurate but these characteristics might change in the future. For details, please refer to the latest update on their official websites. *wikifx is a global forex broker regulatory inquiry app.

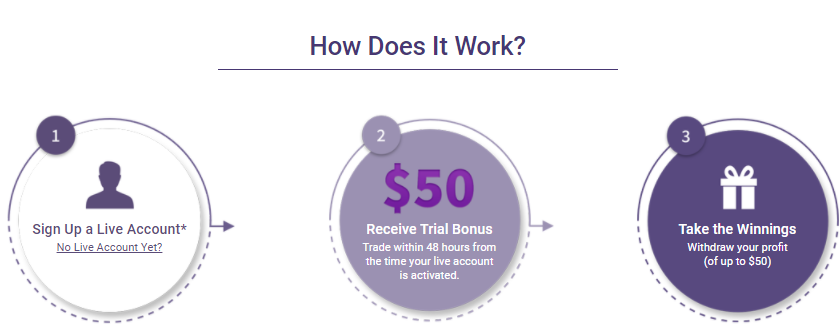

1. Mitrade

Mitrade’s main office is located in australia and holds a number of awards for innovation and mobile accessibility. They provide a unique trading platform, easily accessible on the web or mobile devices. If you’re new to the world of trading forex in malaysia, they offer a demo account that’s valid for 90 days.

The minimum deposit at mitrade is $50 and they offer negative balance protection, ensuring your account won’t go below 0. At mitrade there is a very low threshold amount, the minimum size per trade is as low as 0.01 lots for many markets.

The leverage amount is up to 1:200 and they offer clients competitive spreads, zero commissions, as well as articles to help first-time traders understand the scope of forex in malaysia.

Regulated by

Australian securities and investment commission (ASIC)

Forex no deposit bonus 2020

Sign up easily on the website for a live account. Within 48 hours of your account being activated, you’ll be transferred the no deposit bonus ( trial bonus for new clients). The bonus is limited to 300 eligible customers each day.

This no deposit bonus has an expiry, which is 48 hours from activation of the bonus. If you want to withdraw your earnings up to a $50 profit, do so within this timeframe. After the 48 hour event, you can submit regular withdrawal/deposit requests for your account.

Open live account, and apply this trial bonus!

XM group (XM) is said to be a suitable forex broker choice for beginners as well as vets in the trading industry. At XM you have the choice of 2 trading platforms: metatrader 4, an award-winning platform that is mostly used for forex trading, and metatrader 5, a multi-asset platform for traders.

Regulated by

Cyprus securities and exchange commission (cysec)

International financial services commission (IFSC)

Financial conduct authority (FCA)

Australian securities and investment commission (ASIC)

Forex no deposit bonus 2020

For details, please refer to the latest update on their official website.

3. Tickmill

Tickmill is based in london but operates in many countries across the world. Their MT4 platform is easily navigable and provides 50+ indicators, charting tools, and EA trading, among other features. Forex traders can benefit from 60+ currency pairs, and open a demo account to test their platform before committing. The downside is they do not have MT5 integration.

Regulated by

Seychelles financial services authority (FSA)

Financial conduct authority (FCA)

Cyprus securities and exchange commission (cysec)

Forex no deposit bonus 2020

For details, please refer to the latest update on their official website.

Fxopen operates on MT4 and MT5 trading platforms, with a web-based option available, and a range of CFD instruments. The broker allows trade of over 50 currency pairs. Spreads vary depending on the pairs.

Regulated by

Financial conduct authority (FCA)

Australian securities and investment commission (ASIC)

Forex no deposit bonus 2020

For details, please refer to the latest update on their official website.

5. Just2trade

Just2trade offers traders a multitude of accounts to choose from before advancing with their trades, depending on each person’s needs. They connect their clients via the whotrades social network app.

Spreads and commissions are low at just2trade, and depending on the plan chosen, there may or may not be monthly fees for your account.

Regulated by

Cyprus securities and exchange commission (cysec)

Forex no deposit bonus 2020

For details, please refer to the latest update on their official website.

FBS broker services are based in belize, and have been on market for 2-5 years. They’re licensed for MT4 and MT5 trading platforms. FBS offers negative balance protection, giving you some security.

Regulated by

Cyprus securities and exchange commission (cysec)

International financial services commission (IFSC)

Forex no deposit bonus 2020

For details, please refer to the latest update on their official website.

Forex bonus scams are not a new problem. In review news sites you can get hundreds of forex bonus schemes, some of which even record up to thousands of dollars in bonuses with no conditions attached.

In asia there are a number of brokers operating under ponzi schemes (unsustainable multi-level operations), attracting traders through huge bonus programs. These exchanges launch huge bonuses but then the trader has no way to withdraw money, or encounters a banking system error. So, as a forex trader, how do you know which no deposit bonus is a scam?

How can you be sure a forex broker with no deposit bonus isn’t a scam?

The rule of thumb here is common sense. If a no deposit bonus looks too good to be true, it probably is. As you can see from our list, a typical amount is around $30 to $50 for a no deposit bonus. I’ve seen offers for 250$ or even 1,000$, which is way more than the usual amount.

The simplest, most reliable way is to choose forex no deposit bonus programs from certified brokers serving malaysia that have been on the market for at least 3-5 years. With reputable forex brokers, the bonus will be appropriate and support many future benefits.

A couple of tips to keep your money safe:

Watch out for unlicensed brokers. If a broker is legitimate, they won’t hesitate to tell the world about how safe your money will be in their hands, with proof.

Also keep an eye out for false advertising. This means that the no deposit bonus they’re advertising should align with the terms and conditions on their page. If there’s a discrepancy, be wary of the opportunity.

Lastly, take a look at the terms and conditions to see if they are published with transparency. Transparency equals honesty: brokers offering scams have something to hide and do so with strangely-worded terms and loopholes.

Is the no deposit bonus a scam?

No. As we’ve outlined above, scams do exist, but if you pay attention to the details you will be able to spot a scam from a mile away.

Can I withdraw a no deposit bonus?

This depends on the broker. Certain terms and conditions state you can’t directly withdraw it, but you can withdraw earnings made from the forex bonus. Oftentimes you’ll have to profit a certain amount, or turnover x number of lots, before being qualified to withdraw. Check the broker’s terms to find out.

Why do forex brokers provide no deposit bonuses?

Forex no deposit bonus is a way for brokers to get your business, and for you to start trading without requiring your own start-up capital. The bonus is enticing for people who are just starting out, or who want to try out a service without investing immediately in the malaysian market.

If you find a quality broker with a forex no deposit bonus in 2020, it’s a win-win, as the broker wants you to make money through their business and you don’t have to risk your own equity!

The content presented above, whether from a third party or not, is considered as general advice only. This article does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Mitrade does not represent that the information provided here is accurate, current or complete. Mitrade is not a financial advisor and all services are provided on an execution only basis. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. *CFD trading carries a high level of risk and is not suitable for all investors. Please read the PDS before choosing to start trading.

On-the-go trading on mobile app and web

Provide a full range of quality column content for global investors

Risk warning:

Mitrade does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products.

All of our products are over-the-counter derivatives over global underlying assets. Mitrade provides execution only service, acting as principle at all times.

Mitrade does not issue, buy or sell any cryptocurrencies nor is it a cryptocurrency exchange.

This website is owned and operated by mitrade global pty ltd ABN 90 149 011 361, AFSL 398528. This AFSL authorises us to carry on a financial services business in australia. Contact mitrade at cs@mitrade.Com.

The information on this site is not intended for residents of the united states, canada, japan, new zealand or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For certain jurisdictions, card processing service is provided by mitrade services ltd (a company registered in england and wales under number 11804044 with registered address at 27 old gloucester street, london, WC1N 3AX, united kingdom). Mitrade services ltd is wholly owned subsidiary of mitrade global pty ltd.

Secured by SSL. © mitrade copyright, all rights reserved.

5 reliable online forex brokers for african traders

More and more africans are taking to online trading of currency and other derivative instruments such as stocks, commodities and cryptocurrencies to earn a living. However, a major challenge most african traders face is getting reliable forex brokers to deal with.

Unfortunately, the majority of forex brokers hardly accept traders from africa. African traders are therefore on a constant search of credible platforms to fulfill their needs. And very often they fall victim of fraudsters who parade themselves as forex brokers.

If you are from africa and you are desirous of trading the global market but are constrained because you have not been able to get a credible forex broker to use; here is a list of online brokers that accept african traders on their platforms.

This post addresses the need of new traders or experienced traders who are looking for reliable online brokers to use for their online trading activities. If you are new to online trading and seeking the knowledge to get you started, check out this other post: online trading of financial assets: it’s not be as difficult as you think

Three types of brokers

Many people really don’t realize that all brokers are not the same. And most importantly, the type of broker you deal with, to a very large extent determines the kind of trading experience that you will have.

There are three classes of forex brokers:

Market maker

The first and most common type of forex brokers are the dealers or market makers. This type of broker helps the trader route his trade to the market. Thus, they operate the dealing desk model.

They collect your order, process it and route it through the market. What this means is that when you are buying, you buy from the broker and when you sell, you also sell to them. Trading via a dealing desk broker or market maker offers some benefits. The most important of this is that you are able to trade in really small lot sizes.

However, market makers take the opposite side of your trade and may not likely hedge. What this simply means is that they gain when you lose money and lose money when you gain. Would such a broker protect your interest? Not likely at all.

STP broker

The other type of forex brokers is the STP or straight through processing broker. He is a non-dealing desk broker and what this means is that the broker routes your orders directly to the liquidity provider.

Liquidity providers are usually financial institutions that play in the inter bank market. They include the banks, hedge funds and mutual funds. How the STP broker makes money is on the spreads.

Thus the more you win as a trader, the more money the broker makes. If you are losing money, the broker is very likely to lose money also. So it is in his best interest that you make money. However, you may not be able to trade in small lot sizes.

ECN broker

The other type of non-dealing desk broker is the ECN (electronic communication network) broker. The ECN broker not only gives the trader routes your order directly to the liquidity provider but also allows you to interact with them on their network.

The ECN broker does not earn money on the spread but charges the trader a commission on all trades. So whether the trader makes money or not he is entitled to his commission.

So what type of broker should you be using? The one whose business model meets your trading goals! However, it’s important that we add that to trade with an ECN broker, you have to be experienced.

How to choose an online forex broker

Here are some of the things you have to watch out for:

Regulated broker

So many online forex brokers are not regulated, particularly in africa. Dealing with an unregulated financial services provider puts your funds at risks. Since there is no authority to report to in the event of an infraction, you and your money are at the mercy of the broker.

History and reputation

It is in your interest to choose a forex broker that has been around for sometime, has positive reviews by clients, and has the financial muscle to do their. When you deal with a fragile institution, your investment is likely to go down when the institution goes down.

Account type offered

Choose a broker that has a variety of accounts that caters for different skill levels: beginner, intermediate and advanced. These brokers offer demo accounts with virtual money that traders can use to learn and get used to the trading environment before commuting real money to trade.

Instruments offered

We selected online brokers that offer a variety of products that appeal to the interest of individual traders. These include stocks, currency, commodities, stock indices, cryptocurrencies and etfs.

Minimum deposit required

To many traders, the minimum they will need to open an account is a very important factor. Some brokers accepts as little as USD5 while others can go as high as USD1000. The firms we list here accept minimal sums for account opening, some as little as USD10.

Local office or support

Particularly for african traders, it is important you deal with a broker that has a local office or representative in your country. This will help to facilitate support and technical assistance where and when needed.

Best online forex brokers for african traders

Now here are our list of best online forex brokers for nigeria and african traders and those

#1. Fintrust managers

Fintrust managers is an ‘A” book online broker with a strong presence in africa and europe. It offers access to the global financial markets with a robust platform that allows users to trade forex, stocks, commodity cfds as well as cryptocurrency and etfs.

Fintrust managers offers financial services to clients around the world and complies with the regulations of each country where they have a presence.

With as little as US$20 one can open an account and start trading on the fintrust platforms. These platforms can be accessed on desktop, mobile app and the web. And the best part, their flexible deposit options allows their clients to fund their accounts in their domestic currency and trade in foreign currency.

For a reliable trading platform that offers low and flexible deposit options, low spreads, no hidden fees, leverage of up 1:1000 and a variety of instruments, then check out fintrust managers.

Fintrust managers have their offices in nigeria and offers their services globally.

#2. Deriv

Formerly binary.Com, this company has a robust 20 years history of providing trading platforms and services for over one million traders worldwide.

This company delivers its trading services via three platforms namely: dtrader (a web based platform), MT5 and dbot (an automated trading system). This is in addition to binary.Com’s smart trader.

Deriv is licensed in multiple jurisdictions including malta, lauban, british virgin islands and vanuatu. It offers tight spreads and minimal trading fees. And with just USD5, one can open an account and start trading over the 100 products on offer spread across currency pairs, binary options, stock indices, synthetic indices and commodities.

Deposit and withdrawal of funds is easy and can mostly be achieved within 24 hours. Options available include bank wires, credit/debit cards, e-wallets and cryptocurrencies like bitcoin, ethereum, litecoin and tether.

Deriv has a large network of affiliate and IB managers in africa and they are available to provide you with support.

#3. Hot forex

This online forex broker is based in cyprus. It is a brand name of HF market (europe) licensed by the cysec. It also has some cross border licenses authorizing it to offer trading services in these jurisdictions including dubai, england, south africa and more.

Thus, hotforex offers services in most parts of the world including africa with representative offices in nigeria and kenya.

The company was set up in 2010. It boasts of having created over 2 million accounts, employed over 200 people globally, supports more than 27 languages and has over 35 industry awards in its belt.

Hotforex is an STP broker, offers 17 trading tools and over 150 instruments in forex and cfds. This includes indices, metals, energy, stocks, commodities, bonds and cryptocurrencies.

Minimum amount to open an account and trade through this platform is USD5. They offer fixed and floating leverage which is good for traders with smaller accounts. With about 6 account types, traders have a variety of options with the benefit of negative balance protection.

#4. Alpari

Founded in 1998, alpari is one of the world’s oldest forex brokers with a presence in africa. They have local presence in abuja, nigeria and offers and offer friendly trading platform support, competitive spread, and options to make deposits in local currency.

Alpari is an ECN broker with very low fees and offer a wide range of instruments including forex, indices and spot metals. New users can open a trading account with zero amount.

Alpari is fully licensed and regulated by the financial services commission of mauritius.

#5. FXTM

FXTM has a very high rating in nigeria. It’s a trusted broker that has a cross border registrations in UK, cyprus, and belize.

FXTM offers a variety of account types and allows deposit in your domestic currency. The minimum amount for opening an account for its nigerian customers is NGN2000 (or USD5). Deposit and withdrawal of funds is easy with many options including cash deposit, debit and credit cards

Apart from trading forex, FXTM also offers cfds in commodities. They also provide free resources to help their learn and trade better. These resources come in the form of news, commentary, analysis, articles, ebooks, and webinars.

FXTM has offices in lagos and abuja, nigeria. It worn the best broker awards in nigeria in 2020.

In conclusion

Someone once told me: “if you choose the wrong broker, it’s got to make you a lot broker”. You see there are a lot of scammers out there, so you have to exercise care when deciding on a forex broker to deal with.

Always know that trading in financial instruments, much more so, derivatives is risky. Don’t compound the risk by dealing with the wrong broker. Define your objectives clearly. Consider the options and do your due diligence and select the forex broker that best meets your needs.

ECN forex brokers

ECN or electronic communication network is a technology bridge built with the purpose to links retail forex market participants or traders to liquidity providers. So eventually ECN is a non dealing desk bridge with straight-through processing execution that enables execution in a direct connection between the parties. Read more about ECN through wikipedia.

What is ECN broker?

So ECN brokers automatically match requested trading orders to sell or buy at the best available price from available market participants (learn about NASDAQ market participants), while at some time EUR USD spread maybe even 0 pip.

Apart from the competitive trading costs and due to its functions ECN technology also results in extended trading time too, along with high efficiency for automated trading and a variety of strategies suitable for both retail or institutional traders. Besides, ECN execution cannot cause any misunderstanding between the trader and the broker as its interbank connectivity brings transparent trading conditions.

What is ECN fee?

The trading brokers offering ECN account and connection usually offer an interbank spread from 0.0 pips and do charge a fixed commission per lot as a trading cost or fee.

ECN vs standard account

Unlike forex market maker brokers offering standard account that typically charge fixed spread for forex trading added above the quotes you can see via trading terminal, the ECN working with commission fee model. It means, typically there is no commission charge for standard accounts, but a spread only basis while ECN costs split between the interbank spread from 0 pip and commission charge per lot.

- Depending on the strategy you deploy ECN spreads from 0 pips does not necessarily mean lower trading costs, as for particular strategies fixed or variable spread as a trading fee is a much better option. ECN brokers and technology indeed more suitable for experienced traders, professionals or those that operate bigger sizes. While the standard account and market maker execution model might be a good option for beginning traders, for some strategies and regular size traders.

Best ECN forex broker

Firstly, the best ECN broker is a heavily regulated broker, as it is a trustable one in which you would not worry about necessary compliance and safety measures towards your money. The only way to trade with a true ECN broker is to select among the broker with the confirmed regulatory status along with its strong legit obligations. Learn about different type of brokers through SEC website.

Like the regulated brokers you will find in the listing below offers some of the best ECN trading conditions along with applicable standards of operation, transparent conditions and privacy policy.

- GO markets– best overall ECN broker 2020

- FP markets – lowest spread ECN broker 2020

- Exness – best MT4 ECN broker 2020

- XM – best ECN broker for beginners 2020

- Pepperstone– best for scalping and EA ECN 2020

ECN forex brokers list

These are the regulated brokers that offer ECN trading:

so, let's see, what we have: read our regulated forex brokers reviews with trading conditions, user's reviews and rating. Choose your broker from our regulated forex broker list. At reliable forex brokers

Contents of the article

- Top forex bonus promo

- Brokers

- Regulated forex brokers

- Can I trade forex without a broker?

- Do I need license to trade forex?

- Are forex brokers regulated?

- What does a regulated broker mean?

- How do I know if my forex broker is regulated?

- How to choose best forex broker?

- How to find a reliable forex broker

- Reliable forex signals

- What to look for in a reliable broker

- Avoiding bad forex brokers: signs to look out for

- Finding a reliable #account is essential

- Reliable forex brokers

- О рынке forex

- Brokers

- Regulated forex brokers

- Can I trade forex without a broker?

- Do I need license to trade forex?

- Are forex brokers regulated?

- What does a regulated broker mean?

- How do I know if my forex broker is regulated?

- How to choose best forex broker?

- Forex brokers in india

- Reliable forex brokers

- О рынке forex

- Best ECN forex broker

- What is an ECN forex broker?

- What are the advantages of an ECN forex broker?

- True ECN forex broker pros:

- What is an electronic communication network (ECN)?

- How does an ECN work?

- What is a market maker (dealing desk) non-ECN forex broker?

- True ECN forex broker vs market maker

- How do I apply for a true ECN forex broker account?

- Welcome to mitrade

- 5 reliable online forex brokers for african traders

- Three types of brokers

- Market maker

- STP broker

- ECN broker

- How to choose an online forex broker

- Regulated broker

- History and reputation

- Account type offered

- Instruments offered

- Minimum deposit required

- Local office or support

- Best online forex brokers for african traders

- #1. Fintrust managers

- #2. Deriv

- #3. Hot forex

- #4. Alpari

- #5. FXTM

- ECN forex brokers

- Best ECN forex broker

- ECN forex brokers list

Comments

Post a Comment